|

|

发表于 9-12-2017 07:41 AM

|

显示全部楼层

发表于 9-12-2017 07:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | Three Months | Three Months | Six Months | Six Months | 01 Jul 2017

To | 01 Jul 2016

To | 01 Apr 2017

To | 01 Apr 2016

To | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 86,529 | 77,200 | 181,732 | 151,069 | | 2 | Profit/(loss) before tax | 4,102 | 2,544 | 9,382 | 4,817 | | 3 | Profit/(loss) for the period | 2,557 | 1,759 | 6,586 | 2,912 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,557 | 1,759 | 6,586 | 2,912 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.93 | 1.33 | 4.98 | 2.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8600 | 1.3300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2018 01:17 AM

|

显示全部楼层

发表于 3-1-2018 01:17 AM

|

显示全部楼层

Date of change | 31 Dec 2017 | Name | YAM TUNKU TAN SRI IMRAN IBNI ALMARHUM TUANKU JA'AFAR | Age | 69 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | After many years at the helm of Aluminium Company of Malaysia Berhad ("Alcom"), Y.A.M. Tunku Tan Sri Imran ibni Almarhum Tuanku Ja'afar felt that it is the right time for him to resign as Director and Chairman of the Board of Directors of Alcom. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2018 03:54 AM

|

显示全部楼层

发表于 3-1-2018 03:54 AM

|

显示全部楼层

本帖最后由 icy97 于 3-1-2018 04:05 AM 编辑

9213万买百乐园地皮

马制铝多元化至房产领域

2018年1月3日

(吉隆坡2日讯)马制铝(ALCOM,2674,主板工业产品股)以9212万9400令吉,向百乐园(PARAMON,1724,主板产业股)收购两块位于雪州双溪毛糯的地皮,多元化至产业领域。

马制铝今日向交易所报备,间接独资子公司EM Hub私人有限公司,已与百乐园独自子公司Seleksi Megah私人有限公司(简称SMSB)签两项协议,分别为买卖协议和授权书。

执行买卖协议后,SMSB将授权EM Hub处理该土地的发展事宜,包括提交申请发展该地段的所有必须资料。

这两片地皮皆属租赁工业地契,总面积达9.4英亩。该公司计划发展成工业园区共两栋。

随着收购计划,马制铝也宣布多元化至房地产业务,料能进新收入来源。目前,该公司主要从事制造和贸易铝板和铝箔产品。

根据初步计划,该公司预计,房地产业务在未来几年,料贡献净利25%或以上。

Alcom集团取代上市

此外,马制铝司还建议内部重组,通过换股计划,以1:1比例,马制铝所有股东将与去年12月22日成的Alcom集团有限公司交换股票。

截至去年12月26日,马制铝已发行股本为1亿3433万848股,完成换股后,股东在Alcom集团中,维持同样的股票数量。

同时,Alcom集团将取代马制铝的上市地位,总已发行股为1亿3433万850股。

因此,Alcom集团旗下将有两大业务,分别是SCLand发展私人有限公司营运的产业业务,及马制铝营运的铝产品制造业务。【e南洋】

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | ALUMINIUM COMPANY OF MALAYSIA BERHAD ("ALCOM" OR THE "COMPANY")(I) PROPOSED ACQUISITION;(II) PROPOSED DIVERSIFICATION; AND(III) PROPOSED INTERNAL REORGANISATION(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of Alcom, UOB Kay Hian Securities (M) Sdn Bhd (“UOBKH”) wishes to announce that the Company proposes to undertake the following:- | (I) | proposed acquisition by EM Hub Sdn Bhd (“EM Hub”), a wholly-owned indirect subsidiary of Alcom, of a parcel of vacant leasehold industrial land held under the land title no. H.S.(D) 242971 PT10568 and H.S.(D) 242972 PT10570, both in Pekan Baru Sungai Buloh, District of Petaling, State of Selangor from Seleksi Megah Sdn Bhd (“SMSB”), a wholly-owned subsidiary of Paramount Corporation Berhad, at a total cash consideration of RM92,129,400 (“Proposed Acquisition”); | | (II) | proposed diversification of the principal activities of Alcom and its subsidiaries to include property development activities (“Proposed Diversification”); and | | (III) | proposed internal reorganisation by way of a members’ scheme of arrangement under Section 366 of the Companies Act, 2016 comprising the following:- | | | - proposed share exchange of up to 134,330,848 ordinary shares in Alcom as at 26 December 2017, being the latest practicable date prior to the date of this announcement (“LPD”) (“Alcom Share(s)”), representing the entire issued share capital of Alcom with up to 134,330,848 new ordinary shares in Alcom Group Berhad (“Newco”) (“Newco Share(s)”) on the basis of 1 Newco Share for every 1 existing Alcom Share held on an entitlement date to be determined (“Proposed Share Exchange”); and

