|

|

【LYC 0075 交流专区】(前名 MEXTER)

[复制链接]

[复制链接]

|

|

|

发表于 20-12-2017 04:38 AM

|

显示全部楼层

发表于 20-12-2017 04:38 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | I-ZEN RESIDENCES SDN. BHD. | Address | F603, Pusat Dagangan Phileo Damansara 1

No.9, Jalan 16/11 Off Jalan Damansara

Petaling Jaya

46350 Selangor

Malaysia. | Company No. | 883043-V | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 12 Dec 2017 | Name & address of registered holder | I-Zen Residences Sdn. Bhd.F603, Pusat Dagangan Phileo Damansara 1No.9, Jalan 16/11 Off Jalan Damansara46350 Petaling JayaSelangor |

No of securities disposed | 2,000,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Disposal of Ordinary Shares through Off Market Deal | Nature of interest | Direct Interest |  | Date of notice | 14 Dec 2017 | Date notice received by Listed Issuer | 14 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2017 02:36 AM

|

显示全部楼层

发表于 21-12-2017 02:36 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | Private Placement of up to 20% of the share capital of Mexter | No. of shares issued under this corporate proposal | 14,900,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.4800 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) 0.000 | | Latest issued share capital after the above corporate proposal in the following | Units | 241,924,440 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 34,134,744.000 | Listing Date | 20 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2018 01:24 AM

|

显示全部楼层

发表于 6-2-2018 01:24 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant 'A' | No. of shares issued under this corporate proposal | 4,590,600 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 250,655,440 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 35,269,774.000 | Listing Date | 06 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:14 AM

|

显示全部楼层

发表于 10-2-2018 03:14 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant 'A' | No. of shares issued under this corporate proposal | 7,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 257,655,440 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 36,179,774.000 | Listing Date | 12 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 01:18 AM

|

显示全部楼层

发表于 28-2-2018 01:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,674 |

| 13,783 |

| | 2 | Profit/(loss) before tax | -1,058 |

| -2,960 |

| | 3 | Profit/(loss) for the period | -1,058 |

| -2,956 |

| | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -999 |

| -2,610 |

| | 5 | Basic earnings/(loss) per share (Subunit) | -0.41 |

| -1.18 |

| | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 |

| 0.00 |

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0900 | 0.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 06:35 AM

|

显示全部楼层

发表于 24-5-2018 06:35 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,392 |

| 18,175 |

| | 2 | Profit/(loss) before tax | -2,428 |

| -5,388 |

| | 3 | Profit/(loss) for the period | -2,486 |

| -5,442 |

| | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,543 |

| -5,153 |

| | 5 | Basic earnings/(loss) per share (Subunit) | -0.98 |

| -2.30 |

| | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 |

| 0.00 |

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0800 | 0.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2018 01:37 AM

|

显示全部楼层

发表于 13-6-2018 01:37 AM

|

显示全部楼层

本帖最后由 icy97 于 16-6-2018 04:46 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MEXTER TECHNOLOGY BERHAD ("MEXTER" OR THE "COMPANY")- INCORPORATION OF A WHOLLY-OWNED SUBSIDIARY COMPANY | 1. Introduction Pursuant to Rule 9.19(23) of Bursa Malaysia Securities Berhad ACE Market Listing Requirements, the Board of Directors of MEXTER wishes to inform that the Company has on 5 June 2018 incorporated a 100 % owned subsidiary known as LYC Senior Living Sdn Bhd (Company No. 1282603-P) (" LYCSL ").

2. Information of LYCSL LYCSL was incorporated as a private limited company by shares. The share capital of LYCSL is RM1,000.00 comprising 1,000 ordinary shares. The intended principal activities of LYCSL are to carry on the business as provision of senior nursing home care and related services.

3. Financial Effect of the Incorporation of LYCSL The incorporation of LYCSL does not have any effect on the share capital and substantial shareholders’ shareholdings of MEXTER. It is also not expected to have any material effect on the net assets, gearing and earnings of MEXTER for the financial year ending 31 March 2018.

4. Directors’ and Major Shareholders’ Interests None of the Directors or major shareholders of MEXTER or persons connected with them, have any direct or indirect interest in the incorporation of LYCSL.

