|

|

发表于 14-5-2017 06:51 AM

|

显示全部楼层

发表于 14-5-2017 06:51 AM

|

显示全部楼层

本帖最后由 icy97 于 16-5-2017 03:00 AM 编辑

达洋以股代息送柏达纳股票

2017年5月13日

(吉隆坡12日讯)达洋企业(DAYANG,5141,主板贸服股)建议,派送高达2亿9222万9202股的柏达纳(PERDANA,7108,主板贸服股)股票,除了“以股代息”回馈股东。

此外,也可提升后者的公众持股率。

达洋企业向交易所报备,截至4月30日,该公司共持柏达纳98%,而“以股代息”的份额,则约是37.5%股权。

因此,达洋企业在柏达纳的持股率,随后将降至60.5%。

该公司表示,将动用盈利保留户头来完成上述活动。

达洋企业收购了柏达纳后,后者的公众持股率一直低于10%,最后在2015年9月30日遭交易所勒令停牌。

只有在柏达纳的公众持股率恢复至25%以上,该股才能恢复交易。

达洋企业在周一(8日)也向交易所申请,进一步延长符合公众持股率要求的期限。

改善公众持股率

目前,达洋企业共持有柏达纳的98%股权,意味着公众持股率只有2%。

因此,建议以股代息不仅能回馈股东,也可改善柏达纳公众持股率长期不达标的情况。

同时,也让股东在不涉及成本的情况下,直接投资在柏达纳。

上述建议料第三季完成。【e南洋】

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | DAYANG ENTERPRISE HOLDINGS BERHAD ("DAYANG" OR "COMPANY")PROPOSED DISTRIBUTION OF UP TO 292,229,202 ORDINARY SHARES IN PERDANA PETROLEUM BERHAD ("PERDANA") ("PERDANA SHARES") BY WAY OF DIVIDEND-IN-SPECIE TO THE SHAREHOLDERS OF DAYANG ("PROPOSED DIVIDEND-IN-SPECIE") | On behalf of the Board of Directors of the Company, Maybank Investment Bank Berhad wishes to announce that the Company proposes to distribute up to 292,229,202 Perdana Shares, representing about 37.5% equity interest in Perdana, by way of dividend-in-specie to the shareholders of the Company.

Please refer to the attachment for further details on the Proposed Dividend-In-Specie.

This Announcement is dated 12 May 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5425797

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2017 07:05 AM

|

显示全部楼层

发表于 21-5-2017 07:05 AM

|

显示全部楼层

本帖最后由 icy97 于 23-5-2017 02:47 AM 编辑

达洋企业

以股代息激励正面

2017年5月16日

分析:丰隆投行研究

目标价:1.42令吉

最新进展:

达洋企业(DAYANG,5141,主板贸服股)建议以股代息,派送高达2亿9222万9202股的柏达纳(PERDANA,7108,主板贸服股)股票,相等于37.5%股权。

目前,达洋企业共持有柏达纳的98%股权,随后,达洋企业的持股率将减至60.5%。

行家建议:

这对达洋企业十分正面,会更好地反映该公司持有的股权价值。

在柏达纳的股票流通率增加后,将可提供额外的筹资途经。

假设根据达洋企业当初强制全购柏达纳的成本每股1.55令吉,派发37.5%的股票当股息,意味着达洋企业的股东可获得每股价值51仙的柏达纳股票,回酬率达41.7%。

不过,由于去年油价大跌,以上的假设已经不实际,因为那是在油价崩跌之前的高溢价估值。

根据我们估计,柏达纳98%股权的合理价值预计为3亿7080万令吉,因此,股东获得的股息是每股14仙,或11%的回酬率。

以股代息对达洋企业的盈利影响甚小,维持盈利预测、“买入”评级和1.42令吉的目标价。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2017 03:57 AM