- proposed assumption of the listing status of Alcom by Newco, the admission of Newco to, and withdrawal of Alcom from the Official List of Bursa Malaysia Securities Berhad (“Bursa Securities”) with the listing of and quotation for all the Newco Shares on the Main Market of Bursa Securities (“Proposed Transfer of Listing Status”).

The Proposed Share Exchange and the Proposed Transfer of Listing Status are collectively referred to as the “Proposed Internal Reorganisation”. |

In conjunction with the Proposals, on 2 January 2018, Alcom Group had entered into the following agreements:- | (I) | a conditional sale and purchase agreement between EM Hub and SMSB in relation to the Proposed Acquisition (“SPA”); | | (II) | a power of attorney between EM Hub and SMSB in favour of EM Hub in conjunction with the Proposed Acquisition (“Power of Attorney”); and | | (III) | a conditional scheme agreement between the Company with Newco for the purpose of the implementation of the Proposed Internal Reorganisation (“Scheme Agreement”). |

Further details on the Proposals are set out in the attachment below.

This announcement is dated 2 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5654257

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2018 04:31 AM

|

显示全部楼层

发表于 11-1-2018 04:31 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2018 07:11 AM 编辑

马制铝厂委任苏巴汉为新主席

Emir Zainul/theedgemarkets.com

January 10, 2018 20:11 pm +08

(吉隆坡10日讯)马制铝厂(Aluminium Co of Malaysia Bhd,Alcom)委任巫统邓普勒花园(Taman Templer)前州议员拿督斯里苏巴汉(Subahan Kamal)为独立非执行主席,即时生效。

文告显示,年届52的Subahan从事数门生意,涉足建筑、培训与教育、产业发展、项目管理及物流领域。

他在人民银行(Bank Rakyat)展开职业生涯,于1989至1994年期间,在企业规划部门任职。

1994年,他加入了公务员领域,担任财政部议会秘书的私人秘书。1995至1998年,他担任副财长的高级私人秘书,并在1999年成为人力资源部副部长的高级私人秘书。

1996年,他启动了政治生涯,担任国阵蒂蒂旺沙青年团财政,国阵青年团执行委员会成员,并在2008至2013年期间,成为雪州邓普勒花园州议员。

目前,他是雪州足球总会会长、大马曲棍球联合会会长、玛拉科技大学(Universiti Teknologi Mara)的课程顾问委员会成员及Wawasan Qi Group主席。

同时,他也入主冠旺(Can-One Bhd)及The New Straits Times Press (Malaysia) Bhd的董事部。

(编译:魏素雯)

