|

|

【WCEHB 3565 交流专区】(前名 KEURO)

[复制链接]

[复制链接]

|

|

|

发表于 24-8-2017 05:28 AM

|

显示全部楼层

发表于 24-8-2017 05:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 137,578 | 236,336 | 137,578 | 236,336 | | 2 | Profit/(loss) before tax | 9,502 | 10,349 | 9,502 | 10,349 | | 3 | Profit/(loss) for the period | 8,902 | 8,896 | 8,902 | 8,896 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,681 | 8,503 | 8,681 | 8,503 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.87 | 0.85 | 0.87 | 0.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6644 | 0.6561

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-11-2017 06:04 AM

|

显示全部楼层

发表于 26-11-2017 06:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 251,613 | 166,390 | 389,191 | 402,726 | | 2 | Profit/(loss) before tax | 7,886 | 9,887 | 17,387 | 20,236 | | 3 | Profit/(loss) for the period | 7,445 | 9,163 | 16,346 | 18,059 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,973 | 8,862 | 15,654 | 17,365 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.70 | 0.88 | 1.56 | 1.73 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6711 | 0.6561

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2017 02:49 AM

|

显示全部楼层

发表于 28-11-2017 02:49 AM

|

显示全部楼层

Date of change | 23 Nov 2017 | Name | DATUK IR HAMZAH BIN HASAN | Age | 66 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Director | New Position | Chairman | Directorate | Independent and Non Executive |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2017 02:50 AM

|

显示全部楼层

发表于 28-11-2017 02:50 AM

|

显示全部楼层

Date of change | 23 Nov 2017 | Name | DATO' ABDUL HAMID BIN MUSTAPHA | Age | 71 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Completed 12-year tenure. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2018 04:26 AM

|

显示全部楼层

发表于 23-2-2018 04:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 153,882 | 181,194 | 543,073 | 583,920 | | 2 | Profit/(loss) before tax | 11,892 | 6,840 | 29,279 | 27,076 | | 3 | Profit/(loss) for the period | 10,468 | 6,056 | 26,814 | 24,115 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,260 | 5,664 | 25,914 | 23,029 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.02 | 0.56 | 2.58 | 2.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7096 | 0.6838

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2018 04:47 AM

|

显示全部楼层

发表于 24-2-2018 04:47 AM

|

显示全部楼层

Date of change | 23 Feb 2018 | Name | TAN SRI PANG TEE CHEW | Age | 65 | Gender | Male | Nationality | Malaysia | Designation | Non-Independent Director | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Personal Commiment | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | | Working experience and occupation | | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest:35,000 Ordinary shares in WCE Holdings Berhad.Indirect interest:93,415,100 Ordinary shares in WCE Holdings Berhad held by United Frontiers Holdings Limited by virtue of Section 8(4) of the Companies Act 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2018 02:35 AM

|

显示全部楼层

发表于 28-3-2018 02:35 AM

|

显示全部楼层

本帖最后由 icy97 于 30-3-2018 07:56 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | PROPOSED RENOUNCEABLE RIGHTS ISSUE OF FIVE (5)-YEAR, ZERO COUPON REDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS TO BE ISSUED AT 100% OF ITS NOMINAL VALUE OF RM0.50 EACH ("RCULS") TOGETHER WITH FREE DETACHABLE WARRANTS ("WARRANTS"), ON THE BASIS OF FIVE (5) RCULS FOR EVERY SIX (6) EXISTING ORDINARY SHARES HELD IN WCE HOLDINGS BERHAD ("WCEHB") AND ONE (1) WARRANT FOR EVERY THREE (3) RCULS SUBSCRIBED FOR, ON AN ENTITLEMENT DATE TO BE DETERMINED LATER ("PROPOSED RIGHTS ISSUE") | On behalf of the Board of Directors of WCEHB, RHB Investment Bank Berhad wishes to announce that WCEHB is proposing to undertake the proposed renounceable rights issue of five (5)-year, zero coupon redeemable convertible unsecured loan stocks to be issued at 100% of its nominal value of RM0.50 each (“RCULS”) together with free detachable warrants (“Warrants”), on the basis of five (5) RCULS for every six (6) existing ordinary shares held in WCEHB and one (1) Warrant for every three (3) RCULS subscribed for, on an entitlement date to be determined later (“Proposed Rights Issue”).