|

显示全部楼层

发表于 30-5-2017 03:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 117,910 | 111,830 | 117,910 | 111,830 | | 2 | Profit/(loss) before tax | -36,753 | -22,739 | -36,753 | -22,739 | | 3 | Profit/(loss) for the period | -43,494 | -26,803 | -43,494 | -26,803 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -42,583 | -26,386 | -42,583 | -26,386 | | 5 | Basic earnings/(loss) per share (Subunit) | -4.85 | -3.01 | -4.85 | -3.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3900 | 1.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2017 01:16 AM

|

显示全部楼层

发表于 7-8-2017 01:16 AM

|

显示全部楼层

小股东患得患失/万年船

2017年8月6日

小股东大权利

本周的达洋企业(DAYANG)股东特大,是建议以特别股息的方式把柏达纳(PERDANA)的37.5%股票派给股东,以达到后者符合公众持股的要求。

这是达洋企业全面收购柏达纳不成功,却又想保持后者的上市地位所做出的决定。

达洋企业是在2015年5月,以每股1.55令吉的出价来收购柏达纳,当时油价已经在走下坡,达洋企业似乎过早出手,价钱较高;不过却遭到柏达纳的小股东顽抗,最后只持有了98%的控制权。

拜收购后停牌之福,柏达纳没什么变动,而达洋企业的股价却从收购那时的大约3令吉,一路跌到1令吉,惨不忍睹,也让小股东饱受折腾。

这次的以股代息,不像之前的合顺(UMW)派合顺油气(UMWOG),那是“全派”,把合顺油气全派出去,和它割绝关系。

达洋企业只是派发其中37.5%,之后还是柏达纳大股东。

达洋企业的小股东此时的心情正是患得患失。

达洋企业是以1股派0.3股的方式把柏达纳派出来,照本钱(1.55令吉)来算,是派出46.5仙的股息,以目前达洋企业的1令吉股价,周息率非常丰厚。

不过,如今油价低迷,别说1.55令吉,柏达纳如果重新交易,有没有1令吉的股价也成为疑问,如果两边股价相对调整,即达洋企业调整46.5仙,而柏达纳则向下调整,那么达洋企业的小股东无可置疑是大输家。

唯一可以庆幸的是,股额没有调整。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2017 05:14 AM

|

显示全部楼层

发表于 24-8-2017 05:14 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 191,017 | 193,581 | 308,927 | 305,411 | | 2 | Profit/(loss) before tax | -35,598 | 12,808 | -72,351 | -9,930 | | 3 | Profit/(loss) for the period | -49,761 | -2,347 | -93,255 | -29,149 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -48,098 | -1,953 | -90,803 | -28,338 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.12 | -0.22 | -9.99 | -3.23 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2800 | 1.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2017 03:53 AM

|

显示全部楼层

发表于 30-9-2017 03:53 AM

|

显示全部楼层

本帖最后由 icy97 于 1-10-2017 03:35 AM 编辑

达洋获国油勘探5年合约

2017年9月30日

(吉隆坡29日讯)达洋企业(DAYANG,5141,主板贸服股)宣布 ,获得国油勘探(Petronas Carigali)颁发的维修、承建以及改装(MCM)供应服务配套A(岸外)-砂拉越石油合约。

该公司向交易所报备,这项合约将为期5年,及延长1年选择权,从9月20日起生效,并会在2022年9月19日到期。

不过,该公司并无透露合约价值。

根据合约,工作范围就是进行国油勘探发出的工作订单,以及将包括提供普遍有关上部结构(topside)维修、油井维修准备工作,及改善设施计划的工作或服务。【e南洋】

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR PROVISION OF MAINTENANCE, CONSTRUCTION AND MODIFICATION (MCM) SERVICES FOR PETRONAS CARIGALI SDN BHD FOR PACKAGE A (OFFSHORE) - SARAWAK OIL ("the CONTRACT") | 1. INTRODUCTION The Board of Directors of Dayang Enterprise Holdings Bhd (" Dayang") or ("the Company") is pleased to announce that its wholly-owned subsidiary, Dayang Enterprise Sdn Bhd ("DESB"), has been awarded a contract on 20 September 2017 from PETRONAS Carigali Sdn Bhd ("PETRONAS Carigali") for Provision of Maintenance, Construction and Modification (MCM) Services Package A (Offshore) - Sarawak Oil ("the Contract").

