|

|

发表于 11-12-2015 10:58 PM

|

显示全部楼层

发表于 11-12-2015 10:58 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | FOCUS LUMBER BERHAD ("FLBHD" or "THE COMPANY")CLARIFYING THE DIRECTORS' AND SUBSTANTIAL SHAREHOLDERS' INTERESTS IN THE COMPANY | The announcements all made by the Company on 10 December 2015 (“Announcements”), pertaining to Changes in Director’s Interest pursuant to Section 135 of the Companies Act 1965, Change in Substantial Shareholders’ Interest pursuant to Form 29B and Notice of Person Ceasing Substantial Shareholders pursuant to Form 29C refer.

Please refer to the attachment for details of the announcement. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4949065

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-12-2015 12:34 PM

|

显示全部楼层

发表于 17-12-2015 12:34 PM

|

显示全部楼层

|

hi icy97, just need some advice, why the company is a cash rich and quarterly was earning but the major director selling the shares? thanks |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2016 03:06 AM

|

显示全部楼层

发表于 23-2-2016 03:06 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 57,767 | 41,398 | 180,733 | 150,419 | | 2 | Profit/(loss) before tax | 11,796 | 5,614 | 36,317 | 17,295 | | 3 | Profit/(loss) for the period | 10,702 | 5,073 | 31,722 | 16,032 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,702 | 5,073 | 31,722 | 16,032 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.37 | 4.92 | 30.74 | 15.53 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.00 | 8.00 | 15.00 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4200 | 1.2600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2016 05:35 PM

|

显示全部楼层

发表于 23-2-2016 05:35 PM

|

显示全部楼层

本帖最后由 icy97 于 23-2-2016 05:46 PM 编辑

Flbhd 5197 富佳木业rm 2.63 buy in-- Flbhd 5197 富佳木业rm 2.63 buy in--

2015 全年eps=30.7 sen ,合理的pe=10 ,stock price=rm3.07

dividen=15 sen ,dy=5.7%

公司于31-12-2015 现金有5781万,无任何债务.

http://www.focuslumber.com.my/

http://www.malaysiastock.biz/Cor ... p;securityCode=5197

Good Buying Opportunity - Koon Yew Yin

Author: Koon Yew Yin | Publish date: Thu, 21 Jan 2016

http://klse.i3investor.com/blogs/koonyewyinblog/90216.jsp

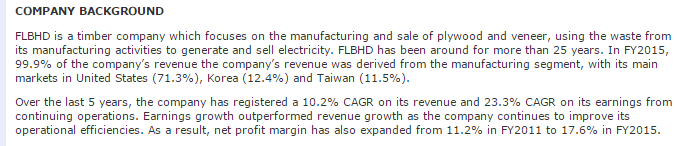

FOCUS LUMBER

Focus Lumber manufactures plywood and veneers. It exports 97% of its products and mainly to USA. It is a zero debt company with huge cash pile of 83 cents per share. Its profitability has improved for the past few quarters due to the fact that Ringgit has weakened significantly over the past few quarters. As low crude oil price leads to low gas price in US, people in US has more disposable income which leads to higher spending. Furniture players will benefit from this

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2016 11:24 PM

|

显示全部楼层

发表于 23-2-2016 11:24 PM

|

显示全部楼层

本帖最后由 icy97 于 23-2-2016 11:37 PM 编辑

1170.【富佳佳绩】- FLBHD(5197)业绩盈利破新高,派发10仙股息!

uesday, November 17, 2015

http://harryteo.blogspot.my/2015/11/1170-flbhd519710.html

昨天元宵佳节,富佳木材公布了不错的业绩盈利。业绩以及盈利算算突破了历史新高,EPS是10.37仙,比去年同期上涨了111%。2015年的全年营业额以及税后盈利分别上涨了20%以及98%。笔者将会小小分享一下个人对FLBHD所做的功课。

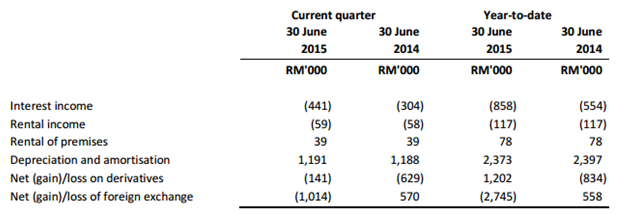

从上图我们可以看到,FLBHD的营业额以及盈利已经连续走高了4年。Profit Margin更是从8.7%上升至17.6%。而全年的EPS是30.74,以现在RM2.60的股价计算,PE大约是8.46。而且ROE更是进步到了21.65, 周息率大约是5.77%。

