|

|

发表于 30-5-2017 04:59 AM

|

显示全部楼层

发表于 30-5-2017 04:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,865 | 63,017 | 167,546 | 244,818 | | 2 | Profit/(loss) before tax | 915 | 2,537 | 25,441 | 28,409 | | 3 | Profit/(loss) for the period | 187 | 2,832 | 17,905 | 20,717 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,451 | 3,605 | 14,442 | 20,411 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.36 | 0.90 | 3.61 | 5.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1000 | 1.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-7-2017 05:53 AM

|

显示全部楼层

发表于 13-7-2017 05:53 AM

|

显示全部楼层

Kerjaya子公司承包建筑

龙城雪州发展6.5亿高档屋

2017年7月12日

(莎阿南12日讯)龙城集团(BCB,6602,主板产业股)委任Kerjaya(KERJAYA,7161,主板建筑股)子公司为承包商的雪兰莪莎阿南住宅计划,发展总值达6亿5000万令吉,放眼2019年第四季竣工。

龙城集团董事经理丹斯里拿督陈成龙指出,这项住宅计划Broadleaf Residence,是位于哥打甘文宁的美树家园(Hometree)综合产业发展的第二期项目。

在这项目中,将兴建265个住宅单,涵盖166间三层半独立式洋房、99间三层楼独立洋房单位、私人游泳池、健身房和相关工程,主要瞄准有意在莎阿南、巴生和哥打甘文宁附近置产的中上阶级买家。

建筑工程已动工,放眼2019年第四季竣工,预计今年8月尾举行正式推介礼,并在2020年移交钥匙。

岩土工程耗4000万

陈成龙是在与Kerjaya的签约仪式上发表谈话,出席者包括龙城集团行董事罗国湧、Kerjaya Prospek(大马)私人有限公司主席拿督郑荣和,以及项目董事郑荣忠。

Kerjaya Prospek负责建设工程,合约总值达2亿736万2500令吉。

陈成龙指出,为了确保当地土壤处理过程完善,除了应用常规的土木与结构工程学,公司也将花费4000万令吉投入岩土工程。

“我们已投入200万令吉向岩土工程公司寻求咨询服务。”

此外,龙城集团和Kerjaya Prospek将各自拿出30万令吉,若是此项目能在大马建筑工业发展局(CIDB)的建筑品质评估系统(QLASSIC)中,取得82分,全60万令吉将会当做奖励给Kerjaya Prospek。

寻巴生谷优质地皮

陈成龙表示,目前正在巴生谷找寻优质地皮,并致力迎合现今市场的需求去发展不同类型的项目。

主要集中在居銮产业发展的龙城集团,在巴生谷的产业计划只有位于哥打甘文宁和满家乐。

其中,占地150英亩的美树家园,共分5期发展,首三期都是住宅发展,第一期已经在去年完成并移交钥匙,第三期则是排屋为主。

第四期和第五期皆为商业发展。第四期占地20英亩,风格将类似满家乐的购物广场Publika,趋向现代化店屋模式、

“第三和第四期已经呈交建筑设计图,期望可在明年展开推介。”

第五期发展项目则已经动工,以商业区为主,当中或包含屋业,发展总值达1.05亿令吉,放眼今年底推出该项目。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 26-8-2017 04:12 AM

|

显示全部楼层

发表于 26-8-2017 04:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 55,654 | 56,390 | 223,200 | 301,034 | | 2 | Profit/(loss) before tax | -4,034 | 11,718 | 21,407 | 37,921 | | 3 | Profit/(loss) for the period | -6,685 | 5,013 | 11,220 | 24,398 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,567 | 6,812 | 9,875 | 25,681 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.14 | 1.70 | 2.47 | 6.41 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0900 | 1.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2017 04:46 AM

