|

|

发表于 25-8-2016 11:17 PM

|

显示全部楼层

发表于 25-8-2016 11:17 PM

|

显示全部楼层

本帖最后由 icy97 于 26-8-2016 01:29 AM 编辑

TGUAN(7034)盈利YOY上涨105%,手握99.866 mil净现金,派发6仙【惊喜】股息!

Thursday, August 25, 2016

http://harryteo.blogspot.my/2016/08/1334-tguan7034yoy10599866-mil6.html

TGUAN(7034)交出了非常出色的业绩,营业额以及盈利YOY分别进步了105%。而现在全年的EPS = 51.65仙也是历史新高,PE = 8.58, ROE = 13.28。而且新买进的机器会在下半年贡献更多的盈利,前景可说是非常亮眼。

最让让股东们欣慰的就是TGUAN给了股东们一个大惊喜,笔者曾经在股东大会反映周息率逊色于往年。结果管理层真的聆听了股东们的心声,在3个月后的今天派发了6仙的Interim Dividend,预计在9月28日除权。而TGUAN在FY2015的Final Dividend才在7月29日除权,笔者这个月才收到9仙的股息。这也意味着2016年1月买进至今的投资者可以获得15仙的股息,相当于4.7%左右的周息率。

- 公司最新季度的营业额以及Net profit分别比上个季度进步了2.14%以及11.20%。Net Profit Margin也提升到了7.92%的新高。

- 由于公司是净现金公司,所以终于摆脱了外汇亏损的命运,这个季度迎来了2.149 mil的Forex Gain。

- 此外, 塑料产品的盈利是历史第2高,而F&B的营业额以及盈利都突破了历史新高。

- 最夸张的是TGUAN手上的现金增加到137.706 mil以及总债务减少到37.84 mil。所以手上的Net cash搞到99.866 mil,这也给了管理层派发更高股息的底气。

- 现金流以及资产债务表比上个季度出色,相信公司可以利用这些现金继续发展公司。

可以很明显的看到公司的Profit Margin从去年的5.4%进步到7.6%,而且这是在美金开始走低的情况下做到的。

Plastic and Petroleum Products:

大家可以看到Q2的Gross Profit Margin比上个季度进步了不少,而Q4的PM超过10%是因为当时的美金汇率在顶峰。因此TGUAN注重quality以及value的策略已经开始见到了成果,Profit Margin不停进步就是最好的证明。

此外,公司的CAPITAL EXPENDITURE比去年多了许多,今年两个季就高达19.18 mil。公司花费的资金开发新产品以及引进新机器,相信未来的营业额以及盈利会更加出色。

而F&B的营业额以及盈利算算都来到新高,虽然涨幅不多,但是积少成多,公司未来的目标是要让F&B贡献10%的总盈利。而且Organic Noodle厂相信会在明年贡献更多的盈利,因为COFCO中粮会是他们潜在的客户。

这个季度的盈利上升主要是因为塑料产品销售量增加,而贡献最多的垃圾袋以及食物保鲜膜。此外,美金(今年Q2 = 4.012比去年Q2的 3.66高了9%左右)以及日元走强都是提高Profit Margin的主要推手。

F&B部门的营业持续进步是因为茶叶以及咖啡的需求增加,而且Organic noodle的子公司也开始贡献盈利。

这一次盈利包括了2.021 mil的Disposal gain以及2.149的外汇盈利。而拉伸膜以及工业塑料包装的盈利贡献减低,主要是因为较高的Depreciation,公司花费大笔自己研究新引进的33 layer nano tech 机器,以及美金走低的影响。

公司对未来两个季度的业绩保持乐观,TGUAN将会引进两条新的PVC Food Wrap line。它们分别会在2016Q4以及2017Q1安装,所以公司预计未来两个季度销售量以及产品研发都会继续增长。可以预计今年的盈利要超越FY2015不是难题,而且随着公司不断扩充,FY2017要比今年出色也是大有可为。因此TGUAN是一家值得长期持有的Cash Rich成长股。

以上纯属分享,买卖请自负。

Harryt30

19.40p.m.

