|

|

发表于 23-2-2018 04:41 AM

|

显示全部楼层

发表于 23-2-2018 04:41 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | EDEN INC. BERHAD ("EDEN" OR "THE COMPANY") - TAX LIABILITY OF THE COMPANY | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the previous announcement.

Further to the announcement made by the Company on 21 February 2018, reference no. GA1-21022018-00078, the Board of Directors of Eden wishes to provide the following additional information:- - the amount of RM3,193,142.81 claimed under the Petition is inclusive of tax penalty of RM780,447.05;

- no interest charge from the claim under the Petition; and

- as at 31 January 2018, the Company had made payment amounted to RM1,154,833.00 to IRB for the tax liability.

This announcement is dated 22 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 07:07 AM

|

显示全部楼层

发表于 7-3-2018 07:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,135 | 12,461 | 51,931 | 51,278 | | 2 | Profit/(loss) before tax | 1,740 | -14,363 | -12,588 | -16,410 | | 3 | Profit/(loss) for the period | -5,121 | -20,405 | -17,263 | -22,960 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,802 | -19,732 | -16,500 | -23,061 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.54 | -6.34 | -5.30 | -7.41 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7900 | 0.8400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-5-2018 01:27 AM

|

显示全部楼层

发表于 7-5-2018 01:27 AM

|

显示全部楼层

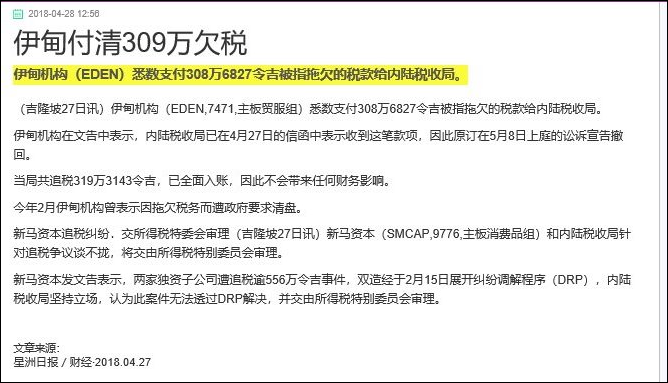

Type | Announcement | Subject | MATERIAL LITIGATION | Description | EDEN INC. BERHAD ("EDEN" OR "THE COMPANY") - TAX LIABILITY OF THE COMPANY | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the previous announcement.

Further to the announcement made by the Company on 21 February 2018 and 22 February 2018, the Board of Directors of Eden is pleased to announce that Eden had on 27 April 2018, made the full and final payment for the sum of RM3,086,827.19 to IRB, being the balance due and payable to IRB together with cost.

This amount payable has been affirmed by the letter received from IRB dated 27 April 2018 of which the Petition will be withdrawn on the 8 May 2018 before the Honourable High Court Judge.

The payment of RM3,086,827.19 consists of: Tax and penalty: RM3,082,877.39

Cost : RM3,949.80

The tax liability totalling RM3,193,142.81 as claimed in the Petition has been fully provided for and reflected in the audited accounts in the respective years and therefore there is no financial effect on the tax liability of the Company.

This announcement is dated 27 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-5-2018 11:14 AM

|

显示全部楼层

发表于 10-5-2018 11:14 AM

|

显示全部楼层

本帖最后由 icy97 于 12-5-2018 01:07 AM 编辑

Type | Announcement | Subject | AUDIT REPORT - MODIFIED OPINION / MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

MATERIAL UNCERTAINTY RELATED TO GOING CONCERN | Description | EDEN INC. BERHAD ("EDEN" OR THE COMPANY")STATEMENT OF MATERIAL UNCERTAINTY RELATED TO GOING CONCERN IN RESPECT OF EDEN'S FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017 | The Board of Directors of Eden wishes to announce that its External Auditors, Messrs. Ernst & Young have issued a statement of "Material Uncertainty Related to Going Concern" in respect of Eden's Financial Statements for the financial year ended 31 December 2017.

Please refer to the announcement attached below for further information.

This announcement is dated 7 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5785081

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 05:19 AM

|

显示全部楼层

发表于 19-5-2018 05:19 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 03:50 AM 编辑

Type | Announcement | Subject | MATERIAL LITIGATION | Description | EDEN INC. BERHAD ("EDEN" OR "THE COMPANY") - TAX LIABILITY OF THE COMPANY | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the previous announcement.

Further to the announcements made by the Company on 21 February 2018, 22 February 2018 and 27 April 2018, the Board of Directors of Eden wishes to inform that the Company had on 14 May 2018 received a letter from IRB confirming the following matters:-

i) IRB had received full settlement from the Company for the Income Tax Debt due with regards to the Petition; and

ii) IRB had withdrawn the Petition against the Company on 8 May 2018.

