|

|

楼主 |

发表于 15-3-2018 05:53 AM

|

显示全部楼层

本帖最后由 icy97 于 16-3-2018 03:05 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | RIGHTS WITH BONUS ISSUE AND WARRANTS | Unless otherwise stated, the words and abbreviations used herein shall have the same meaning as those defined in the Company’s abridged prospectus dated 21 February 2018 in relation to the Rights with Bonus Issue and Warrants (“Abridged Prospectus”))

On behalf of the Board, Maybank IB wishes to announce that as at the close of the acceptance, excess application and payment for the Rights with Bonus Issue and Warrants at 5.00 p.m. on 8 March 2018 (“Closing Date”), HEB had received valid acceptances and excess applications for 55,861,801 Rights Shares, representing an over-subscription of 23,953,700 Rights Shares or approximately 75.07% over the total number of 31,908,101 Rights Shares available for subscription under the Rights with Bonus Issue and Warrants.

The details of the valid acceptances and excess applications received as at the Closing Date are as follows: | | No. of Rights Shares | % of total Rights Shares available for subscription | | Total valid acceptances | 31,461,782 | 98.60 | | Total valid excess applications | 24,400,019 | 76.47 | | Total valid acceptances and excess applications | 55,861,801 | 175.07 | | Total Rights Shares available for subscription | 31,908,101 | 100.00 | | Over-subscription | 23,953,700 | 75.07 |

Successful applicants of the Rights Shares will be given Bonus Shares on the basis of one (1) Bonus Share for every two (2) Rights Shares subscribed, and Warrants on the basis of three (3) Warrants for every two (2) Rights Shares subscribed.

As set out in Section 9.4 of the Abridged Prospectus, it is the intention of the Board to allot the Excess Rights with Bonus Issue and Warrants in a fair and equitable manner in the following order of priority:

1. firstly, to minimise the incidence of odd lots; 2. secondly, to the Entitled Shareholders who have applied for the Excess Rights with Bonus Issue and Warrants on a pro-rata basis and in board lots, calculated based on their respective shareholdings as per their CDS Accounts on the Entitlement Date; 3. thirdly, to the Entitled Shareholders who have applied for the Excess Rights with Bonus Issue and Warrants on a pro-rata basis and in board lots, calculated based on the quantum of Excess Rights with Bonus Issue and Warrants applied for; and 4. lastly, to the renouncees/transferees who have applied for the Excess Rights with Bonus Issue and Warrants on a pro-rata basis and in board lots, calculated based on the quantum of Excess Rights with Bonus Issue and Warrants applied for.

In the event of any balance of excess Rights Shares after steps (i), (ii), (iii) and (iv) are completed, steps (ii), (iii) and (iv) will be repeated to allocate the balance excess Rights Shares until such balance is exhausted.

Nevertheless, the Board reserves the right to allot the excess Rights Shares applied for in such manner as it deems fit and expedient, and in the best interest of HEB, subject always to such allocation being made in a fair and equitable manner, and that the intention of the Board as set out in steps (i) to (iv) above is achieved.

The Rights Shares, Bonus Shares and Warrants are expected to be listed and quoted on the Main Market of Bursa Securities on 21 March 2018.

This Announcement is dated 14 March 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2018 04:58 AM

|

显示全部楼层

Profile for Securities of PLC

Instrument Category | Securities of PLC | Instrument Type | Warrants | Description | ISSUANCE OF 47,862,151 FREE DETACHABLE WARRANTS IN HSS ENGINEERS BERHAD ("WARRANTS") ISSUED PURSUANT TO THE RIGHTS WITH BONUS ISSUE AND WARRANTS |

Listing Date | 21 Mar 2018 | Issue Date | 16 Mar 2018 | Issue/ Ask Price | Not Applicable | Issue Size Indicator | Unit | Issue Size in Unit | 47,862,151 | Maturity | Mandatory | Maturity Date | 15 Mar 2023 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 5.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 1.7000 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 1:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Cash | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2018 06:28 AM

|

显示全部楼层

Name | VICTECH SOLUTIONS SDN BHD | Address | 2-1, Jalan Sri Hartamas 8

Sri Hartamas

Kuala Lumpur

50480 Wilayah Persekutuan

Malaysia. | Company No. | 1137771-A | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 16 Mar 2018 | 10,205,751 | Others | Direct Interest | Name of registered holder | Victech Solutions Sdn Bhd | Address of registered holder | 2-1, Jalan Sri Hartamas 8 Sri Hartamas 50480 Kuala Lumpur | Description of "Others" Type of Transaction | Rights Issue | | 2 | 16 Mar 2018 | 5,102,881 | Others | Direct Interest | Name of registered holder | Victech Solutions Sdn Bhd | Address of registered holder | 2-1, Jalan Sri Hartamas 8 Sri Hartamas 50480 Kuala Lumpur | Description of "Others" Type of Transaction | Bonus Issue |

