|

|

【SMCAP 9776 交流专区】(前名 FARMBES)

[复制链接]

|

|

|

楼主 |

发表于 15-3-2018 05:43 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SINMAH CAPITAL BERHAD (FORMERLY KNOWN AS FARMS BEST BERHAD) ("THE COMPANY" OR "SCB")- INCORPORATION OF A NEW SUBSIDIARY | The Board of Directors of Sinmah Capital Berhad (Formerly known as Farm’s Best Berhad) (“the Company” or “SCB”) wishes to announce that on 13 March, 2018, the 70% owned subsidiary of the Company, Sinmah Amegajaya Healthcare Sdn. Bhd. ("SAHSB") had incorporated a new subsidiary known as SAH Mutiara Sdn. Bhd. (“SMSB”) under the Companies Act, 2016. The intended principal activities are investment holding, property development and construction.

SMSB was incorporated with an issued and paid-up share capital of RM1,000.00 comprising 1,000 ordinary shares. 85% of the issued and paid-up share capital of SMSB is owned by SAHSB and 15% is owned by K Shanmuganathan A/L Krisnan.

The above incorporation does not have any effect on the issued and paid-up share capital of the Company and has no material effect on the earnings and net assets of the Company and its subsidiaries for the financial year ending 31 December 2018.

None of the directors and/or substantial shareholders of the Company, or persons connected to such director and/or substantial shareholder has any interest, direct or indirect, in the said incorporation.

This announcement is dated 13 March, 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-4-2018 10:51 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SINMAH CAPITAL BERHAD (FORMERLY KNOWN AS FARMS BEST BERHAD) ("THE COMPANY" OR "SCB")- INCORPORATION OF A NEW SUBSIDIARY | The Board of Directors of Sinmah Capital Berhad (Formerly known as Farm’s Best Berhad) (“the Company” or “SCB”) wishes to announce that on 6 April, 2018, the 70% owned subsidiary of the Company, Sinmah Amegajaya Healthcare Sdn. Bhd. ("SAHSB") had incorporated a new subsidiary known as SAH Medical Center Sdn. Bhd. (“SMCSB”) under the Companies Act, 2016. The intended principal activities are hospital development, management and construction and healthcare investment.

SMCSB was incorporated with an issued share capital of RM1,000.00 comprising 1,000 ordinary shares. 100% of the issued share capital of SMSB is owned by SAHSB. Upon incorporation, SMCSB shall become a wholly-owned subsidiary of SAHSB.

The above incorporation does not have any effect on the issued share capital of the Company and has no material effect on the earnings and net assets of the Company and its subsidiaries for the financial year ending 31 December 2018.

None of the directors and/or substantial shareholders of the Company, or persons connected to such director and/or substantial shareholder has any interest, direct or indirect, in the said incorporation.

This announcement is dated 9 April, 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-5-2018 02:22 AM

