|

|

发表于 12-10-2015 12:42 AM

|

显示全部楼层

发表于 12-10-2015 12:42 AM

|

显示全部楼层

傲奔看好现金循环机推增长

财经新闻 财经 2015-10-11 11:03

(吉隆坡8日讯)傲奔系统(OPENSYS,0040,创业板)乐观旗下现金循环存取款机(cash recycling Machines,简称:现金循环机)业务的市场潜力,可推动业务增长。

傲奔系统总执行长陈继骏在公司特大后指出,如今的技术发展趋势是把自动提款机(ATMs)和现金存款机(CDMs)的功能,结合成现金循环机,他说,现金循环机可同时做为存款和提款之用,所以称为循环使用(recycled)。

傲奔系统目前的三大业务,分别为自动提款或存款机、账单支付系统,以及客户支援与服务业务。

他看好,现金循环机在我国的潜能一片光明,并对该业务的增长前景感到乐观。

我国目前拥有1.7万台自动提款机和现金存款机,年增长率是5%。

他说:“光是更换取代旧机,已经是个庞大的市场。”

令吉贬值冲击微

在高效的服务机行业来讲,傲奔系统目前的市占率是80%。

陈继骏表示,现金循环机将减低银行在未使用浮动现金、现金保留、硬件与软件的成本。

“银行可在这方面节省高达30%的运营成本。”

傲奔系统的大部分客户都是银行。

谈到令吉贬值带来的冲击,陈继骏表示,货币汇率导致成本上涨,所以自助提款或存款机业务略微受到影响。然而,另两项业务则可部分缓冲上述业务的冲击。”

截至6月30日的次季,傲奔系统净利上扬1%至121万令吉,稍微优于上财年同期的120万令吉。

上半年净利则按年增41%至432万7000令吉。【南洋网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2015 08:16 PM

|

显示全部楼层

发表于 21-11-2015 08:16 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2015 | 30 Sep 2014 | 30 Sep 2015 | 30 Sep 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,469 | 12,306 | 55,377 | 32,165 | | 2 | Profit/(loss) before tax | 2,482 | 1,917 | 8,473 | 6,026 | | 3 | Profit/(loss) for the period | 1,720 | 1,414 | 6,047 | 4,474 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,720 | 1,414 | 6,047 | 4,474 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.58 | 0.47 | 2.03 | 1.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.50 | 1.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1457 | 0.1329

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2016 04:15 AM

|

显示全部楼层

发表于 28-2-2016 04:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,129 | 13,136 | 72,506 | 45,301 | | 2 | Profit/(loss) before tax | 2,172 | 1,504 | 10,645 | 7,530 | | 3 | Profit/(loss) for the period | 1,713 | 1,124 | 7,761 | 5,598 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,713 | 1,124 | 7,761 | 5,598 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.58 | 0.38 | 2.61 | 1.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 1.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1511 | 0.1772

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2016 04:21 AM

|

显示全部楼层

发表于 28-2-2016 04:21 AM

|

显示全部楼层

EX-date | 29 Mar 2016 | Entitlement date | 31 Mar 2016 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim tax exempt dividend of 5% equivalent to 0.5 sen per ordinary share of 10 sen each | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | 31 Mar 2016 to 31 Mar 2016 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MEGA CORPORATE SERVICES SDN BHDLevel 15-2, Bangunan Faber Imperial CourtJalan Sultan Ismail50250Kuala LumpurTel:03-26924271Fax:03-27325388 | Payment date | 20 Apr 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 Mar 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 5.0000 | Par Value | Malaysian Ringgit (MYR) 0.100 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2016 01:09 AM

|

显示全部楼层

发表于 31-5-2016 01:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,134 | 27,426 | 11,134 | 27,426 | | 2 | Profit/(loss) before tax | 1,339 | 4,268 | 1,339 | 4,268 | | 3 | Profit/(loss) for the period | 992 | 3,115 | 992 | 3,115 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 992 | 3,115 | 992 | 3,115 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.33 | 1.05 | 0.33 | 1.05 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.50 | 0.50 | 0.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1481 | 0.1498

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2016 02:11 AM

|

显示全部楼层

发表于 29-6-2016 02:11 AM

|

显示全部楼层

本帖最后由 icy97 于 29-6-2016 04:12 AM 编辑

Opensys - Bright Prospects Ahead ?