2. VALUE AND DURATION OF CONTRACT The contract duration will be for a primary period of five (5) years with one (1) year extension option effective 20 September 2017 and will expire on 19 September 2022 at an agreed fixed schedule of rates. The details of the scope of work in relation to the Contract will be addressed in a work order which will be issued by PETRONAS Carigali and shall include any or all other work or services which is generally related to Topside Structural Maintenance, Workover Preparation and Facilities Improvement Project.

3. FINANCIAL EFFECTS The Contract will have no effect on the Issued and Paid-up Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company for the duration of the Contract.

4. RISK FACTORS Risk factors affecting the award include execution risks such as availability of skilled manpower and materials, changes in prices of materials, changes in political, economic and regulatory conditions. Throughout the years, DESB has established its track record and expertise to undertake these projects. Notwithstanding this, DESB shall ensure strict compliance to the safety and operational procedures in the execution of contract requirements.

5. DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS None of the Directors and/or major shareholders and/or persons connected with them have any direct or indirect interest in the Contract.

6. DIRECTORS' STATEMENT The Board of Directors of the Company is of the opinion that the acceptance of the Contract is in the best interest of the Company.

This announcement is dated 29 September 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2017 05:26 AM

|

显示全部楼层

发表于 3-10-2017 05:26 AM

|

显示全部楼层

本帖最后由 icy97 于 3-10-2017 06:16 AM 编辑

达洋企业

新合约价值逾10亿

2017年10月3日

分析:MIDF投资研究

目标价:83仙

最新进展

达洋企业(DAYANG,5141,主板贸服股)宣布 ,获得国油勘探(Petronas Carigali)颁发的维修、承建以及改装(MCM)供应服务配套A(岸外)-砂拉越石油合约。

这项合约将为期5年,及延长1年选择权,从9月20日起生效,并会在2022年9月19日到期。

不过,该公司并无透露合约价值。

该新合约将进一步推高公司手持订单逾30亿令吉,足以让公司忙碌至2022年。

行家建议

尽管新合约并无透露价值,但我们估计总合约价值逾10亿令吉。

目前,公司有7艘平均船龄4.7年的工作驳船,另有9艘平均船龄6年的工作船,皆符合国油和其他承包商的规格要求。

基于上述新合约符合预期,因此我们维持全年净利预测。

该公司将在2018财年上半年,开始规划和调动离岸资产,意味着实际活动及盈利贡献,将在下半年才开始。

我们预测达洋企业的盈利上涨周期,将从2018财年下半年开始,因此建议投资者“短线卖出”,以从正面的消息里锁定利益,维持目标价83仙。

【e南洋】

国油合约价估料达15亿.达洋财测维持

(吉隆坡2日讯)达洋企业(DAYANG,5141,主板贸服组)获得国油探勘公司(Petronas Carigali)颁给“5+1”服务合约。

合约价值视服务次数而定

该公司将负责砂拉越石油的离岸维修、建筑和调正服务为期5年,可续约一年,合约价值视服务次数而定。

分析

肯纳格对该公司取得这项期待已久的合约持正面看法,虽然合约价值未公布,但相信介于10亿至15亿令吉。

至于赚幅则料低于之前所赢得的合约,估计约15至20%,相比油价崩盘前的赚幅达20至25%。

达洋企业在2011年曾获国油颁发8亿令吉维修合约,之后工程增加,令合约价值扩大至14亿令吉。

该行保持财测不变,因已预期今年的合约填补为15亿令吉及此合约只在2018年才贡献显著盈利。

持30亿订单

MIDF研究指出,包含此合约后,该公司手上的合约订单共逾30亿令吉,可忙碌至2022年。

该行指出,达洋企业对国油的维持、建筑和调正工程并不陌生,该公司早前在2013年已为国油提供相关工程。

该行表示,此合约是在预期之中,相信该公司在2018财年上半年展开岸外资产的规划和调度及相关活动只在2018财年下半年才启动,到时才带来显著盈利。

该行预期达洋企业的盈利上升周期将于2018财年下半年开始,因此建议投资者套此正面消息传出后展开短期沽售。

但该行重申,达洋企业的基本面保持良好,同时手握强劲订单。

文章来源:

星洲日报‧财经‧2017.10.02 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-10-2017 06:49 AM

|

显示全部楼层

发表于 12-10-2017 06:49 AM

|

显示全部楼层

送柏达纳37.5%.达洋以股代息延至年杪

(吉隆坡10日讯)达洋企业(DAYANG,5141,主板贸服组)以股代息,派发柏达纳石油(PERDANA,7108,主板贸服组)37.5%股权的计划,可望于今年杪落实,届时达洋企业股东可获得一笔丰硕回酬。

达洋企业是透过特别股息方式派发柏达纳石油股票,有关计划已经获得股东通过,原订是在9月杪完成,惟由于交易所需时审批柏达纳石油的价值而推迟了。

丰隆证券相信,柏达纳石油的订价有点难度,因该股的最后收盘价为1令吉54仙,而这已是2014年的事了。

不过,该行相信,有关计划仍将在2017年杪完成。

依估计,所派发的柏达纳估值约为每股31仙,以达洋最后闭市价计,回酬率约是13%,而且柏达纳估值或远高于此。

此外,达洋企业早前获得国油勘探(PETRONASCARIGALI)一项5年合约,为砂拉越石油配套A(岸外)项目提供保养、建设与修改服务,可选择续约一年。

合约总值虽未透露,惟据丰隆证券探悉,有关合约或逾10亿令吉,可望大幅推高现有的30亿订单总值。

有鉴于此,达洋企业2018年的整体前景更美好,该行给予买进评级,目标1令吉20仙。

文章来源:

星洲日报/财经‧2017.10.11 |

|

|

|

|

|

|

|

|

|

|

|

发表于 3-11-2017 03:54 AM

|

显示全部楼层

发表于 3-11-2017 03:54 AM

|

显示全部楼层

EX-date | 14 Nov 2017 | Entitlement date | 16 Nov 2017 | Entitlement time | 05:00 PM | Entitlement subject | Dividend in specie | Entitlement description | Distribution of up to 292,229,202 ordinary shares in Perdana Petroleum Berhad (Perdana) (Perdana Shares), representing approximately 37.5% equity interest in Perdana held by Dayang Enterprise Holdings Bhd (Dayang) on the basis of approximately 0.302 Perdana Share for each ordinary share held in Dayang (Dayang Share) to the entitled shareholders of Dayang by way of dividend-in-specie (Dividend-In-Specie) | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 16 Nov 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 0.302 : 1 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-11-2017 03:45 AM

|

显示全部楼层

发表于 22-11-2017 03:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 212,803 | 203,629 | 521,730 | 509,040 | | 2 | Profit/(loss) before tax | 14,804 | 47,499 | -57,547 | 37,569 | | 3 | Profit/(loss) for the period | 747 | 36,338 | -92,508 | 7,189 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,122 | 36,174 | -89,681 | 7,836 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.12 | 4.12 | -9.67 | 0.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8000 | 1.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2017 05:49 AM

|

显示全部楼层

发表于 22-12-2017 05:49 AM

|

显示全部楼层

阔别2年复盘跌停板

柏达纳料再跌向25仙

2017年12月19日

(吉隆坡18日讯)相隔逾两年后,柏达纳(PERDANA,7108,主板贸服股)今日恢复交易,但马上一度大跌30仙或31.25%,触及跌停板水平,以66仙闭市,而分析员预计,该股将会进一步跌至25仙的合理价位。在2015年9月30日因公众持股率低于10%而被勒令停牌的柏达纳,在母公司达洋企业(DAYANG,5141,主板贸服股)完成“以股代息”,公众持股提高至20.016%,进而在今日恢复交易。