|

显示全部楼层

发表于 26-10-2017 04:46 AM

|

显示全部楼层

icy97 发表于 28-3-2017 02:42 AM

龙城集团3460万购峇株巴辖面积18.9公顷地段

By Adam Aziz / theedgemarkets.com | March 27, 2017 : 6:48 PM MYT

(吉隆坡27日讯)龙城集团(BCB Bhd)以3460万令吉,收购6幅位于峇株巴辖、合共面积18.91公顷 ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Acquisition by BCB Land Sdn Bhd, a wholly-owned subsidiary of BCB Berhad, of six (6) adjoining lots of freehold agricultural lands all in the Mukim of Simpang Kanan, District of Batu Pahat, Johor measuring 2,035,341 Sq. Ft. in aggregate for a total cash consideration of RM34,600,797.00. | (Unless stated otherwise, definitions used in this announcement shall carry the same meanings as defined in the announcement dated 27 March 2017).

Further to the announcement dated 27 March 2017 pertaining to the aforesaid subject matter, the Board of Directors of BCB wishes to announce that the Acquisition has been completed today.

This Announcement is dated 25 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-11-2017 05:36 AM

|

显示全部楼层

发表于 7-11-2017 05:36 AM

|

显示全部楼层

本帖最后由 icy97 于 8-11-2017 05:05 AM 编辑

龙城集团1329万售8公寓

(吉隆坡7日讯)龙城集团(BCB,6602,主板产业组)以1328万8400令吉向创始人兼董事经理丹斯里陈成龙、陈伟圣、陈伶俐在内的董事脱售8个公寓单位。

该公司发文告表示,上述公寓单位销售将对公司盈利作出正面贡献。

文章来源:

星洲日报·财经·2017.11.06

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | BCB BERHAD - RELATED PARTY TRANSACTIONS ON SALE OF PROPERTIES TO DIRECTORS | The Board of Directors of BCB Berhad (“Company”) wishes to announce that the Company had on 6 November 2017, entered into sale and purchase agreements with Tan Sri Dato’ Tan Seng Leong, Tan Vin Sern and Tan Lindy (“Purchasers”) for sale of properties. The Purchasers are Directors of the Company.

Please refer to announcement details in the attachment.

This announcement is dated 6 November 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5594309

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-11-2017 05:36 AM

|

显示全部楼层

发表于 26-11-2017 05:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 70,010 | 96,471 | 70,010 | 96,471 | | 2 | Profit/(loss) before tax | 8,381 | 14,960 | 8,381 | 14,960 | | 3 | Profit/(loss) for the period | 5,606 | 10,947 | 5,606 | 10,947 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,169 | 7,616 | 6,169 | 7,616 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.54 | 1.90 | 1.54 | 1.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1000 | 1.0900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2018 06:20 AM

|

显示全部楼层

发表于 24-2-2018 06:20 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 86,219 | 43,210 | 156,229 | 139,681 | | 2 | Profit/(loss) before tax | 6,982 | 9,566 | 15,363 | 24,526 | | 3 | Profit/(loss) for the period | 5,207 | 6,771 | 10,812 | 17,718 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,979 | 5,375 | 12,148 | 12,991 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.49 | 1.34 | 3.03 | 3.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1100 | 1.0900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-5-2018 02:17 AM

|

显示全部楼层

发表于 28-5-2018 02:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 82,584 | 27,865 | 238,813 | 167,546 | | 2 | Profit/(loss) before tax | 2,916 | 915 | 18,279 | 25,441 | | 3 | Profit/(loss) for the period | 2,420 | 187 | 13,232 | 17,905 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,198 | 1,451 | 14,346 | 14,442 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.55 | 0.36 | 3.58 | 3.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1200 | 1.0900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 04:02 AM

|

显示全部楼层

发表于 30-5-2018 04:02 AM

|

显示全部楼层

Date of change | 28 May 2018 | Name | MR TAN VIN SHYAN | Age | 29 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Due to his other work commitment |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-6-2018 12:53 AM

|

显示全部楼层

发表于 26-6-2018 12:53 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | BCB BERHAD - RELATED PARTY TRANSACTION ON ACQUISITION OF PROPERTY | The Board of Directors of BCB Berhad (“Company”) wishes to announce that BCB Construction Sdn. Bhd., a wholly-owned subsidiary of the Company had on 25 June 2018, entered into a Sale and Purchase Agreement with Evergreen Ratio Sdn. Bhd. for the acquisition of one (1) unit of Five Storey Shop Office in Kluang, Johor for a total consideration of RM4,300,000.00.

