|

|

【HENGYUAN 4324 交流专区】 (前名 SHELL)

[复制链接]

[复制链接]

|

|

|

发表于 28-12-2017 05:27 PM

|

显示全部楼层

发表于 28-12-2017 05:27 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2017 04:13 PM

|

显示全部楼层

发表于 30-12-2017 04:13 PM

|

显示全部楼层

|

2017 RM16.30大涨 (rm14.27 +702.96%) |

|

|

|

|

|

|

|

|

|

|

|

发表于 9-1-2018 05:09 AM

|

显示全部楼层

发表于 9-1-2018 05:09 AM

|

显示全部楼层

如何应对恒源火箭升势?/官有缘

2018年1月8日

生财有缘●官有缘

著名股票投资者

从恒源炼油(HENGYUAN,4324,主板工业产品股)的股价走势图来看,在短短12个月内,该股从约2.50令吉的水平,走高至17令吉以上的高位,涨幅高达700%,创造了马股的新纪录,史无前例。

一些所谓的图表专家认为,没有任何股票可以无限期上涨或下跌,股价必定会在某个时候回调。因此,他们可能较为没远见,太早沽出套利,求个落袋平安。

但当他们看到股价继续像导弹般发射时,他们又会如何反应?

一些自以为是的投资者可能基于“吃亏心态”,不愿以比卖出时更高的价位再买进。只有少数虚心及懂得控制情绪的人可以理智思考,承认犯错,愿以更高价再买进。

公司赚少时卖出

我已说过很多次,我不擅长日内交易(Day Trade)、高卖后再低买回。若要这样做,我得盯紧价格起落,还要迅速做决定。

既然我不擅长短线交易,所以我制定了自己的卖股原则,只会在公司财报出现盈利减少时才卖出。

从恒源炼油来看,该公司还未有盈利下跌的情况,因此我不会买出手上任何一股。

在我的价值投资法方面,我阅读过许多著名投资大师的投资相关著作,如班杰明葛拉汉、巴菲特、彼得林治等等。他们同样提倡价值投资法。

是的,如果你真的要买入一家被低估、股价低于净有形资产(NTA)的股票,你不会亏钱,但你可能要等一段时间才能赚钱。

比如说,近来大马各城镇的产业供应过剩,你可以买入许多股价低于净有形资产的产业股,但你要等多年后,房价才会再度回升。

来看看我的黄金准则,这可能是你无法在课本找到的。如你运用我的黄金法则,你可更快赚钱。

最看重盈利前景

在净有形资产、回酬率、良现金流、拥有定存现金等的健康财报这些选股标准中,最重要的还是盈利增长前景,也是能推高股价最有力的催化剂。

当我看到一家公司的季度财报突然盈利大涨,我会开始买进。如果该公司的盈利持续增长,我会通过按金融资的方式继续加码。

公布业绩前还能涨

事实上,根据末季较好的裂解价差(Crack Spread),恒源炼油净利大有可能继续增长。即使该股已处于17.00令吉以上的高位,我还是会继续买入,因为我相信在该公司于下月底公布末季财报前,股价还会上升。

我曾经用同样的手法买入和沽出纬树(LATITUD,7006,主板消费产品股)、威铖(VS,6963,主板工业产品股)和利兴工业(LIIHEN,7089,主板消费产品股),这些股都在今年内上涨几倍。

我很自豪地说, 我曾是这三家公司里的第二大股东。

我相信这篇文章能够协助投资者改善他们的赢钱技术。

备注:此评论为作者意见与看法,不代表本报立场,也非推荐买入或卖出,不应将之作为投资指引或决定。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-1-2018 06:12 AM

