|

|

【ASIABRN 7722 交流专区】亚州品牌(前名 HINGYAP)

[复制链接]

|

|

|

发表于 6-2-2018 01:33 AM

|

显示全部楼层

发表于 6-2-2018 01:33 AM

|

显示全部楼层

Name | EVEREST HECTARE SDN. BHD. | Address | Level 7, Menara Milenium, Jalan Damanlela,

Pusat Bandar Damansara,

Damansara Heights,

Kuala Lumpur

50490 Wilayah Persekutuan

Malaysia. | Company No. | 906715-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 30 Jan 2018 | 7,080,000 | Disposed | Direct Interest | Name of registered holder | Kenanga Nominees (Tempatan) Sdn. Bhd. | Address of registered holder | Level 15, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan. | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares | Nature of interest | Direct Interest | Direct (units) | 40,157,477 | Direct (%) | 50.757 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 40,157,477 | Date of notice | 05 Feb 2018 | Date notice received by Listed Issuer | 05 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:21 AM

|

显示全部楼层

发表于 10-2-2018 03:21 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | MISS CHOO BAY SEE | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Choo Bay SeeNo. 7, Jalan Birai U8/70A,Bukit Jelutong,40150 Shah Alam,Selangor Darul Ehsan. |

| Date interest acquired & no of securities acquired | Date interest acquired | 06 Feb 2018 | No of securities | 1,600,000 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares via Direct Business Transaction | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 5,180,000 | Direct (%) | 6.547 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 09 Feb 2018 | Date notice received by Listed Issuer | 09 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:21 AM

|

显示全部楼层

发表于 10-2-2018 03:21 AM

|

显示全部楼层

Name | NG TIONG SENG CORPORATION SDN. BHD. | Address | Lot 1282, Jalan Bukit Kemuning,

Seksyen 32,

Shah Alam

40460 Selangor

Malaysia. | Company No. | 17024-P | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 08 Feb 2018 | 1,650,000 | Disposed | Direct Interest | Name of registered holder | NG TIONG SENG CORPORATION SDN. BHD. | Address of registered holder | Lot 1282, Jalan Bukit Kemuning, Seksyen 32, 40460 Shah Alam, Selangor Darul Ehsan. | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares via Direct Business Transaction | Nature of interest | Direct Interest | Direct (units) | 8,716,258 | Direct (%) | 11.017 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 8,716,258 | Date of notice | 09 Feb 2018 | Date notice received by Listed Issuer | 09 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-2-2018 03:58 AM

|

显示全部楼层

发表于 14-2-2018 03:58 AM

|

显示全部楼层

本帖最后由 icy97 于 15-2-2018 05:03 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 35,547 | 47,818 | 114,786 | 123,534 | | 2 | Profit/(loss) before tax | -4,051 | -13,578 | -3,509 | -22,309 | | 3 | Profit/(loss) for the period | -4,507 | -14,875 | -4,788 | -34,825 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,507 | -14,875 | -4,788 | -34,825 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.70 | -18.80 | -6.05 | -44.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6600 | 1.7200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2018 05:54 AM

|

显示全部楼层

发表于 15-3-2018 05:54 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | PROPOSED ISSUANCE AND ALLOTMENT OF 37,206,586 NEW ORDINARY SHARES IN ABB ("ABB SHARES") ("PROPOSED SHARE ISSUANCE") | No. of shares issued under this corporate proposal | 37,206,586 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.7410 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 116,323,800 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 158,000,681.000 | Listing Date | 15 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-3-2018 04:44 AM

|

显示全部楼层

发表于 18-3-2018 04:44 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | TRACKLAND SDN. BHD. | Address | 118B, Jalan SS 24/2, Taman Megah,

Petaling Jaya

47301 Selangor

Malaysia. | Company No. | 962253-T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Trackland Sdn. Bhd.118B, Jalan SS 24/2, Taman Megah, 47301 Petaling Jaya, Selangor Darul Ehsan. |

| Date interest acquired & no of securities acquired | Date interest acquired | 14 Mar 2018 | No of securities | 37,206,586 | Circumstances by reason of which Securities Holder has interest | Subscription of shares pursuant to a Share Issuance exercise. | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 37,206,586 | Direct (%) | 31.985 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 16 Mar 2018 | Date notice received by Listed Issuer | 16 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-4-2018 06:09 PM

|

显示全部楼层

发表于 13-4-2018 06:09 PM

|

显示全部楼层

Date of change | 11 Apr 2018 | Name | MR NG CHIN HUAT | Age | 48 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Chairman | New Position | Managing Director | Directorate | Executive |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-4-2018 06:09 PM

