|

|

发表于 3-1-2018 02:48 AM

|

显示全部楼层

发表于 3-1-2018 02:48 AM

|

显示全部楼层

本帖最后由 icy97 于 4-1-2018 06:31 AM 编辑

MAA集团营运总监退休

2018年1月4日

(吉隆坡3日讯)MAA集团(MAA,1198,主板金融股)宣布,营运总监姚杜杰(译音)退休,今日生效。

MAA集团今日向交易所报备,今年60岁的姚杜杰宣布退休,他持有该集团0.03%股权。

姚杜杰是英国特许公认会计师协会(ACCA)和大马会计师协会(MIA)的成员。

他于1980年完成学业,在会计和金融方面拥有丰富经验,曾在保险公司和会计所担任多种职位。

2002年5月,他加入MAA集团担任营运总监的职位,一直到去年12月31日宣告退休。在这之前,他曾在马联合保险有限公司担任多项职位。【e南洋】

Date of change | 02 Jan 2018 | Name | MR YEO TOOK KEAT | Age | 60 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Chief Operating Officer | New Position | Non Executive Director | Directorate | Non Independent and Non Executive | Qualifications | Mr Yeo is a Fellow of The Association of Chartered Certified Accountants, United Kingdom and a Member of the Malaysian Institute of Accountants. | Working experience and occupation | Mr Yeo has vast experience in accounting and finance having served with various capacities in insurance companies and audit firms upon completing his studies in 1980. He joined Malaysian Assurance Alliance Berhad in 1986 and has held several positions, the last of which was as Senior Vice President Finance & Administration before his transfer to MAA Group Berhad in May 2002 as the Group Chief Operating Officer until his retirement on 31 December 2017. | Family relationship with any director and/or major shareholder of the listed issuer | Mr Yeo does not have any family relationship with any director and/or major shareholders of the Company. | Any conflict of interests that he/she has with the listed issuer | Mr Yeo does not have any personal interest in any business arrangements involving the Company. | Details of any interest in the securities of the listed issuer or its subsidiaries | Mr Yeo has direct shareholdings of 80,000 (0.03%) in MAA Group Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2018 05:57 AM

|

显示全部楼层

发表于 6-3-2018 05:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 43,744 | 3,951 | 119,024 | 297,438 | | 2 | Profit/(loss) before tax | -3,961 | -21,427 | 28,626 | 266,537 | | 3 | Profit/(loss) for the period | -5,379 | -21,369 | 26,344 | 262,742 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,479 | -21,369 | 25,136 | 262,290 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.00 | -7.40 | 9.19 | 92.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.09 | 0.41 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0500 | 2.0000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2018 02:59 AM

|

显示全部楼层

发表于 11-3-2018 02:59 AM

|

显示全部楼层

EX-date | 22 Mar 2018 | Entitlement date | 26 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Dividend of 3 sen per share under the Single-Tier System in respect of the financial year ending 31 December 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | 26 Mar 2018 to 26 Mar 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRACE MANAGEMENT SERVICES SDN BHDSuite 12.03, 12th Floor566 Jalan Ipoh51200 Kuala LumpurTel: 03-6252 8880Fax: 03-6252 8080 | Payment date | 25 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 26 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 06:53 AM

|

显示全部楼层

发表于 11-4-2018 06:53 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-4-2018 02:33 AM

