|

|

【AHEALTH 7090 交流专区】艾柏士保健

[复制链接]

[复制链接]

|

|

|

发表于 17-8-2017 01:19 AM

|

显示全部楼层

发表于 17-8-2017 01:19 AM

|

显示全部楼层

EX-date | 13 Sep 2017 | Entitlement date | 15 Sep 2017 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | Interim Single Tier Dividend of 5.5 sen per ordinary share for the financial year ending 31 December 2017. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaTel:0377201188Fax:0377201111 | Payment date | 29 Sep 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Sep 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.055 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2017 05:10 AM

|

显示全部楼层

发表于 18-8-2017 05:10 AM

|

显示全部楼层

业绩符预期.艾柏士保健具3优势

(吉隆坡17日讯)艾柏士保健(AHEALTH,7090,主板消费品组)次季净利微扬6.71%至1029万9000令吉,符合大众研究预期,该行认为正面的表现可在未来几季获得持续。

第二季营业额按年增长5.9%,主要是制造与行销业务增长14.4%;尤其品牌产品销售在新加坡与其他国际市场特强。

大众说,配合营业额增长,税前与营运赚益分别改善至8.2%与8.7%(前期为7.8%与8.4%);同期亦获更高存款利息,使净赚益保持6.6%。

首半年的制造与销售业务增长8.6%,批发与业务则增长5.0%,促使半年业务在新加坡、政府部门与合约制造服务支撑下,让净利按年增长4.8%至2040万令吉,大约达到大众预期的53%。

其联号公司海峡艾柏士的贡献,由190万减至170万令吉,主要因为销售走低。

第二季派息5.5仙,预测派息可由去年29.8仙增至今年的32.8仙,周息率2.5%。

大众研究喜爱此股,主要是新的口服液制造新产能会于2018年运行,其二、强劲盈亏表和净现金(每股67仙),其三、与很多跨国药厂有很好协作和有广泛经销网、采购柜台等。

该行维持财测,预测艾柏士保健2017财政年可录得3840万令吉净利,保持“超越大市”评级和5令吉30仙目标价。

文章来源:

星洲日报‧财经‧报道:张启华‧2017.08.17 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2017 12:04 AM

|

显示全部楼层

发表于 7-9-2017 12:04 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2017 04:44 AM 编辑

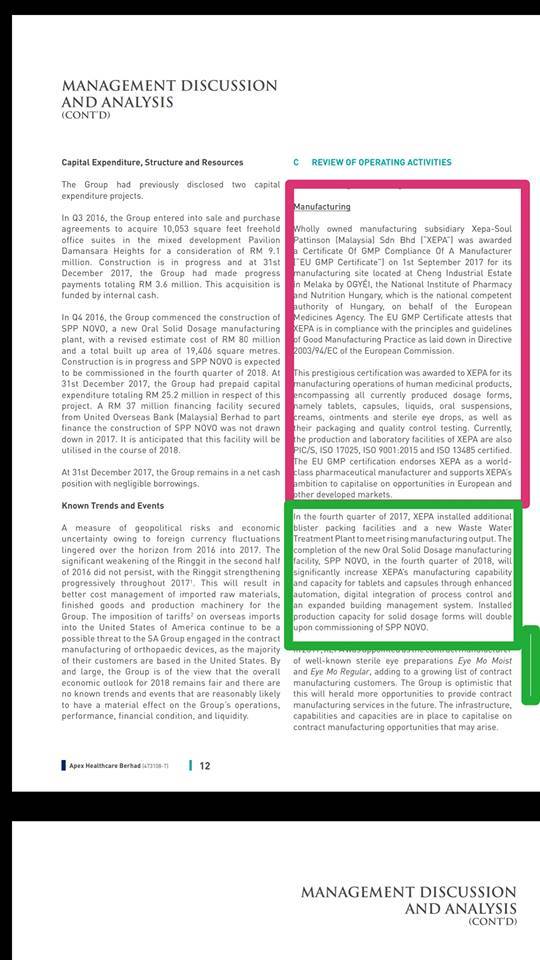

APEX保健获欧盟GMP认证

2017年9月9日

(吉隆坡8日讯)APEX保健(AHEALTH,7090,主板消费产品股)旗下的Xepa-Soul Pattinson(马)私人有限公司,获欧洲药物局颁发GMP合规生产商认证。

APEX保健向交易所报备,位于马六甲的Xepa-Soul Pattinson厂房于前天收到该认证,并由OGYEI——匈牙利药剂和营养国家机构代为颁发。

获得认证意味着Xepa-Soul Pattinson已达到欧盟执行委员会对于良好生产操作的要求,有助于公司获得更多欧洲的生产合约,包括药片、胶囊、药液、口服混悬剂和眼药水生产合约。