|

显示全部楼层

发表于 19-1-2018 06:12 AM

|

显示全部楼层

如何应对恒源过山车走势?/官有缘

2018年1月18日

生财有缘●官有缘

著名股票投资者

对于恒源炼油(HENGYUAN,4324,主板工业产品股)股价波动如此大,我和很多投资者一样,也感到困惑。

该股在单日交易的最高点和最高点,有时会超过1令吉。

就像我先前提过的,恒源炼油从2.50令吉的价位,直飚至19令吉的高位,在短短的一年内写下800%的涨幅,已经创造马股的历史,是我未曾见过的情况。

因此,很多人问我对此股的意见,我的回答总是:“不知道如何应对”,因为我以前也没见过这种情况。

供大家参考,我还没开始认真地脱售恒源炼油。

我和家人们共持有逾2000万股。

恒源炼油是我们第二大投资,最大的投资是在捷硕资源(JAKS,4723 ,主板建筑股)。

对于一些人说,我撰写了那么多关于恒源炼油的文章,是为了炒作股价,鼓励投资者买入,然后我再趁机脱售。

脱售不必事先通知

我写这些稿并非鼓励任何人买卖恒源炼油。

如果你决定进行交易,则需承担自己的盈利或亏损风险。

请谨记,不管我何时开始脱售该股,我也没有义务告诉任何人。

备注:此评论为作者意见与看法,不代表本报立场,也非推荐买入或卖出,不应将之作为投资指引或决定。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2018 02:22 AM

|

显示全部楼层

发表于 24-1-2018 02:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-2-2018 08:24 AM

|

显示全部楼层

发表于 3-2-2018 08:24 AM

|

显示全部楼层

本帖最后由 icy97 于 4-2-2018 03:34 AM 编辑

恒源精煉董事經理3月離職

2018年2月02日

(吉隆坡2日訊)恒源精煉(HENGYUAN,4324,主要板工業)董事經理馬登史托宣布辭去職務,從3月1日起生效。

該公司向馬證交所報備,基于暫調期限結束,馬登史托將辭去董事經理一職。

根據恒源精煉年報顯示,他是在2016年12月22日受委出任董事經理一職。

他在此前擔任蜆殼總營運長,主要是配合公司在2015年進行的主要架構轉型。

馬登史托是受聘于山東恒源石油化工股份有限公司,從蜆殼借調協助恒源精煉順利轉移,以符合新的燃料規格,並設定未來的發展途徑。

截至2016年低,大馬恒源國際有限公司持續恒源精煉51.02%股權,是山東恒源石化公司的子公司。【中国报财经】

Date of change | 01 Mar 2018 | Name | MR MARTINUS JOSEPH MARINUS ALOYSIUS STALS | Age | 51 | Gender | Male | Nationality | Netherlands | Designation | Managing Director | Directorate | Executive | Type of change | Resignation | Reason | End of secondment |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2018 05:15 AM

|

显示全部楼层

发表于 1-3-2018 05:15 AM

|

显示全部楼层

本帖最后由 icy97 于 4-3-2018 07:45 AM 编辑

恒源炼油末季少赚12%

2018年2月28日

(吉隆坡27日讯)恒源炼油(HENGYUAN,4324,主板工业产品股)截至12月杪末季,净利按年减少11.7%,不过仍派发每股2仙股息。

恒源炼油在今天向交易所报备,净利从2016财年的2亿781万令吉或每股69.27仙,减少至1亿8355万3000令吉或每股61.18仙。

若不纳入该季税务开销6374万令吉,其税前盈利为2亿4729万6000令吉,转为按年提高19.4%,归功于赚幅提高和外汇收益。

末季营业额从前年的25亿3182万6000令吉,年增22.1%至30亿9210万5000令吉,归功于旗下提炼产品售价高于市价20%至30%。

全年净利翻1.7倍

累计全年,净利则按年暴增1.7倍,至9亿922万1000令吉或每股303.07仙;营业额也年增38.5%,至115亿8346万7000令吉。

另一方面,恒源炼油宣布派发每股2仙的中期股息,除权日于3月16日,派息日在4月17日。累计全年共派发每股2仙股息。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,092,105 | 2,531,826 | 11,583,467 | 8,365,330 | | 2 | Profit/(loss) before tax | 247,296 | 207,049 | 972,964 | 335,273 | | 3 | Profit/(loss) for the period | 183,553 | 207,810 | 909,221 | 335,273 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 183,553 | 207,810 | 909,221 | 335,273 | | 5 | Basic earnings/(loss) per share (Subunit) | 61.18 | 69.27 | 303.07 | 111.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 2.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.9034 | 3.3681