|

显示全部楼层

发表于 23-4-2018 02:33 AM

|

显示全部楼层

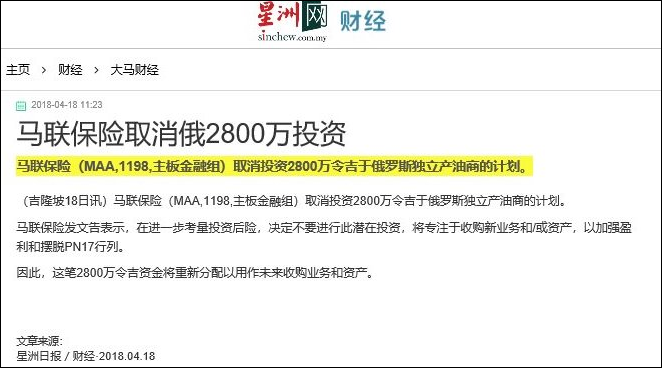

Type | Announcement | Subject | OTHERS | Description | MAA GROUP BERHAD ("MAAG" OR "COMPANY") PROPOSED VARIATION TO THE UTILISATION OF PROCEEDS FROM THE DISPOSAL OF MAA TAKAFUL BERHAD ("PROPOSAL") | We refer to the announcement dated 3 April 2018 in relation to the Proposal (“Announcement”).

Unless otherwise stated, all the abbreviations used herein shall have the same meanings as those used in the Announcement.

As set out in Section 2, note (d) of the Announcement, the Company had initially proposed to vary RM28.00 million from the utilisation of proceeds for future investment opportunities/prospective new business to be acquired and to utilise the aforesaid amount for a potential investment in an independent oil producer in Kaliningrad, Russia (“Potential Investment”). Following further consideration by the Board, the Company wishes to announce that the Board has decided not to proceed with the Potential Investment after assessing the risks associated with the Potential Investment and would like to focus on acquiring new business(es) and/or assets to enhance MAAG’s earnings profile, regulate its financial condition and address its PN17 status.

In this regard, the amount of RM28.00 million will be re-allocated for future investment opportunities/prospective businesses and/or assets to be acquired by the Group. Relevant announcement(s) will be made by the Company where required.

Save as disclosed above, there are no changes to the other details relating to the Proposal.

The circular to shareholders containing details of the Proposal will be despatched to the shareholders of MAAG in due course.

This announcement is dated 17 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2018 04:38 AM

|

显示全部楼层

发表于 29-5-2018 04:38 AM

|

显示全部楼层

本帖最后由 icy97 于 30-5-2018 01:36 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 39,164 | 4,036 | 39,164 | 4,036 | | 2 | Profit/(loss) before tax | -11,196 | -1,290 | -11,196 | -1,290 | | 3 | Profit/(loss) for the period | -12,621 | -1,319 | -12,621 | -1,319 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -12,630 | -1,319 | -12,630 | -1,319 | | 5 | Basic earnings/(loss) per share (Subunit) | -4.62 | -0.48 | -4.62 | -0.48 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 6.00 | 3.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9700 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2018 02:22 AM

|

显示全部楼层

发表于 28-6-2018 02:22 AM

|

显示全部楼层

Name | MELEWAR EQUITIES SDN BHD | Address | Suite 12.03, 12th Floor

No. 566, Jalan Ipoh

Kuala Lumpur

51200 Wilayah Persekutuan

Malaysia. | Company No. | 89878-X | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 25 Jun 2018 | 38,513,030 | Disposed | Direct Interest | Name of registered holder | Melewar Equities Sdn Bhd | Address of registered holder | Suite 12.03, 12th Floor, No. 566, Jalan Ipoh, 51200 Kuala Lumpur | Description of "Others" Type of Transaction | | | 2 | 25 Jun 2018 | 78,839,140 | Acquired | Deemed Interest | Name of registered holder | Melewar Acquisitions Limited | Address of registered holder | Craigmuir Chambers Road Town, Tortola VG 1110 British Virgin Islands | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | 1) Disposal of 38,513,030 ordinary shares by Melewar Equities Sdn Bhd via married deal transaction.2) Acquisition of 78,839,140 ordinary shares by Melewar Acquisitions Limited via married deal transaction. | Nature of interest | Direct and Indirect Interest | Direct (units) | 0 | Direct (%) | 0 | Indirect/deemed interest (units) | 78,839,140 | Indirect/deemed interest (%) | 28.824 | Total no of securities after change | 78,839,140 | Date of notice | 27 Jun 2018 | Date notice received by Listed Issuer | 27 Jun 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2018 02:22 AM

|

显示全部楼层

发表于 28-6-2018 02:22 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | MELEWAR ACQUISITIONS LIMITED | Address | Craigmuir Chambers, Road Town, Tortola, VG 1110, British Virgin Islands.

