|

|

发表于 29-5-2015 12:59 AM

|

显示全部楼层

发表于 29-5-2015 12:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2015 | 31 Mar 2014 | 31 Mar 2015 | 31 Mar 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 160,788 | 177,760 | 160,788 | 177,760 | | 2 | Profit/(loss) before tax | 3,768 | 9,938 | 3,768 | 9,938 | | 3 | Profit/(loss) for the period | 4,341 | 8,994 | 4,341 | 8,994 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,629 | 8,713 | 4,629 | 8,713 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.40 | 8.28 | 4.40 | 8.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3400 | 3.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2015 02:52 AM

|

显示全部楼层

发表于 31-5-2015 02:52 AM

|

显示全部楼层

EX-date | 27 Jul 2015 | Entitlement date | 29 Jul 2015 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | A Final Single Tier Dividend of 4% subject to members' approval | Period of interest payment | to | Financial Year End | 31 Dec 2014 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD (578473-T)2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah10050Tel:604-2282321Fax:042272391 | Payment date | 18 Aug 2015 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Jul 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 4.0000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-7-2015 04:56 PM

|

显示全部楼层

发表于 1-7-2015 04:56 PM

|

显示全部楼层

2年耗资6500万 通源再增新生产线

财经新闻 财经 2015-07-01 12:24

(溪大年30日讯)通源工业(TGUAN,7034,主板工业产品股)将耗资6500万令吉,于今年和明年2年内,在双溪大年的厂房增加新生产线。

该公司董事经理拿督洪本铨指出,增加生产线目的,是要提升产能和推介新的包装产品。

他日前在公司股东大会后透露,该公司将于今年内耗资3000万令吉安装新的生产线,其余3500万令吉则作为明年的发展用途。

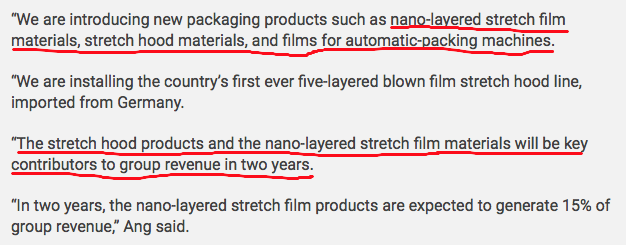

他说:“我们将推介新的包装产品,包括纳米拉伸膜、压缩包装原料及自动包转机械的拉伸膜。”

“我们正在安装国内首个5层拉伸膜压缩包装原料的生产线,该设备由德国进口。”

他预计,压缩包装产品和纳米拉伸膜原料的生产,将成为公司未来2年内主要的营业额贡献。

他说:“未来2年内,纳米伸膜原产品料为公司带来15%营业额贡献。”

至于PVC食品保鲜膜,随着今年2月安装了新的机器,料在今年贡献8%的营业额。

“安装了新机械后,PVC食品保鲜膜的产能,已经上涨至每月720公吨。”

为了创新,该公司也设立了亚太区内第一个研发中心,加速公司产品发展和革新。【南洋网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2015 05:16 AM

|

显示全部楼层

发表于 4-8-2015 05:16 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-8-2015 03:14 PM

|

显示全部楼层

发表于 20-8-2015 03:14 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2015 | 30 Jun 2014 | 30 Jun 2015 | 30 Jun 2014 | $$'000 | $$'000 | $$'000 | $$'00 |

| 1 | Revenue | 173,229 | 195,974 | 334,017 | 373,734 | | 2 | Profit/(loss) before tax | 8,529 | 9,000 | 12,297 | 18,938 | | 3 | Profit/(loss) for the period | 7,458 | 8,430 | 11,799 | 17,424 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,101 | 8,025 | 11,730 | 16,738 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.75 | 7.63 | 11.15 | 15.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 3.00 | 0.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4200 | 3.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2015 03:17 AM