Circumstances by reason of which change has occurred | 1. Subscription of Rights with Bonus Issue and Warrants on the basis of one (1) Rights Share for every ten (10) Ordinary Shares held 2. Bonus Issue on the basis of one (1) Bonus Share for every two (2) Rights Shares subscribed | Nature of interest | Direct Interest | Direct (units) | 115,308,632 | Direct (%) | 28.746 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 115,308,632 | Date of notice | 20 Mar 2018 | Date notice received by Listed Issuer | 20 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2018 06:29 AM

|

显示全部楼层

Name | FLAMINGO WORKS SDN BHD | Address | 2-1, Jalan Sri Hartamas 8

Sri Hartamas

Kuala Lumpur

50480 Wilayah Persekutuan

Malaysia. | Company No. | 1136271-T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 16 Mar 2018 | 10,000,000 | Others | Direct Interest | Name of registered holder | Flamingo Works Sdn Bhd | Address of registered holder | 2-1, Jalan Sri Hartamas 8 Sri Hartamas 50480 Kuala Lumpur | Description of "Others" Type of Transaction | Rights Issue | | 2 | 16 Mar 2018 | 5,000,000 | Others | Direct Interest | Name of registered holder | Flamingo Works Sdn Bhd | Address of registered holder | 2-1, Jalan Sri Hartamas 8 Sri Hartamas 50480 Kuala Lumpur | Description of "Others" Type of Transaction | Bonus Issue |

Circumstances by reason of which change has occurred | 1. Subscription of Rights with Bonus Issue and Warrants on the basis of one (1) Rights Share for every ten (10) Ordinary Shares held 2. Bonus Issue on the basis of one (1) Bonus Share for every two (2) Rights Shares subscribed | Nature of interest | Direct Interest | Direct (units) | 115,000,000 | Direct (%) | 28.669 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 115,000,000 | Date of notice | 20 Mar 2018 | Date notice received by Listed Issuer | 20 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2018 03:26 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Acquisitions | Details of corporate proposal | ACQUISITION OF THE ENTIRE EQUITY INTEREST IN SMHB ENGINEERING SDN BHD FOR A PURCHASE CONSIDERATION OF RM270,000,000 TO BE SATISFIED VIA THE ISSUANCE OF 94,736,842 NEW ORDINARY SHARES IN HSS ENGINEERS BERHAD ("HEB") ("HEB SHARE") AT AN ISSUE PRICE OF RM1.14 PER HEB SHARE AND RM162,000,000 IN CASH | No. of shares issued under this corporate proposal | 94,736,842 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.1400 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 495,862,003 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 206,086,585.070 | Listing Date | 28 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-4-2018 07:15 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | DATUK IR TEO CHOK BOO | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | DATUK IR. TEO CHOK BOO49, JALAN BUKIT SEGAR 7TAMAN BUKIT SEGAR56100 KUALA LUMPURDATIN TEE KUI KIAU49, JALAN BUKIT SEGAR 7TAMAN BUKIT SEGAR56100 KUALA LUMPURIR. TEO KOON HAU49, JALAN BUKIT SEGAR 7TAMAN BUKIT SEGAR56100 KUALA LUMPUR |

| Date interest acquired & no of securities acquired | Date interest acquired | 27 Mar 2018 | No of securities | 49,802,001 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares pursuant to Share Sale Agreement dated 27 October 2017 | Nature of interest | Direct and Indirect Interest |  | | Total no of securities after change | Direct (units) | 33,157,895 | Direct (%) | 6.687 | Indirect/deemed interest (units) | 16,644,106 | Indirect/deemed interest (%) | 3.357 | Date of notice | 30 Mar 2018 | Date notice received by Listed Issuer | 30 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-4-2018 07:21 PM