|

显示全部楼层

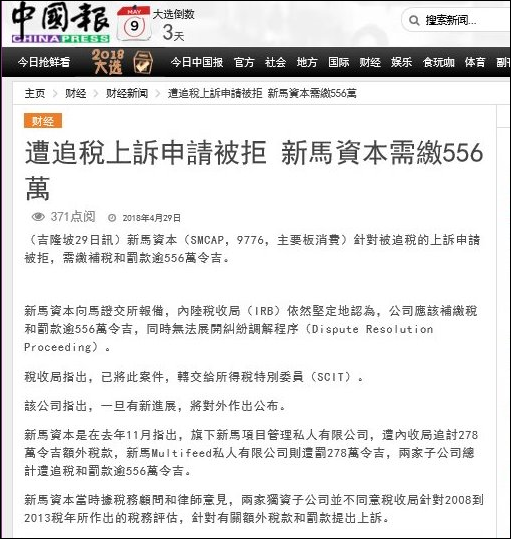

Type | Announcement | Subject | OTHERS | Description | SINMAH CAPITAL BERHAD (FORMERLY KNOWN AS FARM'S BEST BERHAD) ("THE COMPANY" OR "SCB")SINMAH PROJECT MANAGEMENT SDN. BHD. ("SPMSB")SINMAH MULTIFEED SDN. BHD. ("SMSB")DISPUTE RESOLUTION PROCEEDINGS SESSION FIXED BY INLAND REVENUE BOARD IN RELATION TO THE ADDITIONAL TAX ASSESSMENT AND PENALTIES SERVED TO SPMSB AND SMSB, BOTH THE WHOLLY OWNED SUBSIDIARIES OF THE COMPANY | Further to the announcements dated 21 November, 2017, 28 November, 2017, 11 December, 2017, 4 January, 2018 and 21 February, 2018, the Board of Directors of Sinmah Capital Berhad (Formerly known as Farm’s Best Berhad) (“the Company” or “SCB”) wishes to announce that following the Dispute Resolution Proceeding ("DRP") held on 15 February 2018, Inland Revenue Board ("IRB") hold their stand and was of the opinion that the case cannot be settled through DRP. They had forwarded the case to the Special Commisioner of Income Tax for registration for trial.

The Board of SCB will make such further announcements as and when there are fresh developments arising from the above matter.

This announcement is dated 27 April, 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-5-2018 06:55 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SINMAH CAPITAL BERHAD (FORMERLY KNOWN AS FARM'S BEST BERHAD) ("SINMAH" OR THE "COMPANY")(I) DISPOSAL OF BREEDER FARM LAND AND ASSETS TO FARMS BEST FOOD INDUSTRIES SDN BHD ("FBF") ("DISPOSAL OF BREEDER FARMS")(II) DISPOSAL OF BROILER FARM LANDS AND FARMS TO FBF ("DISPOSAL OF BROILER FARMS") | We refer to the announcements dated 25 November 2016, 29 November 2016, 6 January 2017, 24 January 2017, 17 March 2017, 22 March 2017, 19 May 2017, 29 September 2017, 7 October 2017, 8 December 2017 and 12 December 2017 in relation to the Disposal of Breeder Farms and Disposal of Broiler Farms (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of the Board, TA Securities wishes to announce that the Disposal of Breeder Farms has been completed on 23 May 2018 in accordance with the terms and conditions of the Breeder Farm SPAs.

This announcement is dated 23 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-6-2018 03:13 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 69,284 | 81,796 | 69,284 | 81,796 | | 2 | Profit/(loss) before tax | -5,087 | -2,161 | -5,087 | -2,161 | | 3 | Profit/(loss) for the period | -5,222 | -2,313 | -5,222 | -2,313 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,195 | -2,333 | -5,195 | -2,333 | | 5 | Basic earnings/(loss) per share (Subunit) | -8.50 | -3.82 | -8.50 | -3.82 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7060 | 1.7910

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-6-2018 05:42 AM

|

显示全部楼层

Expiry/Maturity of the securities

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 1.0000 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 27 Jun 2018 05:00 PM | Date & Time of Suspension | 28 Jun 2018 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 06 Jul 2018 04:00 PM | Date & Time of Expiry | 13 Jul 2018 05:00 PM | Date & Time for Delisting | 16 Jul 2018 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5825149

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-7-2018 01:43 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SINMAH CAPITAL BERHAD ("SINMAH" OR THE "COMPANY")(I) DISPOSAL OF BREEDER FARM LAND AND ASSETS TO FARM'S BEST FOOD INDUSTRIES SDN BHD ("FBF") ("DISPOSAL OF BREEDER FARMS")(II) DISPOSAL OF BROILER FARM LANDS AND FARMS TO FBF ("DISPOSAL OF BROILER FARMS") | We refer to the announcements dated 25 November 2016, 29 November 2016, 6 January 2017, 24 January 2017, 17 March 2017, 22 March 2017, 19 May 2017, 29 September 2017, 7 October 2017, 8 December 2017, 12 December 2017, 23 May 2018 and 3 July 2018 in relation to the Disposal of Breeder Farms and Disposal of Broiler Farms (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

As announced on 3 July 2018, Sinmah Livestocks and FBF had mutually agreed to terminate the Broiler Farms SPA 5 due to the non-fulfilment of the conditions precedent, particularly the approval from the relevant authority to change the expressed condition of the title of the applicable Broiler Farm 5 to “ternakan ayam” to be obtained by Sinmah Livestocks and the approval of the veterinary and operating licences for the broiler farm to be obtained by Sinmah Livestocks.

