|

|

发表于 8-9-2018 02:53 AM

|

显示全部楼层

发表于 8-9-2018 02:53 AM

|

显示全部楼层

Name | SBI HOLDINGS, INC | Address | 1-6-1 ROPPONGI

MINATO-WARD

TOKYO

Japan. | Company No. | 0104-01-045208 | Nationality/Country of incorporation | Japan | Descriptions (Class) | ORDINARY SHARES |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 03 Sep 2018 | 62,045,600 | Acquired | Direct Interest | Name of registered holder | SBI Holdings, Inc | Address of registered holder | 1-6-1 Roppongi Minato-Ward Tokyo Japan | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | ACQUISITION OF DIRECT INTEREST BY WAY OF DIRECT BUSINESS TRANSACTIONS | Nature of interest | Direct Interest | Direct (units) | 114,087,031 | Direct (%) | 19.929 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 114,087,031 | Date of notice | 05 Sep 2018 | Date notice received by Listed Issuer | 06 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 02:22 AM

|

显示全部楼层

发表于 6-11-2018 02:22 AM

|

显示全部楼层

本帖最后由 icy97 于 10-11-2018 08:04 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

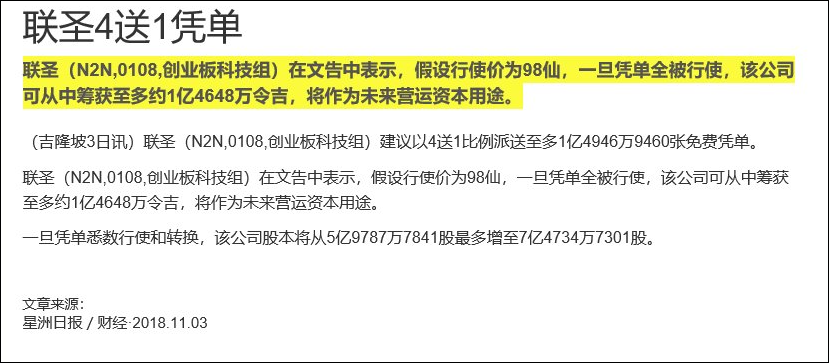

OTHER ISSUE OF SECURITIES | Description | N2N CONNECT BERHAD ("N2N" OR "COMPANY")PROPOSED BONUS ISSUE OF WARRANTS | On behalf of the Board of Directors of N2N (“Board”), Affin Hwang Investment Bank Berhad ("Affin Hwang IB") wishes to announce that the Company proposes to undertake a proposed bonus issue of up to 149,469,460 free warrants in N2N ("Warrant(s)") on the basis of 1 Warrant for every 4 existing ordinary shares in N2N ("N2N Share(s)" or "Share(s)") held on an entitlement date to be determined and announced later ("Entitlement Date") ("Proposed Bonus Issue of Warrants").

Please refer to the attachment for further details.

This announcement is dated 2 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5964897

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2018 05:40 AM

|

显示全部楼层

发表于 2-12-2018 05:40 AM

|

显示全部楼层

本帖最后由 icy97 于 4-12-2018 06:32 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 25,238 | 28,156 | 80,253 | 69,616 | | 2 | Profit/(loss) before tax | 3,463 | 5,013 | 15,299 | 18,544 | | 3 | Profit/(loss) for the period | 2,122 | 4,992 | 10,045 | 18,495 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,213 | 5,092 | 10,288 | 18,660 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.39 | 1.08 | 1.94 | 3.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 3.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4600 | 0.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2018 05:40 AM

|

显示全部楼层

发表于 2-12-2018 05:40 AM

|

显示全部楼层

EX-date | 06 Dec 2018 | Entitlement date | 10 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second Interim Dividend of 1 sen per share (Single Tier Dividend) in respect of the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:03 78490777Fax:03 78418151 | Payment date | 07 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 06:09 AM