以上是FLBHD历年派息的数据,可以看到股息从以前的6仙缓慢的增长到现在15仙。只要公司的盈利持续增长,相信股息还是有机会增长的。

上图是2014年Segmentation的比较,我们可以看到Plywood Manufacturing的盈利进步了大约72%,而Electricity也从1.36 mil进步到2015年的2.154mil。

大家仔细一看的话,FLBHD的现金从上个季度的85.47 mil减少到现在的57.819 mil。主要原因是派发了15.48 mil的股息以及购买了16.2 mil的Investment securities。或许这也是好消息,因为公司的现金太多没有好好利用也不是好事。由于资料有限,也不知道公司到底买什么securities,这要等到Annual report出炉才能知道。

上图的就可以看到公司买了新的Investment securities以及增加了Plant & equipment的投资。希望借此可以增加产能以及减少生产成本。

公司说明了盈利走高主要是【销售额】以及【美金走扬】拉高了Profit Margin。不少人担心FLBHD在美金走跌之后就会沉沦,但是笔者却认为这太过主观。因为Q3的USDMYR从4.05上升到4.28,汇率上涨了4.5%。但是营业额却上涨了35%。这也说明了FLBHD的Plywood的需求不断增长才会导致Revenue上升。

此外,公司也致力现代化他们的器材以减少成本,间接可以抵消成本走高的不利因素。因此笔者认为FLBHD今年的盈利还是有成长的空间,而且151Q的EPS只有3.22,接下来的EPS分别是7.80,9.35,以及10.37,平均3个季度都有9仙的EPS。因此FLBHD的EPS下个季度会很轻易就超过了之前。

笔者持有FLBHD接近1年,中间股价也经历了几轮的回调。时间+成长会为投资者带来丰盛的Return,耐心是不可缺少的。共勉之。

以上纯属功课分享,买卖请自负。

魔法师Harryt30

16.15p.m.

2016.02.23 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2016 07:52 PM

|

显示全部楼层

发表于 28-2-2016 07:52 PM

|

显示全部楼层

2月26号, 周五跌破2.6大关了。

想问下各位预测FLBhd 2016 年Q1 的业绩能和Q4 2015年媲美吗? |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2016 02:01 AM

|

显示全部楼层

发表于 11-5-2016 02:01 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (29A)Particulars of Substantial Securities HolderName | MR KOON YEW YIN | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary Shares of RM0.50 each | Name & address of registered holder | 1. TA Nominees (Tempatan) Sdn Bhd Pledged Securities Account for Koon Yew Yin1st Floor, Plaza Teh Teng SengNo. 227 Jalan Kampar30250 Ipoh, Perak2. Kenanga Nominees (Tempatan) Sdn Bhd Pledged Securities Account for Koon Yew Yin (002)Ground Floor, Bangunan ECM Libra8 Jalan Damansara Endah, Damansara Heights50490 Kuala Lumpur3. Alliancegroup Nominees (Tempatan) Sdn Bhd Pledged Securities Account for Koon Yew Yin (6000051)17th Floor, Menara Multi-PurposeCapital Square, No. 8 Jalan Munshi Abdullah50100 Kuala Lumpur4. Maybank Nominees (Tempatan) Sdn Bhd Pledged Securities Account for Koon Yew Yin14th Floor, Menara Maybank100, Jalan Tun Perak50050 Kuala Lumpur5. Affin Hwang (Tempatan) Sdn Bhd Pledged Securities Account for Koon Yew YinNo. 1, Lintang Pekan BaruOff Jalan Meru41050 Klang, Selangor6. RHB Nominees (Tempatan) Sdn Bhd Pledged Securities Account for Koon Yew Yin21-25 Jalan Seenivasagam30450 Ipoh, Perak |

| Date interest acquired & no of securities acquired | Currency | Malaysian Ringgit (MYR) | Date interest acquired | 11 Apr 2016 | No of securities | 6,931,000 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares | Nature of interest | Direct | Price Transacted ($$) |

|

| | Total no of securities after change | Direct (units) | 6,931,000 | Direct (%) | 6.716 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 11 Apr 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2016 02:11 PM

