|

|

发表于 31-3-2018 12:47 AM

|

显示全部楼层

发表于 31-3-2018 12:47 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | Arbitration between Malaysia Marine and Heavy Engineering Sdn Bhd and Sime Darby Engineering Sdn Bhd (Announcement pursuant to paragraphs 9.03 and 9.04(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Further to the announcement dated 19 March 2015, Sime Darby Berhad ("Sime Darby") wishes to announce that Sime Darby Engineering Sdn Bhd ("SDE"), an indirect wholly-owned subsidiary of Sime Darby had, on 19 March 2018, received a notification from the Asian International Arbitration Centre dated 16 March 2018 that the Arbitral Tribunal had issued its award on 13 March 2018 wherein the Tribunal ordered SDE to pay to Malaysia Marine and Heavy Engineering Sdn Bhd damages for claims in relation to the dispute arising pursuant to the Sale and Purchase Agreement dated 25 August 2011 and the Supplemental Sale and Purchase Agreement dated 30 March 2012, as well as interest and arbitration costs. SDE is in the process of reviewing the award.

The award is not expected to have a material effect on the earnings and the net assets of the Sime Darby Group for the financial year ending 30 June 2018.

None of the Directors or major shareholders of Sime Darby or persons connected with them has any interest, direct or indirect, in the aforesaid award.

Sime Darby will make further announcements on any material development on this matter from time to time.

This announcement is dated 27 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2018 06:38 AM

|

显示全部楼层

发表于 3-4-2018 06:38 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | Arbitration between the Consortium of Sime Darby Engineering Sdn Bhd and Swiber Offshore Construction Pte Ltd and Oil & Natural Gas Corporation Ltd(Announcement pursuant to paragraphs 9.03 and 9.04(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Further to the announcement dated 6 June 2016, Sime Darby Berhad ("Sime Darby") wishes to announce that Sime Darby Engineering Sdn Bhd ("SDE"), an indirect wholly-owned subsidiary of Sime Darby had, on 22 March 2018, received the decision of the Arbitral Tribunal pertaining to the claim by SDE together with Swiber Offshore Construction Pte Ltd (“Swiber”) (collectively referred to as the “Consortium”) against Oil and Natural Gas Corporation Limited (“ONGC”) in relation to the Process Platform for B-193 Project ("Project").

The Tribunal had ordered ONGC to pay the Consortium a net sum of US$5,127,915 as a full and final settlement of all claims. ONGC had, on 27 March 2018, filed an application at the High Court in Mumbai, India to set aside the decision. SDE is seeking legal advice from its lawyers on the next course of action in relation to ONGC’s application.

SDE and Swiber had entered into a Consortium Agreement dated 19 May 2010 for the execution of the Project for a total contract price of US$618,376,022. The Consortium and ONGC had executed the contract for the Project on 3 July 2010. Disputes relating to the Project have since arisen.

The Tribunal’s decision is not expected to have a material effect on the earnings and the net assets of the Sime Darby Group for the financial year ending 30 June 2018.

None of the Directors or major shareholders of Sime Darby or persons connected with them has any interest, direct or indirect, in the aforesaid award.

This announcement is dated 30 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-5-2018 06:13 AM

|

显示全部楼层

发表于 28-5-2018 06:13 AM

|

显示全部楼层

本帖最后由 icy97 于 3-6-2018 06:06 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 8,294,000 | 7,867,000 | 25,253,000 | 22,887,000 | | 2 | Profit/(loss) before tax | 210,000 | 310,000 | 724,000 | 909,000 | | 3 | Profit/(loss) for the period | 148,000 | 768,000 | 1,886,000 | 2,056,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 135,000 | 692,000 | 1,756,000 | 1,867,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.00 | 10.20 | 25.80 | 28.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 2.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0800 | 5.4900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-6-2018 03:52 AM

