|

|

【MAGNUM 3859 交流专区】万能 (前名MPHB 马化控股)

[复制链接]

[复制链接]

|

|

|

发表于 27-2-2018 09:19 PM

|

显示全部楼层

发表于 27-2-2018 09:19 PM

|

显示全部楼层

本帖最后由 icy97 于 1-3-2018 05:31 AM 编辑

万能末季净利扬20%

2018年2月28日

http://www.enanyang.my/news/20180228/万能末季净利扬20/

(吉隆坡27日讯)博彩业务表现佳,带动万能(MAGNUM,3859,主板贸服股)截至12月31日末季净利,按年增长20.14%,并派发每股4仙第三次中期单层股息。

该公司末季净利从去年同季的4396万令吉或每股3.09仙,增至5281万令吉或3.71仙。

同时,营业额从6亿3381万令吉,按年提高6.51%至6亿7509万令吉,主要归功于博彩业务。

4D积宝游戏销售增加,带动博彩业务取得更高销售额。

合计全年,净利按年攀升8.94%,至2亿662万令吉或每股14.52仙;营业额则微跌0.38%,至26亿4921万令吉。

根据去年过去两季的表现,董事部预计2018财年至少能达到上财年表现,特别是营业额。

| | | 3859 MAGNUM MAGNUM BERHAD | | Quarterly rpt on consolidated results for the financial period ended 31/12/2017 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2017 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/12/2017 | 31/12/2016 | 31/12/2017 | 31/12/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 675,086 | 633,814 | 2,649,207 | 2,659,344 | | 2 | Profit/Loss Before Tax | 86,467 | 74,532 | 306,776 | 284,490 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 52,808 | 43,957 | 206,620 | 189,656 | | 4 | Net Profit/Loss For The Period | 53,332 | 44,618 | 209,457 | 192,922 | | 5 | Basic Earnings/Loss Per Shares (sen) | 3.71 | 3.09 | 14.52 | 13.33 | | 6 | Dividend Per Share (sen) | 4.00 | 3.00 | 11.00 | 13.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.7400 | 1.7000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2018 09:20 PM

|

显示全部楼层

发表于 27-2-2018 09:20 PM

|

显示全部楼层

本帖最后由 icy97 于 3-3-2018 05:03 AM 编辑

EX-date | 13 Mar 2018 | Entitlement date | 15 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Third Interim Single Tier Dividend of 4 sen per share for the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | METRA MANAGEMENT SDN BHD30.02, 30th Floor, Menara Multi-PurposeCapital SquareNo. 8 Jalan Munshi Abdullah50100Kuala LumpurTel:0326983232Fax:0326980313 | Payment date | 30 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 02:03 AM

|

显示全部楼层

发表于 5-3-2018 02:03 AM

|

显示全部楼层

万能

U Mobile上市利好

2018年3月1日

分析:大华继显研究

目标价:2令吉

最新进展

博彩业务表现佳,万能(MAGNUM,3859,主板贸服股)截至12月31日末季净利,按年增长20.14%,至5281万令吉或3.71仙,并派发4仙股息。

营业额按年提高6.51%至6亿7509万令吉。

合计全年,净利按年攀升8.94%,至2亿662万令吉或每股14.52仙;营业额则微跌0.38%,至26亿4921万令吉。

行家建议

今年万能有3个利好——可能套现U Mobile投资、税务罚款很可能大减,以及修改博彩法令。

可能在下半年上市的U Mobile是个大利好,万能投资的账目价值为2.6亿令吉,将大大改善资本管理。

据悉,追税金额已经从原本的4.76亿令吉,调整至低于4亿令吉。

虽然末季业绩亮眼,但今年测字领域的销售增长料只有低单位数增幅,万能的销售是由积宝游戏推动,可能无法持续。

去年6月至今,万能股价已涨16%,因此下调评级至“守住”,仍维持2令吉目标价。

虽然派息率保守预计70%,但今明财年的回酬介于5.4%至5.5%,依然吸引。

一旦万能累计足够的现金储备来重启100%派息率的作风,届时回酬将走高至8%以上。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 05:27 AM

