|

|

【EVERGRN 5101 交流专区】长青纤维板

[复制链接]

[复制链接]

|

|

|

发表于 8-4-2015 01:20 AM

|

显示全部楼层

发表于 8-4-2015 01:20 AM

|

显示全部楼层

原料降價‧美元走高‧長青纖維板盈利看俏

2015-04-07 17:00

(吉隆坡7日訊)長青纖維板(EVERGRN,5101,主板工業產品組)業務重組計劃開始收效,加上生產原料價格走低及美元匯率偏高等利好支撐,預料該公司短中期內的盈利前景保持亮麗。

豐隆研究指出,該公司未來盈利增長獲得3項利好因素支撐,包括木材銷售價走高(特別是美元兌馬幣匯率增值)、銷售組合較高的加值產品(取得較高的盈利賺幅)、及公司管理層持續努力整合其營運,使成本架構進一步改善。

長青纖維板產品價格賺幅有增無減,因美元匯率走高(出口銷售營收佔65%至70%),美元匯率每起10仙將使其2015年淨利增長9%、生產原料價格下跌,特別是橡膠樹木及粘合膠價格走低(占中密度纖維板生產成本55%至65%之間)利好推動。

豐隆研究重新將長青纖維板納入研究名單後指出,該公司其他業務也扭轉劣勢取得盈利,如板廠及纖維板領域,以及恢復股息政策,都是股價表現的利好催化因素。

該公司為亞洲首5大工程木基產品生產商之一,主要生產中密度纖維板及刨花板,年產量達逾130萬立方公尺。該公司在大馬也擁有2間樹脂廠(製造粘合膠供本身用途)、4千410英畝的橡膠樹園土地,包括逾500英畝已種有橡膠樹。

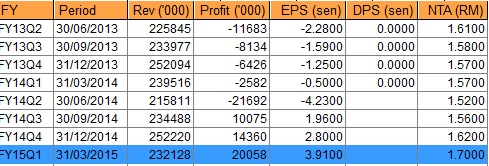

該公司業務自2012年以來開始走下坡,並連續7季蒙受虧損,惟在內部重組計劃及外圍因素改善後,而從2014年第三季開始轉虧為盈。

該行預測該公司2015年及2016年淨利將多倍增長,即從2014年的20萬令吉,分別增長至6千430萬令吉及8千630萬令吉,而2017年則為8千650萬令吉。

該行對該公司給予“買進”評級,目標價為1令吉47仙,或等於2015年及2016年每股盈利14.7仙的平均本益比10倍水平。(星洲日報/財經‧報道:李文龍)

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2015 02:04 AM

|

显示全部楼层

发表于 24-5-2015 02:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2015 | 31 Mar 2014 | 31 Mar 2015 | 31 Mar 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 232,128 | 239,516 | 232,128 | 239,516 | | 2 | Profit/(loss) before tax | 24,781 | -2,869 | 24,781 | -2,869 | | 3 | Profit/(loss) for the period | 20,506 | -3,188 | 20,506 | -3,188 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 20,058 | -2,582 | 20,058 | -2,582 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.91 | -0.50 | 3.91 | -0.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7000 | 1.6200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2015 02:55 AM

|

显示全部楼层

发表于 11-6-2015 02:55 AM

|

显示全部楼层

Name | LEMBAGA TABUNG HAJI | Address | 201, JALAN TUN RAZAK,

PETI SURAT 11025,

KUALA LUMPUR

50732 Wilayah Persekutuan

Malaysia. | NRIC/Passport No/Company No. | ACT 5351995 | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | ORDINARY SHARES OF RM0.25 EACH | Name & address of registered holder | LEMBAGA TABUNG HAJI201, JALAN TUN RAZAK,PETI SURAT 11025,KUALA LUMPUR 50732 |