This announcement is dated 5 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2018 11:47 PM

|

显示全部楼层

发表于 13-8-2018 11:47 PM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant "A" | No. of shares issued under this corporate proposal | 3,794,400 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 268,466,940 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 37,585,269.000 | Listing Date | 14 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-8-2018 01:42 AM

|

显示全部楼层

发表于 15-8-2018 01:42 AM

|

显示全部楼层

Expiry/Maturity of the securities

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 0.1300 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 24 Aug 2018 05:00 PM | Date & Time of Suspension | 27 Aug 2018 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 05 Sep 2018 04:00 PM | Date & Time of Expiry | 14 Sep 2018 05:00 PM | Date & Time for Delisting | 18 Sep 2018 09:00 AM |

| Remarks : | | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the attached notice to warrant holders.Pursuant to the terms and conditions as stipulated in the Deed Poll governing the Warrants 2013/2018, the expiry date for the exercise of Warrants 2013/2018 falls on Monday, 17 September 2018, which is a non-Market Day, and hence, the last date for the exercise of Warrants 2013/2018 shall be Friday, 14 September 2018, which is the Market Day immediately preceding such expiry date.This announcement is dated 14 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5883189

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 04:47 AM

|

显示全部楼层

发表于 25-8-2018 04:47 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant "A" | No. of shares issued under this corporate proposal | 3,651,300 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 273,089,540 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 38,186,207.000 | Listing Date | 27 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 07:14 AM

|

显示全部楼层

发表于 25-8-2018 07:14 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,744 | 4,309 | 4,744 | 4,309 | | 2 | Profit/(loss) before tax | -1,589 | -1,069 | -1,589 | -1,069 | | 3 | Profit/(loss) for the period | -1,587 | -1,067 | -1,587 | -1,067 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,488 | -925 | -1,488 | -925 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.57 | -0.46 | -0.57 | -0.46 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0700 | 0.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 03:55 AM

|

显示全部楼层

发表于 7-9-2018 03:55 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant "A" | No. of shares issued under this corporate proposal | 10,243,700 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 283,333,240 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 39,517,888.000 | Listing Date | 04 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 06:03 AM

|

显示全部楼层

发表于 8-9-2018 06:03 AM

|

显示全部楼层

本帖最后由 icy97 于 12-9-2018 01:49 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MEXTER TECHNOLOGY BERHAD ("MEXTER" OR "COMPANY")PROPOSED DISPOSAL OF 80% EQUITY INTEREST IN MEXCOMM SDN BHD ("MEXCOMM"), A SUBSIDIARY OF MEXTER TO CHAN WAI FONG FOR A CASH CONSIDERATION OF RM187,727.20 ("PROPOSED DISPOSAL") | On behalf of the Board of Directors of Mexter ("Board"), Public Investment Bank Berhad wishes to announce that the Company had on 7 September 2018 entered into a sale and purchase of shares agreement with Chan Wai Fong to dispose its entire 80,000 ordinary shares in MexComm, representing 80% equity interest in MexComm for a cash consideration of RM187,727.20.

Please refer to the attached announcement for details in relation to the Proposed Disposal.

This announcement is dated 7 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5909417

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-9-2018 04:48 AM

|

显示全部楼层

发表于 13-9-2018 04:48 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant "A" | No. of shares issued under this corporate proposal | 8,184,500 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 291,517,740 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 40,581,873.000 | Listing Date | 13 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 02:48 AM

|

显示全部楼层

发表于 14-9-2018 02:48 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant "A" | No. of shares issued under this corporate proposal | 27,901,100 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 319,418,840 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 44,209,016.000 | Listing Date | 14 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 03:34 AM

|

显示全部楼层

发表于 14-9-2018 03:34 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MEXTER TECHNOLOGY BERHAD ("MEXTER" OR "COMPANY")PROPOSED DISPOSAL OF 80% EQUITY INTEREST IN MEXCOMM SDN BHD ("MEXCOMM"), A SUBSIDIARY OF MEXTER TO CHAN WAI FONG FOR A CASH CONSIDERATION OF RM187,727.20 ("PROPOSED DISPOSAL") | (For consistency, the abbreviations used throughout this announcement shall have the same meanings as defined in the earlier announcement(s), where applicable, unless stated otherwise or defined herein.)

Reference is made to the Company’s announcement dated 7 September 2018 in relation to the Proposed Disposal (“Announcement”).