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 07:48 AM

|

显示全部楼层

发表于 4-3-2018 07:48 AM

|

显示全部楼层

EX-date | 16 Mar 2018 | Entitlement date | 20 Mar 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single-tier interim dividend of RM0.02 per ordinary share in respect of the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi, 59200 Kuala Lumpur | Payment date | 17 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 20 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2018 05:42 AM

|

显示全部楼层

发表于 8-3-2018 05:42 AM

|

显示全部楼层

Date of change | 01 Mar 2018 | Name | MR WANG, ZONGQUAN | Age | 54 | Gender | Male | Nationality | China | Type of change | Redesignation | Previous Position | Non-Independent Director | New Position | Deputy Chairman | Directorate | Non Independent and Non Executive | Qualifications | Degree in Chemical Machinery, Chengdu Institute of Water Conservancy and Hydropower Survey and Design (1988) | Working experience and occupation | Mr. Wang, ZongQuan held the following positions in Shandong Hengyuan Petrochecmial Company Limited eputy Chief at the No.2 Catalyst Workshop from August 1988 to January 1994;Director of the Equipment and Power Department from January 1994 to August 1999;Manager of Installation Company from August 1999 to August 2001;Director of the Equipment and Power Department from August 2001 to April 2002; andChief Engineer & Vice General Manager from April 2002 to present.Mr. Wang has been a non-executive non-independent director of Hengyuan Refining Company Berhad since 22 December 2016. eputy Chief at the No.2 Catalyst Workshop from August 1988 to January 1994;Director of the Equipment and Power Department from January 1994 to August 1999;Manager of Installation Company from August 1999 to August 2001;Director of the Equipment and Power Department from August 2001 to April 2002; andChief Engineer & Vice General Manager from April 2002 to present.Mr. Wang has been a non-executive non-independent director of Hengyuan Refining Company Berhad since 22 December 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2018 05:53 AM

|

显示全部楼层

发表于 8-3-2018 05:53 AM

|

显示全部楼层

Date of change | 01 Mar 2018 | Name | MR DAVID RONALD KEAT | Age | 57 | Gender | Male | Nationality | New Zealand | Type of change | Appointment | Designation | Chief Executive Officer | Qualifications | i) Bachelor of Science in Chemistry - University of Auckland, New Zealandii) Bachelor of Engineering (Hons) in Chemistry & Materials - University of Auckland, New Zealand | Working experience and occupation | David has held a wide variety of technical, project and executive roles in the oil refining, gas and gas to liquids companies over the last 33 years.David commenced his career with The New Zealand Refining Company Ltd (NZRC) in 1985 where over 14 years he held a wide variety of posts including Process Engineer, Lab Manager, IT Manager and Shift Manager. In 1999 he joined Abu Dhabi Gas Industries Ltd, (Gasco), a joint venture with Shell, as a Shell Secondee. In 2002 he joined Shell MDS (Malaysia) Ltd as a Senior Manager (Operations) until 2005 when he re-joined NZRC as its Project Director for Point Forward Project for 1 ½ years before serving as the Refining Manager for the next 3 ½ years. From May 2010 he served as Senior Manager - Operations and HSE with the Oman Refining and Petrochemical Industries Company (Orpic), Oman. From March 2012 to April 2016 David was the Vice President, Technical and Engineering Support with Abu Dhabi Gas Industries (Al Hosn Gas), Abu Dhabi, UAE.David has been the Chief Operating Officer of Hengyuan Refining Company Berhad since 13 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 05:04 AM

