|

|

发表于 13-6-2018 06:31 AM

|

显示全部楼层

发表于 13-6-2018 06:31 AM

|

显示全部楼层

Date of change | 08 Jun 2018 | Name | DR LISA LIM POH LIN | Age | 41 | Gender | Female | Nationality | Malaysia | Designation | Director | Directorate | Independent and Non Executive | Type of change | Appointment | Qualifications | Bachelor of Arts Degree in Engineering and Master in Engineering, Cambridge University (2000)Ph.D in Engineering (2006)Chartered Financial Analyst Charterholder | Working experience and occupation | 2007 - March 2018 : Fund Manager, Columbia Threadneedle2005 - 2006 : Assistant Professor, National University of Singapore, Singapore2001 - 2002 : Associate Consultant, The Boston Consulting Group (Jakarta and Kuala Lumpur)2000 : Investment Banking Analyst, Morgan Stanley Dean Witter, Singapore |

Type | Announcement | Subject | OTHERS | Description | Media Statement - Axiata Appoints New Director to Further Strengthen Board Diversity | We are pleased to provide hereunder the media statement by Axiata in relation to the appointment of Dr Lim Poh Lin as Independent Non-Executive Director effective today.

This announcement is dated 8 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5820889

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2018 02:06 AM

|

显示全部楼层

发表于 14-6-2018 02:06 AM

|

显示全部楼层

本帖最后由 icy97 于 18-6-2018 03:37 AM 编辑

亚通出售柬子公司10%股权

財经 最后更新 2018年06月12日 21时41分

(吉隆坡12日讯) 亚通(AXIATA,6888,主板贸服股)宣布,M&Y亚洲电讯控股有限公司(MYATH)行使认购选择权,完成收购亚通柬埔寨子公司的额外10%股权。

虽然亚通並未在今日文告披露股权脱售的行使价格,不过根据早前的文告,这项交易的成交价预计將达到9240万美元(约3亿6930万令吉)。

亚通在去年5月杪宣布,该集团、柬埔寨子公司-Axiata投资有限公司(AIC)、三井物產(Mitsui & Co.,Ltd.)及MYATH,共4家公司签署股权买卖协议,AIC以6600万美元(当时约2亿8570万令吉),將亚通(柬埔寨)控股有限公司(ACH)的10%股权售予MYATH。

三井物產持有MYATH的50%股权。亚通(柬埔寨)控股有限公司是Smart Axiata有限公司(SA)的控股公司。

当时, AIC 、MYATH 和Southerns Coast Ventures有限公司( SCV ) , 三方也签署修改及重申股东协议(ARSA),而MYATH拥有认购选择权(CallOption),可认购ACH的额外10%股权。在今天的交易完成后,AIC、MYATH和SCV各持有ACH的72.5%、20%和7.5%股权。【东方网财经】

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL OF UP TO 20% STAKE IN AXIATA (CAMBODIA) HOLDINGS LIMITED, THE HOLDING COMPANY OF SMART AXIATA CO., LTD | We refer to our announcements dated 19 May 2017 and 1 June 2017 in relation to the Proposed Disposal (“Announcements”). Unless otherwise stated, the definitions used herein shall have the same meanings as set out in the Announcements.

We are pleased to announce that MY Asia has today completed the exercise of the Mitsui Call Option in accordance with the terms of the ARSA.

AIC and M&Y Asia now respectively holds 72.5% and 20% in ACH with the balance 7.5% held by SCV.

This announcement is dated 12 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-7-2018 02:13 AM

|

显示全部楼层

发表于 12-7-2018 02:13 AM

|

显示全部楼层

本帖最后由 icy97 于 13-7-2018 05:03 AM 编辑

Type | Announcement | Subject | OTHERS | Description | INCORPORATION OF COMPANY - AXIATA DIGITAL LABS (PRIVATE) LIMITED | We wish to inform that Axiata Investments (Labuan) Limited, a wholly-owned subsidiary of Axiata Group Berhad (“Axiata”), had on 10 July 2018 completed the incorporation of AXIATA DIGITAL LABS (PRIVATE) LIMITED (“ADL”) (Company No. PV00201847), a private company limited by shares, in Sri Lanka, under the Companies Act, No. 7 of 2007 of Sri Lanka.

