|

|

发表于 7-3-2017 03:08 AM

|

显示全部楼层

发表于 7-3-2017 03:08 AM

|

显示全部楼层

Date of change | 28 Feb 2017 | Name | MR DAVID KHOO CHONG BENG | Age | 44 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Principal Officer | Reason | For career advancement | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | He is a member of the Malaysian Institute of Accountants ("MIA"). | Working experience and occupation | He commenced his career in year 1995 with an accounting firm for 2 years and was with a Big Four accounting firm for 3 years before he joined the NTPM Holdings Berhad ("NTHB") in year 2000 as a Senior Accountant. He was then promoted as Finance Manager in year 2006 and as the Financial Controller in year 2009. | Family relationship with any director and/or major shareholder of the listed issuer | Nil. | Any conflict of interests that he/she has with the listed issuer | Nil. | Details of any interest in the securities of the listed issuer or its subsidiaries | Nil. |

| Remarks : | | Mr. David Khoo Chong Beng has resigned as Financial Controller of NTHB Group with effect from 28 February 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2017 06:21 AM

|

显示全部楼层

发表于 11-3-2017 06:21 AM

|

显示全部楼层

本帖最后由 icy97 于 12-3-2017 05:03 AM 编辑

启顺造纸

第三季净利跌12.3%

2017年3月11日

(吉隆坡10日讯)启顺造纸(NTPM,5066,主板消费产品股)在截至1月31日第三季,净利年跌12.3%,报1549万1000令吉,上财年同季为1765万6000令吉。

该公司向马交所报备,第三季营业额则从前去年的1亿6102万3000令吉,年增5.8%,至1亿7036万7000令吉。

累计首9个月,启顺造纸净利录得4091万5000令吉或每股3.6仙,按年减少14.1%;而营业额则年升6.3%,至4亿8600万7000令吉。

劳工成本涨冲击赚幅

启顺造纸在财报中解释,营业额增长归功于纸巾产品的销量增加。

然而由于越南纸巾业务面临亏损,加上能源与劳工成本上涨冲击赚幅的影响,因此冲击盈利表现。 【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2017 | 31 Jan 2016 | 31 Jan 2017 | 31 Jan 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 170,367 | 161,023 | 486,007 | 457,050 | | 2 | Profit/(loss) before tax | 22,785 | 24,255 | 58,476 | 65,369 | | 3 | Profit/(loss) for the period | 15,491 | 17,656 | 40,915 | 47,620 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 15,491 | 17,656 | 40,915 | 47,620 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.40 | 1.60 | 3.60 | 4.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.80 | 1.60 | 0.80 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3800 | 0.3700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2017 06:19 AM

|

显示全部楼层

发表于 15-3-2017 06:19 AM

|

显示全部楼层

高劳力成本.启顺3年财测下修

(吉隆坡13日讯)启顺造纸业(NTPM,5066,主板消费品组)第三季净利跌12.3%,至1550万令吉,主要受越南厂房刚投产所累,分析员相信启顺会鉴定成本调控与强化营运效益措施。

该行鉴于高劳力成本与水电费用是当前挑战,而调低2017至2019财政年盈利16至20%。

首9个月净利走低14.1%,至4090万令吉,主要是越南厂房投运后,因各种营运成本,高能源与人事成本、高销售与经销成本而蒙高亏损。

大众研究认为,越南纸厂营运将继续压缩赚益,至少收入中期呈显著后才可减压。

纸巾等相关产品第三季营收增长5.8%,至1亿1930万令吉,首9个月营收增长6.9%,惟赚益从17.1%跌至13.4%。个人护理品第三季营收增9.2%,至5110万令吉;首9个月扬5%,至1亿4900万令吉,使其税前盈利走强17.7%,赚益由8%改善至8.9%。

大众研究保持“中和”评级,目标价由88仙调低至81仙。

文章来源:

星洲日报‧财经‧2017.03.14 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2017 12:41 AM

|

显示全部楼层

发表于 30-6-2017 12:41 AM

|

显示全部楼层

本帖最后由 icy97 于 1-7-2017 03:18 AM 编辑

啟順造紙業末季淨利跌11% 擬開發新產品

2017年6月29日

(吉隆坡29日訊)啟順造紙業(NTPM,5066,主要板消費)截至4月底末季,淨利按年跌10.9%,達895萬令吉,受各種成本攀升影響;該公司每股派息0.8仙,與上財年同期相同。

