|

|

发表于 5-10-2016 10:48 PM

|

显示全部楼层

发表于 5-10-2016 10:48 PM

|

显示全部楼层

本帖最后由 icy97 于 6-10-2016 12:14 AM 编辑

浅谈MBL

Wednesday, October 5, 2016

http://bblifediary.blogspot.my/2016/10/mbl.html

业务

- 设计和生产油籽压榨器与辅助机器

- 设计、生产、安装和经营油籽压榨厂房以及制造和销售配件

MBL(麻坡万利集团,5152,主板工业产品股),成立于1987年,并于2009年上市大马交易所主板。

MBL主要是提供一站式石油石料生产线安装的销售和服务,其中包括配置的设计,制造,安装和调试服务。

MBL的产品有80%供出口,其产品赢得信誉和市场,除了马来西亚外,海外市场份额包括印尼、尼日利亚、巴布亚新几内亚、墨西哥、哥斯达黎加、哥伦比亚、葡萄牙、南非印度、所罗门群岛、比利时、危地马拉、菲律宾、新加坡、斯里兰卡、坦桑尼亚、泰国、香港、瓦努阿图、象牙海岸、荷兰、喀麦隆、加蓬、委内瑞拉和美国。

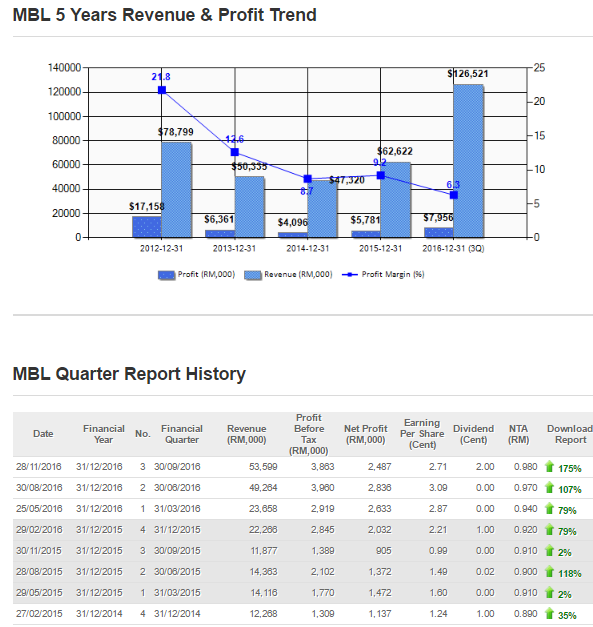

首先,来看看MBL过去数个季度的业绩:

从MBL的季度业绩来看,该公司过去三个季度的业绩非常亮丽,而且连续三个季度取得增长。

再来看看它过去数年的业绩:

截至2016年6月30日,虽然只过了半年,但MBL净利已达到547万令吉,而去年全年净利则是578万令吉。以此来看,现财政年的总业绩将肯定超越2015年。

MBL虽然是一家从事与油棕业相关的公司,但却没有直接参与油棕种植业务,而是一家专门为油棕领域服务的公司,所以它的前景展望与油棕业息息相关。

最近,棕油价格有逐步走高的趋势,至今维持在2600-2700令吉之间。如果棕油价继续上扬,相信也会带动整个种植领域,MBL也有机会受惠。

以该公司目前的净利来计算,其合理价处于RM1.36左右。

免责声明:

以上投资分析,纯属本人个人意见和观点。

在买进一家公司的股份前,请先做功课并了解该公司,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负!

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2016 06:06 AM

|

显示全部楼层

发表于 27-10-2016 06:06 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MUAR BAN LEE GROUP BERHAD (MBL OR THE COMPANY)SHARE SUBSCRIPTION OF IDR12,540,000,000.00 (WHICH EQUIVALENT TO RM3,931,290.00) FOR A NEWLY PAID UP SHARE CAPITAL IN PT BANYUASIN NUSANTARA SEJAHTERA (BNS) BY ITS WHOLLY-OWNED SUBSIDIARY, MUAR BAN LEE ENGINEERING SDN BHD (MBLE) WHICH REPRESENTING 33% EQUITY INTEREST IN BNS AND TO BE SATISFIED IN CASH (THE SUBSCRIPTION) | 1. INTRODUCTION The Board of Directors (“Board”) of MBL, wishes to announce that MBLE has entered into an agreement on 24 October 2016 to subscribe a newly addition allotment of IDR12,540,000,000.00 (which is equivalent to RM3,931,290.00) paid up share capital in BNS at par value and to be settled in cash. The new subscription of share capital invested by MBLE is presented 33% shareholding on total issued and paid up share capital of BNS.

2. DETAILS OF THE SUBSCRIPTION Pursuant to the Subscription, MBLE is allocate a total share capital amounted IDR12,540,000,000.00 which is equivalent to RM3,931,290.00 (“Purchase Consideration”) based on total settlement in cash. From the subscription, total shareholding held by MBLE will represented 33% equity interest in BNS and BNS is become a Associate Company of MBLE. (a) Basis and justification for the purchase consideration The Purchase Consideration was arrived at on a willing buyer-willing seller basis, and after taking into consideration the audited consolidated net assets of BNS as at 31 December 2015 and the potential earnings of BNS. (b) Salient terms of the Subscription Payment Terms The share application money shall be paid to BNS upon submission of share application. There are no liabilities including contingent liabilities and guarantees to be assumed by BNS under the Subscription, other than those arising in the ordinary course of business of BNS.