Please refer to announcement details in the attachment.

This announcement is dated 25 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5834777

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:41 AM

|

显示全部楼层

发表于 28-8-2018 06:41 AM

|

显示全部楼层

Date of change | 25 Aug 2018 | Name | ENCIK ABD MANAP BIN HUSSAIN | Age | 66 | Gender | Male | Nationality | Malaysia | Designation | Independent Director | Directorate | Independent and Non Executive | Type of change | Demised |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 03:00 AM

|

显示全部楼层

发表于 31-8-2018 03:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 78,197 | 54,608 | 317,010 | 222,154 | | 2 | Profit/(loss) before tax | 35,824 | -4,392 | 54,103 | 21,050 | | 3 | Profit/(loss) for the period | 34,427 | -6,865 | 47,658 | 11,041 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,022 | -4,566 | 31,367 | 9,796 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.25 | -1.14 | 7.83 | 2.47 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1600 | 1.0900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2018 05:24 AM

|

显示全部楼层

发表于 20-9-2018 05:24 AM

|

显示全部楼层

本帖最后由 icy97 于 23-9-2018 05:21 AM 编辑

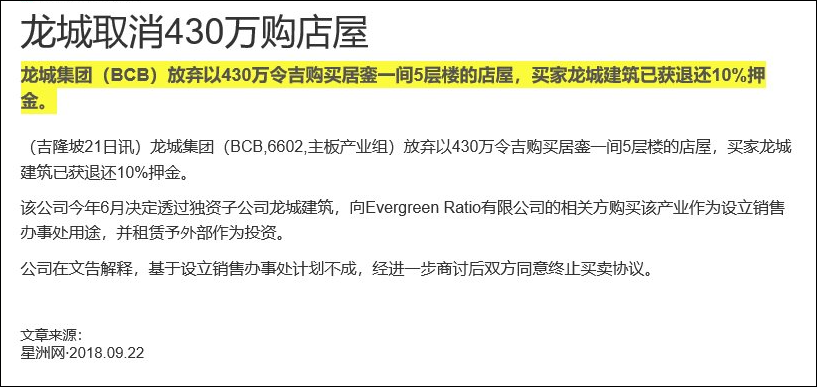

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | BCB BERHAD - RELATED PARTY TRANSACTION ON ACQUISITION OF PROPERTY | 1. INTRODUCTION

We refer to the announcement dated 25 June 2018 in relation to the acquisition of one (1) unit of Five Storey Shop Office in Kluang, Johor by BCB Construction Sdn Bhd (“Purchaser”), a wholly-owned subsidiary of BCB Berhad ("BCB" or “Company”) from Evergreen Ratio Sdn Bhd ("Vendor") for a total consideration of RM4,300,000.00 pursuant to the Sale and Purchase Agreement dated 25 June 2018 (“SPA”).

2. TERMINATION OF SPA

The Board of Directors (“Board”) of BCB wishes to announce that the Purchaser had on 19 September 2018 entered into a Deed of Revocation (“Deed”) with the Vendor to mutually terminate and rescind the SPA.

Subsequent to the execution of the Deed, the Vendor has agreed to release the Purchaser from the due performance and observance of the SPA.

3. FINANCIAL EFFECTS

The Termination of SPA will not have any effect on the share capital and substantial shareholders’ shareholdings and it is not expected to have any material effect on the earnings per share, net assets per share and gearing of the Company for the financial year ending 30 June 2019.

4. DIRECTORS AND MAJOR SHAREHOLDERS' INTEREST

None of the Directors and/or major shareholders and/or persons connected with the Directors and/or major shareholders of the Company has any direct or indirect interest in the abovementioned termination.