|

显示全部楼层

发表于 5-3-2018 05:27 AM

|

显示全部楼层

派彩率料跌.万能财测向好

(吉隆坡28日讯)万能(MAGNUM,3859,主板贸服组)核心盈利报捷,分析员不排除该公司未来盈利有望成长。

联昌研究表示,万能全年核心净利报2亿零600万令吉,比预测高出了4%。

展望未来,联昌认为,非法测字可能会蚕食合法业者市场,因非法测字无需缴付税务,因此,非法测字可提供更高派彩率。

联昌估计,目前,非法测字的规模,是合法业者的1.5至2倍。

联昌预期,万能来年派彩率较低,因此上调2018及2019财政年的每股净利预测,调高6至9%,未来3年的周息率介于6至6.5%,对比综指的周息率只有3%,万能周息率相当诱人。

维持“买进”评级以股息贴现模式(DDM)估值万能后,联昌决定维持“买进”

评级,目标价从1令吉77仙提高至1令吉84仙。

文章来源:

星洲日报‧财经‧2018.03.01 |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 03:03 AM

|

显示全部楼层

发表于 16-3-2018 03:03 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2018 07:13 AM

|

显示全部楼层

发表于 12-5-2018 07:13 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2018 09:41 PM

|

显示全部楼层

发表于 21-5-2018 09:41 PM

|

显示全部楼层

本帖最后由 icy97 于 24-5-2018 01:53 AM 编辑

EX-date | 13 Jun 2018 | Entitlement date | 18 Jun 2018 | Entitlement time | 04:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Single Tier Dividend of 4 sen per share for the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | METRA MANAGEMENT SDN BHD30.02, 30th Floor, Menara Multi-PurposeCapital SquareNo. 8 Jalan Munshi Abdullah50100Kuala LumpurTel:0326983232Fax:0326980313 | Payment date | 29 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 18 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2018 09:42 PM