|

显示全部楼层

发表于 21-8-2015 03:17 AM

|

显示全部楼层

買進券商心頭好‧賺幅復甦 估值低 通源工業3大利好撐腰

財經股市20 Aug 2015 20:54

券商 :聯昌證券研究

目標價:2.44令吉

通源工業(TGUAN,7034,主要板工業)估值低,加上日本出口市場回揚,以及賺幅復甦為潛在重估催化劑,促使我們維持“增持”投資評級。

通源工業2015財年上半年淨利,符合我們和市場的預測。

我們對該公司來自日本的銷售持續疲弱不感意外,因為日本次季國內生產總值(GDP)萎縮。

該公司第5和第6個PVC食品保鮮膜生產線,在次季順利投入運作,對該公司來說,是個正面因素。

我們相信,PVC食品保鮮膜產品,在該公司的產品系列中,提供的盈利賺幅最高。

另外,該公司也注重伸縮薄膜(stretch film)業務。該公司計劃在今年安裝33層的納米技術(Nanotechnology)伸縮薄膜生產線。

過去幾年,我們發現該公司在歐洲的競爭對手,都採用這高科技納米技術,而取得強勁盈利賺幅。

我們因而看漲該公司的伸縮薄膜業務,以及2016年的淨利表現。

考量到利息、稅務、折舊與攤銷前盈利(EBITDA)賺幅復甦,以及日本出口市場的營業額出現反彈的跡象,這2大潛在重估催化劑,加上該股估值不高,故維持“增持”投資評級。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-9-2015 12:42 AM

|

显示全部楼层

发表于 4-9-2015 12:42 AM

|

显示全部楼层

EX-date | 18 Sep 2015 | Entitlement date | 22 Sep 2015 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | SECOND SEMI-ANNUAL INTEREST PAYMENT ON 5-YEAR 5% PER ANNUM IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS ("ICULS") | Period of interest payment | 09 Apr 2015 to 08 Oct 2015 | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah10050 PenangTel:042282321Fax:042272391 | Payment date | 09 Oct 2015 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 22 Sep 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 5.0000 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2015 01:04 AM

|

显示全部楼层

发表于 20-11-2015 01:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2015 | 30 Sep 2014 | 30 Sep 2015 | 30 Sep 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 182,349 | 191,875 | 516,366 | 565,609 | | 2 | Profit/(loss) before tax | 12,742 | 4,398 | 25,039 | 23,336 | | 3 | Profit/(loss) for the period | 11,681 | 5,198 | 23,480 | 22,622 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,256 | 4,915 | 22,986 | 21,653 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.70 | 4.67 | 21.85 | 20.58 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.5900 | 3.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2015 05:10 AM

|

显示全部楼层

发表于 21-11-2015 05:10 AM

|

显示全部楼层

財測目標價獲上調 通源工業母子晉上升榜

2015年11月20日 股市

(吉隆坡20日訊)通源工業(TGUAN,7034,主要板工業)擴充高賺幅的生產線,可改善獲利,獲券商調高財測和目標價;刺激母股連同旗下二憑單齊漲,佔據十大上升股榜。

受到利好帶動,通源工業開盤即漲15仙,以2.40令吉開跑,盤中飆升22仙或10%至2.47令吉,創下去年9月份以來最高水平。

憑單通源工業-WA(TGUAN-WA,7034WA,主要板憑單)也不甘示弱,一度勁揚23仙或21%至1.32令吉;通源工業-LA(TGUAN-LA,7034LA,主要板債券憑單)同樣呈升勢,盤中升20仙或10%至2.22令吉。

同行首選股

除了業績符合預測,聯昌證券研究視該公司年中展開的PVC第5和第6條食品保鮮膜生產線,為長期正面因素,因為食品保鮮膜是公司眾多產品當中,帶來的賺幅最高。

報告指出,PVC食品保鮮膜的稅前賺幅可介于15%至20%之間,或甚至超過20%;伸縮薄膜(stretch film)賺幅為約5%至6%左右。

考量到擴充高賺幅的生產線,肯納格證券研究將該公司2015和2016財年的核心淨利預測,上調至介于2530萬至2590萬令吉之間,目標價也從2.40令吉,上調至2.45令吉,維持“跑贏大市”投資評級。

聯昌證券研究視該股為包裝業的首選股,維持該股“增持”投資評級,目標價從2.44令吉,調高至2.52令吉。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2016 01:15 AM

|

显示全部楼层

发表于 11-1-2016 01:15 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2016 01:41 AM 编辑

【浴火凤凰】 - 浅谈TGUAN(7034),准备赞翅高飞的猴年!

