|

|

发表于 29-8-2015 11:31 PM

|

显示全部楼层

发表于 29-8-2015 11:31 PM

|

显示全部楼层

Date of change | 27 Aug 2015 | Name | MR WU, MAO-YUAN | Age | 58 | Nationality | Taiwan, Province of China | Type of change | Redesignation | Previous Position | Non Executive Director | New Position | Executive Director | Directorate | Executive | Qualifications | Mr. Wu graduated with a diploma in Mechanical Engineering from Taiwan Zhen Xin University in 1997. | Working experience and occupation | Mr. Wu was appointed to the Board of DUFU as Non-Independent Non Executive Director on 19 December 2012. Upon graduation, he started his career in year 1979 as an Engineering Assistant responsible for the design and manufacturing of production jig and fixture with Da Di Ling Company. Subsequently, Wu joined Jin Feng Corp. in 1981 as a supervisor leading the production team to manufacture motorcycle components. In 1988-1992, he joined Lee Bai Corp Ltd. as a production manager and he formed and started a new precision machining group for the Company. In 1993, Mr. Wu worked in Dufu Malaysia where he was responsible for overseeing the factory operation as well as technology for Dufu. He left Malaysia in 2002 to personally setup and established Futron Technology Limited in Guang Zhou, China to manufacture and produce production parts for computer related components.Throughout his career in the past 20 over years he had demonstrated not only his high technical skill, but had also proven his management capability by bringing success to many of the companies he served.He is the Managing Director of Futron Technology Limited & Compliance Officer of Superior Plating Technology Co. Ltd. | Family relationship with any director and/or major shareholder of the listed issuer | | Any conflict of interests that he/she has with the listed issuer | | Details of any interest in the securities of the listed issuer or its subsidiaries | 4,612,500 Ordinary Shares of RM0.50 each in Dufu Technology Corp. Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2015 01:36 AM

|

显示全部楼层

发表于 9-9-2015 01:36 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2015 04:03 PM 编辑

杜甫240万聘顾问 确保CEO离职营运顺畅

财经新闻 财经 2015-09-09 07:52

(吉隆坡8日讯)杜甫科技(DUFU,7233,主板工业产品股)以240万令吉聘请Aspire Ambience公司(AASB),提供顾问服务,以在掌舵手离职后保持营运顺畅。

根据文告,杜甫科技今日与AASB达成协议,AASB将在杜甫科技代理总执行长杨炳海(译音)管理业务发展期间,提供培训、指引和顾问服务。

同时,AASB也会检视杜甫科技的业务、合约和策略等,放眼提高公司的行业地位,并探讨扩展计划。

杜甫科技指出,由于杨宝有辞去了执行董事和总执行长职位,为了确保在寻得新总执行长之前,公司能够顺利运作,因而聘请AASB提供相关服务。

双方的协议已在今日生效,为期6个月,每月费用为40万令吉,另有6个月的延长选择权。

值得注意的是,AASB的董事和股东是杨宝有,以及杨宝有的妻子林美玲(译音)。

早前,由于杜甫科技的高层涉及滥用公款,所以委任了Messrs Ferrier Hodgson MH作为调查审计师,并在独立调查报告出炉前,暂停了总执行长和财务总监职权。

独立调查报告出炉后,有关高层舞弊滥用公款的事件,出现更新进展,杨宝有因而在8月27日辞去总执行长职位。【南洋网财经】

Type | Announcement | Subject | OTHERS | Description | DUFU TECHOLOGY CORP. BERHAD (DUFU OR THE COMPANY)- UPDATES ON ANNOUNCEMENT IN RELATION TO RECEIPT OF ALLEGATION LETTER | Unless stated otherwise, definitions used in this announcement shall carry the same meaning as defined in the announcement dated February 11, 2015, March 3, 2015,

March 7, 2015, May 27, 2015, June 29, 2015, July 7, 2015, July 16, 2015, July 31, 2015 and August 27, 2015 respectively in relation to the Receipt of Allegation Letter.