|

显示全部楼层

发表于 21-5-2018 09:42 PM

|

显示全部楼层

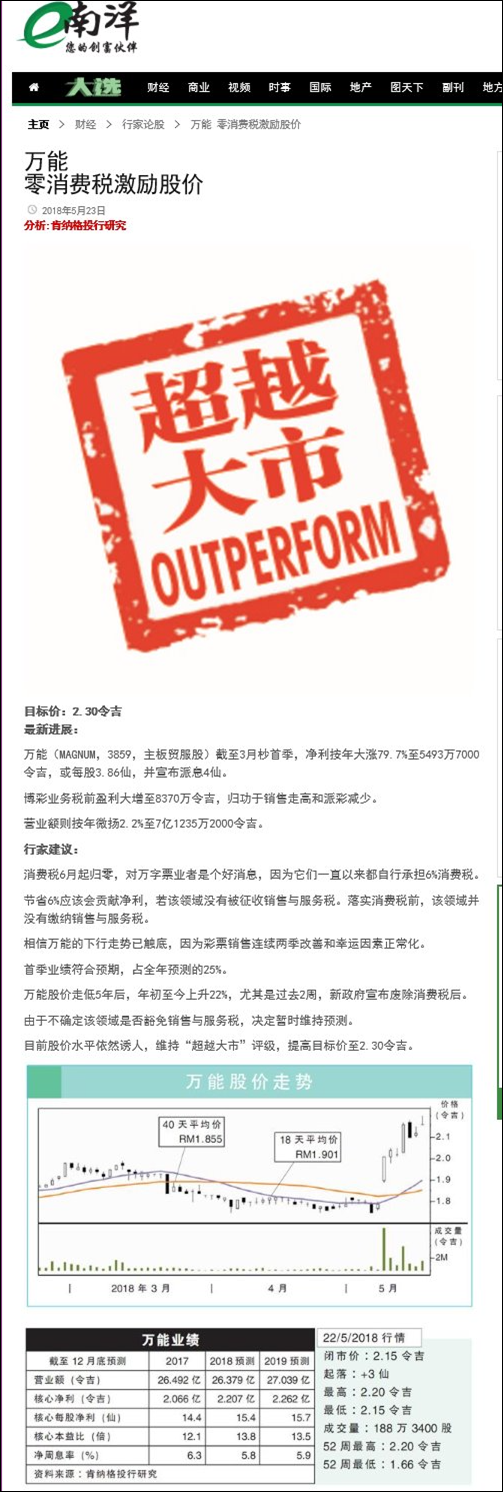

本帖最后由 icy97 于 2-6-2018 05:19 AM 编辑

| 3859 MAGNUM MAGNUM BERHAD | | Quarterly rpt on consolidated results for the financial period ended 31/03/2018 | | Quarter: | 1st Quarter | | Financial Year End: | 31/12/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/03/2018 | 31/03/2017 | 31/03/2018 | 31/03/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 712,352 | 697,084 | 712,352 | 697,084 | | 2 | Profit/Loss Before Tax | 79,935 | 46,017 | 79,935 | 46,017 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 54,937 | 30,570 | 54,937 | 30,570 | | 4 | Net Profit/Loss For The Period | 55,735 | 31,373 | 55,735 | 31,373 | | 5 | Basic Earnings/Loss Per Shares (sen) | 3.86 | 2.15 | 3.86 | 2.15 | | 6 | Dividend Per Share (sen) | 4.00 | 0.00 | 4.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.7400 | 1.7400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2018 07:40 PM

|

显示全部楼层

发表于 23-5-2018 07:40 PM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 05:51 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2018 05:19 AM

|

显示全部楼层

发表于 4-6-2018 05:19 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 02:36 AM

|

显示全部楼层

发表于 12-6-2018 02:36 AM

|

显示全部楼层

Date of change | 01 Jun 2018 | Name | MR LUM FOOK SENG | Age | 53 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | Mr Lum Fook Seng is a Registered Accountant and Fellow of The Chartered Association of Certified Accountants (ACCA) and a graduate of The Institute of Chartered Secretaries Association (ICSA). | Working experience and occupation | Mr Lum Fook Seng started his accountancy career in the Property sector for 3 years before joining Leisure Management Berhad (now known as Magnum 4D Berhad) on 12 February 1992 and to-date, has more than 26 years of experience in the Gaming industry.Currently, he is the Head, Finance & Administration and his key responsibilities includes financial and management reporting, regulatory compliance, tax planning and compliance, treasury and financing, human resource and administration matters of Magnum 4D Group of companies.Mr Lum also sits on the Board of various gaming and non-gaming subsidiaries of the Magnum Berhad Group. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | 236 ordinary shares in Magnum Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2018 04:08 AM

|

显示全部楼层

发表于 31-7-2018 04:08 AM

|

显示全部楼层

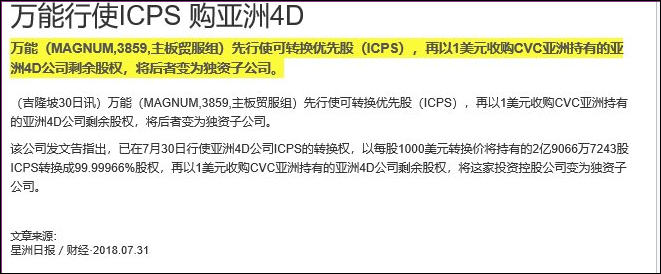

本帖最后由 icy97 于 1-8-2018 06:24 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Acquisition Of New Subsidiary, Asia 4D Company Limited, Arising From The Conversion Of Irredeemable Convertible Preference Shares Into Ordinary Shares In Asia 4D Company Limited and The Purchase Of Equity Interest In Asia 4D Company Limited From Asia 4D Holdings Limited | (1) Introduction Reference is made to our announcements dated 9 February 2011, 16 February 2011, 14 March 2011, 17 March 2011, 11 April 2011, 26 April 2011, 27 April 2011, 5 May 2011, 20 May 2011, 25 May 2011 and 10 June 2011 in connection with the subscription of Irredeemable Convertible Preference Shares (“ICPS”) by Magnum Berhad (“Magnum” or “the Company”) in Asia 4D Company Limited (“Asia 4D Company”) and the put option granted by Magnum to Asia 4D Holdings Limited (“Asia 4D Holdings”) in respect of one (1) ordinary share in Asia 4D Company. The Board of Directors of Magnum wishes to announce that Magnum had on 30 July 2018 converted its 290,667,243 ICPS in Asia 4D Company, held pursuant to the Subscription Agreement dated 11 March 2011 entered into between Magnum and Asia 4D Company, into ordinary shares in Asia 4D Company at the conversion price of USD1,000.00 per ordinary share (“ICPS Conversion”) in accordance with the terms of the ICPS.