这也提供了Xepa-Soul Pattinson在欧盟申请非专利药品品牌的机会,同时,也增强在现有市场的生厂商地位。

Xepa-Soul Pattinson为非专利药品生产商,产品范围涵盖药片、胶囊、口服液、霜类、药膏和消毒眼药水,以治疗广大的疾病群组,主要供应至医疗保健专业人士和消费者。【e南洋】

Type | Announcement | Subject | OTHERS | Description | Award of Certificate Of GMP Compliance Of A Manufacturer to Xepa-Soul Pattinson (Malaysia) Sdn Bhd, a wholly-owned subsidiary of Apex Healthcare Berhad for compliance with the principles and guidelines of Good Manufacturing Practice laid down in Directive 2003/94/EC of the European Commission. | The Board of Directors of Apex Healthcare Berhad (“AHB” or “the Company”) is pleased to announce that its wholly-owned subsidiary, Xepa-Soul Pattinson (Malaysia) Sdn Bhd (“Xepa”), has been awarded a Certificate Of GMP Compliance Of A Manufacturer (“EU GMP Certificate” or “the Award”) for its manufacturing site located at Lot 1-5, Jalan TTC 1, Cheng Industrial Estate, 75250 Melaka, Malaysia, by OGYéI, the National Institute of Pharmacy and Nutrition Hungary, on behalf of the European Medicines Agency.

Kindly refer to the attachment for further information.

This announcement is dated 6 September 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5536741

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-11-2017 03:07 AM

|

显示全部楼层

发表于 15-11-2017 03:07 AM

|

显示全部楼层

本帖最后由 icy97 于 16-11-2017 06:55 AM 编辑

药品销售增加.艾柏士保健第三季多赚29%

(吉隆坡14日讯)大马消费产品以及马新公共领域销售走扬,提振艾柏士保健(AHEALTH,7090,主板消费品组)截至2017年9月30日止第三季净利成长29%至1127万令吉,提振首9月净利上扬12%至3165万8000令吉。

营业额则按年上扬10.33%至1亿5773万令吉,首9月营业额上扬6.99%至4亿6767万9000令吉。

该公司营业额稳健成长,主要是售予政府的药物以及合约制造销售服务增加。同时,在银行存款利息走扬以及脱售额外资产,皆提振公司表现。

展望未来,预料维持第三季的稳健表现,主要是公司专注产品开发、提升品牌管理、客户服务以及营运效率。另外,该季药物制造部门也获得欧盟优良制造产品认证,为未来成长提供良好机会。

文章来源:

星洲日报‧财经‧2017.11.15

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 157,730 | 142,960 | 467,679 | 437,123 | | 2 | Profit/(loss) before tax | 13,302 | 11,536 | 39,667 | 36,215 | | 3 | Profit/(loss) for the period | 11,290 | 8,748 | 31,689 | 28,222 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,270 | 8,736 | 31,658 | 28,198 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.62 | 7.46 | 27.02 | 24.07 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 5.50 | 5.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8200 | 2.6600 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-11-2017 07:09 AM

|

显示全部楼层

发表于 30-11-2017 07:09 AM

|

显示全部楼层

艾柏士保健增产后.盈利料更强劲

tang问:

艾柏士保健(AHEALTH,7090,主板消费品组)最新业绩表现如何?前景可好?

答:艾柏士保健最新公布的第三季业绩超越预期,分析员认为未来几季仍可保正面增长,2018年增产能后盈利更强劲。

大众研究表示,艾柏士保健第三季净利涨29.0%至1130万令吉,带动首9月净利增长12.3%至3170万令吉,相等于全年财测的83%,表现胜预期。

艾柏士第三季营收按年增长10.3%,其中制造业增长13.0%,批发业务改善10.0%,主要得力于马新两国消费品与药剂品销售。这也拉抬其营运、税前与赚幅至8.0%、8.4%与7.1%,相比前期各为7.5%、8.1%与6.1%。

该公司从银行存款获更高利息收入,并从脱售资产获40万令吉收益,所获再投资奖掖使其获更强劲盈利,大众研究预期未来几季可保正面表现,调高今后3财政年财测9%至16%。

大众看好艾柏士保健,口服固体类药剂之生产设施2018年增产能,同时具有每股69仙的净现金,并与跨国药厂协作良好,全国有广泛网络销售药剂、非处方药和消费品。

艾芬黄氏研究也预期该公司明年增产能后,可获更强盈利增长。

首9个月营收按年扬7%至4亿6770万令吉,主要受政府领域之药剂销售和合约生产拉抬,总盈利按年增长6%至1亿零600万令吉。

艾芬指出,基于第三季税率只15%(去年同期24%),使首9个月净利按年增12%至3170万令吉,维持今后3年财测不变,预期2016-2020年盈利年均复合成长率可达18%。