Further to the Company’s announcement dated August 27, 2015, the Board wishes to inform that Dufu Industries Sdn. Bhd. (Company No. 165467-T) [“DISB”], a wholly-owned subsidiary of DUFU has on September 8, 2015, entered into an Agreement for Independent Contractor Services [the “Services Agreement”] with Aspire Ambience Sdn. Bhd. (Company No. 1154406-V) [the “Independent Contractor” or “AASB”] to retain Independent Contractor to perform the services as detailed in the announcement attached attached herein. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4861585

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-10-2015 01:51 AM

|

显示全部楼层

发表于 1-10-2015 01:51 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (29A)| DUFU TECHNOLOGY CORP. BERHAD |

Particulars of Substantial Securities HolderName | PERFECT FULL YEN SDN BHD | Address | 57-G PERSIARAN BAYAN INDAH

BAYAN BAY, SUNGAI NIBONG

BAYAN LEPAS

11900 Pulau Pinang | NRIC/Passport No/Company No. | 1132973-D | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary Shares of RM0.50 each | Name & address of registered holder | PERFECT FULL YEN SDN BHD57-G PERSIARAN BAYAN INDAHBAYAN BAY, SUNGAI NIBONG |

| Date interest acquired & no of securities acquired | Currency |

| | Date interest acquired | 29 Sep 2015 | No of securities | 9,321,400 | Circumstances by reason of which Securities Holder has interest | Off Market Deal | Nature of interest | Direct Interest | Price Transacted ($$) |

|

| | Total no of securities after change | Direct (units) | 15,844,648 | Direct (%) | 9.03 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 30 Sep 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2015 03:12 AM

|

显示全部楼层

发表于 24-11-2015 03:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2015 | 30 Sep 2014 | 30 Sep 2015 | 30 Sep 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 47,979 | 34,792 | 122,684 | 92,907 | | 2 | Profit/(loss) before tax | 6,289 | 7,374 | 9,329 | 7,076 | | 3 | Profit/(loss) for the period | 4,616 | 7,252 | 7,771 | 6,993 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,616 | 7,252 | 7,771 | 6,993 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.63 | 4.13 | 4.43 | 3.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6220 | 0.5770

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-11-2015 02:35 AM

|

显示全部楼层

发表于 26-11-2015 02:35 AM

|

显示全部楼层

本帖最后由 icy97 于 13-12-2015 02:18 AM 编辑

杜甫科技进行内部重组

经济新闻

12/12/201519:53

(吉隆坡12日讯)杜甫科技机构有限公司(DUFU,7233,工业产品组)已在中国收到监管当局发出的批准证书和营业执照证书,使到旗下的富创有限公司可以以570万美元,出售富创科技有限公司全部股权予控股公司杜甫科技。

它致函大马交易所说:“今次进行内部业务重组的目的,是要精简集团的架构。”

富创有限公司的业务涉及制造和经营光学仪器、磁碟驱动器及零件贸易,它的注册资本达570万美元。【光华日报财经】

Type | Announcement | Subject | OTHERS | Description | RE-ORGANISATION OF DUFU TECHNOLOGY CORP. BERHAD'S GROUP STRUCTURE | RE-ORGANISATION OF DUFU TECHNOLOGY CORP. BERHAD’S GROUP STRUCTURE The Board of Directors of Dufu Technology Corp. Berhad (“DUFU” or “the Company”) is pleased to announce that it had on November 25, 2015 received the Certificate of Approval and business license from the Regulatory Authorities in People’s Republic of China (“PRC”) on completion of the disposal of the entire equity interest in the capital of Futron Technology Co., Ltd (“Futron Ltd”) by Futron Technology Limited (“Futron”) to its holding company, DUFU for a consideration of USD5,700,000.00. [“the Re-organization”]

Organisation Chart of DUFU Group before and after the Re-Organisation Please refer to Appendix 1 and 2 respectively for the Organisation Charts.

Information on DUFU DUFU was incorporated in Malaysia on May 30, 2002 under the Companies, Act 1965 (“the AC”) as a private limited company under the name of Dufu Technology Corp. Sdn Bhd. Dufu was subsequently converted in a public limited company on December 26, 2002 and assumed its present name. The Company was listed on the Second Board of Bursa Malaysia Securities Berhad (“Bursa Securities”) on February 28, 2007 and subsequently transferred to the then Main Board of Bursa Securities on September 11, 2008. The authorised share capital of DUFU as at todate is RM100,000,000.00 divided into 200,000,000 ordinary shares of RM0.50 each of which RM87,735,185.00 comprising 175,470,370 ordinary shares of RM0.50 each has been fully paid up. The principal activities of the Company are investment holdings and providing management services.