|

显示全部楼层

发表于 15-1-2019 06:09 AM

|

显示全部楼层

EX-date | 03 Jan 2019 | Entitlement date | 07 Jan 2019 | Entitlement time | 05:00 PM | Entitlement subject | Bonus Issue | Entitlement description | BONUS ISSUE OF UP TO 149,469,460 FREE WARRANTS IN N2N CONNECT BERHAD ("N2N") ("WARRANT(S)") ON THE BASIS OF 1 WARRANT FOR EVERY 4 EXISTING ORDINARY SHARES IN N2N ("N2N SHARE(S)" OR "SHARE(S)") HELD BY ENTITLED SHAREHOLDERS OF N2N AT 5:00 PM ON 7 JANUARY 2019 ("ENTITLEMENT DATE") ("BONUS ISSUE OF WARRANTS") | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangorT: (03) 7841 8000F: (03) 7841 8151/8152 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Jan 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 4 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2019 07:00 AM

|

显示全部楼层

发表于 24-1-2019 07:00 AM

|

显示全部楼层

Name | N2N CONNECT HOLDINGS SDN BHD | Address | 3RD FLOOR NO. 17

JALAN IPOH KECIL

KUALA LUMPUR

50350 Wilayah Persekutuan

Malaysia. | Company No. | 659264-X | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 26 Dec 2018 | 65,276,321 | Disposed | Direct Interest | Name of registered holder | N2N Connect Holdings Sdn Bhd | Address of registered holder | 3rd Floor No. 17 Jalan Ipoh Kecil 50350 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares via Direct Business Transaction | Nature of interest | Direct Interest | Direct (units) | 91,622,095 | Direct (%) | 16.351 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 91,622,095 | Date of notice | 26 Dec 2018 | Date notice received by Listed Issuer | 26 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2019 07:39 AM

|

显示全部楼层

发表于 24-1-2019 07:39 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | SBI JAPANNEXT CO., LTD. | Address | 3-1-1 Roppongi

Minato-Ward

Tokyo

Japan. | Company No. | 0100-01-139289 | Nationality/Country of incorporation | Japan | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | SBI Japannext Co., Ltd. |

| Date interest acquired & no of securities acquired | Date interest acquired | 26 Dec 2018 | No of securities | 65,276,321 | Circumstances by reason of which Securities Holder has interest | Acquisition of direct interest by way of Direct Business Transaction. | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 65,276,321 | Direct (%) | 11.649 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 27 Dec 2018 | Date notice received by Listed Issuer | 27 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 05:53 AM

|

显示全部楼层

发表于 1-2-2019 05:53 AM

|

显示全部楼层

Profile for Securities of PLC

Instrument Category | Securities of PLC | Instrument Type | Warrants | Description | BONUS ISSUE OF 140,089,954 FREE WARRANTS IN N2N CONNECT BERHAD ("N2N") ("WARRANTS") ISSUED PURSUANT TO THE BONUS ISSUE OF UP TO 149,469,460 WARRANTS ON THE BASIS OF 1 WARRANT FOR EVERY 4 EXISTING ORDINARY SHARES IN N2N ("N2N SHARE(S)" OR "SHARE(S)") HELD BY THE ENTITLED SHAREHOLDERS OF N2N AT 5:00 PM ON 7 JANUARY 2019 |

Listing Date | 15 Jan 2019 | Issue Date | 09 Jan 2019 | Issue/ Ask Price | Not Applicable | Issue Size Indicator | Unit | Issue Size in Unit | 140,089,954 | Maturity | Mandatory | Maturity Date | 08 Jan 2024 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 5.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.8300 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 1:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Cash | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 05:41 AM

|

显示全部楼层

发表于 21-2-2019 05:41 AM

|

显示全部楼层

Date of change | 13 Feb 2019 | Name | MR KOK WAN CHUN | Age | 50 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Association of Chartered Certified Accountants (Accounting) | Tunku Abdul Rahman College | |

