|

|

发表于 19-7-2015 09:54 PM

|

显示全部楼层

发表于 19-7-2015 09:54 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2015 09:57 PM

|

显示全部楼层

发表于 19-7-2015 09:57 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2015 12:23 AM

|

显示全部楼层

发表于 20-7-2015 12:23 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2015 05:04 AM

|

显示全部楼层

发表于 29-8-2015 05:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2015 | 30 Jun 2014 | 30 Jun 2015 | 30 Jun 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 164,635 | 180,976 | 324,404 | 350,561 | | 2 | Profit/(loss) before tax | 10,786 | 14,469 | 18,358 | 32,722 | | 3 | Profit/(loss) for the period | 6,422 | 10,389 | 11,604 | 25,808 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,611 | 10,365 | 11,946 | 25,743 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.38 | 2.39 | 2.50 | 5.93 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8000 | 3.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2015 06:19 AM

|

显示全部楼层

发表于 29-11-2015 06:19 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2015 | 30 Sep 2014 | 30 Sep 2015 | 30 Sep 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 191,314 | 155,576 | 515,718 | 506,137 | | 2 | Profit/(loss) before tax | 26,797 | 16,926 | 45,155 | 49,648 | | 3 | Profit/(loss) for the period | 21,125 | 11,898 | 32,729 | 37,706 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 21,198 | 11,902 | 33,144 | 37,645 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.44 | 2.74 | 6.94 | 8.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8300 | 3.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2015 03:55 AM

|

显示全部楼层

发表于 2-12-2015 03:55 AM

|

显示全部楼层

黃傳寬控股 業績表現符合預期

2015年11月30日 買進券商心頭好

券商:艾芬黃氏資本研究

合理價:1.36令吉

黃傳寬控股(WTK,4243,主要板工業)業績表現符合預期,但2015至2017財年每股盈利年複成長率(CAGR)達16.3%備受看好,由木製品平均售價穩定、美元走強和成熟棕油種植地增加提振。

該公司首9個月營業額按年起1.9%至5億1570萬令吉,淨利亦增14.2%至3840萬令吉。黃傳寬控股核心淨利符合市場預期,但高于我們的估計,因源自木材業務有較高貢獻和賺幅。

投資評級維持“買進”

在考量到較高的首9個月業績表現,我們將黃傳寬控股2015至2017財年每股盈利預測上修6%到12%,其中提振因素包括合板平均售價預測上調6%到9%,每立方米約535美元(約2292令吉)至545美元(約2335令吉);以及圓木生產成本降低9%到11%之間,至每立方米105美元(約450令吉)到110美元(約471令吉)之間。

同時,黃傳寬控股目標價也從1.26令吉上調至1.36令吉,投資評級維持“買進”。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-1-2016 07:42 PM

|

显示全部楼层

发表于 5-1-2016 07:42 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 5-1-2016 09:03 PM

|

显示全部楼层

发表于 5-1-2016 09:03 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 5-1-2016 09:04 PM

