|

|

发表于 31-8-2018 06:39 AM

|

显示全部楼层

发表于 31-8-2018 06:39 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 02:04 AM 编辑

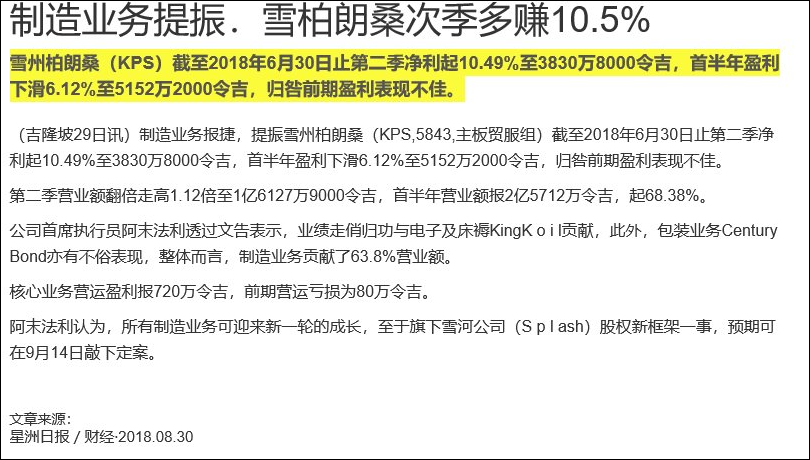

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 161,279 | 75,946 | 257,120 | 152,704 | | 2 | Profit/(loss) before tax | 41,591 | 37,615 | 57,137 | 59,958 | | 3 | Profit/(loss) for the period | 39,433 | 35,591 | 53,636 | 56,790 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 38,308 | 34,671 | 51,522 | 54,879 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.10 | 6.50 | 9.60 | 10.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.25 | 4.25 | 4.25 | 4.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5900 | 2.5300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:23 AM

|

显示全部楼层

发表于 29-9-2018 06:23 AM

|

显示全部楼层

本帖最后由 icy97 于 30-9-2018 07:42 AM 编辑

Type | Announcement | Subject | OTHERS | Description | KUMPULAN PERANGSANG SELANGOR BERHAD (PERANGSANG SELANGOR OR COMPANY)PROPOSED DISPOSAL BY SYARIKAT PENGELUAR AIR SELANGOR HOLDINGS BERHAD (SPLASH HOLDINGS), AN INDIRECT 30% ASSOCIATED COMPANY OF PERANGSANG SELANGOR, OF THE ENTIRE EQUITY INTEREST AND REDEEMABLE UNSECURED LOAN STOCKS (RULS) OF SPLASH HOLDINGS WHOLLY-OWNED SUBSIDIARY, SYARIKAT PENGELUAR AIR SUNGAI SELANGOR SDN BHD (SPLASH) TO PENGURUSAN AIR SELANGOR SDN BHD (AIR SELANGOR) (PROPOSED DISPOSAL) | Please refer attachment below.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-10-2018 01:59 AM

|

显示全部楼层

发表于 13-10-2018 01:59 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INCORPORATION OF A WHOLLY-OWNED SUBSIDIARY, PERANGSANG CAPITAL SDN BHD | Pursuant to Paragraph 9.19(23) of Bursa Malaysia Securities Berhad’s Main Market Listing Requirements, the Board of Directors of Kumpulan Perangsang Selangor Berhad (“Perangsang Selangor”) wishes to announce that Perangsang Selangor has on 10 October 2018, incorporated a wholly-owned subsidiary known as Perangsang Capital Sdn Bhd (“Perangsang Capital”) (Co. No. 1299008-V) (“Incorporation”).

The intended principal activity of Perangsang Capital is as an investment holding company.

The share capital of Perangsang Capital is RM2.00 divided into two (2) ordinary shares.

The Incorporation is not expected to have any material effect on the net assets per share and earnings per share, as well as the gearing of Perangsang Selangor group of companies for the financial year ending 31 December 2018.

None of the Directors and/or major shareholders of Perangsang Selangor and/or persons connected to them have any interests, direct or indirect, in the Incorporation.

