|

|

【NHFATT 7060 交流专区】新鸿发集团

[复制链接]

[复制链接]

|

|

|

发表于 14-4-2012 12:01 AM

|

显示全部楼层

发表于 14-4-2012 12:01 AM

|

显示全部楼层

新鴻發斥300萬購油壓機

企業13/04/2012 20:51

(巴生13日訊)汽車替代零件製造商及分銷商新鴻發(NHFATT,7060,主要板消費)宣佈,已簽約購買3 部價值100萬美元(約300萬令吉)的油壓機。

新鴻發發表文告說,獨資子公司汽車環球零件工業私人有限公司(Auto Global Parts Industries)今日在台北世界貿易中心南港展覽館,與鴻霖油壓有限公司簽約。

這些油壓機重達500至1000公噸,預計將增加現有工廠的金屬沖壓線的生產能力,將用于製造新鴻發的汽車替換鈑金配件,如汽車發動機罩、防護板、車門及行李蓋。

新鴻發董事經理陳日新說:“ 隨著新鴻發在海外市場的成長,我們看到公司產品需求量正增加,長遠目標是擴大區域和國際市場。因此這些機器的投資是必要的。”

他指出,這3部油壓機將附加現有的生產線,有助提高現有生產設施效率,預計可在明年第2季能運扺。

“我們選擇從鴻霖購買這些機器,是因為這家公司專業從事油壓機並已20年了。新鴻發常會選者擇高技術以確保最高標準及生產一貫優質的產品。”[ChinaPress] |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2012 04:30 PM

|

显示全部楼层

发表于 1-5-2012 04:30 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2012 03:27 AM

|

显示全部楼层

发表于 4-5-2012 03:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 31/03/2012 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 31/03/2012 | 31/03/2011 | 31/03/2012 | 31/03/2011 | | $$'000 | $$'000 | $$'000 | $$'000 | | 1 | Revenue | 54,018 | 53,710 | 54,018 | 53,710 | | 2 | Profit/(loss) before tax | 5,670 | 7,809 | 5,670 | 7,809 | | 3 | Profit/(loss) for the period | 4,095 | 7,169 | 4,095 | 7,169 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,095 | 7,082 | 4,095 | 7,082 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.45 | 9.42 | 5.45 | 9.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.9000 | 3.8500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-5-2012 01:44 AM

|

显示全部楼层

发表于 5-5-2012 01:44 AM

|

显示全部楼层

新鸿发营业额微增

财经新闻 财经 2012-05-04 12:40

(吉隆坡3日讯)新鸿发(NHFatt,7060,主板消费产品股) 截至今年3月31日首季,取得5401万8000令吉营业额,比上财年同期的5371万令吉,按年微涨0.57%。

现财年首季净利则按年劲挫42.18%至409万5000令吉,上财年同期则报708万2000令吉。

新鸿发现财年首季的每股盈利为5.45仙,比上财年同期的9.42仙,按年大跌42.14%。

新鸿发指出,现财年首季营业额增长归功出口销售报捷。

“可是,制造与营运成本增加,以及外汇亏损提高,导致现财年首季净利萎缩。”[Nanyang] |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2012 02:02 AM

|

显示全部楼层

发表于 25-5-2012 02:02 AM

|

显示全部楼层

本帖最后由 icy97 于 25-5-2012 02:25 AM 编辑

| Submitting Merchant Bank | : | - | | Company Name | : | NEW HOONG FATT HOLDINGS BERHAD | | Stock Name | : | NHFATT | | Date Announced | : | 24/05/2012 |

| EX-date | : | 20/06/2012 | | Entitlement date | : | 22/06/2012 | | Entitlement time | : | 05:00:00 PM | | Entitlement subject | : | Final Dividend | | Entitlement description | : | | Final single tier dividend of eight (8) sen and a special final single tier dividend of one (1) sen per ordinary share of RM1.00 each for the financial year ended 31 December 2011 |

| | Period of interest payment | : | to | | Financial Year End | : | 31/12/2011 | | Share transfer book & register of members will be | : | to closed from (both dates inclusive) for the purpose of determining the entitlements | | Registrar's name ,address, telephone no | : | Tricor Investor Services Sdn Bhd