|

显示全部楼层

发表于 5-1-2016 09:04 PM

|

显示全部楼层

之前的年报,冷眼先生

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 01:40 PM

|

显示全部楼层

发表于 6-1-2016 01:40 PM

|

显示全部楼层

本帖最后由 icy97 于 6-1-2016 01:49 PM 编辑

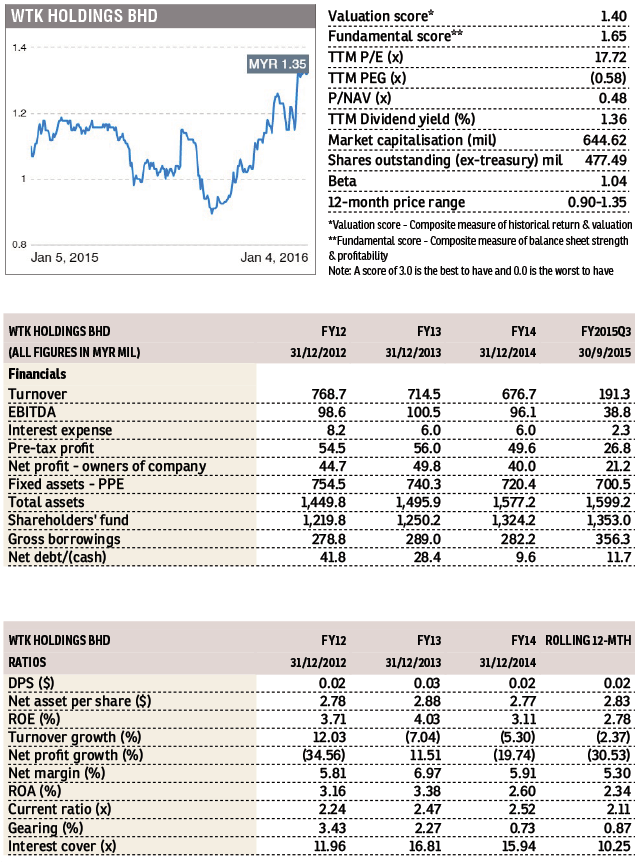

Stock With Momentum: WTK

By Asia Analytica / The Edge Financial Daily | January 6, 2016 : 10:20 AM MYT

http://www.theedgemarkets.com/my/article/stock-momentum-wtk

WTK Holdings Bhd ( Valuation: 1.40, Fundamental: 1.65) (-ve)

SHARES of WTK (Fundamental: 1.65/3, Valuation: 1.4/3) saw active trading yesterday, closing 8.2% higher at RM1.46.

WTK is primarily involved in the extraction and sale of timber, plywood, veneer and sawn timber, which accounted for about 81% of its revenue in 2014. The company also trades and manufactures various foil and tapes products, cultivates oil palms, and provides offshore service vessels to oil majors.

In 2014, WTK derived 87.0% of its revenue from export, with key markets being Japan, India and Taiwan.

For 3Q2015, net profit expanded an outsized 78.1% y-y to RM21.2 million on the back of a 23.0% increase in revenue to RM191.3 million, due to increased sales of plywood products and higher forex gains.

WTK entered into a sale and purchase agreement last October, to dispose of its investment properties at Wisma Central for RM51.0 million. The transaction is expected to give rise to a disposal gain of approximately RM16 million upon completion.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-2-2016 06:30 PM

|

显示全部楼层

发表于 3-2-2016 06:30 PM

|

显示全部楼层

本帖最后由 icy97 于 3-2-2016 07:20 PM 编辑

多空一线:黄传宽控股 上挑RM1.55

财经 股市 多空一线 2016-02-03 12:06

http://www.nanyang.com/node/746838?tid=704

周二,日股与港股纷纷下跌,冲击马股的后市表现,重量级蓝筹股主导整体大市回落。

期间,马股交投活动划出一个巩固回调的利淡走势,于1655点水平线上,取得应有的技术支撑。

富时隆综指于2月2日,处于1653.18点报收,按日跌14.63点或0.88%。

黄传宽控股(WTK,4243,主板工业产品股)于2月2日闭市时反弹了。它于闭市时收1.45令吉,按日涨6仙或4.32%。

黄传宽控股的日线图表走势,于2月2日的交投趋势,上破一道短线顶头阻力线(B1:B2)上报收。

它的日线平滑异同移动均线指标(MACD),于2016年2月2日的交投走势,已处于一段持续上升趋势。

它处于“0”支撑线上波动,黄传宽控股的后市交投走势,料会出现一段回试下限支持线的支撑。

黄传宽控股的日线图表走势于回试后,或会显现一段反弹走势,或会上挑1.46至1.55令吉的阻力位。

免责声明

本文纯属技术面分析,仅供参考,并非推荐购买。投资前请咨询专业金融师。

敏源 技术分析教父

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2016 05:24 PM

|

显示全部楼层

发表于 26-2-2016 05:24 PM

|

显示全部楼层

本帖最后由 icy97 于 26-2-2016 06:26 PM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 208,523 | 170,515 | 724,241 | 676,652 | | 2 | Profit/(loss) before tax | 30,714 | -37 | 75,869 | 49,611 | | 3 | Profit/(loss) for the period | 25,818 | 1,792 | 58,547 | 39,498 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 26,415 | 2,333 | 59,559 | 39,978 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.53 | 0.54 | 12.47 | 9.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.49 | 1.83 | 2.49 | 1.83 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8900 | 3.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2016 06:26 PM