This announcement is dated 11 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:12 AM

|

显示全部楼层

发表于 18-10-2018 05:12 AM

|

显示全部楼层

本帖最后由 icy97 于 18-10-2018 06:15 AM 编辑

Type | Announcement | Subject | OTHERS | Description | KUMPULAN PERANGSANG SELANGOR BERHAD (PERANGSANG SELANGOR OR COMPANY) FRAMEWORK AGREEMENT ENTERED INTO BETWEEN AQUA-FLO SDN BHD AND PENGURUSAN AIR SELANGOR SDN BHD FOR THE SUPPLY AND DELIVERY OF CHEMICALS TO WATER TREATMENT PLANTS IN SELANGOR AND FEDERAL TERRITORIES OF KUALA LUMPUR AND PUTRAJAYA FOR YEARS 2018-2020 FOR A TOTAL ESTIMATED CONTRACT SUM OF RM162,545,214.00 | Please refer attachment below. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5944561

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-10-2018 03:58 AM

|

显示全部楼层

发表于 19-10-2018 03:58 AM

|

显示全部楼层

本帖最后由 icy97 于 20-10-2018 01:56 AM 编辑

Type | Announcement | Subject | OTHERS | Description | KUMPULAN PERANGSANG SELANGOR BERHAD (PERANGSANG SELANGOR OR COMPANY)FRAMEWORK AGREEMENT ENTERED INTO BETWEEN AQUA-FLO SDN BHD AND PENGURUSAN AIR SELANGOR SDN BHD FOR THE SUPPLY AND DELIVERY OF CHEMICALS TO WATER TREATMENT PLANTS IN SELANGOR AND FEDERAL TERRITORIES OF KUALA LUMPUR AND PUTRAJAYA FOR YEARS 2018 2020 FOR A TOTAL ESTIMATED CONTRACT SUM OF RM162,545,214.00 | Reference is made to the Company’s announcements dated 17 October 2018 and 18 October 2018 in relation to the Framework Agreement entered into between Aqua-Flo Sdn Bhd and Pengurusan Air Selangor Sdn Bhd for the supply and delivery of chemicals to water treatment plants in Selangor and Federal Territories of Kuala Lumpur and Putrajaya for years 2018 – 2020 for a total estimated contract sum of RM162,545,214.00 (“Announcement”).

Unless otherwise stated, words and phrases used in this announcement shall have the same meanings as defined in the aforesaid Announcement.

Further to the announcement dated 18 October 2018, the Board of Directors of Perangsang Selangor wishes to update that the Group has in the ordinary course of business entered into the following recurrent related party transaction (“RRPT”)* with the same related party namely Air Selangor within the preceding 12 months period i.e. from 18 October 2017 to 17 October 2018 : Transacting subsidiaries of Perangsang Selangor | Nature of Transaction | Date of Announcement | Aggregated value of RRPT transacted from 18 October 2017 to 17 October 2018 (RM) | Percentage Ratio (%) | Smartpipe Technology Sdn Bhd | Laying of new pipes to replace existing pipes in Selangor and Federal Territories of Kuala Lumpur and Putrajaya. | 2 July 2018 (Please refer to the announcement made on the above date for further details.) | 0 (The estimated contract value: RM20,000,242.70. However, as at to-date the work/ transaction has not yet commence). | 0 |

*Note: No mandate is obtained from the shareholders of Perangsang Selangor in respect of the above RRPT pursuant to Paragraph 10.09(2) of the MMLR.

The Company will continue to monitor its obligations to ensure compliance of Paragraph 10.09 of the MMLR with respect to the RRPT.

This announcement is dated 19 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 05:40 AM

|

显示全部楼层

发表于 30-10-2018 05:40 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL OF 100% OF EQUITY STAKE IN CENGREEN GLOBAL SDN BHD BY PRESTIGE PACKAGES SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF CENTURY BOND BHD, WHERE CENTURY BOND BHD IS A 98.9% SUBSIDIARY OF PERANGSANG PACKAGING SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF KUMPULAN PERANGSANG SELANGOR BERHAD (PROPOSED DISPOSAL) | The terms used herein shall, unless the context otherwise stated, bear the same meaning as those defined in the announcement of Perangsang Selangor in relation to the Proposed Disposal dated 24 August 2018.

Reference is made to the announcements dated 24 August 2018 in relation to the Proposed Disposal.

Perangsang Selangor wishes to announce that the Proposed Disposal has been completed today in accordance with the terms of the Share Sale Agreement.