Date of change | 10 Jan 2018 | Name | DATO' SERI SUBAHAN BIN KAMAL | Age | 52 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Appointment | Qualifications | He holds a Bachelor of Science (Hons.) Degree in Accounting (Major in Finance and Minor in Economics) from Southern Illinois University at Carbondale, Illinois, United States of America. He is a member of the Malaysian Insurance Institute. | Working experience and occupation | He started his employment career with Bank Rakyat Corporate Planning Department in 1989 to 1994. He joined the civil service sector in 1994. He served as Private Secretary to the Parliamentary Secretary, Ministry of Finance (1994 to 1995), Senior Private Secretary to the Deputy Minister of Finance (1995 to 1998) and Senior Private Secretary to the Deputy Minister of Human Resource (1999).In 1996, he commenced his political career. He was the Treasurer for Barisan Nasional Youth Titiwangsa, Federal Territory; Executive Committee Member of Barisan Nasional Youth Malaysia, and the Selangor State Assemblyman for Taman Templer, Selangor from 2008 to 2013.He is currently the President of Football Association of Selangor. He was the Manager of Malaysian National Football Team from 2009 to 2013. He is also the President of the Malaysian Hockey Confederation; a member of Curriculum Advisory Board, Universiti Teknologi MARA, Malaysia (UiTM); and Chairman of Wawasan Qi Group.He has several businesses involved in constructions, training and education, property development, project management and logistics. | Directorships in public companies and listed issuers (if any) | Can-One BerhadThe New Straits Times Press (Malaysia) Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 02:59 AM

|

显示全部楼层

发表于 25-1-2018 02:59 AM

|

显示全部楼层

Date of change | 24 Jan 2018 | Name | MR MARC FRANCIS YEOH MIN CHANG | Age | 33 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Appointment | Qualifications | - Master of Business Administration in Finance from University of Southern Queensland, Australia- Bachelor of Science Degree in Electrical and Electronic Engineering (Magna cum Laude) from Marquette University, United States of America | Working experience and occupation | He is the Group Managing Director of Can-One Berhad ("Can-One"). Prior to this, he was the Chief Operating Officer cum Executive Director of Can-One group of companies. Before he joined Can-One, he was with Axiata Group Berhad group of companies serving in various senior positions abroad from 2007 to 2010. | Directorships in public companies and listed issuers (if any) | Can-One Berhad | Family relationship with any director and/or major shareholder of the listed issuer | He is the son of Yeoh Jin Hoe, the Executive Director and major shareholder of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 05:58 AM

|

显示全部楼层

发表于 4-3-2018 05:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | Three Months | Three Months | Nine Months | Nine Months | 01 Oct 2017

To | 01 Oct 2016

To | 01 Apr 2017

To | 01 Apr 2016

To | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 103,373 | 81,789 | 285,104 | 232,858 | | 2 | Profit/(loss) before tax | 4,021 | 5,753 | 13,403 | 10,570 | | 3 | Profit/(loss) for the period | 3,069 | 3,732 | 9,655 | 6,644 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,543 | 3,732 | 10,129 | 6,644 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.30 | 2.82 | 7.24 | 5.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 1.3300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2018 06:09 AM

|

显示全部楼层

发表于 9-6-2018 06:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 101,040 | 0 | 101,040 | 0 | | 2 | Profit/(loss) before tax | 724 | 0 | 724 | 0 | | 3 | Profit/(loss) for the period | 188 | 0 | 188 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 188 | 0 | 188 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.14 | 0.00 | 0.14 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 0.0000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2018 12:17 AM

|

显示全部楼层

发表于 6-7-2018 12:17 AM

|

显示全部楼层

icy97 发表于 3-1-2018 03:54 AM

9213万买百乐园地皮

马制铝多元化至房产领域

2018年1月3日

(吉隆坡2日讯)马制铝(ALCOM,2674,主板工业产品股)以9212万9400令吉,向百乐园(PARAMON,1724,主板产业股)收购两块位于雪州双溪毛糯的地皮, ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ALUMINIUM COMPANY OF MALAYSIA BERHAD ("ALCOM" OR THE "COMPANY")ACQUISITION BY EM HUB SDN BHD, A WHOLLY-OWNED INDIRECT SUBSIDIARY OF ALCOM, OF A PARCEL OF VACANT LEASEHOLD INDUSTRIAL LAND HELD UNDER LAND TITLES HSD 242971 PT 10568 AND HSD 242972 PT 10570, BOTH IN PEKAN BARU SUNGAI BULOH, DISTRICT OF PETALING, STATE OF SELANGOR FROM SELEKSI MEGAH SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF PARAMOUNT CORPORATION BERHAD, FOR A TOTAL CASH CONSIDERATION OF RM92,129,400 ("ACQUISITION") | The terms used herein shall have the same meaning as those defined in the circular to shareholders dated 26 April 2018 unless otherwise stated.