This announcement is dated 5 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-7-2018 04:45 AM

|

显示全部楼层

EX-date | 06 Aug 2018 | Entitlement date | 08 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Rights Issue | Entitlement description | RENOUNCEABLE RIGHTS ISSUE OF UP TO 152,708,157 NEW ORDINARY SHARES IN SINMAH CAPITAL BERHAD ("SINMAH") ("SINMAH SHARES") ("RIGHTS SHARES") ON THE BASIS OF 5 RIGHTS SHARES FOR EVERY 2 EXISTING SINMAH SHARES HELD AS AT 5.00 P.M. ON 8 AUGUST 2018 ("ENTITLEMENT DATE") AT AN ISSUE PRICE OF RM0.20 PER RIGHTS SHARE, TOGETHER WITH UP TO 38,177,039 FREE DETACHABLE WARRANTS ("RIGHTS WARRANTS") ON THE BASIS OF 1 RIGHTS WARRANT FOR EVERY 4 RIGHTS SHARES SUBSCRIBED FOR ("RIGHTS ISSUE") | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:03-78490777Fax:03-78418151/52 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 20 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) | 152,708,157 | Entitlement indicator | Ratio | Ratio | 5 : 2 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.200 |

Despatch date | 10 Aug 2018 | Date for commencement of trading of rights | 09 Aug 2018 | Date for cessation of trading of rights | 16 Aug 2018 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 29 Aug 2018 | Listing Date of the Rights Securities | 12 Sep 2018 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 15 Aug 2018 | | 05:00:00 PM | Transfer of provisional allotment of rights | 20 Aug 2018 | | 04:00:00 PM | Acceptance and payment | 24 Aug 2018 | | 05:00:00 PM | Excess share application and payment | 24 Aug 2018 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-8-2018 03:28 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | SINMAH CAPITAL BERHAD ("SINMAH" OR THE "COMPANY")(I) RIGHTS ISSUE;(II) EXEMPTION; (III) SIS;(IV) JOINT VENTURE; AND(V) DIVERSIFICATION(COLLECTIVELY REFERRED TO AS THE "CORPORATE EXERCISES") | We refer to the announcements dated 8 June 2017, 20 July 2017, 21 July 2017, 28 July 2017, 15 September 2017, 16 November 2017, 29 November 2017, 5 December 2017, 6 December 2017, 26 January 2018, 5 February 2018, 5 March 2018, 14 March 2018, 15 March 2018, 7 May 2018, 16 May 2018, 31 May 2018, 1 June 2018, 4 July 2018, 25 July 2018 and 7 August 2018 in relation to the Corporate Exercises (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of the Board, TA Securities wishes to announce that as at the close of acceptance, excess application and payment for the Rights Issue at 5.00 p.m. on 24 August 2018 (“Closing Date”), the Company had received valid acceptances and excess applications for a total of 201,011,276 Rights Shares, representing a subscription rate of 131.63% over the total number of Rights Shares available for subscription under the Rights Issue, resulting in an over-subscription rate of 31.63%.

The details of valid acceptances and excess applications received as at the Closing Date are as follows:

| No. of Rights Shares | Percentage of total Rights Shares available for subscription (%) | Total valid acceptances | 143,098,861 | 93.71 | Total valid excess applications | 57,912,415 | 37.92 | Total valid acceptances and excess applications | 201,011,276 | 131.63 | Total Rights Shares available for subscription | 152,708,157 | 100.00 | Over-subscription | 48,303,119 | 31.63 |

The Board has applied the following basis in allocating the excess Rights Shares with Rights Warrants, in accordance with the Abridged Prospectus dated 8 August 2018: (i) firstly, to minimise the incidence of odd lots;