同期,營業額按年攀升10%,從1億4466萬令吉增至1億5925萬令吉。

該公司全年淨利跌13.5%至4989萬令吉;營業額起7.3%,至6億4552萬令吉。

此外,啟順造紙業旗下資產取得1140萬令吉重估收益,其中1080萬令吉帶來淨逆轉和遞延稅盈余,而早前呈報的200萬令吉重估赤字,則根據大馬財報標準重新納入收入報表中。

展望未來,該公司尋求加強客戶基礎和分銷管道途徑,並有意開發新產品,及聯營進軍與現有業務具協同效益的新業務。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2017 | 30 Apr 2016 | 30 Apr 2017 | 30 Apr 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 159,246 | 144,655 | 645,524 | 601,706 | | 2 | Profit/(loss) before tax | 13,901 | 12,820 | 72,378 | 78,189 | | 3 | Profit/(loss) for the period | 8,952 | 10,047 | 49,868 | 57,667 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,952 | 10,047 | 49,868 | 57,667 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.80 | 0.90 | 4.40 | 5.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.80 | 0.80 | 2.40 | 1.60 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4000 | 0.3700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2017 12:43 AM

|

显示全部楼层

发表于 30-6-2017 12:43 AM

|

显示全部楼层

本帖最后由 icy97 于 1-7-2017 03:19 AM 编辑

Type | Announcement | Subject | OTHERS | Description | NTPM HOLDINGS BERHAD ("NTHB" or "the Company")- Proposed Final Dividend | With reference to the announcement made on 29 June 2017 on the proposed final dividend for year ended 30 April 2017 (“Earlier Announcement”), the Company wishes to clarify that arising from the migration to the no par value regime under the Companies Act 2016, par value is no longer relevant.

In view of this, the Company wish to clarify that the Board of Directors had recommended a Single-Tier Final Dividend of 0.80 sen per Ordinary Share for the financial year ended 30 April 2017. Based on the share capital of 1,123,120,000 ordinary shares as at 30 April 2017, the Single-Tier Final Dividend payable would be approximately RM8.98 million.

The above proposed final dividend will be subject to the shareholders’ approval at the forthcoming Annual General Meeting.

Save for the abovementioned, there is no change to the other information as disclosed in the Earlier Announcement.

This announcement is dated 30 June 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2017 12:44 AM

|

显示全部楼层

发表于 30-6-2017 12:44 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | NTPM HOLDINGS BHD. ("the Company" or "NTHB")- REVALUATION OF PROPERTIES | In compliance with Paragraph 9.19 (46) of Chapter 9 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad ("Bursa Securities"), the Board of Directors ("the Board") of the Company is pleased to announce that the Company has undertaken a revaluation on the Company’s properties. The Revaluation Surplus has been incorporated into the unaudited interim financial report on consolidated results of NTHB for the fourth financial year ended 30 April 2017 and audited financial statements of NTHB Group for the financial year ended 30 April 2017.

Please refer to the attachment for the details of the revaluation of properties.

This announcement is dated 29 June 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5473617

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2017 02:57 AM

|

显示全部楼层

发表于 2-7-2017 02:57 AM

|

显示全部楼层

税率走高拖累业绩‧启顺利空压境

(吉隆坡30日讯)实际税率走高,拖累启顺造纸业(NTPM,5066,主板消费品组)第四季业绩,分析员认为该公司在未来仍会面对劳工成本、水电费以及消费情绪低迷等利空,因而调低该公司财测。

财测下调

大众研究指出,启顺造纸业全年净利下挫13.5%至4990万令吉,不过第四季营运盈利以税前净利皆按年成长8.4%,惟在更高实际税率拖累下,税后净利按年走低10.9%。

大众预测其生产成本将持续走高,因此下调2018至2019年财测5至12%。

该公司纸张生产营业额按年成长7.5%,但第四季度税前净利按年下挫15.1%至800万令吉,2017财政年则按年走低16.2%,主要是原料价格、劳工以及生产成本走高等所导致。

至于个人保健产品部份,在纸尿片的销量增加情况下,该公司第四季营业和税前盈利分别按年成长16%和30.1%,其2017全年的税前盈利赚幅,也按年增加9.6%,对比2016年则是7.9%。

通膨持续和生活成本走高,消费者生活支出谨慎,预料将影响启顺造纸业营运。在未来,劳工成本以及水电费会是该公司最主要面对难题,必须维持整体的营运成本不超出控制范围内。

