|

|

发表于 30-5-2016 01:11 AM

|

显示全部楼层

发表于 30-5-2016 01:11 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 290,504 | 257,468 | 290,504 | 257,468 | | 2 | Profit/(loss) before tax | 16,319 | 7,678 | 16,319 | 7,678 | | 3 | Profit/(loss) for the period | 11,278 | 5,824 | 11,278 | 5,824 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,077 | 5,207 | 11,077 | 5,207 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.63 | 1.71 | 3.63 | 1.71 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.7800 | 2.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-7-2016 04:17 AM

|

显示全部楼层

发表于 1-7-2016 04:17 AM

|

显示全部楼层

本帖最后由 icy97 于 1-7-2016 05:17 PM 编辑

慕达5000万购新机械.增纸盒产能

(吉隆坡30日讯)慕达控股(MUDA,3883,主板工业产品组)添购新机械增加纸盒产能,并放眼在未来增加纸盒市占率。

慕达控股副董事经理拿督林俊聪在股东大会后表示,公司于今年投入5000万令吉的资本开支作为扩建加影纸盒工厂及添购一架新机械的费用。

“该工厂目前每月产能3000公吨,在新机械投入运作后,在4至5年里产能将可增加至每月6000公吨。”

他补充,扩建工程约2个月前开始,预计今年11月将能完工并在今年杪进行试运。

慕达控股目前共有5家纸盒制造厂及两家纸张制造厂。

另外,他提到预计在去年7月生产机制蜡光纸(Machine Glazed Paper)的机械,因为面对技术问题,延迟至今年7月才投入运作。

他指出,蜡光纸用于食物包装等领域,而该领域注重卫生,因此必须申请许多证书,该公司目前正着手申请相关证书。

林俊聪说,公司有意进军胶手套间隔纸市场。

他说,该领域同样高度注重卫生,因此,同样面对申请不同证书的问题。

林俊聪预测包装纸领域每年将维持4至5%的增长,对于该公司来说,尚有发展机会。

他说,至于纸盒领域,整个市场的需求约120万至140万公吨,而该公司市占率则有约15%,因此拥有很大发展空间。

他指出,至少在未来5年,该公司将专注大马市场,并尽量提升市占率。

文章来源:

星洲日报/财经‧2016.07.01 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-8-2016 02:38 AM

|

显示全部楼层

发表于 19-8-2016 02:38 AM

|

显示全部楼层

火魔夜袭纸厂 5句钟烧毁3仓库

社会 2016年08月18日

(威南18日讯)火魔在中元节拜访纸厂,大火席捲3间佔地19英亩的大货仓,熊熊燃烧逾5句钟,造成无法估计的损失,庆幸未有伤亡报告。

遭火魔肆虐的是位于新邦安拔打昔的慕达纸厂有限公司,该厂的3间成品仓库惨遭大火吞噬90%,失火原因有待消防局鉴证组深入调查。

这起火灾意外是于週三晚10时20分发生,狂烧时火舌冲天歷时3句余钟,远至7公里外都可在夜空中看到熊熊火光,状甚骇人。

据志愿消拯队成员透露,大火狂烧时完全束手无策,只能在旁喷洒水,阻火势蔓延至其他厂房。大火在5句钟后才变成零星火势,货仓已焚成废墟。消防员在午夜后仍驻守,至今日中午,废墟中还有零星火势未灭。

针对这场火患,据檳州消拯局初步报告指出,消拯队抵达时,该3个仓库已陷入火海中。

消防栓水压低

3间仓库约佔地19英亩,其中2间面积为33万6000平方尺,另一个面积是16万平方尺,全都被烧燬90%。因仓库內之货物是易燃品,当消拯队前往时,火势已失控。拯救队伍先切断火路,以避免火势蔓延至其他建筑物。

「遭火烧毁的厂仓库大又宽,火势快速延烧。消拯队出动29名成员外,也获得邻近12支志愿消防队参与。救灾拯救队伍面对最大的挑战是消防栓水压低,及迫切需要大量水源来灌灭火种。因此寻求更多的援助方式,包括出动威省全部的政府消拯队,包括2辆消防水槽车。警方也在场维持交通次序,国能、红新月队都在场提供帮助。」