|

显示全部楼层

发表于 11-5-2016 02:11 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2016 04:02 PM

|

显示全部楼层

发表于 11-5-2016 04:02 PM

|

显示全部楼层

我最好笑的是,星期五还想问问这个股怎样,哪里知道星期1买进了,就大跌。

幸好现在股价平稳。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2016 01:10 AM

|

显示全部楼层

发表于 23-5-2016 01:10 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 53,286 | 30,032 | 53,286 | 30,032 | | 2 | Profit/(loss) before tax | 4,358 | 3,839 | 4,358 | 3,839 | | 3 | Profit/(loss) for the period | 3,312 | 3,323 | 3,312 | 3,323 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,312 | 3,323 | 3,312 | 3,323 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.21 | 3.22 | 3.21 | 3.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4500 | 1.4200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2016 11:25 PM

|

显示全部楼层

发表于 23-5-2016 11:25 PM

|

显示全部楼层

本帖最后由 icy97 于 24-5-2016 12:38 AM 编辑

【浅谈富佳】- FLBHD(5197) 挑战重重,主因源自【外汇+Tax】双杀,到底何去何从?

Sunday, May 22, 2016

http://harryteo.blogspot.my/2016/05/1260-flbhd5197-tax.html

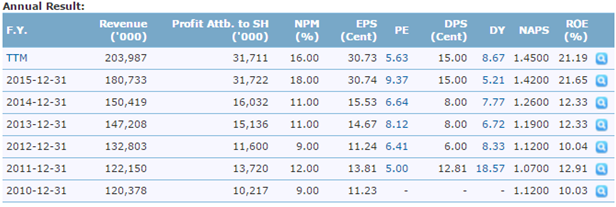

FLBHD的业绩在5月20日出炉,盈利从去年Q1的3.323 mil下跌到最新的3.312 mil,盈利下跌了RM11,000。不过营业额按年计算却上涨了77%,也就是上涨了23.2 mil。现在市场都对FLBHD感到非常悲观,应该不少人会选择在星期把FLBHD卖掉, 很大可能性会出现惶恐性暴跌。不过在决定买卖之前,你是否读完整份季度报告,知道了所有的前因后果吗??

那到底什么原因导致盈利下跌呢,我们就先看看这家公司的季度报告里写了什么。希望笔者的一些功课可以大家些许的帮助,买卖前自己也要做足功课。 首先,大家可以看到FLBHD的Profit Margin大跳水,从去年的17.8% 的Profit Margin下跌到最新的6.2%。不过Q1一向是FLBHD的单季,这从过往几年的业绩阴盈利都可以看到。从上图我们可以看到FLBHD的最新营业额其实是历史第2高,但是盈利却如此不堪,会不会让大家搞到懊恼呢??

不过大家仔细一看上图,其实FLBHD的税前盈利是比去年Q1多了12%的。把盈利拉低的主因之一就是Tax,待会会有详细的解说。

从上图我们可以看到Trade and other receivables减少了不少,那就意味着公司收回了至少6.5 mil的账目。加上这个季度赚到的钱,其实公司的现金流有了很大的进步。

仔细一看,Other Investment增加到了26.434 mil,而现金也变成62.47 mil,两者相加 = 88.9 mil。Other Investment因为列入Current Asset,所以是可以在短期内转换成现金的。此外,笔者在2015的年度报告读到,Other investment其实是放进Money Market Fund赚取利息,平均的Interest Rate是3.61%.。

全年return 可以是 = 26.434 x 3.61% = 0.954 mil.

所以预计Other Investment以及Cash in Bank全年可以带来接近2 mil的利息收入。以103.2 mil的股数计算,每股现金 = 88.9/103.2 = 86.1仙。

2015年公司派发了15仙的股息,以FLBHD每股86.1仙的现金来看,公司未来5年的派息完全不是问题。而且FLBHD是【0借贷】的公司,所以是0 Finance Cost。上图是FLBHD的业绩Summary,蓝色格子代表利好因素,红色格子代表利空因素。

利好因素:- 公司的木材销售量增加以及161Q的美金汇率比15Q1高了不不少,所以Revenue才可以进步到53.2 mil。

利空因素: - 公司蒙受大笔的Foreign Currency translation losses

- 美金相比15Q4下跌了9%,去年12月31日USD/MYR = 4.2935, 而3月31日是3.904。所以3个月下跌了39仙,相当于9.07%。

- 不过让我惊讶的是FLBHD不是使用Quarterly rate而是当个季度最后一天的汇率。个人认为使用Quarterly rate是比较准确的,因为一天的汇率不等同一个季度。