Details of changesCurrency: Malaysian Ringgit (MYR) | Type of transaction | Date of change | No of securities

| Price Transacted (RM)

| | Disposed | 01 Jun 2015 | 500,000

| 1.189

| | Disposed | 02 Jun 2015 | 500,000

| 1.221

| | Disposed | 03 Jun 2015 | 1,734,500

| 1.248

| | Disposed | 04 Jun 2015 | 1,000,000

| 1.234

| | Disposed | 05 Jun 2015 | 1,000,000

| 1.246

| | Disposed | 08 Jun 2015 | 2,000,000

| 1.304

|

Circumstances by reason of which change has occurred | DISPOSAL OF 6,734,500 SHARES (REPRESENTING 1.313%) IN THE OPEN MARKET | Nature of interest | DIRECT | Direct (units) | 27,374,300 | Direct (%) | 5.336 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 27,374,300 | Date of notice | 09 Jun 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2015 03:01 PM

|

显示全部楼层

发表于 13-6-2015 03:01 PM

|

显示全部楼层

本帖最后由 icy97 于 13-6-2015 09:37 PM 编辑

EVERGRN 枯木逢春

Wednesday, June 10, 2015

http://bblifediary.blogspot.com/

EVERGRN(长青纤维板,5101,主板工业产品股),成立于1971年,于2005年3月10日上市大马交易所主板。

这家由新加坡人郭文治所创办的公司,其业务主要是涉及生产中密度纤维板(MDF)、木屑胶合板(Particleboard)以及其他木制品和家具产品。

EVERGRN其实是东南亚最大的中密度纤维板(MDF)生产商,年产量超过130万立方米。

该公司的大本营位于柔佛巴株峇辖,同时在泰国、印尼和新加坡都设有厂房。

虽然贵为木材业的佼佼者,该公司在2012年第4季至2014年第2季这段期间,业绩表现非常不理想,而且还连续七个季度面对亏损,而这也导致了该公司的股价在40至65仙之间游走了两年。

为了改善业务,该公司于2014年进行了一系列内部重组,将部分生产线搬到印尼,以节省成本,并提高效率,同时也整顿巴株峇辖的工厂营运。

该公司在积极整顿了业务之后,终于在2014财政年第3季看到了成果,成功转亏为盈,并且今已经连续三个季度出现增长。

EVERGRN的业务以出口市场为主,该公司有超过70%的产品出口到外国,因此美元汇率走高将令该公司受惠。

虽然业绩已经复苏,但跟2010年的高峰时期相比,却还有一段距离。

在该公司管理层积极改善成本、提高生产效率,以及美元汇率走高的情况来看,相信EVERGRN想要恢复以往的风光,应该指日可待。

个人给予EVERGRN的合理价:RM1.56

免责声明:

以上投资分析,纯属本人个人意见和观点。

在买进一家公司的股份前,请先做功课并了解该公司,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负! |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2015 04:31 PM

|

显示全部楼层

发表于 14-6-2015 04:31 PM

|

显示全部楼层

Date of change | 15 Jun 2015 | Name | Mr KUO JEN CHIU | Age | 52 | Nationality | Singapore | Type of change | Redesignation | Previous Position | Chief Operating Officer | New Position | Chief Operating Officer | Directorate | Executive | Qualifications | Degree in Computer Science from the University of Wisconsin, United States. | Working experience and occupation | His career started in 1990 as a Marketing Manager with Evergreen Timber Products Co. Pte Ltd (ETP) in Singapore. In the capacity of Chief Operating Officer, he oversees the Finance, Marketing and Operations of the Group and his responsibilities include identifying opportunities and developing new markets. | Family relationship with any director and/or major shareholder of the listed issuer | He is the son of Kuo Wen Chi and Hsu Mei Lan, brother of Kuo Jen Chang and Kuo Huei Chen and uncle of Justin, Henry and Jeffrey Kuo. | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | He holds 1.95% of shares in the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2015 04:32 PM