Information on Futron Ltd Futron Ltd was incorporated in PRC on May 31, 2002 and is principally involved in the manufacturing and trading of optics and magnetism driver and parts. The registered capital of Futron Ltd as at June 3, 2015 is USD5,700,000

Rationale The Re-Organisation is an internal re-structuring to streamline the group structure of DUFU.

Financial Effect There will not be any material effect arising from the Re-Organisation on the net assets, earnings per share, share capital and substantial shareholding of DUFU and its subsidiaries (“DUFU Group”) for the financial year ending December 31, 2015.

Approval Required The Re-Organisation is not subject to the approval of the shareholders of DUFU, or any regulatory authorities in Malaysia. The regulatory authorities in PRC has vide its Certificate of Approval dated June 3, 2015 approved the Re-organization.

Liabilities to be Assumed after the Acquisition No liabilities will be assumed by the DUFU Group arising from the Re-Organisation.

Directors and Substantial Shareholders Interest None of the Directors and Substantial Shareholders or person connected with the Directors or Substantial Shareholders of DUFU Group has any interest, direct or indirect in the Re-Organisation.

Statement by the Board of Directors The Directors of DUFU are of opinion that the Re-Organisation is in the best interest of DUFU. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4930837

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-12-2015 01:18 AM

|

显示全部楼层

发表于 8-12-2015 01:18 AM

|

显示全部楼层

| DUFU TECHNOLOGY CORP. BERHAD |

EX-date | 29 Dec 2015 | Entitlement date | 31 Dec 2015 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single Tier Special Interim Dividend of 2 Sen per share for the year ending December 31, 2015 | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHDLevel 7, Menara MileniumJalan Damanlela, Pusat Bandar DamansaraDamansara Heights50490 Kuala LumpurTel:0320849000Fax:0320949940 | Payment date | 19 Jan 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 Dec 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0200 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-12-2015 11:55 PM

|

显示全部楼层

发表于 13-12-2015 11:55 PM

|

显示全部楼层

本帖最后由 icy97 于 14-12-2015 12:03 AM 编辑

顾问费该是24万, not 2.4 million。

这版的版主实在不好当,so many counter announcement to post .... |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2015 11:01 AM

|

显示全部楼层

发表于 27-12-2015 11:01 AM

|

显示全部楼层

终于轮到杜甫了。

year low :0.28 , current : 0.52

dividend : 0.02 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2016 04:15 AM

|

显示全部楼层

发表于 1-1-2016 04:15 AM

|

显示全部楼层

Date of change | 02 Jan 2016 | Name | MR KHOO LAY TATT | Age | 42 | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Independent Director | New Position | Executive Director | Directorate | Executive | Qualifications | Mr. Khoo graduated from Tunku Abdul Rahman College with an Institute of Chartered Secretaries and Administrators (ICSA) Professional Degree and a Diploma in Commerce (Business Management) in 1996. He is a Chartered Secretary by profession and also a Certified Financial Planner (CFP) and a Certified Member of the Financial Planning Association of Malaysia (FPAM). He is also a Fellow member of the Institute of Chartered Secretaries and Administrators (ICSA / MAICSA). | Working experience and occupation | Upon graduation, Mr. Khoo started his career in May 1996 as Company Secretarial Officer in the Corporate & Legal Division of a commercial bank. He left the bank as an Executive cum Company Secretary of its subsidiaries in 2000. He joined a Secretarial Services firm in Penang as the Assistant Manager and left the said firm in 2005 as a Senior Manager. During his tenure, he was involved in numerous initial public offerings and corporate exercises undertaken by listed companies.Currently, he sits on the Board of three public companies listed on the Main Market of Bursa Securities, namely:-1) Acme Holdings Berhad as Independent, Non-Executive Director;2) P.I.E Industrial Berhad as Independent, Non-Executive Director; and3) Saudee Group Berhad as Independent, Non-Executive Director. | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | 200,000 Ordinary Shares of RM0.50 each in Dufu Technology Corp. Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2016 12:46 PM

|

显示全部楼层

发表于 13-1-2016 12:46 PM

|

显示全部楼层

本帖最后由 icy97 于 13-1-2016 01:54 PM 编辑

DUFU - Unusual Market Activity ("UMA") query by Bursa Securities| DUFU TECHNOLOGY CORP. BERHAD |

Bursa Malaysia Securities Berhad has on 13 January 2016 issued an UMA query on the sharp rise in price and high volume of DUFU’s shares today.