(ii) secondly, to the Entitled Shareholders who have applied for excess Rights Shares with Rights Warrants, on a pro-rata basis and in board lots, calculated based on their respective shareholdings in the Company on the Entitlement Date;

(iii) thirdly, to the Entitled Shareholders who have applied for excess Rights Shares with Rights Warrants, on a pro-rata basis and in board lots, calculated based on the quantum of excess Rights Shares with Rights Warrants applied for; and

(iv) fourthly, to transferee(s)/renouncee(s) who have applied for the excess Rights Shares with Rights Warrants, on a pro-rata basis and in board lots, based on the quantum of excess Rights Shares with Rights Warrants applied for.

If there is any remaining excess Rights Shares with Rights Warrants after steps (i) to (iv) have been carried out, steps (ii) to (iv) will be repeated until all remaining excess Rights Shares with Rights Warrants have been allocated.

The Rights Shares with Rights Warrants are expected to be listed and quoted on the Main Market of Bursa Securities on 12 September 2018.

This announcement is dated 29 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-8-2018 05:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 41,018 | 74,196 | 110,302 | 155,993 | | 2 | Profit/(loss) before tax | -633 | -5,732 | -5,720 | -7,894 | | 3 | Profit/(loss) for the period | -5,005 | -8,567 | -10,227 | -10,880 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,941 | -8,601 | -10,136 | -10,933 | | 5 | Basic earnings/(loss) per share (Subunit) | -8.09 | -14.08 | -16.59 | -17.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6251 | 1.7910

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-9-2018 05:58 AM

|

显示全部楼层

Profile for Securities of PLC

Instrument Category | Securities of PLC | Instrument Type | Warrants | Description | SINMAH CAPITAL BERHAD ("SINMAH" OR THE "COMPANY")ISSUANCE OF 38,177,039 FREE DETACHABLE WARRANTS ("RIGHTS WARRANTS") TO THE ENTITLED SHAREHOLDERS OF SINMAH PURSUANT TO THE RENOUNCEABLE RIGHTS ISSUE OF 152,708,157 ORDINARY SHARES IN SINMAH ("SINMAH SHARES") ("RIGHTS SHARES") ON THE BASIS OF 5 RIGHTS SHARES FOR EVERY 2 EXISTING SINMAH SHARES HELD AS AT 5.00 P.M. ON 8 AUGUST 2018 AT AN ISSUE PRICE OF RM0.20 PER RIGHTS SHARE, TOGETHER WITH 38,177,039 FREE DETACHABLE WARRANTS ("RIGHTS WARRANTS") ON THE BASIS OF 1 RIGHTS WARRANT FOR EVERY 4 RIGHTS SHARES SUBSCRIBED FOR ("RIGHTS ISSUE") |

Listing Date | 12 Sep 2018 | Issue Date | 30 Aug 2018 | Issue/ Ask Price | Not Applicable | Issue Size Indicator | Unit | Issue Size in Unit | 38,177,039 | Maturity | Mandatory | Maturity Date | 29 Aug 2023 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 5.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.2000 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 1:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Cash | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-9-2018 05:16 AM