Sunday, January 10, 2016

http://harryteo.blogspot.my/2016/01/1195-tguan7034.html

2016年将会是挑战重重的一年,所以笔者选股也变得更加谨慎。今年要跟大家分享是全马最大的胶袋以及塑膜生厂商之一,TGUAN(7034)。这家公司创立于1942年,创业初期涉及咖啡以及茶叶的贸易与分销,70年代开始设计塑料产品的制造以及贸易。公司在1997年挂牌上市,现在的市值为3亿6千1百万,属于小型成长股。

从上图我们可以看到公司的业绩以及盈利从2011年一直进步到2013年。可是在2014年的盈利在业绩上涨的情况下却下跌了,这到底是什么情况呢??打开季度报告一看,原来是公司蒙受接近10mil收不回的烂账以及外汇亏损。不过雨后总是会有彩虹的,公司在2014年透过借贷以及跟股东发行债卷筹了100m来扩张产线以及提高产品品质。

公司预计总产能可以从2014年的120,000 MT提高到2016的170,000MT。这是否说明2016年TGUAN的业绩以及盈利可以托新高呢??就让我们拭目以待。

上图是TGUAN过往的EPS记录,笔者发现除了2014年Q4蒙受亏损,这家公司之前一次的亏损还要追溯到2008年Q4的金融风暴时期。因此笔者认为这家公司是一家营运能力出色的公司。经历2014年以及2015年的休整期,笔者深信2016年才是这家公司展翅高飞的一年。

假设排出去年Q4亏损的盈利,TGUAN在最新的3个季度EPS为21.85。去年10月-12月是美金最强的季度,由于大部分的债务是美金导致蒙受外汇亏损。可是TGUAN还是受益于美金走高,Resin - 树脂价格走低,以及产量逐渐增加的利好因素。笔者对2月公布的业绩抱着不小的期待,希望产线增加后可以让TGUAN的盈利突破新高。

此外,公司在2015Q3公布,中国的产线也由亏转盈,这对公司有着非常显著的正面贡献。亚太区域第1台精锐的机械,能够生产33层合成的纳米技术拉伸膜产线也会在2015年年底开始运作,现进的科技技术也可以让TGUAN处于领先的地位。

而且这家公司的各大股东都很有名头,大家不妨注意2014年的Annual Report,你们会看到笔者很尊敬的一位投资前辈。而且最近管有缘官佬也在他的部落客公开说他已经买进TGUAN。虽然现在TGUAN的PE高达19.18,但是笔者相信业绩出炉后肯定会把PE拉低。投资股票是看公司未来的前景以及盈利,你认同吗?? |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2016 04:38 PM

|

显示全部楼层

发表于 12-2-2016 04:38 PM

|

显示全部楼层

拟联营进军中国有机面 通源放眼分拆饮食业务

财经新闻 财经 2016-02-12 12:12

(吉隆坡11日讯)吉打包装公司通源工业(TGUAN,7034,主板工业产品股)计划和中国企业中粮集团(COFCP)合作,进军中国有机面市场,最终将饮食与消费产品业务分拆。

通源工业认为,在三年内,饮食与消费产品业务,比起核心业务———包装,将会获得更理想的赚幅、净利以及估值。

该公司执行董事洪世明(译音)向《The Edge》指出,中粮集团已向同源工业表达有意愿展开合作计划,设立联营公司。

洪世明是该公司董事经理拿督洪本铨的儿子。中粮集团是中国国有食品加工控股公司,也是中国国内最大的食品加工、制造和贸易集团。

洪世明不愿透露其中的合作详情,只表示双方的讨论正进行中。

“我们可能通过在旗下子公司Everprosper食品工业有限公司参股的方式,或两者设立新公司的方式完成。这全都按照有机面业务的规模而定。中粮集团在者联营计划中,至少持有40%股权。”