|

显示全部楼层

发表于 7-4-2018 05:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 07:00 AM

|

显示全部楼层

发表于 24-5-2018 07:00 AM

|

显示全部楼层

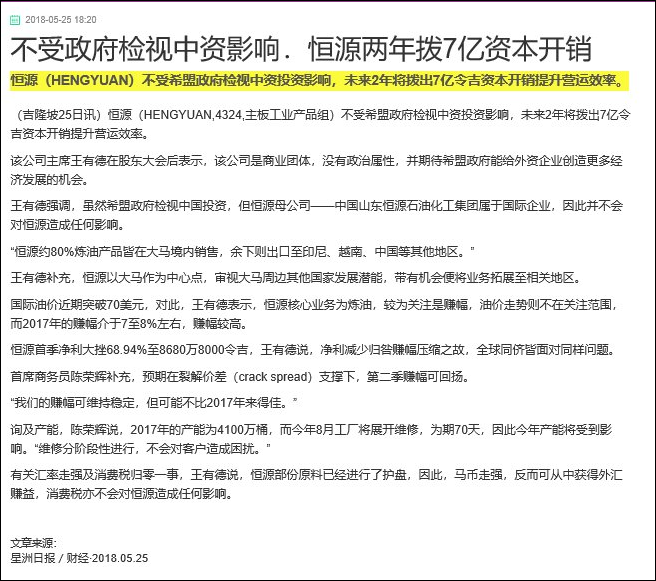

本帖最后由 icy97 于 2-6-2018 05:28 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,060,784 | 2,931,560 | 3,060,784 | 2,931,560 | | 2 | Profit/(loss) before tax | 108,803 | 279,485 | 108,803 | 279,485 | | 3 | Profit/(loss) for the period | 86,808 | 279,485 | 86,808 | 279,485 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 86,808 | 279,485 | 86,808 | 279,485 | | 5 | Basic earnings/(loss) per share (Subunit) | 28.94 | 93.16 | 28.94 | 93.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.9531 | 5.9623

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-6-2018 06:11 AM

|

显示全部楼层

发表于 3-6-2018 06:11 AM

|

显示全部楼层

本帖最后由 icy97 于 4-6-2018 06:18 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 03:56 AM

|

显示全部楼层

发表于 12-6-2018 03:56 AM

|

显示全部楼层

Date of change | 01 Jun 2018 | Name | MISS WANG, CHAO-JEN | Age | 54 | Gender | Female | Nationality | Taiwan, Province of China | Type of change | Appointment | Designation | Others | Qualifications | Bachelor of Accounting - Fu-Jen Catholic University Taiwan | Working experience and occupation | Ms. Jocelyn Wang Chao-Jen (Jocelyn) brings with her 29 years of experience in both operational and executive positions in various organisations including National Oil Companies, State-Owned Enterprises and Private Companies across different business sectors such as Chemicals, Base Oil, Lubricant Supply Chain, Retail, Coal Gasification and Internal Audit.Her work experiences are as follows:-1988-1992 KPMG/Taipei; Hsinchu; Kaohsiung office- Financial Auditor1992-2000/Taiwan Chlorine Industries/Kaohsiung- Accounting Supervisor, Accounting Manager, Administration Manager2000-2017 Royal Dutch Shell Group of Companies (Shell)Within the Shell Group, Jocelyn held 5 different senior managerial positions including Head of Finance, Deputy General Manager, Regional Audit Manager, and was appointed as a Director in 7 joint venture companies (JV Cos or individually JV Co) during her service within Shell, making significant contributions in the governance of the JV Cos. The details are as follows:-1. 2000-2004 - CPC Shell Lubricants Corporation (Kaohsiung, Taiwan) Finance Vice President2. 2004-2008 - Sinopec and Shell (Jiangsu) Petroleum Marketing Co Ltd. (Suzhou-Jiangsu, China) Accounting Manager3. 2008 to October 2011 - Shell (China) Limited (Beijing, China) Retail Finance Manager4. November 2011 to April 2014 - Yueyang Sinopec and Shell Coal Gasification Co., Ltd. (Yueyang-Hunan, China) Deputy General Manager5. 2014 to October 2017 - Shell Asia Pacific and Finance Operations Internal Audit Manager, Finance | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | NIL |

| Remarks : | | Ms Wang was appointed as Deputy Chief Executive Officer with effect from 1 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 08:19 PM

|

显示全部楼层

发表于 30-8-2018 08:19 PM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 02:48 AM 编辑