|

显示全部楼层

Name | F.C.H. HOLDINGS SDN. BHD. | Address | Block 8-16-1 Jalan 15/155B

Arcade Esplanad

Taman Bukit Jalil

Kuala Lumpur

57000 Wilayah Persekutuan

Malaysia. | Company No. | 57091-T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Share |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 12 Sep 2018 | 332,053 | Acquired | Direct Interest | Name of registered holder | F.C.H. HOLDINGS SDN. BHD. | Address of registered holder | Block 8-16-1 Jalan 15/155B, Arcade Esplanad Taman Bukit Jalil, 57000 Kuala Lumpur | Description of "Others" Type of Transaction | | | 2 | 12 Sep 2018 | 60,693,395 | Acquired | Indirect Interest | Name of registered holder | JF Apex Nominees (Tempatan) Sdn. Bhd. pledged securities account for F.C.H. Holdings Sdn. Bhd. | Address of registered holder | 6th Floor, Menara Apex, Off Jalan Semenyih, Bukit Mewah, 43000 Kajang, Selangor Darul Ehsan | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Subscription of Rights Shares pursuant to the Company's Rights Issues with Warrants.Subscription of Rights Shares by JF Apex Nominees (Tempatan) Sdn. Bhd. pledged securities account for F.C.H. Holdings Sdn. Bhd. pursuant to the Company's Rights Issues with Warrants. | Nature of interest | Direct and Indirect Interest | Direct (units) | 447,153 | Direct (%) | 0.21 | Indirect/deemed interest (units) | 82,042,100 | Indirect/deemed interest (%) | 38.37 | Total no of securities after change | 82,489,253 | Date of notice | 12 Sep 2018 | Date notice received by Listed Issuer | 12 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-11-2018 02:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SINMAH CAPITAL BERHAD ("THE COMPANY" OR "SCB")- INCORPORATION OF A NEW SUBSIDIARY | The Board of Directors of Sinmah Capital Berhad (“the Company” or “SCB”) wishes to announce that on 2 November, 2018, the 70% owned subsidiary of the Company, Sinmah Amegajaya Healthcare Sdn. Bhd. ("SAHSB") had incorporated a new subsidiary known as Sterling Healthcare Sdn. Bhd. (“SHSB”) under the Companies Act, 2016. SAHSB is a 70% owned subsidiary of Sinmah Development Sdn. Bhd., a wholly owned subsidiary of the Company, which is in turn a 70% owned subsidiary of the Company. The intended principal activities are to acquire or set up and run hospitals, clinics, nursing homes, maternity and planning units and pathological laboratories, provide medical plans, deal in all types of medical equipment, medicines, pharmaceutical products and all other activities related thereto without limitations.

SHSB was incorporated with an issued share capital of RM2.00 comprising 20 ordinary shares. 100% of the issued share capital of SHSB is owned by SAHSB. Upon incorporation, SHSB shall become a wholly-owned subsidiary of SAHSB.

The above incorporation does not have any effect on the issued share capital of the Company and has no material effect on the earnings and net assets of the Company and its subsidiaries for the financial year ending 31 December 2018.

None of the directors and/or substantial shareholders of the Company, or persons connected to such director and/or substantial shareholder has any interest, direct or indirect, in the said incorporation.

This announcement is dated 2 November, 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-12-2018 07:50 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 40,049 | 71,915 | 150,351 | 227,908 | | 2 | Profit/(loss) before tax | -13,158 | -5,641 | -18,878 | -13,535 | | 3 | Profit/(loss) for the period | -14,647 | -5,747 | -24,875 | -16,627 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -14,526 | -5,702 | -24,663 | -16,635 | | 5 | Basic earnings/(loss) per share (Subunit) | -12.72 | -9.33 | -31.23 | -27.23 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5378 | 1.7910

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-1-2019 03:36 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITIONS OF TWO (2) PROPERTY DEVELOPMENT COMPANIES ("PROPOSED ACQUISITIONS") | On behalf of the Board of Directors of Sinmah, TA Securities Holdings Berhad wishes to announce that the Company proposes to undertake the Proposed Acquisitions.

Please refer to the attachment for further details.

This announcement is dated 6 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-1-2019 04:59 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SINMAH CAPITAL BERHAD ("THE COMPANY" OR "SCB")SINMAH DEVELOPMENT SDN. BHD. ("SDSB")SINMAH AMEGAJAYA HEALTHCARE SDN. BHD. ("SAHSB")SAH MEDICAL CENTER SDN. BHD. ("SMCSB")- DISPOSAL OF THE EQUITY INTEREST IN SMCSB BY SAHSB, THE 70% OWNED SUBSIDIARY OF SDSB, THE WHOLLY OWNED SUBSIDIARY OF THE COMPANY | The Board of Directors of SCB is pleased to announce that SAHSB, the 70% owned subsidiary of SDSB, the wholly owned subsidiary of SCB had on 7 January, 2019 entered into a Sale and Purchase of Shares Agreement (“SSA”) with Shaik Mohammed Haikhal Bin Abdul Rahim to dispose of 50 ordinary shares, representing 5% equity interest in SMCSB (“the Sale Shares”) for a total cash consideration of RM50.00 (“the Disposal”).