|

显示全部楼层

发表于 14-6-2015 04:32 PM

|

显示全部楼层

Date of change | 15 Jun 2015 | Name | Mr KUO WEN CHI | Age | 81 | Nationality | Singapore | Type of change | Redesignation | Previous Position | Executive Deputy Chairman | New Position | Executive Deputy Chairman | Directorate | Executive | Qualifications | | Working experience and occupation | His career started in 1949 as a Production Supervisor at Lin Shan Hao Plywood Co Ltd in Taiwan. He brought a wealth of experience in the wood-based industry when he moved to Singapore in 1972 to establish his own business with the incorporation of Evergreen Timber Products Co. Pte Ltd (ETP). He was then appointed the Managing Director and was responsible for the overall management of ETP. In 1977, he ventured into Malaysia to establish the Evergreen Group of Companies and was the main driving force behind the growth and development of the Group. His current responsibilities include strategic business planning and developing strategic directions for Evergreen Group. | Family relationship with any director and/or major shareholder of the listed issuer | He is the husband of Hsu Mei Lan, father of Kuo Jen Chang, Kuo Jen Chiu and Kuo Huei Chen and grandfather of Justin, Henry and Jeffrey Kuo. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2015 04:33 PM

|

显示全部楼层

发表于 14-6-2015 04:33 PM

|

显示全部楼层

ate of change | 15 Jun 2015 | Name | Mr KUO JEN CHANG | Age | 52 | Nationality | Singapore | Type of change | Redesignation | Previous Position | Chief Executive Officer | New Position | Chief Executive Officer | Directorate | Executive | Qualifications | Bachelor Degree in Electronic Engineering from the University of Wisconsin, United States. | Working experience and occupation | His career started in 1987 when he joined Evergreen Timber Products Co. Pte Ltd (ETP) in Singapore as Procurement Manager responsible for sourcing and negotiations of machinery for the upgrading and expansion of the Company. In 1989, he was appointed Director of Evergreen Décor Products (M) Sdn Bhd (EDP); which was then a subsidiary in the group. He was overseeing the entire operations of the Company up until 1992. In the capacity of Chief Executive Officer, he is responsible for the Group's entire directions and operations. | Family relationship with any director and/or major shareholder of the listed issuer | He is the son of Kuo Wen Chi and Hsu Mei Lan, brother of Kuo Jen Chiu and Kuo Huei Chen and uncle of Justin, Henry and Jeffrey Kuo. | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | He holds 18.5% of shares in the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2015 04:34 PM

|

显示全部楼层

发表于 14-6-2015 04:34 PM

|

显示全部楼层

Date of change | 15 Jun 2015 | Name | Miss MARY HENERIETTA LIM KIM NEO | Age | 52 | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Executive Director | Directorate | Executive | Qualifications | Master in Business Administration from the University Master of Preston, United States | Working experience and occupation | Her career started in 1984 as a Human Resources / Administrative Office with a consulting engineering firm. in 1992, she left for the manufacturing industry and joined the Company as a Human Resources / Administrative Executive to oversee the Human Resource and Administrative Department. Subsequently in 1995 she was promoted to Human Resources and Administrative Manager and was also appointed as a Director. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2015 01:40 AM

|

显示全部楼层

发表于 18-6-2015 01:40 AM

|

显示全部楼层

常青纖維板 看好從美元升值受惠

財經股市17 Jun 2015 23:00

(吉隆坡17日訊)常青纖維板(EVERGRN,5101,主要板工業)美元計價營業額佔總數70%,佔生產成本僅25%至30%,料可在這一美元升值潮中受惠。

常青纖維板股價受激勵回彈,早盤以1.25令吉開跑,休市起5仙,報1.26令吉。該股在盤中多次上探1.28令吉全日最高水平,但閉市掛1.26令吉,起5仙,成交量達396萬1400股。