2016.08.25

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2016 04:59 AM

|

显示全部楼层

发表于 28-8-2016 04:59 AM

|

显示全部楼层

EX-date | 26 Sep 2016 | Entitlement date | 28 Sep 2016 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single Tier Interim Dividend of 6% | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah, 10050 PenangTel:042282321Fax:042272391 | Payment date | 28 Oct 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Sep 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 6 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2016 03:02 AM

|

显示全部楼层

发表于 29-8-2016 03:02 AM

|

显示全部楼层

Date of change | 25 Aug 2016 | Name | DATO’ TENGKU SARAFUDIN BADLISHAH BIN DATO' SERI DIRAJA TAN SRI TUNKU SALLEHUDDIN | Age | 49 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Appointment | Qualifications | i) Bachelors Degree in Law from Brunel University, London;ii) Barrister at Law from the Inner Temple, England. | Working experience and occupation | Dato' Tengku Sarafudin Badlishah started his career at Sime Darby Berhad in 1992 and was attached to the Corporate Planning and Legal Department. Later, he moved on to the Industrial Relations Department.He was admitted as an Advocate and Solicitor of High Court of Malaya in 1994 upon completion of his pupillage at Messrs Shearn Delamore & Co.In 1997, Dato' Tengku Sarafudin Badlishah joined Pesaka Jardine Fleming Sdn Bhd (PJF), a financial advisory company. At PJF, he was involved in compliance, secretarial and legal matters. He was the executor of Jardine Fleming Group company secretarial requirements in Malaysia and also the company secretary for Jardine Fleming Apex Unit Trusts Berhad.In late 1999, Dato' Tengku Sarafudin Badlishah joined the Legal Department of the Malaysian Communications and Multimedia Commission (MCMC). He was the Head of Legal and Secretarial Department at MCMC.Dato' Tengku Sarafudin Badlishah is currently a partner in the legal firm, Kamil Hashim Raj & Lim. | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | Dato' Tengku Sarafudin Badlishah is the cousin of Tengku Muzzammil Bin Tengku Makram, Independent Non-Executive Director. |

Date of change | 25 Aug 2016 | Name | ENCIK TENGKU MUZZAMMIL BIN TENGKU MAKRAM | Age | 42 | Gender | Male | Nationality | Malaysia | Designation | Independent Director | Directorate | Independent and Non Executive | Type of change | Appointment | Qualifications | Diploma in Business and Marketing from Stamford Group of Colleges. | Working experience and occupation | Tengku Muzzammil Bin Tengku Makram started his career at Pembinaan Jayabumi (S) Sdn Bhd in 1996 as Marketing Executive. Thereafter, in 1997, he assumed the role as Special Project Executive in FACB Berhad.In 1998, Tengku Muzzammil joined R. AT Design Sdn Bhd as an Assistant Manager and was promoted to General Manager in 2002. He then joined Premont Corporation Sdn Bhd in 2002 as the Managing Director.Tengku Muzzammil is the owner of TM Med Sdn Bhd which specialises in the provision of medical supplies to Government hospital and is currently the Vise President of Corporate Affair and Communication in Haisan Berhad. | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | Tengku Muzzammil is the cousin of Dato' Tengku Sarafudin Badlishah Bin Dato' Seri Diraja Tan Sri Tunku Sallehuddin, Indepedent Non-Executive Chairman. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2016 05:53 AM

|

显示全部楼层

发表于 7-9-2016 05:53 AM

|

显示全部楼层

| THONG GUAN INDUSTRIES BERHAD |

EX-date | 26 Sep 2016 | Entitlement date | 28 Sep 2016 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | FOURTH SEMI ANNUAL INTEREST PAYMENT ON 5-YEAR 5% PER ANNUM IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS ("ICULS") | Period of interest payment | 11 Apr 2016 to 08 Oct 2016 | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah, 10050 PenangTel:042282321Fax:042272391 | Payment date | 10 Oct 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Sep 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 5 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2016 05:27 AM

|

显示全部楼层

发表于 27-10-2016 05:27 AM

|

显示全部楼层

| THONG GUAN INDUSTRIES BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Loan Stocks | Details of corporate proposal | Conversion of Irredeemable Convertible Unsecured Loan Stocks to Ordinary Shares | No. of shares issued under this corporate proposal | 3,392,800 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.0000 | Par Value ($$) | Malaysian Ringgit (MYR) 1.000 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 112,453,975 | Currency | Malaysian Ringgit (MYR) 112,453,975.000 | Listing Date | 26 Oct 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-11-2016 12:40 AM