3. INFORMATION ON MBLE MBLE, (Company No. 166822-V), a company incorporated pursuant to the laws of Malaysia and having its business address at JR52, Lot 1818, Jalan Raja, Kawasan Perindustrian Bukit Pasir, 84300 Muar, Johor. The Company is principally involved in manufacturing and trading in all kinds of machinery, tools, plants, hardwares, building materials, accessories and engineering requisites. The authorised share capital of MBLE is RM5,000,000.00 comprising of 5,000,000 ordinary shares of RM1/- each and the issued and paid-up share capital is RM2,000,000.00.

4. INFORMATION ON BNS BNS (AHU-35861.A.H.01.01 Tahun 2011), a limited liability company existing under the laws of the Republic of Indonesia incorporated on date 19 July 2011 and its principal activities are dealing in manufacturing coconut oil, crude oil, crude palm oil, palm kernel oil and to market and distribute the said products manufactured. The company status of BNS was PT Penanaman Modal Asing (PMA) which listed in the Akta No. 88 dated 30/06/2011, confirmed by Menteri Hukum dan Hak Asasi Manusia (MHHAM) in decision letter dated 19/07/2011 No AHU-35861.AH.0101. Tahun 2011 and which also announced and uploaded in Berita Negara Rep Indonesia dated 02/10/2012 No 79 Tambahan No, 56817. The principal address of BNS is at Jalan Tanjung Siapi-api, Keseluruhan Karang Anyar, Kecamatan Muara Telang, Banyuasin, Sumatera Selatan, Indonesia. Currently, the authorised and paid up share capital of BNS is IDR16,000,000,000 comprised of 16,000 ordinary shares of IDR1,000,000 per share and the issued and paid up share capital of BNS is IDR16,000,000,000.00 which were contributed by Tuan Khor Soo Ping, Malaysian, (50%) and Tuan Sian, Indonesian (50%). Pursuant to the acceptance of share subscriptions by MBLE and other parties and upon completion of the capital injection, the authorised and paid up share capital of BNS will be increased to IDR38,000,000,000.00 comprised of 38,000 ordinary shares of IDR1,000,000 per share. New shareholders structure of BNS will be:- MBLE, Malaysian Corporation 33% Tuan Khor Soo Ping, Malaysian 31% Tuan Sian, Indonesian 31% Lina, Indonesian (new shareholders) 5% The earnings per share of BNS is ID58,662 (equivalent to RM18.39) and its fair value is IDR1,209,506 (equivalent to RM379.15) per ordinary share as per financial result for the year ended 31 December 2015.

5. SOURCE OF FUNDING Funding for the investment in BNS by MBLE is sourced from its internal generated funds.

6. EFFECTS OF THE SUBSCRIPTION The Subscription is not expected to have any material effect on MBL’s consolidated earnings, earnings per share, Net Asset (NA), NA per share and gearing. The Subscription will not have any effect on MBL’s share capital and substantial shareholders’ shareholding.

7. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST The Related Parties are deemed interested in the Subscription and have abstained themselves from Board deliberation and voting on the resolution approving the Subscription. Save as disclosed, none of the other Directors, Major Shareholders and/or persons connected to them have any interest, direct or indirect, in the Subscription.

8. APPROVALS REQUIRED The Subscription is not subject to the approval of the shareholders of MBL and relevant government authorities. Approval from the government authorities in Indonesia, directors and shareholder of BNS and the directors of MBL are request.

9. DIRECTORS’ STATEMENT The Board of MBL, after considered all aspects related to this investment and is in the opinion that the Subscription would be in the best interest for the MBL to venture into upstream industry of crude palm oil and palm kernel oil processing and manufacturing. The consideration also fair and reasonable and on normal commercial terms which is a best interest for the Company and their shareholders as a whole and do not detrimental to the interest of the minority shareholders as the investment is expected to contribute positively to the consolidated future earnings of MBL.

10. AUDIT COMMITTEE’S STATEMENT After reviewed the financial and operational due diligence reporting and considered all aspects of the Subscription, the Audit Committee of MBL is of the opinion that the Subscription is:- (a) in the best interest of MBL to venture into upstream industry of crude palm oil and palm kernel oil processing and manufacturing; (b) fair and reasonable and on normal commercial terms; and (c) not detrimental to the interest of the minority shareholders as the Subscription is expected to contribute positively to the consolidated future earnings of MBL.

11. PARAGRAPH 10.02(G) OF THE MAIN MARKET LISTING REQUIREMENTS OF BURSA MALAYSIA SECURITIES BERHAD The highest percentage ratio pursuant to Paragraph 10.02(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad applicable to the Subscription is 4.29% calculated based on total value of the consideration of the Subscription compared with the net assets of MBL Group.

12. DOCUMENTS AVAILABLE FOR INSPECTION The relevant documents will be made available for inspection at the registered office of MBL at 85, Muntri Street, 10200 Penang from Monday to Friday (except public holiday) for a period of three (3) months from the date of this announcement.

