|

|

发表于 7-10-2017 05:15 AM

|

显示全部楼层

发表于 7-10-2017 05:15 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2017 03:04 AM 编辑

睦兴旺获卡塔尔1.2亿合约

2017年10月7日

(吉隆坡6日讯)睦兴旺(MUHIBAH,5703,主板建筑股)持股49%的睦兴旺工程中东有限公司(MEME),获得总值1亿580万里亚尔(约1亿2050万令吉)的新合约,提供设计与建筑服务。

睦兴旺今日向马交所报备,根据合约,该公司将会在卡塔尔Um Alhoul经济特区,设计与兴建辅助设施和路面,以及所有与升降船平台、吊车和运河地区北部有关的工程。

明年次季完工

该公司表示,建筑工程即日开始,预计明年次季完成。

该合约将正面贡献本财年及未来财年的盈利和净资产。

今年1月,MEME获得卡塔尔经济区公司(Manateq)颁发总值3亿5670万里亚尔(约4亿3810万令吉)合约,兴建道路和基础建设。

睦兴旺表示,MEME今日所获得的合约,与以上合约有关。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MUHIBBAH" OR "THE COMPANY") ADDITIONAL WORK ORDER FOR THE CONTRACT AT UM ALHOUL SPECIAL ECONOMIC ZONE (QEZ-3) PHASE 2.1 (PORTION 2A, MARINE CLUSTER), QATAR FOR THE ECONOMIC ZONE COMPANY OF QATAR (MANATEQ) | INTRODUCTION

The Board of Directors (“the Board”) of Muhibbah is pleased to announce that Muhibbah Engineering Middle East LLC, an entity in which Muhibbah has 49% equity interest, has been awarded an additional work order for the Design and Construction of Complementary Utilities and Pavements with all associated works complete for Syncrolift, Travel lift and North side of canal areas at Um Alhoul Special Economic Zone (QEZ-3), Qatar for a total contract price of approximately Qatari Riyal 105.8 million (equivalent to approximately RM120.5 million) (“Work Order”). This additional Work Order is associated to a contract announced in January 2017 for the construction of roads and infrastructure works at Um Alhoul Economic Zone (QEZ-3) currently under way of approximately Qatari Riyal 356.7 million (equivalent to approximately RM438.1 million).

DURATION OF WORK ORDER

The construction works for the Work Order is to be commenced immediately and is expected to be completed by end of second quarter of 2018.

FINANCIAL EFFECTS

The Work Order is expected to contribute positively to the earnings and net assets of Muhibbah Group for the current and future financial years.

The Work Order does not have any impact on the share capital and/or shareholding structure of Muhibbah.

DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

None of the Directors and/or major shareholders and persons connected to the Directors and/or major shareholders of Muhibbah have any interest, direct or indirect, in the Work Order.

DIRECTORS' STATEMENT

The Board, after considering all the relevant factors, is of the opinion that the Work Order is in the best interest of Muhibbah Group.

This announcement is dated 6th October 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-10-2017 05:20 AM

|

显示全部楼层

发表于 10-10-2017 05:20 AM

|

显示全部楼层

攫卡塔尔合约.睦兴旺估值廉宜

(吉隆坡9日讯)睦兴旺工程(MUHIBAH,5703,主板建筑组)宣布再度获得卡塔尔政府颁发道路工程合约,约总值1亿零580万里亚尔(约1亿2050万令吉)。

上述合约是由旗下持股49%的中东睦兴旺工程攫取,该工程预料在明年第二季完成。

联昌研究表示,这是和该公司在2017年1月获颁的4亿3800万令吉基建工程合约相关的新增合约。

新合约将令该公司手上的工程订单增加6.3%,至20亿令吉。

假设税前赚幅为8%,联昌预期该公司在今年第四季可获200万令吉盈利,其余780万令吉盈利则在2018年进账。

安联星展研究表示,睦兴旺工程今年来所赢得的基建工程令人鼓舞,约为10亿令吉。

该行假设睦兴旺工程今年接下来可再获4亿令吉合约。

该公司目前的建筑订单共15亿令吉,若加上吊机和船坞合约订单则达到20亿令吉。

安联星展指出,虽然睦兴旺工程至今未显著参与捷运和轻快铁工程,但成功取得更多海事项目。其估值仍然廉宜,在9倍本益比水平交易,而2016至2019年3年盈利复合年均成长率为14%。

文章来源:

星洲日报‧财经‧2017.10.09 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2017 03:54 AM

|

显示全部楼层

发表于 11-10-2017 03:54 AM

|

显示全部楼层

本帖最后由 icy97 于 11-10-2017 05:03 AM 编辑

睦兴旺获1.68亿合约

2017年10月11日

(吉隆坡10日讯)睦兴旺(MUHIBAH,5703,主板建筑股)获颁合约,在登嘉楼甘马挽(Kemaman)兴建和完成吉利地(Kertih)生物聚合物园的主要基建工程,总值1.68亿令吉。