Author: Icon8888 | Publish date: Mon, 27 Jun 2016, 04:06 PM

http://klse.i3investor.com/blogs/icon8888/99160.jsp

1. Principal Business Activities

Opensys is principally involved in provision of solutions to the financial services industry in the areas of self-serviced machines and relevant IT services.

If you don't understand what is "self-serviced machines", they are those elereonic kiosks such as ATMs, Cheque Deposit Machines, Cash Deposit Machines, etc. Opensys' customers are mostly banks, but insurance companies and utility companies also make use of its products.

2. Background Financials

Based on 298 mil shares and price of 28 sen, Openys has market cap of RM83 mil. It reported net profit of RM7.8 mil for the FYE 31 December 2015. As such, historical PER is 10.6 times.

The group has borrowings of RM10 mil and cash of RM21 mil. Its shareholders' fund is RM44 mil. Based on 14 sen net assets per share, PBR is 2 times.

3. Historical Profitability

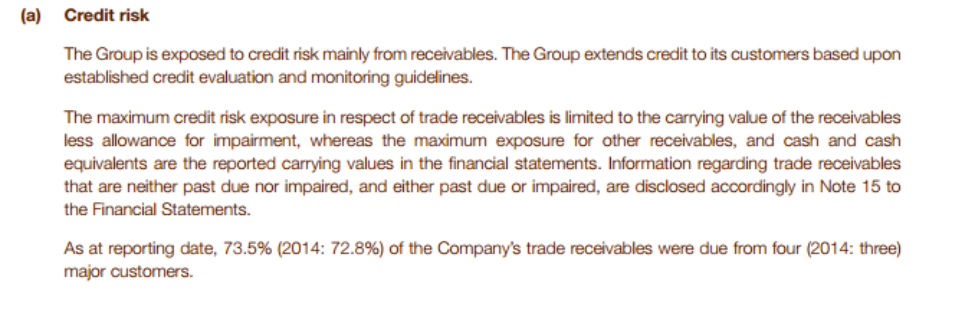

The group's revenue and net profit has been on upward trend since FY2012.

Annual Result:

F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | NPM (%) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) | 2015-12-31 | 72,506 | 7,761 | 11.00 | 2.61 | | 1.00 | | 0.1511 | 17.27 | 2014-12-31 | 45,301 | 5,598 | 13.00 | 1.88 | | 1.00 | | 0.1772 | 10.61 | 2013-12-31 | 33,237 | 4,660 | 15.00 | 2.08 | | 1.00 | | 0.1622 | 12.82 | 2012-12-31 | 32,982 | 3,529 | 11.00 | 1.58 | | 1.10 | | 0.1513 | 10.44 |