13. ESTIMATED TIMEFRAME FOR COMPLETION The Subscription will be completed within 30 days.

This announcement is dated 25 October 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2016 08:08 PM

|

显示全部楼层

发表于 29-11-2016 08:08 PM

|

显示全部楼层

本帖最后由 icy97 于 29-11-2016 10:23 PM 编辑

【CPKO来势汹汹】- MBL(5152)盈利YOY进步175%,种植盈利步步高升!

Monday, November 28, 2016

http://harryteo.blogspot.my/2016/11/1284cpko-mbl5152yoy175.html

MBL(5152)今天公布了最新的业绩,2.487 mil的Net Profit,YOY进步了175%。3个季度7.956 mil的盈利已经是4年新高,相信盈利在CPKO走高的情况下,Q4会更加出色。今年MBL的价量一起上涨,RM1.12的闭市价格是2年新高。而且在盈利走高的情况下,公司也有可能提高派息。

上图是MBL主要业务的表现,Manufacturing的营业额QOQ下跌1.452 mil,盈利QOQ从2.998 mil下滑到2.435 mil。不过Edible Oil Miling的盈利继续突破新高,1.864 mil的PBT比上个季度进步了40.9%。10月1号截至11月28日,2个月的平均CPKO价格是RM6,043.5, 比Q3足足上涨了7.25%。最新的CPKO价格 = RM6,867.5, 因此Q4的CPKO平均价格有望继续上涨。

从上图我们可以看到,CPKO价格上个季度了10.74%, PBT进步了40.9%。假设Q4的价格可以维持在RM6,500以上,相信Q4的Edible Oil Miling业务会很出色。

上图是CPKO最近2年的对比,可以看到CPKO在2016处于上升的趋势当中。

而在10月24日,公司收购了PT BNS大约33%的股份,总额 = RM3.931 mil。这家公司跟2015年10月收购的公司一样,都是从事Palm Kernel Crushing Plant。因此预计明年的盈利会在新公司的贡献下继续走高。

QOQ的话,PBT下跌了0.1 mil。但是这个季度的Tax Expense = RM658k 比之前两个季度总和还要高,因此Net Profit被拉低不少。公司最新季度的盈利QOQ下跌,主要原因是Manufacturing部门的盈利贡献下滑。笔者之前心中的预期是公司盈利可以破新高,不过却失算了。

不过Edible Oil Miling - 提炼CPKO的税前盈利贡献从上个季度26.47%提升到32.38%。因此笔者预期在CPKO价格走高下,Edible Oil Miling盈利贡献的比例会持续增长。而且公司收购了33%的新公司,这将会是公司盈利进步的成长引擎。棕油的价格现在处于4年的新高,因此MBL明年的成长是值得期待的。

以上纯属分享,买卖请自负。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2016 03:00 AM

|

显示全部楼层

发表于 2-12-2016 03:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 53,599 | 11,877 | 126,521 | 40,356 | | 2 | Profit/(loss) before tax | 3,863 | 1,389 | 10,742 | 5,265 | | 3 | Profit/(loss) for the period | 3,265 | 1,028 | 9,398 | 4,376 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,487 | 905 | 7,956 | 3,753 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.71 | 0.99 | 8.65 | 4.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 2.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9800 | 0.9200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-2-2017 10:33 AM

|

显示全部楼层

发表于 3-2-2017 10:33 AM

|

显示全部楼层

|

之前收购的PT Banyuasin Nusantara应该会贡献在下个quarter report吧?二月尾三月头应该可以看到? |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2017 05:39 AM

|

显示全部楼层

发表于 4-3-2017 05:39 AM

|

显示全部楼层

| MUAR BAN LEE GROUP BERHAD |

EX-date | 10 Mar 2017 | Entitlement date | 14 Mar 2017 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second interim single tier dividend of 2.0 sen per share in respect of the financial year ended 31 December 2016 | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, Standard Chartered Bank Chambers2, Leboh Pantai10300Tel:042625333Fax:042622018 | Payment date | 29 Mar 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Mar 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2017 04:38 AM

|

显示全部楼层

发表于 6-3-2017 04:38 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 54,040 | 22,266 | 180,561 | 62,622 | | 2 | Profit/(loss) before tax | 5,729 | 2,941 | 16,472 | 8,202 | | 3 | Profit/(loss) for the period | 4,198 | 1,985 | 13,596 | 6,357 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,830 | 2,431 | 11,786 | 6,180 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.17 | 2.64 | 12.81 | 6.72 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 1.00 | 2.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0600 | 0.9200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-3-2017 04:17 AM

|

显示全部楼层

发表于 29-3-2017 04:17 AM

|

显示全部楼层

本帖最后由 icy97 于 29-3-2017 06:52 AM 编辑

麻坡万利3510万售子公司

财经 2017年03月28日

(吉隆坡28日讯)麻坡万利(MBL,5152,主板工业股)宣布,旗下子公司--麻坡万利园丘私人有限公司(MBLPlantation),与Everhome国际私人有限公司(简称Everhome公司)签署谅解备忘录,建议以总值3510万令吉,脱售Sokor Gemilang Ladang私人有限公司(简称SGLSB)的100%股权予后者。