两家证券行都是给予超越大市的评级,目标价则是介于5令吉92仙至6令吉10仙之间。

文章来源:

星洲日报‧投资致富‧投资问诊‧文:李文龙‧2017.11.26 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2018 05:06 AM

|

显示全部楼层

发表于 23-2-2018 05:06 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 152,585 | 144,146 | 620,264 | 581,269 | | 2 | Profit/(loss) before tax | 16,380 | 10,079 | 56,047 | 46,294 | | 3 | Profit/(loss) for the period | 12,799 | 6,766 | 44,488 | 34,988 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 12,801 | 6,757 | 44,459 | 34,955 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.93 | 5.77 | 37.95 | 29.84 | | 6 | Proposed/Declared dividend per share (Subunit) | 6.50 | 6.00 | 12.00 | 11.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.9300 | 2.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2018 05:10 AM

|

显示全部楼层

发表于 23-2-2018 05:10 AM

|

显示全部楼层

EX-date | 30 May 2018 | Entitlement date | 01 Jun 2018 | Entitlement time |

| | Entitlement subject | Final Dividend | Entitlement description | Final single-tier dividend of 6.50 sen per ordinary share for the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaSelangor Darul EhsanTel:0377201188Fax:0377201111 | Payment date | 14 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 01 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.065 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2018 03:53 AM

|

显示全部楼层

发表于 28-3-2018 03:53 AM

|

显示全部楼层

Date of change | 27 Mar 2018 | Name | MR TONG YEW SUM | Age | 75 | Gender | Male | Nationality | Malaysia | Designation | Independent Director | Directorate | Independent and Non Executive | Type of change | Demised |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2018 07:21 AM

|

显示全部楼层

发表于 27-5-2018 07:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 168,400 | 154,652 | 168,400 | 154,652 | | 2 | Profit/(loss) before tax | 16,526 | 12,912 | 16,526 | 12,912 | | 3 | Profit/(loss) for the period | 13,221 | 10,099 | 13,221 | 10,099 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,181 | 10,091 | 13,181 | 10,091 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.25 | 8.61 | 11.25 | 8.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0400 | 2.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2018 05:27 AM

|

显示全部楼层

发表于 3-7-2018 05:27 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 04:30 AM

|

显示全部楼层

发表于 17-8-2018 04:30 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 155,946 | 155,297 | 324,346 | 309,949 | | 2 | Profit/(loss) before tax | 17,368 | 13,453 | 33,894 | 26,365 | | 3 | Profit/(loss) for the period | 13,701 | 10,300 | 26,922 | 20,399 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,699 | 10,297 | 26,880 | 20,388 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.69 | 8.79 | 22.95 | 17.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 6.50 | 5.50 | 6.50 | 5.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0800 | 2.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 04:32 AM

|

显示全部楼层

发表于 17-8-2018 04:32 AM

|

显示全部楼层

EX-date | 12 Sep 2018 | Entitlement date | 14 Sep 2018 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | Interim Single Tier Dividend of 6.5 sen per ordinary share for the financial year ending 31 December 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaTel:0377201188Fax:0377201111 | Payment date | 28 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.065 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-8-2018 05:46 AM

|

显示全部楼层

发表于 19-8-2018 05:46 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2018 01:10 AM

|

显示全部楼层

发表于 17-11-2018 01:10 AM

|

显示全部楼层

基本面选股系列-案例分析

读者们大家好,从案例分析来看,我们会选择在医疗领域中的两只股作为分析。第一只股会介绍的是Apex Healthcare Berhad (7090) 。为什么会选择医疗领域呢?因为预算案前有透露会加大次领域的拨款,而且在医疗领域算是每个国家未来会大力发展的一块,算是一个未来趋势。那为何众多医疗股中会选择Apex 呢?因为之前十月份技术问股中有读者询问此股的技术面,小编看了后发现到apex 在十月非常悲观的月份时走势竟然还很坚挺着,就吸引到小编的眼球,所以用简单的基本面分析去看该间公司。感谢该读者提供了这间公司让我们分析,所以加入我们telegram 小组是很重要的!读者们要注意,当我们介绍此公司时,该股已经在六月到十月期间有了个50%的涨幅。所以此案例分析纯属是让你用最简单的方法在年报和季报找到有爆发潜质的公司,绝无买卖建议。下个案例2会分析一个有可能爆发的公司。好的,现在步入主题来分析Apex Healthcare