|

显示全部楼层

发表于 13-4-2018 06:09 PM

|

显示全部楼层

Date of change | 11 Apr 2018 | Name | DATO' SRI TAN THIAN POH | Age | 62 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | Dato' Sri Tan Thian Poh graduated from the Chartered Institute of Certified Accountants and holds a Masters degree in Business Administration. | Working experience and occupation | Dato' Sri Tan Thian Poh is the founder and Managing Director of Siang Poh group of companies, a vertically integrated textile group involved in the manufacturing and distribution of textile and apparels for more than 30 years. He is the president of the Malaysian Textile Manufacturers Association since 2013 and the Chairman of the ASEAN Federation of Textile Industries (AFTEX) from 2015 to 2017. He serves as the Advisor of the SME and Human Resource Development Committee at the Associated Chinese Chambers of Commerce and Industry of Malaysia. He is also a member of the Industrial Relations panel at the Malaysian Employers Federation. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest - 1,000 Ordinary Shares of Asia Brands BerhadIndirect Interest - 37,206,586 Ordinary Shares of Asia Brands Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-5-2018 06:04 PM

|

显示全部楼层

发表于 8-5-2018 06:04 PM

|

显示全部楼层

Date of change | 30 Apr 2018 | Name | MR DAVID TAN CHIN WEE | Age | 26 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | David Tan Chin Wee graduated from the City University, London, United Kingdom, with a Bachelor's degree in Actuarial Science and a Master's degree in Finance from the Cass Business School, United Kingdom. | Working experience and occupation | David Tan Chin Wee holds a Master in Investment Management from Cass Business School, United Kingdom. Upon his graduation, he joined Capital Dynamics Asset Management Sdn. Bhd. as Equities Analyst. Prior to joining Asia Brands Berhad, he was attached to Kantar TNS Malaysia as Associate Consultant.David officially joined Asia Brands Berhad as Management Trainee with effect from April 2018. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | David Tan Chin Wee is the son of Dato' Sri Tan Thian Poh, the Non-Independent Non-Executive Director cum Chairman of Asia Brands Berhad and a substantial shareholder. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 12:58 AM

|

显示全部楼层

发表于 12-6-2018 12:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 35,802 | 42,017 | 150,588 | 165,551 | | 2 | Profit/(loss) before tax | -14,489 | -28,034 | -17,998 | -50,343 | | 3 | Profit/(loss) for the period | -14,408 | -23,669 | -19,196 | -58,494 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -14,408 | -23,669 | -19,196 | -58,494 | | 5 | Basic earnings/(loss) per share (Subunit) | -17.84 | -29.92 | -23.77 | -73.93 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2400 | 1.7200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2018 02:49 AM

|

显示全部楼层

发表于 3-7-2018 02:49 AM

|

显示全部楼层

本帖最后由 icy97 于 4-7-2018 05:22 AM 编辑

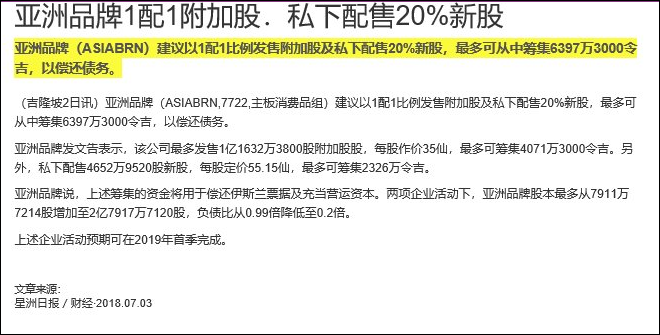

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | ASIA BRANDS BERHAD ("ABB" OR THE "COMPANY")(I) PROPOSED RIGHTS ISSUE; AND(II) PROPOSED PRIVATE PLACEMENT(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of ABB (“Board”), Inter-Pacific Securities Sdn Bhd (“IPS”) wishes to announce that the Company proposes to undertake the following: (i) proposed renounceable rights issue of up to 116,323,800 new ordinary shares of ABB (“ABB Share(s)”) (“Rights Share(s)”) at an issue price of RM0.35 per Rights Share (“Rights Issue Price”) on the basis of one (1) Rights Share for every one (1) existing ABB Share held by the entitled shareholders of ABB on an entitlement date to be determined and announced later (“Proposed Rights Issue”); and

(ii) proposed private placement of up to 46,529,520 ABB Shares (“Placement Share(s)”) representing up to 20% of the enlarged issued ABB Shares upon completion and assuming full subscription of the Proposed Rights Issue (“Proposed Private Placement”).

(The Proposed Rights Issue and the Proposed Private Placement are collectively referred to as the “Proposals”.)

Further details of the Proposals are set out in the attachment below.