该公司发文告指出,麻坡万利园丘私人有限公司將脱售SGLSB公司每股面值1令吉的200万股,相等于该公司100%股权。

上述交易价已將SGLSB与吉兰丹州Perbadanan Pembangunan Ladang Rakyat签署一项发展种植地协议纳入考量。

文告也指出,脱售所得资金將用作公司未来营运资本、偿还贷款、以及拓展核心业务。

该公司从2015年起,就积极寻求脱售这家子公司,当时曾建议以相等价格脱售该公司100%股权给Kenali Berkat私人有限公司,【东方网财经】

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | MUAR BAN LEE GROUP BERHAD ("MBL" OR "THE COMPANY")MEMORANDUM OF UNDERSTANDING IN RELATION TO THE PROPOSED DISPOSAL OF 100% EQUITY INTEREST IN SOKOR GEMILANG LADANG SDN BHD BY MBL PLANTATION SDN BHD TO EVERHOME INTERNATIONAL (M) SDN. BHD. ("PROPOSED DISPOSAL") | 1. INTRODUCTION The Board of Directors (“Board”) of Muar Ban Lee Group Berhad (“MBL” or “the Company”), wishes to announce that MBL Plantation Sdn. Bhd. (“MBLPSB”), a wholly-owned subsidiary of the Company, has today entered into a Memorandum of Understanding (“MOU”) with Everhome International (M) Sdn. Bhd. (“EISB” or Proposed share acquirer”) to outline the basic principles for the disposal of entire issued and paid-up ordinary share capital of Sokor Gemilang Ladang Sdn. Bhd. (“SGLSB”) to EISB (“Proposed Disposal”).

2. THE MOU i) The Proposed Disposal shall have no binding effect until the entering into a definite agreement (“DA”). The MOU sets out the understanding and intention of the parties during this interim exploratory period. The DA is expected to be executed within (6) months from the date of the MOU. Full announcement of the Proposed Disposal will be made in the event the parties execute a DA. ii) Pursuant to the MOU, MBLPSB will dispose 2,000,000 ordinary shares in SGLSB (“Sale Shares”), representing 100% equity interest in SGLSB and novation of the sum owing from the creditors of SGLSB to EISB for a total consideration of RM35,100,000 (“Sale Consideration”) to be satisfied by cash. iii) The Sale Consideration was arrived at on a willing buyer-willing seller basis and after taking into account the proposed offer price based on the land use right bind in the plantation land development agreement between SGLSB and Perbadanan Pembangunan Ladang Rakyat Negeri Kelantan (“PPLRNK”) on Lot 2282, Mukim Sokor, District of Sokor, Jajahan Kuala Krai, Kelantan.

3. INFORMATION ON SGLSB SGLSB was incorporated under the Companies Act 1965 on 28 July 2006 in Malaysia as a private limited company. The principal activities of SGLSB consist of cultivation of oil palm plantation. As today, the issued share capital of SGLSB is RM2,000,000 comprising 2,000,000 ordinary shares. SGLSB is a whole-owned subsidiary of MBLPSB. SGLSB had on 27 August 2006 entered into a Plantation Development Agreement with PPLNK wherein SGLSB acquired the right to develop the plantation land into oil palm plantation and/or rubber plantation for such periods and subject to such terms and conditions contained therein. The plantation land measuring 789 hectares or approximately 1,949.7 acres is located in Mukim Sokor, District of Sokor, Jajahan Kuala Krai, Kelantan. Currently the plantation land is planted with oil palm.

4. INFORMATION ON EISB EISB was incorporated under the Companies Act 1965 on 10 March 1997 in Malaysia as a private limited company. The principal activities of EISB are trading of furniture and related products. As today, the issued share capital of EISB is RM300,000 comprising 300,000 ordinary shares.

5. RATIONALE The Proposed Disposal will represent a strategic opportunity for MBL Group to cash out an avenue to realise its investment. The proceeds from the Disposal would provide future cash flow for the Group’s working capital purposes, reduce its borrowings and/or contribute towards expansion of its core business.

6. EFFECTS OF THE PROPOSED DISPOSAL The effects of the Proposed Disposal will only be determined upon finalisation of the terms of Proposal Disposal.

7. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST None of the Directors and major shareholders of MBL or persons connected with them has any interest, direct or indirect, in the MOU.

8. AUDIT COMMITTEE & DIRECTORS’ OPINION The Audit Committee of MBL, after giving due consideration, is of the opinion that the entering into the MOU is in the best interest of the MBL Group. The Board of Directors of MBL is also the opinion that the MOU is in the best interest of the MBL Group.

9. APPROVALS REQUIRED The MOU is not subject to the approval of the shareholders of MBL or any regulatory authority. However, the Proposed Disposal is subject to due diligence exercise and prior approval from shareholders of MBL and relevant authorities. Appropriate announcement(s) will be made on the proposal in due course.

10. DOCUMENTS AVAILABLE FOR INSPECTION The MOU will be made available for inspection at the registered office of MBL at 85, Muntri Street, 10200 Penang from Monday to Friday (except public holiday) for a period of three (3) months from the date of this announcement.

This announcement is dated 28 March 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-4-2017 05:12 AM

|

显示全部楼层

发表于 5-4-2017 05:12 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ADDITIONAL INVESTMENT IN WHOLLY-OWNED SUBSIDIARY, MBL PLANTATION SDN BHD ("MBLPSB") | Announcement Details :

1.INTRODUCTION The Board of Directors of Muar Ban Lee Group Berhad (“MBL”) is pleased to announce that MBL had on 4 April 2017 acquired additional 300,000 new ordinary shares of MBLPSB for a total consideration of RM300,000/- at an issue price of RM1.00 each.