| | | Working experience and occupation | 2013 - 2018 - - Part time Lecturer, Sunway University-- Sessional Tutor, Monash University-- Principal Consultant, AAA Solutions Sdn Bhd2011 2012Chief Operating Officer, Enterprise Service Group, Patimas Computers Berhad2007 - 2010Vice President, Patimas Computers Berhad2004 - 2006 Group Financial Controller, Patimas Computers Berhad2003 - 2004 General Manager, Sales and Operations, Cordoda Corporation Sdn Bhd2000 - 2003Financial Controller, Cordoda Corporation Sdn Bhd1998 - 1999Financial Controller, Patimas (M) Sdn Bhd1996 - 1997Accountant, Patimas (M) Sdn Bhd1993 - 1995Assistant Accountant, Patimas (M) Sdn Bhd1992 - 1993Audit Senior, Lim, Tay & Co1991 - 1992Audit Assistant, Lim, Tay & Co |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2019 08:59 AM

|

显示全部楼层

发表于 25-2-2019 08:59 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | N2N CONNECT BERHAD (N2N OR THE COMPANY)ACQUISITION OF A SUBSIDIARY COMPANY | 1. Introduction

The Board of Directors of N2N wishes to announce that the Company had, on 22 February 2019, acquired 100% of the total issued and paid up capital in Asianext Sdn. Bhd. (“Acquisition”) comprising 2 ordinary shares, from N2N Connect Holdings Sdn Bhd, for a total cash consideration of RM2.00 (Ringgit Malaysia : Two) only.

Pursuant to the Acquisition, Asianext Sdn. Bhd. becomes a subsidiary of the Company.

2. Information on Asianext Sdn. Bhd.

Asianext Sdn. Bhd. (Company No. : 1284641-D), having its registered office address at 3rd Floor, No. 17, Jalan Ipoh Kecil, 50350 Kuala Lumpur, was incorporated in Malaysia on 25 June 2018 as a private limited company. The issued share capital of Asianext Sdn. Bhd. is RM2.00 (Ringgit Malaysia : Two) only, comprising 2 fully paid ordinary shares.

The principal activities of Asianext Sdn. Bhd. are to provide, operate and maintain a digital asset exchange and alternative trading system.

3. Financial Effects

The Acquisition is not expected to have any material effect on the earnings and net assets of the Company for the financial year ending 31 December 2019.

4. Interests of Directors, Major Shareholders and/or Persons Connected to them

Tiang Boon Hwa and Lai Su Ping are the Directors of N2N Connect Holdings Sdn Bhd. and they each hold 70% and 30, respectively, of the shares of N2N Connect Holdings Sdn Bhd.

Save for the above, none of the Directors, major shareholders of the Company and/or persons connected to them have any interest, either direct or indirect, in the Acquisition.

This announcement is dated 22 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 04:34 AM

|

显示全部楼层

发表于 26-2-2019 04:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,802 | 27,669 | 108,055 | 97,285 | | 2 | Profit/(loss) before tax | 3,930 | 6,607 | 19,229 | 25,151 | | 3 | Profit/(loss) for the period | 2,684 | 5,242 | 12,729 | 23,737 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,807 | 5,318 | 13,095 | 23,978 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.49 | 1.13 | 2.42 | 5.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 0.00 | 4.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4400 | 0.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-3-2019 04:51 AM

|

显示全部楼层

发表于 18-3-2019 04:51 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | N2N CONNECT BERHAD ("N2N" OR "THE COMPANY")MEMORANDUM OF UNDERSTANDING WITH SBI HOLDINGS, INC. | 1. INTRODUCTION

The Board of Directors of N2N Connect Berhad (“N2N” or “the Company”) is pleased to announce that the Company had on 6 March 2019, entered into a Memorandum of Understanding (“MOU”) with SBI Holdings, Inc. (“SBI”) to set out the general understanding of Company and SBI’s intended engagement in a joint venture in the Asia Pacific region.

SBI is a substantial shareholder of the Company, holding 20.36% shares in the Company.

2. BACKGROUND INFORMATION

SBI is the holding company of internet financial institutions in Japan, including without limitation, on-line securities broker, on-line retail bank, on-line retail insurance company, on-line retail virtual currencies exchange, proprietary trading system operator, and margin trading company.