Virgin Islands, British. | Company No. | 1959962 | Nationality/Country of incorporation | Virgin Islands, British | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Melewar Acquisitions Limited Craigmuir Chambers, Road Town, Tortola, VG 1110, British Virgin Islands. |

| Date interest acquired & no of securities acquired | Date interest acquired | 25 Jun 2018 | No of securities | 78,839,140 | Circumstances by reason of which Securities Holder has interest | Acquisition via married deal transaction. | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 78,839,140 | Direct (%) | 28.824 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 27 Jun 2018 | Date notice received by Listed Issuer | 27 Jun 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 05:31 AM

|

显示全部楼层

发表于 31-8-2018 05:31 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 40,827 | 29,998 | 79,991 | 34,034 | | 2 | Profit/(loss) before tax | 370 | 24,385 | -10,826 | 23,095 | | 3 | Profit/(loss) for the period | -1,177 | 23,891 | -13,798 | 22,572 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,158 | 23,653 | -13,788 | 22,334 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.42 | 8.65 | -5.04 | 8.17 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 3.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9400 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 05:33 AM

|

显示全部楼层

发表于 31-8-2018 05:33 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MAA GROUP BERHAD ("MAAG" OR "THE COMPANY") - INCORPORATION OF NEW COMPANY BY SUBSIDIARY COMPANY | The Board of Directors of MAAG wishes to announce that its wholly owned subsidiary, MAA Corporation Sdn Bhd (Company No. 160773-W) has on 29 August 2018 incorporated a company by the name of MAAX Venture Sdn. Bhd. (“MAAXVENTURE”) with paid-up capital of RM2.00 consist of two (2) ordinary shares with issue price of RM1.00 each.

The intended principal activity of MAAXVENTURE is to carry on peer to peer ("P2P") financing business. MAAXVENTURE will be making submission to the Securities Commission of Malaysia for approval to operate the P2P financing.

The Company received the Certificate of Incorporation of the MAAXVENTURE on 29 August 2018.

This announcement is dated 29 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-12-2018 06:50 AM

|

显示全部楼层

发表于 4-12-2018 06:50 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 45,271 | 42,310 | 125,262 | 76,344 | | 2 | Profit/(loss) before tax | -1,863 | 49 | -12,689 | 23,144 | | 3 | Profit/(loss) for the period | -2,603 | 481 | -16,401 | 23,053 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,633 | 91 | -16,421 | 22,425 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.96 | 0.03 | -6.00 | 8.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 3.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9300 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2019 04:23 AM

|

显示全部楼层

发表于 13-1-2019 04:23 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MAA Group Berhad ("MAAG" or "the Company")Proposed disposal by Columbus Capital Singapore Pte Ltd ("CCS"), a sub-subsidiary of MAAG of 47.95% equity interest held in Columbus Capital Pty Limited ("CCA") ("Proposed Disposal") | 1. THE PROPOSED DISPOSAL

The Board of Directors of MAAG (“Board”), wishes to announce that on 10 December 2018, CCS, a wholly owned subsidiary of MAA International Investments Ltd (“MAAII”), which in turn is a wholly owned subsidiary of MAA Corporation Sdn Bhd, which in turn is a wholly owned subsidiary of the Company had entered into a Share Sale Agreement (“SSA”) with Consortia Group Holdings Pty Limited (“Consortia” or the “Purchaser”), for the disposal of 24,336,000 shares which is equivalent to 47.95% equity interest held in CCA (“Sale Shares”) at a total cash consideration of AUD21.0 million (“Disposal Consideration”).