|

显示全部楼层

本帖最后由 icy97 于 15-4-2018 04:02 AM 编辑

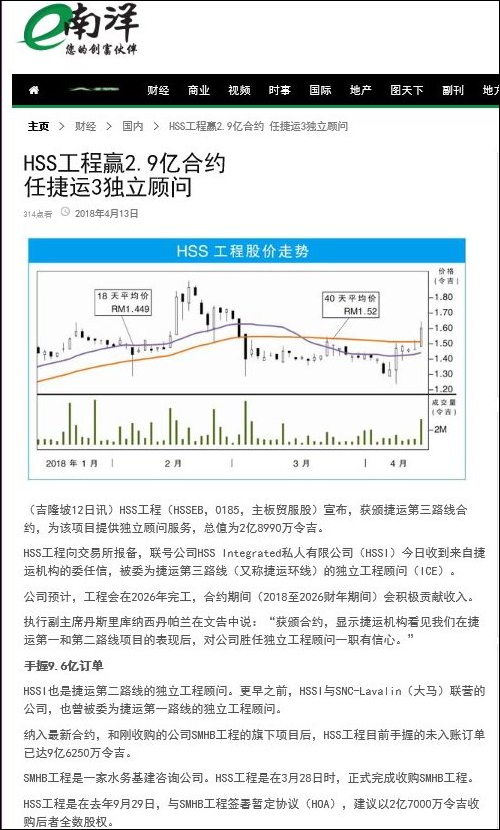

Type | Announcement | Subject | OTHERS | Description | HSS Engineers Berhad ("HEB") - Acceptance of Appointment as the Independent Consultant Engineer for Projek Mass Rapid Transit Lembah Kelang : Laluan 3, Circle Line | Introduction

HEB wishes to announce that its associate company, HSS Integrated Sdn Bhd ("HSSI"), has on 12 April April 2018 accepted a Letter of Appointment dated 26 March 2018 from Mass Rapid Transit Corporation Sdn Bhd appointing HSSI as the Independent Consultant Engineer for “Projek Mass Rapid Transit Lembah Kelang: Laluan 3, Circle Line” (“Contract”).

Information on the Contract

The Contract, with a value of RM289,893,789 (inclusive of GST), commenced on 6 March 2018 and is expected to complete in 2026. Pursuant to the exclusive teaming arrangement between HSSI and HEB’s wholly-owned subsidiary, HSS Engineering Sdn Bhd ("HSSE"), HSSI and HSSE will be collaborating exclusively to execute and complete the Contract.

Financial Effects

The Contract is expected to contribute positively to the revenue, earnings and net assets of HEB Group for financial years ending 31 December 2018 to 31 December 2026.

The Contract will not have any impact on the share capital and/or shareholding structure of HEB.

Directors’ and/or major shareholders’ interests

None of the Directors and/ or Major Shareholders of HEB and persons connected to them has any interest, direct or indirect, in the Contract.

Risk Factors

The risk factors affecting the Contract include, but not limited to, execution risks such as dependency on the progress of the Mass Rapid Transit Lembah Kelang: Laluan 3, Circle Line given that HSSI’s role as Independent Consultant Engineer pursuant to the Contract. HEB Group has, throughout the years, established its track record and expertise to undertake such projects. As such, the Board of Directors believes that HEB Group is able to mitigate the aforesaid risk factors.

Directors’ Statement

The Board of Directors, after considering all the relevant factors, is of the opinion that the acceptance of the Contract is in the best interest of HEB Group.

This announcement is dated 12 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-4-2018 06:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-5-2018 10:57 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | HSS Engineers Berhad - Press Release: Third Annual General Meeting | |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 11-5-2018 04:21 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-5-2018 06:05 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 34,011 | 29,261 | 34,011 | 29,261 | | 2 | Profit/(loss) before tax | 2,134 | 4,527 | 2,134 | 4,527 | | 3 | Profit/(loss) for the period | 881 | 3,159 | 881 | 3,159 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 881 | 3,159 | 881 | 3,159 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.24 | 0.91 | 0.24 | 0.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6400 | 0.2800

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-5-2018 06:12 AM

|

显示全部楼层

Date of change | 15 May 2018 | Name | DATUK IR TEO CHOK BOO | Age | 64 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Appointment | Qualifications | BSc (Eng) Hons, University of Aston, Birmingham, UK - 1978MEng, Asian Institute of Technology, Bangkok - 1981 | Working experience and occupation | Presently, Datuk Ir. Teo is the Managing Director of SMHB Sdn Bhd ("SMHB"). He joined SMHB in 1978 after graduated from University of Aston in Birmingham, United Kingdom with a First Class Honours degree in Civil Engineering. He has 40 years of experience in various sectors of engineering, particularly in dams and water-related projects. Datuk Ir. Teo played a pivotal role in the water sector in Malaysia, being the project director for several mega water supply projects including Raw Water Supply to Pengerang Integrated Petroleum Complex ("PIPC"), Sungai Selangor Water Supply, Interstate Water Transfer schemes from Pahang to Selangor and various other water supply schemes. He has been involved in the design of more than 20 water supply dams in Malaysia. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest: 33,157,895 ordinary sharesIndirect Interest: 16,644,106 ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-5-2018 06:15 AM

