|

|

发表于 17-10-2017 02:26 AM

|

显示全部楼层

发表于 17-10-2017 02:26 AM

|

显示全部楼层

本帖最后由 icy97 于 17-10-2017 03:48 AM 编辑

阿末查基获2.9亿MRT2合约

2017年10月17日

(吉隆坡16日讯)阿末查基(AZRB,7078,主板建筑股)宣布,获捷运机构(MRT Corp)颁发价值2亿8850万令吉的捷运(MRT)第二路线配套合约。

这将阿末查基年初至今所获得的合约价值,推高至5亿250万令吉,未入账订单也提升至40亿令吉,可维持集团忙碌长达3至4年。

阿末查基文告指出,该合约为双溪毛糯-沙登-布城(SSP)路线铁道的S206配套合约,并负责兴建其中三个高架站,及沙登再也南部、Seri Kembangan和博特拉大学的相关工程。

该工程预计即将动工,为期48个月,可为集团截至12月秒的2017至2021财年,带来净利贡献。

阿末查基集团董事经理拿督斯里旺查卡利亚指出,该项目证明了集团作为铁路基建建筑商的专业能力和良好纪录。

“以我们的经验和技能,相信集团已准备好竞标接下来的大型铁路项目,如东海岸铁路(ECRL) 、巴生谷捷运第3期项目及隆新高铁(HSR)。”【e南洋】

Type | Announcement | Subject | OTHERS | Description | LETTER TO SUCCESSFUL NOMINATED SUB-CONTRACTOR ISSUED BY MASS RAPID TRANSIT CORPORATION SDN BHD TO AHMAD ZAKI SDN BHD | Introduction The Board of Directors of Ahmad Zaki Resources Berhad (“AZRB or the Company”) is pleased to announce that its wholly-owned subsidiary, Ahmad Zaki Sdn Bhd (“AZSB”) had on 13 October 2017, received and accepted a Letter to Successful Nominated Sub-Contractor from Mass Rapid Transit Corporation Sdn Bhd (“the Award”) for a project known as “Projek Mass Rapid Transit Laluan 2: Sungai Buloh-Serdang-Putrajaya - Package S206: Construction and Completion of Elevated Stations and Other Associated Works at Serdang Raya (South), Seri Kembangan and UPM” (“the Works”).

Information on the Works The Award for the Works amounted to a total value of RM288,470,744.31. The Works is expected to commence immediately, and would last for the next 48 months until September 2021.

Financial effects The Works is expected to contribute positively to the Group’s future earnings.

Directors’ and Substantial Shareholders’ interest None of the Directors and Substantial Shareholders of AZRB or any persons connected with them has any interest, direct or indirect, in the aforesaid Works.

Statement by the Board of Directors The Board of AZRB is of the opinion that the Works is in the best interest of the Company.

This announcement is dated 16 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-10-2017 02:48 AM

|

显示全部楼层

发表于 17-10-2017 02:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-11-2017 05:25 AM

|

显示全部楼层

发表于 7-11-2017 05:25 AM

|

显示全部楼层

Date of change | 06 Nov 2017 | Name | ENCIK KHAIRUDIN BIN HJ MOHD ALI | Age | 42 | Gender | Male | Nationality | Malaysia | Type of change | Vacation Of Office | Designation | Chief Financial Officer | Reason | En Khairudin Hj Mohd Ali will vacate office as the Chief Financial Officer of Ahmad Zaki Resources Berhad Group due to internal restructuring and re-designated as Chief Compliance Officer with effect from 6 November 2017. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | 1. Member of Malaysian Institute of Accountants (MIA).2. Member of Malaysian Institute of Certified Public Accountants (MICPA).3. BA (Hons) Accounting and Finance, De Montfort University, Leicester, UK. | Working experience and occupation | Encik Khairudin Hj Mohd Ali has over 20 years of experience in auditing, financial management, accounting and reporting, treasury management, corporate planning and providing advisory support in the areas of investment and privatisation. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | He holds 15,000 ordinary shares in Ahmad Zaki Resources Berhad. |

| Remarks : | | En Khairudin Hj Mohd Ali is being re-designated as Chief Compliance Officer of Ahmad Zaki Resources Berhad Group with effect from 6 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-11-2017 05:26 AM

|

显示全部楼层

发表于 7-11-2017 05:26 AM

|

显示全部楼层

Date of change | 06 Nov 2017 | Name | ENCIK WAN SHARIMAN BIN WAN MOHAMED | Age | 50 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Principal Officer | Qualifications | Master in Business Administration (with Distinction), Nottingham Trent University, UK. | Working experience and occupation | En Wan Shariman Wan Mohamed has more than 25 years working experience and held various senior management positions in both private and public listed companies. |