2. BASIS OF ARRIVING AT THE DISPOSAL CONSIDERATION

The Disposal Consideration of AUD21.0 million was arrived at on a willing buyer willing seller basis and after taking into account the following financial considerations:

(a) CCA’s net assets of AUD20.9 million based on its unaudited financial statements as at 30 September 2018; and (b) a price-to-book ratio of approximately 2.09 times based on CCA’s unaudited net assets as at 30 September 2018.

3. SALIENT TERMS OF SSA

The salient terms of SSA include, among others, the following:

3.1 Disposal Consideration

The Disposal Consideration for the Sale Shares is AUD21.0 million.

3.2 Manner of Payment of the Disposal Consideration

The Disposal Consideration of AUD21.0 million shall be satisfied in cash by the Purchaser in the following manner:

(a) the initial consideration of AUD19,459,010 at Completion; and (b) the balance consideration of AUD1,540,990 to be paid 12 months from Completion.

3.3 Completion Deliverables

Before Completion, each party must perform, or procure the performance of among others, the following actions:

(a) A board resolution of CCS approving CCS’s entry into the SSA and the transaction contemplated by the SSA; (b) A board resolution of Consortia approving Consortia’s entry into the SSA and the transaction contemplated by the SSA and procure the passing of board resolution of Consortia’s nominee approving Consortia’s nominee acquisition of the one share pursuant to the SSA; and (c) Consortia to procure the payment or repayment of RM266,374.28 to any member of CCS.

3.4 Completion

The completion of the sale and purchase of the shares shall take place on 20 December 2018 or such other date agreed by CCS and Consortia in writing.

4. LIABILITIES TO BE ASSUMED BY THE PURCHASER

There are no liabilities to be assumed by the Purchaser arising from the Proposed Disposal.

5. COSTS OF INVESTMENT

CCS’s costs of investment in CCA are as follows:

| Type of Shares | Date of Investment | No. of Shares held in CCA | Cost of Investment | | | | '000 | RM'000 | | | | | | | Ordinary Shares | 28 September 2009 | 2,000 | -(*) | | Series A Preference Shares | 6 October 2006 28 September 2009 | 16,500 | 45,976 | | Series B Preference Shares | 21 September 2012 29 May 2013 | 5,836 | 9,308 | | | | | | | | Total | 24,336 | 55,284 |

(*) negligible

6. INFORMATION ON CCA

CCA was incorporated in Australia under the Corporation Act 2001 on 4 May 2006 which is principally involved in retail mortgage lending and loan securitisation.

The issued share capital of CCA and the list of CCA’s shareholders are as follows:

| | No. of Share | CCS's shareholding | Consortia's shareholding | | | No. of share | No. of share | | '000 | '000 | % | '000 | % | | | | | | | | | Ordinary shares | 22,000 | 2,000 | 9.09% | 20,000 | 90.91% | | Series A Preference Shares | 17,500 | 16,500 | 94.29% | 1,000 | 5.71% | | Series B Preference Shares | 11,250 | 5,836 | 51.88% | 5,414 | 48.12% | | | | | | | | | Total | 50,750 | 24,336 | 47.95% | 26,414 | 52.05% |

The key financial information of CCA for the past three (3) financial years ended 31 December (“FYE”) 2015 to FYE 2017 are set out below:

| | Audited | | | FYE 2015 | FYE 2016 | FYE 2017 | | | (AUD'000) | (AUD'000) | (AUD'000) | | Revenue | 49,063 | 62,772 | 88,244 | | Profit after tax | 633 | 1,229 | 3,817 | | Net assets | 13,821 | 13,789 | 19,052 |

7. INFORMATION ON CONSORTIA, THE PURCHASER

Consortia is a company incorporated in Australia under the Corporation Act 2001 on 4 May 2006. The principal activity of the company is investment holding.

As at 30 November 2018, the issued and paid-up share capital of Consortia is AUD3,301,000.