This announcement is dated 19 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 05:27 AM

|

显示全部楼层

发表于 22-9-2018 05:27 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | BCB BERHAD - RELATED PARTY TRANSACTION ON ACQUISITION OF PROPERTY | (Unless stated otherwise, definitions used in this announcement shall carry the same meanings as defined in the announcements dated 25 June 2018 and 19 September 2018).

Further to the announcements dated 25 June 2018 and 19 September 2018 in respect of acquisition of one (1) unit of Five Storey Shop Office in Kluang, Johor (“Property”) by BCB Construction Sdn Bhd (“Purchaser”), a wholly-owned subsidiary of BCB Berhad ("BCB" or “Company”), the Company wishes to provide the following additional information:-

1. The 10% deposit has been returned to the Purchaser.

2. The Purchaser had initially planned to purchase the Property with an intention to set up Sales Office, lease out certain areas to external parties and for investment. After further discussion, the Purchaser’s plan to set up Sales Office at the Property did not materialize and the parties have since mutually agreed to terminate the SPA.

This announcement is dated 21 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:38 AM

|

显示全部楼层

发表于 2-1-2019 07:38 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 95,504 | 66,485 | 95,504 | 66,485 | | 2 | Profit/(loss) before tax | 13,725 | 8,130 | 13,725 | 8,130 | | 3 | Profit/(loss) for the period | 10,454 | 5,355 | 10,454 | 5,355 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,794 | 6,018 | 7,794 | 6,018 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.95 | 1.50 | 1.95 | 1.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1700 | 1.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 02:45 AM

|

显示全部楼层

发表于 26-2-2019 02:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 114,458 | 84,292 | 209,962 | 150,777 | | 2 | Profit/(loss) before tax | 11,905 | 6,845 | 25,630 | 14,975 | | 3 | Profit/(loss) for the period | 9,334 | 5,070 | 19,788 | 10,424 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,617 | 5,897 | 13,411 | 11,915 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.41 | 1.47 | 3.36 | 2.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1900 | 1.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2019 03:41 AM

|

显示全部楼层

发表于 28-6-2019 03:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 100,930 | 79,760 | 310,892 | 230,537 | | 2 | Profit/(loss) before tax | 5,075 | 1,867 | 30,705 | 16,842 | | 3 | Profit/(loss) for the period | 3,514 | 1,370 | 23,302 | 11,794 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,869 | 1,146 | 17,280 | 13,062 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.97 | 0.29 | 4.32 | 3.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1900 | 1.1500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2019 05:23 AM

|

显示全部楼层

发表于 8-8-2019 05:23 AM

|

显示全部楼层

Date of change | 31 Dec 2019 | Name | MR LOW KOK YUNG | Age | 50 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Resignation | Reason | Due to personal reason |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2019 08:49 AM

|

显示全部楼层

发表于 29-8-2019 08:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 121,131 | 69,571 | 432,024 | 300,108 | | 2 | Profit/(loss) before tax | 43,492 | -4,136 | 74,198 | 12,706 | | 3 | Profit/(loss) for the period | 33,672 | -4,191 | 56,975 | 7,603 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 21,733 | -6,782 | 39,013 | 6,279 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.44 | -1.69 | 9.76 | 1.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1200 | 1.0300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-11-2019 07:54 AM

|

显示全部楼层

发表于 7-11-2019 07:54 AM

|

显示全部楼层

Date of change | 21 Oct 2019 | Name | MR TAN KIAN WHOO | Age | 43 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Chartered Accountant | Malaysian Institute of Accountants | | | 2 | Professional Qualification | Certified Practising Accountant | Certified Practising Accountant (CPA), Australia | | | 3 | Degree | Bachelor of Business Degree in Accounting and Finance | University of Technology, Sydney, Australia | |

| | | Working experience and occupation | Mr. Tan Kian Whoo has more than 19 years of experience in finance management, financial reporting, corporate finance, treasury reporting, auditing and taxation.He began his career with Ernst & Young as an external auditor. Prior to his appointment, he has held various senior finance positions in among others, Titijaya Land Berhad, Glomac Berhad, Maddusalat Berhad, and MK Land Berhad. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|