|

|

【ATRIUM 5130 交流专区】亚天产业信托

[复制链接]

[复制链接]

|

|

|

发表于 27-10-2017 05:02 AM

|

显示全部楼层

发表于 27-10-2017 05:02 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,312 | 3,840 | 12,989 | 10,592 | | 2 | Profit/(loss) before tax | 2,294 | 1,859 | 6,873 | 5,351 | | 3 | Profit/(loss) for the period | 2,294 | 1,859 | 6,873 | 5,351 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,294 | 1,859 | 6,873 | 5,351 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.88 | 1.53 | 5.64 | 4.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.85 | 1.50 | 1.85 | 1.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4085 | 1.4051

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2017 05:04 AM

|

显示全部楼层

发表于 27-10-2017 05:04 AM

|

显示全部楼层

EX-date | 08 Nov 2017 | Entitlement date | 10 Nov 2017 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | Third interim income distribution of 1.85 sen per unit in respect of the three (3) months period from 1 July 2017 to 30 September 2017. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:03-27839299Fax:03-27839222 | Payment date | 30 Nov 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Nov 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0185 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2018 05:41 AM

|

显示全部楼层

发表于 9-2-2018 05:41 AM

|

显示全部楼层

本帖最后由 icy97 于 9-2-2018 06:37 AM 编辑

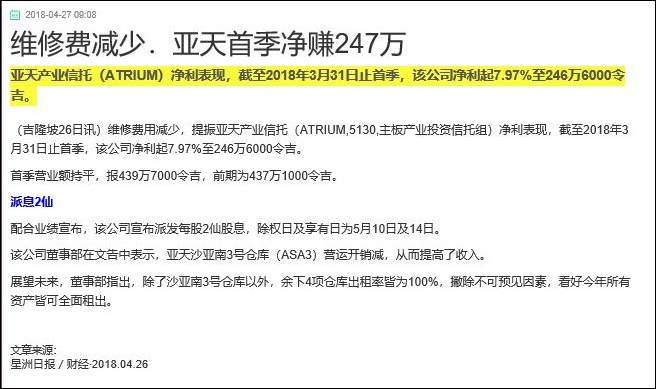

亚天产托末季赚1126万

2018年2月9日

(吉隆坡8日讯)亚天产托(ATRIUM,5130,主板产业信托股)截至12月31日末季,净赚1126万4000令吉或每单位1.78仙,上财年同季则净亏66万4000万令吉或1.52仙。

该产托向交易所报备,末季表现获得改善主要是因为重估投资产业合理价格取得910万令吉盈余,还有其他收入增加,超越开销。

派息1.85仙

同时,末季营业额从393万令吉,按年提高9.8%,达431万5000令吉,归功于Atrium莎阿南2资产的租金收入增加。

合计全年,净利按年激增2.87倍,达1813万7000令吉或每单位7.42仙;营业额则上升19.16%,达1730万4000令吉。

亚天产托亦宣布,派发每单位1.85仙第四次及终期股息,除权日落在2月21日,并在3月16日支付股息。

该产托在末季时已全面出租所有产业,除了Atrium莎亚南3资产之外,管理公司放眼在完成提升资产活动后,于次季转交空地占有权。

同时,Atrium蒲种资产的租户已发出提早解约的通知,并已获得新租户,租约将从1月开始生效。

接下来,该产托管理公司将持续积极寻购优质资产,以改善收益率和专注在知名租户的长租策略。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,315 | 3,930 | 17,304 | 14,522 | | 2 | Profit/(loss) before tax | 11,275 | -664 | 18,148 | 4,687 | | 3 | Profit/(loss) for the period | 11,264 | -664 | 18,137 | 4,687 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,264 | -664 | 18,137 | 4,687 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.78 | 1.52 | 7.42 | 5.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.85 | 1.60 | 1.85 | 1.60 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4825 | 1.4051

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2018 05:41 AM

|

显示全部楼层

发表于 9-2-2018 05:41 AM

|

显示全部楼层

EX-date | 21 Feb 2018 | Entitlement date | 23 Feb 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | Fourth and final income distribution of 1.85 sen per unit in respect of the three (3) months period from 1 October 2017 to 31 December 2017. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 16 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 23 Feb 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0185 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2018 06:00 AM

|

显示全部楼层

发表于 9-2-2018 06:00 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Revaluation of Atrium Shah Alam 1, Atrium Shah Alam 2, Atrium Puchong and Atrium USJ (collectively known as "the Investment Properties"). | The Board of Directors of Atrium REIT Managers Sdn. Bhd., the Manager of Atrium Real Estate Investment Trust ("Atrium REIT"), wishes to announce that Pacific Trustees Berhad, the Trustee of Atrium REIT, has carried out the revaluation of the Investment Properties held by Atrium REIT.