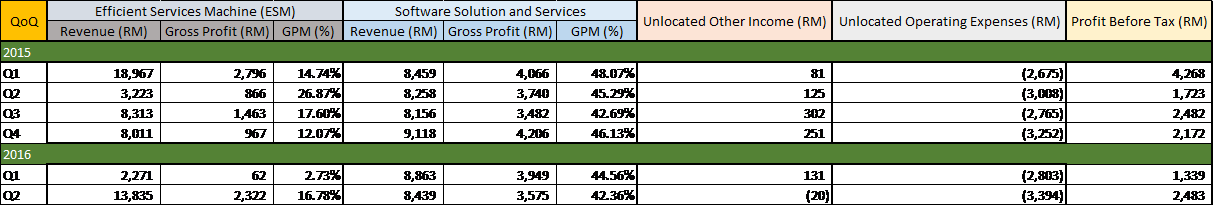

Details of recent quarters' performance are as set out below :-

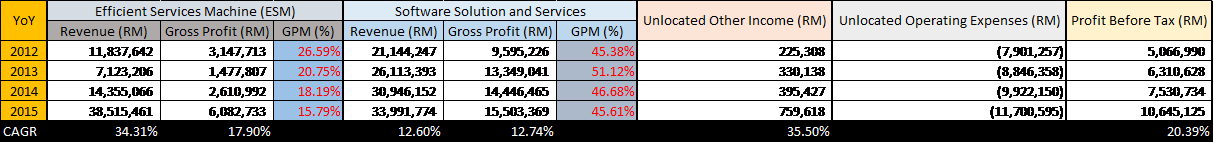

In FY2015, the group's net profit increased by 39%, in line with higher revenue. However, first quarter of FY2016 was disappointing, with EPS of 0.3 sen only.

What is so great about this stock ? Why do I write about it ?

4. Future Prospects

What is exciting about this group is its prospects. There are many juicy details in the just released 2015 annual report and quarterly report.

In the 2015 annual report, the group mentioned that traditionally, cash withdrawal and cash deposit are done separately via ATMs and Cash Deposit Machines respectively. However, their latest product, Cash Recycling Machine (CRM), can perform the above two tasks through one machine. This new machine is expected to gain wide acceptance as it will result in cost saving for end users (banks, insurance companies, etc). In addition, only 6% of banks machines are currently CRM. As such, there is still huge potential for the product.

The huge demand for CRM is more than just a concept. It is already materialising in real life. In its latest financial report for the quarter ended March 2016, the company stated that in the first quarter of 2016 alone, they achieved CRM order book more than the total amount last year.

5. Concluding Remarks

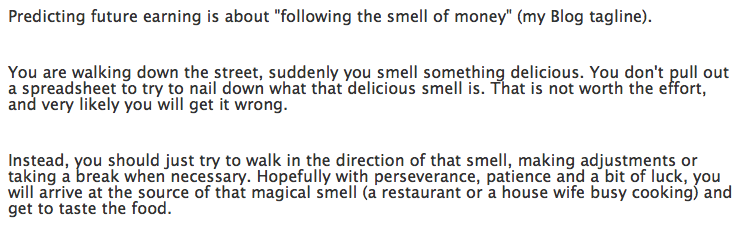

On 20 June 2016, I wrote the article "It Is The Future Earning That Matters, Stupid" to discuss my observation and belief that future earning has huge bearing on share price.

http://klse.i3investor.com/blogs/icon8888/98931.jsp

On 23 June 2016, I wrote the article "Predicting Future Earning" to discuss how one can make use of bits and pieces of information to try to predict future earning.

http://klse.i3investor.com/blogs/icon8888/98931.jsp

In that article, I explicitly mentioned that "predicting future earning" is NOT about pulling out a spreadsheet to build a financial model to derive next year EPS. It is more like "walking down the street following the smell of delicious food" :-

Opensys is one good example of how I pick stock by following the smell of money.

As mentioned above, I got to know about the huge latent demand for the group's new product, Cash Recycling Machine, through management discussions in the 2015 annual report and March 2016 quarterly report.

Do I know how much the group's profit will grow ? No, I don't. All I know is that it is LIKELY to grow.

And my guess is that the additional demand should be quite substantial as only 6% of existing bank machines are CRMs. Hopefully this will lead to substantial additional profit.

Do I know when the profit will grow ? Again, I don't know. But since the company mentioned that it achieved strong order book for CRM in Q1 of 2016 (more than the entire last year), I guess it is a matter of two to three quarters for the profit to show up.

That is all it takes to arouse my interest. But before I jump in, I did a quick check of the group's balance sheets and cash flow. I also checked the PE Ratio.

They looked reasonable.

Armed with the above information and knowledge, I pressed the Buy button. Please note I didn't even bother to come up with a prediction for 2016 EPS. There is simply not sufficient information to do that. Garbage in garbage out, it will be a waste of time.

Will I be successful with this stock ? Nobody knows.