On behalf of the Board of Directors of the Company, Public Investment Bank Berhad is pleased to furnish herewith additional information pertaining to the Announcement: (i) the utilisation of proceeds from the repayment of the Debt and the expected timeframe for utilisation of the proceeds. The proceeds from the repayment of the Debt shall be utilised for working capital requirements of the Group and is expected to be utilised within twelve (12) months from the date of receipt of each installments. (ii) the length of time the SPS is made available for inspection.

A copy of the SPA is available for inspection at the registered office of the Company at Lot 6.05, Level 6, KPMG Tower, 8 First Avenue, Bandar Utama, 47800 Petaling Jaya, Selangor Darul Ehsan, from Mondays to Fridays (excluding public holidays) during normal office hours for a period of three (3) months from the date of the Announcement.

This announcement is dated 13 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 03:42 AM

|

显示全部楼层

发表于 14-9-2018 03:42 AM

|

显示全部楼层

Name | LYC CAPITAL SDN BHD | Address | F-2-10, Block F, Plaza Damas, No. 60, Jalan Sri Hartamas 1

Kuala Lumpur

50480 Wilayah Persekutuan

Malaysia. | Company No. | 1083157-V | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 07 Sep 2018 | 6,221,000 | Others | Direct Interest | Name of registered holder | LYC Capital Sdn Bhd | Address of registered holder | F-2-10, Block F, Plaza Damas, No. 60, Jalan Sri Hartamas 1 50480 Kuala Lumpur | Description of "Others" Type of Transaction | Warrants Conversion |

Circumstances by reason of which change has occurred | Conversion of warrants to ordinary shares | Nature of interest | Direct Interest | Direct (units) | 64,406,400 | Direct (%) | 20.164 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 64,406,400 | Date of notice | 13 Sep 2018 | Date notice received by Listed Issuer | 13 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 01:46 AM

|

显示全部楼层

发表于 22-9-2018 01:46 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrant "A" | No. of shares issued under this corporate proposal | 5,445,500 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1300 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 324,864,340 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 44,916,931.000 | Listing Date | 21 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2018 06:50 AM

|

显示全部楼层

发表于 3-10-2018 06:50 AM

|

显示全部楼层

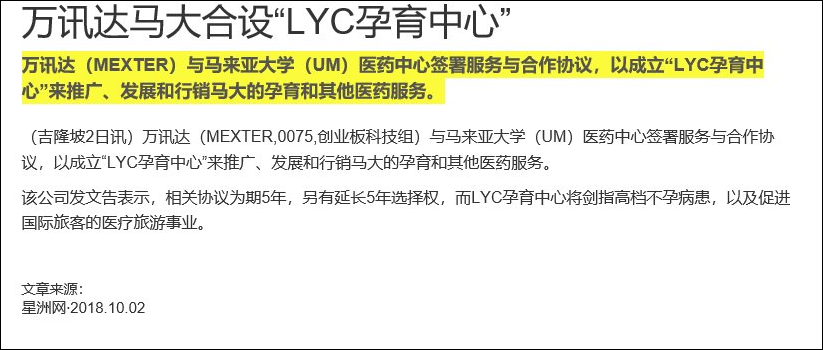

本帖最后由 icy97 于 9-10-2018 03:00 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MEXTER TECHNOLOGY BERHAD (MEXTER OR THE COMPANY)SERVICE AND COLLABORATION AGREEMENT ENTERED BETWEEN LYC MEDICARE SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF MEXTER TECHNOLOGY BERHAD AND UNIVERSITY MALAYA MEDICAL CENTRE (UMMC), VIA UNIVERSITY MALAYA (UM) (COLLECTIVELY REFERRED AS PARTIES) | 1.0 INTRODUCTION The Board of Directors of Mexter (“Board”) wishes to announce that LYC Medicare Sdn Bhd (Company No. 680188-M) (herein referred to as “LYCM”), a wholly-owned subsidiary of the Company had on 1 October 2018 entered into a Service and Collaboration Agreement (“Agreement”) with UMMC via UM, a university established under the Universities and University Colleges Act 1971 and having its registered address at Lembah Pantai, 59100, Kuala Lumpur to establish a brand namely “LYC Fertility Centre” in collaboration with UM brand, to promote, develop, and market UMMC’s fertility and other medical services. Based on the Agreement, the parties have agreed to collaborate with each other to market UMMC’s fertility and other medical services via LYCM’s establishment of “LYC Fertility Centre”, a service provider to cater for high-end fertility patients and also to promote medical tourism for international patients.