2.INFORMATION ON MBLPSB MBLPSB was incorporated on 29 February 2012 under the Companies Act 1965 as a private limited company and is a wholly owned subsidiary of MBL. From the additional 300,000 ordinary shares issued to MBL, the issued share capital of MBLPSB was increased from RM100,000 to RM400,000 comprising 400,000 ordinary shares. The principal activity of MBLPSB is an investment holding company involving in agricultural industry.

3.SOURCE OF FUNDING The total consideration for the additional investment is proposed to be wholly satisfied by cash through internally-generated funds of MBL.

4.FINANCIAL EFFECTS a) Share Capital and substantial shareholders’ shareholding The additional Investment does not have any effect on the share capital of MBL and the shareholdings of its substantial shareholders. b) Earnings The additional Investment is not expected to have any material impact on the earnings of MBL for the current financial year ending 31 December 2017. c) Net Assets The additional Investment is not expected to have any material effect on the net assets per share of MBL for the current financial year ending 31 December 2017. d) Gearing The additional Investment is not expected to have any material effect on the gearing of the MBL Group.

5.DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST Dato’ Chua Ah Ba @ Chua Eng Ka, Mr. Chua En Hom, Mr. Chua Eng Hui, Mr. Chua Heok Wee and Tan Sri Dato’ Seri Tan King Tai @ Tan Khoon Hai declared that they are directors of MBLPSB and hence regarded as interested in the investment.

6.APPROVALS REQUIRED The additional investment in MBLPSB does not require the approval of shareholders of MBL and the relevant government authorities.

7.DIRECTORS’ RECOMMENDATION The Board of Directors is of the opinion that the additional investment is in the best interest of MBL, fair, reasonable and on normal commercial terms and not detrimental to the interest of the minority shareholders.

8.PARAGRAPH 10.02(G) OF THE MAIN MARKET LISTING REQUIREMENTS OF BURSA MALAYSIA SECURITIES BERHAD The highest percentage ratio pursuant to Paragraph 10.02(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad applicable to the additional Investment is 0.33% calculated based on total value of the consideration of the Proposed Acquisition compared with the net assets of MBL Group.

9.This announcement is dated 4 April 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-5-2017 03:13 AM

|

显示全部楼层

发表于 26-5-2017 03:13 AM

|

显示全部楼层

本帖最后由 icy97 于 26-5-2017 05:26 AM 编辑

MBL (5152) - 棕油提炼器材公司

2017年5月23日星期二

http://wesharenwetrade.blogspot.my/2017/05/mbl-5152.html

MBL全名Muar Ban Lee,一看就知道这家公司是在Muar (麻坡)起家的。是一家市值非常小的棕油提炼器材公司,目前规模只有CBIP的10%而已。CBIP(7076)是另一间规模比较大的棕油炼油厂制造商。那么MBL的生意与CBIP这种大规模的炼油厂制造商相比又有什么不同呢?

主要业务:

棕榈仁油榨油机制造商 - 设计和制造主要用于棕榈仁油提取的棕榈仁油籽油榨油机。 MBL还生产称为EK(Automated)系列的自动化棕榈仁油种子榨汁机。

Copra Oil Exteller或Coconut Oil Exteller的油脂驱散剂生产商 - 采用螺旋压榨加工技术,由工程技术团队精心改进。可以粉碎和压榨棕油籽或椰子,随之抽油。

过滤机 - 用于过滤从油籽榨油机提取的粗核油和粗油,以去除杂质和污泥含量。它们也可用于过滤其他类型的提取油。

废水处理工厂 - 这项业务只在公司网站看到但却不在年报中的营业额份额中,相信只占非常少的贡献,是非核心业务。

公司管理层与经营策略

目前已经由年仅44岁的第二代Chua Heok Wee任职Managing Director,有好的接班人。不过看了其他“高层”的年龄都不年轻了,许多都在60岁以上。公司要有好的发展可能还需要引进更多的新血。

公司还是focus在和“油”有关的业务,目前正考虑增加生产线来应对持续增加的订单。同时也设下目标要提高榨油量,让榨油更有效率也减少浪费。

目前公司已经有3间office在印尼,也计划增加一个service centre以供应机械零件。除此以外,公司并不排除寻找好的投资项目,投资方向为下游业务比如炼油厂。

投资亮点 & 风险

1. 衣食住行兼柴米油盐酱醋茶 - 民以食为天,食油是食品工业中重要的一环,你能想象煮菜不用油吗?最近食油起价了但我们人民也无可奈何要继续用油,而且使用量绝对不比起价前少,由此可见这门传统生意的“霸道”所在。也许有人说“棕油”不够健康,所以公司也diversified了榨椰子油业务。总之不论什么油,都要经过机器榨出来,所以MBL的业务就有保障了。

2. 正处于爆发性成长 - 2016年的营业额差不多是2015年的三倍!EPS (每股盈余)也增加了1倍左右。而且从营业额分布中可以看到所有的业务的营业额都增加了,证明公司各方面都在成长。从最近四个季度的表现来看,无论是营业额还是盈利都比2015年同期高了一个档次,代表成长是持续性的。