|

显示全部楼层

发表于 15-6-2018 03:52 AM

|

显示全部楼层

本帖最后由 icy97 于 18-6-2018 02:45 AM 编辑

业绩疲弱股价大跌 森那美走势脱离基本面

財经 最后更新 2018年05月28日 21时13分

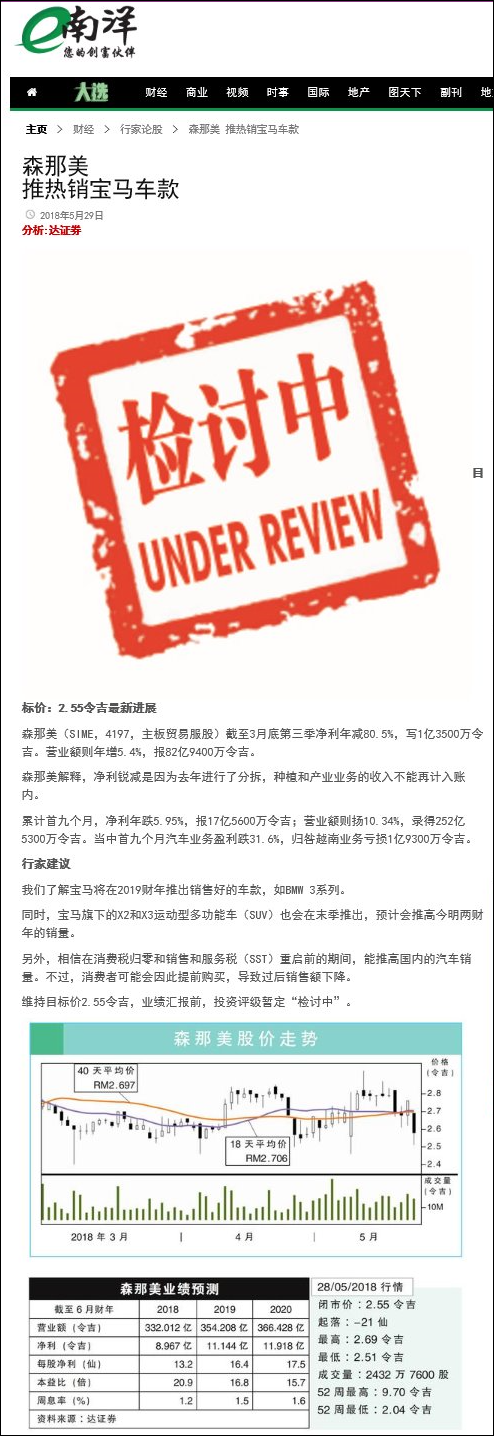

(吉隆坡28日讯)市场人士对森那美(SIME,4197,主板贸服股)在2018財政年第3季(截至3月31日止)交出的业绩成绩单看法不一,但普遍认为该股估值偏高,股价走势已开始脱离基本面。

受疲软业绩拖累,森那美今日大热下挫21仙或7.61%,以2.55令吉掛收,全天成交量为2432万7600股,是全场第11大下跌股与第13大热门股。

工业汽车业务撑前景

达证券分析员指出,排除一次性因素后,儘管森那美首9个月净利仅占其原先预测的63%,但考虑到工业业务可受惠于当前的较高煤炭价格,加上开斋节促销活动刺激汽车销量,该公司末季业绩有望显著提升,因此,今年首3季的表现算是符合预期。

「从过往记录来看, 末季一般上是森那美表现最好的季度。」

展望前景,丰隆投行分析员相信,森那美工业业务將续受益于澳洲矿务和中国建筑业的强劲需求,而即將推出的数个新车款可支撑汽车业务销量,惟,激烈竞爭和谨慎消费情绪皆成挑战。

达证券分析员则指出, 宝马预计在2019財政年推出最受欢迎的3系列新车款,加上计划在2018財政年末季推出的X2、X3等休旅车(SUV)新车款,森那美汽车业务將在2019至2020財政年间受到激励。

同时, 他表示, 在消费税(GST)被调整为0%、销售及服务税重启的空窗期间,森那美在大马的汽车销量將提升,不过,预料许多消费者將会提前购车,因此,往后的销量將下滑。