- 假设使用Quarterly Rate, 去年Q4是4.28, 而今年Q1是4.22, 相差不到2%,Foreign Currency translation losses就不会这么多。

- Lower average Selling price导致profit margin下跌。

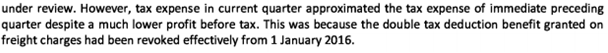

- Double tax deduction benefit granted被废除导致Tax增加,也减少了公司的盈利。

公司说美金走低影响公司的profit margin,此外7月1号开始的最低薪金也会减少例如。因此公司决定增加产量以及抵消成本增加的负面因素。

为了证实外汇转换亏损时来自公司的资产,笔者找出了公司在2015年年底持有的美金现金 = 23.194 mil。2015自美国结算的Trade receivable是11.01mil(2014 is 12.438 mil),其他国家大约是2 mil左右。

而我们在上图看到公司在这个季度的外汇亏损失3.557 mil。

笔者计算到的美金资产(包括现金receivable)是34.2 mil,美金下跌了大约9%。 所以34.2 mil x 9% = 3.078 mil。而且当时还马币对比其他国家的货币也是走强的,所以其他国家Trade receivable预估也有0.18 mil左右的Foreign Currency translation losses。

所以笔者初步估算的Foreign Currency translation losses大越是3.25 mil。不要忘记这3个月公司的现金也增加了不少,所以Foreign Currency translation losses增加到3.557 mil是有可能的。而2014年公司美金现金以及Trade receivable大约相等于18.19 mil (cash) + 12.44mil = 30.63 mil。而马币在去年全年大约下跌了22.8%, 30.63 mil x 0.23 = 7.0449 mil。

笔者计算出来的答案跟去年全年的外汇盈利相差低于0.05%。不过以上都是笔者自己的推算,如有错误,请大家多多见谅。

现在美金的汇率是4.07左右,比当初3月31日的3.904又高了17仙,这是否意 味美金假设可以走强到6月尾,Foreign currency translation losses可以变成Foreign currency translation gains??

不过外汇始终是Extra bonus,公司的营业额以及产线优化才是刺激公司盈利走高的主因。因为Double tax deduction benefit在1月1号撤销,所以16Q1比去年Q1足足多了0.53 mil。所以单单在外汇以及TAX的影响之下,盈利足足减少了接近4 mil。这种情况可能接下来会发生在不少其他出口公司的身上。

总结:

以现金流以及股息来看,FLBHD无疑是非常出色的。假设美国在6月升息,这可能回到导致美金走高,FLBHD也有所回弹。而且FLBHD最近几个季度销售量以及产量有所增加,长期是有看头的。公司也积极打开日本市场,希望可以通过日本2020的奥运分到一些甜头。

不过,现在盈利在没有进步的情况下,很大可能会遭受大量的卖压。而这种情形也发 生在去年的5月公布的业绩,当时候FLBHD的货柜因为美国港口罢工而进不到港口,盈利当个季度下跌19%,股价也下跌了10%左右。不过最后Delay 的货柜被记录在Q2导致盈利大涨,股价也是从那个时候开始走高。

缺乏耐心的投资者或许要有止损的觉悟,因为这家公司需要时间让市场消化外汇的因素。假设你做了功课,你心里或许就会有答案了。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2016 01:03 AM

|

显示全部楼层

发表于 25-5-2016 01:03 AM

|

显示全部楼层

哭哭鸟 发表于 23-5-2016 11:25 PM

【浅谈富佳】- FLBHD(5197) 挑战重重,主因源自【外汇+Tax】双杀,到底何去何从?

Sunday, May 22, 2016

http://harryteo.blogspot.my/2016/05/1260-flbhd5197-tax.html

FLBHD的业绩在5月20日出炉,盈利从去年Q ...

谢谢分享。。。

功课做得真足。

小弟没做功课,可是知道foreign currency作怪。看了你的解说。决定继续买继续hold。。。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2016 11:21 PM

|

显示全部楼层

发表于 31-5-2016 11:21 PM

|

显示全部楼层

本帖最后由 icy97 于 31-5-2016 11:40 PM 编辑

【回归根本】- FLBHD(5197) Excluding 外汇盈利/亏损会变得怎么样? + Tax Rate = 24%.