In this respect, investors are advised to take note of the Company’s reply to the above UMA query which will be posted at Bursa Malaysia’s website under the company announcements,http://www.bursamalaysia.com/market/listed-companies/company-announcements/ when making their investment decision. |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2016 08:51 PM

|

显示全部楼层

发表于 13-1-2016 08:51 PM

|

显示全部楼层

本帖最后由 icy97 于 14-1-2016 02:32 AM 编辑

股價異熱飆5年新高 Dufu科技機構遭質詢

2016年1月13日

http://www.chinapress.com.my/20160113/股價異熱飆5年新高-dufu科技機構遭質詢/

(吉隆坡13日訊)Dufu科技機構(DUFU,7233,主要板工業)因股價異常大熱飆升,創下至少5年以來的最高水平,遭馬證交所發出“異常交易活動”(UMA)質詢。

Dufu科技機構晚間回應指,向董事和主要股東作出諮詢后,指對可能導致公司交投活躍的消息毫不知情,包括未有留意到可能涉及公司貿易活動報導和傳言、未對交易活動賬目作解說,同時也符合大馬交易所9.03上市條例。

該股以51.5仙開市,增0.5仙,一度漲15仙或29%至66仙,為至少5年以來的最高水平,休市暫掛61.5仙,上揚10.5仙;半日成交量4004萬5600股。

該股午盤升勢漸退,閉市時報63仙,起12仙,成交量4647萬8300股,為10大熱門股季軍。

該股價在去年11月初從32仙的價位大幅飆升,在12月中沖破50仙水平,與今年初的49仙相比,該股年初至今漲14仙或29%。

基于Dufu科技機構在未有特別企業活動下大漲,遭馬證交所發出“異常交易活動”質詢,並需提供或推高股價走勢的最新企業發展。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2016 04:27 AM

|

显示全部楼层

发表于 28-2-2016 04:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 53,753 | 43,116 | 176,442 | 136,023 | | 2 | Profit/(loss) before tax | 6,652 | 140 | 15,981 | 7,216 | | 3 | Profit/(loss) for the period | 3,171 | -730 | 10,942 | 6,263 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,171 | -730 | 10,942 | 6,263 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.80 | -0.41 | 6.23 | 3.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 2.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6580 | 0.5700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2016 03:28 AM

|

显示全部楼层

发表于 27-4-2016 03:28 AM

|

显示全部楼层

| DUFU TECHNOLOGY CORP. BERHAD |

EX-date | 27 May 2016 | Entitlement date | 31 May 2016 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Single Tier Final Dividend of 1.1 sen per share for the financial year ended 31 December 2015 | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHDLevel 7, Menara MileniumJalan Damanlela, Pusat Bandar DamansaraDamansara Heights50490Kuala LumpurTel:0320849000Fax:0320949940 | Payment date | 15 Jun 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 May 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0110 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2016 04:59 AM

|

显示全部楼层

发表于 22-5-2016 04:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 41,027 | 34,958 | 41,027 | 34,958 | | 2 | Profit/(loss) before tax | 5,331 | 212 | 5,331 | 212 | | 3 | Profit/(loss) for the period | 4,567 | 547 | 4,567 | 547 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,567 | 547 | 4,567 | 547 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.60 | 0.31 | 2.60 | 0.31 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6240 | 0.6580