另一方面,马银行投行分析员称,森那美最新业绩虽好於预期,但其当前股价已充分反映利好,估值偏高。

丰隆投行分析员亦指,森那美股价走势脱离基本面,除估值极高外,其股息亦无吸引力。

【东方网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-6-2018 02:29 AM

|

显示全部楼层

发表于 24-6-2018 02:29 AM

|

显示全部楼层

提振汽车业 工业长期挑战 新政策对森那美衝击不大

財经 最后更新 2018年06月20日 21时17分

(吉隆坡20日讯)希盟政府逐步落实百日新政,至今已分別调低消费税至0%,及喊停隆新高铁(HSR)和捷运3號线(MRT 3)计划,这些进展对森那美(SIME,4197,主板贸服股)无疑是利弊参半。不过,马银行金英投行分析员认为,就目前而言新政府主政对该公司衝击应该不大。

森那美自去年將种植与產业业务分拆上市后,其核心业务转为汽车与工业业务。分析员指出, 目前希盟政府实施的新政策,短期內料提振森那美的汽车销售,但长期而言,其工业业务將充满不明朗。

「零消费税使汽车售价下跌, 料可推动公司汽车业务;而取消隆新高铁和捷运3號线等项目,则会导致建筑业放缓,影响公司工业设备在市场上的需求。」

不过,马银行金英投行分析员指出,森那美目前的股价相对合理,因此,將该公司投资评级上调至「守住」,但目標价维持在2.45令吉。值得注意的是,马银行金英投行于去年杪,自森那美將业务分拆上市起,便未再给予该公司「买入」投资评级。

分析员续说,虽然零消费税让汽车售价下跌了6%,会刺激森那美汽车销量;但由於这项政策从6月1日才开始实行,因此分析员认为,这对公司第4季(6月30日结算)营收并不会带来显著贡献。

「因为5月份的购车者可能会推迟至6月份后才拿车,以享有更低廉的汽车价格。」

税务假期汽车热销

无论如何,分析员指出,在9月1日销售与服务税(SST)推出前长达3个月的税务假期,將会是汽车热销的巔峰时期。「尤其是主流车款,如丰田Vios 和本田Civic车款更会大受追捧。」

至於森那美分销的宝马和现代(Hyundai)品牌车款料也將受到提振。该公司目前的汽车业务比重占国內汽车领域总营收的17%至20%,也佔公司总营业额比重约11%至12%。

长期而言,隆新高铁和捷运3號线计划取消,而东海岸铁路(ECRL)计划也仍有变数,严重打击我国建筑领域,因此,森那美工业设备的市场需求料会隨之减缓。

不过,分析员认为,隨著煤炭价格上涨,带动澳洲的採矿活动復甦,未来森那美的工业设备需求亦会水涨船高。

「截至3月份,该公司的工业订单总值按季提高了5%,至23亿令吉。」

森那美的工业业务比重占行业总营收的8%至11%,也相当於公司本身总营收比重的3%。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2018 12:23 AM