This announcement is dated 18 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 02:56 AM

|

显示全部楼层

发表于 11-6-2018 02:56 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 21,808 | 9,910 | 21,808 | 9,910 | | 2 | Profit/(loss) before tax | -3,057 | -6,090 | -3,057 | -6,090 | | 3 | Profit/(loss) for the period | -3,077 | -6,112 | -3,077 | -6,112 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,820 | -6,199 | -2,820 | -6,199 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.91 | -1.99 | -0.91 | -1.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7800 | 0.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 01:33 AM

|

显示全部楼层

发表于 27-7-2018 01:33 AM

|

显示全部楼层

EX-date | 08 Aug 2018 | Entitlement date | 10 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Bonus Issue | Entitlement description | Issuance of up to 155,681,135 Free Warrants in Eden Inc. Berhad ("Eden" or the "Company") ("Free Warrants") on the basis of one (1) Free Warrant for every two (2) existing ordinary shares in Eden ("Eden Shares") held on 10 August 2018. | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHDLevel 7, Menara MileniumJalan Damanlela, Pusat Bandar DamansaraDamansara Heights50490Kuala LumpurTel:0320849000Fax:0320949940 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 2 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-8-2018 05:10 AM

|

显示全部楼层

发表于 2-8-2018 05:10 AM

|

显示全部楼层

Name | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address | 17TH FLOOR MENARA CIMB,

JALAN STESEN SENTRAL 2,

KUALA LUMPUR SENTRAL,

KUALA LUMPUR

50470 Wilayah Persekutuan

Malaysia. | Company No. | 265449-P | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Share |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 17 Jul 2018 | 479,700 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 2 | 18 Jul 2018 | 1,183,800 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 3 | 19 Jul 2018 | 422,600 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 4 | 20 Jul 2018 | 132,200 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 5 | 23 Jul 2018 | 1,713,100 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 6 | 24 Jul 2018 | 672,700 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 7 | 25 Jul 2018 | 1,337,500 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 8 | 26 Jul 2018 | 880,000 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 9 | 27 Jul 2018 | 255,700 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | | | 10 | 30 Jul 2018 | 850,000 | Disposed | Indirect Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD (PENGURUSAN DANAHARTA NASIONAL BERHAD) | Address of registered holder | 17TH FLOOR MENARA CIMB, JALAN STESEN SENTRAL 2, KUALA LUMPUR SENTRAL, 50470 KUALA LUMPUR. | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal / Sold | Nature of interest | Indirect Interest | Direct (units) | 0 | Direct (%) | 0 | Indirect/deemed interest (units) | 3,111,308 | Indirect/deemed interest (%) | 5.37 | Total no of securities after change | 3,111,308 | Date of notice | 30 Jul 2018 | Date notice received by Listed Issuer | 31 Jul 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 02:19 AM

|

显示全部楼层

发表于 21-8-2018 02:19 AM

|

显示全部楼层

Profile for Securities of PLC

Instrument Category | Securities of PLC | Instrument Type | Warrants | Description | Issuance of 155,681,114 free warrants in Eden Inc. Berhad ("Eden" or "Company") ("Free Warrants") on the basis of one (1) Free Warrant for every two (2) existing ordinary shares in Eden ("Eden Shares") held as at 5:00 p.m. on 10 August 2018 ("Free Warrants Issue") |

Listing Date | 21 Aug 2018 | Issue Date | 14 Aug 2018 | Issue/ Ask Price | Not Applicable | Issue Size Indicator | Unit | Issue Size in Unit | 155,681,114 | Maturity | Mandatory | Maturity Date | 13 Aug 2021 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 3.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.3000 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 1:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Cash | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 02:54 AM

|

显示全部楼层

发表于 24-8-2018 02:54 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 8,980,690 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2227 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 320,342,961 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 313,362,270.660 | Listing Date | 24 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 04:48 AM

|

显示全部楼层

发表于 25-8-2018 04:48 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 4,490,345 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2227 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 324,833,306 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 314,362,270.495 | Listing Date | 27 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 06:08 AM

|

显示全部楼层

发表于 1-9-2018 06:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 14,413 | 10,814 | 36,221 | 20,723 | | 2 | Profit/(loss) before tax | -2,803 | -5,021 | -5,859 | -11,113 | | 3 | Profit/(loss) for the period | -2,857 | -5,257 | -5,933 | -11,372 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,487 | -4,793 | -5,305 | -10,995 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.80 | -1.54 | -1.70 | -3.53 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7700 | 0.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 01:51 AM