Further information on the Revaluation is disclosed in the attachment herein.

This announcement is dated 8 February 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5687885

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2018 06:23 AM

|

显示全部楼层

发表于 1-5-2018 06:23 AM

|

显示全部楼层

本帖最后由 icy97 于 7-5-2018 12:56 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,397 | 4,371 | 4,397 | 4,371 | | 2 | Profit/(loss) before tax | 2,466 | 2,284 | 2,466 | 2,284 | | 3 | Profit/(loss) for the period | 2,466 | 2,284 | 2,466 | 2,284 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,466 | 2,284 | 2,466 | 2,284 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.02 | 1.88 | 2.02 | 1.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 1.85 | 2.00 | 1.85 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4842 | 1.4825

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2018 06:33 AM

|

显示全部楼层

发表于 1-5-2018 06:33 AM

|

显示全部楼层

本帖最后由 icy97 于 10-5-2018 06:44 PM 编辑

EX-date | 14 May 2018 | Entitlement date | 16 May 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | First interim income distribution of 2.00 sen per unit in respect of the three (3) months period from 1 January 2018 to 31 March 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 31 May 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 16 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2018 04:56 AM

|

显示全部楼层

发表于 26-7-2018 04:56 AM

|

显示全部楼层

本帖最后由 icy97 于 28-7-2018 05:19 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,478 | 4,306 | 8,875 | 8,677 | | 2 | Profit/(loss) before tax | 2,543 | 2,294 | 5,010 | 4,579 | | 3 | Profit/(loss) for the period | 2,543 | 2,294 | 5,010 | 4,579 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,543 | 2,294 | 5,010 | 4,579 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.09 | 1.88 | 4.11 | 3.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 1.85 | 2.00 | 1.85 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4851 | 1.4825

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2018 04:58 AM

|

显示全部楼层

发表于 26-7-2018 04:58 AM

|

显示全部楼层

EX-date | 10 Aug 2018 | Entitlement date | 14 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | Second interim income distribution of 2.00 sen per unit in respect of the three (3) months period from 1 April 2018 to 30 June 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 30 Aug 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 03:50 AM

|

显示全部楼层

发表于 8-9-2018 03:50 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Acceptance of Banking Facility | The Board of Directors of Atrium REIT Managers Sdn. Bhd. (Company No. : 710526-V), the Manager of Atrium Real Estate Investment Trust (“Atrium REIT”) wishes to announce that the Trustee of Atrium REIT, namely Pacific Trustees Bhd, has accepted the Banking Facility on 6 September 2018.

Please refer to the attachment for the details on Banking Facility.

This announcement is dated 6 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5908361

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 08:08 AM

|

显示全部楼层

发表于 27-10-2018 08:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 5,004 | 4,312 | 13,879 | 12,989 | | 2 | Profit/(loss) before tax | 2,470 | 2,294 | 7,480 | 6,873 | | 3 | Profit/(loss) for the period | 2,470 | 2,294 | 7,480 | 6,873 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,470 | 2,294 | 7,480 | 6,873 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.03 | 1.88 | 6.14 | 5.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 1.85 | 6.00 | 5.55 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4854 | 1.4825

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 08:12 AM

|

显示全部楼层

发表于 27-10-2018 08:12 AM

|

显示全部楼层

EX-date | 09 Nov 2018 | Entitlement date | 13 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | Third interim income distribution of 2.00 sen per unit in respect of the three (3) months period from 1 July 2018 to 30 September 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 30 Nov 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 01:36 AM

|

显示全部楼层

发表于 6-11-2018 01:36 AM

|

显示全部楼层

本帖最后由 icy97 于 8-11-2018 07:19 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ATRIUM REAL ESTATE INVESTMENT TRUST ("ATRIUM REIT")(I) PROPOSED ACQUISITION 1; AND(II) PROPOSED ACQUISITION 2 | On behalf of the Board of Directors of Atrium REIT Managers Sdn Bhd ("Manager"), UOB Kay Hian Securities (M) Sdn Bhd ("UOBKH") wishes to announce that Pacific Trustees Berhad, the trustee for Atrium REIT ("Trustee" or "Purchaser"), had, on 1 November 2018, accepted the letter of offer by Lumileds Malaysia Sdn Bhd ("Lumileds" or "Vendor") dated 11 October 2018 for the following ("Letter of Acceptance"):- - Proposed acquisition and leaseback of a piece of leasehold land known as Lot No. 2027 and Plot No. 203, Mukim 12, Daerah Barat Daya, Pulau Pinang held under Pajakan Negeri 2850 and H.S.(D) 14852 respectively, together with the factory and all buildings erected thereon ("Property 1") from the Vendor for a cash consideration of RM50.0 million ("Purchase Consideration 1") ("Proposed Acquisition 1"); and

- Proposed acquisition of a lease and leaseback in respect of a piece of leasehold land known as Lot No. 70812, Mukim 12, Daerah Barat Daya, Pulau Pinang held under Pajakan Negeri 9036 ("Lease") together with the factory and all buildings erected thereon ("Property 2") from the Vendor for a cash consideration of RM130.0 million ("Purchase Consideration 2") ("Proposed Acquisition 2").