Level 17, The Gardens North Tower

Mid Valley City

Lingkaran Syed Putra

59200 Kuala Lumpur

Tel No.: 03-2264 3883 |

| | Payment date | : | 12/07/2012 |

a. |

Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers |

| : | 22/06/2012 |

b. |

Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| : | |

c. |

Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. |

| | Number of new shares/securities issued (units) (If applicable) |

| : | | | Entitlement indicator | : | Currency | | Currency | : | Malaysian Ringgit (MYR) | | Entitlement in Currency | : | 0.09 |

| | Remarks : | | The proposed Final Single Tier Dividends are subject to shareholders' approval at the forthcoming Fifteenth Annual General Meeting of the Company to be held on 18 June 2012. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-6-2012 02:13 AM

|

显示全部楼层

发表于 19-6-2012 02:13 AM

|

显示全部楼层

出口收入增26% 新鴻發續專注擴外

財經股市18/06/2012 23:10

(吉隆坡18日訊)汽車替代零件製造商及分銷商新鴻發(NHFATT,7060,主要板消費)說,隨著2011年出口業務收入穩定增長26.1%,將持續擴張海外業務,尤其是印尼。

自東南亞自由貿易區在2010年落實后,該公司在全球市場有強大吸引力,出口收入在過去5年穩定增長;出口收入值從2010年的5180萬令吉,增長至2011年的6510萬令吉。

今年首季總收入按年增長0.6%至5400萬令吉。

新鴻發董事經理陳日新在常年股東大會記者會上表示:“ 我們努力擴大公司在東協國家市佔率。”

為迎合新鴻發產品日益增長需求,該公司已投資德國最先進的3D雷射切割科技在巴生的廠房。

陳日新說,公司目前專注東協市場,如泰國、印尼、馬來西亞、新加坡等國家業務發展,尤其是印尼,暫不會開拓新市場。

該公司今年將撥出3000萬令吉作為資本開銷,主要製作新模具。此外,新鴻發位于鵝嘜工廠將在今年7月搬遷至泗岩沫;泗岩沫新建築的廠庫共耗資700萬令吉,預計本年底竣工。

該公司說,雖然今年全球經濟展望仍不穩定,但仍樂觀認為在本財年中將有良好表現。[ChinaPress] |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-6-2012 09:27 PM

|

显示全部楼层

发表于 19-6-2012 09:27 PM

|

显示全部楼层

上!上!上!!!!! |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-6-2012 11:38 PM

|

显示全部楼层

本帖最后由 icy97 于 20-6-2012 12:40 AM 编辑

业务转至国外增盈利‧新鸿发瞄准东盟车市

大馬 2012-06-19 11:38

(吉隆坡18日讯)新鸿发集团(NHFATT,7060,主板消费品组)瞄准日益蓬勃的东盟汽车市场,希望可在当地市场分一杯羹,並逐渐將业务转移至国外市场以提高公司盈利表现。

新鸿发董事经理陈日新在股东大会上表示,自东盟自由贸易区(AFTA)实施后,有效为公司业务扩展至东盟市场,並为公司的出口营业额在过去5年里带来稳步成长。

“我们致力於扩大东盟汽车更换零件的市场份额,而目前我们也已在当地取得显著的地位。”

陈日新表示,预计东盟共同体在2015年落实后,將成为驱动公司国外营业成长的引擎,他们並放眼公司在2015年后业务可进一步扩展至越南、缅甸等地区。

大马市场小

“对於汽车零件销售而言,大马是一个很小的市场,我们往后將会把业务注重在更庞大的国外市场上。”

截至2011年財政年,公司出口营业额按年上涨26.10%至6千510万令吉,並佔有公司总营业额的30%。

当被询及公司为何在2011年財年净利会下滑时,陈日新表示,因一些扩展活动加上员工薪资提高下,促使公司去年盈利受影响。

“我们去年在印尼及中国分別设立了一家子公司,但预计在上述公司投入运作后,可改善公司的盈利表现。”