洪世明也指出,市场上并没有很多企业从事有机面业务,而该产品的赚幅是高过普通面食产品。

“我们已有两次到中国和对方会面商讨,目前计划在农历新年后前往参观。”

洪世明提到,中粮同意提供有机面粉,并在获得来自中国政府的有机食品认证后,通源工业才能进行大量生产。

通源工业预料,从中国的有机面食市场,为公司的面食业务在未来两年内,贡献70%的销售额。【南洋网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2016 09:44 PM

|

显示全部楼层

发表于 25-2-2016 09:44 PM

|

显示全部楼层

本帖最后由 icy97 于 25-2-2016 10:12 PM 编辑

| 7034 | | Quarterly rpt on consolidated results for the financial period ended 31/12/2015 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2015 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/12/2015 | 31/12/2014 | 31/12/2015 | 31/12/2014 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 195,724 | 166,981 | 712,090 | 740,227 | | 2 | Profit/Loss Before Tax | 18,133 | (4,513) | 43,172 | 18,819 | | 3 | Profit/Loss After Tax and Minority Interest | 15,518 | (4,168) | 38,504 | 17,483 | | 4 | Net Profit/Loss For The Period | 16,199 | (4,221) | 39,679 | 18,398 | | 5 | Basic Earnings/Loss Per Shares (sen) | 14.75 | (3.96) | 36.60 | 16.62 | | 6 | Dividend Per Share (sen) | 9.00 | 4.00 | 9.00 | 7.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 3.7000 | 3.2500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2016 03:06 PM

|

显示全部楼层

发表于 26-2-2016 03:06 PM

|

显示全部楼层

本帖最后由 icy97 于 26-2-2016 05:20 PM 编辑

Thong Guan (7) - A Tsunami Of Profit

Author: Icon8888 | Publish date: Thu, 25 Feb 2016, 10:21 PM

http://klse.i3investor.com/blogs/icon8888/91958.jsp

1. Excellent Results

Thong Guan released its December 2015 quarterly result today with EPS of 9.8 sen per quarter (after factoring in full conversion of ICULS).

The EPS of 9.8 sen is very closed to my forecast of 9.4 sen. Please refer to this article.

http://klse.i3investor.com/blogs/icon8888/88890.jsp

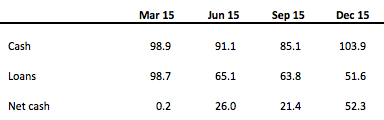

2. Balance Sheets Continue to Improve

In March 2015 quarter, net cash was RM0.2 mil. It has now increased to RM52.3 mil. Based on 158 mil shares, net cash per share is 33 sen.

3. Interesting Insights From Cash Flow Statement

So far, I have written 6 articles about Thong Guan. But I have never discussed its cashflow in detail.

Dear readers, there is one piece of very interesting information embedded in the cashflow statement below. Do you manage to spot it ? I give you 2 minutes.

Ok, time's up.

The interesting information is that from 2014 until 2015, the group has only spent RM55 mil on capex.

What is the implication ?

Thong Guan has stated numerous time that during the period from 2014 until 2016, the group will be spending RM100 mil on capex. As such, the RM55 mil capex so far is only half way through.

If you still don't get it - the recent earning explosion is caused by half of the capex only. What will happen after the entire RM100 mil was fully spent ? It is time to stretch your imagination !!!

Previously, if you tell people that Thong Guan can make RM60 mil per annum, people will say you are crazy. This is because in the past 10 years, Thong Guan's profit hovered around RM20 mil to RM30 mil.

But with this latest quarter's net profit of RM15.5 mil, most people will readily accept that RM60 mil can be the norm (let's just say that strong USD will be here for the next few years - which is my view).