I believe that investing is 50% skills, 50% luck. My role is to assemble a portoflio of stocks with potential for earning growth. Whether those stocks will finally grow or not, I leave it to God to decide.

That is how I punt the market.

Appendix - Opensys' Customers

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2016 12:35 PM

来自手机

|

显示全部楼层

发表于 28-7-2016 12:35 PM

来自手机

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2016 06:38 PM

|

显示全部楼层

发表于 28-7-2016 06:38 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2016 06:06 PM

|

显示全部楼层

发表于 25-8-2016 06:06 PM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2016 09:44 PM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 21,824 | 11,481 | 32,957 | 38,908 | | 2 | Profit/(loss) before tax | 2,483 | 1,723 | 3,822 | 5,991 | | 3 | Profit/(loss) for the period | 1,858 | 1,212 | 2,850 | 4,327 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,858 | 1,212 | 2,850 | 4,327 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.62 | 0.41 | 0.96 | 1.45 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.50 | 0.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1543 | 0.1498

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2016 04:53 AM

|

显示全部楼层

发表于 28-8-2016 04:53 AM

|

显示全部楼层

EX-date | 28 Sep 2016 | Entitlement date | 30 Sep 2016 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second interim tax exempt dividend of 5% equivalent to 0.5 sen per ordinary share of 10 sen each | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | 30 Sep 2016 to 30 Sep 2016 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MEGA CORPORATE SERVICES SDN BHDLevel 15-2, Bangunan Faber Imperial CourtJalan Sultan Ismail50250 Kuala LumpurTel:03-26924271Fax:03-27325388 | Payment date | 19 Oct 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Sep 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 5 | Par Value | Malaysian Ringgit (MYR) 0.100 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2016 11:59 AM

|

显示全部楼层

发表于 28-8-2016 11:59 AM

|

显示全部楼层

|

大规模更新 ATM的情况都是在8月才有所行动吧。。相信下个月季的qr开会显示赚钱。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2016 11:49 AM

|

显示全部楼层

发表于 26-10-2016 11:49 AM

|

显示全部楼层

本帖最后由 icy97 于 27-10-2016 12:21 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2016 04:32 PM

|

显示全部楼层

发表于 26-10-2016 04:32 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2016 04:45 PM

|

显示全部楼层

发表于 26-10-2016 04:45 PM

|

显示全部楼层

暫時沒有..

只是一直放在Watchlist里留意而已..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2016 05:49 PM

|

显示全部楼层

发表于 26-10-2016 05:49 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2016 06:12 PM

|

显示全部楼层

发表于 26-10-2016 06:12 PM

|

显示全部楼层

恭喜..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-11-2016 01:21 AM

|

显示全部楼层

发表于 14-11-2016 01:21 AM

|

显示全部楼层

本帖最后由 icy97 于 14-11-2016 02:33 AM 编辑

OpenSys (M) Bhd (0040) - Robust Growth Ahead

Author: noobnnew | Publish date: Sat, 12 Nov 2016, 10:41 AM

http://klse.i3investor.com/blogs/noobnnew/108645.jsp

As one of the penny stock that below RM1 that recommended by Cold Eye, OpenSys (M) Bhd had fly into our radar. For those who want to understand the fundamental of OpenSys, you are welcome to read the article published by Shinado in the link below. He had done a good job that we couldn’t done it better.

http://klse.i3investor.com/blogs/shinado/92831.jsp

One of the famous blogger Icon8888 had cover OpenSys previously as well that mentioned about the future prospect of the company in end of June 2016. Those who are interested can read about in the link below.

http://klse.i3investor.com/blogs/icon8888/99160.jsp

Same as every article that published by Icon previously, the share price of OpenSys had surged to all time high at around 41sen but drop drastically after the Q2 financial result came out as the result are not as good as aspect by speculator. Some of the member in i3 even comment that the company account seems fishy due to high receivable. The purposed of this article is to examine that whether the prospect of OpenSys is as good as it promoted by Icon and also Cold Eye.