|

显示全部楼层

发表于 9-11-2016 12:40 AM

|

显示全部楼层

本帖最后由 icy97 于 9-11-2016 02:30 AM 编辑

冷眼推荐股(二):TGUAN

Tuesday, November 8, 2016

http://bblifediary.blogspot.my/2016/11/tguan.html

业务

- 进口、生产和销售茶叶及咖啡

- 生产塑料袋、包装袋、塑料膜

- 有机面食

TGUAN(通源工业,7034,主板工业产品股),成立于1942年,并于1997年12月上市大马交易所第二板,之后于2002年5月转至主板。

TGUAN于1942年由洪通源(Ang Thong Guan)所创办,最初只是在小镇里从事包装行业,并且兼营茶叶和咖啡经销的贸易公司。

TGUAN旗下的茶叶和咖啡以888和666品牌销售,而888这个咖啡品牌相信对很多人都不陌生。

TGUAN于60年代开始生产以吸管和塑料绳为主的塑料产品。

到了70年代,不断地扩大经营与产品规模,包括生产塑料袋、塑料条、餐巾纸及仿制纸巾等。

80年代,马来西亚工业处于复兴时期,加上政府大力支持外商直接投资,TGUAN也在这个时期把生产基地扩张到了沙巴,以顺应东马发展的需要。

2016年,TGUAN再次将业务多元化其业务,与中国合作伙伴COFCO(中粮集团)联合进军中国的有机面市场。

- 拉伸膜 (Stretch film)

用来包装货物,以防在运输过程中接触到水份而导致损坏,普遍应用在工业领域、物流业、运输业等。 - 垃圾袋(Garbage Bags)

主要出口到日本,TGUAN目前是大马对日本最大的垃圾袋出口商。 - 软包装(Flexible Packaging)

主要应用在食品工业。 - 保鲜膜 (Food Wrap)

用途非常广泛,该公司是与韩国公司PowerWrap联营生产,目前是大马最大保鲜膜制造商。 - 888 & 666 咖啡粉与茶

该公司发迹的老业务,占公司营业额约5%。 - 有机面食(Organic noodles)

与中国COFCO联营在中国生产与销售有机面食。

TGUAN目前的本益比(PE)大约处在4倍左右,股东基金回酬率(ROE)介于9%,估计2016年有望成长13%。

(冷眼前辈确实是以低本益比和高成长作为考量。)

而股息方面,该公司过去每年都只派息1次,然而相信由于今年盈利大好的关系,该公司已经派发了6仙中期股息,全年股息或许会达到15仙,周息率(DY)在3.6%左右。

免责声明:

以上投资分析,纯属本人个人意见和观点。

文章所提做出的数据与价格仅供参考,建议大家在买进一家公司的股份前,请先做功课并了解该公司,并衡量应何时进场和离场,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负! |

|

|

|

|

|

|

|

|

|

|

|

发表于 9-11-2016 03:56 AM

|

显示全部楼层

发表于 9-11-2016 03:56 AM

|

显示全部楼层

| THONG GUAN INDUSTRIES BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Loan Stocks | Details of corporate proposal | Conversion of Irredeemable Convertible Unsecured Loan Stocks to Ordinary Shares | No. of shares issued under this corporate proposal | 2,247,200 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.0000 | Par Value ($$) | Malaysian Ringgit (MYR) 1.000 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 115,075,225 | Currency | Malaysian Ringgit (MYR) 115,075,225.000 | Listing Date | 09 Nov 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2016 11:46 PM

|

显示全部楼层

发表于 24-11-2016 11:46 PM

|

显示全部楼层

本帖最后由 icy97 于 27-11-2016 07:01 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 187,916 | 182,349 | 551,107 | 516,366 | | 2 | Profit/(loss) before tax | 17,518 | 12,742 | 51,302 | 25,039 | | 3 | Profit/(loss) for the period | 15,993 | 11,681 | 44,720 | 23,480 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 15,569 | 11,256 | 43,164 | 22,986 | | 5 | Basic earnings/(loss) per share (Subunit) | 14.79 | 10.70 | 41.01 | 21.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 6.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.9700 | 3.7000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-11-2016 10:50 AM

|

显示全部楼层

发表于 25-11-2016 10:50 AM

|

显示全部楼层

本帖最后由 icy97 于 27-11-2016 07:03 AM 编辑

【THONG GUAN INDUSTRIES BERHAD】

Author: GoldenEggs | Publish date: Fri, 25 Nov 2016, 10:32 AM

http://klse.i3investor.com/blogs/Goldeneggs/109962.jsp

今天就和大家聊一聊这家公司,这是一家做plastic的公司,主要用于食物包装,保鲜膜(50%),垃圾袋(可以分解,出口到三十个国家包括日本)还有一些F&B。最近也有收购了一家organic noodles 的工厂,而引起我兴趣的是这家面厂之前有上过THESTAR的SME那一版,没想到就被收购了。

老实说,市场对这家公司的估值是很不公平,公司MD也在受访时说过,THONG GUAN 的股价被低估。这点我很认同,因为THONG GUAN 是一家成长股,单单看PE 7就觉得太低了,而且可以看得出公司管理层是非常有野心,不停的想办法扩充及赚更多的钱。