Tuesday, May 31, 2016

http://harryteo.blogspot.my/2016/05/1271-flbhd5197-excluding-tax-rate-24.html

昨天去参加了Hevea的AGM, 遇到了3位来自Johor的股东。其中一位是FLBHD的股东(F先生),之前他也去了FLBHD在Sabah的股东大会。他告诉我FLBHD的股东非常的专业,而且也很详细耐心地回答股东的问题。所以F先生本身还是很看好FLBHD,毕竟FLBHD拥接近89 mil的现金在手。此外,管理层也表示今年的产量也比去年增加了不少。

公司出口至美国的plywood主要是用来制造旅游休闲车(RV), 现在RV的销售量已经是08金融风暴后的新高。因此FLBHD的产品在美国还是很有Demand的,所以我们可以看到FLBHD在淡季的Q1也可以有53.286 mil的营业额,位居历史第2高。

此外,他还说网络说应该有人好好计算FLBHD的Operating Profit成长,看看再排出外汇的因素之下,FLBHD到底赚了多少钱。因此笔者就做了一张图表供大家参考:

- 大家看看黄色的Total Forex Gain/Loss,2015年的外汇盈利是5.251 mil。扣除外汇盈利,公司的PBT是31.066 mil。

- 而公司在2015年的Corporate Tax rate是12.65%,由于排除外汇后的盈利减少。所以笔者使用了12%的Tax rate,PBT就是27.338 mil。比真正的31.722 mil减少了13.82%。但是也是非常出色盈利了,所以FLBHD【排除了外汇】后的EPS是26.49,还是处于非常出色的水平。

- 不过来到了2016年,公司享有较低的Tax rate,主要是因为因为他们出口plywood以及laminated veneer wood至国外,所以享有Double tax deduction Benefit。

- 去年整年FLBHD的Annual Corporate Tax rate是12.65%,可是最近季度却几乎上涨了1倍,Q1是24%的Tax。这也是为什么公司在赚了更多钱的情况下,Profit after tax却下跌。

- 假设仔细看,2016Q的Profit Before Tax Excluding Forex Gain/Loss (000)是7.792 mil,足足比2015Q1的4.227mil提升了84.34%。

总结:

- 假设诚如管理层所说,4月的产量已经比2015一起Q1来高的话,公司的operating profit正在处于正面的成长中。

- 不过公司在股东大会也表明,原木料的供应有限,这是公司正在面对的一个问题。

- 其次,公司的不再享有Double Tax Deduction Benefit,公司必须增加产能以抵消这个负面因素。

总体而言,FLBHD假设可以持续派发15仙或以上的股息,公司的Dividend Yield就有 7 - 8%。而RM2.00以下的价格是有严重被低估的迹象,因此今天股价再度站回RM2以上。

公司在股东大会说2016Q1使用了3.905的汇率,最近汇率都在4.10附近徘徊。只要6月30日的汇率可以维持在这个水平,公司应改会有1.5 - 2.0 mil之间的外汇盈利。

【回归根本】,只要公司的产量增加并持有有订单,2016年FLBHD是有能力克服种种困难,创造出更好的价值回馈股东。毕竟每年派息6 - 8%的公司,在大马没有可以做到的上市公司不到100家。

以上纯属分享,买卖自负。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-6-2016 01:31 PM

|

显示全部楼层

发表于 1-6-2016 01:31 PM

|

显示全部楼层

哭哭鸟 发表于 31-5-2016 11:21 PM

【回归根本】- FLBHD(5197) Excluding 外汇盈利/亏损会变得怎么样? + Tax Rate = 24%.

Tuesday, May 31, 2016

http://harryteo.blogspot.my/2016/05/1271-flbhd5197-excluding-tax-rate-24.html

昨天去参加了 ...

1.91没进场,后悔了。

希望会暴跌。。

还有就是他的foreign currency算法很有问题,其实如果他拿平均锐换,其实赚更多咯。

by the way,如果照现在这个情形走的话,mean下一季的财报肯定会比去年更好。去年的同期外汇美元才3.5多。

如果看currency的话,现在大概4.12,要跟去年10月的比较,那时股价也是在1.8-1.9之间。现在的价钱fair price.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2016 03:52 AM

|

显示全部楼层

发表于 4-6-2016 03:52 AM

|

显示全部楼层

Date of change | 01 Jun 2016 | Name | MR YANG SEN | Age | 45 | Gender | Male | Nationality | Taiwan, Province of China | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Due to family commitments | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | | Working experience and occupation | | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | 4,388,881 Ordinary Shares of RM0.50 each |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-7-2016 11:00 PM

|

显示全部楼层

发表于 5-7-2016 11:00 PM

|

显示全部楼层

本帖最后由 icy97 于 5-7-2016 11:21 PM 编辑

富家木业FLBHD - 该守或该走?