|

显示全部楼层

发表于 3-7-2018 12:23 AM

|

显示全部楼层

本帖最后由 icy97 于 3-7-2018 05:05 AM 编辑

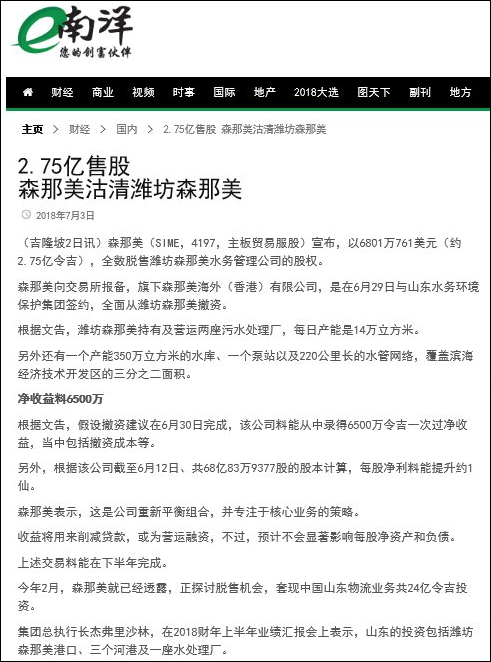

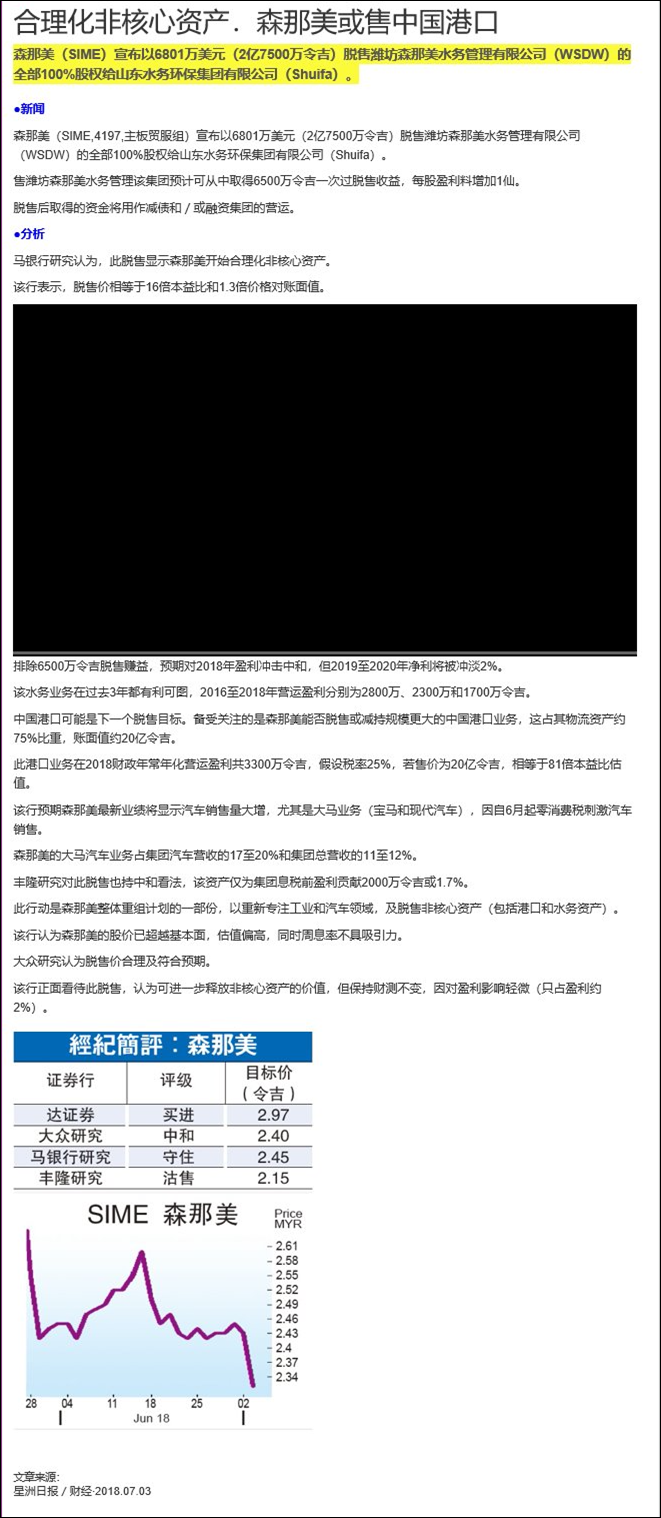

Type | Announcement | Subject | OTHERS | Description | Proposed Divestment of 100% Equity Interest in Weifang Sime Darby Water Management Co., Ltd.(Announcement pursuant to Chapter 9.19(24) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Sime Darby Berhad (“Sime Darby”) wishes to announce that Sime Darby Overseas (HK) Limited, an indirect wholly-owned subsidiary of Sime Darby incorporated in Hong Kong, has on 29 June 2018, entered into a share purchase agreement (“SPA”) with Shandong Water Environmental Protection Group Co., Ltd (“Purchaser”) to divest its entire 100% equity interest in Weifang Sime Darby Water Management Co., Ltd ("WSDW"), an indirect wholly-owned subsidiary of Sime Darby incorporated in the People’s Republic of China, to the Purchaser for a total cash consideration of USD68,010,761 (equivalent to RMB450.0 million or approximately RM275 million) subject to the terms and conditions of the SPA ("Proposed Divestment").

Upon completion of the Proposed Divestment, WSDW will cease to be a subsidiary of Sime Darby.

Please refer to the attachment for details of the announcement.