|

显示全部楼层

Date of change | 15 May 2018 | Name | IR PREM KUMAR A/L M VASUDEVAN | Age | 58 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Appointment | Qualifications | BE (Hons), University of Malaya | Working experience and occupation | Ir. Prem Kumar joined SMHB Sdn Bhd ("SMHB") after graduated from Universiti Malaya in 1985. He is a professional engineer in Electrical Engineering with 33 years of experience in project management, design, contact administration, inspection, testing and commissioning of electrical and instrumentation/telemetry equipment for various projects in Malaysia, Singapore and Brunei. His areas of expertise include M&E services for the development of MRT, water supply and sewage treatment plants, dam, water distribution, irrigation and flood control and rehabilitation and upgrading of water treatment plant. He also has experience in the management of municipal, clinical and hazardous wastes as well as telecommunication systems particularly for water and wastewater industry. He was the President of the Association of Consulting Engineers Malaysia from 2014 to 2016. Currently, he is in charge of SMHB's Business Division and involved in the management of megaprojects including the Langat 2 Water Supply Scheme and the KVMRT Line 2 Project. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest: 7,590,447 ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-6-2018 06:01 AM

|

显示全部楼层

本帖最后由 icy97 于 16-6-2018 06:16 AM 编辑

Type | Announcement | Subject | OTHERS | Description | HSS ENGINEERS BERHAD ("the Company") - Projek Mass Rapid Transit Lembah Kelang : Laluan 3, Circle Line | Introduction

Reference is made to the Company’s announcement dated 12 April 2018 in relation to the appointment of its associate company, HSS Integrated Sdn Bhd ("HSSI") as the Independent Consultant Engineer for “Projek Mass Rapid Transit Lembah Kelang : Laluan 3, Circle Line” (“Contract”).

Termination

The Company wishes to announce that HSSI has on 7 June 2018 received a 30 days written notice from Mass Rapid Transit Corporation Sdn Bhd terminating the Contract following Government’s decision not to proceed with the “Projek Mass Rapid Transit Lembah Kelang : Laluan 3, Circle Line”.

Financial Effects

The decision is not expected to have any significant impact on the operations and financials of the Company and its group given that only preliminary works have commenced this far, which will be compensated for in accordance with the terms and conditions of the Contract.

The decision will not have any impact on the share capital and/or shareholding structure of the Company.

Risk Factors

The Board of Directors does not envisage any specific risk to be associated with the termination of the Contract.

Directors’ and/or major shareholders’ interests

None of the Directors and/ or Major Shareholders of the Company and persons connected to them has any interest, direct or indirect, in the Contract.

This announcement is dated 7 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-7-2018 02:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-7-2018 12:32 AM

|

显示全部楼层

本帖最后由 icy97 于 10-7-2018 01:17 AM 编辑

icy97 发表于 18-1-2018 05:00 AM

HSS工程再获东海岸铁路合约

2018年1月18日

(吉隆坡17日讯)已是东海岸铁路(ECRL)赢家的HSS工程(HSSEB,0185,主板贸服股),再获该大型基建项目的合约,为东铁提供顾问服务,总值约2500万令吉。

HSS ...

Type | Announcement | Subject | OTHERS | Description | HSS ENGINEERS BERHAD ("the Company")- Detail Design and Shop Drawing Design Consultancy Services for Infrastructure Works for the East Coast Rail Link | Introduction

Reference is made to the Company’s announcement dated 17 January 2018 in relation to the appointment of its associate company, HSS Integrated Sdn Bhd (“HSSI”) as the Consultant to provide Detail Design and Shop Drawing Design Consultancy Services for Infrastructure Works for the East Coast Rail Link (“ECRL”) from KM0 to KM213.5 of the ECRL (“Contract”).

Suspension of Services Due to Government’s Review

The Company wishes to announce that following the instruction received by China Communication Construction (ECRL) Sdn Bhd (“Client”) from Malaysia Rail Link Sdn Bhd on 4 July 2018 in regard to ECRL project suspension, HSSI has on 9 July 2018 received a letter from the Client dated 6 July 2018 on suspension of HSSI’s services effective immediately until further notice.