Further details on the Proposed Rights Issue are set out in the attachment below.

This Announcement is dated 26 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5735897

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2018 05:12 AM

|

显示全部楼层

发表于 27-5-2018 05:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 337,517 | 285,454 | 880,590 | 869,374 | | 2 | Profit/(loss) before tax | -11,954 | 12,718 | 17,325 | 39,794 | | 3 | Profit/(loss) for the period | -11,760 | 10,993 | 15,054 | 35,108 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -12,233 | 12,127 | 13,681 | 35,156 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.22 | 1.21 | 1.36 | 3.51 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6974 | 0.6838

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 03:06 AM

|

显示全部楼层

发表于 22-8-2018 03:06 AM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2018 01:16 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 180,346 | 137,578 | 180,346 | 137,578 | | 2 | Profit/(loss) before tax | 10,180 | 9,750 | 10,180 | 9,750 | | 3 | Profit/(loss) for the period | 9,622 | 9,150 | 9,622 | 9,150 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,267 | 8,929 | 9,267 | 8,929 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.92 | 0.89 | 0.92 | 0.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7078 | 0.6985

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 07:15 AM

|

显示全部楼层

发表于 25-8-2018 07:15 AM

|

显示全部楼层

本帖最后由 icy97 于 26-8-2018 03:02 AM 编辑

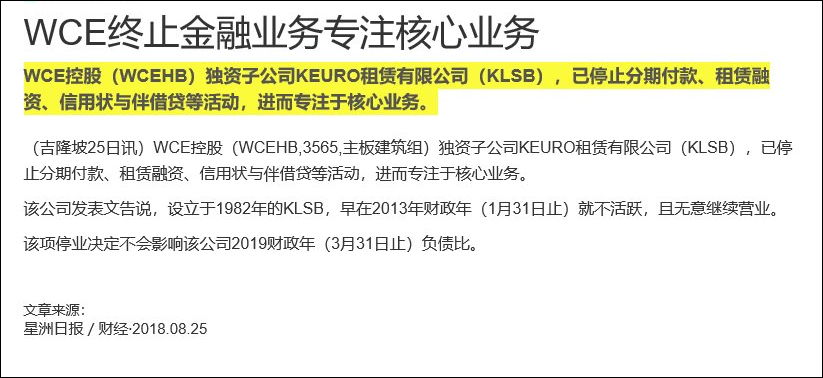

Type | Announcement | Subject | OTHERS | Description | WCE HOLDINGS BERHAD ("WCEHB" or "the Company")- Cessation of Business Operations of KEURO Leasing Sdn. Bhd., a wholly-owned subsidiary of WCEHB | The Board of Directors of WCEHB wishes to announce that KEURO Leasing Sdn. Bhd., a wholly-owned subsidiary of the Company, had decided to cease the business operations in hire purchase, lease financing, letter of credit, money lending and factoring services.

The details of the announcement are as set out in the attachment below.

This announcement is dated 24 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5893001

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-10-2018 05:23 AM

|

显示全部楼层

发表于 28-10-2018 05:23 AM

|

显示全部楼层

Name | TAN SRI DATO' SURIN UPATKOON | Nationality/Country of incorporation | Thailand | Descriptions (Class) | Ordinary shares. |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 18 Oct 2018 | 85,765,500 | Others | Indirect Interest | Name of registered holder | MWE Holdings Berhad | Address of registered holder | 846 Jalan Besar Sungai Bakap 14200 Sungai Jawi Penang | Description of "Others" Type of Transaction | Interest via Cypress | | 2 | 18 Oct 2018 | 55,800,000 | Others | Indirect Interest | Name of registered holder | HLB Nominees (Tempatan) Sendirian Berhad | Address of registered holder | Level 5, Wisma Hong Leong 18 Jalan Perak 50450 Kuala Lumpur | Description of "Others" Type of Transaction | Interest via Cypress | | 3 | 18 Oct 2018 | 90,000,000 | Others | Indirect Interest | Name of registered holder | Malaysia Nominees (Tempatan) Sendirian Berhad | Address of registered holder | 13th Floor, Menara OCBC 18 Jalan Tun Perak 50050 Kuala Lumpur | Description of "Others" Type of Transaction | Interest via Cypress | | 4 | 18 Oct 2018 | 25,000,000 | Others | Indirect Interest | Name of registered holder | CIMB Islamic Nominees (Tempatan) Sdn Bhd | Address of registered holder | 17th Floor, Menara CIMB Jalan Stesen Sentral 2 Kuala Lumpur Sentral 50470 Kuala Lumpur | Description of "Others" Type of Transaction | Interest via Cypress |