至於薪资方面,陈日新表示,薪资目前佔有公司约20%的营运成本,相信公司往后多添置机器后,可弥补薪资高涨带来的压力。

此外,公司耗资700万令吉將位於泗岩沫(Segambut)的仓库扩大至双层楼高,並预计在今年尾完成。(星洲日报/財经)

http://biz.sinchew-i.com/node/61781 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-6-2012 12:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-6-2012 05:18 PM

|

显示全部楼层

发表于 20-6-2012 05:18 PM

|

显示全部楼层

yatlokfatt 发表于 20-6-2012 12:06 AM

????????????????? |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-8-2012 07:31 PM

|

显示全部楼层

发表于 2-8-2012 07:31 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30/06/2012 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30/06/2012 | 30/06/2011 | 30/06/2012 | 30/06/2011 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 54,622 | 59,333 | 108,640 | 113,043 | | 2 | Profit/(loss) before tax | 9,835 | 8,146 | 15,505 | 15,955 | | 3 | Profit/(loss) for the period | 9,457 | 7,151 | 13,552 | 14,320 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,457 | 7,069 | 13,552 | 14,151 | | 5 | Basic earnings/(loss) per share (Subunit) | 12.58 | 9.41 | 18.03 | 18.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.0300 | 3.8500 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-8-2012 10:26 AM

|

显示全部楼层

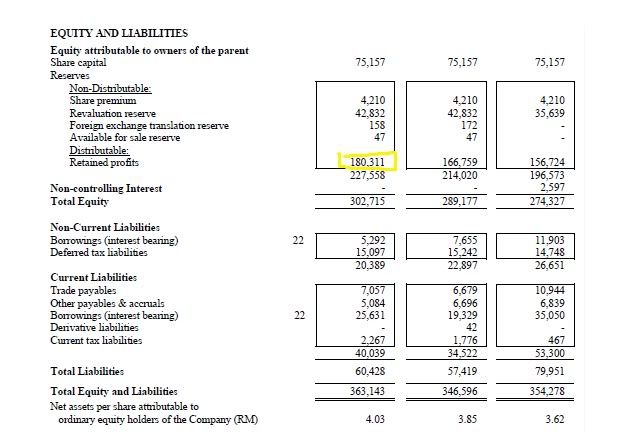

公司的可以分发累积收益已经来到180million了。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-11-2012 10:39 PM

|

显示全部楼层

Quarterly rpt on consolidated results for the financial period ended 30/9/2012| NEW HOONG FATT HOLDINGS BERHAD |

| Financial Year End | 31/12/2012 | | Quarter | 3 | | Quarterly report for the financial period ended | 30/09/2012 | | The figures | have not been audited |

SUMMARY OF KEY FINANCIAL INFORMATION

30/09/2012 |

INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30/09/2012 | 30/09/2011 | 30/09/2012 | 30/09/2011 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 53,864 | 50,755 | 162,504 | 163,798 | | 2 | Profit/(loss) before tax | 8,837 | 8,106 | 24,342 | 24,061 | | 3 | Profit/(loss) for the period | 7,622 | 7,041 | 21,174 | 21,361 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,622 | 7,102 | 21,174 | 21,253 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.14 | 9.45 | 28.17 | 28.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 3.00 | 3.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.0400 | 3.8500 |

| Remarks : | | The Board of Directors is pleased to declare an interim single tier dividend of 3 sen per ordinary share of RM1.00 each in respect of the financial year ending 31 December 2012. The dividend will be paid on 20 December 2012 to all shareholders registered in the Record of Depositors on 6 December 2012. |

本帖最后由 icy97 于 20-11-2012 10:59 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2012 11:00 PM

|

显示全部楼层

发表于 20-11-2012 11:00 PM

|

显示全部楼层

| NEW HOONG FATT HOLDINGS BERHAD |

EX-date | 04/12/2012 | Entitlement date | 06/12/2012 | Entitlement time | 05:00:00 PM | Entitlement subject | Interim Dividend | Entitlement description | An interim single tier dividend of 3 sen per ordinary share of RM1.00 each for the financial year ending 31 December 2012 | Period of interest payment | to | Financial Year End | 31/12/2012 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlements | Registrar's name ,address, telephone no | Tricor Investor Services Sdn Bhd

Level 17, The Gardens North Tower

Mid Valley City

Lingkaran Syed Putra

59200 Kuala Lumpur

Tel No.: 03-2264 3883 | Payment date | 20/12/2012 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 06/12/2012 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2012 10:26 AM

|

显示全部楼层

发表于 21-11-2012 10:26 AM

|

显示全部楼层

|

这只股升得很慢。。。。。。。。但是盈利好像开始稳定了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2012 10:46 PM

|

显示全部楼层

发表于 19-12-2012 10:46 PM

|

显示全部楼层

新鴻發2290萬購印尼地

財經股市20/12/2012 22:45

(吉隆坡20日訊)我國汽車后備零件生產及經銷商新鴻發(NHFATT,7060,主要板消費),以2290萬令吉收購印尼土地。

新鴻發向馬交所報備,子公司印尼PT新鴻發汽車供應(NHF Indonesia)購買土地。

“我們目前租借倉庫經營生意,購買土地是為了未來的擴充計劃。”