This announcement is dated 29th October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 08:16 AM

|

显示全部楼层

发表于 30-12-2018 08:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 153,644 | 85,602 | 410,764 | 238,306 | | 2 | Profit/(loss) before tax | -265,865 | 14,672 | -208,727 | 74,629 | | 3 | Profit/(loss) for the period | -272,470 | 13,512 | -218,833 | 70,301 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -274,574 | 12,867 | -223,051 | 67,745 | | 5 | Basic earnings/(loss) per share (Subunit) | -51.10 | 2.40 | -41.50 | 12.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 4.25 | 4.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0800 | 2.5300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2019 03:34 AM

|

显示全部楼层

发表于 27-1-2019 03:34 AM

|

显示全部楼层

Date of change | 01 Jan 2019 | Name | ENCIK AHMAD FARIZ BIN HASSAN | Age | 42 | Gender | Male | Nationality | Malaysia | Designation | Managing Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | BACHELOR OF ACCOUNTANCY WITH HONOURS | UNIVERSITI TEKNOLOGI MARA | | | 2 | Diploma | DIPLOMA IN ACCOUNTANCY | UNIVERSITI TEKNOLOGI MARA | |

Working experience and occupation | MAY 2016 - CURRENTKUMPULAN PERANGSANG SELANGOR BERHAD, CHIEF EXECUTIVE OFFICERSEPTEMBER 2015 - APRIL 2016KUMPULAN PERANGSANG SELANGOR BERHAD, ACTING CHIEF EXECUTIVE OFFICERAPRIL 2015 - AUGUST 2015KUMPULAN PERANGSANG SELANGOR BERHAD, HEAD OF STRATEGIC PLANNING & INVESTMENTJANUARY 2015 - MARCH 2015KHAZANAH NASIONAL BHD, SENIOR VICE PRESIDENT (INVESTMENT)2011 - 2014COSMO RESTAURANTS SDN BHD (BURGER KING), CHIEF OPERATING OFFICER, SECONDED FROM EKUITI NASIONAL BERHAD ("EKUINAS")2010 - 2011EKUINAS, INVESTMENT MANAGER2005 - 2010CIMB PRIVATE EQUITY, MANAGER2003 - 2005CIMB INVESTMENT BANK, TREASURYJAN 2003 - SEPT 2003MALAYSIAN RESOURCES CORPORATION BERHAD ("MRCB"), CORPORATE GOVERNANCE2000 - 2003MK LAND HOLDINGS BERHAD, INTERNAL AUDIT AND RISK MANAGEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 05:44 AM

|

显示全部楼层

发表于 9-2-2019 05:44 AM

|

显示全部楼层

Date of change | 01 Jan 2019 | Name | ENCIK AZLAN BIN ABDUL JALIL | Age | 42 | Gender | Male | Nationality | Malaysia | Type of change | Others | Designation | Others | Description | RE-DESIGNATION |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelors of Science (Hons) in Accounting | University of Wales, Cardiff, United Kingdom | |

| | | Working experience and occupation | Prior to this position, Encik Azlan bin Abdul Jalil ("Encik Azlan") was the Chief Investment Officer since 1 July 2017. He joined Perangsang Selangor as Assistant General Manager of Strategic Planning and Investment on 1 December 2015 and was promoted to Director of Strategic Planning and Investment on 1 June 2016. Prior to joining Perangsang Selangor, Azlan was with Hong Leong Islamic Bank Berhad where he led and managed the banks Islamic corporate banking end, comprising debt capital market transaction; loan syndication and debt restructuring exercises, servicing numerous type of clients encompassing government, government link companies, corporates and small and medium enterprises. His last position there was Head of Wholesale Banking. Encik Azlan has extensively developed his banking and finance experience for over 17 years, starting from CIMB Investment Bank Berhad, Kuwait Finance House, Saudi-Arabian based Siraaj Capital Limited and HSBC Bank (Malaysia) Berhad. Notably, during his tenure at Bursa Malaysia Berhad, he led the business development arm driving the Islamic finance initiatives to a greater height, enhancing market awareness of the Malaysian Islamic finance initiatives and successfully increased participation of global financial institution players when he was the Head of Sales and Market Development there. He started his career as an Associate with PricewaterhouseCoopers in the Audit and Business Advisory specialising in banking sector. | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | NIL |

| Remarks : | | Encik Azlan has been re-designated from Director of Strategic Planning and Investment to Deputy Chief Executive Officer (Strategy & Investments) with effect from 1 January 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 05:45 AM