This announcement is dated 2 July 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5842913

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-7-2018 01:54 AM

|

显示全部楼层

发表于 13-7-2018 01:54 AM

|

显示全部楼层

Date of change | 12 Jul 2018 | Name | MR CHEAH YONG HOCK | Age | 56 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | To concentrate and focus on his position as the Group Chief Executive Officer of the Company. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | | Working experience and occupation | | Family relationship with any director and/or major shareholder of the listed issuer | | Any conflict of interests that he/she has with the listed issuer | | Details of any interest in the securities of the listed issuer or its subsidiaries | |

| Remarks : | | Following the resignation of Mr. Cheah Yong Hock as an Executive Director of Asia Brands Berhad, Mr. Cheah remains as the Group Chief Executive Officer of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 04:36 AM

|

显示全部楼层

发表于 28-7-2018 04:36 AM

|

显示全部楼层

Type | Announcement | Subject | AUDIT REPORT - MODIFIED OPINION / MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

MATERIAL UNCERTAINTY RELATED TO GOING CONCERN | Description | ASIA BRANDS BERHAD ("ABB" or "THE COMPANY") - STATEMENT OF MATERIAL UNCERTAINTY RELATED TO GOING CONCERN IN RESPECT OF ABB'S FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 MARCH 2018 | Pursuant to paragraph 9.19 (37) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of ABB wishes to announce that its external auditors, Messrs. UHY, have issued a statement of "Material Uncertainty Related to Going Concern" in respect of ABB's financial statements for the financial year ended 31 March 2018.

Please refer to attachment below for further details.

This announcement is dated 27 July 2018.

Please refer attachment below. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5867705

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 02:07 AM

|

显示全部楼层

发表于 31-8-2018 02:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 39,713 | 44,179 | 39,713 | 44,179 | | 2 | Profit/(loss) before tax | 2,032 | 2,528 | 2,032 | 2,528 | | 3 | Profit/(loss) for the period | 2,032 | 2,528 | 2,032 | 2,528 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,453 | 1,820 | 1,453 | 1,820 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.25 | 2.30 | 1.25 | 2.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2600 | 1.7400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2018 07:47 AM

|

显示全部楼层

发表于 28-11-2018 07:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 35,549 | 35,060 | 75,262 | 79,239 | | 2 | Profit/(loss) before tax | 1,251 | -1,986 | 3,283 | 542 | | 3 | Profit/(loss) for the period | 933 | -2,101 | 2,386 | -281 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 933 | -2,101 | 2,386 | -281 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.80 | -2.66 | 2.05 | -0.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2600 | 1.7200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2018 03:56 AM

|

显示全部楼层

发表于 28-12-2018 03:56 AM

|

显示全部楼层

EX-date | 10 Dec 2018 | Entitlement date | 12 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Rights Issue | Entitlement description | RENOUNCEABLE RIGHTS ISSUE OF UP TO 116,323,800 NEW ORDINARY SHARES OF ASIA BRANDS BERHAD ("ABB") ("ABB SHARE(S)") ("RIGHTS SHARE(S)") AT AN ISSUE PRICE OF RM0.35 PER RIGHTS SHARE ON THE BASIS OF ONE (1) RIGHTS SHARE FOR EVERY ONE (1) EXISTING ABB SHARE HELD BY THE ENTITLED SHAREHOLDERS OF ABB AS AT 5.00 P.M. ON 12 DECEMBER 2018 WITH A MINIMUM SUBSCRIPTION LEVEL OF 86,130,321 RIGHTS SHARES | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHDLevel 7, Menara MileniumJalan Damanlela, Pusat Bandar DamansaraDamansara Heights50490 Kuala LumpurTel:0320849000Fax:0320949940 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 24 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) | 116,323,800 | Entitlement indicator | Ratio | Ratio | 1 : 1 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.350 |

Despatch date | 14 Dec 2018 | Date for commencement of trading of rights | 13 Dec 2018 | Date for cessation of trading of rights | 20 Dec 2018 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 08 Jan 2019 | Listing Date of the Rights Securities | 14 Jan 2019 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 19 Dec 2018 | | 05:00:00 PM | Transfer of provisional allotment of rights | 24 Dec 2018 | | 04:00:00 PM | Acceptance and payment | 28 Dec 2018 | | 05:00:00 PM | Excess share application and payment | 28 Dec 2018 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2019 06:40 AM

|

显示全部楼层

发表于 30-1-2019 06:40 AM

|

显示全部楼层

本帖最后由 icy97 于 30-1-2019 06:42 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | ASIA BRANDS BERHAD ("ABB" OR THE "COMPANY")(I) RIGHTS ISSUE; AND(II) PRIVATE PLACEMENT(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | We refer to the announcements dated 2 July 2018, 9 July 2018, 26 July 2018, 27 July 2018, 21 August 2018, 12 September 2018, 28 November 2018, 11 December 2018 and 12 December 2018 in relation to the Proposals ("Announcements"). Unless stated otherwise, abbreviations and definitions used throughout this announcement shall be the same as those in the Announcements.