Remarks :

En Wan Shariman Wan Mohamed is being appointed as the Executive Director - Property Division following an internal restructuring of Ahmad Zaki Resources Berhad ("AZRB") Group. He is presently the Director of Corporate Services of AZRB Group.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-11-2017 05:26 AM

|

显示全部楼层

发表于 7-11-2017 05:26 AM

|

显示全部楼层

Date of change | 06 Nov 2017 | Name | ENCIK MOHAMMAD ASHRAF BIN MD RADZI | Age | 39 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | 1. Member of Malaysian Institute of Accountants (MIA)2. Member of Association of Chartered Certified Accountants (ACCA), UK3. Capital Markets Services Representative License (CMRSL) Modules 12 & 19, Securities Commission, Malaysia4. Bachelor Accounting (Hons), University Tenaga Nasional | Working experience and occupation | En Mohammad Ashraf Md Radzi has over 15 years of experience in auditing, financial management, accounting and reporting, treasury management, corporate planning and providing advisory support in the areas of investment and privatisation. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-11-2017 05:27 AM

|

显示全部楼层

发表于 7-11-2017 05:27 AM

|

显示全部楼层

Date of change | 06 Nov 2017 | Name | ENCIK MOHAMMAD FAUZI BIN HAJI AHMAD | Age | 51 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Principal Officer | Qualifications | Bachelor in Civil Engineering, University of Pittsburgh, USA | Working experience and occupation | En Mohammad Fauzi Ahmad has more than 28 years working experience and has held various senior management positions in his career. | Directorships in public companies and listed issuers (if any) | Nil | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Nil |

| Remarks : | | En Mohammad Fauzi Ahmad is being appointed as the Executive Director - Concession Division following an internal restructuring of Ahmad Zaki Resources Berhad ("AZRB") Group.He was previously the Senior General Manager for Special Projects under the Engineering & Construction Division of AZRB Group. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 05:39 AM

|

显示全部楼层

发表于 6-12-2017 05:39 AM

|

显示全部楼层

本帖最后由 icy97 于 11-12-2017 01:39 AM 编辑

种植油气营运改善

阿末查基第三季多赚18%

2017年12月1日

(吉隆坡30日讯)阿末查基(AZRB,7078,主板建筑股)截至9月30日第三季,净利录得1003万1000令吉或每股1.89仙,年增17.71%。

营业额年增8.82%,报2亿9475万3000令吉。

合计九个月,净赚3198万5000令吉,大增68.94%;营业额减7.33%,达7亿8241万8000令吉。

阿末查基今日向交易所报备,第三季营业额增长,主要原因是种植和油气领域营运改善。不过,税前盈利减39.1%至1880万令吉,因为上财年同季特许经营领域的收入走高。

不过,部分被建筑业务的净利,和种植业务损失减少抵消。

首九个月营业额减少,归咎于建筑业务收入减少,但税前盈利增4%,归功于特许经营领域的设施管理收入,以及种植领域损失降低。

末季增长亮眼

集团董事经理拿督斯里旺查卡利亚在文告中指出,本季度业绩超越去年表现,集团在首九个月的净利超越去年水平,并放眼继续超越水准。

他称,集团新增订单,加上特许经营领域的经常收入,及种植领域损失持续减少,料增长势头能延续至末季。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 294,753 | 270,854 | 782,418 | 844,275 | | 2 | Profit/(loss) before tax | 18,751 | 30,808 | 47,247 | 45,412 | | 3 | Profit/(loss) for the period | 9,023 | 6,520 | 29,573 | 16,165 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,031 | 8,522 | 31,985 | 18,933 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.89 | 1.76 | 6.24 | 3.92 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8569 | 0.7543