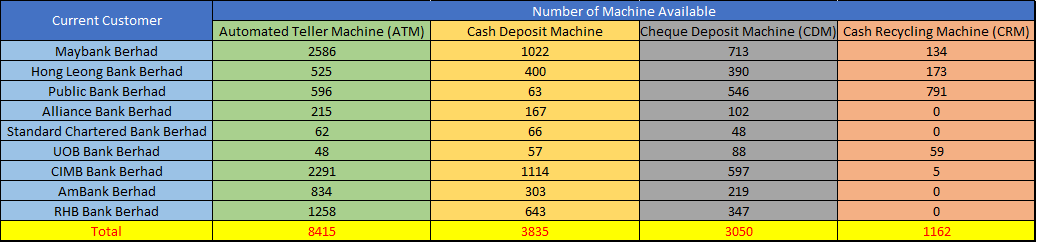

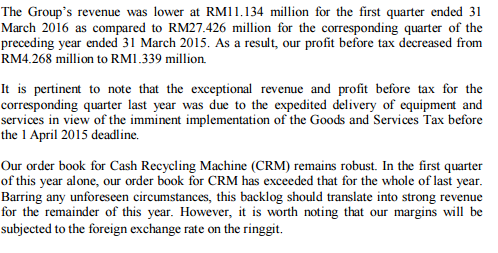

The table below had shown the number of self-service machine available throughout Malaysia by the customer of OpenSys as at 31 December 2015.

As we can see, currently there are 1162 units of Cash Recycling Machine available in Malaysia. Public Bank have the most number of CRM machines follow by Hong Leong Bank and Malayan Banking Berhad. The number of CRM are almost 8x lower and 3x lower than ATM and Cash Deposit Machine available nationwide. Based on the excerpt of the annual report below, we understand that bank branches can replace two ATM/CDMs with on CRM without compromising the quality of services provided. Besides that the action also will help the bank to save their operational cost up to 30%.

Judging from the current number of 8415 units of ATM and 3835 units of CDM available without considering the future growth of CRM installation in new places. If all the current customer are going to replace their old ATM/CDM machines to CRM, the market still need about 4000 units of CRM. So, the question now will be how OpenSys benefit from the CRM Market compare to all its competitor.

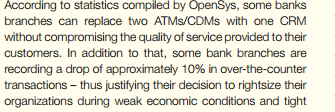

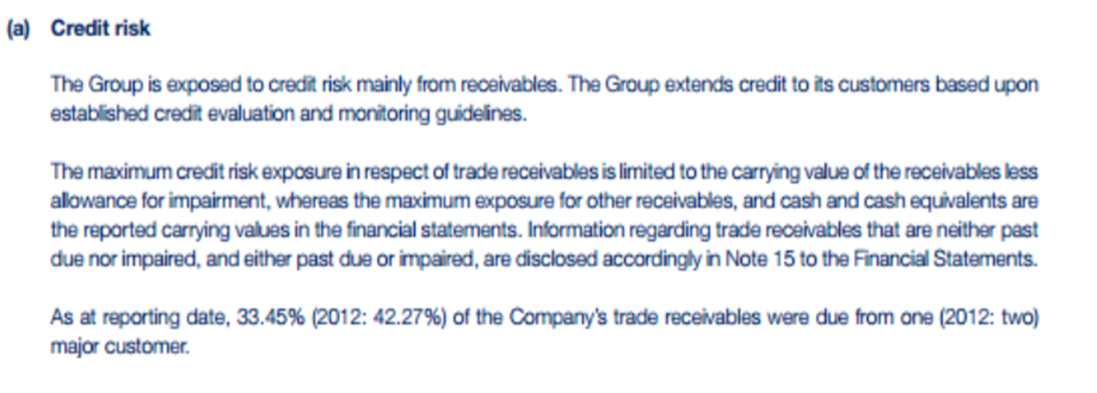

The number of CRM available in Malaysia are only 52 units in the year of 2011, before that there are no data of CRM installed among the local financial institution. One of the interesting thing noted when we study the annual report was coincidentally OpenSys also begin to shift into CRM business in the year of 2011. By studying the financial notes from the annual report in 2013 below, we noted the management mentioned that main trade receivables are from 2 customer in the year of 2012 and 1 in 2013.