On behalf of the Board, IPS wishes to announce that as at the close of acceptance, excess application and payment for the Rights Issue as at 5.00 p.m. on Friday, 28 December 2018, the total acceptances and excess applications for the Rights Issue were 122,443,161 Rights Shares, which represents an over-subscription of 5.26% over the total number of 116,323,800 Rights Shares available for subscription under the Rights Issue, the details of which are as set out below:

| No. of Rights Shares | % | Acceptances | 112,249,301 | 96.50 | Excess applications | 10,193,860 | 8.76 | Total acceptances and excess applications | 122,443,161 | 105.26 | Total Rights Shares available for subscription | 116,323,800 | 100.00 | Over-subscription | 6,119,361 | 5.26 |

It is the intention of the Board to allot the Excess Rights Shares on a fair and equitable basis. The Board has applied the following basis and priority in allocating the Excess Rights Shares, in accordance with the Abridged Prospectus dated 12 December 2018:

(i) firstly, to minimise the incidence of odd lots;

(ii) secondly, for allocation to Entitled Shareholders who have applied for Excess Rights Shares on a pro-rata basis and in board lots, calculated based on their respective shareholdings as at the Entitlement Date;

(iii) thirdly, for allocation to Entitled Shareholders who have applied for Excess Rights Shares on a pro-rata basis and in board lots, calculated based on the quantum of their respective Excess Rights Shares applied for; and

(iv) lastly, for allocation to renouncee(s)/transferee(s) who have applied for Excess Rights Shares on a pro-rata basis and in board lots, calculated based on the quantum of their respective Excess Rights Shares applied for.

After the above sequence of allocations is completed, any balance of Excess Rights Shares will be allocated again through steps (ii)-(iv) above until all Excess Rights Shares are fully allocated.

This announcement is dated 8 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 04:25 AM

|

显示全部楼层

发表于 1-2-2019 04:25 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Rights Issue | Details of corporate proposal | RENOUNCEABLE RIGHTS ISSUE OF UP TO 116,323,800 NEW ORDINARY SHARES OF ASIA BRANDS BERHAD ("ABB") ("ABB SHARE(S)") ("RIGHTS SHARE(S)") AT AN ISSUE PRICE OF RM0.35 PER RIGHTS SHARE ON THE BASIS OF ONE (1) RIGHTS SHARE FOR EVERY ONE (1) EXISTING ABB SHARE HELD BY THE ENTITLED SHAREHOLDERS OF ABB AS AT 5.00 P.M. ON 12 DECEMBER 2018 WITH A MINIMUM SUBSCRIPTION LEVEL OF 86,130,321 RIGHTS SHARES | No. of shares issued under this corporate proposal | 116,323,800 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.3500 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 232,647,600 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 198,714,011.000 | Listing Date | 14 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 08:25 AM

|

显示全部楼层

发表于 1-2-2019 08:25 AM

|

显示全部楼层

Name | TRACKLAND SDN. BHD. | Address | 118B, Jalan SS 24/2, Taman Megah,

Petaling Jaya

47301 Selangor

Malaysia. | Company No. | 962253-T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 09 Jan 2019 | 37,206,586 | Others | Direct Interest | Name of registered holder | Trackland Sdn. Bhd. | Address of registered holder | 118B, Jalan SS 24/2, Taman Megah, Petaling Jaya 47301 Selangor Malaysia. | Description of "Others" Type of Transaction | Subscription |

Circumstances by reason of which change has occurred | Subscription of Rights Shares | Nature of interest | Direct Interest | Direct (units) | 74,413,172 | Direct (%) | 31.985 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 74,413,172 | Date of notice | 15 Jan 2019 | Date notice received by Listed Issuer | 15 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 08:26 AM

|

显示全部楼层

发表于 1-2-2019 08:26 AM

|

显示全部楼层

Name | EVEREST HECTARE SDN. BHD. | Address | Level 7, Menara Milenium, Jalan Damanlela,

Pusat Bandar Damansara, Damansara Heights,

Kuala Lumpur

50490 Wilayah Persekutuan

Malaysia. | Company No. | 906715-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 09 Jan 2019 | 38,557,477 | Others | Direct Interest | Name of registered holder | Kenanga Nominees (Tempatan) Sdn. Bhd. | Address of registered holder | Level 15, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan. | Description of "Others" Type of Transaction | Subscription |

Circumstances by reason of which change has occurred | Subscription of Rights Shares | Nature of interest | Direct Interest | Direct (units) | 77,114,954 | Direct (%) | 33.147 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 77,114,954 | Date of notice | 15 Jan 2019 | Date notice received by Listed Issuer | 15 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|