Tue, 5 Jul 2016, 03:01 PM

FLB今天闭市时,再跌3cent,创下了9个月新低。从1月高峰RM3.00左右跌至今天的RM1.71,FLB总共在6个月里跌了43%!到底这股发生了什么事?笔者有位朋友在1年前从RM1.60-1.70左右买入,股价暴涨至RM3.00也没套利,然后再看着它跌回成本价,犹如坐了一趟过山车。心情肯定很复杂。

FLB是由3名伙伴成立于1980年,是一家以沙巴为基地的胶合板制造商。它在2011年上市于大马主要板。创始人分别是来自台湾的“林氏”、“陆氏”和“杨氏”。FLB的股权结构主要是由个别股东组成,没有一名股东拥有超过10%。这3大家族在近一年发生了股权变动,当中不知发生什么事。陆氏家族在2015年大幅度售股,从16%降至7%,继续持股的成员也从3位变成1位。林氏家族个个成员则增股,从18%增至24%,而杨氏家族并没有多大变化。目前,陆氏依然还在抛股。

FLB近年的业绩都挺出色的,主要归功于外汇盈利。根据2015年财报,FLB有高达99%的销售是来自出口,主要以USD来交易。翻看FLB的季度报告,FLB在近3个季度的外汇盈利如下:

FY15Q3 (7月至9月) – RM4.27m

FY15Q4 (10月至12月) – RM0.03m

FY16Q1 (1月至3月) – (RM3.56m)

USD/MYR在FY15Q4时,正处在4.25左右,为何FLB却没有外汇盈利呢?仔细看看USD/MYR的图表,你会发现USD/MYR在FY15Q3时是从3.75暴涨至接近4.50,在FY15Q4时徘徊于4.25左右,在FY16Q1时从4.30暴跌至4.00左右。这说明了只有很大的跌幅和涨幅,才会造成巨大的外汇盈利或亏损。FLB在之前兑换的外汇和之后兑换的外汇,之间的差距就会是所谓的账面外汇盈利或亏损。对于FY16Q2的看法,笔者认为FLB会有外汇盈利,预计在RM1.5m至2m左右。

此外,FLB之前拥有的货运费双重扣税津贴也在2016年被撤销。它在2014年和2015年节省了高达RM3.0m和RM3.8m的税。在失去了双重扣税津贴后,FLB必须依照政府规定的企业税率24%来交税。

在FY16Q1季度报告里,管理层表示FLB目前面对其他生产商的激烈价格竞争。外围因素也充满了挑战,尤其沙巴的最低薪金制度将在7月从RM800提升至RM920。面对这些挑战,FLB将会专注在提高生产量,以降低生产成本。或许这也是FLB仅能做的应对措施吧。值得一提的是,FLB在2015年投入的CAPEX高达RM4.5m,和2013年的RM2.0m和2014年的RM2.7m相比,高出了不少。管理层曾表示FLB将投入资金以购买先进的机械设备,不知这CAPEX是不是投入了这一项。

总结来说,近几年FLB主要依靠扣税津贴和外汇盈利来提升业绩。可是,一旦这2个利好因素消失,恐怕FLB将回去之前FY13的业绩。从生意角度来看,FLB其实并没有真正在成长,也没有在扩展生意。这可解释为何它在FY12-14的业绩都差不多一样。

目前,FLB拥有RM62m的现金。基于FY16的表现预料比FY15来的差,笔者预计FLB将不会再派发15cent股息。保守估计股息应该是和FY13和FY14的8cent一样。以目前的股价RM1.71来计算,股息率是4.68%。

至于它的潜在价值,在失去扣税津贴和外汇盈利的利好下,笔者估计FLB的FY16净利会在RM15-16m左右。以103.2m的股数来计算,每股净利将会是15 cent左右。再以PE 10 至 12倍来推算,FLB的潜在价值大约是每股RM1.50 – 1.80。