慕达纸业是马来西亚慕达控股集团全资子公司,在吉隆坡上市。

慕达纸业旗下在我国有两家纸厂,分別位于加影和打昔。慕达纸业年总產约有50万吨,產品包括瓦楞原纸、双灰纸板和包装纸等,是採用回收纸来造新纸的纸厂。慕达纸业废纸的用量非常大,每年回收的废纸高达60万吨。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2016 05:04 AM

|

显示全部楼层

发表于 28-8-2016 05:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 284,786 | 258,929 | 575,290 | 516,397 | | 2 | Profit/(loss) before tax | 6,111 | 6,145 | 22,430 | 13,823 | | 3 | Profit/(loss) for the period | 5,255 | 3,386 | 16,533 | 9,210 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,574 | 3,735 | 16,651 | 8,942 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.83 | 1.22 | 5.46 | 2.93 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8000 | 2.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-9-2016 06:22 AM

|

显示全部楼层

发表于 4-9-2016 06:22 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2016 07:03 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION OF 20% EQUITY INTEREST IN EE SIN PAPER PRODUCTS PTE LTD BY INTRAPAC (SINGAPORE) PTE LTD, A 70% OWNED SUBSIDIARY OF MUDA HOLDINGS BERHAD | The Board of Directors of Muda Holdings Berhad ("the Company") wishes to announce that the Company, through its 70% owned subsidiary, Intrapac (Singapore) Pte Ltd has on 2 September 2016 entered into a Share Agreement with Mr Tan Kuo Keng to acquire 40,000 shares of S$1.00 each representing 20% of the paid up capital of Ee Sin Paper Products Pte Ltd for a total cash consideration of Singapore Dollars Nine Hundred Fifty Thousand (S$950,000.00) (equivalent to RM2,842,020 at assumed exchange rate of RM2.9916 for S$1.00).

Please refer to the attachment for announcement details. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5197125

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-11-2016 02:25 AM

|

显示全部楼层

发表于 15-11-2016 02:25 AM

|

显示全部楼层

本帖最后由 icy97 于 15-11-2016 04:40 AM 编辑

慕达第三季转亏1575万

2016年11月15日

(吉隆坡14日讯)慕达(MUDA,3883,主板工业产品股)截止9月杪第三季,转盈为亏,净亏1575万令吉,上财年同季净利为745万4000令吉。

该公司向马交所报备,营业额则上升7.87%,从上财年同期2亿6103万7000令吉,增加至2亿8157万6000令吉。

营业额上扬,归功于合适售价、工业纸品需求增加、纸品包装领域的销售价格和销售量提升。

令吉的疲软,促使本地工业纸品包装领域的需求增长,因顾客将进口产品转为本地产品,以减少交易风险和库存过剩。

累计首9个月,净利暴跌94.55%,报89万4000令吉,主要是全球经济前景疲弱和不确定;营业额却上扬10.22%,报8亿5686万6000令吉。

该公司指出,纸品需求削弱加剧了当地工业纸品和纸包装产品生产商之间的竞争。

展望未来,集团预计海外和国内市场的工业纸品和纸品包装的需求,将会保持平稳,并预计下季度回收纸的供应紧张。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 281,576 | 261,037 | 856,866 | 777,434 | | 2 | Profit/(loss) before tax | -14,860 | 8,556 | 7,570 | 22,379 | | 3 | Profit/(loss) for the period | -16,017 | 7,455 | 516 | 16,665 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -15,757 | 7,454 | 894 | 16,396 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.17 | 2.44 | 0.29 | 5.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.7300 | 2.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2017 05:39 AM

|

显示全部楼层

发表于 24-2-2017 05:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 360,888 | 347,418 | 1,217,754 | 1,124,852 | | 2 | Profit/(loss) before tax | 23,916 | 18,763 | 31,486 | 41,142 | | 3 | Profit/(loss) for the period | 20,318 | 11,566 | 20,834 | 28,231 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,913 | 9,859 | 18,807 | 26,255 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.87 | 3.23 | 6.17 | 8.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.03 | 0.03 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.7700 | 2.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2017 05:07 AM

|

显示全部楼层

发表于 1-5-2017 05:07 AM

|

显示全部楼层

EX-date | 28 Jun 2017 | Entitlement date | 30 Jun 2017 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 3 sen per share in respect of financial year ended 31 December 2016 | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | 30 Jun 2017 to 30 Jun 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MUDA MANAGEMENT SERVICES SDN BHDLot 7, Jalan 51A/24146100 Petaling JayaSelangor Darul EhsanTel:03-7875 9549Fax:03-7873 8435 | Payment date | 20 Jul 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Jun 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2017 02:25 AM