購買該土地的資金,其中透過內部融資及向印尼銀行貸款200億印尼盾(約640萬令吉)。

該土地位于印尼耶加達本加鄰安,約1萬1830平方公尺,可建築範圍約7540平方米。[ChinaPress]

| NEW HOONG FATT HOLDINGS BERHAD |

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | INTENTION TO ACQUIRE PROPERTIES IN INDONESIA | The Board of Directors of New Hoong Fatt Holdings Berhad (“Company” or “NHF”) wishes to announce that PT NHF Auto Supplies Indonesia, an indirect wholly-owned subsidiary of NHF, had on 18 December 2012 executed the letters of offer at Jakarta, Indonesia to purchase properties with a factory/warehouse building erected thereon comprising eight (8) pieces of lands adjacent to each other and situated at Jalan Raya Kamal Muara, Kamal Muara, Penjaringan, Jakarta Utara, Indonesia from Mr Nayon and Ms Venny Wijaya, who are father and daughter, both Indonesian citizens residing in Indonesia.

This announcement is dated 19 December 2012.

|

本帖最后由 icy97 于 21-12-2012 01:59 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2012 12:58 AM

|

显示全部楼层

发表于 21-12-2012 12:58 AM

|

显示全部楼层

新鸿发购印尼仓储厂房

财经新闻 财经 2012-12-21 11:33

(吉隆坡20日讯)新鸿发(NHFatt,7060,主板消费产品股)向马交所报备,旗下印尼间接子公司印尼新鸿发汽车供应(PT NHF)将以2290万令吉收购雅加达一座仓储厂房。

新鸿发说,印尼新鸿发汽车供应目前租用厂房生产,收购上述仓储厂房旨在拓展业务。

新鸿发的上述收购资金部份将由内部筹集及向银行借代贷。

另一方面,新鸿发董事经理陈日新透过文告表示,公司将再度参与上海汽配展(Automechanika Shanghai),接下来将积极探讨亚洲增长中市场潜力。

探讨亚洲市场

陈日新说,公司连续第三年参与国际知名的上海汽配展,冀望透过这贸易展会见现有客户,强化双方关系,公司将专注探讨对产品有高需求的亚洲增长中市场。

新鸿发过去一年积极争取和强化印尼与中国市场,并成功拓展新出口市场至阿尔及利亚、巴西、突尼西亚、孟加拉、摩洛哥和越南。

目前,新鸿发出口50个国家。[Nanyang]

| NEW HOONG FATT HOLDINGS BERHAD |

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | INTENTION TO ACQUIRE PROPERTIES IN INDONESIA | (Unless otherwise stated, definitions used in this announcement shall carry the same meanings as defined in the announcement dated 19 December 2012 (“Announcement”) on the Intention to Acquire Properties in Indonesia)

Further to the Announcement, the Board of Directors of NHF wishes to announce the following additional information in relation to the payment terms of the Proposed Acquisition of Properties:

1. The payment structure in Indonesia with regards to sale and purchase of landed properties usually involves 100% of the consideration price to be paid in full upon signing of sale and purchase agreements together with the delivery of vacant possession. If the transaction involves a sale of a property from an individual to a company, the land title of the subject property has to be converted from freehold to leasehold land, in accordance with the land regulations in Indonesia, before it can be registered in the purchaser's name. The tenure of such lease is usually 30 years upon conversion and renewable upon expiry.

2. Instead of paying 100% of the Consideration Price, PT NHF had negotiated with the Vendors to pay Deposit of 40% of Consideration Price upon signing of the Offer Letters and 55% of the Consideration Price upon signing of sale and purchase agreements (“SPA”). After the execution of the Offer Letters, the title of the Lands will be converted from freehold to leasehold land and this process normally takes about two (2) to three (3) weeks to complete. Meanwhile, the SPA for the Proposed Acquisition of Properties will be drawn up and at the same time PT NHF will be obtaining financing from a financial institution / bank in Indonesia.