We refer to the previous announcements in relation to the Acquisition.

On behalf of the Board of Alcom, UOBKH is pleased to announce that the Balance Purchase Price has been paid by Alcom in accordance with the terms of the SPA, marking the completion of the Acquisition.

This announcement is dated 5 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2018 04:21 AM

|

显示全部楼层

发表于 20-7-2018 04:21 AM

|

显示全部楼层

本帖最后由 icy97 于 21-7-2018 06:20 AM 编辑

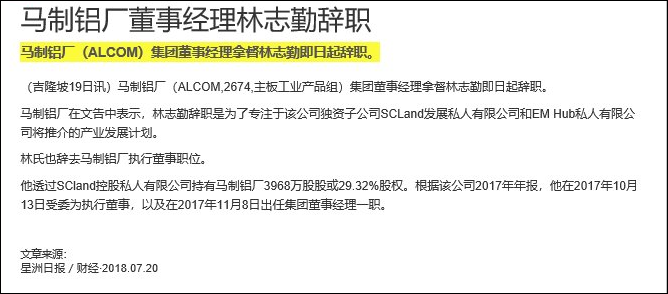

Date of change | 19 Jul 2018 | Name | DATO' LIM CHEE KHOON | Age | 51 | Gender | Male | Nationality | Malaysia | Designation | Managing Director | Directorate | Executive | Type of change | Resignation | Reason | In order to focus and emphasise on the property development project(s) to be launched by wholly-owned subsidiary, SCLand Development Sdn. Bhd. and wholly-owned indirect subsidiary, EM Hub Sd. Bhd. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | Not Applicable | Working experience and occupation | Not Applicable | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Indirect interest in 39,675,554 ordinary shares in Aluminium Company of Malaysia Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2018 02:59 AM

|

显示全部楼层

发表于 21-7-2018 02:59 AM

|

显示全部楼层

| ALUMINIUM COMPANY OF MALAYSIA BERHAD |

EX-date | 01 Aug 2018 | Entitlement date | 03 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Others | Entitlement description | Entitlement date for the exchange of all the issued ordinary shares in Aluminium Company of Malaysia Berhad ("Alcom") ("Alcom Share(s)") with new ordinary shares in Alcom Group Berhad ("AGB Share(s)"), on the basis of 1 new AGB Share for every 1 existing Alcom Share held, via a scheme of arrangement under Section 366 of the Companies Act, 2016 ("Share Exchange") | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:0327839299Fax:0327839222 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 03 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 1 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 02:36 AM

|

显示全部楼层

发表于 31-8-2018 02:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 100,852 | 0 | 201,892 | 0 | | 2 | Profit/(loss) before tax | 1,740 | 0 | 2,464 | 0 | | 3 | Profit/(loss) for the period | 356 | 0 | 544 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 356 | 0 | 544 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.27 | 0.00 | 0.41 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 0.0000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 08:04 AM

|

显示全部楼层

发表于 7-9-2018 08:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ACQUISITION OF SCLAND DEVELOPMENT SDN. BHD. | The Board of Directors of Alcom Group Berhad (“AGB”) wishes to announce that AGB has on 27 August 2018 acquired one (1) ordinary share representing the entire issued and paid-up share capital of SCLand Development Sdn. Bhd. (Company No. 1254837-T) ("SDSB") from wholly-owned subsidiary, Aluminium Company of Malaysia Berhad, at a total cash consideration of RM1.00 ("Acquisition").

SDSB was incorporated in Malaysia under the Companies Act, 2016 on 8 November 2017. The principal activity of SDSB is property holding and development.