In the whole year of 2012, Public Bank had installed 146 units of CRM whereas Maybank had installed 40 units. We believe that they are the two major customer that mentioned by the management of OpenSys. In the year of 2013, Public Bank had installed more than 200 units of CRM which make him the single largest customer of OpenSys with huge trade receivables.

If we continue to go through the annual report in 2014 and 2015, we will noticed that the management continue to mentioned that the trade receivables in 2014 are from 3 different customer in 2014 and 4 different customer in 2015. The new bank that installed CRM in 2014 is Hong Leong Bank and 2015 is CIMB. Therefore, by putting the puzzle together, we believe that currently the four main customer that purchasing CRM from OpenSys are Maybank, Public Bank, Hong Leong Bank, Public Bank and CIMB which are 4 out of 5 banks that had already installed the CRM.

Since the installation of CIMB and HLB still low compare to Maybank and Public Bank, we expect that both of the bank will continue the installation of CRM in near future in order to achieve cost efficiency management. From the observation above, we also does not worry about the huge receivable in the balance sheet of OpenSys as it was almost unlikely for local financial institution to default their payment obligation. The future for OpenSys is bright as well since there are still RHB, AMBank and Alliance Bank as an existing customer for the Cheque Management Solution of OpenSys that are still do not adopt CRM in their business. Given the past record of OpenSys, we believe that OpenSys able to convince all these bank to purchase their CRM as well.

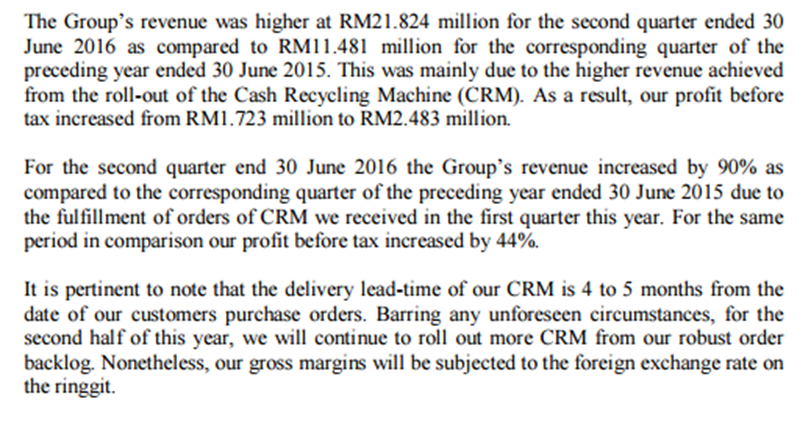

Some of the investor might argue that the profit margin of CRM is not as high as expected therefore OpenSys might not be able to benefit much from it even OpenSys is the market leader in CRM business. Below had showed the segmented revenue of OpenSys.

From the first table, we are able to observe that the revenue contribution of ESM had increased from only 35% of revenue increased to more than 50% in 2015 and judging from the CRM installation rate, we expect the contribution of ESM will continue to growth in the next few years. Compare to the net profit margin of ESM that range from 15% to 25%, the SSS clearly provide a higher profit margin at around 45% to 50% each year. However, we noted that the revenue are stable and no growth in the past few years. This is due to the revenue contribution of SSS are per transaction basis which means that OpenSys will charge certain amount of fees for each cheque process through their machine. We have the reason to believe that the revenue from the SSS business will having exponential growth in future after the installation of CRM slowdown. This is due to OpenSys are offering free solution services for the first few years to their customer that purchased the CRM from them. Upon the completion of installation on CRM, it will be time to charge for the SSS services. Hence the company will not experience any slowdown or decline in their revenue even there are low CRM installation in the future due to new contribution from their Cash Recycling Solution provided.