Financial Effects

The suspension is not expected to have any significant financial impact on the operations and financials of the Company in the financial period up to date of the suspension as completed work shall be compensated for in accordance with the terms and conditions of the Contract.

However, for the period subsequent to the suspension date, the Company shall only be able to assess the actual financial impact on the operations and financials of the Company upon receipt of clear direction from the Client and/or Malaysia Rail Link Sdn Bhd after completion of the Government’s review of the ECRL. In the event the suspension of the Contract is lifted, it is expected for the Contract to contribute positively to the revenue and earnings of the Company.

The suspension of the Contract will not have any impact on the share capital and/or shareholding structure of the Company.

Risk Factors

The Board of Directors does not envisage any specific risk to be associated with the suspension of the Contract.

Directors’ and/or major shareholders’ interests

None of the Directors and/ or Major Shareholders of the Company and persons connected to them has any interest, direct or indirect, in the Contract.

The Company will make further announcements in relation to any material developments concerning the Contract.

This announcement is dated 9 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-7-2018 12:33 AM

|

显示全部楼层

icy97 发表于 29-12-2017 03:43 AM

提供监督顾问服务

HSS赢8250万东铁合约

2017年12月29日

(吉隆坡28日讯)已是东海岸铁路(ECRL)赢家的HSS工程(HSSEB,0185,主板贸服股),再获该大型基建项目的合约,为东铁提供监督顾问服务,总值约8250 ...

Type | Announcement | Subject | OTHERS | Description | HSS ENGINEERS BERHAD ("the Company")- Supervising Consultancy Services for Infrastructure Works for the East Coast Rail Link | Introduction

Reference is made to the Company’s announcement dated 28 December 2017 in relation to the appointment of its associate company, HSS Integrated Sdn Bhd ("HSSI") as the Consultant to provide Supervising Consultancy Services for Infrastructure Works for the East Coast Rail Link (“ECRL”) Package 1 from KM0 to KM231.5 of the ECRL (“Contract”).

Suspension of Services Due to Government’s Review

The Company wishes to announce that following the instruction received by China Communication Construction (ECRL) Sdn Bhd (“Client”) from Malaysia Rail Link Sdn Bhd on 4 July 2018 in regard to ECRL project suspension, HSSI has on 9 July 2018 received a letter from the Client dated 6 July 2018 on suspension of HSSI’s services effective immediately until further notice.

Financial Effects

Pending Government’s review, the suspension is not expected to have any significant financial impact on the operations and financials of the Company in the current financial period given the duration of the Contract is for a period of approximately 7 years and only preliminary mobilization of supervision staff has commenced which will be compensated for in accordance with the terms and conditions of the Contract. In the event the suspension of the Contract is lifted, it is expected for the Contract to contribute positively to the revenue and earnings of the Company.

The suspension of the Contract will not have any impact on the share capital and/or shareholding structure of the Company.

Risk Factors The Board of Directors does not envisage any specific risk to be associated with the suspension of the Contract.

Directors’ and/or major shareholders’ interests

None of the Directors and/ or Major Shareholders of the Company and persons connected to them has any interest, direct or indirect, in the Contract.

The Company will make further announcements in relation to any material developments concerning the Contract.

This announcement is dated 9 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 16-8-2018 01:24 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 55,074 | 37,870 | 89,085 | 67,131 | | 2 | Profit/(loss) before tax | 9,982 | 4,489 | 12,116 | 9,016 | | 3 | Profit/(loss) for the period | 6,899 | 2,970 | 7,780 | 6,129 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,899 | 2,970 | 7,780 | 6,129 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.60 | 0.85 | 1.79 | 1.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6500 | 0.2800

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-11-2018 07:18 AM

|

显示全部楼层

本帖最后由 icy97 于 14-12-2018 03:41 AM 编辑

hss第三季净利暴涨2.2倍

http://www.enanyang.my/news/20181116/hss第三季净利暴涨2-2倍/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 53,829 | 37,374 | 142,914 | 104,505 | | 2 | Profit/(loss) before tax | 12,171 | 3,848 | 24,287 | 12,864 | | 3 | Profit/(loss) for the period | 9,149 | 2,847 | 16,929 | 8,976 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,149 | 2,847 | 16,929 | 8,976 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.01 | 0.82 | 3.72 | 2.58 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6700 | 0.2800

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-12-2018 07:49 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|