睦兴旺向交易所报备,上述合约是由东海岸经济区域发展协会(ECERDC)所颁发。

合约内容包括土木工程、兴建道路及沟渠及公用服务,包括污水处理厂、网络泵站、高架水箱、分站大楼等。

该公司表示,合约预计能在24个月内完成,相信能贡献现有及未来财年的净利和净资产。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MUHIBBAH" OR "THE COMPANY") AWARD FOR THE CONSTRUCTION AND COMPLETION OF MAIN INFRASTRUCTURE WORKS FOR KERTIH BIOPOLYMER PARK (PHASE 3) IN LOT Q, AT KERTIH BIOPOLYMER PARK, KEMAMAN, TERENGGANU DARUL IMAN | INTRODUCTION

The Board of Directors of Muhibbah Engineering (M) Bhd (“Muhibbah” or “the Company”) is pleased to announce that the Company has received a Letter of Acceptance from the East Coast Economic Region Development Council (“ECERDC") for the construction and completion of main infrastructure works for Kertih Biopolymer Park at Kertih Biopolymer Park, Kemaman, Terengganu Darul Iman with a contract value of RM168 million (“the Contract”).

The ECERDC is a statutory body established by Federal Government of Malaysia to spearhead the socio-economic development of the East Coast Economic Region.

The Contract involves the construction of major earthworks, road and drainage works, utility services including sewerage treatment plant, network pump station, elevated water tank, sub-station building and other associated works.

DURATION OF CONTRACT

Estimated Site Possession is in November 2017 and the Contract is expected to be completed within twenty-four (24) months from the Date of Site Possession.

FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net assets of Muhibbah Group for the current and future financial years.

The Contract does not have any impact on the share capital and/or shareholding structure of Muhibbah.

DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

None of the Directors and/or major shareholders and persons connected to the Directors and/or major shareholders have any interest, direct or indirect, in the Contract.

DIRECTORS' STATEMENT

The Board, after considering all the relevant factors, is of the opinion that the award of the Contract is in the best interest of Muhibbah Group.

This announcement is dated 10 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 02:20 AM

|

显示全部楼层

发表于 6-12-2017 02:20 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 372,446 | 384,958 | 1,081,781 | 1,273,032 | | 2 | Profit/(loss) before tax | 50,652 | 33,537 | 163,090 | 123,126 | | 3 | Profit/(loss) for the period | 47,853 | 38,829 | 145,968 | 112,129 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 27,952 | 22,555 | 95,097 | 73,115 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.82 | 4.69 | 19.80 | 15.43 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1200 | 2.0300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-12-2017 04:53 AM

|

显示全部楼层

发表于 25-12-2017 04:53 AM

|

显示全部楼层

本帖最后由 icy97 于 26-12-2017 03:02 AM 编辑

睦兴旺赢1.89亿捷运合约

2017年12月22日

(吉隆坡21日讯)睦兴旺(MUHIBAH,5703,主板建筑股)宣布获得捷运公司颁发合约,总值1.89亿令吉。

睦兴旺向交易所报备,合约内容主要是提供设计、供应、装置、使用、调试噪音障碍和外壳服务(配套V201至V210)。

该合约即将动工,预计会在2019年杪竣工,将会贡献现有及未来财政年。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MUHIBBAH" OR "THE COMPANY") ACCEPTANCE OF AWARD FOR THE DESIGN, SUPPLY, INSTALLATION, TESTING AND COMMISSIONING OF NOISE BARRIERS AND ENCLOSURES (PACKAGE V201 TO V210) FOR MASS RAPID TRANSIT LALUAN 2: SUNGAI BULOH-SERDANG-PUTRAJAYA PROJECT | INTRODUCTION

The Board of Directors of Muhibbah (“the Board”) is pleased to announce that Muhibbah Engineering (M) Bhd has accepted the award from the Mass Rapid Transit Corporation Sdn Bhd for the Design, Supply, Installation, Testing and Commissioning of Noise Barriers and Enclosures (Package V201 to V210) (“the Contract”) for a contract sum of approximately RM189 Million.

DURATION OF CONTRACT

The Contract is scheduled to commence immediately and is expected to be substantially completed by end of 2019.

FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net assets of the Muhibbah Group for the current and future financial years.

The Contract does not have any impact on the share capital and/or shareholding structure of Muhibbah.

RISKS

The risk factors affecting the Contract includes changes in economic, regulatory environment and operational risks such as completion risk, fluctuation of material price and foreign currencies which the Group would take appropriate measures to mitigate the risks.

DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

None of the Directors and/or major shareholders and persons connected to the Directors and/or major shareholders of Muhibbah have any interest, direct or indirect, in the Contract.

DIRECTORS' STATEMENT

The Board, after considering all the relevant factors, is of the opinion that the Contract is in the best interest of Muhibbah Group.