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 06:02 AM

|

显示全部楼层

发表于 6-12-2017 06:02 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-12-2017 05:29 AM

|

显示全部楼层

发表于 20-12-2017 05:29 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INVESTMENT IN NEW SUBSIDIARY | We wish to announce that pursuant to Chapter 9, Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, Ahmad Zaki Resources Berhad ("AZRB") has on 15 December 2017 acquired 2 ordinary shares, representing the entire issued and paid-up share capital of Sambungan Lebuhraya Timur Sdn Bhd (“SLT”) from Tan Sri Dato’ Sri Haji Wan Zaki bin Haji Wan Muda and Dato’ Sri Wan Zakariah bin Haji Wan Muda for a total cash consideration of RM2/- (“the Acquisition”). Following the Acquisition, SLT is a wholly-owned subsidiary of AZRB.

SLT is a company incorporated in Malaysia and having its registered address at Menara AZRB, No. 71, Persiaran Gurney, 54000 Kuala Lumpur. SLT has an issued and paid-up share capital of RM100,000. Its intended principal activities are constructing highways and bridges, maintenance and operator of toll highway.

The Acquisition does not have any material impact on the earnings and the net assets of AZRB.

Save for Tan Sri Dato’ Sri Haji Wan Zaki bin Haji Wan Muda and Dato’ Sri Wan Zakariah bin Haji Wan Muda, who are the common directors and shareholders in AZRB and SLT, none of the directors and/or major shareholders of AZRB and persons connected with them have any interest, direct or indirect in the Acquisition.

The Directors of AZRB is of the opinion that the Acquisition is in the best interests of the Group.

This announcement is dated 15 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-12-2017 04:55 AM

|

显示全部楼层

发表于 25-12-2017 04:55 AM

|

显示全部楼层

本帖最后由 icy97 于 26-12-2017 05:31 AM 编辑

阿末查基获1.38亿令吉合约

Syahirah Syed Jaafar/theedgemarkets.com

December 21, 2017 20:54 pm +08

(吉隆坡21日讯)阿末查基(Ahmad Zaki Resources Bhd)获得价值1亿3838万令吉的合约,为霹雳国油科技大学(Universiti Teknologi Petronas)的地球科学和石油工程学院打造两间学术建筑物,以及为国家能源(Tenaga Nasional Bhd)打造33kv变电站。

根据文告,国油科技学院私人有限公司(Institute of Technology Petronas Sdn Bhd)把上述合约颁给阿末查基的独资子公司阿末查基私人有限公司(Ahmad Zaki Sdn Bhd)。

上述工程预计在30个月内完成,即2020年7月15日。

阿末查基说:“这个工程有望为集团的未来收益,作出积极贡献。

(编译:魏素雯)

Type | Announcement | Subject | OTHERS | Description | THE PROPOSED CONSTRUCTION AND COMPLETION OF BLOCK 11 & BLOCK 12 OF ACADEMIC BUILDINGS FOR FACULTY OF GEOSCIENCES AND PETROLEUM ENGINEERING AND TNB 33KV SUBSTATION AT UNIVERSITI TEKNOLOGI PETRONAS, BANDAR SERI ISKANDAR , PERAK DARUL RIDZUAN-LETTER OF AWARD | The Board of Directors of Ahmad Zaki Resources Berhad (“AZRB or the Company”) is pleased to announce that its wholly-owned subsidiary, Ahmad Zaki Sdn Bhd has on 21 December 2017, received and accepted a Letter of Award from Institute of Technology Petronas Sdn Bhd (“the Award”) for a project known as “The Proposed Construction and Completion of Block 11 & Block 12 of Academic Buildings for Faculty of Geosciences and Petroleum Engineering and TNB 33kv Substation at Universiti Teknologi Petronas, Bandar Seri Iskandar, Perak Darul Ridzuan” (“the Contract Works”).

The Award for the Contract Works amounted to a total value of RM138,380,277.91. The Contract Works is expected to be completed in the next 30 months until 15 July 2020.

The Contract Works is expected to contribute positively to the Group’s future earnings.

None of the Directors and Substantial Shareholders of AZRB or any persons connected with them has any interest, direct or indirect, in the Contract Works.

The Board of AZRB is of the opinion that the Contract Works is in the best interest of the Company.

