|

|

【SPSETIA 8664 交流专区】实达集团

[复制链接]

[复制链接]

|

|

|

发表于 5-5-2018 03:38 AM

|

显示全部楼层

发表于 5-5-2018 03:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-5-2018 11:01 AM

|

显示全部楼层

发表于 10-5-2018 11:01 AM

|

显示全部楼层

本帖最后由 icy97 于 11-5-2018 04:22 AM 编辑

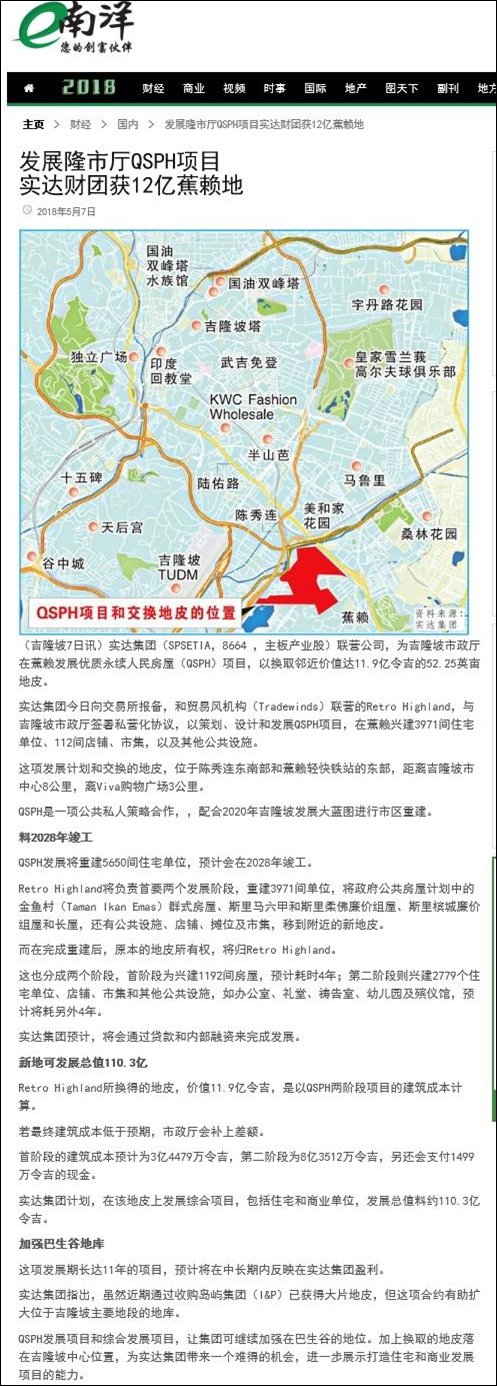

Type | Announcement | Subject | OTHERS | Description | S P SETIA BERHAD ("S P SETIA" OR "COMPANY")PRIVATISATION AGREEMENT BETWEEN RETRO HIGHLAND SDN BHD ("RETRO HIGHLAND") AND DATUK BANDAR KUALA LUMPUR ("DBKL") FOR THE PLANNING, DESIGN, CONSTRUCTION, COMPLETION AND COMMISSIONING OF QUALITY SUSTAINABLE PEOPLE HOUSING IN CHERAS, KUALA LUMPUR IN RETURN FOR 52.25 ACRES OF LEASEHOLD LAND IN CHERAS, KUALA LUMPUR | The Board of Directors of S P Setia (“Board”) wishes to announce that Retro Highland, a 50% jointly controlled entity of S P Setia, had on 7 May 2018 entered into a Privatisation Agreement with DBKL for the planning, design, construction, completion and commissioning of Quality Sustainable People Housing (“QSPH”) project (“Privatisation Agreement”), which entails the construction of 3,971 residential units, 112 units of shops/stalls, a market and other public facilities (“QSPH Development”). In return, Retro Highland will be awarded with 52.25 acres of leasehold land in Cheras, Kuala Lumpur (“Exchange Land”) to be used for mixed development.

Please refer to the attachments for more information.

This announcement is dated 7 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5784685

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2018 01:29 AM

|

显示全部楼层

发表于 12-5-2018 01:29 AM

|

显示全部楼层

本帖最后由 icy97 于 13-5-2018 03:43 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-5-2018 02:47 AM

|

显示全部楼层

发表于 13-5-2018 02:47 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 01:00 AM

|

显示全部楼层

发表于 16-5-2018 01:00 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2018 03:55 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 655,502 | 1,026,587 | 655,502 | 1,026,587 | | 2 | Profit/(loss) before tax | 94,396 | 184,470 | 94,396 | 184,470 | | 3 | Profit/(loss) for the period | 80,444 | 127,250 | 80,444 | 127,250 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 61,486 | 112,115 | 61,486 | 112,115 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.70 | 3.44 | 1.70 | 3.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0700 | 3.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 04:06 AM

|

显示全部楼层

发表于 20-5-2018 04:06 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 06:38 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 06:23 AM

|

显示全部楼层

发表于 20-5-2018 06:23 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2018 03:50 AM

|

显示全部楼层

发表于 16-6-2018 03:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2018 11:18 PM

|

显示全部楼层

发表于 18-6-2018 11:18 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2018 06:09 AM

|

显示全部楼层

发表于 26-7-2018 06:09 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-7-2018 02:56 AM