这是一家值得长期持有的股票,尤其是现在的估值很低,进场是很合适的,进了之后不要看股价,看季度报告就好了。

市场很喜欢关注各种大环境对盈利的影响,例如升息,铁价,美金种种无法控制的因素,我就比较喜欢有着优秀管理层的公司,因为长期成长才能不受大环境的支配而影响盈利。

我粗略的计算的TGUAN的估值,如果要公司价值三年翻一倍,公司必须有35%的成长,目前来看这是有可能的,而想赚20%的话,公司只需有15%的成长。从这个角度看的话,要在thong guan 要达成我的目标20%的回报,是有很大的可能。派息方面,公司的Dividend也在慢慢的往上爬,从06年的3cents到现在的15cents。公司在回馈股东方面也是很不错了。

我注意到很多说,起了很多了,downside很大。我想说如果你以这个方式来评断安全性或者估值,那所有的富豪股不是downside像无底洞?要注意在股价上升的同时,盈利也在上涨,价值在不断的上升。

笔者有在提供一项服务,就是把我对BURSA的公司的估值计算了,并从最便宜的方式往上排,过去我都是自己使用,目前我会在合适的价格下分享给有兴趣的读者。如果没有兴趣,就直接ignore,不要把在股市亏钱的怒气发泄在无辜的笔者身上。有兴趣者可以去我的page看一看。谢谢!https://www.facebook.com/SungaiPinang-Capital-

顺便分享下这个访问视频,

https://www.youtube.com/watch?v=d_VX1908RiE

还有就是刚刚说的organic 公司的报道:

http://www.thestar.com.my/…/…/21/everyones-got-to-eat-right/

原来当时就有说到有上市公司有兴趣。。呵呵 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-12-2016 05:55 AM

|

显示全部楼层

发表于 7-12-2016 05:55 AM

|

显示全部楼层

订单增加 令吉贬值

通源工业今年净利看俏

2016年11月22日

(吉隆坡21日讯)通源工业(TGUAN,7034,主板工业产品股)预见,随着来自亚洲客户的订单增加,加上令吉贬值,将提升该公司今年净利表现。

根据《星报》,该公司董事经理拿督洪本铨受访时指出,该公司今年预计将会在营业额和净利取得双位数增长。

洪本铨说:“今年的拉伸膜和保鲜膜产品订单表现,已取得20%增长。”

他补充,菲律宾、越南和韩国市场增长最强劲,同时,该公司也从日本、澳洲、纽西兰和南非也获得强劲订单。

至于通源工业新的面食业务,洪本铨透露,目前已经完成位于双溪大年的厂房建设,总值400万令吉。

该制面厂每年可生产总值相当于6000万令吉的面食产品。

“新厂房仍然有空间装置额外生产装备,预料在未来几年内完成,能够将产能在进一步提高到总值相当于每年1亿5000万令吉的面食产品。”

他放眼明年,可从面食生产业务,取得总值2000万令吉销售,主要市场是东盟和中国。

该公司旗下的面条品牌包括“Golden Noodle”、“Vitame”及“Men No Sato”。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-1-2017 06:18 PM

|

显示全部楼层

发表于 17-1-2017 06:18 PM

|

显示全部楼层

本帖最后由 icy97 于 18-1-2017 12:29 AM 编辑

[TGUAN 7034] 有FUND吃, 有饭吃 !

Author: zefftan | Publish date: Mon, 16 Jan 2017, 01:22 PM

http://klse.i3investor.com/blogs/zefftan/113898.jsp

TGUAN(通源工业,7034 主版-工业)在过去一年里无论是股价表现或者是业绩数额 总算不负众望,比上不足比下有余。

因为此股的见报率颇高,加上众多网络前辈都有深入的分析此股的基本面,所以此篇就不必多言了。

由于去年10月份ICULS 债卷到了成熟期,任何持有者皆可任意转换成母股,因此开此帖主要是要向大家分享一下最近TGUAN的股权变动。

通源工业的股权动向

股票数量解析

2014附加股之前的原始股数 : 105,204,500 (1.05亿)

总发行债卷ICULS : 52,602,250 (5千两百六十万)

已转换债卷ICULS : 12,640,622 ( 1千两百六十万)

剩下未转换之ICULS : 39,961,628 (4千万)

已转换凭单 WARRANT-A : 717,915 (7百18千)

截至今日的股数 : 118,563,037 (1.18亿)

股权分配解析 (根据2015财年报 截止于2016 APRIL 一号)