This announcement is dated 21 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 02:02 AM

|

显示全部楼层

发表于 5-3-2018 02:02 AM

|

显示全部楼层

本帖最后由 icy97 于 6-3-2018 04:43 AM 编辑

阿末查基末季亏375万

2018年3月1日

(吉隆坡28日讯)因偿还税收局款项,阿末查基(AZRB,7078,主板建筑股)截至去年12月杪末季由盈转亏,净亏375万1000令吉或每股0.71仙,上财年同期为净赚827万6000令吉或每股1.46仙。

阿末查基今日向交易所报备,由于在当季清偿工程和建筑业务被税收局追讨2011至2016年的1220万令吉额外税款,加上罚金,导致净利蒙受380万令吉亏损。

全年净利增3.8%

该季营业额则按年大跌50.06%,取得1亿7826万7000令吉,归咎于工程和建筑业务。

合计全年,净利按年增加3.77%,报2823万4000令吉;营业额则按年跌20.03%,达9亿6068万5000令吉,因主要建筑项目完成速度较慢,抵消了特许经营和种植业务的营业额。

撇除单次税收影响,阿末查全年调整后净利应达4590万令吉,年增14.2%,这主要归功于良好的建筑项目混合、IIUM医院特许经营收入,及种植业务损失减少。

集团董事经理拿督斯里旺查卡利亚在文告中指出,尽管年杪面临许多难题,但公司营运依然表现良好,尤其是种植业务。

随着更多建筑合约颁出、种植领域持续表现亮眼,以及Tok Bali Supply Base码头的活动和客户料提升,他乐观看待今年业绩表现。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 178,267 | 356,998 | 960,685 | 1,201,273 | | 2 | Profit/(loss) before tax | 14,319 | 5,050 | 61,566 | 50,462 | | 3 | Profit/(loss) for the period | -3,776 | 8,452 | 25,797 | 24,617 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,751 | 8,276 | 28,234 | 27,209 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.71 | 1.46 | 5.46 | 5.62 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.50 | 2.00 | 1.50 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8598 | 0.7570

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2018 04:45 AM

|

显示全部楼层

发表于 6-3-2018 04:45 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 01:48 AM

|

显示全部楼层

发表于 19-5-2018 01:48 AM

|

显示全部楼层

本帖最后由 icy97 于 22-5-2018 02:24 AM 编辑

Type | Announcement | Subject | OTHERS | Description | CONSTRUCTION OF JALAN HANG JEBAT, JALAN STADIUM (VICTORIA INSTITUTIONS) AND CHINWOO TUNNELS, ELEVATED U-TURN AND FLYOVER, GALLOWAY PEDESTRIAN BRIDGE, RELOCATION OF EXISTING UTILITIES, UPGRADING AND IMPROVEMENT OF SURFACE ROAD AND ASSOCIATED WORKS, MUKIM BANDAR KUALA LUMPUR, DAERAH KUALA LUMPUR, WILAYAH PERSEKUTUAN FOR PNB MERDEKA VENTURES SDN BHD - LETTER OF ACCEPTANCE | The Board of Directors of Ahmad Zaki Resources Berhad (“AZRB” or “the Company”) is pleased to announce that its wholly-owned subsidiary, Ahmad Zaki Sdn Bhd had on 16 May 2018, received and accepted a Letter of Acceptance from PNB Merdeka Ventures Sdn Bhd (“the Award”) for a project known as “Construction of Jalan Hang Jebat, Jalan Stadium (Victoria Institutions) and Chinwoo Tunnels, Elevated U-Turn and Flyover, Galloway Pedestrian Bridge, Relocation of Existing Utilities, Upgrading and Improvement of Surface Road and Associated Works, Mukim Bandar Kuala Lumpur, Daerah Kuala Lumpur, Wilayah Persekutuan” (“the Contract Works”).

The Award for the Contract Works amounted to a total value of RM197,961,918.51 excluding GST. The Contract Works shall commence on 21 May 2018 and is to be completed within 883 calendar days from commencement date.

The Contract Works is expected to contribute positively to the Group’s future earnings.

None of the Directors and Substantial Shareholders of AZRB or any persons connected with them has any interest, direct or indirect, in the Contract Works. The Board of AZRB is of the opinion that the Contract Works is in the best interest of the Company.