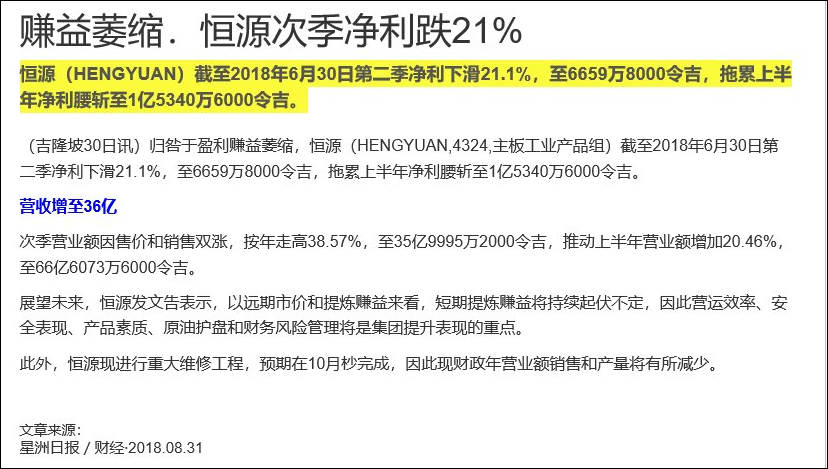

| 4324 HENGYUAN HENGYUAN REFINING COMPANY BERHAD | | Quarterly rpt on consolidated results for the financial period ended 30/06/2018 | | Quarter: | 2nd Quarter | | Financial Year End: | 31/12/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/06/2018 | 30/06/2017 | 30/06/2018 | 30/06/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 3,599,952 | 2,597,978 | 6,660,736 | 5,529,538 | | 2 | Profit/Loss Before Tax | 51,601 | 84,407 | 160,404 | 363,892 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 66,598 | 84,407 | 153,406 | 363,892 | | 4 | Net Profit/Loss For The Period | 66,598 | 84,407 | 153,406 | 363,892 | | 5 | Basic Earnings/Loss Per Shares (sen) | 22.20 | 28.14 | 51.14 | 121.30 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 6.2080 | 5.9623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 01:44 AM

|

显示全部楼层

发表于 8-9-2018 01:44 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 05:33 AM 编辑

Type | Announcement | Subject | OTHERS | Description | INVESTMENT ON THE CLEAN AIR REGULATION PROJECT | 1. INTRODUCTION The Board of Directors of Hengyuan Refining Company Berhad (“HRC” or “Company”) wishes to announce that it has approved the investment for the Clean Air Regulation Project (“CAR Project”) to be executed within its refining complex in Port Dickson.

The CAR Project is undertaken to ensure that the refinery’s emissions comply with the Clean Air Regulation (“CAR”) requirements mandated by the Malaysian regulatory authorities via the installation of air pollution control systems at the Long Residue Catalytic Cracking Unit and Plat-2, and an emission monitoring system on HRC’s flue gas stacks.

2. TOTAL INVESTMENT COST The Total Investment Cost for the CAR Project is estimated at USD48 million.

3. PROJECT COMPLETION The CAR currently requires compliance by June 2019.

4. FINANCIAL EFFECTS The CAR Project will be financed using a mix of cash flow generated from operations and a further draw down from an existing term loan.

5. DIRECTORS’ AND SUBSTANTIAL SHAREHOLDERS’ INTEREST None of the directors or substantial shareholders of HRC or persons connected with them have any interest, whether direct or indirect, in the investment decision.

6. STATEMENT BY DIRECTORS HRC’s Board of Directors is of the opinion that the above investment decision is in the ordinary course of business and is in the best interest of the Company.

7. APPROVALS REQUIRED This investment decision is not subject to the approval of shareholders of HRC or any relevant authorities.

This announcement is dated 5 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 02:14 AM

|

显示全部楼层

发表于 6-11-2018 02:14 AM

|

显示全部楼层

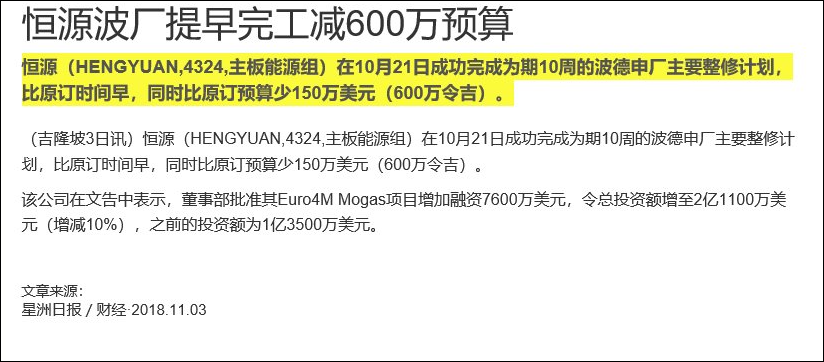

本帖最后由 icy97 于 10-11-2018 08:06 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Major Turnaround Success and Revised Full Fund Release of USD211 million +/- 10% for the Euro4M Mogas Project | 1. INTRODUCTION The Board of Directors of Hengyuan Refining Company Berhad (“HRC” or “Company”) wishes to announce that HRC successfully completed its planned 10-week Major Turnaround (“MTA”) on 21 October 2018, ahead of schedule and below budget by USD1.5 million or RM6 million. The MTA at the Company’s Port Dickson refinery was the largest in its 55-year history. Separately, the Board of Directors approved an increase in funding of USD76 million for the Euro4M Mogas project (“Project”), bringing the total investment to USD211 million +/- 10%. The additional capital expenditure will be used to expedite long lead and additional equipment for a larger scope of activities and to upgrade the Project to deliver refining capability for the production of both Euro4M and future Euro5M mogas specifications when required. HRC anticipates completion of the upgraded Project by Quarter 1, 2020. The previous announcement on the final investment decision of the Project of USD135 million +/- 10% was made through Bursa Malaysia Securities Berhad on 16 June 2017.