N2N is principally involved in the research and development of software packages and provision of design, programming and consultancy services and related activities.

SBI has incorporated and operating DigitAEx Limited (“Global Max”) as the legal entity to be the operator of digital asset exchange for clients in the Asia Pacific region (other than Japan). Global Max is currently pursing obtaining a license to engage such business in Hong Kong. Global Max is a fully owned subsidiary of SBI.

N2N has incorporated and operating ASIANEXT SDN BHD (“Asianext”) as the legal entity to be the operator of digital asset exchange for clients in the Asia Pacific region. Asianext is currently applying for a license to engage in such business in Malaysia, and has plans to obtain license to engage in such business in other Asia Pacific countries. Asianext is a fully owned subsidiary of N2N.

3. SALIENT TERMS OF THE MOU

N2N and SBI wishes to jointly establish and operate a company that will become a holding company of operators of digital asset exchange for clients in the Asia Pacific region. Subject to further system, regulatory, legal, financial, accounting and tax, due diligence and consideration by N2N and SBI, N2N and SBI currently agree:

- to form a holding company to cover formation of digital exchanges for all Asia Pacific countries (other than Japan), that will result in both parties’ holding equal shareholding in each digital exchange.

- to contribute each of their expertise and resources to cause the holding company and each of the operators in the respective Asia Pacific regions (other than Japan) to be successful.

- to enable N2N to invest in Global Max and to enable SBI to invest in Asianext.

N2N and SBI will create a team to agree on the details of the Joint Venture and enter into definitive agreements.

The term of the MOU will continue until the earlier of execution of a legally binding definitive agreement on the matters related to the joint venture between N2N and SBI or the elapse of one (1) year anniversary of the signing of the MOU.

3. RATIONALE OF THE MOU

The MOU is meant to facilitate N2N’s plans to venture into the digital asset exchange business across the Asia Pacific region.

4 EFFECTS OF THE MOU

The MOU will not have any effect on the earnings per share, net assets per share, gearing, issued and paid-up share capital and substantial shareholders’ shareholdings of N2N for the financial year ending 31 December 2019.

5. APPROVALS REQUIRED

The MOU is not subject to any approvals from the relevant regulatory authorities nor the shareholders of the Company.

6. INTEREST OF DIRECTORS, SUBSTANTIAL SHAREHOLDERS AND/OR PERSONS CONNECTED

Save as disclosed above, none of the Directors and/or other substantial shareholders and/or persons connected to the Directors or substantial shareholders of N2N have any interest, whether directly or indirectly, in the MOU.

7. DIRECTORS’ RECOMMENDATION

The Board having considered all the relevant factors in respect of the MOU is of the opinion that the MOU is in the best interest of N2N.

This announcement is dated 6 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-4-2019 05:02 AM

|

显示全部楼层

发表于 5-4-2019 05:02 AM

|

显示全部楼层

Name | SBI HOLDINGS, INC | Address | 1-6-1 ROPPONGI

MINATO-WARD

TOKYO

Japan. | Company No. | 0104-01-045208 | Nationality/Country of incorporation | Japan | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 19 Mar 2019 | 11,207,200 | Disposed | Direct Interest | Name of registered holder | SBI Holdings, Inc. | Address of registered holder | 1-6-1 Roppongi Minato-Ward Tokyo Japan | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of direct interest by way of Direct Business Transactions | Nature of interest | Direct Interest | Direct (units) | 102,879,831 | Direct (%) | 18.36 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 102,879,831 | Date of notice | 20 Mar 2019 | Date notice received by Listed Issuer | 20 Mar 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-6-2019 04:39 AM

|

显示全部楼层

发表于 25-6-2019 04:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,248 | 25,683 | 27,248 | 25,683 | | 2 | Profit/(loss) before tax | 5,774 | 6,740 | 5,774 | 6,740 | | 3 | Profit/(loss) for the period | 5,486 | 6,613 | 5,486 | 6,613 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,589 | 6,693 | 5,589 | 6,693 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.04 | 1.39 | 1.04 | 1.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 3.00 | 0.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4500 | 0.4400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-6-2019 04:41 AM