|

显示全部楼层

发表于 19-5-2017 02:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 316,724 | 290,504 | 316,724 | 290,504 | | 2 | Profit/(loss) before tax | 20,926 | 16,319 | 20,926 | 16,319 | | 3 | Profit/(loss) for the period | 18,527 | 11,278 | 18,527 | 11,278 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 18,147 | 11,077 | 18,147 | 11,077 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.95 | 3.63 | 5.95 | 3.63 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8600 | 2.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-8-2017 05:16 AM

|

显示全部楼层

发表于 26-8-2017 05:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 325,901 | 284,786 | 642,625 | 575,290 | | 2 | Profit/(loss) before tax | 4,925 | 6,111 | 25,851 | 22,430 | | 3 | Profit/(loss) for the period | 3,467 | 5,255 | 21,994 | 16,533 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,126 | 5,574 | 22,273 | 16,651 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.35 | 1.83 | 7.30 | 5.46 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8700 | 2.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2017 05:22 AM

|

显示全部楼层

发表于 30-9-2017 05:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 12:32 AM

|

显示全部楼层

发表于 29-11-2017 12:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 353,879 | 281,576 | 996,504 | 856,866 | | 2 | Profit/(loss) before tax | 4,020 | -14,860 | 29,871 | 7,570 | | 3 | Profit/(loss) for the period | 26 | -16,017 | 22,020 | 516 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 523 | -15,757 | 22,796 | 894 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.17 | -5.17 | 7.47 | 0.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0500 | 2.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 12:38 AM

|

显示全部楼层

发表于 29-11-2017 12:38 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | REVALUATION OF PROPERTIES | Pursuant to paragraph 9.19(46) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Muda Holdings Berhad ("Muda") wishes to announce that Muda Group has carried out a revaluation exercise on the Muda Group properties.

The details of the announcement is attached herewith for your reference.

This annoucement is dated 24 November 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5615061

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 03:06 AM

|

显示全部楼层

发表于 28-2-2018 03:06 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 451,947 | 360,888 | 1,448,451 | 1,217,754 | | 2 | Profit/(loss) before tax | 35,504 | 23,916 | 65,375 | 31,486 | | 3 | Profit/(loss) for the period | 37,890 | 20,318 | 59,910 | 20,834 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 35,970 | 17,913 | 58,766 | 18,807 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.79 | 5.87 | 19.26 | 6.17 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 3.50 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.1600 | 2.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2018 07:48 AM

|

显示全部楼层

发表于 31-3-2018 07:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-5-2018 05:01 AM

|

显示全部楼层

发表于 2-5-2018 05:01 AM

|

显示全部楼层

EX-date | 27 Jun 2018 | Entitlement date | 29 Jun 2018 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 3.5 sen per share in respect of financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | 29 Jun 2018 to 29 Jun 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MUDA MANAGEMENT SERVICES SDN BHDLot 7, Jalan 51A/24146100 Petaling JayaSelangor Darul EhsanTel:03-7875 9549Fax:03-7873 8435 | Payment date | 19 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.035 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-5-2018 02:20 AM

|

显示全部楼层

发表于 9-5-2018 02:20 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | MADAM SIN POAY SIM | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | 1) Sin Poay Sim11A, Jalan Senyum MatahariCountry Heights, 43000 KajangSelangor Darul Ehsan2) Hartaban Holdings Sdn BhdLot 7, Jalan 51A/24146100 Petaling JayaSelangor Darul Ehsan3) Malaysia Nominees (Tempatan) Sendirian BerhadPledged Securities Account For Hartaban Holdings Sdn BhdLevel 13 Menara OCBC18 Jalan Tun Perak50050 Kuala Lumpur4) Styme Sdn BhdLot 7 Jalan 51A/24146100 Petaling JayaSelangor Darul Ehsan5) Tri-Yen Enterprise Sdn BhdLot 7 Jalan 51A/24146100 Petaling JayaSelangor Darul Ehsan6) Lim Wan Hoi11A, Jalan Senyum Matahari, Country Heights, 43000 KajangSelangor Darul Ehsan. |

| Date interest acquired & no of securities acquired | Date interest acquired | 29 Mar 2018 | No of securities | 117,526,713 | Circumstances by reason of which Securities Holder has interest | 1) Direct Interest2) Transfer of interest in Hartaban Holdings Sdn Bhd upon demise of spouse, Mr Lim Wan Hoi and deemed interested by virtue of interest in Hartaban Holdings Sdn Bhd pursuant to Section 8 of the Companies Act, 2016 | Nature of interest | Direct and Indirect Interest |  | | Total no of securities after change | Direct (units) | 2,357,200 | Direct (%) | 0.773 | Indirect/deemed interest (units) | 115,169,513 | Indirect/deemed interest (%) | 37.75 | Date of notice | 30 Apr 2018 | Date notice received by Listed Issuer | 30 Apr 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 03:21 AM