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2016 03:09 AM

|

显示全部楼层

发表于 17-6-2016 03:09 AM

|

显示全部楼层

2013年 right issue 两毛钱无人问津,现在已经破六毛,加上两次派息3.1分。好难捉摸。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2016 02:15 AM

|

显示全部楼层

发表于 1-9-2016 02:15 AM

|

显示全部楼层

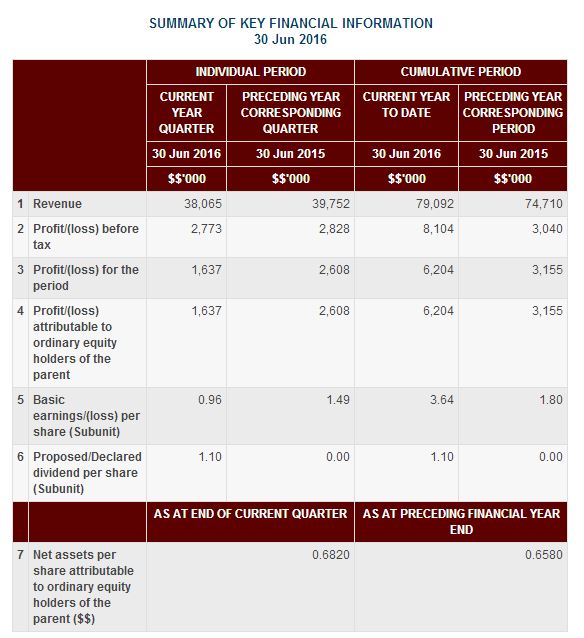

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 38,065 | 39,752 | 79,092 | 74,710 | | 2 | Profit/(loss) before tax | 2,773 | 2,828 | 8,104 | 3,040 | | 3 | Profit/(loss) for the period | 1,637 | 2,608 | 6,204 | 3,155 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,637 | 2,608 | 6,204 | 3,155 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.96 | 1.49 | 3.64 | 1.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.10 | 0.00 | 1.10 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6820 | 0.6580

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2016 02:16 AM

|

显示全部楼层

发表于 1-9-2016 02:16 AM

|

显示全部楼层

Date of change | 29 Aug 2016 | Name | MR YEOH BENG HOOI | Age | 52 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Executive Officer | Qualifications | Diploma in Electronic Engineering from Butterworth Institute of Technology | Working experience and occupation | In 1988, he started his career as an Assistant Engineer with Advanced Micro Devices Inc., an U.S.A. based semiconductor company, to assist engineers in carrying out engineering activities. In 1990, he was appointed Senior Reliability Laboratory Technician in the same company. In 1992, he joined Read-Rite Malaysia as QA Engineer, where he was responsible for the First Article Qualification and suppliers quality. In 1995, he joined XOLOX Malaysia, an U.S.A-based company which is involved in stamping and over-moulding, as an Engineering Manager to start up an over-moulding facility. He was responsible for engineering tasks that include self-bonded coil winding, over-moulding, sub-assembly as well as product testing. In 1996, he was appointed as the Director of Engineering/QA of XOLOX Malaysia . His responsibility extended to R&D, Prototyping and tooling design. He has managed technology transfer, installed full manufacturing capabilities in Malaysia, and achieved Top Quality Supplier for several quarters from his major customer. In 2000, he joined Wong Engineering Corporation Bhd, a company listed on the then Second Board of the Bursa Securities which is involved in precision machining and stamping, as Deputy General Manager with responsibility to develop a low costs Actuator product for consumer electronics. In 2001, he was appointed Executive Director of WE Advance Devices Sdn Bhd, where he was responsible for operations in the Assembly Division, product R&D, and process development. He joined DISB, a subsidiary of Dufu Technology Corp. Berhad in 2004 as Chief Operation Officer, primaril responsibile to lead the machining and metal stamping operations including engineering, manufacturing, quality and human resources to meet the overall company objectives. | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | 90,000 Ordinary Shares of RM0.50 each in Dufu Technology Corp. Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2016 05:18 AM

|

显示全部楼层

发表于 9-9-2016 05:18 AM

|

显示全部楼层

| DUFU TECHNOLOGY CORP. BERHAD |

EX-date | 28 Sep 2016 | Entitlement date | 30 Sep 2016 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Single Tier Dividend of 1 Sen per share for the year ending December 31, 2016 | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHDLevel 7, Menara MileniumJalan Damanlela, Pusat Bandar DamansaraDamansara Heights50490Kuala LumpurTel:0320849000Fax:0320949940 | Payment date | 10 Oct 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Sep 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-9-2016 03:59 AM

|

显示全部楼层

发表于 11-9-2016 03:59 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (29A)| DUFU TECHNOLOGY CORP. BERHAD |