|

显示全部楼层

发表于 25-6-2019 04:41 AM

|

显示全部楼层

EX-date | 07 Jun 2019 | Entitlement date | 10 Jun 2019 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Dividend of 1 sen per share (Single Tier Dividend) in respect of the financial year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | 10 Jun 2019 to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378418088Fax:0378418100 | Payment date | 26 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 26 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2019 05:54 AM

|

显示全部楼层

发表于 22-8-2019 05:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 26,168 | 29,332 | 53,416 | 55,015 | | 2 | Profit/(loss) before tax | 3,776 | 5,096 | 9,550 | 11,836 | | 3 | Profit/(loss) for the period | 2,861 | 1,310 | 8,347 | 7,923 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,958 | 1,382 | 8,547 | 8,075 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.53 | 0.26 | 1.59 | 1.59 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 0.00 | 1.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4500 | 0.4400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2020 06:40 AM

|

显示全部楼层

发表于 1-2-2020 06:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 25,450 | 25,238 | 78,866 | 80,253 | | 2 | Profit/(loss) before tax | 5,729 | 3,463 | 15,280 | 15,299 | | 3 | Profit/(loss) for the period | 5,457 | 2,122 | 13,804 | 10,045 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,559 | 2,213 | 14,106 | 10,288 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.00 | 0.39 | 2.62 | 1.94 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 1.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4600 | 0.4400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2020 07:49 AM

|

显示全部楼层

发表于 1-5-2020 07:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 26,229 | 27,865 | 105,095 | 108,118 | | 2 | Profit/(loss) before tax | 2,296 | 3,992 | 17,575 | 19,291 | | 3 | Profit/(loss) for the period | 1,465 | 2,746 | 15,269 | 12,791 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,573 | 2,868 | 15,679 | 13,156 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.28 | 0.51 | 2.92 | 2.46 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 1.00 | 1.00 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4600 | 0.4400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2020 05:44 AM

|

显示全部楼层

发表于 19-5-2020 05:44 AM

|

显示全部楼层

Entitlement subject | First Interim Dividend | Entitlement description | First Interim Dividend of 1 sen per share (Single Tier Dividend) in respect of the financial year ending 31 December 2020. | Ex-Date | 14 Apr 2020 | Entitlement date | 15 Apr 2020 | Entitlement time | 5:00 PM | Financial Year End | 31 Dec 2020 | Period |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Payment Date | 14 May 2020 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 15 Apr 2020 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units)

(If applicable) |

| | Entitlement indicator | Currency | Announced Currency | Malaysian Ringgit (MYR) | Disbursed Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | Malaysian Ringgit (MYR) 0.0100 |

Entitlement subject | Special Dividend | Entitlement description | Special Dividend of 1 sen per share (Single Tier Dividend) in respect of the financial year ended 31 December 2019. | Ex-Date | 14 Apr 2020 | Entitlement date | 15 Apr 2020 | Entitlement time | 5:00 PM | Financial Year End | 31 Dec 2019 | Period |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Payment Date | 14 May 2020 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 15 Apr 2020 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units)

(If applicable) |

| | Entitlement indicator | Currency | Announced Currency | Malaysian Ringgit (MYR) | Disbursed Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | Malaysian Ringgit (MYR) 0.0100 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2020 08:29 AM

|

显示全部楼层

发表于 4-7-2020 08:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2020 | 31 Mar 2019 | 31 Mar 2020 | 31 Mar 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 26,261 | 27,248 | 26,261 | 27,248 | | 2 | Profit/(loss) before tax | 4,719 | 5,774 | 4,719 | 5,774 | | 3 | Profit/(loss) for the period | 3,656 | 5,486 | 3,656 | 5,486 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,762 | 5,589 | 3,762 | 5,589 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.70 | 1.04 | 0.70 | 1.04 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 2.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4700 | 0.4600

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|