大众相信该公司将会持续其成本节约努力以及提高营运效率,同时也会寻找机会开发新产品、强化顾客群数目以及改善分销管道。

综合以上,大众维持该公司评级“中和”不变,调低目标价至71仙。

文章来源:

星洲日报/财经·文:傅文耀·2017.06.30 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2017 11:31 PM

|

显示全部楼层

发表于 30-8-2017 11:31 PM

|

显示全部楼层

EX-date | 27 Sep 2017 | Entitlement date | 29 Sep 2017 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | A single tier final dividend of 0.80 sen per Ordinary Share | Period of interest payment | to | Financial Year End | 30 Apr 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHD (PENANG)Suite 18.05, MWE PlazaNo. 8 Lebuh Farquhar10200Tel:042631966Fax:042628544 | Payment date | 17 Oct 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Sep 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.008 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2017 03:37 AM

|

显示全部楼层

发表于 22-9-2017 03:37 AM

|

显示全部楼层

本帖最后由 icy97 于 22-9-2017 04:17 AM 编辑

启顺造纸首季赚1212万

2017年9月22日

(吉隆坡21日讯)启顺造纸(NTPM,5066,主板消费产品股)截至7月杪首季,净赚1211万9000令吉或每股1.10仙,比上财年同期938万1000令吉,年增29.2%。

营业额则从1亿5143万1000令吉,按年扬16.32%,报1亿7615万令吉。

启顺造纸今日向交易所报备,营业额增长主要归功于纸巾和个人护理产品的销量增加,尤其是纸巾产品。

细分业务来看,纸张产品营业额达1亿2400万令吉,按年涨17.7%;个人护理产品营业额则按年扬13.3%,赚5210万令吉。

展望未来,我国次季经济强增5.8%,惟预计今年私人开销将迎来逆风,主要因为成本高昂拉高通胀、令吉走贬对进口产品和服务的溢出效应,以及消费情绪疲软。

面对这些挑战,启顺造纸已拟定策略和实施节约成本,提高营运效率,同时继续研发新产品、强化客户基础及改善分销管道。

因此,董事部对公司前景保持谨慎乐观。 【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2017 | 31 Jul 2016 | 31 Jul 2017 | 31 Jul 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 176,150 | 151,431 | 176,150 | 151,431 | | 2 | Profit/(loss) before tax | 17,877 | 14,015 | 17,877 | 14,015 | | 3 | Profit/(loss) for the period | 12,119 | 9,381 | 12,119 | 9,381 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 12,119 | 9,381 | 12,119 | 9,381 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.10 | 0.80 | 1.10 | 0.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4100 | 0.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2017 03:37 AM

|

显示全部楼层

发表于 22-9-2017 03:37 AM

|

显示全部楼层

EX-date | 05 Oct 2017 | Entitlement date | 09 Oct 2017 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Single Tier Dividend of 0.80 sen per Ordinary Share for financial year ending 30 April 2018 | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHD (PENANG)Suite 18.05, MWE PlazaNo. 8, Lebuh Farquhar10200 Georgetown, PenangTel:042631966Fax:042628544 | Payment date | 23 Oct 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 09 Oct 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.008 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-9-2017 04:28 AM

|

显示全部楼层

发表于 26-9-2017 04:28 AM

|

显示全部楼层

启顺造纸

明年净利回稳

2017年9月26日

分析:大众投行研究

目标价:71仙

最新进展

启顺造纸(NTPM,5066,主板消费产品股)截至7月杪首季,净赚1211万9000令吉或每股1.10仙,比上财年同期938万1000令吉,年增29.2%。

营业额则从1亿5143万1000令吉,按年扬16.32%,报1亿7615万令吉。

行家建议

该季净利达我们全年预测的21%。

我们预计,该公司将专注推动销售量和持续改善赚幅,使2018财年净利逐渐回稳。

展望未来,该公司纸张业务也会在越南胡志明市和槟城的厂房,分别增加两台和一台纸巾机器设备,以提升产量和迎合本地与区域市场需求。

因此,预计越南厂房每年的产能将提高4万公吨,槟城的年产能则增加2万公吨,总共提升现有生产水平约50%产能。

私人护理产品方面,该公司将努力提高婴儿尿布产品的销售量及减少生产成本。

维持“中和”评级,预计2018财年每股净利为5.1仙,按14倍本益比计算,维持71仙的目标价。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-12-2017 02:26 AM

|

显示全部楼层

发表于 20-12-2017 02:26 AM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2017 04:25 AM 编辑