But now with this latest insight gained from analysing the cashflow statement, I am sticking my neck out to be the first one to plant the flag - should we revise upwards our expectation and aim for earnings of at least RM70 mil ? (EPS of 44 sen based on 158 mil shares)

The possibility is there. However, as usual, only time can tell.

My optimisim does not exist in vacuum - the following article dated 26 June 2015 contains details of 2016 capex.

As stated in the article above, the group will be spending RM35 mil on capex in 2016 to produce nano layered strecth flm and stretch hood. These two new products will be KEY CONTRIBUTORS TO GROUP REVENUE IN TWO YEARS.

Sounds like big impact projects !!!

Just in case you wonder what is strecth hood, this is how it looked like.

4. Noodle Division Will Be The New Star Performer

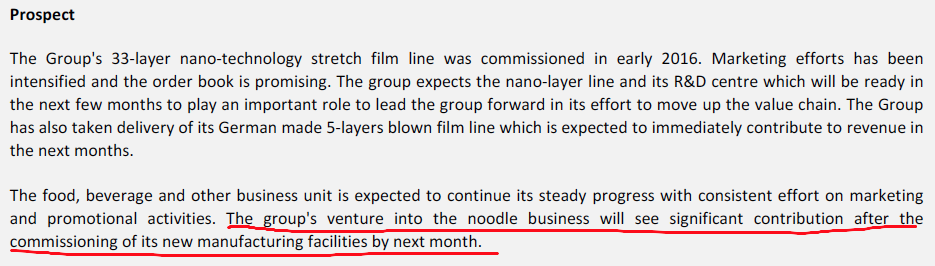

If you think that whatever I wrote above is already sizzling hot, just wait until you read about its noodle division. In the latest quarterly report, the company has some positive things to say about this division :-

If you are scratching your head wondering what is happening in the noodle division, you must have missed out this latest article dated 11 February 2016 :-