Apex Healthcare Berhad (Ahealth,7090)

简单来看该公司的业务类型

1. Pharma Division

2. Consumer Healthy Care Division

3. Diagnostic and Medical Division

4. Retails pharmacy Division

基本上就是制造和销售药品,保健品,医疗器具,机械和用品,分销第三方的药物等等的业务。

公司连续六个季度Yoy and QoQ 持续进步,每个财政年的业绩都在进,这是一个难得的成绩。此外公司也是个净现金公司,手中此有大量的现金。

读者可能会问,我要怎样发掘这种好公司呢?其实只需要在每个季度报告发行的月份去看看。看看那个公司的业绩异常好,新高或有兴趣的,就按进去看看,慢慢就可以掌握到好公司再把他们放进去watchlist 里头等待时间。不然的话,未来加入我们的telegram,让我们为你进行筛选节省你的时间

好的,业绩稳定的增长也不足以去让股价短时间的暴涨。小编相信除了业绩持续进步之外,很大原因是四月份出炉的17n年度报告。

小编知道年度报告有整百面那么多,读者们时间有限。通常小编也是用懒人的方法去看年报,就是直接去看Chairman statement,management analysis and discussion. 在这个section里,公司老板会用图片和简洁的方式让股东知道这年度的成绩,和未来的展望和发展计划。

在Ahealth 的年报有两点要注意:

1. Ahealth 属下子公司 Xepa-soul Pattision(M) sdn bhd, 简称XEPA ,在2017年九月拿到 EU GMP certificate. 这个认证让XEPA 所生产的所有药品包括dosage form,capsule,tablets,liquids,oral suspection,creams,ointment, sterilized eye drops是符合了欧洲的规格,肯定了XEPA 作为世界级的药物生产商。 这让Ahealth 进军欧洲加入很大很大的分数,未来销售量很大机会爆表。

2.其二就是即将要开张的New Oral Dosage manufacturing plant简称SPP NOVO,会在2018年底开始生产跑车,产能会是现有的两倍。要知道Oral Dosage 贡献现有营业额接近一半。产能提升能刺激销售额。如没意外,未来的营业额会有不少的增长。

好了,管理层信心满满在年报里提起那么正面的展望,再加上五月份的业绩那么好的催化之下。股价就从五月五块多上到十月份8.7左右,涨幅有60%。这就是用简单的方法来看某公司是否有大增长的可能性。

下回会用这种方法来分析另一间具有同样潜质的工作,现在股价还在横摆着。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2018 07:15 AM

|

显示全部楼层

发表于 28-11-2018 07:15 AM

|

显示全部楼层

本帖最后由 icy97 于 14-12-2018 03:59 AM 编辑

apex保健第三季多赚32%

http://www.enanyang.my/news/20181117/apex保健第三季多赚32/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 165,253 | 157,730 | 489,599 | 467,679 | | 2 | Profit/(loss) before tax | 18,637 | 13,302 | 52,531 | 39,667 | | 3 | Profit/(loss) for the period | 14,942 | 11,290 | 41,864 | 31,689 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 14,897 | 11,270 | 41,777 | 31,658 | | 5 | Basic earnings/(loss) per share (Subunit) | 12.71 | 9.62 | 35.65 | 27.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 6.50 | 5.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.1200 | 2.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2018 06:24 AM

|

显示全部楼层

发表于 15-12-2018 06:24 AM

|

显示全部楼层

业绩惊艷前景看俏 艾柏士股价大步走高

財经 最后更新 2018年11月16日 21时09分

http://www.orientaldaily.com.my/s/267882

(吉隆坡16日讯)艾柏士保健(AHEALTH,7090)刚出炉的第3季度业绩超出市场预期,鉴于该公司未来成长前景稳健、SPP NOVO新厂房將投產,以及其广大分销网络等利好因素,因此,分析员持续看好其未来展望,并维持该股「买入」的投资评级。

隨著標青业绩出炉,艾柏士保健今日股价大幅走高,早盘以8.21令吉高开,盘中逐步攀升,至全天最高的8.53令吉,並以此价位报收,上扬43仙或5.31%,成交量为16万股。该股也是今日第2大上升股。

艾柏士保健2018財政年第3季(截至9月30日止)净利按年成长32.2%,至1490万令吉,营收也上升5%,至1亿6525万令吉,首9个月净利也按年走强32%,至3565万令吉,营收亦增加5%,至4亿8960万令吉。