大股东 (洪家) 大约持了 43%-44%左右的母股股权 ,债卷ICULS 和 凭单 WARRANTS

其余的股权主要分配在一些超级散户(著名的有如 梁孙健博士 / 冷眼大师)和其他个人名义持股手中。

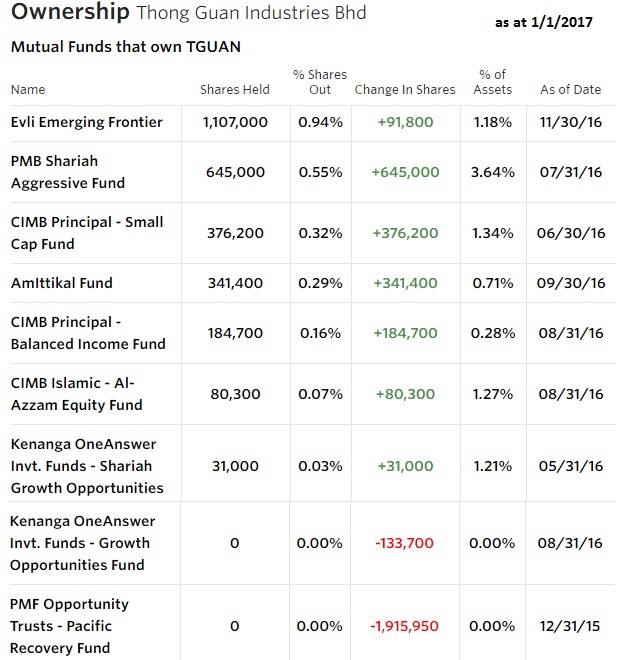

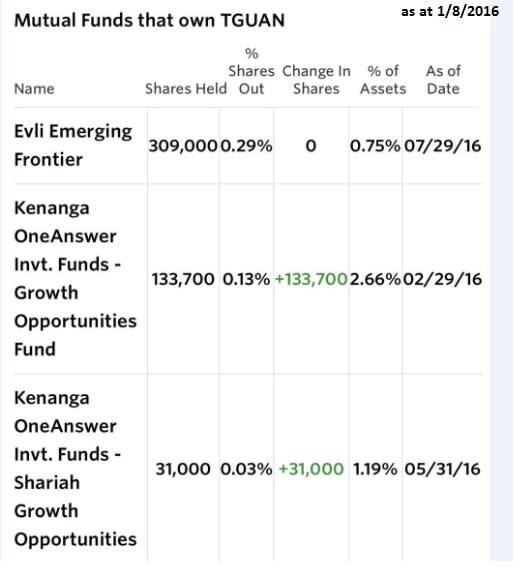

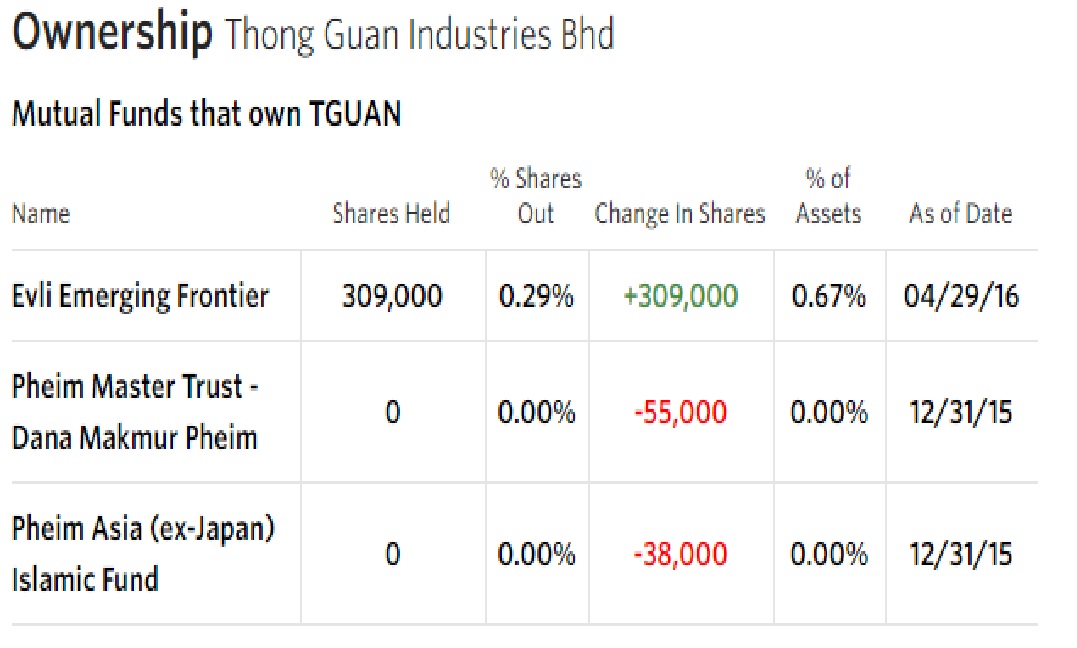

在过去的一年里,尤其是发布年报后,TGUAN冒出了了许多机构投资者,但这一切都鲜为人知。以下就为大家公布一些:

As at 1/5/2016

由此可见,越来越多的机构投资者对此股进行投资。

从刚开始的EVLI EMERGING FUND 到 最新的CIMB 和 AMIttikal FUND

过中KENANGA似乎退了些股权。(KENANGA 偏爱 SCGM SLP SCIENTX)

CIMB最近开始追踪了TGUAN而且还给了 RM5.72 target price, 所以其目的应该不难猜测

结论

陆陆续续的ICULS转换应该是来自大股东,因为ICULS股东里面除了洪家之外剩下的持股数都不超过两百万。

至于为何要转换ICULS呢,好处或许如下 :

1) 节省interest expenses

2) 大股东可以分得更多股息

3) 有可能要派红股

由于债卷是要完全进行转换的(无可幸免),所以我们可以直接当成母股总数为 157,806, 750

以目前年赚 五千八百万来说,每股盈利为37仙 , 以当前股价为准RM4.34 , 本益比为 11.7倍

比起同行,其实本益比15倍的估价 其实并不过分,毕竟它的发展蓝图不弱于任何一家同行,目前也有25%制派息率

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-1-2017 06:03 AM

|

显示全部楼层

发表于 18-1-2017 06:03 AM

|

显示全部楼层

開拓新市場提升生產線 通源工業放眼更佳盈利

2017年1月17日

(雙溪大年17日訊)通源工業(TGUAN,7034,主要板工業)在經濟疲弱中突破重圍,今年將更積極開拓新市場和提升生產線,放眼2017年稅前盈利可突破7000萬令吉。

該公司董事經理拿督洪本銓指出,通源工業至2016年9月16日的稅前盈利為5100萬令吉,單單塑料的銷售量,總銷售量就高達9萬8000公噸。

縱使面對全球經濟挑戰,包括亞洲尤其中國將面對即將上任的美國新任總統特朗普的施壓等,他估計公司今年將繼續取得驕人的成長與亮麗的表現。

“在通源工業團隊的齊心合力下,今年(2017年)公司將更積極開拓新的市場,投資3500萬令吉作為提升生產線用途,估計將突破7000萬令吉稅前盈利,及突破11萬5000公噸的總銷售量。”

“公司將繼續增加投資在拉伸膜(strecth film)、吹塑薄膜(blown film)及塑料產品(PVC Product)的新機械及技術上,同時專注于自動化工業的發展。”

他日前在通源工業慶祝創業75週年常年宴會致詞時,這么指出。

出席嘉賓包括公司執行董事拿督洪本欽、執行董事拿督洪本松、執行董事洪詩銘及來自國內外的主管級領袖。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2017 07:37 PM

|

显示全部楼层

发表于 27-2-2017 07:37 PM

|

显示全部楼层

本帖最后由 icy97 于 28-2-2017 01:57 AM 编辑

7034

| | Quarterly rpt on consolidated results for the financial period ended 31/12/2016 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2016 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/12/2016 | 31/12/2015 | 31/12/2016 | 31/12/2015 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 195,743 | 195,724 | 746,850 | 710,998 | | 2 | Profit/Loss Before Tax | 18,397 | 18,133 | 69,699 | 43,125 | | 3 | Profit/Loss After Tax and Minority Interest | 14,922 | 15,518 | 58,086 | 38,510 | | 4 | Net Profit/Loss For The Period | 15,490 | 16,199 | 60,210 | 39,656 | | 5 | Basic Earnings/Loss Per Shares (sen) | 13.90 | 14.75 | 54.11 | 36.60 | | 6 | Dividend Per Share (sen) | 6.00 | 9.00 | 12.00 | 9.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 3.6500 | 3.7000 |

|

| | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2017 06:21 PM

|

显示全部楼层

发表于 28-2-2017 06:21 PM

|

显示全部楼层

本帖最后由 icy97 于 1-3-2017 01:17 AM 编辑

Thong Guan Industries - FY16 Within Expectations

28 Feb 2017

FY16 core earnings of RM53.6m came in within our (104%) and consensus (98%) expectations. A 6.0 sen dividend was declared, which was below expectations (82%). Increase FY17E earnings by 3.6% and introduce FY18E NP of RM68.2m. Maintain MARKET PERFORM as upsides have been accounted for, but upgrade TP to RM4.76 based on a higher FY17E FD EPS of 32.6 sen and Target PER of 14.6x.