KUALA LUMPUR: Kedah-based packaging group Thong Guan Industries Bhd plans to work with its Chinese partner, the COFCO group, to tap the organic noodles market in China, and eventually spin off its food and beverage (F&B) and other consumable product business, which is deemed to have a better margin, profit and valuation than its core packaging business, in three years. The group, which is expecting double-digit growth in both its top and bottom lines for the financial year ending Dec 31, 2016 (FY16), underpinned by continued expansion, is also on the hunt for merger and acquisition opportunities to grow its packaging segment. In the planned organic noodles venture, Thong Guan executive director Ang See Meng, son of group managing director Datuk Ang Poon Chuan, told The Edge Financial Daily recently that COFCO, which stands for China National Cereals, Oils and Foodstuffs Corp, had shown its interest in jointly participating in the business. One of China’s state-owned food processing holding companies, COFCO is also China’s largest food processing, manufacturer and trading group. “We have not decided on the joint-venture details. It could be equity participation in Everprosper Food Industries Sdn Bhd, a new subsidiary of ours, which includes all related subsidiaries, or another new company we will form. It depends on the project size [of the organic instant noodles venture],” See Meng said. According to See Meng, not many companies make organic noodles now and the margin is higher compared with conventional noodles. COFCO, he said, has expressed its interest in taking up at least a 40% stake in the venture, which he expects to take off sometime this year. “Our discussions with COFCO are still ongoing. They see [the] potential in organic noodles for babies and organic instant noodles, and would like the noodles to be sold online. They also said Chinese consumers prefer imported food. We have visited them in Beijing twice so far. They are planning a visit after the Chinese New Year,” See Meng said. The new venture will need certification papers from the Chinese government before it can mass-produce organic noodles for the Chinese market. “They (COFCO) have agreed to supply us organic flour in order for us to get the organic certification from China,” See Meng shared. See Meng believes Thong Guan has the capability to export organic noodles worldwide and be the first to export organic noodles for consumption by Chinese babies, which are deemed a billion-dollar business. The group’s noodles are now exported to 10 countries. China makes up about 10% of its total noodle sales — relatively small as the group only started supplying its noodles to COFCO two months ago. With the new organic noodle venture, Thong Guan expects the Chinese market to contribute at least 70% of its total noodle sales in two years. “I believe there will be more orders, especially when we start providing organic noodles,” See Meng said, adding that besides COFCO, Thong Guan also gets orders from other Chinese companies. The group is now looking at setting up a branch and warehouse in Shuzhou to cater to growing demand. With the planned venture and capacity expansion, Thong Guan expects revenue contribution from its F&B and other consumable product segment to grow to 30% in two to three years. The F&B and other consumable product segment makes up about 10% to 15% of group revenue now, but contributes about 30% of its profit. Its core plastic packaging segment, meanwhile, contributes about 85% of the group’s revenue, but 70% of its profit. Clearly, the margin is higher in the non-core segment. “Our packaging division is stable and we are one of the largest in Asia. We want to realise more value from our F&B and other consumable product segment, so that it can stand alone and generate more value for shareholders,” See Meng said. Thus, the group will eventually spin off its F&B and other consumable product segment as the market has not priced in the value of the segment of the group, hidden as it is below the plastic packaging segment. “We definitely plan to list it as [a] separate entity in two to three years. It won’t necessarily be in Malaysia, as we hope to hedge the risk [of being only in one market]. For an industrial packaging company, the fair valuation is only between eight and 10 times P/E (price/earnings). But for F&B and other consumables, the market will give us more than 10 times P/E,” he added. As for the M&A hunt for its packaging business, Thong Guan is now talking with two packaging firms, one each in Malaysia and Vietnam. “The prices are still high now, so we are waiting for a more suitable time. We are talking, but it may take a while,” said See Meng, without giving a specific time frame for when the talks will come to an end. Meanwhile, this year will mark the group’s last phase of its three-year RM100 million capital expenditure plan that began in 2014. The group spent RM60 million in the last two years. The remaining RM30 million will be used this year to expand its noodle business, fund a new polyvinyl chloride line and initiate its five-layer blown film stretch hood line. “With the machinery we put in over the past two years, we are looking at double-digit growth for FY16,” said See Meng, adding that 2016 will be a better year for the group. Thong Guan’s net profit grew 2.6 times to RM11.26 million in the third quarter ended Sept 30, 2015, from RM4.92 million a year ago. For the cumulative nine-month period (9MFY15), the group’s net profit rose 6.16% to RM22.99 million from RM21.65 million in 9MFY14. The improvement was mainly due to higher margins from exports. Its shares closed down six sen or 2% at RM2.94 yesterday, valuing it at RM309.5 million.

===============

For your information, COFCO is no kicimeow company. It is a State Owned Enterprise and is the largest food trading and distribution company in China. It handles a wide variety of agricultural produce including edible oil, wheat, rice, sugar, tea, milk, etc.

Appendix - Thong Guan's Organic Noodles Partner - COFCO

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2016 12:15 AM

|

显示全部楼层

发表于 27-2-2016 12:15 AM

|

显示全部楼层

本帖最后由 icy97 于 27-2-2016 12:28 AM 编辑

通源工業財測投資評級獲上調

2016年2月26日

http://www.chinapress.com.my/20160226/財測投資評級獲上調-通源工業漲18仙/

(吉隆坡26日訊)通源工業(TGUAN,7034,主要板工業)業績超越預測,加上股息具吸引力,獲券商上調財測和投資評級,股價應聲一度勁揚20仙或6.7%至3.18令吉,為1月19日以來最高價位。

聯昌證券研究說,通源工業2015財年淨利,比該行設下的全年預測高出58%。

股息方面,肯納格證券研究指出,該公司宣布派發每股9仙終期股息,將全年股息增至13仙,比預期的7.4仙股息來得高。有關派息相等于4.4%股息回酬。

肯納格證券研究說,該公司擴大賺幅相對較高的生產線。其中,該公司的33層納米技術(Nanotechnology)伸縮薄膜(stretch film)生產線,早在首季投入運作。