Circumstances by reason of which change has occurred | Hanton Capital Limited ("HCL") has on 18 October 2018 entered into a Share Sale and Purchase Agreement with Tan Sri Dato' Surin Upatkoon ("TDSU") on the acquisition of 99.99% shareholding interest in Pinjaya Sdn Bhd ("Pinjaya") of which Pinjaya is the substantial shareholder of MWE Holdings Berhad ("MWE") and in turn MWE is a substantial shareholder of the WCE Holdings Berhad ("WCE").HCL is deemed to have indirect interest in these WCE shares held through Pinjaya.Cedar Holdings Limited ("CHL") and Kularb Kaew Company Limited ("KKCL") are deemed to have indirect interests in the WCE shares held through HCL.Cypress Holdings Limited ("Cypress") is deemed to have indirect interest in the WCE shares held through CHL and KKCL.TDSU therefore ceased to have indirect interest in WCE shares held through Pinjaya but he is deemed to have indirect interest in the WCE shares held through Cypress. | Nature of interest | Indirect Interest | Direct (units) |

| | Direct (%) |

| | Indirect/deemed interest (units) | 256,565,500 | Indirect/deemed interest (%) | 25.587 | Total no of securities after change | 256,565,500 | Date of notice | 22 Oct 2018 | Date notice received by Listed Issuer | 25 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 06:56 AM

|

显示全部楼层

发表于 30-12-2018 06:56 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | WCE HOLDINGS BERHAD ("WCEHB" OR THE "COMPANY")(I) PROPOSED RIGHTS ISSUE OF RCPS; AND(II) PROPOSED AMENDMENTS | Reference is made to the announcement by RHB Investment Bank Berhad (“RHB Investment Bank”) on behalf of the Board of Directors of WCEHB (“Board”) on 26 March 2018 in relation to the proposed renounceable rights issue of five (5)-year, zero coupon redeemable convertible unsecured loan stocks to be issued at 100% of its nominal value of RM0.50 each (“RCULS”) together with free detachable warrants (“Warrants”), on the basis of five (5) RCULS for every six (6) existing ordinary shares in WCEHB and one (1) Warrant for every three (3) RCULS subscribed for, on an entitlement date to be determined later (“Proposed Rights Issue of RCULS”).

On behalf of the Board, RHB Investment Bank wishes to announce that the Board has resolved to vary the Proposed Rights Issue of RCULS to the proposed renounceable rights issue of new redeemable convertible preference shares in WCEHB (“RCPS”) together with Warrants to raise gross proceeds of up to RM485 million (“Proposed Rights Issue of RCPS”).

In order to facilitate the implementation of the Proposed Rights Issue of RCPS, the Company also proposes to undertake the proposed amendments to the Constitution of WCEHB (“Proposed Amendments”) to amend and/or include certain clauses in the existing Constitution of the Company.

Further details on the Proposed Rights Issue of RCPS and Proposed Amendments are set out in the attachment below.

This Announcement is dated 28 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5988913

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 06:57 AM

|

显示全部楼层

发表于 30-12-2018 06:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 189,429 | 251,613 | 369,775 | 389,191 | | 2 | Profit/(loss) before tax | 2,237 | 9,391 | 12,417 | 19,140 | | 3 | Profit/(loss) for the period | 1,754 | 8,950 | 11,376 | 18,099 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,443 | 8,478 | 10,710 | 17,407 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.14 | 0.85 | 1.07 | 1.74 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7092 | 0.6985

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2019 07:17 AM

|

显示全部楼层

发表于 23-2-2019 07:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 123,296 | 153,882 | 493,071 | 543,073 | | 2 | Profit/(loss) before tax | 10,659 | 11,046 | 23,076 | 30,186 | | 3 | Profit/(loss) for the period | 10,337 | 9,622 | 21,713 | 27,721 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,337 | 9,622 | 21,713 | 27,721 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.01 | 0.94 | 2.08 | 2.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6982 | 0.6774