|

显示全部楼层

发表于 30-5-2018 03:21 AM

|

显示全部楼层

Date of change | 28 May 2018 | Name | DATUK LIM CHIUN CHEONG | Age | 54 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Deputy Managing Director | New Position | Managing Director | Directorate | Executive | Qualifications | 1. Bachelor of Science Degree from Arizona State University2. Bachelor of Law Degree, University of Birmingham, United Kingdom | Working experience and occupation | Datuk Lim Chiun Cheong was appointed as Executive Director on 1 September 2005 and was re-designation as Deputy Managing Director on 1 July 2006. He is a member of the Executive Committee and sits on the board of several local and overseas subsidiaries in the Group. Currently, he is involved in the management of the Manufacturing and Trading Divisions of the Group. Datuk Lim Chiun Cheong joined the Group as Legal Assistant in October 1991 and thereafter held several senior positions in the Group from 1992 to 2005. He is a committee member of the Malaysian Pulp & Paper Manufacturers Association. | Family relationship with any director and/or major shareholder of the listed issuer | Datuk Lim Chiun Cheong is the son of Tan Sri Lim Guan Teik, the Non-Executive Chairman of the Company and nephew of Dato' Lim Wan Peng, an Executive Director of the Company. | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Muda Holdings Berhad - 715,500 shares (Direct) and 126,836,813 shares (Indirect) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 03:23 AM

|

显示全部楼层

发表于 30-5-2018 03:23 AM

|

显示全部楼层

Date of change | 28 May 2018 | Name | DATO' AZAMAN BIN ABU BAKAR | Age | 71 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Managing Director | New Position | Executive Deputy Chairman | Directorate | Executive | Qualifications | 1. Bachelor of Arts Degree, University of Malaya2. Master in Management Degree, Asian Institute of Management, Manila | Working experience and occupation | Dato' Azaman was the Executive Director of Muda Holdings Berhad from 19 March 1985 to 21 October 1992. He held the post as Deputy Chairman from 22 October 1992 until his redesignation as Managing Director on 23 April 2004.He is the Chairman of the Executive Committee and sits on the board of several local and overseas subsidiaries in the Group. Currently, he is the President of the Malaysian Pulp & Paper Manufacturers Association.He began his career as a marketing executive in Harper Gilfillan and joined Urban Development Authority (UDA) in 1974. His last position in UDA was that of Director in charge of property management and marketing. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Muda Holdings Berhad - 100,000 shares (Direct) and 114,770,013 shares (Indirect) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 03:54 AM

|

显示全部楼层

发表于 30-5-2018 03:54 AM

|

显示全部楼层

本帖最后由 icy97 于 17-6-2018 05:45 AM 编辑

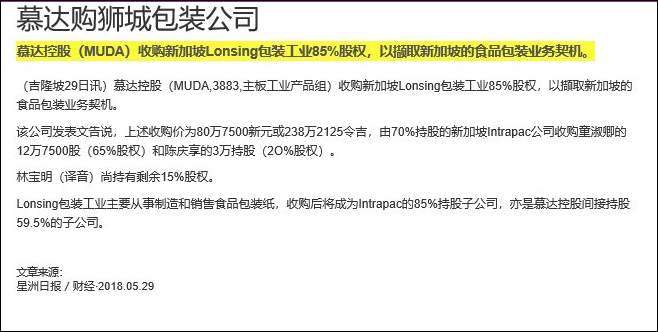

Type | Announcement | Subject | OTHERS | Description | Acquisition of 85% interest in Lonsing Packaging Industries Pte Ltd by Intrapac (Singapore) Pte Ltd, a 70% owned subsidiary of Muda Holdings Berhad | Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Muda Holdings Berhad ("the Company") wishes to announce that the Company, through its 70% owned subsidiary, Intrapac (Singapore) Pte Ltd (Company No. 198204948Z) had on 28 May 2018 acquired 85% interest in Lonsing Packaging Industries Pte Ltd (Company No. 198103810Z) comprising 127,500 ordinary shares from Ms Tong Sow Kheng (ID No. S0782618D) (97,500 shares) and Mr Tan Kheng Hiang (ID No. S0160872Z) (30,000 shares) for a total consideration of Singapore Dollars Eight Hundred and Seven Thousand and Five Hundred (S$807,500.00) which is equivalent to RM2,382,125.00 at assumed exchange rate of RM2.95 to S$1.00.

Please refer to the attachment for further details.

This announcement is dated 28 May 2018.

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|