Referring to the excerpt from Q1 2016 issue by the management, we noted the management mentioned that the order book for first quarter has exceeded whole of last year. Since the CRM installation was 422 unit last year, we expected the order book will be in between 450 to 550 units this year for OpenSys.

Based on the QoQ breakdown of segmental reporting below, we noted that the said strong order book still are not reporting in the latest quarterly result. Hence we have reason to believe that a strong result will be posted by management in coming Q3. As the management continue to hint in their Q2 financial result that it normally take 4 to 5 months for OpenSys to deliver the product once it was ordered.

In short, we are positive to the bright future of OpenSys due to following reason,

- Strong upcoming Q3 result

- Market leader for CRM

- Robust growth ahead due to low CRM installation from local financial institution

- Sustainable income as the low CRM revenue in future will be able to compensated by revenue from Cash Recycling Solution

- Strong balance sheet and Cashflow

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals. By the time of writing, the author have a LONG POSITION on OpenSys BHD.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-11-2016 01:24 AM

|

显示全部楼层

发表于 25-11-2016 01:24 AM

|

显示全部楼层

本帖最后由 icy97 于 28-11-2016 02:21 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 30,778 | 16,469 | 63,736 | 55,377 | | 2 | Profit/(loss) before tax | 2,338 | 2,482 | 6,160 | 8,473 | | 3 | Profit/(loss) for the period | 1,681 | 1,720 | 4,531 | 6,047 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,681 | 1,720 | 4,531 | 6,047 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.56 | 0.58 | 1.52 | 2.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.50 | 1.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1550 | 0.1498

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2016 08:12 PM

|

显示全部楼层

发表于 29-11-2016 08:12 PM

|

显示全部楼层

本帖最后由 icy97 于 29-11-2016 10:27 PM 编辑

傲奔系统 OPENSYS – 浅谈业务&业绩

OPENSYS成立于1995年,在2004年1月上市于大马创业板,主要是一家专为金融业服务的科技公司。它最主要的产品为自动交易机械和“现金循环机” (Cash Recycling Machine) 。这些服务机可提供现金回收,支票存款和账单支付等等,以降低对人手的依赖,同时强化客户便利。

在本地, OPENSYS已经为许多大型银行,保险公司和电信公司提供这些服务机,包括【MAYBANK】、【CIMB】、【UOB】、【RHB】、【DIGI】等等。

OPENSYS的优势在于CRM机。如无意外,它在本地并未有任何竞争对手。CRM机是一部融合了ATM机和CDM机功能的现金回收再利用服务机。CRM机可以接受现金存款,然后再“回收”重新分配到现金提款。因此,这部机可大幅度降低银行成本约30%,也可省去很多工作,例如现金保养,现金处理,空间租用,硬件和软件。

除了可省去大约 30%的开销, CRM机也提供了更好的服务水平。银行的客户可省去在ATM机提款,然后在CDM机存款的时间。CRM机可以一次性地完成这两点。

OPENSYS的科技搭档是日本的 【OKI ELECTRIC】。 【OKI】是CRM机的鼻祖,早在1982年就研发及推出了这现金循环科技。

除了CRM机,OPENSYS的产品也包括支票存款机 (Cheque Deposit Machine)。通过将支票存入,这部机可以通过互联网进行传输以及电子资金转账。此外,OPENSYS在电信和保险行业使用的缴费服务机可让客户支付账单,重装预付卡和使用现金、支票、信用卡和续约保险费。 OPENSYS通过提供硬件和软件,修改商业应用程序和分发软件更新,来管理整部机。

OPENSYS在上个星期发布了FY16Q3的业绩,其盈利按年按季分别下滑2%和10%。虽然跌幅不大,但是这盈利属于低于预期的业绩。管理层曾在FY16Q1季报里提到,OPENSYS在第一季度获得的CRM订单已经超越去年一整年的订单,预计可在剩余的FY16里作出显著的贡献。然而,OPENSYS却迟迟无法在FY16Q2和FY16Q3交出满意的盈利表现。早前因看好公司今年表现而买入的股友,纷纷在业绩出炉后抛售OPENSYS,符合了“希望越大,失望越大”这句词语。