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2019 06:43 AM

|

显示全部楼层

发表于 8-4-2019 06:43 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | WCE HOLDINGS BERHAD (the Company)GLOBAL SETTLEMENT AGREEMENT WITH TALAM TRANSFORM BERHAD (TTB) | The Board wishes to announce that on this date, the Company has entered into a Global Settlement Agreement with TTB and the salient terms and condition of the Global Settlement

are as follows:

(a) The Company and its related corporations recorded a net amount owing by TTB of RM23,091,722 whereas the books of TTB and its related corporations recorded a net amount

owing to the Company and its related corporations of RM17,012,056. Both parties mutually agreed to a net amount of RM19,042,983.

(b) TTB has claimed for monetary losses on the Company for land auctioned by Bangkok Bank Berhad of RM38,346,643.

The parties agreed to set-off the net amount owing to the Company of RM19,042,983 and the amount of claim by TTB for monetary losses for land auctioned by Bangkok Bank Berhad of RM38,346,643 resulting in a net amount owing to TTB by the Company of RM19,303,660.

This announcement is dated 27 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2019 07:42 AM

|

显示全部楼层

发表于 27-6-2019 07:42 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 266,573 | 337,517 | 759,644 | 880,590 | | 2 | Profit/(loss) before tax | -80 | -1,397 | 22,996 | 28,789 | | 3 | Profit/(loss) for the period | 22 | -1,275 | 21,735 | 26,446 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -371 | -1,748 | 20,467 | 25,073 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.04 | -0.17 | 2.04 | 2.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6983 | 0.6779

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-8-2019 06:42 AM

|

显示全部楼层

发表于 20-8-2019 06:42 AM

|

显示全部楼层

本帖最后由 icy97 于 22-8-2019 07:47 AM 编辑

wce控股首季净利微跌

https://www.enanyang.my/news/20190822/wce控股首季净利微跌/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 383,193 | 180,346 | 383,193 | 180,346 | | 2 | Profit/(loss) before tax | 11,071 | 10,180 | 11,071 | 10,180 | | 3 | Profit/(loss) for the period | 9,976 | 9,622 | 9,976 | 9,622 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,226 | 9,267 | 9,226 | 9,267 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.92 | 0.92 | 0.92 | 0.92 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7075 | 0.6983

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2019 08:20 AM

|

显示全部楼层

发表于 1-11-2019 08:20 AM

|

显示全部楼层

EX-date | 23 Oct 2019 | Entitlement date | 24 Oct 2019 | Entitlement time | 05:00 PM | Entitlement subject | Rights Issue | Entitlement description | Renounceable rights issue of 2,005,471,176 new redeemable convertible preference shares in WCE Holdings Berhad ("WCEHB") ("RCPS") at an issue price of RM0.24 per RCPS, together with 501,367,794 free detachable warrants ("Warrants"), on the basis of two (2) RCPS for every one (1) existing ordinary share in WCEHB held by the entitled shareholders as at 5:00 p.m. on 24 October 2019 and one (1) Warrant for every four (4) RCPS subscribed for ("Rights Issue of RCPS") | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | METRA MANAGEMENT SDN BHD35th Floor, Menara Multi-PurposeCapital SquareNo. 8, Jalan Munshi Abdullah50100 Kuala LumpurTel: +603 2698 3232Fax: +603 2698 0313 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 24 Oct 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 22 Oct 2019 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 2 : 1 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.240 |

Despatch date | 29 Oct 2019 | Date for commencement of trading of rights | 25 Oct 2019 | Date for cessation of trading of rights | 04 Nov 2019 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 14 Nov 2019 | Listing Date of the Rights Securities | 25 Nov 2019 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 01 Nov 2019 | | 05:00:00 PM | Transfer of provisional allotment of rights | 05 Nov 2019 | | 04:30:00 PM | Acceptance and payment | 11 Nov 2019 | | 05:00:00 PM | Excess share application and payment | 11 Nov 2019 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2020 06:04 AM

|

显示全部楼层

发表于 24-1-2020 06:04 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | WCE HOLDINGS BERHAD ("WCEHB" OR THE "COMPANY")RIGHTS ISSUE OF RCPS | We refer to the earlier announcements in relation to the Rights Issue of RCPS. Unless otherwise stated, the terms used herein shall have the same meaning as defined in the said announcements.

