|

|

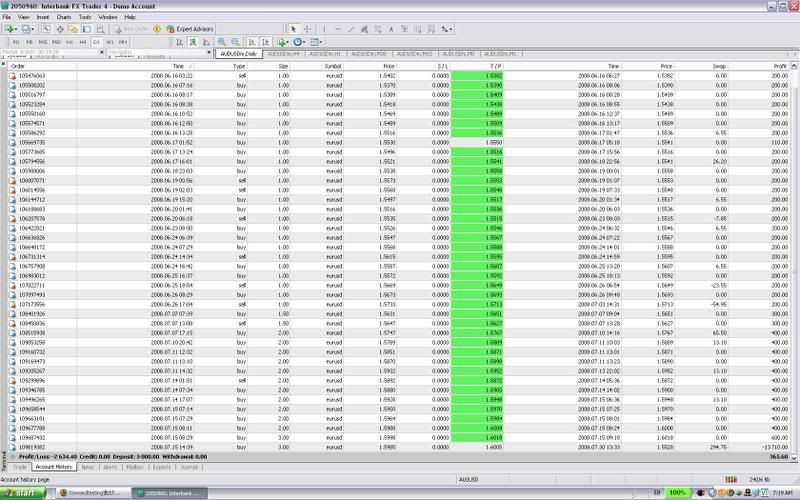

forwardtesting我炒外汇策略15/7赚320%

[复制链接]

|

|

|

楼主 |

发表于 12-7-2008 10:52 AM

|

显示全部楼层

回复 109# liew3289 的帖子

我不是那麼在意別人怎樣看我,

baby?? 我覺得我看的書和經驗比你多. 不過是我覺得la.. 你的英文很差,我想你只能看孫子兵法, 那我介紹的書, 你應該沒辦法看的明白. 你給了我你的電話要我call 你, 我知道跟你講話是浪費我的時間, 我們的channel 完全不一樣. 不過很高心認識你.

你要make forex friends, 這裡是很多. 但是為何你不在美國英國的forex forum跟人交流? 在那裡你會學習到跟多東西,

forexfactory - 以前很hot, 會有每個星期news的提示.

strategyfxbuilder

y2.cn 中國的forex 論壇, 裡面有一個wu9138, 傳奇人物, 4年前我就開始看他的post, 到今天還在post, 幫了很多人賺錢.

你身邊有鬼老朋友嗎? forex 市場 是全球, 地球地圖的中間畫一條線, 左邊是美國歐洲, 人口集中, westerner, London, New york, L.A 都是金融所, 很明顯, 在美國時間和london 時間外匯的交易量是大過亞洲時間, 你有沒有試過在美國或英國炒forex? 當你在美國或英國, 你是最接近那邊的人和市場, 你要的fundamental analysis, 就是從你的鬼老朋友們的談話中, 時事討論過程中, 得到一些direction guide, 你多點出國, 認識多點鬼老, 對你的forex career 是很有幫助的. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-7-2008 03:02 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2008 05:40 PM

|

显示全部楼层

发表于 14-7-2008 05:40 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2008 06:03 PM

|

显示全部楼层

发表于 14-7-2008 06:03 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2008 07:13 PM

|

显示全部楼层

发表于 14-7-2008 07:13 PM

|

显示全部楼层

|

一个人凭己的经验得出的结论当然是最好,但是时间就浪费得多了,如果能将书本知识和实际工作结合起来,那才是最好的. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-7-2008 04:21 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2008 03:25 AM

|

显示全部楼层

发表于 21-7-2008 03:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2008 10:56 PM

|

显示全部楼层

发表于 21-7-2008 10:56 PM

|

显示全部楼层

回复 127# 庄家 的帖子

Hi friend,

Actually i never post any strategic or comment in cari forum before (forex discussion).

But this time i want share something with u all.

I play forex almost 3 year and read alot of strategic from many forum.

But seriously, i don't so like people here. Because they don't know how to appreciate people when people share out they own strategic. Not like orther forum, they will backtest it and even work or not, they will not shoot each orther like here.

In malaysia i really hope that all willing to help each orther to make all success and not shoot people you are wrong or x@&^5..... :-(

alway remember three important thing. stop loss, displine and momey management.

If u can make every order winning percentrade 50% and win 100pip and stop lose is 50pip (ratio 2:1). then you is successful trader.

Like Souki strategic, no stop lose. don't shoot him/she again. cos he/she never wrong. this is hedging. I also do that and without stop lose (I succes in forex by hedging strategic without stop lose). the important thing is you must know how your strategic work. Don't gambling.

Last thing, try to appreciate people who sharing something in forum.

Good luck. |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2008 10:59 PM

|

显示全部楼层

发表于 21-7-2008 10:59 PM

|

显示全部楼层

回复 128# hlang07 的帖子

sorry for my poor english. (actually my chinese or malay also not good  ) )

Thanks. |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 12:51 AM

|

显示全部楼层

发表于 22-7-2008 12:51 AM

|

显示全部楼层

Try to be nice may not be right always. Hedging is a form of stop-loss to me. If you are hedging, it's fine. If the purpose of this forum is to help each other for doing better, maybe u should sound at some wrong concept alleged by whoever who has faith for the wrong concept which may be adopted by many.