Immediately following the ICPS Conversion, Asia 4D Company became a 99.99966%-owned subsidiary of Magnum.

In view of the above ICPS Conversion, Asia 4D Holdings, which is owned by CVC Capital Partners Asia Pacific III L.P. both of which are substantial shareholders of the Company, had on 30 July 2018 exercised its put option for Asia 4D Holdings to sell to Magnum and to require Magnum to purchase from Asia 4D Holdings one (1) ordinary share representing the entire equity interest in Asia 4D Company at the total exercise price of USD1.00 pursuant to the Put Option Agreement dated 25 May 2011 entered into between Magnum and Asia 4D Holdings (“Put Option Purchase”). Subject to the terms of the said Put Option Agreement, completion of the Put Option Purchase is expected to occur within seven weeks from the date hereof. When completed, the Put Option Purchase will result in Asia 4D Company becoming a wholly-owned subsidiary of Magnum.

(2) Information on Asia 4D Company Asia 4D Company was incorporated on 4 December 2007 as a private limited company in the Federal Territory of Labuan, Malaysia under the Labuan Companies Act 1990. The principal business activity of Asia 4D Company is investment holding.

The Directors of Asia 4D Company are Atiff Ibrahim Gill, Tan Tor Choo and Chow Wai Yong.

The total issued and paid-up share capital of Asia 4D Company is RM875,170,006.00 comprising 1 ordinary share (held solely by Asia 4D Holdings) and 290,667,243 ICPS (held solely by Magnum).

The shareholding structure of Asia 4D Company before and after the ICPS Conversion and Put Option Purchase (collectively “Transactions”) is as follows: | Shareholder | %Existing Shareholding BEFORE Transactions | %Shareholding AFTER ICPS Conversion | %Shareholding AFTER Transactions | | Asia 4D Holdings | 100% Ordinary Share | 0.00034% Ordinary Share | - | | Magnum | 100% ICPS | 99.99966% Ordinary Shares | 100% Ordinary Share |

(3) Rationale for the Transactions Pursuant to the Subscription Agreement dated 11 March 2011 and Put Option Agreement dated 25 May 2011, the exercise period for the ICPS Conversion and the Put Option Purchase is from 1 January 2014 to 31 July 2018 (“Conversion Period”).

In view of the imminent expiry of the Conversion Period, Magnum had exercised the ICPS Conversion and in view of the ICPS Conversion, Asia 4D Holdings had exercised the Put Option Purchase accordingly.

Following the Transactions, Asia 4D Company will become a wholly-owned subsidiary of Magnum.

(4) Effects of the Transactions 4.1 Share capital and substantial shareholders’ shareholding The Transactions does not have any effect on the share capital and substantial shareholders’ shareholdings of the Company. 4.2 Earnings per share, net assets per share and gearing The Transactions does not have any material effect on the earnings per share, net assets per share and gearing of the Magnum Group for the financial year ending 31 December 2018.

(5) Directors’ and Major Shareholders’ Interest A Director of the Company, Mr Sigit Prasetya, had declared his interest in the Transactions by virtue of the fact that he is a director of Asia 4D Holdings Limited.

Save for Mr Sigit Prasetya, Asia 4D Holdings and CVC Capital Partners Asia Pacific III L.P., none of the directors and/or substantial shareholders and/or persons connected with them have any interest, direct or indirect, in the Transactions.