不过,经过两年的休息后,柏达纳今日如市场预期般大跌,甫开市即暴跌30仙或31.25%,之后维持在66仙水平直至闭市,成交量58万3400股。

蒙亏拉低账面价值

肯纳格投行研究指出,股价大跌主要是在这两年间,柏达纳因累计亏损1亿6000万令吉,导致账面价值减20%;再者,预期今明两年租用率仍低于收支平衡的水平。

此外,同是岸外支援船的同行,目前在0.2至0.5倍的价格对账面价值水平交易。而柏达纳在截至今年第三季时,其每股账面价值已跌至72仙。

“我们认为,柏达纳明年的价格对账面价值为0.4倍,相等于合理价格为25仙,这比两年前的1.54令吉闭市水平低84%,也比第三季的每股账面价值少65%。”

柏达纳今年首9个月核心净亏为6200万令吉,平均租用率53%,我们预计全年将持续蒙受亏损。

未来,该公司冀将船只租用率改善至80%,除了和达洋企业策略合作,目前手持2亿3770万令吉的订单,能确保未来2至3年收益。

此外,该公司正竞标国内和东盟的2亿7000万至3亿5000万令吉合约,包括14项新租约,期长从3个月至5年不等。

达洋减持降负担

另一方面,柏达纳放眼在未来6个月内,完成10%私下配售活动,筹资所得将用在营运资本和偿还贷款。这将把达洋企业在柏达纳的有效股权,降低至55%。

分析员认为,虽然柏达纳对达洋企业带来下行压力,但55%股权其实仅占后者的16%,约12仙估值。

“我们目前维持达洋企业73仙的目标价,相等于明年11.8倍的本益比,以及0.7倍的价格对账面价值。

同时,继续保持‘超越大市’的评级。”

该行看好,达洋企业手持33亿令吉的订单,加上减少在柏达纳的持股权,有望支撑明年业绩复苏。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2017 03:19 AM

|

显示全部楼层

发表于 26-12-2017 03:19 AM

|

显示全部楼层

达洋企业

明年财测上调22%

2017年12月23日

分析:MIDF投行研究

目标价:95仙

最新进展

达洋企业(DAYANG,5141,主板贸服股)截至9月30日第三季净利按年下跌96.9%,达112万2000令吉,营业额则升4.51,达2亿1280万令吉。

不过,岸外支援船使用率改善,从次季44%,提高至第三季超过75%。

行家建议

虽然季候风季节会导致岸外活动减少,但我们相信达洋企业的岸外活动依然活跃,主要是因为国油和生产共享承包商(PSC)积极颁发工程。

考虑到目前岸外活动水平,我们看好达洋企业最快在2018财年次季展开盈利上升周期。

我们相信,达洋企业将会在2018财年录得强劲营业额,可能会达到2014财年水平,且转为更高的盈利。

这是基于维修、承建以及改装(MCM)业务订单、2017年至2019年国油活动展望、达洋企业和子公司柏达纳(PERDANA,7108,主板贸服股)的船使用率高,还有柏达纳有望在明年转亏为盈而作出的推测。

因此,我们把达洋企业2018财年财测调升22.1%,达7340万令吉。该集团的订单合约达34.15亿令吉,也在竞标着80亿令吉的合约。

另外,柏达纳的船使用率目前平均达55%,估计明年将会提高至70%至80%。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2018 04:30 AM

|

显示全部楼层

发表于 24-2-2018 04:30 AM

|

显示全部楼层

本帖最后由 icy97 于 25-2-2018 06:11 AM 编辑

外汇亏损.租金减少.达洋末季转亏5425万

(吉隆坡23日讯)受外汇亏损1960万令吉及租金赚益减少影响,达洋企业(DAYANG,5141,主板贸服组)截至2017年12月31日第四季由盈转亏,录得净亏损5425万2000令吉,比较前期为吉4670万7000令吉,连带全年也录得赤字,净亏损1亿4393万3000令吉,去年同期为净利5454万3000令吉。