|

显示全部楼层

发表于 26-2-2016 06:26 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Proposed Final Dividend | The Board of Directors of W T K Holdings Berhad recommended a final single-tier dividend of 4.98% or 2.49 sen net per share of RM0.50 each in respect of the financial year ended 31 December 2015 ("Proposed Final Dividend") for shareholders' approval at the forthcoming Annual General Meeting.

The entitlement and payment dates for the Proposed Final Dividend have yet to be decided and shall be announced at a later date.

This announcement is dated 26 February 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2016 08:17 PM

|

显示全部楼层

发表于 8-3-2016 08:17 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2016 02:36 AM

|

显示全部楼层

发表于 30-5-2016 02:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 194,345 | 159,769 | 194,345 | 159,769 | | 2 | Profit/(loss) before tax | 8,838 | 7,572 | 8,838 | 7,572 | | 3 | Profit/(loss) for the period | 5,828 | 5,182 | 5,828 | 5,182 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,193 | 5,335 | 6,193 | 5,335 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.30 | 1.12 | 1.30 | 1.12 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.9000 | 2.8900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-6-2016 05:49 PM

|

显示全部楼层

发表于 3-6-2016 05:49 PM

|

显示全部楼层

本帖最后由 icy97 于 3-6-2016 08:16 PM 编辑

EX-date | 17 Jun 2016 | Entitlement date | 21 Jun 2016 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single-Tier Dividend of 4.98% or 2.49 sen net per share of RM0.50 each in respect of the financial year ended 31 December 2015 | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Symphony Share Registrars Sdn BhdLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul Ehsan, MalaysiaTel. No: 603-7841 8000 / 603-7849 0777Fax. No: 603-7841 8151 / 603-7841 8152 | Payment date | 05 Jul 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 Jun 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 4.98 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2016 02:54 AM

|

显示全部楼层

发表于 6-6-2016 02:54 AM

|

显示全部楼层

黃傳寬家族掀爭權糾紛 3年涉34宗案件

2016年5月31日

(吉隆坡31日訊)已故砂州知名企業家及富商拿督斯里黃傳寬一手創辦的木業王朝正處多事之秋,黃傳寬控股(WTK,4243,主要板工業)旗下黃傳寬房地產私人有限公司目前涉及多達34宗錯綜複雜的股權糾紛案件,當中更有家族成員被指以欺詐手法騙取股權。

財經週刊《The Edge》報導,由于各持己見,上述所有案件正在詩巫高庭審理,當中涉及多宗起訴及反訴案件,部份更多是私人恩怨,有些還被拖延長達至少3年,迄今仍無法和解。

黃傳寬房地產是黃氏家族私人投資公司,持有黃傳寬控股13.6%股權。

上述家族糾紛始于黃傳寬次子,也是黃傳寬控股前總執行長黃啟耐于2013年3月11日逝世開始。

黃啟耐是黃傳寬房地產大股東,持有49.8%股權,其子黃豪良(譯音)則持股4.88%,黃啟耐及兒子總持股權共54.68%。

黃傳寬控股主席邦曼查拿督黃啟曄(76歲)及非執行董事黃啟哲(譯音)則分別持有黃傳寬房地產公司22.66%股權或817萬股,當中有525萬股被指是以非法手段從黃啟耐處騙取。