ADL was incorporated with a stated capital of LKR10 comprising of 1 ordinary share of LKR10 each. The principal activity of ADL is to function as Software Development and IT Enabled Services venture of Axiata Group.

The incorporation of ADL is not expected to have any material effect on the earning and Net Tangible Assets of Axiata for financial year ending 31 December 2018.

None of the Directors and/or major shareholders of Axiata and/or persons connected to them have any direct or indirect interest in the incorporation of ADL.

This announcement is dated 11 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2018 03:55 AM

|

显示全部楼层

发表于 14-7-2018 03:55 AM

|

显示全部楼层

本帖最后由 icy97 于 16-7-2018 02:43 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PROPOSED DIVESTMENT OF MULTINET PAKISTAN (PRIVATE) LIMITED | We wish to announce that Axiata Investments (Labuan) Limited (“AIL”), a wholly owned subsidiary of Axiata Group Berhad (“Axiata”) had today entered into a Share Purchase Agreement with Adnan Asdar Ali (“AA”) for the divestment by AIL of its entire 89.0% stake in Multinet Pakistan (Private) Limited (“Multinet”) for a sum of USD1.0 on a cash free and debt free basis (“Proposed Divestment of Multinet”). AA is the current shareholder of Multinet holding the remaining 11.0% stake in Multinet.

The above is pursuant to Axiata’s earlier announcement of the Quarterly Results for the quarter ended 31 December 2017 released on 23 February 2018.

Multinet is engaged in the business of providing telecommunication and electronic media services including internet services, design, development, implementation of networks including a wide range of non-mobile telecommunications services with a focus on the Business to Business (B2B) segment of the market. A facility-based operator with fibre optic network across Pakistan, Multinet supports fibre-optic connectivity, Long Distance International (LDI) originations / terminations and co-location services. For the last few years, Multinet’s financial performance has been declining with accumulated losses of PKR754.0 million (equivalent to approximately RM25.64 million) for the financial year ended 31 December 2017. Accordingly, Multinet’s contribution to Axiata’s financial and business performance is immaterial.

The Proposed Divestment of Multinet is subject to amongst others, the fulfillment of regulatory and third-party approvals and is not expected to have any material effect on Axiata’s consolidated Net Assets (“NA”), NA per share, gearing and consolidated earnings for the financial year ending 31 December 2018.

None of the Directors and major shareholders of Axiata and/or persons connected to them has any direct or indirect interest in the Proposed Divestment of Multinet. The Board of Directors of Axiata, after having considered all aspects is of the opinion that the Proposed Divestment of Multinet is in the best interests of Axiata.

This announcement is dated 13 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2018 02:33 AM

|

显示全部楼层

发表于 20-7-2018 02:33 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | DIVIDEND REINVESTMENT SCHEME | No. of shares issued under this corporate proposal | 19,927,680 | Issue price per share ($$) | Malaysian Ringgit (MYR) 3.9700 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 9,069,666,993 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 13,496,849,145.600 | Listing Date | 20 Jul 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 04:42 AM

|

显示全部楼层

发表于 27-7-2018 04:42 AM

|

显示全部楼层

本帖最后由 icy97 于 28-7-2018 06:54 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 04:46 AM