全年亏1.44亿

末季营业额报1亿7375万5000令吉,按年减12.77%,拖累全年营业额微减1.8%,至6亿9548万5000令吉。

该公司发文告表示,尽管岸外支援船舰使用率减少,同时船租也下滑25%,但维修、装配与营运工程(HUC)、甲板结构维修保养(TSM)工程和设计、采购、施工及启用(EPCC)活动和获利正有所改善。

“展望2018年,集团将从剩余28亿令吉中攫取营业额,并将继续在新维修保养、建筑及改装(MCM)合约及剩余HUC、EOCC和岸外支援船舰租金等核心竞争力范围内营运。”

达洋企业说,以现有大型石油公司释单及工程规划趋势来看,2018年将是忙碌的一年,对前景依旧乐观。

“随着油价徘徊在每桶60美元水平,MCM、HUC和EPCC现出现更多续约活动,集团也等待部份石油公司竞标结果,若成功得标订单将出现进一步填补。”

整体来看,达洋企业仍继续审慎追求更多合约填补及管理集团现金流以应对非常严峻的市况。

文章来源:

星洲日报/财经‧2018.02.24

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 173,755 | 199,198 | 695,485 | 708,238 | | 2 | Profit/(loss) before tax | -6,292 | 41,115 | -63,839 | 78,684 | | 3 | Profit/(loss) for the period | -59,708 | 46,791 | -152,216 | 53,980 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -54,252 | 46,707 | -143,933 | 54,543 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.62 | 5.33 | -15.36 | 6.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9800 | 1.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2018 07:28 AM

|

显示全部楼层

发表于 27-5-2018 07:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 148,782 | 117,910 | 148,782 | 117,910 | | 2 | Profit/(loss) before tax | -35,979 | -36,753 | -35,979 | -36,753 | | 3 | Profit/(loss) for the period | -47,649 | -43,494 | -47,649 | -43,494 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -21,307 | -42,583 | -21,307 | -42,583 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.21 | -4.85 | -2.12 | -4.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9600 | 0.9900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 04:19 AM

|

显示全部楼层

发表于 28-7-2018 04:19 AM

|

显示全部楼层

本帖最后由 icy97 于 28-7-2018 07:39 AM 编辑

达洋企业获Murphy Oil颁发5年合约

Neily Syafiqah Eusoff/theedgemarkets.com

July 27, 2018 19:21 pm +08

(吉隆坡27日讯)达洋企业(Dayang Enterprise Holdings Bhd)独资子公司Dayang Enterprise Sdn Bhd(DESB),获Murphy Sarawak Oil Co Ltd与Murphy Sabah Oil Co Ltd颁发为期5年的合约,以提供泛马来西亚维护、建造和改造(PM-MCM)。

达洋企业向大马交易所报备,该合约没有确定的价值,因为它取决于按固定费率表发给它的工单。

“合约为期5年,从今年7月17日起生效,截止日期为2023年7月16日,并可选择续约1年。”

“影响该合约的风险因素包括执行风险,如技术人员和材料的可用性、材料价格的变动,以及政治、经济和监管条件的变化。”

达洋企业预计,该合约可为集团盈利作出积极的贡献,以及不会影响其发行股本。

(编译:魏素雯)

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR THE PROVISION OF PAN MALAYSIA MAINTENANCE, CONSTRUCTION AND MODIFICATION ("PM-MCM") CONTRACT FOR YEAR 2018 TO 2023 | 1. INTRODUCTION The Board of Directors of Dayang Enterprise Holdings Bhd ("DEHB" or "the Company") is pleased to announce that its wholly-owned subsidiary company, Dayang Enterprise Sdn Bhd ("DESB"), has been awarded a contract by Murphy Sarawak Oil Co. Ltd and Murphy Sabah Oil Co. Ltd for the Provision of Pan Malaysia Maintenance, Construction and Modification ("PM-MCM") Contract for year 2018 to 2023.