启顺造纸次季净利跌60%

2017年12月15日

(吉隆坡14日讯)成本走高,拖累启顺造纸(NTPM,5066,主板消费产品股)截至10月31日次季,净利暴跌60.3%至636万2000令吉;惟营业额则扬3%,报1亿6926万9000令吉。

累计上半年,净利挫27.3%至1848万1000令吉;营业额起9.4%,报3亿4541万9000令吉。

启顺造纸向交易所报备,上半年营业额增长,主要归功于纸巾和个人护理产品的销售额增加;惟税前盈利则是走跌22.04%,因原料和员工成本走高。

该公司旨在控制成本,并放眼扩大客户规模及提升经销管道。

同时,也放眼开发新产品,若有任何可以与现有业务模式产生协同效应的扩张计划,启顺造纸也将探讨进军新业务的机会。

未来,董事部谨慎乐观看待前景。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2017 | 31 Oct 2016 | 31 Oct 2017 | 31 Oct 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 169,269 | 164,210 | 345,419 | 315,641 | | 2 | Profit/(loss) before tax | 9,947 | 21,677 | 27,824 | 35,692 | | 3 | Profit/(loss) for the period | 6,362 | 16,044 | 18,481 | 25,425 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,362 | 16,044 | 18,481 | 25,425 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.60 | 1.40 | 1.60 | 2.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 1.60 | 0.80 | 1.60 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4000 | 0.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2017 04:56 AM

|

显示全部楼层

发表于 22-12-2017 04:56 AM

|

显示全部楼层

启顺造纸

成本涨赚幅受压

2017年12月16日

分析:大众投行研究

目标价:61仙

最新进展:

成本走高,拖累启顺造纸(NTPM,5066,主板消费产品股)截至10月31日次季,净利暴跌60.3%至636万2000令吉;惟营业额则扬3%,报1亿6926万9000令吉。

累计上半年,净利挫27.3%至1848万1000令吉;营业额起9.4%,报3亿4541万9000令吉。

惟税前盈利走跌22.04%,因原料和员工成本走高。

行家建议:

启顺造纸次季表现疲弱,上半年净利只占全年预测32.4%。

虽然营业额符合预期,占全年预测50%,但赚幅走软,归咎于原料价格攀升,尤其是全球供需不稳定的纸浆价格。

接下来,该公司持续提高纸巾产量,越南与槟城厂房年产量,料分别增4万公吨与2万公吨,代表着目前的产量会起50%。

若扩展计划顺利,产品需求持续,长期将推动销售量。

考虑到原料成本走高,我们下修2018至2020财年的盈利预测,幅度介于24%至39%。

维持“中和”评级,但目标价从71仙减至61仙。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 05:12 AM

|

显示全部楼层

发表于 25-3-2018 05:12 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 02:34 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2018 | 31 Jan 2017 | 31 Jan 2018 | 31 Jan 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 180,989 | 170,367 | 526,408 | 486,007 | | 2 | Profit/(loss) before tax | 12,702 | 22,785 | 40,525 | 58,476 | | 3 | Profit/(loss) for the period | 10,050 | 15,491 | 28,530 | 40,915 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,050 | 15,491 | 28,530 | 40,915 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.90 | 1.40 | 2.50 | 3.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.80 | 0.00 | 1.60 | 1.60 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4100 | 0.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 05:15 AM

|

显示全部楼层

发表于 25-3-2018 05:15 AM

|

显示全部楼层

EX-date | 05 Apr 2018 | Entitlement date | 09 Apr 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Second Interim Single Tier Dividend of 0.80 sen per Ordinary share for the financial year ending 30 April 2018 | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHD (PENANG)Suite 18.05, MWE PlazaNo. 8 Lebuh Farquhar10200 Georgetown, PenangTel:042631966Fax:042628544 | Payment date | 23 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 09 Apr 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.008 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-3-2018 07:42 AM

|

显示全部楼层

发表于 30-3-2018 07:42 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-6-2018 08:59 PM

|

显示全部楼层

发表于 25-6-2018 08:59 PM

|

显示全部楼层

本帖最后由 icy97 于 26-6-2018 01:34 AM 编辑

| 5066 NTPM NTPM HOLDINGS BHD | | Quarterly rpt on consolidated results for the financial period ended 30/04/2018 | | Quarter: | 4th Quarter | | Financial Year End: | 30/04/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/04/2018 | 30/04/2017 | 30/04/2018 | 30/04/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 164,519 | 159,246 | 690,928 | 645,524 | | 2 | Profit/Loss Before Tax | 3,834 | 13,901 | 44,359 | 72,378 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,180 | 8,952 | 29,710 | 49,868 | | 4 | Net Profit/Loss For The Period | 1,180 | 8,952 | 29,710 | 49,868 | | 5 | Basic Earnings/Loss Per Shares (sen) | 0.11 | 0.80 | 2.60 | 4.40 | | 6 | Dividend Per Share (sen) | 0.80 | 0.80 | 1.60 | 2.40 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 0.4100 | 0.4000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-6-2018 12:54 AM