|

显示全部楼层

发表于 29-7-2018 02:56 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 02:45 AM

|

显示全部楼层

发表于 24-8-2018 02:45 AM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2018 01:06 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 925,970 | 866,350 | 1,581,472 | 1,892,937 | | 2 | Profit/(loss) before tax | 535,028 | 234,351 | 629,424 | 418,821 | | 3 | Profit/(loss) for the period | 491,237 | 273,500 | 571,681 | 400,750 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 442,740 | 250,566 | 504,226 | 362,681 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.48 | 7.69 | 13.51 | 11.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.00 | 4.00 | 4.00 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0500 | 3.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 02:52 AM

|

显示全部楼层

发表于 24-8-2018 02:52 AM

|

显示全部楼层

EX-date | 05 Sep 2018 | Entitlement date | 07 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Others | Entitlement description | Preferential dividend of 6.49% per annum (payable semi-annually and based on the issue price of RM1.00) per Islamic redeemable convertible preference shares ("RCPS-i A") for the period from 1 January 2018 up to and including 30 June 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 03 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 3.245 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 02:52 AM

|

显示全部楼层

发表于 24-8-2018 02:52 AM

|

显示全部楼层

EX-date | 05 Sep 2018 | Entitlement date | 07 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Others | Entitlement description | Preferential dividend of 5.93% per annum (payable semi-annually and based on the issue price of RM0.88) per Class B Islamic redeemable convertible preference shares ("RCPS-i B") for the period from 1 January 2018 up to and including 30 June 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 03 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 2.6092 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-8-2018 02:42 AM

|

显示全部楼层

发表于 26-8-2018 02:42 AM

|

显示全部楼层

本帖最后由 icy97 于 26-8-2018 03:03 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2018 05:20 AM

|

显示全部楼层

发表于 28-9-2018 05:20 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

OTHER ISSUE OF SECURITIES | Description | DIVIDEND REINVESTMENT PLAN ("DRP") THAT PROVIDES THE SHAREHOLDERS OF S P SETIA WITH AN OPTION TO ELECT TO REINVEST THEIR ENTIRE INTERIM DIVIDEND OF 4.0 SEN PER ORDINARY SHARE IN S P SETIA (S P SETIA SHARE(S)) FOR THE FINANCIAL YEAR ENDING 31 DECEMBER 2018 INTO NEW S P SETIA SHARES ("10TH DRP") | Reference is made to the Company's announcements dated 23 August 2018, 7 September 2018 and 26 September 2018.

On behalf of the Board of Directors of S P Setia ("Board"), MIDF Amanah Investment Bank Berhad ("MIDF Investment") wishes to announce that the issue price of the new S P Setia Shares to be issued pursuant to the 10th DRP ("New Share(s)") has been fixed today ("Price-Fixing Date") at RM2.40 per New Share.

The issue price of the New Share has been determined based on the following: - 5-day volume weighted average market price ("VWAMP") of S P Setia Shares up to and including 26 September 2018, being the last trading date prior to the Price-Fixing Date, of RM2.70:

- A dividend adjustment of 4.0 sen to the 5-day VWAMP ("Ex-Dividend VWAMP"); and

- A discount of RM0.26 which is approximately 9.77% discount to the Ex-Dividend VWAMP of RM2.66.

On behalf of the Board, MIDF Investment also wishes to announce that the entitlement date pursuant to the Interim Dividend and 10th DRP has been fixed for 11 October 2018 ("Entitlement Date"). The relevant documents and the dividend reinvestment form in relation to the 10th DRP will be dispatched to the entitled shareholders within 2 market days after the Entitlement Date (i.e. by 15 October 2018). The expected date for the allotment and issuance of the New Shares as well as the payment for the cash dividend for the entitled shareholders is on 9 November 2018.

This announcement is dated 27 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2018 05:27 AM

|

显示全部楼层

发表于 28-9-2018 05:27 AM

|

显示全部楼层

EX-date | 09 Oct 2018 | Entitlement date | 11 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend (with Dividend Re-Investment Plan) | Entitlement description | INTERIM DIVIDEND OF 4.0 SEN PER ORDINARY SHARE IN S P SETIA (S P SETIA SHARE(S)) FOR THE FINANCIAL YEAR ENDING 31 DECEMBER 2018 TOGETHER WITH DIVIDEND RE-INVESTMENT PLAN | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 09 Nov 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 05:05 AM

|

显示全部楼层

发表于 16-10-2018 05:05 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2018 04:27 AM

|

显示全部楼层

发表于 31-10-2018 04:27 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | NOTICES OF ADDITIONAL ASSESSMENT RAISED ON S P SETIA BERHAD | Further to the announcement dated 28 March 2018 on the above matter, S P Setia Berhad (“the Company”) wishes to inform that the Company has reached an amicable settlement with the Inland Revenue Board of Malaysia (“MIRB”) in respect of the additional taxes imposed on the Company via MIRB’s letter dated 27 March 2018. Pursuant to the notices of reduced assessment all dated 16 October 2018 (received by the Company on 25 October 2018), the total sum payable in respect of the tax settlement is RM2,602,307.58.

With the above, the tax dispute between the Company and the MIRB has been settled amicably.

This announcement is dated 25 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-11-2018 04:32 AM

|

显示全部楼层

发表于 9-11-2018 04:32 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|