8. UTILISATION OF PROCEEDS

The proceeds of AUD21.0 million to be received from the Proposed Disposal are intended to be utilised towards future investment opportunities/prospective new businesses of the Company. As at the date of this announcement, the Board has not yet identified any potential investment opportunities. The Board is still evaluating options for the optimal utilisation of the said proceeds in order to maximize its shareholders’ value.

The Company will make the necessary announcements on any material developments in respect of the above in accordance with the Main Market Listing Requirements of Bursa Malaysia Securities Berhad (“Listing Requirements”). If the nature of the transaction requires shareholders’ approval pursuant to the Listing Requirements, the Board will seek the necessary approval from the shareholders of MAAG at an Extraordinary Meeting to be convened.

9. RATIONALE FOR THE PROPOSED DISPOSAL

The Proposed Disposal represents an excellent opportunity for MAAG to unlock and realise the value of its investment in CCA at a satisfactory price.

10. EFFECTS OF THE PROPOSED DISPOSAL

10.1 Share Capital

The Proposed Disposal will not have any effect on the issued and paid-up share capital of the Company as the Disposal Consideration will be satisfied by way of cash.

10.2 Net Assets (“NA”) per Share and Gearing

For illustration purpose, the proforma effects of the Proposal Disposal on the NA per MAAG share and gearing of the MAAG group based on its latest audited consolidated financial statements as at 31 December 2017 are set out below:

| Group Level | Audited as at 31 December 2017 | After Proposed Disposal | | | RM'000 | RM'000 | | | | | | Share capital | 304,354 | 304,354 | | Retained earnings | 259,140 | (*) 258,951 | | Reserves | (4,168) | (*) 3,727 | | Equity attributable to owners of the Company | 559,326 | 567,032 | | Non-controlling interests | 3,300 | 3,300 | | Total equity | 562,626 | 570,332 | | | | | | No. of MAAG shares | 273,518 | 273,518 | | NA per MAAG share (RM) | 2.04 | 2.07 | | Total borrowings (RM’000) | - | - | | Gearing ratio (times) | - | - |

Note: (*) For illustration purpose, based on the audited consolidated financial statements of MAAG as at 31 December 2017 and on the assumption that the Proposed Disposal had been completed on that date, the MAAG group expects to realise the following proforma effect:

| | RM'000 | | - Gain on disposal | 7,706 | | - Reclassification of exchange differences from other comprehensive income to profit or loss upon disposal | (7,895) | | Net proforma effect | (189) |

10.3 Substantial Shareholders’ Shareholdings

The Proposed Disposal will not have any effect on the shareholdings of the substantial shareholders of the Company and will not result in a change in the controlling or dominant shareholder of the Company.

10.4 Earnings and Earnings per Share (“EPS”)

The Proposed Disposal is expected to increase the earnings and EPS of the MAAG group for the financial year ending 31 December 2018. The MAAG group expects to realise a non-recurring gain on disposal arising from the Proposed Disposal. However, the actual gain on the Proposed Disposal can only be determined on the completion date, 20 December 2018.

11. APPROVALS REQUIRED

The Proposed Disposal is not subject to and conditional upon approvals from the shareholders of the Company or any other relevant government authorities.

12. DIRECTORS’ AND/OR MAJOR SHAREHOLDERS’ INTERESTS AND/OR PERSONS CONNECTED TO THEM

None of the directors and/or major shareholders of MAAG and/or persons connected to them have any interest, direct or indirect, in the Proposed Disposal.

13. DIRECTORS’ STATEMENT

The Board of Directors of MAAG, after taking into consideration of the rationale for the Proposed Disposal, is of the opinion that the Proposed Disposal is in the best interest of the Company.

The Proposed Disposal is not expected to result in the Company becoming a Cash Company.