|

显示全部楼层

发表于 9-2-2019 05:45 AM

|

显示全部楼层

Date of change | 01 Jan 2019 | Name | PUAN SUZILA BINTI KHAIRUDDIN | Age | 43 | Gender | Female | Nationality | Malaysia | Type of change | Others | Designation | Others | Description | RE-DESIGNATION |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Science (Hons) in Finance and Accounting | University of Salford, United Kingdom | | | 2 | Professional Qualification | Chartered Certified Accountant | Association of Chartered Certified Accountants | |

| | | Working experience and occupation | Prior to this position, Puan Suzila binti Khairuddin ("Puan Suzila") was the Chief Operating Officer since 1 April 2017. Puan Suzila was appointed as Chief Operating Officer/ Chief Financial Officer of Perangsang Selangor on 1 June 2016 and relinquished the Chief Financial Officer position on 1 April 2017. She joined Perangsang Selangor as Finance Manager in December 2003. She was promoted to Senior Manager of Finance on 1 January 2008 and subsequently was promoted to Assistant General Manager of Finance on 1 January 2009. She was appointed as Acting General Manager Finance and Administration on 1 November 2013 and was subsequently promoted to General Manager Finance and Administration on 1 October 2014.Prior to joining Perangsang Selangor, Puan Suzila had four (4) years of audit experience in PricewaterhouseCoopers Malaysia where she was involved in statutory and special audits of public listed companies, multinational corporation and private companies of different industries. | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | PUAN SUZILA HOLDS 32,307 ORDINARY SHARES IN PERANGSANG SELANGOR. |

| Remarks : | | Puan Suzila has been re-designated from Chief Operating Officer to Deputy Chief Executive Officer (Operations) of Kumpulan Perangsang Selangor Berhad with effect from 1 January 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:44 AM

|

显示全部楼层

发表于 11-3-2019 05:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 171,349 | 123,189 | 582,113 | 361,495 | | 2 | Profit/(loss) before tax | 29,042 | -4,744 | -179,686 | 69,886 | | 3 | Profit/(loss) for the period | 22,030 | -7,286 | -196,804 | 63,016 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,429 | -8,983 | -205,623 | 58,762 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.20 | -1.70 | -38.30 | 10.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 4.25 | 4.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1100 | 2.5300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-4-2019 06:40 AM

|

显示全部楼层

发表于 9-4-2019 06:40 AM

|

显示全部楼层

| KUMPULAN PERANGSANG SELANGOR BERHAD |

EX-date | 26 Jun 2019 | Entitlement date | 28 Jun 2019 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | SINGLE TIER FINAL DIVIDEND OF 4.25 SEN PER SHARE IN RESPECT OF THE FINANCIAL YEAR ENDED 31 DECEMBER 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 19 Jul 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0425 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-5-2019 07:21 AM

|

显示全部楼层

发表于 14-5-2019 07:21 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | KUMPULAN PERANGSANG SELANGOR BERHAD ("PERANGSANG SELANGOR" OR THE "COMPANY") PROPOSED SELECTIVE CAPITAL REDUCTION AND REPAYMENT EXERCISE TO BE UNDERTAKEN BY CENTURY BOND BHD. ("CBB") UNDER SECTION 116 OF THE COMPANIES ACT, 2016 ("PROPOSED SCR") | On behalf of the Board of Directors of Perangsang Selangor, CIMB Investment Bank Berhad wishes to announce that Perangsang Packaging Sdn Bhd (“PPSB” or “Non-Entitled Shareholder”), a wholly-owned subsidiary of Perangsang Selangor, has today served a letter to the Board of CBB, setting out PPSB’s intention for CBB to undertake a selective capital reduction and repayment exercise under Section 116 of the Companies Act, 2016. Upon successful completion of the Proposed SCR, PPSB will hold the entire issued share capital of CBB.

Further details of the Proposed SCR are set out in the attachment.

This announcement is dated 16 April 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6127045

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2019 03:45 AM

|

显示全部楼层

发表于 6-6-2019 03:45 AM

|

显示全部楼层

| KUMPULAN PERANGSANG SELANGOR BERHAD |

EX-date | 13 May 2019 | Entitlement date | 15 May 2019 | Entitlement time | 05:00 PM | Entitlement subject | Special Dividend | Entitlement description | Special dividend of 32.6 sen per ordinary share in respect of the financial year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 May 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 May 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 28 May 2019 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.326 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-6-2019 05:01 AM