This announcement is dated 2 July 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5841777

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2018 03:54 AM

|

显示全部楼层

发表于 4-7-2018 03:54 AM

|

显示全部楼层

本帖最后由 icy97 于 4-7-2018 05:17 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 04:59 AM

|

显示全部楼层

发表于 1-9-2018 04:59 AM

|

显示全部楼层

本帖最后由 icy97 于 3-9-2018 04:36 AM 编辑

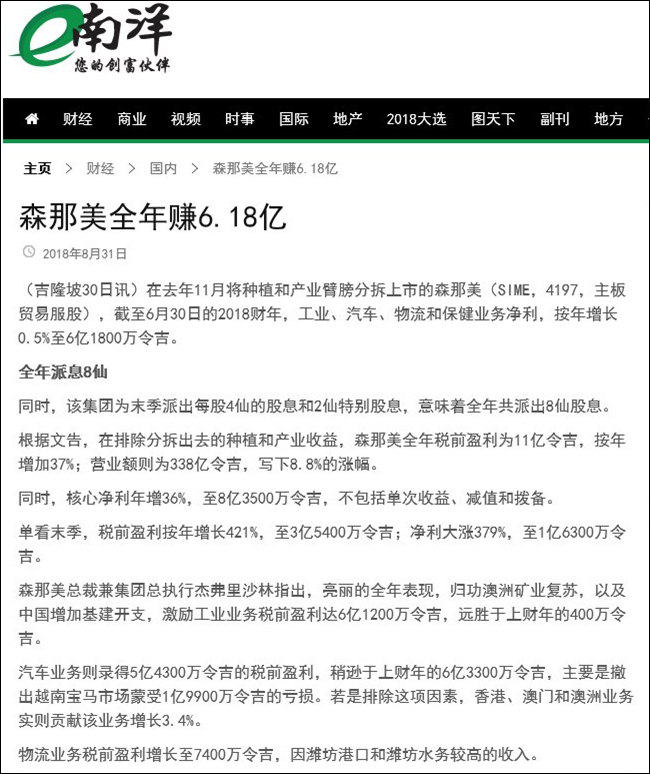

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 8,575,000 | 8,200,000 | 33,828,000 | 31,087,000 | | 2 | Profit/(loss) before tax | 341,000 | 98,000 | 1,065,000 | 1,007,000 | | 3 | Profit/(loss) for the period | 177,000 | 625,000 | 2,063,000 | 2,681,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 163,000 | 571,000 | 1,919,000 | 2,438,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.40 | 8.40 | 28.20 | 36.70 | | 6 | Proposed/Declared dividend per share (Subunit) | 6.00 | 17.00 | 8.00 | 23.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1100 | 5.4900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 05:03 AM

|

显示全部楼层

发表于 1-9-2018 05:03 AM

|

显示全部楼层

EX-date | 27 Sep 2018 | Entitlement date | 01 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second interim dividend of 4 sen per ordinary share in Sime Darby Berhad for the financial year ended 30 June 2018 | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 27 Sep 2018 to 01 Oct 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel: 03-27839299Fax: 03-27839222 | Payment date | 31 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 01 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 27 Sep 2018 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 05:04 AM

|

显示全部楼层

发表于 1-9-2018 05:04 AM

|

显示全部楼层

EX-date | 27 Sep 2018 | Entitlement date | 01 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | Special Dividend | Entitlement description | Special dividend of 2 sen per ordinary share in Sime Darby Berhad for the financial year ended 30 June 2018 | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 27 Sep 2018 to 01 Oct 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel: 03-27839299Fax: 03-27839222 | Payment date | 31 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 01 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 27 Sep 2018 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2018 01:53 AM