14. ESTIMATED TIME FRAME FOR THE COMPLETION OF THE PROPOSED DISPOSAL

Barring any unforeseen circumstances and subject to the fulfillment of all terms and conditions as set out in SSA, the Proposed Disposal is expected to be completed on 20 December 2018.

15. HIGHEST PERCENTAGE RATIO APPLICABLE TO THE PROPOSED DISPOSAL

The highest percentage ratio applicable to this Proposed Disposal as per paragraph 10.02(g) of the Listing Requirements is approximately 24.47%.

16. DOCUMENTS FOR INSPECTION

A copy of the SSA is available for inspection at the registered office of MAAG during office hours from Monday to Friday (except for public holidays) at Suite 11.05, 11th Floor, No. 566, Jalan Ipoh, 51200 Kuala Lumpur for a period of three (3) months from the date of this announcement.

This announcement is dated 10 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 06:36 AM

|

显示全部楼层

发表于 15-1-2019 06:36 AM

|

显示全部楼层

Date of change | 08 Feb 2019 | Name | DATUK MUHAMAD UMAR SWIFT | Age | 54 | Gender | Male | Nationality | Australia | Designation | Chief Executive Officer | Directorate | Executive | Type of change | Resignation | Reason | Datuk Muhamad Umar Swift has tendered his resignation as Chief Executive Officer / Group Managing Director of MAA Group Berhad as he has been offered the position as Chief Executive Officer of Bursa Malaysia Berhad effective 11 February 2019. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Economics | Monash University, Clayton, Australia | Bachelor of Economics | | 2 | Professional Qualification | Accounting | Institute of Chartered Accountants, Australia | Associate Member | | 3 | Professional Qualification | Accounting | CPA Australia | Member | | 4 | Professional Qualification | Taxation | Taxation Institute of Australia | Fellow Member | | 5 | Professional Qualification | Financial Services | Financial Services Institute of Australasia, Australia | Fellow Member | | 6 | Professional Qualification | Accounting | Malaysian Institute of Accountants | Chartered Accountant | | 7 | Professional Qualification | Financial Planning | Malaysian Financial Planning Council | Registered Member | | 8 | Others | Applied Finance and Investment | Securities Institute of Australia | Graduate Diploma |

Working experience and occupation | Present Appointment(s):- Chief Executive Officer ("CEO") / Group Managing Director, MAA Group Berhad- Director, Columbus Capital Pty Limited- Director, MAA General Assurances Philippines, Inc.- Director, MAA International Group- Director, MCIS Insurance Berhad- Member, Board of Trustees, MAA-Medicare Charitable Foundation- Member, Board of Trustees, The Budimas Charitable Foundation- Member, Board of Trustees, Anaho FoundationPast Directorship(s) and/or Appointment(s):- Non-Independent Non-Executive Director, MAA Takaful Berhad (May 2007 - June 2016)- Director, MAAKL Mutual Berhad (March 2008 - December 2013)- Director, Federation of Investment Managers Malaysia (2012 - 2014)- CEO, Malaysian Assurance Alliance Berhad (August 2008 - September 2011)- Deputy CEO, Malaysian Assurance Alliance Berhad (June 2006 - July 2008)- Head, Enterprise Financial Services Group, Malayan Banking Berhad (April 2004 - May 2006)- Director, Mayban Allied Credit & Leasing Sdn Bhd (August 2005 - April 2006)- Director, Mayban Ventures Sdn Bhd (2004 to December 2006)- Practice Leader, Utilities Business, Deloitte Consulting in Malaysia (September 2003 - March 2004)- CEO, Gas Malaysia Sdn Bhd (July 1997 - December 2002)- General Manager, Corporate Finance, Gas Malaysia Sdn Bhd (January 1996- June 1997)- Manager Corporate Banking, Bank of Singapore (Australia) Limited (January 1994 - December 1995)- Manager Corporate Finance, Bank of Singapore (Australia) Limited (November 1992 - December 1993)- Manager, Corporate Recovery, Price Waterhouse (July 1990 - November 1992)- Audit Senior, Price Waterhouse (January 1986 to June 1990) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2019 04:07 AM