艾芬黄氏资本分析员表示,艾柏士保健2018財政年首9个月业绩超越该投行和市场预期,主要得利於较低的有效税率和批发及分销业务较高的盈利赚幅。

另外,该公司首9个月的表现也因为私人製药领域和保健品取得强劲成长而受惠。

「艾柏士保健也受惠于產品组合改善而推高赚幅,其联號公司Straits Apex私人有限公司的盈利贡献增加和有效税率降低是另一功臣。」

新厂投產

展望未来,艾柏士保健的SPP NOVO新厂房將在明年首季正式投运,能够舒缓目前已达到100%產能使用率的厂房。

另外,管理层预测,新厂房投运后的12至18个月,產能將被完全运用。

此外,该公司仿製药的分销网络遍佈全马,也是本地眾多製药公司中,能够从未来医疗政策中受惠的其中一家。

另一边厢,大眾投行分析员指出,艾柏士保健首3季业绩符合该投行全年盈利预测的77%,艾柏士保健私人领域药剂销量上扬,马新两国公共领域销量也成长。

他说,该公司国外製造与销售业务在第3季的营收翻倍成长,至1550万令吉,批发和分销业务表现则持平。

Straits Apex私人有限公司的贡献也从去年同期的70万令吉,增加至230万令吉。

值得一提的是,该分析员指出,鉴於该公司致力拓展自身品牌產品以抬高赚幅,其第3季度的营运、税前和净利赚幅已从前期的8%、8.4%和7.1%,提高至9.9%、11.3%及9%,有鉴於此,该公司来季赚幅料能够维持目前水平。

整体而言,鉴於3大理由,即艾柏士保健未来成长前景稳健、SPP NOVO厂房將投產及强大的分销网络,分析员持续看好该公司前景,并给予该股「买入」建议,目標价为10.20令吉。

另外,大眾投行分析员则给予该股「中和」的评级,目標价为7.58令吉。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:03 AM

|

显示全部楼层

发表于 11-3-2019 05:03 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | APEX HEALTHCARE BERHAD ("AHB" OR THE "COMPANY")PROPOSED BONUS ISSUE OF UP TO 358,929,279 NEW ORDINARY SHARES IN AHB ("AHB SHARE(S)" OR "SHARE(S)") ("BONUS SHARE(S)") ON THE BASIS OF 3 BONUS SHARES FOR EVERY 1 EXISTING AHB SHARE HELD ON AN ENTITLEMENT DATE TO BE DETERMINED LATER ("PROPOSED BONUS ISSUE") | On behalf of the Board of Directors of AHB, UOB Kay Hian Securities (M) Sdn Bhd wishes to announce that the Company proposes to undertake a bonus issue of up to 358,929,279 Bonus Shares on the basis of 3 Bonus Shares for every 1 existing AHB Share held on an entitlement date to be determined later.

Please refer to the attachment for further details on the Proposed Bonus Issue.

This announcement is dated 28 February 2019 |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6082069

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:12 AM

|

显示全部楼层

发表于 11-3-2019 05:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 163,061 | 152,585 | 652,660 | 620,264 | | 2 | Profit/(loss) before tax | 16,739 | 16,380 | 69,270 | 56,047 | | 3 | Profit/(loss) for the period | 16,803 | 12,799 | 58,667 | 44,488 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 16,804 | 12,801 | 58,581 | 44,459 | | 5 | Basic earnings/(loss) per share (Subunit) | 14.33 | 10.93 | 49.94 | 37.95 | | 6 | Proposed/Declared dividend per share (Subunit) | 7.00 | 6.50 | 13.50 | 12.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2500 | 2.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:16 AM

|

显示全部楼层

发表于 11-3-2019 05:16 AM

|

显示全部楼层

EX-date | 30 May 2019 | Entitlement date | 03 Jun 2019 | Entitlement time |

| | Entitlement subject | Final Dividend | Entitlement description | Final single-tier dividend of 7.00 sen per ordinary share for the financial year ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHD(Formerly known as Symphony Share Registrars Sdn Bhd)Level 6, Symphony House Pusat Dagangan Dana 1 Jalan PJU 1A/46 47301 Petaling Jaya Selangor MalaysiaTel:03-78418088Fax: 03-78418100 | Payment date | 14 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 03 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2019 07:10 AM

|

显示全部楼层

发表于 27-6-2019 07:10 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 178,229 | 168,400 | 178,229 | 168,400 | | 2 | Profit/(loss) before tax | 14,543 | 16,526 | 14,543 | 16,526 | | 3 | Profit/(loss) for the period | 11,414 | 13,221 | 11,414 | 13,221 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,399 | 13,181 | 11,399 | 13,181 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.71 | 11.25 | 9.71 | 11.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3400 | 3.2500

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|