OPENSYS在FY16Q3的营业额按年按季增长87%和41%,还创下历史新高。营业额的暴增意味着它已纳入非常多的CRM销售量。然而,盈利的不变主要因为赚幅受压。值得一提,OPENSYS的生产原料大约有70%是从外国采购,而其业务只是专注在本地市场,营业额全数以马币交易。OPENSYS也不曾利用任何金融工具来进行外汇对冲。

因此,当美金兑马币走强,它的利润率肯定受到某种程度的影响。换句话说,OPENSYS的赚幅很多时候取决于外汇的流动率。它在FY14和FY15的平均服务机赚幅是18%,然而在FY16Q3的赚幅只有区区的10%。按照目前美金兑马币的走势 (4.45左右),就算营收和订单再高,OPENSYS的盈利预计难有作为。

此外,OPENSYS的另一项非经常性收入,维修服务及业务流程外包业务,也在FY16Q3走软。实际上,这项业务是OPENSYS的主要盈利来源,而不是CRM机销售。这项业务的贡献一直都很平稳,然而却在FY16Q3按年按季分别下滑12%和14%,是近2年以来的低点。管理层并未在季报中作出任何解释。

目前,本地的ATM机和CDM机的数量大约在16,000左右,年增长率5%。OPENSYS的CRM机渗透率只有区区的6%左右。假设全部本地银行开始在它们的分行安装CRM机,单单是替换这批旧的ATM机和CDM机,这潜在市场可想而知。

但是,回归现实,在马币巨贬的情况下,OPENSYS下个季度的业绩也预计难有作为。它的赚幅最早或许也得在半年后才开始恢复。目前,OPENSYS的PE为17倍,在无法达到预期的情况下,已属偏高。股价还有近一步的潜在下跌空间,短期的支撑价位处在0.335。

RH Research

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-12-2016 12:52 PM

|

显示全部楼层

发表于 8-12-2016 12:52 PM

|

显示全部楼层

本帖最后由 icy97 于 8-12-2016 10:49 PM 编辑

冷眼推荐股(二十一):OPENSYS

Thursday, December 8, 2016

http://bblifediary.blogspot.my/2016/12/opensys.html

业务

- 效率服务机(ESM)销售

- 商业城与外包服务

- 软件

OPENSYS(傲奔系统,0040,创业板科技股),成立于,并于2004年1月29日上市当年的MESDAQ,2009年8月因MESDAQ易名为创业板(ACE)而转至创业板上市。

OPENSYS是一家专为金融业服务的科技公司,该公司主要的产品为效率服务机(EMS),ATM、存款机、存支票机,以及CRM等。

除了在银行业外,EMS也能够处理各种日常琐碎交易,包括付款、账户查询等,所以它也可以被应用在保险、公用事业、政府部门等,以降低对人手的依赖,同时也能够强化客户便利。

目前,OPENSYS的主打产品为CRM,这是该公司向日本OKI所获得的代理权。

| OKI RG7 Cash Recycling Machine |

CRM(Cash Recycling Machine)其实就是提款机(ATM)和存款机(Cash Deposit)的结合。由于旧式的方法需要两台机器分别处理提款和存款,很不符合经济效益。而CRM可一机两用,当一名客户存了钱进CRM后,即刻可以让下一名客户来提取。

除了可替银行节省成本外,还可节省空间和减少人力。

在大马估计拥有6万太的提款机和存款机,如果这些银行逐步采用CRM,对OPENSYS这家小型创业板公司来说,将会是一个非常庞大的商机,问题在于它能够掠取多少的市场份额吧了!

免责声明:

以上投资分析,纯属本人个人意见和观点。

文章所提做出的数据与价格仅供参考,建议大家在买进一家公司的股份前,请先做功课并了解该公司,并衡量应何时进场和离场,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负!

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|