|

显示全部楼层

发表于 22-9-2018 01:51 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 1,536,570 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1627 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 328,836,575 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 315,112,270.321 | Listing Date | 21 Sep 2018 | | 2. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 3,073,140 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1627 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 331,909,715 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 315,612,270.199 | Listing Date | 21 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 07:35 AM

|

显示全部楼层

发表于 11-10-2018 07:35 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | EDEN INC. BERHAD ("EDEN" OR "THE COMPANY") - ACQUISITION OF MEGANTARA ENGINEERING SDN. BHD. BY LANGKAWI BATIK ENTERPRISES SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF EDEN | The Board of Directors of Eden wishes to announce that Langkawi Batik Enterprises Sdn. Bhd. (“LBE”), a wholly-owned subsidiary of Eden, had on 5 October 2018 acquired 90,000 ordinary shares, representing 90% of the total Issued and Paid-Up Share Capital of Megantara Engineering Sdn. Bhd. ("MESB"), from Badrul Hisham bin Mohd Kassim and Mohamad Aizuddin bin Abdullah for a total cash consideration of RM100.00 (Ringgit Malaysia: One Hundred only) ("the Acquisition"). Resulting from the Acquisition, MESB becomes a 90% sub-subsidiary of the Company.

The principal activity of MESB is supplying engineering equipment and other peripherals to the marine industry and supply of manpower to the marine industry. The Acquisition does not have any material effect on the share capital, earnings and net assets of the Company.

None of the Directors and/or Major Shareholders of Eden or persons connected to the Directors and/or Major Shareholders of Eden has any interest, direct or indirect, in the Acquisition.

This announcement is dated 9 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2018 06:07 AM

|

显示全部楼层

发表于 24-10-2018 06:07 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 7,142,857 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1400 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 350,743,841 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 318,512,269.775 | Listing Date | 24 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 04:35 AM

|

显示全部楼层

发表于 18-11-2018 04:35 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 4,310,344 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1160 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 356,839,899 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 319,262,269.639 | Listing Date | 09 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:19 AM

|

显示全部楼层

发表于 27-11-2018 03:19 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 8,620,689 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1160 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 365,460,588 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 320,262,269.563 | Listing Date | 14 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-12-2018 06:01 AM

|

显示全部楼层

发表于 29-12-2018 06:01 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,619 | 15,072 | 47,839 | 35,795 | | 2 | Profit/(loss) before tax | -2,920 | -3,226 | -8,779 | -14,341 | | 3 | Profit/(loss) for the period | -2,917 | -781 | -8,849 | -12,155 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,710 | -714 | -8,014 | -11,712 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.84 | -0.23 | -2.50 | -3.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7700 | 0.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:19 AM

|

显示全部楼层

发表于 30-12-2018 07:19 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 4,166,666 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1200 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 373,361,383 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 321,262,269.356 | Listing Date | 30 Nov 2018 | | 2. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 4,166,666 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1200 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 377,528,049 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 321,762,269.276 | Listing Date | 30 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2019 04:29 AM

|

显示全部楼层

发表于 25-1-2019 04:29 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | EDEN INC. BERHAD ("EDEN" OR "THE COMPANY") - DISPOSAL OF TIME ERA INDUSTRIES SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF TIME ERA SDN. BHD. | The Board of Directors of Eden wishes to announce that Time Era Sdn. Bhd. (“TESB”), a wholly-owned subsidiary of Eden had on 14 December 2018 entered into a Shares Sale Agreement (“SSA”) with Mr. Loh Teck Heng and Mr. Ng See Peng for disposal of 100,000 ordinary shares, representing the entire Issued and Paid-Up Share Capital of Time Era Industries Sdn. Bhd. (“TEISB”), a wholly-owned subsidiary of TESB, for a total consideration of RM74,274.58 (Ringgit Malaysia: Seventy-Four Thousand Two Hundred and Seventy-Four and Cents Fifty-Eight only) (“the Disposal”).

The principal activity of TEISB is manufacturing of plastic injection and moulding.

The Disposal is undertaken for the purpose of disposing the loss making subsidiary as well as to reduce the cost associated in maintaining the subsidiary and consequently to improve the balance sheet of the Group.

Upon completion of the Disposal, TEISB shall cease to be a wholly-owned subsidiary of TESB, which in turn a subsidiary of Eden.

The Disposal does not expects to have any material effect on the share capital, earnings and net assets of the Company.

None of the Directors and/or Major Shareholders of Eden or persons connected to the Directors and/or Major Shareholders of Eden has any interest, direct or indirect, in the Disposal.

This announcement is dated 27 December 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|