|

显示全部楼层

发表于 28-7-2018 04:46 AM

|

显示全部楼层

本帖最后由 icy97 于 29-7-2018 02:18 AM 编辑

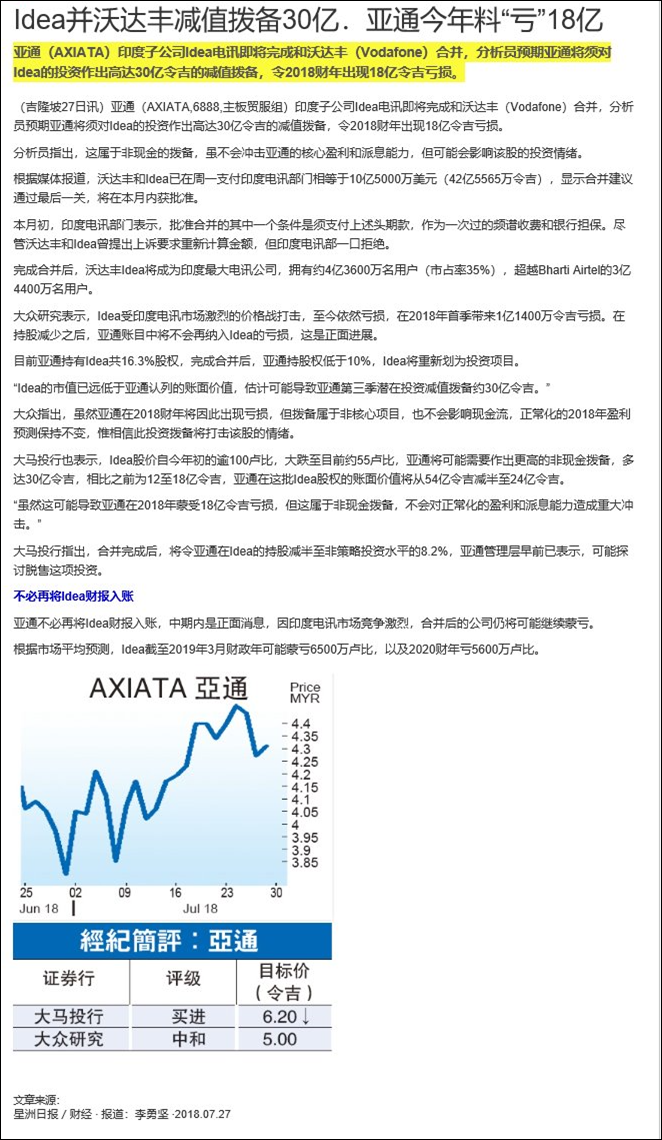

Type | Announcement | Subject | OTHERS | Description | COMPOSITE SCHEME OF AMALGAMATION AND ARRANGEMENT BETWEEN IDEA CELLULAR LIMITED (IDEA) WITH VODAFONE INDIA LIMITED (VIL) AND VODAFONE MOBILE SERVICES LIMITED (VMSL), A WHOLLY - OWNED SUBSIDIARY OF VIL SCHEME) | We refer the notification by Idea on the approval issued by the Department of Telecommunications, Ministry of Communications, Government of India (“DoT”) in relation to the transactions contemplated under the Scheme to the National Stock Exchange of India Limited and BSE Limited on 27 July 2018. The completion of the merger is now subject to National Company Law Tribunal, Mumbai Branch, passing the dissolution order of VMSL and VIL.

The Board of Directors of Axiata wishes to provide the estimated financial impact resulting from the impending completion of the Scheme following the issuance of the above approval by the DoT.

The non-cash financial loss due to applicable accounting standards from the deemed dilution and de-recognition of Idea from associate to simple investment upon completion of the Scheme (“Reclassification of Idea”) is estimated to be approximately RM1.5 billion to RM3.0 billion. The Reclassification of Idea is attributed to the dilution of Axiata Group’s shareholding in the merged enlarged Idea-Vodafone entity from 16.33% to 8.17% upon completion of the Scheme which will result in the loss of certain shareholder’s rights as provided under the Subscription Agreement dated 25 June 2008 between; inter-alia, Axiata Group and Idea in relation to subscription by Axiata Group of shares in Idea.

The estimated loss above is expected to have a material impact on the financial quarter ended 30 June 2018. The actual impact on de-recognition from the Reclassification of Idea will be provided upon completion of the Scheme. Being a non-cash item, the financial impact above will have no bearing to Axiata Group’s current or future cash position.

This announcement is dated 27 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 04:46 AM

|

显示全部楼层

发表于 28-7-2018 04:46 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MEDIA STATEMENT - COMPOSITE SCHEME OF AMALGAMATION AND ARRANGEMENT BETWEEN IDEA CELLULAR LIMITED (IDEA) WITH VODAFONE INDIA LIMITED (VIL) AND VODAFONE MOBILE SERVICES LIMITED (VMSL), A WHOLLY - OWNED SUBSIDIARY OF VIL SCHEME) | We are pleased to provide hereunder the media statement by Axiata titled as Axiata to Become an Investor in the Largest Operator in India with Approval on Merger between Idea and Vodafone India.

This announcement is dated 27 July 2018 |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5868101

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 04:54 AM

|

显示全部楼层

发表于 28-7-2018 04:54 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION OF TANJUNG DIGITAL SDN BHD | We refer to the announcement dated 4 May 2018 in relation to the Proposed Acquisition of TDSB. Unless stated otherwise, the definitions used herein shall have the same meanings as set out in the said announcement.