2. VALUE AND DURATION OF THE CONTRACT The value of the Contract is based on work orders issued by Murphy Sarawak Oil Co. Ltd and Murphy Sabah Oil Co. Ltd throughout the Contract duration and shall include any or all other work and services which is generally related to the scope of works in this Contract at a fixed schedule of rates. The duration of the Contract is for a primary period of five (5) years effective from 17 July 2018 and shall expire on 16 July 2023 with an option to extend for a period of one (1) year.

3. RISK FACTORS Risk factors affecting the award include execution risks such as availability of skilled manpower and materials, changes in prices of materials, changes in political, economic and regulatory conditions. Throughout the years, DESB has established its track record and expertise to undertake these projects. Notwithstanding this, DESB shall ensure strict compliance to the safety and operational procedures in the execution of Contract requirements.

4. FINANCIAL EFFECTS The Contract will have no effect on the issued capital of the Company and is expected to contribute positively to the earnings of the Company over the duration of the Contract.

5. DIRECTORS' AND MAJOR SHAREHOLDERS' INTEREST None of the Directors and/or major shareholders and/or persons connected with the Directors and/or major shareholders of the Company has any direct or indirect interest in the Contract.

6. DIRECTORS' STATEMENT The Board of Directors of the Company is of the opinion that the acceptance of the Contract is in the best interest of the Company.

This announcement is dated 27 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2018 05:29 AM

|

显示全部楼层

发表于 31-7-2018 05:29 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 03:32 AM

|

显示全部楼层

发表于 21-8-2018 03:32 AM

|

显示全部楼层

本帖最后由 icy97 于 21-8-2018 05:01 AM 编辑

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR THE PROVISION OF MAINTENANCE, CONSTRUCTION AND MODIFICATION ("PM-MCM") CONTRACT FOR YEAR 2018 TO 2023 FOR KPOC | 1. INTRODUCTION The Board of Directors of Dayang Enterprise Holdings Bhd ("DEHB" or "the Company") is pleased to announce that its wholly-owned subsidiary company, Dayang Enterprise Sdn Bhd ("DESB"), has been awarded a contract by Kebabangan Petroleum Operating Company Sdn Bhd for the Provision of Maintenance, Construction and Modification ("PM-MCM") Contract for year 2018 to 2023.

2. VALUE AND DURATION OF THE CONTRACT The value of the Contract is based on work orders issued by Kebabangan Petroleum Operating Company Sdn Bhd throughout the Contract duration and shall include any or all other work and services which is generally related to the scope of works in this Contract at a fixed schedule of rates. The duration of the Contract is for a primary period of five (5) years effective from 17 July 2018 and shall expire on 16 July 2023 with an option to extend for a period of one (1) year.

3. RISK FACTORS Risk factors affecting the award include execution risks such as availability of skilled manpower and materials, changes in prices of materials, changes in political, economic and regulatory conditions. Throughout the years, DESB has establised its track record and expertise to undertake these projects. Notwithstanding this, DESB shall ensure strict compliance to the safety and operational procedures in the execution of contract requirements.

4. FINANCIAL EFFECTS The Contract will have no effect on the issued capital of the Company and is expected to contribute positively to the earnings of DEHB over the duration of the Contract.

5. DIRECTORS' AND MAJOR SHAREHOLDERS' INTEREST None of the Directors and/or major shareholders and/or persons connected with the Directors and/or major shareholders of the Company has any direct or indirect interest in the Contract.

6. DIRECTORS' STATEMENT The Board of Directors of the Company is of the opinion that the acceptance of the Contract is in the beat interest of the Company.