Once the SPA have been finalised coupled with the completion of land conversion and approval of bank loan, PT NHF and the Vendors will then sign the SPA and this is expected to be done no later than 6 February 2013 in accordance with the terms contained in the Offer Letters. Upon the execution of the SPA, PT NHF will pay the balance 55% of Consideration Price and the Vendors will hand over the keys to the Properties to PT NHF.

3. PT NHF had further negotiated to retain a sum of 5% of Consideration Price in order to confirm by physical inspection that the Properties are vacant. This will take place immediately after execution of the SPA and the handover of keys to the Properties. Upon confirmation that the Properties are vacant, the balance 5% of the Consideration Price shall be paid to the Vendors immediately. If the Properties are not vacant on the day after the handover of keys, the said balance sum of 5% will be forfeited as compensation for making the Properties vacant. For avoidance of doubt and as an illustration, if the Properties are completely vacant upon inspection on the day of handover of keys, then PT NHF has to pay the balance of 60% (55% + 5%) of the Consideration Price to the Vendors upon signing of the SPA. Thereafter, the title of the Lands can be registered in PT NHF's name.

This announcement is dated 20 December 2012.

|

本帖最后由 icy97 于 21-12-2012 01:12 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2013 10:40 PM

|

显示全部楼层

发表于 30-1-2013 10:40 PM

|

显示全部楼层

icy97 发表于 19-12-2012 10:46 PM

新鴻發2290萬購印尼地

財經股市20/12/2012 22:45

| NEW HOONG FATT HOLDINGS BERHAD |

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ACQUISITION OF PROPERTIES IN INDONESIA | Reference is made to the announcements dated 19 December 2012 and 20 December 2012 respectively on the Intention to Acquire Properties in Indonesia.

Further to the execution of the letters of offer dated 18 December 2012 (“Offer Letters”) in relation to the Intention to Acquire Properties as announced on 19 December 2012 and 20 December 2012 respectively, the Board of Directors of New Hoong Fatt Holdings Berhad (“NHF”) wishes to announce that PT NHF Auto Supplies Indonesia, an indirect wholly-owned subsidiary of NHF, had on 30 January 2013 successfully executed the sale and purchase agreements at Jakarta, Indonesia, in connection with the proposed acquisition of properties from Mr Nayon and Ms Venny Wijaya (“Acquisition of Properties”).

This announcement is dated 30 January 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2013 10:31 PM

|

显示全部楼层

发表于 26-2-2013 10:31 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31/12/2012 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31/12/2012 | 31/12/2011 | 31/12/2012 | 31/12/2011 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 54,963 | 51,772 | 217,467 | 215,570 | | 2 | Profit/(loss) before tax | 3,332 | 1,798 | 27,674 | 25,859 | | 3 | Profit/(loss) for the period | 1,618 | -1,448 | 22,792 | 19,913 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,618 | -1,448 | 22,792 | 19,805 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.15 | -1.93 | 30.33 | 26.35 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.00 | 9.00 | 13.00 | 12.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.0300 | 3.8500 |

| Remarks : | PROPOSED FINAL DIVIDENDS OF A TOTAL 10 SEN PER SHARE

The Board of Directors is pleased to propose a final single tier dividend of 8 sen and a special final single-tier dividend of 2 sen per ordinary share of RM1.00 each for the financial year ended 31 December 2012. The proposed final dividends are subject to the approval of the shareholders at the forthcoming Annual General Meeting of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-5-2013 01:52 AM

|

显示全部楼层

发表于 3-5-2013 01:52 AM

|

显示全部楼层

新鴻發首季淨利揚65%

財經股市2 May 2013 22:15

(吉隆坡2日訊)新鴻發(NHFATT,7060,主要板消費)成功降低生產成本,2013財年首季淨利按年攀高65%,錄得675萬5000令吉。

該公司今日發佈文告指出,相較去年同期錄得的409萬5000令吉淨利,今年首季表現已明顯改善。

“淨利明顯上揚,主要是生產成本減低帶動。”

截至3月31日首季,新鴻發營額按年僅微揚0.5%,至5431萬3000令吉,主要是因旗下製造業營業額貢獻放緩,按年滑落近2%至4070萬令吉,拖累整體表現。

“展望未來,全球經濟前景仍疲軟無力,公司前景仍充滿挑戰,但將續專注提高製造業務效率,推動成長。”[中国报财经] |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|