This announcement is dated 17 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-6-2018 06:37 AM

|

显示全部楼层

发表于 8-6-2018 06:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 304,136 | 250,186 | 304,136 | 250,186 | | 2 | Profit/(loss) before tax | 12,612 | 6,779 | 12,612 | 6,779 | | 3 | Profit/(loss) for the period | 8,230 | 5,093 | 8,230 | 5,093 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,132 | 6,115 | 9,132 | 6,115 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.72 | 1.26 | 1.72 | 1.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8625 | 0.7750

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2018 06:42 AM

|

显示全部楼层

发表于 30-6-2018 06:42 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 06:17 AM

|

显示全部楼层

发表于 1-9-2018 06:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 339,698 | 237,479 | 643,834 | 487,665 | | 2 | Profit/(loss) before tax | 3,638 | 21,717 | 16,250 | 28,496 | | 3 | Profit/(loss) for the period | 2,333 | 15,457 | 10,563 | 20,550 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,306 | 15,839 | 14,438 | 21,954 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.00 | 3.04 | 2.72 | 4.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8801 | 0.8598

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 06:25 AM

|

显示全部楼层

发表于 1-9-2018 06:25 AM

|

显示全部楼层

EX-date | 26 Sep 2018 | Entitlement date | 28 Sep 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single tier interim dividend of 1 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MEGA CORPORATE SERVICES SDN BHDLevel 15-2, Bangunan Faber Imperial CourtJalan Sultan Ismail50250 Kuala LumpurTel :03-26924271Fax:03-27325388 | Payment date | 26 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 06:35 AM

|

显示全部楼层

发表于 1-9-2018 06:35 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 02:47 AM 编辑

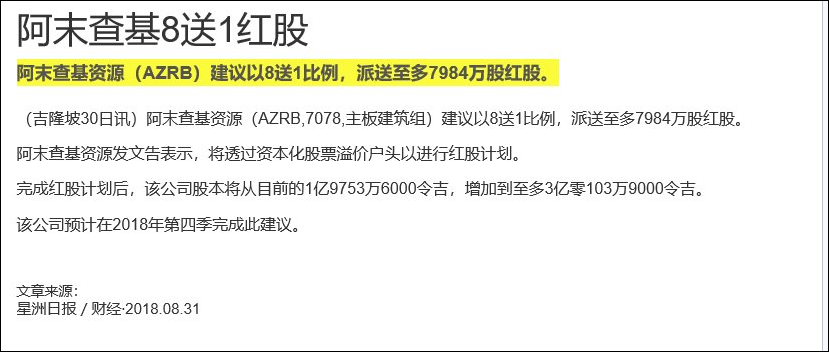

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | AHMAD ZAKI RESOURCES BERHAD ("AZRB" OR THE "COMPANY")PROPOSED BONUS ISSUE OF UP TO 79,840,322 NEW ORDINARY SHARES IN AZRB ("AZRB SHARES" OR THE "SHARE") ("BONUS SHARES") TO BE CREDITED AS FULLY PAID-UP ON THE BASIS OF 1 BONUS SHARE FOR EVERY 8 EXISTING AZRB SHARES HELD ON AN ENTITLEMENT DATE TO BE DETERMINED LATER ("PROPOSED BONUS ISSUE") | On behalf of the Board of Directors of AZRB, UOB Kay Hian Securities (M) Sdn Bhd wishes to announce that the Company proposes to undertake a bonus issue of up to 79,840,322 Bonus Shares to be credited as fully paid-up on the basis of 1 Bonus Share for every 8 existing AZRB Shares held on an entitlement date to be determined later.

Further details on the Proposed Bonus Issue are set out in the attachment enclosed.

This announcement is dated 30 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5901733

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2018 02:16 AM

|

显示全部楼层

发表于 2-9-2018 02:16 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:37 AM

|

显示全部楼层

发表于 2-1-2019 07:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 318,098 | 294,753 | 961,932 | 782,418 | | 2 | Profit/(loss) before tax | 2,293 | 18,751 | 18,543 | 47,247 | | 3 | Profit/(loss) for the period | 1,075 | 9,023 | 11,638 | 29,573 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,145 | 10,031 | 17,583 | 31,985 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.59 | 1.89 | 3.31 | 6.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 1.50 | 1.00 | 1.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8901 | 0.8598

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|