This announcement is dated 20 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 03:33 AM

|

显示全部楼层

发表于 21-8-2018 03:33 AM

|

显示全部楼层

ype | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR THE PROVISION OF PAN MALAYSIA MAINTENANCE, CONSTRUCTION AND MODIFICATION ("PM-MCM") CONTRACT FOR YEAR 2018 TO 2023 | 1. INTRODUCTION The Board of Directors of Dayang Enterprise Holdings Bhd ("DEHB" or "the Company") is pleased to announce that its wholly-owned subsidiary company, Dayang Enterprise Sdn Bhd ("DESB"), has been awarded a contract by Repsol Oil & Gas Malaysia Limited ("REPSOL") for the Provision of Pan Malaysia Maintenance, Construction and Modification ("PM-MCM") Contract for year 2018 to 2023.

2. VALUE AND DURATION OF THE CONTRACT The value of the Contract is based on work orders issued by REPSOL throughout the Contract duration and shall include any or all other work and services which is generally related to the scope of works in this contract at a fixed schedule of rates. The duration of the Contract is for a primary period of five (5) years effective from 17 July 2018 and shall expire on 16 July 2023 with an option to extend for a period of one (1) year.

3. RISK FACTORS Risk factors affecting the award include execution risks such as availability of skilled manpower and materials, changes in prices of materials, changes in political, economic and regulatory conditions. Throughout the years, DESB has established its track record and expertise to undertake these projects. Notwithstanding this, DESB shall ensure strict compliance to the safety and operational procedures in the execution of contract requirements.

4. FINANCIAL EFFECTS The Contract will have no effect on the issued capital of the Company and is expected to contribute positively to the earnings of DEHB over the duration of the Contract.

5. DIRECTORS' AND MAJOR SHAREHOLDERS' INTEREST None of the Directors and/or major shareholders and/or persons connected with the Directors and/or major shareholders of Dayang has any direct or indirect interest in the Contract.

6. DIRECTORS' STATEMENT The Board of Directors of the Company is of the opinion that the acceptance of the Contract is in the best interest of the Comapny.

This announcement is dated 20 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 04:59 AM

|

显示全部楼层

发表于 22-8-2018 04:59 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 06:50 AM

|

显示全部楼层

发表于 25-8-2018 06:50 AM

|

显示全部楼层

本帖最后由 icy97 于 26-8-2018 03:54 AM 编辑

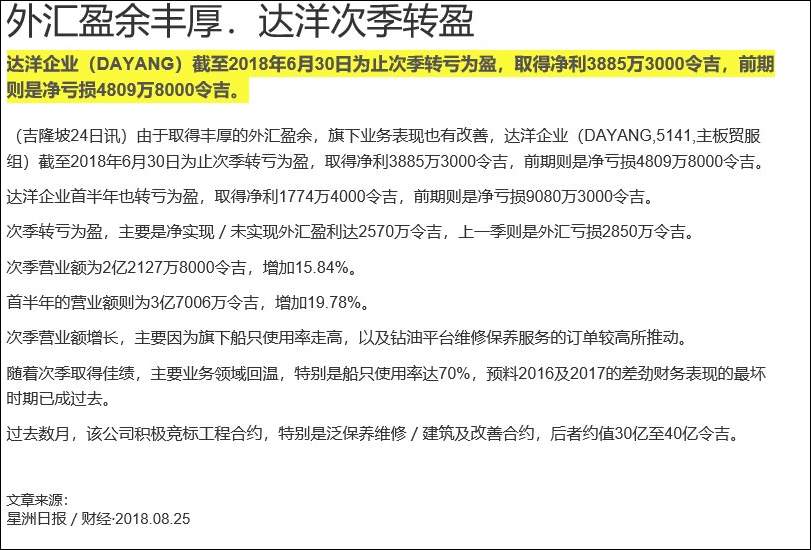

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 221,278 | 191,017 | 370,060 | 308,927 | | 2 | Profit/(loss) before tax | 57,034 | -35,598 | 21,055 | -72,351 | | 3 | Profit/(loss) for the period | 43,041 | -49,761 | -4,608 | -93,255 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 38,853 | -48,098 | 17,744 | -90,803 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.03 | -5.12 | 1.84 | -9.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0100 | 0.9900

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|