Please refer to the attachment for the announcement details. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6029161

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-1-2019 08:03 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SINMAH CAPITAL BERHAD ("THE COMPANY" OR "SCB")SINMAH DEVELOPMENT SDN. BHD. ("SDSB")SINMAH AMEGAJAYA HEALTHCARE SDN. BHD. ("SAHSB")SAH MEDICAL CENTER SDN. BHD. ("SMCSB")- DISPOSAL OF THE EQUITY INTEREST IN SMCSB BY SAHSB, THE 70% OWNED SUBSIDIARY OF SDSB, THE WHOLLY OWNED SUBSIDIARY OF THE COMPANY | We refer to the announcement made on 7 January, 2019 in relation to the disposal of 50 ordinary shares, representing 5% equity interest in SMCSB (“the Sale Shares”) for a total cash consideration of RM50.00 by SAHSB, the 70% owned subsidiary of SDSB, the wholly owned subsidiary of SCB (“the Disposal”).

The Board wishes to announce that SAHSB has received the full sale consideration in respect of the Disposal and the registration of transfer of the Sale Shares to Shaik Mohammed Haikhal Bin Abdul Rahim had been done on 9 January, 2019. Hence, the Disposal is completed on 9 January, 2019.

This announcement is dated 9 January, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-1-2019 05:02 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SINMAH CAPITAL BERHAD ("THE COMPANY" OR "SCB")SINMAH DEVELOPMENT SDN. BHD. ("SDSB")SINMAH AMEGAJAYA HEALTHCARE SDN. BHD. ("SAHSB")SAH MEDICAL CENTER SDN. BHD. ("SMCSB")- SUBSCRIPTION OF ADDITIONAL 4,749,050 ORDINARY SHARES OF RM1.00 EACH IN THE SHARE CAPITAL OF SMCSB BY SAHSB, THE 70% OWNED SUBSIDIARY OF SDSB, A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY | The Board of Directors of Sinmah Capital Berhad (“the Company” or “SCB”) wishes to announce that Sinmah Amegajaya Healthcare Sdn. Bhd. (Company No. 1224148-A) ("SAHSB"), the 70% owned subsidiary of Sinmah Development Sdn. Bhd., a wholly owned subsidiary of the Company has on 10 January, 2019 subcribed additional 4,749,050 ordinary shares at an issue price of RM1.00 per share in the share capital of SAH Medical Center Sdn. Bhd. (Company No. 1275432-X) (“SMCSB”) (hereinafter referred to as “the Subcription of Shares”), thereby increasing SAHSB’s investment in SMCSB from RM950.00 to RM4,750,000.00. SMCSB will remain a 95% owned subsidiary of SAHSB and Encik Shaik Mohammed Haikhal Bin Abdul Rahim will hold 5% equity interest in SAHSB after the Subcription of Shares.

None of the Directors, major shareholders of the Company and/or persons connected to the Directors and/or major shareholders has any interest, direct or indirect in the Subscription of Shares.

The Board of Directors of the Company having considered all aspects of the Subscription of Shares is of the opinion that the Subscription of Shares is in the best interest of SCB Group.

The announcement is dated 10 January, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-2-2019 07:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-2-2019 07:46 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | (i) PROPOSED DIVERSIFICATION INTO HEALTHCARE BUSINESS ("PROPOSED DIVERSIFICATION"); AND(ii) PROPOSED ACQUISITIONS OF TWO (2) PROPERTIES ("PROPOSED ACQUISITIONS").(COLLECTIVELY REFERRED TO AS "PROPOSALS") | On behalf of the Board of Directors of Sinmah, TA Securities Holdings Berhad wishes to announce that the Company proposes to undertake the Proposals. Please refer to the attachment for further details.

This announcement is dated 17 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6038665

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|