Of course, whether wrong or right is subjective sometimes without having gone through enough backtest process, however, whether stop-loss is necessary or not is quite universally agreed be it in a form of hedging or whatever..

How come I didn't see any hedging tranxactions in the statements ? and to say "stop-loss is not required unless you don't have confidence in your system" is different from saying "stop-loss is not necessary if you are going to hedge your positions"

So, the problem here is hedging, maybe I don't understand fully the meanings & operation of hedging. Would like to here from you soon if u don't mind an example of it.

Have a nice day!  |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 01:11 AM

|

显示全部楼层

发表于 22-7-2008 01:11 AM

|

显示全部楼层

回复 128# hlang07 的帖子

And I think as a responsible person must be able to further examine own concept when it is contrary to many people's view instead of insisting it when it's consequence could be a damaging one.

Anyway, thanks for your reminder. My apology to everyone who might have been annoyed.

Looking forward an example of hedging from you if you don't mind.

Regards, |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 01:20 AM

|

显示全部楼层

发表于 22-7-2008 01:20 AM

|

显示全部楼层

我觉得投资inverment ,资金,知识,技术固然重要,但更重要的是正确的做人和投资的出发点.

如果在出发之前,取错了方向,那麽,无论你多麽努力,也无法达成投资的目标. |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 01:21 AM

|

显示全部楼层

发表于 22-7-2008 01:21 AM

|

显示全部楼层

赚钱也一样,首先要有正确的出发点,为了什麽而赚?

为了父母、妻子、儿女的生活过得更好。

为了使你所爱的人的生活有保障。

为了我们退休後能财务自主,不靠儿女过活。

为了追求我们梦想中的美好生活。

为了做人做得更有尊严。

为了对哺育我们的社会人群尽一点反哺的责任。

为了得到我们想得到一切。

正确的出发点,成为促使我们努力赚钱的力量,这股力量,善加引导,会为你带来预想不到的成果。

赚钱,有如做人,做人要跑正道,循正道而行,人生的路,越来越宽。

赚钱之道亦然,依正道而行,越来越顺遂,所谓“君子爱财,取之有道”,这个“道”就是正道。

如果你起步之前,就动了歪念头,走旁门左道,走捷径,越来越狭,最後是举步维艰,甚至走上“不归路”。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 02:39 AM

|

显示全部楼层

发表于 22-7-2008 02:39 AM

|

显示全部楼层

回复 130# 庄家 的帖子

ok.

May be you are right.

He is not hedging. hedging is open buy/sell at the same time.(for me is no need stop lose)

My hedging strategic is open 2 pair as same correlation at the same time (some currency trend move in the same direction)

Example: EUR/USD and GBP/USD.

I will research New + Technical Analysis to find out the entry point.

Even i success or not in forex world is not so important for me. My concern is how i consistant make it success  that why i alway believe that there saying 90% so call trader is loosing money that why i alway believe that there saying 90% so call trader is loosing money  . .

I believe as much you learn as fast you can success.

cheers. |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 02:41 AM

|

显示全部楼层

发表于 22-7-2008 02:41 AM

|

显示全部楼层

回复 133# liew3289 的帖子

Hi liew3289,

Thanks for your advice. |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 03:24 AM

|

显示全部楼层

发表于 22-7-2008 03:24 AM

|

显示全部楼层

原帖由 hlang07 于 22-7-2008 02:39 AM 发表

My hedging strategic is open 2 pair as same correlation at the same time (some ...

Well, everyone is learning (for better) and it should be continued for a long time. Thank you for your example, but could you tell a little bit more about your hedging strategy as I don't get it for the following :

...open 2 pair...

You open 2 positions in 1 currency pair ? or 1 position in each of 2 currency pairs?

If I suppose that you open 1 position in each of 2 currency pairs like you mentioned EUR/USD and GBP/USD,

then, did you sell both ? or buy both or buy 1 pair & sell the other pair ?

Thank you. |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 10:29 AM

|

显示全部楼层

发表于 22-7-2008 10:29 AM

|

显示全部楼层

如果是在涨势,作多一定会赚

如果作多不赚,就不是在涨势

如果是在跌势,作空一定会赚

如果作空不赚,就不是在跌势

赚钱才有波段,赔钱当机立断

赚钱才能加码,赔钱不可摊平

赚钱才是顺势,赔钱乃因逆势

赚钱的人有胆,赔钱的人会寒

向赚钱者取经,向赔钱者取财

先看可赔多少,再算可赚多少 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2008 01:14 PM

|

显示全部楼层

发表于 22-7-2008 01:14 PM

|

显示全部楼层

回复 136# 庄家 的帖子

Normally i will open 1 position in each of 2 currency pair.

I will not simply buy or sell for both pair. I just open the order when new release or technical indicator support. I just follow the trend.

But of course not 100% is correct everytime. That why MM is very important.

Thanks. |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2008 11:27 AM

|

显示全部楼层

发表于 23-7-2008 11:27 AM

|

显示全部楼层

楼主都无post他的新的screenshot来了,应该系沉佐水了  |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2008 09:32 AM

|

显示全部楼层

发表于 31-7-2008 09:32 AM

|

显示全部楼层

最后的结果。。。。。。。。。。。。无言的结局!我发出来不是要羞辱souki兄。只是告诉大家souki兄的策略还不够完善而已。souki兄,持续研究,继续努力吧!加油!

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|