The Acquisition allows AGB to have separate business streams to better reflect the current diverse operations of AGB comprising manufacturing segment and property segment. The separation will provide greater flexibility for business operations and facilitate effective management and accountability of the different business segments.

The Acquisition of SDSB does not have any material effect on the share capital and number of issued shares of AGB nor the shareholdings of the substantial shareholders of AGB. It is also not expected to have any material effect on the net assets and earnings per share of AGB as well as the gearing of AGB for the financial year ending 31 December 2018.

None of the Directors nor major shareholders of AGB and/or persons connected with them have any interest, direct or indirect, in the Acquisition of SDSB other than their respective interests held through AGB.

This announcement is dated 4 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2018 04:44 AM

|

显示全部楼层

发表于 24-10-2018 04:44 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2018 07:27 AM

|

显示全部楼层

发表于 27-12-2018 07:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 83,050 | 0 | 284,942 | 0 | | 2 | Profit/(loss) before tax | 973 | 0 | 3,437 | 0 | | 3 | Profit/(loss) for the period | -533 | 0 | 11 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -533 | 0 | 11 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.40 | 0.00 | 0.01 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 0.0000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2019 06:59 AM

|

显示全部楼层

发表于 6-3-2019 06:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 100,761 | 0 | 385,703 | 0 | | 2 | Profit/(loss) before tax | 4,535 | 0 | 7,972 | 0 | | 3 | Profit/(loss) for the period | 3,426 | 0 | 3,437 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,426 | 0 | 3,437 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.55 | 0.00 | 2.56 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9100 | 0.0000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2019 08:42 AM

|

显示全部楼层

发表于 4-7-2019 08:42 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 92,490 | 101,040 | 92,490 | 101,040 | | 2 | Profit/(loss) before tax | -742 | 724 | -742 | 724 | | 3 | Profit/(loss) for the period | -1,181 | 188 | -1,181 | 188 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,181 | 188 | -1,181 | 188 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.88 | 0.14 | -0.88 | 0.14 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9000 | 0.9100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2019 04:20 AM

|

显示全部楼层

发表于 30-8-2019 04:20 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 90,313 | 100,852 | 182,803 | 201,892 | | 2 | Profit/(loss) before tax | 1,524 | 1,740 | 782 | 2,464 | | 3 | Profit/(loss) for the period | 1,047 | 356 | -134 | 544 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,047 | 356 | -134 | 544 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.78 | 0.27 | -0.10 | 0.41 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9100 | 0.9100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-2-2020 07:58 AM

|

显示全部楼层

发表于 20-2-2020 07:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 89,571 | 83,050 | 272,374 | 284,942 | | 2 | Profit/(loss) before tax | 1,515 | 973 | 2,297 | 3,437 | | 3 | Profit/(loss) for the period | 435 | -533 | 301 | 11 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 435 | -533 | 301 | 11 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.32 | -0.40 | 0.22 | 0.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9100 | 0.9100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-4-2020 07:55 AM

|

显示全部楼层

发表于 25-4-2020 07:55 AM

|

显示全部楼层

本帖最后由 icy97 于 28-4-2020 08:04 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 100,279 | 100,761 | 372,653 | 385,703 | | 2 | Profit/(loss) before tax | 1,364 | 4,535 | 3,661 | 7,972 | | 3 | Profit/(loss) for the period | 47 | 3,426 | 348 | 3,437 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -477 | 3,426 | -176 | 3,437 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.03 | 2.55 | 0.26 | 2.56 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9100 | 0.9100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2020 08:45 AM

|

显示全部楼层

发表于 22-7-2020 08:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2020 | 31 Mar 2019 | 31 Mar 2020 | 31 Mar 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 81,485 | 92,490 | 81,485 | 92,490 | | 2 | Profit/(loss) before tax | -1,289 | -742 | -1,289 | -742 | | 3 | Profit/(loss) for the period | -2,318 | -1,181 | -2,318 | -1,181 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,318 | -1,181 | -2,318 | -1,181 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.73 | -0.88 | -1.73 | -0.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 0.9100

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|