豐隆投銀研究指美元增值將有利于常青纖維板,從目前的匯率走勢來看,關鍵用料如橡膠木材、尿素和甲醇的價格走勢都對公司有利。

同時,該公司管理層承諾會進一步加強盈利表現,包括改善整體生產效率和多元化產品類別至下游業務,因具較高賺幅且受價格競爭影響較少。

雖然常青纖維板在未來2年會有較高資本開銷,但相信淨負債率會維持在低于0.3倍水平,這是基于該公司有能力帶來強勁的營運現金流。

該行將該公司2015至2017財年淨利預測上修3%到15%之間,以反映較高使用率和平均售價預測。

同時,該行亦給予常青纖維板“買進”評級,合理價上修至1.59令吉,看好該公司從強勁美元走勢和低油價受惠、資產負債表穩健,且橡膠種植地價值尚未反映在現有股價估值。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2015 04:44 AM

|

显示全部楼层

发表于 27-6-2015 04:44 AM

|

显示全部楼层

| Type of transaction | Date of change | No of securities

| Price Transacted (RM)

| | Disposed | 09 Jun 2015 | 1,116,000

| 1.294

|

Circumstances by reason of which change has occurred | DISPOSAL OF 1,116,000 SHARES (REPRESENTING 0.217%) IN THE OPEN MARKET | Nature of interest | DIRECT | Direct (units) | 26,258,300 | Direct (%) | 5.119 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 26,258,300 | Date of notice | 25 Jun 2015 |

Notice of Person Ceasing (29C)| EVERGREEN FIBREBOARD BERHAD |

Particulars of Substantial Securities HolderName | LEMBAGA TABUNG HAJI | Address | 201, JALAN TUN RAZAK,

PETI SURAT 11025,

KUALA LUMPUR

50732 Wilayah Persekutuan

Malaysia. | NRIC/Passport No/Company No. | ACT 5351995 | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | ORDINARY SHARES OF RM0.25 EACH | Date of cessation | 10 Jun 2015 | Name & address of registered holder | LEMBAGA TABUNG HAJI201, JALAN TUN RAZAK,PETI SURAT 11025,50732 KUALA LUMPUR |

Currency | Malaysian Ringgit (MYR) | No of securities disposed | 2,000,000 | Price Transacted ($$) | 1.317 | Circumstances by reason of which Securities Holder has interest | DISPOSAL OF 2,000,000 SHARES (REPRESENTING 0.39%) IN THE OPEN MARKET. | Nature of interest | DIRECT |  | Date of notice | 25 Jun 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2015 03:44 PM

|

显示全部楼层

发表于 3-7-2015 03:44 PM

|

显示全部楼层

Evergreen Fibreboard may climb higher after surpassing MYR1.42 to extend its multi-year high. Evergreen Fibreboard may climb higher after surpassing MYR1.42 to extend its multi-year high.

Traders may buy as a bullish bias could be present above this level,

with a target price of MYR1.68, followed by MYR1.75.

The stock may pull back to consolidate if it cannot sustain above the MYR1.42 mark.

In this case, further support is anticipated at MYR1.30,

where traders can exit upon abreach to avoid a further correction.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2015 03:45 PM

|

显示全部楼层

发表于 3-7-2015 03:45 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2015 03:46 PM

|

显示全部楼层

发表于 3-7-2015 03:46 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2015 06:07 PM

|

显示全部楼层

发表于 4-7-2015 06:07 PM

|

显示全部楼层

本帖最后由 kongsenger 于 6-7-2015 05:34 PM 编辑

Evergrn RM1.48 进场,未来丰衣足食。 Evergrn RM1.48 进场,未来丰衣足食。

1)公司于5月公布的Q1 2015 业绩很好,赚了 2005万,Eps=3.91sen ,nta=rm1.7

若下来Q2,Q3,Q4都有1600万(EPS=3.1SEN),则全年可赚6805万(EPS=13.2SEN),公司股数为512978,000股.

现RM1.51只是PE=11.4 在交易,明显被低估了,合理的PE=15,价位=RM1.98

2)于31-3-2015 evergrn 的债务2.88亿,公司有CASH 7041万.

3)30大股东已持有70.92%(363804张),市场流通量只有29.08%(149174张).