We are pleased to announce that edotco MY, a wholly owned subsidiary of edotco Group Sdn Bhd which in turn is a 63.0% subsidiary of Axiata, has today completed the acquisition of the Sale Shares representing 80.0% of the issued share capital of TDSB resulting with TDSB becoming a subsidiary of Axiata.

This announcement is dated 27 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 05:15 AM

|

显示全部楼层

发表于 28-7-2018 05:15 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 07:18 AM

|

显示全部楼层

发表于 28-7-2018 07:18 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | 1. KUALA LUMPUR HIGH COURT CIVIL SUIT NO: D1-22-1960-2008 CELCOM (MALAYSIA) BERHAD (CELCOM) & TECHNOLOGY RESOURCES INDUSTRIES BERHAD (TRI) VS TAN SRI DATO TAJUDIN BIN RAMLI (TSDTR) & 6 OTHERS (CONSPIRACY SUIT)2. KUALA LUMPUR HIGH COURT CIVIL SUIT NO: D5-22-610-2006 CELCOM & TRI) VS TSDTR AND 8 OTHERS (INDEMNITY SUIT) | Axiata Group Berhad (“Axiata”) refers to the following announcements: - - 28 April 2006 by Telekom Malaysia Berhad on the commencement of the Indemnity Suit against, inter alia, TSDTR and Bistamam Ramli (“BR”);

- 24 October 2008 by TM International Berhad (now known as Axiata) on the commencement of the Conspiracy Suit against, inter alia, TSDTR and BR;

- 14 May 2018 by Axiata on the directions by the High Court on 8 May 2018 (as a result of the Receiving Order and Adjudicating Order entered against TSDTR and BR on the same day in the Shah Alam High Court Bankruptcy No. BA-29NCC-1091-02/2016 and the Shah Alam High Court Bankruptcy No. BA-29NCC-1092-02/2016 respectively); and

- 18 July 2018 by Axiata on the filing of the application for leave under Section 8 of the Bankruptcy Act 1967, to continue, inter alia, the Conspiracy and Indemnity Suits against TSDTR and BR.

The Indemnity Suit is in relation to the breaches of duty involving the entry into the Subscription Agreement dated 25 June 1996 (“Subscription Agreement”) between Deutsche Telekom AG, TRI and Celcom, the Supplemental Agreement dated 7 February 2002 (“the 2002 Supplemental Agreement”) and the Amended and Restated Agreement dated 4 April 2002 (“ARSA”) between DeTeAsia Holdings GmbH (“DeTe”), Celcom and TRI. TSDTR and BR were inter alia, directors of Celcom and TRI at time of entry into the Subscription Agreement and the ARSA. Celcom and TRI claim that these agreements were entered into by the various former directors of Celcom and TRI in breach of their fiduciary duties as directors. This litigation is in relation to Celcom and TRI’s claim to seek an indemnity from the various former directors including TSDTR and BR in respect of the sums paid out to DeTe under the Award dated 2 August 2005 handed down by the Tribunal of the International Court of Arbitration of the International Chamber of Commerce Case No. 12615/MS instituted against Celcom.

The Conspiracy Suit is in relation to the Celcom and TRI’s claim that DeTe, Beringin Murni Sdn Bhd and the various former directors of Celcom and TRI including TSDTR and BR (“Defendants”) wrongfully and unlawfully conspired with each other to injure Celcom and TRI by causing and/or committing them to enter into the 2002 Supplemental Agreement and the ARSA with DeTe. This litigation is in relation to Celcom and TRI’s claim to seek damages for conspiracy from the Defendants including TSDTR and BR.

Axiata wishes to announce that at the case management for the Suits on 24 July 2018, the solicitors for Celcom and TRI were informed that TSDTR and BR had, on 5 July 2018 and 9 July 2018 respectively, obtained the sanction of the Director General of Insolvency pursuant to section 38(1)(a) of the Bankruptcy Act 1967 to defend the Conspiracy and Indemnity Suits and to pursue with their counterclaims in the Conspiracy and Indemnity Suits against Celcom and TRI and all appeals arising from the Suits.