This announcement is dated 30 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 09:32 PM

|

显示全部楼层

发表于 24-8-2018 09:32 PM

|

显示全部楼层

本帖最后由 icy97 于 26-8-2018 03:56 AM 编辑

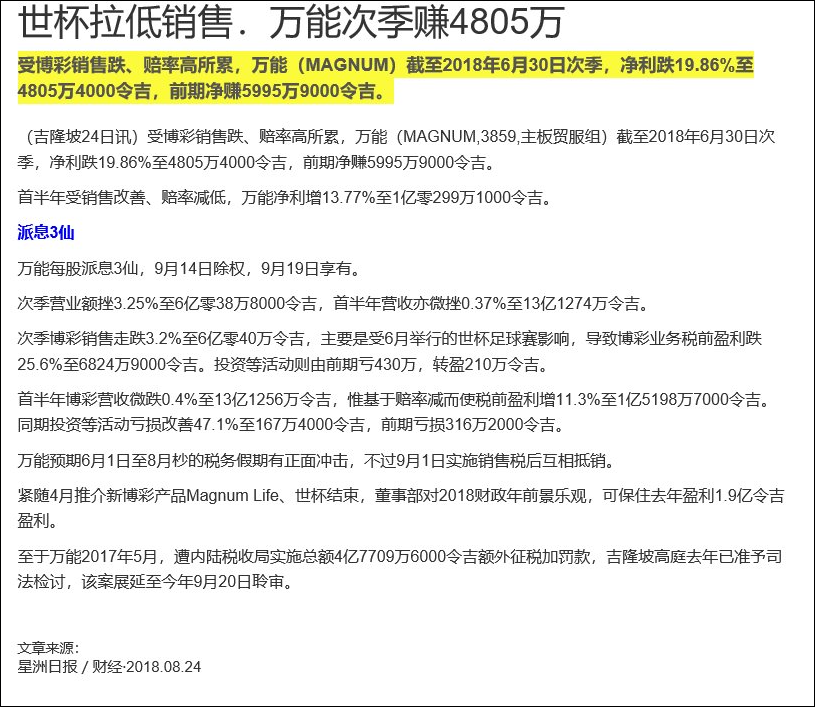

| 3859 MAGNUM MAGNUM BERHAD | | Quarterly rpt on consolidated results for the financial period ended 30/06/2018 | | Quarter: | 2nd Quarter | | Financial Year End: | 31/12/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/06/2018 | 30/06/2017 | 30/06/2018 | 30/06/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 600,388 | 620,583 | 1,312,740 | 1,317,667 | | 2 | Profit/Loss Before Tax | 70,378 | 87,407 | 150,313 | 133,424 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 48,054 | 59,959 | 102,991 | 90,529 | | 4 | Net Profit/Loss For The Period | 48,625 | 60,771 | 104,360 | 92,144 | | 5 | Basic Earnings/Loss Per Shares (sen) | 3.38 | 4.21 | 7.24 | 6.36 | | 6 | Dividend Per Share (sen) | 3.00 | 3.00 | 7.00 | 3.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.7400 | 1.7400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 09:34 PM

|

显示全部楼层

发表于 24-8-2018 09:34 PM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2018 06:44 AM 编辑

EX-date | 14 Sep 2018 | Entitlement date | 19 Sep 2018 | Entitlement time | 04:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second Interim Single Tier Dividend Of 3 Sen Per Share For The Financial Year Ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | METRA MANAGEMENT SDN BHD30.02, 30th Floor, Menara Multi-PurposeCapital SquareNo. 8 Jalan Munshi Abdullah50100Kuala LumpurTel:0326983232Fax:0326980313 | Payment date | 28 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 05:37 AM

|

显示全部楼层

发表于 31-8-2018 05:37 AM

|

显示全部楼层

ype | Announcement | Subject | OTHERS | Description | Acquisition Of New Subsidiary, Asia 4D Company Limited, Arising From The Conversion Of Irredeemable Convertible Preference Shares Into Ordinary Shares In Asia 4D Company Limited and Purchase Of Equity Interest In Asia 4D Company Limited From Asia 4D Holdings Limited | (Unless otherwise stated, all abbreviations and terms used in this announcement shall have the same meanings as those defined in our announcement dated 30 July 2018.)

Reference is made to our announcement made on 30 July 2018 in relation to the above subject matter.