4)Lth 的售股近完成,于26-0702015 尚有26258,000股(5.11%),这些股份想信会保留,

因此接下来的賣压会减少,大家会看到大副度的上升,开往目标价rm2.00

5)公司诚信度是很好的,因此数据造假应该不会发生在这公司上。

6)Evergrn 绝对是投资者的首选股,公司的潜在价值好,成长佳,将会是一只黑马股。

7)买股看公司的未来是否成长,净利多少等,当可见度变得清晰,投资风险相对变小,

股价也将呈现上升势头,Evergrn 会是不错的选择。

8)公司的赚副有8.6%,同行中算是标青的。

9)看好該公司從強勁美元走勢和低油價受惠、資產負債表穩健,且橡膠種植地價值尚未反映在現有股價估值。

10)管理層承諾會進一步加強盈利表現,包括改善整體生產效率和多元化產品類別至下游業務,

因具較高賺幅且受價格競爭影響較少。

11)長青纖維板產品價格賺幅有增無減,因美元匯率走高(出口銷售營收佔65%至70%),

美元匯率每起10仙將使其2015年淨利增長9%、生產原料價格下跌,

特別是橡膠樹木及粘合膠價格走低(占中密度纖維板生產成本55%至65%之間)利好推動。

12)我的估算Q2(8月) share price=rm1.68

Q3(11月) share price=rm1.85

Q4(2月) share price=rm2.00

供参考,进出自负.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-7-2015 07:11 PM

|

显示全部楼层

发表于 9-7-2015 07:11 PM

|

显示全部楼层

本帖最后由 icy97 于 10-7-2015 03:46 AM 编辑

长青纤维板 估值仍诱人

财经 股市 行家论股 2015-07-09 10:59

目标价:2.15令吉

最新进展

自本月初以来,长青纤维板(Evergrn,5101,主板工业产品股)的股价已涨20.7%,增幅比富时隆综指高出20.4%,也突破之前1.59令吉的目标价格。

强劲的股价走势,主要是受益于美元兑令吉走强,以及原油价格走跌。

行家建议

在我们看来,即便股价近期已大涨,但估值仍相当具吸引力。

这是因为,全球的货币政策两极、低原产品价格,以及国内的政治因素悬而未解,都将继续让令吉受压。

再者,公司的主要成本为橡胶原木,以及甲醇和尿素制的胶水,而这两者的价格也维持跌势,支撑公司获利能力。

此外,管理层亦积极提高产量、加强成本效率,以及多元化产品,有助激励更高的业绩表现。

截至3月底,净负债率低于0.3倍,不排除在明年恢复派息的可能。

考量上述因素后,我们将2015至2017财年的净利预估,上调6.4至12.9%。目标价格也跟着调高35.2%,至2.15令吉。

分析:丰隆投行研究

【南洋网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-7-2015 05:54 PM

|

显示全部楼层

发表于 10-7-2015 05:54 PM

|

显示全部楼层

好几年前的5095 hevea 因遇行业不景气,扩展过快,当时差点破产,印象中股价下降至rm0.20多 好几年前的5095 hevea 因遇行业不景气,扩展过快,当时差点破产,印象中股价下降至rm0.20多

,之后公司重整经几年发展至今,业务己上了轨道,前景很好,于10-7-2015公司股价站在rm3.67 ,当年買入者己丰收了.

回头来看5101evergrn的情况有些相似,股价去年有过rm0.47 ,公司在业绩持续改善下,

股价也回升到10-7-2015的rm1.69 ,公司历史高位是rm2.16 ,若往后的净利向好(目前这行业具备了种种利好),

想信要突破这个股位不难,且看公司改写历史吧,终究evergrn过去6年的牛市都在沉睡着,現在是时候奋起了.

希望你的眼光看到幸福的未来.投资快乐.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-7-2015 04:17 AM

|

显示全部楼层

发表于 11-7-2015 04:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-7-2015 04:36 AM

|

显示全部楼层

发表于 12-7-2015 04:36 AM

|

显示全部楼层

長青最糟時刻已過?