|

显示全部楼层

发表于 25-1-2019 04:07 AM

|

显示全部楼层

icy97 发表于 13-1-2019 04:23 AM

(*) negligible

6. INFORMATION ON CCA

CCA was incorporated in Australia under the Corporation Act 2001 on 4 May 2006 which is principally involved in retail mortgage lending and loan securit ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MAA Group Berhad ("MAAG" or "the Company")Proposed disposal by Columbus Capital Singapore Pte Ltd ("CCS"), a sub-subsidiary of MAAG of 47.95% equity interest held in Columbus Capital Pty Limited ("CCA") ("Proposed Disposal") | Reference is made to the announcements made by MAAG on 10 December 2018 and 20 December 2018 in relation to the Share Sale Agreement (“Agreement”) executed between CCS, who is a sub-subsidiary of the Company, with Consortia Group Holdings Pty Limited ("Consortia"), for the disposal of 24,336,000 shares which is equivalent to 47.95% equity interest held in CCA by CCS to Consortia.

The Board of Directors of MAAG wishes to announce that the Proposed Disposal has been completed on 27 December 2018 in accordance with terms and conditions of the Agreement.

This announcement is dated 27 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2019 08:32 AM

|

显示全部楼层

发表于 3-3-2019 08:32 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MAA GROUP BERHAD ("MAAG" OR "COMPANY")PROPOSED SELECTIVE CAPITAL REDUCTION AND REPAYMENT EXERCISE PURSUANT TO SECTION 116 OF THE COMPANIES ACT, 2016 ("PROPOSED SCR") | The Board of Directors of the Company (“Board”) wishes to announce that the Company has today received a letter from Melewar Acquisitions Limited and Melewar Equities (BVI) Ltd (collectively, “Non-Entitled Shareholders”), in their capacity as major shareholders of the Company, requesting the Company to undertake a selective capital reduction and repayment exercise pursuant to Section 116 of the Companies Act, 2016 (“SCR Offer Letter”).

The Proposed SCR entails a selective capital reduction and a corresponding capital repayment of a proposed cash amount of RM1.10 for each ordinary share in MAAG held by all the shareholders of MAAG (other than the Non-Entitled Shareholders) whose names appear in the Record of Depositors of the Company as at the close of business on an entitlement date to be determined and announced later by the Board (“Entitled Shareholders”).

The Board, except for Tunku Dato’ Yaacob Khyra and Tunku Yahaya @ Yahya Bin Tunku Tan Sri Abdullah (“ Interested Directors”), who are deemed to be interested in the Proposed SCR, will deliberate on the Proposed SCR and decide on the next course of action.

In this regard, the Board has today appointed Affin Hwang Investment Bank Berhad as the Principal Adviser in relation to the Proposed SCR, and will appoint an independent adviser to provide comments, opinions, information and recommendations to the Board (except for the Interested Directors) and to the Entitled Shareholders in respect of the Proposed SCR.

Further announcements will be made in due course after the Board’s deliberations.

Please refer to the attached SCR Offer Letter for further details on the Proposed SCR.

This announcement is dated 27 February 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6077553

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2019 07:59 AM

|

显示全部楼层

发表于 6-3-2019 07:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 43,594 | 42,680 | 168,856 | 119,024 | | 2 | Profit/(loss) before tax | -11,684 | 5,484 | -24,373 | 28,628 | | 3 | Profit/(loss) for the period | -10,937 | 3,291 | -27,338 | 26,344 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -11,036 | 2,711 | -27,457 | 25,136 | | 5 | Basic earnings/(loss) per share (Subunit) | -4.03 | 0.99 | -10.04 | 9.19 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 3.00 | 3.00 | 9.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9400 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-6-2019 07:38 AM

|

显示全部楼层

发表于 26-6-2019 07:38 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MAA GROUP BERHAD ("MAAG" or "the Company")CLARIFICATION OF NEWSPAPER ARTICLES IN THE STAR BIZWEEK DATED 18 MAY 2019 AND THE EDGE MALAYSIA DATED 20 MAY 2019 | The terms used herein shall have the same meaning as those defined in the Company’s announcement dated 29 March 2019 in relation to the Proposed SCR, unless otherwise stated.