RH Research

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-7-2016 03:52 AM

|

显示全部楼层

发表于 16-7-2016 03:52 AM

|

显示全部楼层

本帖最后由 icy97 于 20-8-2016 06:57 AM 编辑

Date of change | 15 Jul 2016 | Name | MR LIN HAO YU | Age | 39 | Gender | Male | Nationality | Taiwan, Province of China | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | Major in Electrical & Mechanical from Advanced Vocational School of Agriculture & Technology in Sheng Li Gung Shan Taiwan. Currently he is studying for a diploma degree in Taiwan Shou Fu University. | Working experience and occupation | Lin Hao Yu has about eighteen (18) years of working experience in the timber industry. He started his working career with the Company in 1998 as a general production manager. Then he left to join a veneer production factory in Cambodia from 2000 to 2003 as the production and human resource manager. He returned to Malaysia to join a company involved in sawmilling from 2004 to 2008, holding the position of production manager and also in charge the marketing and sales department.From 2009 till 2015, he started his own business of sawmill factory. He processes a sufficient and broad experience in production, marketing, and human resource. In addition, he is familiar with Sabah timber industry and lumber concession and trading operation. | Directorships in public companies and listed issuers (if any) | Nil | Family relationship with any director and/or major shareholder of the listed issuer | Lin Hao Yu is the son of Lin Fong Ming (an Executive Director and substantial shareholder of the Company) and the brother of Lin Hao Wen (the Managing Director and substantial shareholder of the Company). | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct - 6,775,460 Ordinary Shares of RM0.50 eachIndirect Interest - 889,400 Ordinary Shares of RM0.50 each held by his spouse, Christina Phang Ya Yun pursuant to Section 134(12)(c) of the Companies Act, 1965 | Due Date for MAP | 15 Nov 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2016 02:46 AM

|

显示全部楼层

发表于 4-8-2016 02:46 AM

|

显示全部楼层

Date of change | 03 Aug 2016 | Name | MR LU KUAN-CHENG | Age | 27 | Gender | Male | Nationality | Taiwan, Province of China | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Due to family issue and career planning | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | | Working experience and occupation | | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | 6,090,415 Ordinary Shares of RM0.50 each |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2016 04:16 AM

|

显示全部楼层

发表于 13-8-2016 04:16 AM

|

显示全部楼层

| Type of transaction | Description of Others | Date of change | No of securities

| Price Transacted ($$)

| | Disposed | | 04 Aug 2016 | 60,000

| 1.680

| | Disposed | | 04 Aug 2016 | 70,000

| 1.670

| | Disposed | | 05 Aug 2016 | 20,000

| 1.680

| | Disposed | | 05 Aug 2016 | 40,000

| 1.730

| | Disposed | | 05 Aug 2016 | 40,000

| 1.720

| | Disposed | | 05 Aug 2016 | 40,000

| 1.690

| | Disposed | | 08 Aug 2016 | 50,000

| 1.740

| | Disposed | | 08 Aug 2016 | 60,000

| 1.760

| | Disposed | | 08 Aug 2016 | 100,000

| 1.770

| | Disposed | | 08 Aug 2016 | 90,000

| 1.750

| | Disposed | | 09 Aug 2016 | 7,700

| 1.780

| | Disposed | | 09 Aug 2016 | 150,000

| 1.740

|

Notice of Person Ceasing (29C)Particulars of Substantial Securities HolderName | MR LU KUAN-CHENG | Nationality/Country of incorporation | Taiwan, Province of China | Descriptions (Class & nominal value) | Ordinary Shares of RM0.50 each | Date of cessation | 10 Aug 2016 | Name & address of registered holder | Lu Kuan-ChengMile 3, Jalan MasakKg Ulu Patikang89008 KeningauSabah |

Currency | Malaysian Ringgit (MYR) | No of securities disposed | 90,000 | Price Transacted ($$) | 1.750 | Circumstances by reason of which Securities Holder has interest | Disposal of shares through open market | Nature of interest | Direct |

| Date of notice | 12 Aug 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2016 01:31 PM

|

显示全部楼层

发表于 18-8-2016 01:31 PM

|

显示全部楼层

本帖最后由 icy97 于 18-8-2016 03:07 PM 编辑

Some thoughts on Focus Lumber’s soon-to-be released Q2 results -cc Koon Yew Yin

Author: charlie kun | Publish date: Wed, 17 Aug 2016, 10:48 PM

http://klse.i3investor.com/blogs/charliekun/102367.jsp

The following post by Shaun Loong on Focus Lumber (FLBHD) caught my attention.