On behalf of the Board, RHB Investment Bank wishes to announce that as at the closing date and time for acceptance, excess application and payment for the Rights Issue of RCPS at 5:00 p.m. on 11 November 2019 (“Closing Date”), the Company had received total valid acceptances and excess applications for 2,390,671,471 RCPS with 597,667,867 Warrants as set out in the table below:

| No. of RCPS | No. of Warrants | % of total RCPS with Warrants available for subscription | | Total valid acceptances | 1,927,408,080 | 481,852,020 | 96.11 | | Total valid excess applications (excluding excess applications by the Undertaking Shareholders^) | 89,584,798 | 22,396,199 | 4.47 | | | 2,016,992,878 | 504,248,219 | 100.58 | | Total valid excess applications by the Undertaking Shareholders | 373,678,593 | 93,419,648 | 18.63 | | Total valid acceptances and excess applications | 2,390,671,471 | 597,667,867 | 119.21 | | Total available for subscription | 2,005,471,176 | 501,367,794 | 100.00 | | Over-subscription | 385,200,295 | 96,300,073 | 19.21 |

Note:

^ Undertaking Shareholders comprise IJM, MWE and UFHL who have provided written irrevocable undertakings vide their letters dated 17 May 2019, 28 May 2019 and 10 May 2019 respectively (“Undertakings”), to subscribe in full for their respective entitlements under the Rights Issue of RCPS and to apply for excess RCPS with Warrants in accordance with their respective Undertakings.

The total valid acceptances and excess applications (including excess applications by the Undertaking Shareholders) represent an over-subscription of 385,200,295 RCPS with 96,300,073 Warrants or approximately 19.21% over the total number of RCPS with Warrants available for subscription under the Rights Issue of RCPS.

In view that the RCPS with Warrants have been over-subscribed, the Board will allot the excess RCPS with Warrants in a fair and equitable manner in accordance with the following steps as set out in Section 12.5 of the Abridged Prospectus dated 24 October 2019:

(a) firstly, to the Entitled Shareholders and/or their renouncees and/or transferees (if applicable) (excluding the Undertaking Shareholders) in the following order of priority:

(i) firstly, to minimise the incidence of odd lots;

(ii) secondly, on a pro-rata basis and in board lots, to the Entitled Shareholders (excluding the Undertaking Shareholders) who have applied for the excess RCPS with Warrants, calculated based on their respective shareholdings on the Entitlement Date;

(iii) thirdly, on a pro-rata basis and in board lots, to the Entitled Shareholders (excluding the Undertaking Shareholders) who have applied for the excess RCPS with Warrants, calculated based on the quantum of their respective excess RCPS with Warrants applied for; and

(iv) lastly, on a pro-rata basis and in board lots, to the renouncees and/or transferees (if applicable) who have applied for the excess RCPS with Warrants, calculated based on the quantum of their respective excess RCPS with Warrants applied for;

(b) in the event there is any remaining excess RCPS with Warrants after steps (i) to (iv) above are carried out, steps (ii) to (iv) will be repeated in the same sequence to allocate the remaining excess RCPS with Warrants to the Entitled Shareholders and/or their renouncees and/or transferees (if applicable) (excluding the Undertaking Shareholders); and

(c) any remaining excess RCPS with Warrants thereafter which the Company is unable to allocate to the Entitled Shareholders and/or their renouncees and/or transferees (if applicable) (excluding the Undertaking Shareholders) will then be allocated to the Undertaking Shareholders in accordance with the terms of their respective Undertakings.

The RCPS with Warrants are expected to be listed on the Main Market of Bursa Securities on 25 November 2019.

This Announcement is dated 14 November 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2020 08:12 AM

|

显示全部楼层

发表于 31-1-2020 08:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 228,549 | 189,429 | 611,742 | 369,775 | | 2 | Profit/(loss) before tax | -11,584 | 2,237 | -513 | 12,417 | | 3 | Profit/(loss) for the period | -12,102 | 1,754 | -2,126 | 11,376 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -8,501 | 1,443 | 725 | 10,710 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.85 | 0.14 | 0.07 | 1.07 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6991 | 0.6983

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|