Particulars of Substantial Securities HolderName | EVLI EMERGING FRONTIER FUND | Address | Aleksanterinkatu 19A, 4th floor, 00101 Helsinki, Finland | Company No. | 2556552-6 | Nationality/Country of incorporation | Finland | Descriptions (Class & nominal value) | Ordinary Shares of RM0.50 each | Name & address of registered holder | Same as above |

| Date interest acquired & no of securities acquired | Currency |

| | Date interest acquired | 08 Sep 2016 | No of securities | 9,211,100 | Circumstances by reason of which Securities Holder has interest | Portfolio Investment | Nature of interest | Direct | Price Transacted ($$) |

|

| | Total no of securities after change | Direct (units) | 9,211,100 | Direct (%) | 5.476 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 08 Sep 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2016 12:58 AM

|

显示全部楼层

发表于 28-9-2016 12:58 AM

|

显示全部楼层

本帖最后由 icy97 于 30-9-2016 04:45 AM 编辑

Dufu: Technology leader of micro precision components

Company Background

- An advanced one-stop manufacturing facility offering superior quality manufacturing, engineering capabilities and services. With talented and skilled resources, they are able to deliver from conceptual to physical realities of various product ranges that require basic machining to close tolerance products. Their services also include finished components, modular or sub-modular fabrications and assemblies.

A real leader

- The company has shown a strong earnings credibility despite its smaller size compared with JCY. Dufu still managed to record decent core earnings growth of 9.5% after excluding one-off item in 1H16.

- Meanwhile JCY's 9M16 core earnings of RM19.6m (after add back write-off item) shrank 85%, and in fact it has posted losses in 3Q16 alone.

- Yet, Dufu has been underappreciatedly trading below its book value of 68sen. As at market price of 63.5sen, its price-to-book is only at 0.93x. On the other hand, JCY has been trading slightly higher at 0.96x to its price-to-book value of 57sen.

- FY16 PE wise, Dufu has been trading at 15x based on its annualised FY16 core earnings of RM6.91m or EPS of 4sen while JCY has been wildly trading at 42x based on its annualised FY16 core earnings.

- As a conclusion, Dufu deserves more credit to trade higher. By pegging to conservative PE of 20x, Dufu's fundamental value is arrived at 80sen.

- 20x? It is a normal to technoloy sector. It can go even higher to 30x.

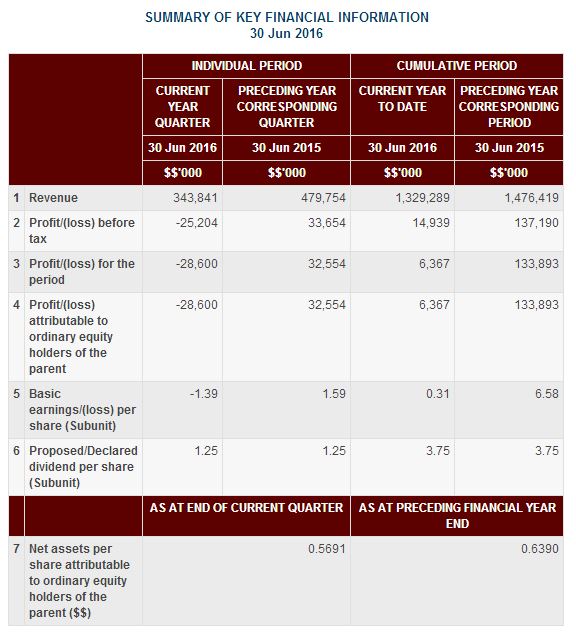

Dufu Technology Bhd's financial statement

Source: Bursa Malaysia

JCY's financial statement

Source: Bursa Malaysia

All The Way Bullish

- Longer-term view, Dufu's share price has been on uptrend since last year. The positive momentum in the stock is in line with its stronger earnings path

- It is now heading to recent high of 70sen.

- Volume has been built up well and not yet reach peak level.

- Should the stock close trading above 70 sen, there is higher chances that stock may meet fundamental value of 80sen.

- Critical support remains at 60sen, immediate resistance stands at 67sen.

- If it were to trade above 70sen, traders may want to target shor-term profit at 77sen instead.

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|