|

显示全部楼层

发表于 26-6-2018 12:54 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | NTPM HOLDINGS BERHAD ("NTHB" or "the Company")- REVALUATION OF PROPERTIES | In compliance with Paragraph 9.19 (46) of Chapter 9 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad ("Bursa Securities"), the Board of Directors ("the Board") of the Company is pleased to announce that the Company has undertaken a revaluation on the Company’s properties. The Revaluation Surplus has been incorporated into the unaudited interim financial report on consolidated results of NTHB for the fourth quarter ended 30 April 2018 and audited financial statements of NTHB Group for the financial year ended 30 April 2018.

Please refer to the attachment for the details of the revaluation of properties.

This announcement is dated 25 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5834825

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-6-2018 12:54 AM

|

显示全部楼层

发表于 26-6-2018 12:54 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | NTPM HOLDINGS BERHAD ("NTHB" or "the Company")- Proposed Final Dividend | The Board of Directors of NTHB is pleased to announce that a proposed final single tier dividend of 0.80 sen per Ordinary Share in respect of the financial year ended 30 April 2018 will be recommended to the shareholders for approval at the forthcoming Annual General Meeting.

The date of payment, the entitlement date and all other relevant information shall be announced at a later date.

This announcement is dated 25 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2018 05:14 AM

|

显示全部楼层

发表于 28-6-2018 05:14 AM

|

显示全部楼层

本帖最后由 icy97 于 29-6-2018 05:01 AM 编辑

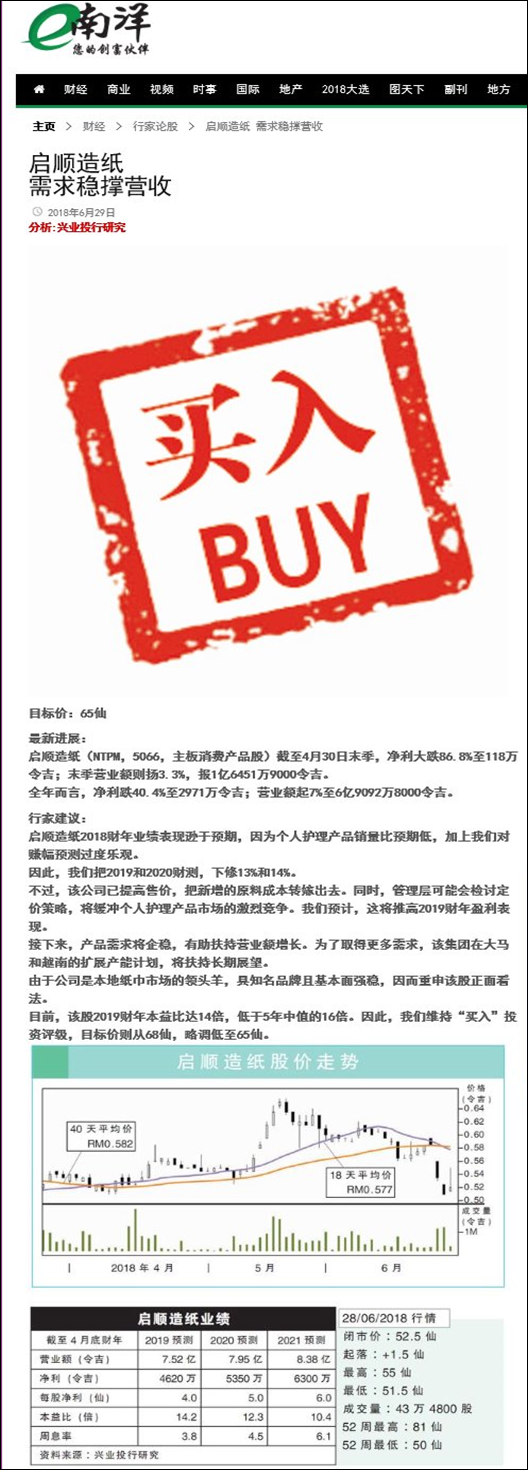

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|