FY16 core net profit (CNP*) of RM53.6m came in within our and consensus expectations at 104% and 98%, respectively. A final dividend of 6.0 sen was announced bringing cumulative FY16 DPS of 12.0 sen, which was below our expectations at 82% as we had assumed a 30% pay-out ratio as TGUAN does not have a formal dividend policy.

Results Highlights. YoY-Ytd, TGUAN saw impressive bottom-line growth of 55%, on the back of modest top-line growth (+5%) but driven mostly by better product margins as PBT margin jumped to 9.3% (from 6.1%). Margin improvements were driven by export sales of plastic products namely premium stretch films, PVC food wrap and garbage bags. QoQ, top-line only increased by 4% on the back of growth from the plastic segment on higher sales volume, while higher financing cost (+173%), and higher effective tax rates in 4Q16 caused CNP to decline by 10%.

Outlook. We expect sustained top and bottom line growths driven by higher margin products with the commissioning of second 33-layer nanotechnology stretch film line, the 8th PVC food wrap line in 2H17, and plans for a 5 layer blown film line which we expect to accrete mostly in FY18. TGUAN is consistently investing in R&D to improve sales and margins on existing products (i.e. stretch film) and continues to revamp its customer base to target more MNCs. We are positive on TGUAN?s prospects, while we expect continued expansion into high-margin production lines to sustain the Plastic segment?s margins going forward.

Increasing FY17E earnings by 3.6%. We increase FY17E by 3.6% to RM60.0m to account for at least one quarter of earnings contributions from the new machinery and introduce FY18E NP of RM68.2m. Additionally, we lowered our dividend pay-out ratio assumptions to 25% (from 30%), closer to FY16 levels with FY17- 18E dividend yields of 2.9-3.3%.

Maintain MARKET PERFORM but increase TP to RM4.76 (from RM4.60). We maintain our MARKET PERFORM call as fundamentals are intact while downsides are limited due to the export-driven play and weak Ringgit environment. We upgrade our TP based on a higher FY17E FD EPS of 32.6 sen (from 31.5 sen) post earnings upgrade, and an unchanged Target PER of 14.6x.

Risks to our call include; (i) volatile plastic resin prices, (ii) foreign currencies risk, (iii) lower-than-expected contribution from its China- based subsidiaries, and (iv) lower-than-expected margin.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2017 02:00 AM

|

显示全部楼层

发表于 1-3-2017 02:00 AM

|

显示全部楼层

本帖最后由 icy97 于 2-3-2017 05:13 AM 编辑

【北方通源】- TGUAN(7034)盈利YOY盈利下滑4%,全年派发12仙股息!

Tuesday, February 28, 2017

http://harryteo.blogspot.my/2017/02/1392-tguan7034yoy412.html

TGUAN(7034)公布了16Q4的业绩,Net Profit YOY下跌了4%。因此今天市场立即给予反应,股价下跌了30仙,相等于6.3%。这次的业绩让笔者感到失望,因为之前预计TGUAN在美金走高以及新机械的贡献下,营业额以及盈利应该都要突破历史新高才对。

不过业绩真的有那么差吗, 我们仔细看看季度报告里的解释,到底是什么原因导致盈利下滑?

虽然Net Profit下滑了4%,但是这个季度的REVENUE以及Profit Before Tax都是历史新高。

公司的全年盈利跟上个季度相比下跌了大约RM0.6 mil,因此市场认为TGUAN的成长已经放慢,今股价跌到RM4.46.

以全年来看,公司的营业额以及盈利分别上涨了5%以及51%。盈利的幅度进步如此之大,主要原因是公司把低Profit Margin的产线卖掉,过后引进最高端的德国先进Stretch Film机器。因此公司的Profit Margin有了很大的提升,从5.4%进步到FY2016的7.8%.