3. 积极扩展业务 - 年报中管理层一再强调要增加生产线、发展海外业务、并购炼油厂等都是很正面的讯息,这些举动也将会有效地帮助生意成长。

4. 大宗物品价格影响 - 棕油业总是离不开棕油价格,如果棕油价格不理想恐怕炼油厂对炼油机械的需求也会减少。和“石油”也一样,当油价下跌时不论是上游业还是下游业都无可幸免。

5. 印尼方面的业务 - 印尼也是棕油强国,可以预见国内也会有好的机械公司生产与MBL相关的产品,届时可能会打乱MBL在印尼的扩展计划。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2017 01:13 AM

|

显示全部楼层

发表于 14-6-2017 01:13 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 47,877 | 23,658 | 47,877 | 23,658 | | 2 | Profit/(loss) before tax | 3,853 | 2,919 | 3,853 | 2,919 | | 3 | Profit/(loss) for the period | 2,951 | 2,845 | 2,951 | 2,845 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,505 | 2,633 | 2,505 | 2,633 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.74 | 2.88 | 2.74 | 2.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0800 | 1.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2017 12:45 AM

|

显示全部楼层

发表于 6-7-2017 12:45 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MUAR BAN LEE GROUP BERHAD (MBL OR THE COMPANY)ADDITIONAL INVESTMENT IN SPA HIDAYAH ENTERPRISE SDNBHD (SPA) BY ITS WHOLLY-OWNED SUBSIDIARY,MBL PLANTATION SDN BHD (MBLP) | Announcement Details : 1.INTRODUCTION The Board of Directors of Muar Ban Lee Group Berhad (“MBL”) is pleased to announce that MBL Plantation Sdn. Bhd (“MBLP”), a wholly-owned subsidiary of MBL, had on 5th July 2017 acquired additional 199,998 new ordinary shares of SPA for a total consideration of RM199,998/- at an issue price of RM1.00 each.

2.INFORMATION ON SPA SPA was incorporated on 18 April 2013 under the Companies Act 1965 as a private limited company and is a wholly owned subsidiary of MBLP. From the additional 199,998 ordinary shares issued to MBLP, the issued share capital of SPA was increased from RM2 to RM200,000 comprising 200,000 ordinary shares. The Company has not commenced business operations since the date of its incorporation SPA intends to involve in the logging activities and cultivating trees and plants.

3. INFORMATION ON MBLP MBLP was incorporated on 29 February 2012 under the Companies Act 1965 as a private limited company and is a wholly owned subsidiary of MBL. The issued share capital of MBLP is RM400,000 comprising 400,000 ordinary shares. MBLP is an investment holding company involving in agricultural industry.

4. SOURCE OF FUNDING The total consideration for the additional investment is proposed to be wholly satisfied by cash through internally-generated funds of MBLP.

5. FINANCIAL EFFECTS i) Share Capital and substantial shareholders’ shareholding The additional investment does not have any effect on the share capital of MBL and the shareholdings of its substantial shareholders. ii) Earnings The additional investment is not expected to have any material impact on the earnings of MBL for the current financial year ending 31 December 2017. iii) Net Assets The additional investment is not expected to have any material effect on the net assets per share of MBL for the current financial year ending 31 December 2017. iv) Gearing The additional investment is not expected to have any material effect on the gearing of the MBL Group.

6. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST Dato’ Chua Ah Ba @ Chua Eng Ka, Mr. Chua En Hom, Mr. Chua Eng Hui, Mr. Chua Heok Wee and Tan Sri Dato’ Seri Tan King Tai @ Tan Khoon Hai declared that they are directors of MBLP and hence regarded as interested in the additional investment. Mr. Chua Eng Hui also the director of SPA.

7. APPROVALS REQUIRED MBLP’s investment in SPA does not require the approval of shareholders of MBL and the relevant government authorities.

8. DIRECTORS’ RECOMMENDATION The Board of Directors is of the opinion that the additional investment is in the best interest of MBL, fair, reasonable and on normal commercial terms and not detrimental to the interest of the minority shareholders.

9. PARAGRAPH 10.02(G) OF THE MAIN MARKET LISTING REQUIREMENTS OF BURSA MALAYSIA SECURITIES BERHAD The highest percentage ratio pursuant to Paragraph 10.02(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad applicable to the additional Investment is 0.19 % calculated based on total value of the consideration of the Proposed Acquisition compared with the net assets of MBL Group.

This announcement is dated 5th July 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-8-2017 11:54 PM

|

显示全部楼层

发表于 3-8-2017 11:54 PM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | Selling machinery and parts to related party related party, PT Banyuasin Nusantara Sejahtera | 1. INTRODUCTION Muar Ban Lee Group Berhad (“MBL” or “the Company”) wishes to announce the following related party transactions (“RPT”) of revenue and / or trading nature (“RRPT”) entered into between Muar Ban Lee Technology Sdn Bhd (“MBLT”), the wholly-owned subsidiary of the Company and the related party, PT Banyuasin Nusantara Sejahtera (“BNS”).Name of related party | Nature of RPT | Amount (RM) | BNS | Selling machinery and parts | 922,353.70 |

2. NATURE OF TRANSACTIONS The RPT entered into by MBLT are in the ordinary course of business and occur frequently and arise at any time and from time to time. These RPT are made on arm’s length basis and on normal commercial terms which are not prejudicial to the interest of the minority shareholders and are on terms not more favourable to BNS than those generally available to the public.