|

显示全部楼层

发表于 2-9-2018 01:53 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Incorporation of Shanghai Sime Darby Motor Trading Co. Ltd. and Changsha Sime Darby Motor Sales and Services Company Limited(Announcement pursuant to Chapter 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Sime Darby Berhad ("Sime Darby") wishes to announce the incorporation of the following subsidiaries in the People's Republic of China ("PRC") as limited companies under the PRC Company Law: | Subsidiary Companies | Date of Incorporation | Date of Issuance of Business Licence | Registered Capital | Principal Activities | | 1. | Shanghai Sime Darby Motor Trading Co. Ltd. ("SHSDT"), an indirect 60%-owned subsidiary of Sime Darby | 24 August 2018 | The business licence dated 24 August 2018 issued by Shanghai Administration for Industry & Commerce was received by Shanghai Sime Darby Motor Commerce Co., Ltd. ("SHSDC"), an indirect 60%-owned subsidiary of Sime Darby, on 29 August 2018. | RMB5 million held by SHSDC | Retail of motor vehicles and spare parts and provision of aftersales services | | 2. | Changsha Sime Darby Motor Sales and Services Company Limited ("CSSD"), an indirect wholly-owned subsidiary of Sime Darby | 27 August 2018 | The business licence dated 27 August 2018 issued by Changsha Administration for Industry & Commerce was received by Changsha Bow Yue Vehicle Services Co., Limited, an indirect wholly-owned subsidiary of Sime Darby, on 29 August 2018 | RMB10 million held by B.M.W. Concessionaires (H.K.) Limited | Retail of motor vehicles and spare parts and provision of aftersales services |

The incorporation of SHSDT and CSSD are not expected to have any material effect on the earnings or net assets of the Sime Darby Group for the financial year ending 30 June 2019. None of the Directors or major shareholders of Sime Darby or persons connected with them has any interest, direct or indirect, in the incorporation.

This announcement is dated 30 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 05:48 AM

|

显示全部楼层

发表于 9-9-2018 05:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2018 05:30 AM

|

显示全部楼层

发表于 28-9-2018 05:30 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Proposed Divestment of 100% Equity Interest in Weifang Sime Darby Water Management Co., Ltd.(Announcement pursuant to Chapter 9.19(24) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | We refer to the announcement dated 2 July 2018.

Sime Darby Berhad ("Sime Darby") wishes to announce that the divestment by Sime Darby Overseas (HK) Limited, an indirect wholly-owned subsidiary of Sime Darby, of its entire 100% equity interest in Weifang Sime Darby Water Management Co., Ltd ("WSDW") to Shandong Water Environmental Protection Group Co., Ltd has been completed on 27 September 2018.

Following the completion of the divestment, WSDW has ceased to be an indirect subsidary of Sime Darby with effect from 27 September 2018.

This announcement is dated 27 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 05:11 AM

|

显示全部楼层

发表于 11-10-2018 05:11 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Incorporation of Weifang Sime Darby Logistics Services Co Ltd(Announcement pursuant to Chapter 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Sime Darby Berhad ("Sime Darby") wishes to announce the incorporation of Weifang Sime Darby Logistics Services Co Ltd ("WSDLS"), an indirect wholly-owned subsidiary of Sime Darby, in the People's Republic of China ("PRC") on 30 July 2018. The Business Licence dated 30 July 2018 issued by the Weifang Administration for Industry & Commerce was received by Sime Darby Overseas (HK) Limited (“SDOHK”), an indirect wholly-owned subsidiary of Sime Darby, on 30 July 2018.

WSDLS was incorporated as a private limited company under the PRC Company Law.

The entire registered capital of WSDLS of USD39,500.00 is held by SDOHK. The intended principal activities of WSDLS are the provision of logistics information consultation services, warehousing services, management of warehousing facilities and related consultation and services. Currently, WSDLS has not commenced operations.

The incorporation of WSDLS is not expected to have any material effect on the earnings or net assets of the Sime Darby Group for the financial year ending 30 June 2019. None of the Directors or major shareholders of Sime Darby or persons connected with them has any interest, direct or indirect, in the incorporation.

This announcement is dated 8 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2018 05:14 AM

|

显示全部楼层

发表于 31-10-2018 05:14 AM

|

显示全部楼层

卡特彼勒报喜 森那美也沾光

財经 最后更新 2018年10月25日 21时12分

(吉隆坡25日讯)美国卡特彼勒(Caterpillar)在2018財政年第3季(截至9月30日)交出高于预期的业绩表现,市场人士相信,对于经销该品牌產品的森那美(SIME,4197,主板消费股)也是个好消息,其工业业务未来盈利料有看头。

不过, 卡特彼勒带来的好消息並未激励森那美,该股今日跟隨大市走势,早盘一度跌14仙或6.36%,至2.06令吉。闭市时,森那美报2.11令吉,下挫9仙或4.09%,全天成交量为1920万股。