虽然美金只是额外的Bonus,公司主要的Operating Profit进步才是王道。管理层曾经在股东大会透入,美金汇率保持在4.05以上将会是对公司有利的价位。

17Q1的Quarterly rate截至2月24日是4.45,处于近年新高的位置。因此短期3 - 6个月,TGUAN还是会享有汇率的优势。而未来新的产线陆续开来,就算马币走强,公司也可以保持成长。

- 上图是公司的资产债务表对比,Net Cash Position从上个季度的RM76.32 mil进步到现在的RM95.967 mil。

- 不过Borrowing从RM36.537 mil上涨到RM56.141 mil,笔者猜测这些借贷用在扩张的用途上。

- 而Cash增加的原因是因为Trade Payable从RM72.2 mil增加到RM110.95 mil。不过D/E Ratio只有0.13,处于非常健康的水平。

- 此外,RM3.815 mil的外汇盈利也是这几年里最高的一次,主要归功于美金走高。

为什么有RM3.815 mil以及营业额历史新高的情况下,TGUAN的盈利会下滑呢?以下是笔者从季度报告里找到的3个导火线:

1. COST OF GOOD SOLD增加

TGUAN的营业额跟比去年上涨了RM19,000,但是COGS却增加了RM1.586 mil。这有可能是因为最低薪金以及原料成本所导致。RESIN的价格走高将会是一个挑战,公司要积极把成本转移给客户。

2. RM3.374 mil的Impairment loss on receivables

去年Q4的时候就有0.703 mil的烂账,这个季度竟然提升到RM3.374 mil。这是很严重的问题,股东大会时必须让管理层跟小股东们好好解释。

3. F& B部门再度亏损

TGUAN的F&B 仿佛有魔咒,连续2年在Q4的时候都会面临亏损。跟上个季度的RM913 K的PBT相比,这个季度的亏损了RM67,000。季度报告的解释是因为有机面部门面临亏损。

TGUAN的Organic Noodle业务刚刚开始不久,这笔亏损有可能是因为Initial set up cost所导致。

总结:

TGUAN这个季度的盈利真的是让很多投资者失望了,不过重要的还是它未来的前景。管理层在Prospect里透露了不少2017年的扩张计划,他们在2017年将会引进以下的新机器: - 2月刚刚安装好第7架PVC Food Wrap Line,预计第8架将会在FY17Q3安装

- 第2家Nano Layer Line的将会在下半年的安装,这台机器每年可以贡献RM90 mil的营业额

- 今年之内会安装一家5-LAYER Blown Film Line

除此之外,Organic Noodle在2017年贡献RM20 mil左右的营业额。在Plastic Packaging以及F&B两个部门一起发力的情况下,管理层也有信心FY2017的销售额以及盈利会保持双位数的成长。

短期市场因为TGUAN的盈利下滑4%而感到失望,不过再给TGUAN几个季度的时间,笔者预计TGUAN的营业额以及盈利未来会继续突破新高。

上图是TGUAN过往10年的成长,过去9年只有在08年风暴以及2014年股价是下跌的。而且2016遇到管理层的时候,他们也说2017年会是更加好的一年。2016年股价涨幅34.29%, 今年2个月的股价涨幅是5.44%,年底会是多少呢,请拭目以待!

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2017 07:01 PM

|

显示全部楼层

发表于 8-3-2017 07:01 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2017 02:40 AM

|

显示全部楼层

发表于 15-3-2017 02:40 AM

|

显示全部楼层

| THONG GUAN INDUSTRIES BERHAD |

EX-date | 27 Mar 2017 | Entitlement date | 29 Mar 2017 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | FIFTH SEMI ANNUAL INTEREST PAYMENT ON 5-YEARS 5% PER ANNUAL IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS ("ICULS") | Period of interest payment | 09 Oct 2016 to 08 Apr 2017 | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah, 10050 PenangTel:042282321Fax:042272391 | Payment date | 10 Apr 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Mar 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 5 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2017 02:24 AM

|

显示全部楼层

发表于 8-4-2017 02:24 AM

|

显示全部楼层

| THONG GUAN INDUSTRIES BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Loan Stocks | Details of corporate proposal | Conversion of Irredeemable Convertible Unsecured Loan Stocks to Ordinary Shares | No. of shares issued under this corporate proposal | 2,626,700 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.0000 | Par Value ($$) | Malaysian Ringgit (MYR) 0.000 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 122,734,698 | Currency | Malaysian Ringgit (MYR) 0.000 | Listing Date | 07 Apr 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2017 05:26 AM

|

显示全部楼层

发表于 1-5-2017 05:26 AM

|

显示全部楼层

| THONG GUAN INDUSTRIES BERHAD |

EX-date | 26 Jul 2017 | Entitlement date | 28 Jul 2017 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single Tier DIvidend of 6 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah10050 PenangTel:042282321Fax:042272391 | Payment date | 18 Aug 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Jul 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.06 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-5-2017 03:15 PM

|

显示全部楼层

发表于 2-5-2017 03:15 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|