3. INFORMATION OF MBLT MBLT, (Company No. 664866-T), a company incorporated pursuant to the laws of Malaysia and having its business address at JR52, Lot 1818, Jalan Raja, Kawasan Perindustrian Bukit Pasir, 84300 Muar, Johor. The Company is principally involved in manufacturer of automated kernel crushing plants and related parts. The issued share capital of MBLT is RM1,000,000.00 comprising of 1,000,000 ordinary shares.

4. INFORMATION OF BNS BNS (AHU-35861.A.H.01.01 Tahun 2011), a limited liability company existing under the laws of the Republic of Indonesia incorporated on date 19 July 2011 and its principal activities are dealing in manufacturing coconut oil, crude oil, crude palm oil, palm kernel oil and to market and distribute the said products manufactured. The principal address of BNS is at Jalan Tanjung Siapi-api, Keseluruhan Karang Anyar, Kecamatan Muara Telang, Banyuasin, Sumatera Selatan, Indonesia. Currently, the authorised and paid up share capital of BNS is IDR38,000,000,000 comprised of 38,000 ordinary shares of IDR1,000,000 per share. BNS is an Associate Company of Muar Ban Lee Engineering Sdn Bhd, the wholly-owned subsidiary of the Company.

5. RATIONALE FOR THE RPT The RPT allows MBL Group to take advantage of efficiency in business particularly competitive pricing and shorter delivery time as well as familiarity with the background, financial wellbeing and management of BNS.

6. FINANCIAL EFFECT OF THE RPT The RPT is not expected to have material effect on the earnings per share, net assets per share and gearing of MBL Group and will have no effect on the share capital and substantial shareholders’ shareholding of MBL Group.

7. INTEREST OF THE DIRECTORS AND MAJOR SHAREHOLDERS None of the directors and / or major shareholders and / or person connected with a director or major shareholders have any interest, direct or indirect in the RPT.

8. STATEMENT BY AUDIT COMMITTEE AND THE BOARD OF DIRECTORS The Audit Committee and the Board of Directors having considered the nature and rationale for the RPT, were of the view that the RPT is in the best interests of the Group, fair, reasonable and on normal commercial terms and not detrimental to the interest of the minority shareholders as the RPT is expected to contribute positively to the consolidated future earnings of MBL.

9. PARAGRAPH 10.02(G) OF THE MAIN MARKET LISTING REQUIREMENTS OF BURSA MALAYSIA SECURITIES BERHAD The highest percentage ratio applicable to the RPT pursuant to Paragraph 10.02(g) of Bursa Malaysia Securities Berhad’s Main Market Listing Requirements is about 0.95%.

This announcement is dated 3 August 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2017 01:13 AM

|

显示全部楼层

发表于 29-8-2017 01:13 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 45,608 | 49,264 | 93,485 | 72,922 | | 2 | Profit/(loss) before tax | 4,475 | 3,960 | 8,328 | 6,879 | | 3 | Profit/(loss) for the period | 2,949 | 3,338 | 5,774 | 6,133 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,828 | 2,836 | 5,333 | 5,469 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.09 | 3.09 | 5.85 | 5.94 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1100 | 1.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2017 05:40 AM

|

显示全部楼层

发表于 1-9-2017 05:40 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INVESTMENT IN WAJAH PERTIWI SDN BHD (WPSB) | 1. INTRODUCTION The Board of Directors of Muar Ban Lee Group Berhad (“MBL”) is pleased to announce that MBL had on 30 August 2017 acquired 380,000 new ordinary shares in WPSB for a total consideration of RM570,000.00.

2. INFORMATION ON WPSB WPSB was incorporated on 26 January 2016 under the Companies Act 1965 as a private limited company. The issued share capital of WPSB is RM400,000 comprising 400,000 ordinary shares. The principle activities of WPSB are involving in manufacturing of automated processing machinery & equipment and related parts & components for palm oil industry. After the acquisition, total shareholding held by MBL will represented 95% equity interest in WPSB and WPSB is become a Subsidiary Company of MBL. Balance 5% equity interest in WPSB will be remained owned by the founder of the Company.

3. SOURCE OF FUNDING The total consideration for the Proposed Acquisition is proposed to be wholly satisfied by cash through internally-generated funds of MBL.

4. FINANCIAL EFFECTS i. Share Capital and substantial shareholders’ shareholding The Investment does not have any effect on the share capital of MBL and the shareholdings of its substantial shareholders. ii. Earnings The Investment is not expected to have any material impact on the earnings of MBL for the current financial year ending 31 December 2017. iii. Net Assets The Investment is not expected to have any material effect on the net assets per share of MBL for the current financial year ending 31 December 2017. iv. Gearing The Investment is not expected to have any material effect on the gearing of the MBL Group.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST None of the directors and / or major shareholders and / or person connected with a director or major shareholders have any interest, direct or indirect in the investment . 6. APPROVALS REQUIRED MBL’s investment in WPSB does not require the approval of shareholders of MBL and the relevant government authorities.

7. DIRECTORS’ RECOMMENDATION The Board of Directors is of the opinion that the investment is in the best interest of MBL, fair, reasonable and on normal commercial terms and not detrimental to the interest of the minority shareholders.