野村证券分析员指出,卡特彼勒在第3季取得的每股净利与销售额皆高於预期,同时,该公司维持今年的盈利预测,並对2019財政年保持乐观。他透露,卡特彼勒同期赚幅继续扩大,主因是7月中期的涨价活动,而该公司还会在明年1月涨价1%到4%。

经销商库存增

卡特彼勒的未交付订单则在第3季按年升19亿美元,至173亿美元之多,所有领域的订单都同步增长。

分析员表示,无论在资源或建筑领域,卡特彼勒亚洲-澳洲业务的营收都保持成长,按年涨幅分別是46%与19%。另外,在大宗商品坚挺的价格支撑下,卡特彼勒亚-澳业务矿业领域的表现依然出色。

在盈利方面,卡特彼勒在建筑与资源部门分別收穫按年成长20%与81%的佳绩,归功於严格的成本管控和正面营运槓桿操作。

该分析员引述卡特彼勒高层称,其亚洲业务儘管受贸易战影响,但客户下单率和该公司未交付订单依然健康,2019年前景乐观。

分析员將森那美的2019財政年(6月30日结账)预估本益比设在20倍,比同行的平均值14倍高,因森那美作为宝马(BMW)和卡特彼勒在亚太区域其中1家最大的经销商,理应享有更高估值。

他相信,由於矿业活动重返上升週期,森那美工业业务將受到激励,该公司2019財政年有望取得22%的盈利成长。

此外,森那美经销的各大汽车品牌將会陆续推出新车款,也有助提振业绩。

综合以上因素,该分析员维持森那美的「买进」评级,不在3.02令吉目標。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2018 07:25 AM

|

显示全部楼层

发表于 31-10-2018 07:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-11-2018 05:05 AM

|

显示全部楼层

发表于 3-11-2018 05:05 AM

|

显示全部楼层

本帖最后由 icy97 于 8-11-2018 02:48 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION OF 100% EQUITY INTEREST IN HEAVY MAINTENANCE GROUP PTY LTD(Announcement pursuant to Chapter 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Sime Darby Berhad (“Sime Darby”) is pleased to announce that Sime Darby Allied Operations Pty Ltd, an indirect wholly-owned subsidiary of Sime Darby, has entered into a conditional share purchase agreement with Pemba Capital Partners Fund I Partnership LP and other minority interests on 29 October 2018 to acquire the entire issued share capital in Heavy Maintenance Group Pty Ltd (“HMG”) for a consideration of AU$58 million (equivalent to approximately RM172 million) on a cash-free and debt-free basis (“Proposed Acquisition”).

Upon completion of the Proposed Acquisition, HMG and its wholly-owned subsidiary, HMG Hardchrome Pty Ltd, will become indirect wholly-owned subsidiaries of Sime Darby.

Please refer to the attachments for details of the announcement.

This announcement is dated 30 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5958349

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-11-2018 07:53 AM

|

显示全部楼层

发表于 4-11-2018 07:53 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Incorporation of Elite Motors Limited(Announcement pursuant to Chapter 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Sime Darby Berhad ("Sime Darby") wishes to announce the incorporation of Elite Motors Limited ("EML"), an indirect wholly-owned subsidiary of Sime Darby, in Hong Kong on 29 October 2018. The Certificate of Incorporation dated 29 October 2018 issued by the Companies Registry of the Government of the Hong Kong Special Administrative Region was received by Sime Darby Motor Services Limited, an indirect wholly-owned subsidiary of Sime Darby, on 30 October 2018.

EML was incorporated as a limited company in Hong Kong under the Companies Ordinance (Chapter 622 of the Laws of Hong Kong). The entire issued share capital of EML of HKD1 divided into one share is held by Sime Darby Motor Group (HK) Limited.

The principal activities of EML are the provision of after-sales services and car testing licence holder.

The incorporation of EML is not expected to have any material effect on the earnings or net assets of the Sime Darby Group for the financial year ending 30 June 2019. None of the Director or major shareholders of Sime Darby or persons connected with them has any interest, direct or indirect, in the incorporation.

The announcement is dated 31 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2018 05:00 AM

|

显示全部楼层

发表于 20-11-2018 05:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2018 05:50 AM

|

显示全部楼层

发表于 20-11-2018 05:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|