考量到上述因素對賺幅前景有利,及美元走強,肯納格證券研究將該公司2016財年核心淨利預測調高12%。

肯納格證券研究則將該股的投資評級從“符合大市”,上調至“跑贏大市”,目標價從3.07令吉,上調至3.40令吉。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2016 03:51 PM

|

显示全部楼层

发表于 11-3-2016 03:51 PM

|

显示全部楼层

EX-date | 23 Mar 2016 | Entitlement date | 25 Mar 2016 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | THIRD SEMI ANNUAL INTEREST PAYMENT ON 5-YEAR 5% PER ANNUM IRREDEEMABLE COVERTIBLE UNSECURED LOAN STOCKS ("ICULS") | Period of interest payment | 09 Oct 2015 to 10 Apr 2016 | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah10050 PenangTel:042282321Fax:042272391 | Payment date | 11 Apr 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 25 Mar 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 5.0000 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2016 07:58 PM

|

显示全部楼层

发表于 28-4-2016 07:58 PM

|

显示全部楼层

本帖最后由 icy97 于 28-4-2016 08:14 PM 编辑

| 7034 TGUAN THONG GUAN INDUSTRIES BHD | | Final Single Tier Dividend of 9% |

| | Entitlement Details: | | Final Single Tier Dividend of 9% |

| | Entitlement Type: | Final Dividend | | Entitlement Date and Time: | 29/07/2016 05:00 AM | | Year Ending/Period Ending/Ended Date: | 31/12/2015 | | EX Date: | 27/07/2016 | | To SCANS Date: |

| | Payment Date: | 18/08/2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2016 02:46 AM

|

显示全部楼层

发表于 30-5-2016 02:46 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 179,670 | 160,788 | 179,670 | 160,788 | | 2 | Profit/(loss) before tax | 15,715 | 3,768 | 15,715 | 3,768 | | 3 | Profit/(loss) for the period | 13,726 | 4,341 | 13,726 | 4,341 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,066 | 4,629 | 13,066 | 4,629 | | 5 | Basic earnings/(loss) per share (Subunit) | 12.42 | 4.40 | 12.42 | 4.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.7500 | 3.7000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2016 11:27 PM

|

显示全部楼层

发表于 30-5-2016 11:27 PM

|

显示全部楼层

Date of change | 26 May 2016 | Name | DATO PADUKA SYED MANSOR BIN SYED KASSIM BARAKBAH | Age | 82 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-6-2016 11:23 PM

|

显示全部楼层

发表于 1-6-2016 11:23 PM

|

显示全部楼层

本帖最后由 icy97 于 1-6-2016 11:41 PM 编辑

【吉打 - AGM游记】- TGUAN(7034) 厚薄积发,【价值】 +【Volume】一齐高飞!

Wednesday, June 1, 2016

http://harryteo.blogspot.my/2016/06/1273-agm-tguan7034-volume.html

上个星期四参加的TGUAN股东大会到今天才有时间写出来,TGUAN股东大会的地点是在Park Avenue Hotel, Sungai Petani, Kedah。而笔者在星期三就提前飞到Penang住宿一晚,隔天和几位朋友两辆车杀到了Sg.Petani。这是笔者第一次参加这么远的股东大会,而我的朋友里则有5位是第一次参加AGM。

股东大会在11a.m开始,而我们在9.30就到了酒店。所以笔者是第一个register我的名字的小股东,而在现场也看到了EG的Managing Director, 原来他也是TGUAN的Non - executive Director。

以上就是TGUAN的Door Gift,有888咖啡粉,有机面,垃圾袋等。由于主办单位没有想到出席的人会那么多,所以只准备了40个人左右的位置,但是出席的股东人数超过了50人。其实也不难预测,因为TGUAN去年盈利以及股价都上涨了不少,出席的股东当然也会增加。