2015-07-11 18:16

長青纖維板(EVERGRN,5101,主板工業產品組)在2010至2012年間,為應付木桐價格走高及緊縮供應,採取了失敗的策略導致蒙受重挫,惟去年,該公司成功收复失地,重新步入可持續獲利狀況。

長青纖維板首席營運員兼執行董事郭仁秋指出,在目前進行的重大工廠重組計劃後,預料該公司的業績將會取得更好表現。

他表示,公司最壞情況已經過去,預料未來數年將可獲得盈利,今年的業績料比去年來得更好。

該公司的重組計劃料將減少營運成本及改善其盈利賺幅,主要是專注高檔纖維板及加值產品。

去年,原中密度纖維板領域,占公司總營業額的75%、加值產品則佔20%、其餘5%則來自自行裝置家私領域。

截至2015年3月31日為止第一季,長青纖維板的營業額走低至2億3千212萬令吉,不過,卻轉虧為盈,取得淨利2千零5萬令吉,前期則是淨虧損258萬令吉。這主要歸功於較低的木桐及粘合膠成本、較高的營運效率、及成本節省等因素。

截至2014年12月31日為止財政年,該公司轉虧為盈,取得淨利200萬令吉,前期還淨虧4千500萬令吉。

他指出,該公司2013及2014年財政年的業績表現欠佳,主要是收購橡膠樹伐木特許經營權,以在2010年及2012年應對偏高的木桐價格及緊縮的供應。

當木桐價格在2013年回軟時,該公司則需要攤銷2千萬令吉的特許經營權的價值。在2014年第2季,該公司再次攤銷余下的2千萬令吉特許經營權價值。(星洲日報) |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2015 08:04 PM

|

显示全部楼层

发表于 21-7-2015 08:04 PM

|

显示全部楼层

美元走強‧重組奏效‧長青纖維板漸入佳境

2015-07-21 16:37

(吉隆坡21日訊)美元走強、原料成本下跌,加上內部重組奏效,長青纖維板(EVERGRN,5101,主板工業產品組)有望進入佳境。

聯昌研究表示,該公司2013財政年至2017財政年賺幅從4%增加至22%,主要是來自美元走強、原料(木板與膠水)及貨運成本走低及內部重組成功。

該行預計,美元每走強1%,該公司2015財政年每股淨利也相應走高10%。

分析員補充,該公司客戶人數超過600人,分佈逾40個國家,其中70%營業額以美元為交易單位。

該公司透過購置新機器以節省勞工及能源成本,以改善賺幅,預期可顯現在2016及2017財政年的淨利。

此外,該公司也關閉無法獲利的工廠並增設刨花板及家具的產能。

聯昌認為,該公司將會脫售非核心業務,預計可籌集1億1千萬令吉(每股21仙),並將該筆資金用作降低負債率或股息用途。

該公司是亞洲其中一家領先中密度纖維板(MDF)製造業者,工廠坐落於大馬、泰國及印尼,年產量達130萬尺。

基於該公司已渡過2012至2014年艱難的時刻,聯昌給予“加碼”評級,目標價2令吉90仙。(星洲日報/財經‧報導:謝汪潮) |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2015 06:35 PM

|

显示全部楼层

发表于 22-7-2015 06:35 PM

|

显示全部楼层

Evergrn5101 長青纤维板能展翅高飞吗?

公司脫售非核心資產后將獲得1.1億令吉現金,可讓公司減少債務或派發股息.

于31-3-2015 evergrn 的债务2.88亿,公司有CASH 7041万,

用1.1亿还了债务,loan只剩下1.78亿,若扣除cash 7048万,公司真正loan只剩1.08亿.

简单用Q1净利2000万算,只要累积多 5个季度就可以清完所有的债务,而成净现金公司,

当然这是在不派息情况下,但我想信以公司过去记录,只要净利多1,2季度就会派息了,成为现金公司,时间上会拉長吧.

从日前整个大环境对公司有利下(橡木原料成本低,美元 强,原油便宜(作粘接剂材料),

公司为此行业的先锋,投资者对公司恢复了信心,要达标机会大,接下来股价走向RM3元是有希望的,

本益比(PE)=20倍,EPS=RM0.15 SEN ,股价-RM3.00

供参考,进出自负. |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|