The Proposed Acquisition 1 and Proposed Acquisition 2 are collectively referred to as the "Proposed Acquisitions".

Further details on the Proposed Acquisitions are set out in the attachment below.

This announcement is dated 1 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5964045

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 02:07 AM

|

显示全部楼层

发表于 9-2-2019 02:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,900 | 4,315 | 18,779 | 17,304 | | 2 | Profit/(loss) before tax | 4,141 | 11,275 | 11,620 | 18,148 | | 3 | Profit/(loss) for the period | 4,141 | 11,264 | 11,620 | 18,137 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,141 | 11,264 | 11,620 | 18,137 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.98 | 1.78 | 8.13 | 7.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.10 | 1.85 | 8.10 | 7.40 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4994 | 1.4825

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 02:08 AM

|

显示全部楼层

发表于 9-2-2019 02:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Revaluation of Investment Properties pursuant to Paragraph 10.02(b)(i) of the Guidelines on Listed Real Estate Investment Trusts ("Listed REIT Guidelines") issued by the Securities Commission Malaysia ("SC") | The Board of Directors of Atrium REIT Managers Sdn. Bhd., the Manager of Atrium Real Estate Investment Trust ("Atrium REIT"), wishes to announce that Pacific Trustees Berhad, the Trustee of Atrium REIT, has carried out the revaluation of the investment properties held by Atrium REIT pursuant to Paragraph 10.02(b)(i) of the Listed REIT Guidelines issued by the SC and the Malaysian Financial Reporting Standard 140.

Further information on the Revaluation is disclosed in the attachment herein.

This announcement is dated 24 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6045473

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 02:08 AM

|

显示全部楼层

发表于 9-2-2019 02:08 AM

|

显示全部楼层

EX-date | 12 Feb 2019 | Entitlement date | 14 Feb 2019 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | Fourth and final income distribution of 2.10 sen per unit in respect of the three (3) months period from 1 October 2018 to 31 December 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Feb 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Feb 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.021 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 05:23 AM

|

显示全部楼层

发表于 21-2-2019 05:23 AM

|

显示全部楼层

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | ATRIUM REAL ESTATE INVESTMENT TRUST ("ATRIUM REIT")(I) PROPOSED ACQUISITION 1; (II) PROPOSED ACQUISITION 2;(III) PROPOSED PLACEMENT; AND(IV) PROPOSED RIGHTS ISSUE(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | We refer to Atrium REIT’s announcements dated 1 November 2018, 14 December 2018, 21 December 2018 and 17 January 2019 in relation to the Proposed Acquisitions.

On behalf of the Board of Directors of the Manager, UOBKH wishes to announce that the Trustee (on behalf of Atrium REIT), had, on 12 February 2019, entered into the following agreements with the Vendor:- - a put and call option agreement (“Option Agreement”) for the option to enter into a conditional sale and purchase agreement (“SPA 1”) (“Option”) and leaseback agreement for the proposed acquisition and leaseback of 2 pieces of leasehold land known as Lot No. 2027 and Plot No. 203, both in Mukim 12, Daerah Barat Daya, Pulau Pinang held under Pajakan Negeri 2850 and H.S.(D) 14852 respectively, together with the factory and all buildings erected thereon (“Property 1”) from the Vendor for a cash consideration of RM50.0 million (“Proposed Acquisition 1”). For avoidance of doubt, the Trustee, on behalf of Atrium REIT, will enter into the SPA 1 and undertake the Proposed Acquisition 1 upon the exercise of the Option under the Option Agreement, which is subject to amongst others, the Certificate of Completion and Compliance (“CCC”) and/or Certificate of Fitness for Occupation (“CFO”) for Property 1 being obtained by the Vendor. Hence, for the purposes of undertaking the Proposed Acquisition 1, Atrium REIT will also seek approval from its unitholders at the unitholders’ meeting to be convened to exercise the Option and undertake the Proposed Acquisition 1 upon the Vendor obtaining the CCC/CFO for Property 1; and

- a conditional sale and purchase agreement for the proposed acquisition of a lease arrangement in respect of a piece of leasehold land known as Lot No. 70812, Mukim 12, Daerah Barat Daya, Pulau Pinang held under Pajakan Negeri 9036 (“Lease”) together with the factory and all buildings erected thereon (“Property 2”) from the Vendor for a cash consideration of RM130.0 million (“SPA 2”) (“Proposed Acquisition 2”). Concurrently with the execution of the SPA 2, the Trustee and Lumileds had also on even date signed in escrow the leaseback agreement whereby the Trustee shall sub-lease Property 2 to the Vendor for a period of 15 years from the completion of SPA 2 (“Completion Date”) (“Leaseback Agreement 2”). The Leaseback Agreement 2 shall take effect on the Completion Date.