Axiata will make further announcements from time to time in respect of any material developments on these 2 matters.

The announcement is dated 26 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-8-2018 04:06 AM

|

显示全部楼层

发表于 3-8-2018 04:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2018 02:44 AM

|

显示全部楼层

发表于 4-8-2018 02:44 AM

|

显示全部楼层

本帖最后由 icy97 于 18-11-2018 05:55 AM 编辑

担任亚通主席10年 阿兹曼莫达今辞职

Sulhi Azman/theedgemarkets.com

August 03, 2018 19:15 pm +08

(吉隆坡3日讯)亚通(Axiata Group Bhd)宣布,丹斯里阿兹曼莫达今日辞去主席一职。

这是随着阿兹曼近期辞去持有亚通37.3%股权的国库控股(Khazanah Nasional Bhd)董事经理职。

亚通赞扬阿兹曼的“十年模范服务”,并将该集团自2008年成立以来的增长和扩张归功阿兹曼的远见领导。

同样在阿兹曼的领导下,亚通的客户群从4000万,在10年间跃升至2017年12月的3亿5000万,成为东盟和南亚第二大电讯集团,营业额在期内增长一倍至240亿令吉。

亚通今日发布文告表示,集团市值从2008年首次公开募股(IPO)的283亿令吉,扩大1.8倍至496亿令吉。

高级独立非执行董事Tan Sri Ghazzali Sheikh Abdul Khalid表示,亚通作为区域冠军和具有强大监管实践的机构,源于阿兹曼的远见、商业敏锐和专业精神。

“身为主席,他始终确保我们按照最高的责任履行我们的信托义务,同时为我们的利益相关者创造长期价值。”

亚通总裁兼集团总执行长Tan Sri Jamaludin Ibrahim说,如果没有阿兹曼的指导、支持与鼓励,亚通无法实现领先的行业地位。

“我将永远记住的一件事是,阿兹曼一直向管理层提出建议,专注于为股东创造长期价值,而不是仅仅关注容易取得的短期利润。”

“因此,业务可持续和增长与短期财务表现同等重要。他当然不喜欢走捷径。”

Jamaludin还赞扬阿兹曼在推动亚通在未来5年内成为新一代数字冠军(New Generation Digital Champion)的新愿景发挥重要作用。

“我代表整个区域的亚通董事部、管理和职员,以及我个人,对阿兹曼这10年领导表示衷心的感谢和赞赏。”

(编译:陈慧珊)

Date of change | 03 Aug 2018 | Name | TAN SRI DATUK AZMAN HJ MOKHTAR | Age | 57 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Resigned as Managing Director of Khazanah Nasional Berhad, the major shareholder of Axiata Group Berhad | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | - British Chevening Scholar- Masters of Philosophy in Development Studies, Darwin College, Cambridge University, UK- Fellow of the Association of Chartered Certified Accountants, UK- Chartered Financial Analyst- Diploma in Islamic Studies, International Islamic University, Malaysia | Working experience and occupation | From June 2004 until 31 July 2018, Azman held the position of Managing Director of Khazanah Nasional Berhad, the strategic investment fund of the Government of Malaysia. Formerly, Azman was the Managing Director and co-founder of BinaFikir Sdn Bhd, Director and Head of Country Research at Salomon Smith Barney Malaysia and Director and Head of Research at Union Bank of Switzerland in Malaysia. He previously served in various capacities with Malaysia's largest utility company, Tenaga Nasional Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2018 02:45 AM

|

显示全部楼层

发表于 4-8-2018 02:45 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2018 04:34 AM

|

显示全部楼层

发表于 4-8-2018 04:34 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2018 04:50 AM