2.0 INFORMATION OF UMMC UMMC was incorporated on 5th August 1968 to serve the three main areas of teaching, research and service. It is under jurisdiction of University of Malaya statute since 25th May 2000 and it is one of the organizations in the Ministry of Higher Education.

3.0 SALIENT TERMS OF THE AGREEMENT 3.1 Scope LYCM shall act as a service provider for the value added non-clinical functions for the patients of LYC Fertility Centre while UMMC will provide the medical related services. LYCM will leverage on the operational and medical excellence of UMMC’s fertility treatment division and market its services by establishing a premium category of service under the branding of LYC Fertility Centre to potential customers seeking treatments for infertility. 3.2 Duration The Agreement shall be effective as of the execution date of the Agreement and shall be for a period of five (5) years unless terminated earlier with an option to extend of an additional five (5) years, subject to fulfilment of certain performance based requirements.

4.0 RATIONALE FOR THE AGREEMENT The Agreement is in line with the Company’s current business direction and strategy to increase the revenue and profits contribution from the healthcare services business segment. With the commencement of the Company’s postpartum care business under LYC Mother & Child Centre Sdn Bhd at Plaza VADS, Taman Tun Dr Ismail, the Company believes the establishment of LYC Fertility Centre will allow it to generate business synergies by referral of potential customers upon successful fertility treatments. The Agreement will also be beneficial to UMMC as it is able to attract fertility patients which are seeking premium services and also to promote medical tourism for international patients. It is expected that the Agreement will also help boost UMMC’s profile in the international market.

5.0 THE RISK IN RELATION TO THE AGREEMENT The risks are the general risks encountered by other companies undertaking a similar endeavor and the Company has taken the necessary steps to protect itself and to mitigate the risks as and when it occurs.

6.0 FINANCIAL EFFECTS This Agreement will not have any material impact on the total share capital of the Company and the earnings and net assets of the Group for the financial year ending 31 March 2019.

7.0 APPROVAL REQUIRED This Agreement is not subject to the approval of shareholders and any other relevant authorities.

8.0 DIRECTORS AND MAJOR SHAREHOLDERS’ INTEREST None of the Directors and/or Major Shareholders of the Company and/or persons connected to them, have any interest, direct or indirect, in the Agreement

9.0 DIRECTORS’ STATEMENT The Board of the Company, having taken into consideration all terms and conditions of the Agreement, is of the opinion that the Agreement is in the best interest of the Company.

This announcement is dated 1 October 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-10-2018 05:43 AM

|

显示全部楼层

发表于 23-10-2018 05:43 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MEXTER TECHNOLOGY BERHAD ("MEXTER" OR THE "COMPANY") - INCORPORATION OF A SUBSIDIARY COMPANY | 1. Introduction Pursuant to Rule 9.19(23) of Bursa Malaysia Securities Berhad ACE Market Listing Requirements, the Board of Directors of MEXTER wishes to announce that the Company has on 19 October 2018 incorporated a 70 % owned subsidiary known as LYC Living Sdn Bhd (Company No. 1300403-D) ("LYCL"). The remaining 30% shareholding is held by Mr Soh Hoo Hong (“Mr Soh”).

2. Information of LYCL LYCL was incorporated as a private limited company by shares. The share capital of LYCL is RM1,000.00 comprising 1,000 ordinary shares. The intended principal activities of LYCL are to provide all services related to lifestyle, wellness, health, healthcare and medicine in particular but not limited to the provision of consultancy, advice, sales and marketing, intellectual property, management, training, recruitment, care, hospital / medical centre / senior living home designs, setting up and operations or any other form of related service or services thereto.

3. Financial Effect of the Incorporation of LYCL The incorporation of LYCL does not have any effect on the share capital and substantial shareholders’ shareholdings of MEXTER. It is also not expected to have any material effect on the net assets, gearing and earnings of MEXTER for the financial year ending 31 March 2019.

4. Directors’ and Major Shareholders’ Interests None of the Directors or major shareholders of MEXTER or persons connected with them, have any direct or indirect interest in the incorporation of LYCL.

This announcement is dated 22 October 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|