2. FINANCIAL EFFECTS The Project will be financed using a mix of cash flow generated from operations and further drawdowns of existing loans.

3. DIRECTORS’ AND SUBSTANTIAL SHAREHOLDERS’ INTEREST None of the directors or substantial shareholders of HRC or persons connected with them have any interest, whether direct or indirect, in the revised full fund release.

4. STATEMENT BY DIRECTORS HRC’s Board of Directors is of the opinion that the above revised full fund release decision is in the ordinary course of business and is in the best interests of the Company.

5. APPROVALS REQUIRED This investment decision is not subject to the approval of shareholders of HRC or any relevant authorities.

This announcement is dated 2 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2018 08:11 PM

|

显示全部楼层

发表于 28-11-2018 08:11 PM

|

显示全部楼层

本帖最后由 icy97 于 7-1-2019 01:03 AM 编辑

恒源炼油第三季转亏1.2亿

http://www.enanyang.my/news/20181129/恒源炼油第三季转亏1-2亿/

| 4324 HENGYUAN HENGYUAN REFINING COMPANY BERHAD | | Quarterly rpt on consolidated results for the financial period ended 30/09/2018 | | Quarter: | 3rd Quarter | | Financial Year End: | 31/12/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/09/2018 | 30/09/2017 | 30/09/2018 | 30/09/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 2,067,137 | 2,961,824 | 8,727,873 | 8,491,362 | | 2 | Profit/Loss Before Tax | (139,431) | 361,776 | 20,973 | 725,668 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | (122,492) | 361,776 | 30,914 | 725,668 | | 4 | Net Profit/Loss For The Period | (122,492) | 361,776 | 30,914 | 725,668 | | 5 | Basic Earnings/Loss Per Shares (sen) | (40.83) | 120.59 | 10.30 | 241.89 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 6.1903 | 5.9623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2019 05:39 AM

|

显示全部楼层

发表于 2-2-2019 05:39 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Full Fund Release of USD66.40 million for the H2GEN Project | 1. Introduction The Board of Directors of Hengyuan Refining Company Berhad (“Company”) wishes to announce that it has approved the full fund release for the H2GEN Project (“H2GEN Project”) to be executed within its refining complex in Port Dickson.

The H2GEN Project is undertaken to supply the refinery with 30 tonnes/day of hydrogen for hydro desulfurization unit#2 and the extractive desulfurization hydro-treating process to meet the 10ppmw sulphur specification. The refinery will be short of hydrogen upon Euro5 gasoil specification implementation in September 2020.

The H2Gen Project is expected to start up in September 2020 to coincide with the Euro5 gasoil legislated date.

2. FINANCIAL EFFECTS The Project will be financed using a mix of cash flow generated from operations and further drawdowns of existing loans.

3. DIRECTORS’ AND SUBSTANTIAL SHAREHOLDERS’ INTEREST None of the directors or substantial shareholders of Company or persons connected with them have any interest, whether direct or indirect, in the full fund release.

4. STATEMENT BY DIRECTORS The Company’s Board of Directors is of the opinion that the above full fund release decision is in the ordinary course of business and is in the best interests of the Company.

5. APPROVALS REQUIRED This investment decision is not subject to the approval of shareholders of Company or any relevant authorities.

This announcement is dated 16 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2019 08:09 AM

|

显示全部楼层

发表于 6-3-2019 08:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,513,364 | 3,092,105 | 11,241,237 | 11,583,467 | | 2 | Profit/(loss) before tax | -45,419 | 247,834 | -24,446 | 973,502 | | 3 | Profit/(loss) for the period | -72 | 204,091 | 30,842 | 929,759 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -72 | 204,091 | 30,842 | 929,759 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.02 | 68.03 | 10.28 | 309.92 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 6.7389 | 5.9623

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|