而我们一共6人就霸占了第一排左边的留个位置,股东大会准时开场。由于飞了这么远来到吉大,笔者准备了不少问题发问。

以下是笔者个几位股东的问题以及来自管理层的回答:

- 笔者最关注的还是美金的课题,因为公司蒙受了不少的外汇损失。TUGAN第三代的Executive Director Alvin Ang回答如下:其实美金上涨利多于弊,TGUAN的业务超过90%是出口之国外,所以都是以美金结算。当美金债务面临亏损的时候,销售而也会因为美金上涨而增加。此外,管理层也解释美金债务的利息比大马低,所以借贷成本也比较低廉的。如果没有记错的话,33 layer machine可以每年贡献 90 mil的revenue。

- 也有股东问了去年7mil多的Impairment loss,Alvin Ang回答那是因为2014年公司买了几个Container的食品给Russia的公司。由于当时油价大跌导致Russia的经济大跌,货币也因此暴跌了一倍以上。所以TGUAN的Russia的客户公司的借贷遭到冻结,因此才会有这笔4 mil++的Impairment loss。不过Executive Director也解释,公司正在跟Russia的客户洽谈讨回这笔欠债。只要Russia的客户的资金稳定下来,公司是有很大机会讨回这笔4 mil++。因此这也算是一个好消息,毕竟这已经record在去年的亏损了。

- 此外,公司也说明虽然今年的营业额下跌,但是盈利以及profit margin有了大幅度的增长。主要是因为公司注重价值多过volume,而且也卖掉了其中一条profit margin比较低的production line给韩国。

- 而管理层也表明Organic Noodle在未来可以每年贡献50 - 60 mil的revenue,听起来很不错对吧?但是因为刚刚收购不久,所以需要时间消化。虽然已经卖了一些面给中粮Copco,但是想要签下合约应该不是短期可以完成的事情。

- 而且管理层也表明中国方面真的很有兴趣TGUAN的Organic noodle,他们有一个wechat group是跟中方洽谈这些事宜的。

- 此外,有人发问,公司的Capacity增加,那么订单是否能够消化。而管理层很有信心的回答,他们完全没有订单方面的问题。

- 股东大会结束后,有机会跟Operation Director, Dato PK Ang深聊了几个小时,所以对TGUAN的技术以及最新科技有了更加深的了解。

- 最难的的是,Dato Pk Ang还带了我们几位有兴趣的股东参加了他们新建Newton Research中心,预计8月多才会正式完工,现在部分机器还没有运到。

- 而我们在Newton也看了一些Video,也对Newton这家新的研究中心有更深的了解。以下是网址:

http://www.newton-centre.my/

总结:

笔者更管理层们交流以及深交后,诚心的觉得这家公司的未来很有前景。我也更Executive director反映了股票不流通,未来不排除Bonus issue。而公司在Q1 order比较少所以盈利QOQ下跌,yoy上涨了182%。相信未来新的机器以及科技会继续为公司带来更有【价值】的产品,从而提高公司的【Volume】以及Profit Margin。

而且公司即将派发9仙的股息,是最近10年最丰厚的一次股息。今天股价闭市RM3.40, 距离新高RM3.45非常靠近。期待TGUAN在今年下半年的表现。共勉之。

以上纯属分享,买卖自负。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-6-2016 03:38 AM

|

显示全部楼层

发表于 8-6-2016 03:38 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Clarification on article titled "Leading packaging maker Thong Guan at undemanding valuation" which appeared in The Edge Malaysia on 6 June 2016 | The Board of Directors of TGIB (“Board”) wishes to clarify that the content of the article was in response to questions raised by journalist as no formal proposal on corporate exercise has been tabled for the Board’s consideration. The Board believes that the share price movements were mainly market reaction to the continued strong Group financial performance as announced on 26 May 2016 and interest shown by prominent value investors.

The Board is cognisant of the need for proper dissemination of information to the public and would release announcement on Bursa Securities on any material issue on a timely basis as required by the Main Market Listing Requirements of the Bursa Securities.

This announcement is dated 7 June 2016. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|