In conjunction with the Proposed Acquisitions, the Board also proposes to undertake the following fund raising exercises:- - proposed placement of up to 24,360,200 new units in Atrium REIT (“Units”), representing up to 20% of the total number of Units in Atrium REIT of 121,801,000 Units at an issue price to be determined later (“Proposed Placement”); and

- proposed renounceable rights issue of up to 58,464,480 new Units (“Rights Units”) to the unitholders of Atrium REIT on the basis of 2 Rights Units for every 5 existing Units after the completion of the Proposed Placement at an issue price to be determined later (“Proposed Rights Issue”).

Further details on the Proposals are set out in the attachment below.

This announcement is dated 12 February 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6061857

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 07:57 AM

|

显示全部楼层

发表于 21-2-2019 07:57 AM

|

显示全部楼层

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | ATRIUM REAL ESTATE INVESTMENT TRUST ("ATRIUM REIT")(I) PROPOSED ACQUISITION 1; (II) PROPOSED ACQUISITION 2;(III) PROPOSED PLACEMENT; AND(IV) PROPOSED RIGHTS ISSUE(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | The terms used herein shall have the same meaning as those defined in the announcement made on 12 February 2019 unless otherwise stated.

We refer to Atrium REIT’s announcement dated 12 February 2019 (“Announcement”) and 13 February 2019 in relation to the Proposals.

In relation thereto, on behalf of the Board of the Manager, UOBKH wishes to announce the following additional information pertaining to the Proposals:-

1. Basis and justification for the Purchase Considerations;

As disclosed in Section 2.7 of the Announcement, the premium of RM10.0 million for Property 2 takes into consideration, amongst others, the Leaseback Agreement 2, the scarcity of available industrial properties in Bayan Lepas industrial zone and the Greenfield Development. In the event the Greenfield Development is undertaken, Atrium REIT is expected to charge additional rental for the newly leasable area /newly constructed facilities at a rate to be mutually agreed by the parties. This could potentially enhance the earnings and dividend yield of the REIT in the future.

2. Effects of the finance costs on the earnings and distributable income; and

Given that Atrium REIT intends to part fund the Proposed Acquisitions through bank borrowings, the finance costs arising from the said bank borrowings will partially set off the earnings to be derived from the Leaseback Arrangements. Nevertheless, the Board is of the view that the net earnings will increase the EPU and DPU of Atrium REIT moving forward.

3. The conditionality of the Proposals:-

The Proposed Private Placement is not conditional upon the Proposed Acquisitions. In the event the Proposed Acquisitions are terminated, the total net proceeds from the Proposed Placement will be utilised for other future acquisitions of Atrium REIT. The Board is confident that the Manager will be able to identify suitable industrial properties located in the Klang Valley, Penang and Johor to substitute Property 1 and Property 2 in the event the Proposed Acquisitions are terminated. As to-date, the Manager remains active in identifying potential acquisitions to expand Atrium REIT’s footprint in the industrial property market.

The Proposed Rights Issue is conditional upon the Proposed Acquisitions as the proceeds to be raised from the Proposed Rights Issue will be utilised to part fund the Proposed Acquisitions and related expenses.

This announcement is dated 14 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-3-2019 05:20 AM

|

显示全部楼层

发表于 20-3-2019 05:20 AM

|

显示全部楼层

| ATRIUM REAL ESTATE INVESTMENT TRUST |

EX-date | 21 Mar 2019 | Entitlement date | 25 Mar 2019 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | First interim income distribution of 1.40 sen per unit in respect of the financial period from 1 January 2019 to 28 February 2019. | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 22 Apr 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 25 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.014 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-4-2019 06:44 AM

|

显示全部楼层

发表于 12-4-2019 06:44 AM

|

显示全部楼层

| ATRIUM REAL ESTATE INVESTMENT TRUST |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PLACEMENT OF UP TO 24,360,200 NEW UNITS IN ATRIUM REIT, REPRESENTING UP TO 20% OF THE TOTAL NUMBER OF UNITS IN ATRIUM REIT | No. of shares issued under this corporate proposal | 12,430,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.0900 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 134,231,000 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 132,900,280.000 | Listing Date | 03 Apr 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|