|

显示全部楼层

发表于 10-8-2018 04:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 05:14 AM

|

显示全部楼层

发表于 17-8-2018 05:14 AM

|

显示全部楼层

本帖最后由 icy97 于 18-8-2018 06:51 AM 编辑

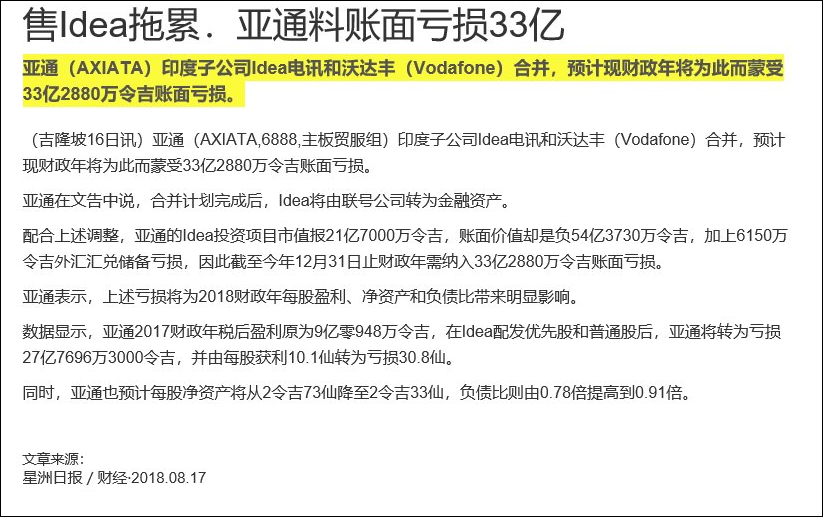

Type | Announcement | Subject | OTHERS | Description | RELINQUISHMENT OF RIGHTS AS SHAREHOLDERS OF IDEA CELLULAR LIMITED (IDEA) | We refer to the announcement by Axiata dated 27 July 2018 on; inter-alia, the estimated financial impact due to the de-recognition of Idea as associate to simple investment (“Announcement”). Unless otherwise stated, the definitions used herein shall have the meanings as set out in the Announcement.

The Board of Directors of Axiata wishes to notify that Axiata Group had on 16 August 2018 unconditionally and irrevocably relinquished some of its rights under the Share Subscription Agreement dated 25 June 2008 between; inter-alia, Axiata Group and Idea in relation to subscription by Axiata Group of shares in Idea, the same having been duly acknowledged by Idea on even date (“Relinquishment of Rights”), which include, amongst others, the following:-

i) Rights to appoint Axiata representative as a Board member of Idea and to the Board Audit Committee of Idea, and ii) Anti-dilution rights.

With the Relinquishment of Rights, Axiata ceases to have significant influence on Idea in accordance with applicable accounting standard which will result in:-

i) Idea being reclassified as a financial asset measured at fair value through other comprehensive income; and ii) An estimated de-recognition loss for financial year ending 31 December 2018 (“FYE2018”) (“De-Recognition Loss”).

Further details on the De-Recognition Loss are provided in the attached announcement.

This announcement is dated 16 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5886233

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 05:10 AM

|

显示全部楼层

发表于 24-8-2018 05:10 AM

|

显示全部楼层

Date of change | 23 Aug 2018 | Name | TAN SRI GHAZZALI BIN SHEIKH ABDUL KHALID | Age | 72 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Director | New Position | Director | Directorate | Independent and Non Executive | Qualifications | Degree in Economics, La Trobe University, Australia | Working experience and occupation | Ghazzali has made his career as a diplomat since 1971 and became the Ambassador of Malaysia to USA in March 1999. Prior to his appointment to Washington, D.C., he served as Deputy Secretary- General at the Ministry of Foreign Affairs, Malaysia.Over the years, his overseas appointments have included postings to Austria, Germany, Hong Kong, Thailand, UK, Zimbabwe and the Permanent Mission of Malaysia to the United Nations in New York, USA. His last position before his retirement in September 2010 was as Ambassador-at-large of the Ministry of Foreign Affairs, Malaysia to which he was appointed in 2006. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 05:11 AM

|

显示全部楼层

发表于 24-8-2018 05:11 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 05:16 AM

|

显示全部楼层

发表于 25-8-2018 05:16 AM

|

显示全部楼层

本帖最后由 icy97 于 26-8-2018 02:39 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 5,867,065 | 6,058,566 | 11,615,314 | 11,939,538 | | 2 | Profit/(loss) before tax | -3,058,198 | 571,271 | -3,016,523 | 963,601 | | 3 | Profit/(loss) for the period | -3,317,675 | 479,077 | -3,412,032 | 741,110 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,357,307 | 407,205 | -3,504,715 | 646,221 | | 5 | Basic earnings/(loss) per share (Subunit) | -37.10 | 4.50 | -38.70 | 7.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 5.00 | 5.00 | 5.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2300 | 2.7300

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|