The Board of Directors of Magnum wishes to announce that the Put Option Purchase had been completed today, 29 August 2018, in accordance with the Put option agreement dated 25 May 2011 entered into between Magnum and Asia 4D Holdings Limited.

Immediately following the completion of the Put Option Purchase, Asia 4D Company Limited, a Labuan Offshore company and currently, a 99.99966%-owned subsidiary of Magnum became a wholly-owned subsidiary of Magnum.

This announcement is dated 29 August 2008.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2018 02:14 AM

|

显示全部楼层

发表于 3-9-2018 02:14 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-9-2018 01:20 AM

|

显示全部楼层

发表于 23-9-2018 01:20 AM

|

显示全部楼层

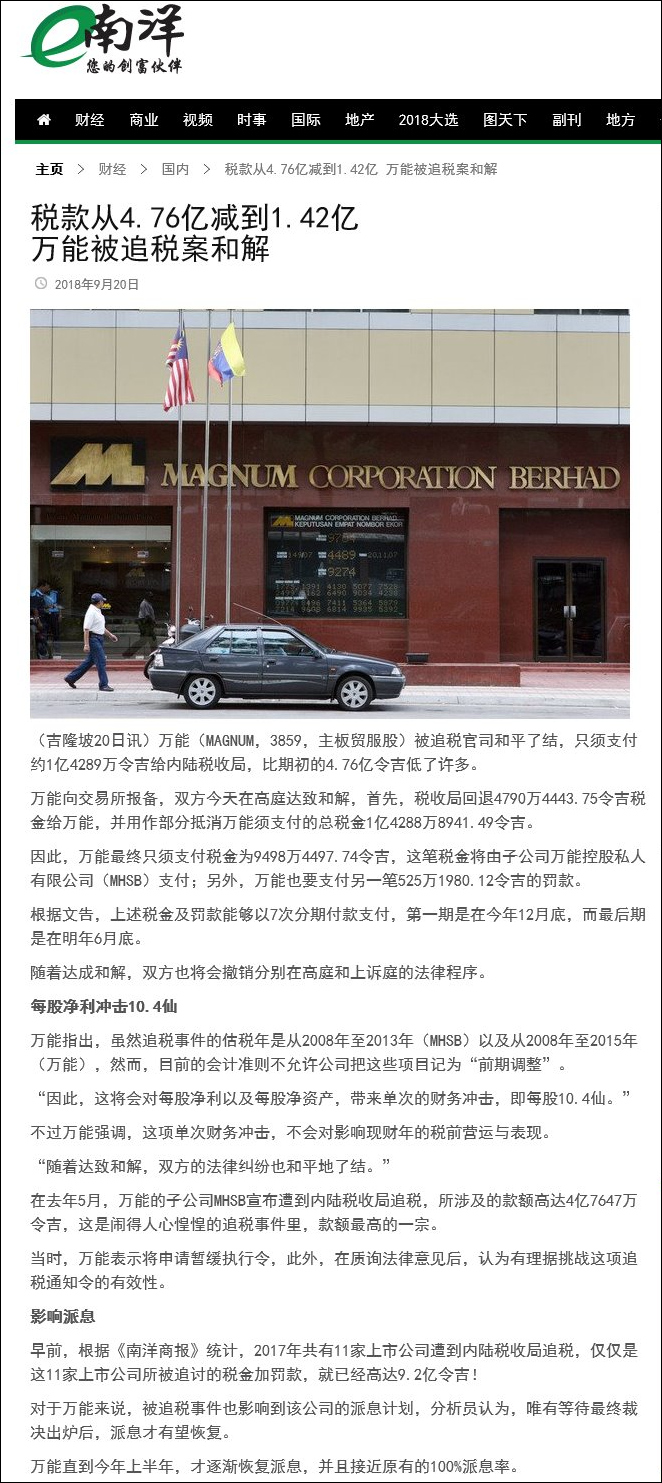

Type | Announcement | Subject | MATERIAL LITIGATION | Description | In The Matter Of Kuala Lumpur High Court Case Nos : WA-25-135-05/2017, WA-25-137-05/2017 And WA-25-172-06/2017 Between Magnum Berhad ("Magnum" Or "Company") And Magnum Holdings Sdn Bhd ("MHSB"), A Wholly-Owned Subsidiary Of Magnum, (Collectively, As Applicants) And Director General Of Inland Revenue (As Respondent) | Reference is made to the Company’s announcements made on 19 May 2017, 6 June 2017, 19 July 2017 and 9 August 2017 pertaining to the leave for commencement of judicial review proceedings granted by the Kuala Lumpur High Court and the subsequent updates that were provided in the Company’s announcements on the quarterly results.

Magnum wishes to announce that the Applicants through their legal counsels with the agreement of the Respondent, had today, 20 September 2018, filed a Consent Order with the Kuala Lumpur High Court to enter into a Consent Judgment for inter-alia, the following:

1) The Respondent will refund the amount of RM 47,904,443.75 by way of offset against RM142,888,941.49 in respect of MHSB, resulting in the nett payable amount of RM 94,984,497.74 by MHSB.

2) The Applicants will make full and final settlement of tax and penalty amounting to RM94,984,497.74 (to be paid by MHSB) and RM5,251,980.12 (to be paid by Magnum) by instalment payments covering the years of assessment from 2008 to 2013 (for MHSB) and from 2008 to 2015 (for Magnum) as follows:-