http://klse.i3investor.com/blogs/shaunloong_blog/101529.jsp

Three key points from Shaun:

1. Stock is oversold and at 10-month low

2. FLBHD is significantly undervalued at 5.5x trailing P/E and 2.7x EV/EBIT

3. Fair value RM2.11 – RM2.24

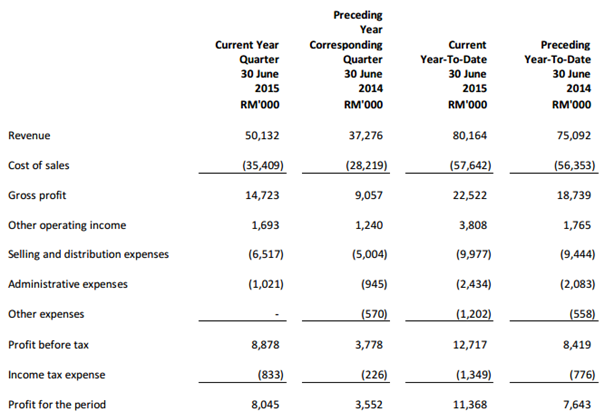

The stock price sank by RM1.37, or 45% from an all-time high of RM3.09 on 11th Jan 2016 to RM1.71 today. The price had discounted a big drop (40%-50%) in earnings for FLBHD this year. Is market overreacting? To answer this question, let’s do a check on the numbers in FY2015 Q2 results for a gauge of FY2016 Q2 results.

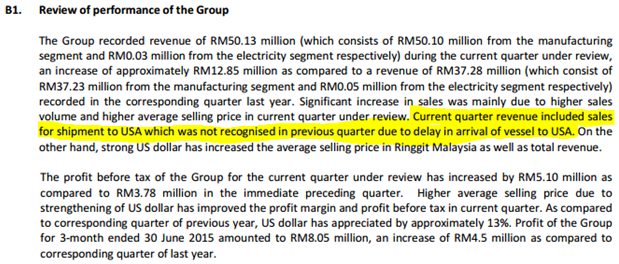

1. Revenue of RM 50.13 million for FY2015 Q2 included sales NOT recognized in FY2015 Q1 due to delay of arrival of vessel to USA (as highlighted above). The sales brought forward to FY2015 Q2 is projected at RM 8 million. Without that one-off sales, the revenue for Q2 is only RM 42 million.

2. Tax rate was 9.38% in FY2015 Q2. Effective 1st January 2016, tax rate of 24% will be applied because the double tax deduction on freight charges had been revoked by the government.

3. Net gain on foreign exchange/derivatives was RM 1.15 million in FY2015 Q2. Any one-off gain should be excluded from the calculation of core profit.

In summary

- Without the one-off sales, the revenue for FY2015 Q2 is only RM 42 million (16% lower than RM 50.13 million).

- Tax rate will increase from 9.38% in FY2015 Q2 to 24% in FY2016.

- Net gain on foreign exchange was RM 1.15 million.

Using the figures above, we can calculate FLBHD’s normalized earnings for FY2015 Q2 for a gauge of FY2016 Q2 results.

- All else being equal, normalized profit before tax was RM 7.46 million or 16% lower than the RM 8.88 million enhanced by one-off sales

- Applying tax rate of 24%, normalized profit after tax was RM 5.67 million or 29% lower than RM 8.05 million

Conclusion

The stock price of FLBHD sank by RM1.36, or 45% from an all-time high of RM3.09 on 11th Jan 2016 to RM1.71 today. Back to my question. Is the market overreacting?

All else being equal, normalized profit after tax for 2016 Q2 is projected at RM 5.67 million or 29% lower. Comparing this to the steep 45% correction of its stock price, it shows the market had over-discounted the stock price of FLBHD by a big margin. What if the actual 2Q results are better than expected? Will the stock price climb above RM3 again?

Investors who trade purely base on the reported figures, without considering one-off sales/gain/loss, will be penalized when they sell in panic. Conversely, smart investors will accumulate more when they are offered great bargains.

Is FLBHD worth investing now that it is oversold? How is its track record of earnings, dividends, ROIC etc? What is the fair value for FLBHD?

“Price is what you pay, value is what you get.”

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|