但黃啟曄及黃啟哲也指責,黃啟耐手中有125萬股是于2004年8月從父親黃傳寬手中不法騙取,因此在2013年3月28日將黃啟耐遺孀馬蔚鳳(譯音,黃啟耐的遺產執行人)及黃傳寬房地產告上法庭,要求法庭判處2007年9月28日發給黃啟耐的400萬股無效,因為該批股權並沒有在常年股東大會上尋求審批。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-6-2016 02:28 AM

|

显示全部楼层

发表于 7-6-2016 02:28 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-6-2016 03:01 AM

|

显示全部楼层

发表于 8-6-2016 03:01 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | W T K Holdings Berhad ("WTK" or "the Company")-Clarification on articles appearing in The Edge Malaysia on 30 May 2016 entitled "Family feud rocks Sarawak's WTK" and on 6 June 2016 entitled "WTK Holdings' top brass allays concerns over family tussle" | Reference is made to the aforesaid articles appearing in The Edge Malaysia, on 30 May 2016 and 6 June 2016 in relation to the ongoing family tussle of Pemanca Datuk Wong Kie Yik and Mr Wong Kie Chie, both who are directors and substantial shareholders of WTK with Datin Kathryn Ma and her family.

Please be informed that :- a) the litigation reported in the aforesaid articles is between the families of Pemanca Datuk Wong Kie Yik and Mr Wong Kie Chie with the family of Datin Kathryn Ma; and b) the Company and its group of companies is not party to nor is involved in any of the litigation mentioned in the aforesaid articles.

The Company will make the necessary announcements in the event the aforesaid litigation has an impact on the Company.

This announcement is dated 7 June 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-6-2016 12:15 AM

|

显示全部楼层

发表于 20-6-2016 12:15 AM

|

显示全部楼层

本帖最后由 icy97 于 20-6-2016 02:00 AM 编辑

WTK控股被低估了?

http://www.sinchew.com.my/node/1538718/

读者Vivia问:

WTK控股(WTK,4243,主板工业产品组)前景如何?是否被低估?曾经听闻会建炼油厂,是否属实呢?

答:WTK控股宣布截至2016年3月31日为止首季业绩时,谈到各业务领域的未来前景,包括木材、种植、油气及制造业与贸易领域。

在木材业务方面,该公司认为,兴衰与全球经济表现息息相关。至于数项影响全球经济因素,包括中国经济成长放缓程度、美国经济复苏能否持续、以及欧洲经济会否转为滞胀等。

日本为该公司三合板的其中主要出口市场;预料日本2016年经济成长可达1.5%,惟前景还是深具挑战,特别是最近季度年度化萎缩了1.1%。它在2016年首季的房屋开工按年增长率为5.5%,惟按季则下跌6.8%。

该公司认为,随着日本经济成长升温,预料最近季度的三合板价格受挤压,及库存偏高的劣势料有所改善。

印度则是该公司的主要树桐出口市场。

预料印度2016年经济成长持续蓬勃,主要是受到原油价格走低,以及信贷宽松等利好的推动与支持。

种植业务方面,最近季度的鲜果串产量按年增加68.5%,预料回酬率将持续改善,因旗下棕油业务进入高产量回酬的周期。政府的生物柴油政策也将推动原棕油的需求,使原棕油价格仍会向上扬升。

制造与贸易业务方面,虽然市场波动及经济情况具挑战,该公司将专注其核心产品的竞争力、加强品牌以为客户提供与众不同的产品。

将以更高加值产品扩充新市场

该公司将通过更高加值及替代产品以扩充至新市场。该公司谨慎看待此业务,并预料2016年取得适度成长。

该公司油气业务旗下的住宿工作船的需求仍然强稳,目前出租给国油及旗下的采油业务。同时,该公司也在砂州为油气管服务与维修领域提供工程服务,预料将为公司未来2年财务表现作出正面贡献。该公司也将积极地参与大马及邻国(如汶莱)的其他工程竞标活动。该公司有信心攫取额外工程合约,以维持公司业务成长及赚利。

至于该公司估值是否被低估,兴业研究在2015年11月30日的研究报告中给予该公司的合理目标价为1令吉45仙。同时,看看其最新季度业绩表现以供参考。

截至2016年3月31日止第一季,WTK控股的净利为619万3000令吉(每股净利为1.30仙)、前期净利为533万5000令吉(每股净利为1.12仙)。营业额为1亿9434万5000令吉,前期为1亿5976万9000令吉。该公司每股资产值为2令吉90仙。

至于该公司会否建炼油厂,这里找不到有关资料而未能确定。

文章来源:

星洲日报/投资致富.投资问诊.文:李文龙.2016.06.19 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|