Reference is made to the article entitled “Obstacles ahead for MAA’s privatisation plan” which appeared on page 3 of The Star Bizweek on Saturday, 18 May 2019 (“Star Bizweek Article”) and the article entitled “MAA minorities want more from privatisation offer” which appeared on pages 19 and 60 of The Edge Malaysia on 20 May 2019 (“Edge Malaysia Article”).

In the Star Bizweek Article, it was mentioned that “MAA, in email replies, tells Star BizWeek that under the Takeover Code issued by the Securities Commission, the offeror of the SCR is not allowed to revise the price”.

In the Edge Malaysia Article, it was mentioned that Tunku Dato' Yaacob Khyra had stated that ‘the offer price cannot be changed as the circular is already out’, and quoted him as saying that “there is no way to change it – Melewar can only make another offer in 12 months”.

In this regard, the Board wishes to clarify that the Rules do not impose any restriction on revisions to the Offer Price under the Proposed SCR. As such, the Joint Offerors may, at their discretion, propose a revised Offer Price, provided that all parties involved (including the Independent Adviser and the shareholders of the Company) are given sufficient time to consider the revised Offer Price prior to the EGM or any adjournment thereof.

With further reference to the Star Bizweek Article, the Board wishes to inform that the above-quoted statement was not made by the Board or the Company.

This announcement is dated 21 May 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2019 08:39 AM

|

显示全部楼层

发表于 4-7-2019 08:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 44,243 | 39,164 | 44,243 | 39,164 | | 2 | Profit/(loss) before tax | 7,782 | -11,196 | 7,782 | -11,196 | | 3 | Profit/(loss) for the period | 6,597 | -12,621 | 6,597 | -12,621 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,566 | -12,630 | 6,566 | -12,630 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.40 | -4.62 | 2.40 | -4.62 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 3.00 | 0.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9600 | 1.9400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2019 05:00 AM

|

显示全部楼层

发表于 23-7-2019 05:00 AM

|

显示全部楼层

EX-date | 23 Jul 2019 | Entitlement date | 24 Jul 2019 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Dividend of 6 sen per Share under the Single-Tier System in respect of the Financial Year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | 24 Jul 2019 to 24 Jul 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRACE MANAGEMENT SERVICES SDN BHDSuite 11.05, 11th Floor,No. 566, Jalan Ipoh,51200 Kuala Lumpur.Tel : 03-6252 8880Fax : 03-6252 8080 | Payment date | 20 Aug 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 24 Jul 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-7-2019 07:20 AM

|

显示全部楼层

发表于 25-7-2019 07:20 AM

|

显示全部楼层

Date of change | 19 Jul 2019 | Name | MISS LIM YONG HUEY | Age | 55 | Gender | Female | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Accounting | Association of Chartered Certified Accountants, United Kingdom | Fellow Member | | 2 | Diploma | Financial and Accounting | Tunku Abdul Rahman College | Graduate Diploma |

| | | Working experience and occupation | Ms Lim Yong Huey started her career as an auditor having served various capacities in audit firms the last with Price Waterhouse before she left the audit profession to join the commercial working as a finance manager in a public listed company.In August 2000, she joined the Company as Executive Manager - Group Finance and progressed within the Company to the position of Senior Vice President - Group Finance in January 2011. As the Senior Vice President - Group Finance, she oversees the overall finance functions, which include financial reporting, finance operations, budgeting, treasury, taxation, payroll and office administration. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|