Date of Payment | Amount of Payment (RM) | MHSB | Magnum | 31 December 2018 | 28,000,000.00 | 2,000,000.00 | 31 January 2019 | 11,164,082.95 | 541,996.70 | 28 February 2019 | 11,164,082.95 | 541,996.70 | 31 March 2019 | 11,164,082.95 | 541,996.70 | 30 April 2019 | 11,164,082.95 | 541,996.70 | 31 May 2019 | 11,164,082.95 | 541,996.70 | 30 June 2019 | 11,164,082.99 | 541,996.62 | Total | 94,984,497.74 | 5,251,980.12 |

Following the filing of the Consent Order, the Applicants will withdraw its judicial review applications before the Kuala Lumpur High Court and the Respondent will withdraw its corresponding appeals before the Court of Appeal.

Despite the years of assessment covered under the Consent Judgment being from 2008 to 2013 (for MHSB) and from 2008 to 2015 (for Magnum), the current accounting standard does not allow these prior years’ matter being treated as prior year adjustments and as such there will be a one-off and non-recurring adverse financial impact to the Basic Earnings Per Share and Net Assets Per Share amounting to 10.4 sen. This one-off and non-recurring settlements will have no impact on the current year’s operations or performance before taxation.

With the above Consent Judgment, the dispute between the Applicants and the Respondent had been settled amicably.

This announcement is made on 20 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2018 05:40 AM

|

显示全部楼层

发表于 30-9-2018 05:40 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 9-10-2018 02:04 AM

|

显示全部楼层

发表于 9-10-2018 02:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 08:21 PM

|

显示全部楼层

发表于 27-11-2018 08:21 PM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 05:45 AM 编辑

付税1亿给税收局-万能第3季净亏7051万

http://www.chinapress.com.my/20181127/付税1亿给税收局-万能第3季净亏7051万/

| 3859 MAGNUM MAGNUM BERHAD | | Quarterly rpt on consolidated results for the financial period ended 30/09/2018 | | Quarter: | 3rd Quarter | | Financial Year End: | 31/12/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/09/2018 | 30/09/2017 | 30/09/2018 | 30/09/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 667,109 | 656,454 | 1,979,849 | 1,974,121 | | 2 | Profit/Loss Before Tax | 58,075 | 86,885 | 208,388 | 220,309 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | (70,509) | 63,283 | 32,482 | 153,812 | | 4 | Net Profit/Loss For The Period | (69,774) | 63,981 | 34,586 | 156,125 | | 5 | Basic Earnings/Loss Per Shares (sen) | (4.96) | 4.45 | 2.28 | 10.81 | | 6 | Dividend Per Share (sen) | 4.00 | 4.00 | 11.00 | 7.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.6600 | 1.7400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|