8. PARAGRAPH 10.02(G) OF THE MAIN MARKET LISTING REQUIREMENTS OF BURSA MALAYSIA SECURITIES BERHAD The highest percentage ratio applicable to the investment pursuant to Paragraph 10.02(g) of Bursa Malaysia Securities Berhad’s Main Market Listing Requirements is about 0.60%.

This announcement is dated 30 August 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2017 01:08 AM

|

显示全部楼层

发表于 29-9-2017 01:08 AM

|

显示全部楼层

icy97 发表于 29-3-2017 04:17 AM

麻坡万利3510万售子公司

财经 2017年03月28日

(吉隆坡28日讯)麻坡万利(MBL,5152,主板工业股)宣布,旗下子公司--麻坡万利园丘私人有限公司(MBLPlantation),与Everhome国际私人有限公司(简称Everhome公 ...

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | MUAR BAN LEE GROUP BERHAD ("MBL" OR "THE COMPANY")-EXPIRY OF MEMORANDUM OF UNDERSTANDING IN RELATION TO THE PROPOSED DISPOSAL OF 100% EQUITY INTEREST IN SOKOR GEMILANG LADANG SDN BHD BY MBL PLANTATION SDN BHD TO EVERHOME INTERNATIONAL (M) SDN. BHD. ("PROPOSED DISPOSAL") | We refer to our announcements dated 28 March 2017 and 28 June 2017.

The Board of Directors of MBL wishes to announce that there is no conclusion on the negotiations between the parties as at the expiry date of the MOU. In view thereof, the MOU expires and lapses on 28 September 2017 ("Mou expiry").

Upon the MOU expiry, neither party shall have any claim against the other, save and except for any antecedent claim.

The MOU expiry will not have any material financial impact on the MBL Group.

This announcement is dated 28 September 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-10-2017 02:56 AM

|

显示全部楼层

发表于 14-10-2017 02:56 AM

|

显示全部楼层

本帖最后由 icy97 于 17-10-2017 03:50 AM 编辑

麻坡万利拟私配10%摊还贷款

Sangeetha Amarthalingam/theedgemarkets.com

October 13, 2017 20:21 pm MYT

(吉隆坡13日讯)棕油机器制造商麻坡万利(Muar Ban Lee Group Bhd)计划配售高达10%的新股予第三方投资者或投资者,冀从中筹措约1000万令吉,以摊还银行贷款。

该集团表示,将私下配售高达912万股新股,惟发行价将在日后敲定及公布。

假设这批股权为每股1.10令吉,该集团可筹措约1004万令吉,此发行价也将比5日成交量加权平均价(VWAMP)(截至10月10日)1.1677令吉折价5.8%。

这笔资金将用以摊还989万令吉的银行贷款,以及付清进行这项企业活动的费用。

这项减债计划将可为该集团每年省下近27万2000令吉的利息,其负债比率也从0.2倍,缩减至0.09倍。

麻坡万利估计,这项私配活动将在2018年首季完成。

(编译:倪嫣鴽)

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | MUAR BAN LEE GROUP BERHAD (MBL OR THE COMPANY)PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED SHARES OF MBL | On behalf of the Board of Directors of MBL (“Board”), Inter-Pacific Securities Sdn Bhd (“IPS”) wishes to announce that the Company proposes to undertake a private placement of up to 10% of the issued shares of MBL (“Proposed Private Placement”).

Please refer to the attachment for further details.

This announcement is dated 13 October 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5571729

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2017 06:38 AM

|

显示全部楼层

发表于 2-12-2017 06:38 AM

|

显示全部楼层

本帖最后由 icy97 于 10-12-2017 05:49 AM 编辑

麻坡万利第三季多赚34%

2017年11月29日

(吉隆坡28日讯)麻坡万利集团(MBL,5152,主板工业产品股)截至9月杪第三季,净利按年涨33.98%至333万2000令吉,或每股3.65仙。

不过,营业额却按年减少7.63%,取得4951万令吉。

合计九个月,净利年升8.92%至866万6000令吉;营业额年增13.02%,报1亿4299万5000令吉。

麻坡万利集团今日向交易所报备,当季营业额减少,但首九个月却增加,主要因为项目入账时间不同,加上榨油业务销量增加。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 49,510 | 53,599 | 142,995 | 126,521 | | 2 | Profit/(loss) before tax | 5,156 | 3,863 | 13,484 | 10,742 | | 3 | Profit/(loss) for the period | 3,861 | 3,265 | 9,635 | 9,398 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,332 | 2,487 | 8,666 | 7,956 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.65 | 2.71 | 9.50 | 8.65 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1500 | 1.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2018 11:01 PM

|

显示全部楼层

发表于 16-1-2018 11:01 PM

|

显示全部楼层

| MUAR BAN LEE GROUP BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED SHARES OF MBL | No. of shares issued under this corporate proposal | 4,626,980 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.1300 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 96,626,980 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 52,386,333.400 | Listing Date | 17 Jan 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:16 AM

|

显示全部楼层

发表于 10-2-2018 03:16 AM

|

显示全部楼层

| MUAR BAN LEE GROUP BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED SHARES OF MBL | No. of shares issued under this corporate proposal | 2,250,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.1800 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 98,876,980 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 55,041,333.400 | Listing Date | 12 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|