|

显示全部楼层

发表于 25-6-2019 05:01 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | KUMPULAN PERANGSANG SELANGOR BERHAD ("PERANGSANG SELANGOR")PROPOSED ACQUISITION OF 100% EQUITY INTEREST IN TOYOPLAS MANUFACTURING (MALAYSIA) SDN. BHD. BY PERANGSANG DINAMIK SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF PERANGSANG SELANGOR, FOR A CASH CONSIDERATION OF RM311,250,000 | On behalf of the Board of Directors of Perangsang Selangor, RHB Investment Bank Berhad wishes to announce that Perangsang Dinamik Sdn. Bhd. ("Purchaser"), a wholly-owned subsidiary of Perangsang Selangor, had on 17 May 2019, entered into a share sale agreement with Toyoplas Consolidated Limited (“Vendor”), Lim Lai An and Lim Hui Bian for the proposed acquisition of 100% equity interest in Toyoplas Manufacturing (Malaysia) Sdn. Bhd. (after the completion of the Pre-Acquisition Exercise (as defined in the attachment below)) for a cash consideration of RM311,250,000 (equivalent to USD75,000,000) from the Vendor by the Purchaser ("Proposed Acquisition").

Please refer to the attachment below for details of the Proposed Acquisition.

This announcement is dated 17 May 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6164837

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-7-2019 08:53 AM

|

显示全部楼层

发表于 5-7-2019 08:53 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 157,461 | 95,841 | 157,461 | 95,841 | | 2 | Profit/(loss) before tax | 7,176 | 15,546 | 7,176 | 15,546 | | 3 | Profit/(loss) for the period | 2,501 | 14,204 | 2,501 | 14,204 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,169 | 13,214 | 1,169 | 13,214 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.20 | 2.50 | 0.20 | 2.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1100 | 2.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2019 05:58 AM

|

显示全部楼层

发表于 14-7-2019 05:58 AM

|

显示全部楼层

| KUMPULAN PERANGSANG SELANGOR BERHAD |

Date of change | 15 Jun 2019 | Name | DATO KAMARUL BAHARIN BIN ABBAS | Age | 72 | Gender | Male | Nationality | Malaysia | Designation | Independent Director | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Expiry of 9 years independent director tenure. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Diploma | Business Studies | ITM | | | 2 | Diploma | Marketing | UK | | | 3 | Others | Member of Institute of Marketing | UK | |

Working experience and occupation | Member of Parliament - Teluk KemangTenaga Ehsan Sdn Bhd - Executive Chairman, 1987Pernas Trading Sdn Bhd - Sales Manager, 1971 - 1974Nestle Products (M) Ltd - Marketing Executive, 1968 - 1971 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-7-2019 06:14 AM

|

显示全部楼层

发表于 16-7-2019 06:14 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | KUMPULAN PERANGSANG SELANGOR BERHAD (PERANGSANG SELANGOR OR COMPANY)PROPOSED OFFER TO PURCHASE ALL THE SECURITIES IN SISTEM PENYURAIAN TRAFIK KL BARAT SDN BHD (SPRINT) BY MINISTER OF FINANCE (INCOPORATED) (MOF INC) | Kindly refer to the attached document for the details.

This announcement is dated 24 June 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6199601

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2019 03:17 AM

|

显示全部楼层

发表于 16-8-2019 03:17 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION OF 100% EQUITY INTEREST IN TOYOPLAS MANUFACTURING (MALAYSIA) SDN. BHD. BY PERANGSANG DINAMIK SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF PERANGSANG SELANGOR, FOR A CASH CONSIDERATION OF RM311,250,000 | Unless otherwise defined herein, the abbreviations and definitions used in the announcements dated 17 May 2019, 17 June 2019, 9 July 2019, 24 July 2019 and 31 July 2019 (collectively "Announcements") shall apply herein.

We refer to the Announcements in relation to the Proposed Acquisition.

On behalf of the Board, RHB Investment Bank wishes to announce that the Proposed Acquisition has been completed today under the terms and conditions of the SSA.

This announcement is dated 15 August 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2019 02:55 AM

|

显示全部楼层

发表于 31-8-2019 02:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 159,163 | 161,279 | 316,624 | 257,120 | | 2 | Profit/(loss) before tax | 9,842 | 41,591 | 17,018 | 57,137 | | 3 | Profit/(loss) for the period | 4,740 | 39,433 | 7,241 | 53,636 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,932 | 38,308 | 4,100 | 51,522 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.50 | 7.10 | 0.80 | 9.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 36.85 | 4.25 | 36.85 | 4.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7500 | 2.1100

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|