This announcement is dated 21 December 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2017 03:20 AM

|

显示全部楼层

发表于 26-12-2017 03:20 AM

|

显示全部楼层

睦兴旺

基建海事工程陆续有来

2017年12月23日

分析:兴业投行

目标价:3.75令吉

最新进展

睦兴旺(MUHIBAH,5703,主板建筑股)宣布获得捷运公司颁发总值1.89亿令吉的合约。

该合约即将动工,预计会在2019年杪竣工,将会贡献现有及未来财政年。

行家建议

我们对睦兴旺获颁这项合约略感到正面,符合我们对2017财年新订单合约达11亿的预测。

假设这项合约净赚幅达5%,预计总盈利达930万令吉,或占我们2018财年净利预测的7.9%。

睦兴旺的工程执行风险低,因为拥有工程、采购、施工和调试(EPCC)工程纪录,这包括边佳兰炼油与石油化工综合发展(RAPID)和其他油气相关工程。包括新获颁合约,该集团订单合约达21亿令吉。

我们预计,集团短期内会获得更多工程,主要是基建和海事相关合约。

大部分RAPID相关合约将在明年接近竣工阶段,所以油气相关工程占订单合约比重减少。

针对睦兴旺持股率达21%的柬埔寨机场,因预测游客到达率高,所以料明年搭客量取得双位数增长。

由于柬埔寨旅游业处于初期成长阶段,所以我们看好这机场的增长前景。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2017 05:36 AM

|

显示全部楼层

发表于 28-12-2017 05:36 AM

|

显示全部楼层

本帖最后由 icy97 于 28-12-2017 06:07 AM 编辑

睦兴旺获国能7000万合约

柔佛建钢筋混凝土码头平台

2017年12月28日

(吉隆坡27日讯)睦兴旺(MUHIBAH,5703,主板建筑股)宣布,获得国家能源(TENAGA,5347,主板贸服股)颁发约7000万令吉合约,在柔佛建设钢筋混凝土码头和平台。

睦兴旺今日向交易所报备,将负责为在柔佛的230千伏特(kV)士尼邦(Senibong)转换站,及从电流接驳站(PMU)士尼邦至士尼邦转换站的230千伏特架空线的建设项目,提供钢筋混凝土码头和平台的建设服务。

该项目预计12个月内完成,从明年首季开始,将贡献睦兴旺目前和未来财年的净利和净资产。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MUHIBBAH" OR "THE COMPANY") ACCEPTANCE OF AWARD FOR THE CONSTRUCTION OF REINFORCED CONCRETE JETTY AND PLATFORM FOR THE ESTABLISHMENT OF 230kV SENIBONG SWITCHING STATION AND 230kV OVERHEAD LINE FROM PMU SENIBONG TO SENIBONG SWITCHING STATION IN JOHOR BAHRU, JOHOR DARUL TA'ZIM, MALAYSIA | INTRODUCTION

The Board of Directors of Muhibbah (“the Board”) is pleased to announce that Muhibbah Engineering (M) Bhd has received an award from Tenaga Nasional Berhad for the Construction of Reinforced Concrete Jetty and Platform for the Establishment of 230kV Senibong Switching Station and 230kV Overhead Line from PMU Senibong to Senibong Switching Station in Johor Bahru, Johor Darul Ta’zim, Malaysia (“the Contract”) for a contract sum of approximately RM70 Million.

DURATION OF CONTRACT

The Contract is scheduled to commence in the first quarter of 2018 and is expected to be completed within twelve (12) months from the commencement date.

FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net assets of the Muhibbah Group for the current and future financial years.

The Contract does not have any impact on the share capital and/or shareholding structure of Muhibbah.

RISKS

The risk factors affecting the Contract include changes in economic and regulatory environment and general operational risks. The Group will take appropriate measures to mitigate such risks.

DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

None of the Directors and/or major shareholders and persons connected to the Directors and/or major shareholders of Muhibbah have any interest, direct or indirect, in the Contract.

DIRECTORS' STATEMENT

The Board, after considering all the relevant factors, is of the opinion that the Contract is in the best interest of Muhibbah Group.

This announcement is dated 27 December 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2018 05:51 AM

|

显示全部楼层

发表于 11-1-2018 05:51 AM

|

显示全部楼层

睦兴旺首选小型建筑股

2018年1月11日

分析:MIDF投资研究

目标价:3.60令吉

最新进展:

迈入2018年,睦兴旺(MUHIBAH,5703,主板建筑股)在新的一年的首周股价涨幅已达13.7%。

回顾稍早前,睦兴旺在去年12月27日时,获得国家能源(TENAGA,5347,主板贸服股)颁发约7000万令吉合约,在柔佛建设钢筋混凝土码头和平台。

另外,在同月21日,获得捷运公司颁发总值1.89亿令吉合约,负责提供设计、供应、装置、使用、调试噪音障碍和外壳服务。

行家建议:

上财年,睦兴旺成功拿下总值16亿令吉的新订单,比我们的预测要高出6亿令吉或62.6%。

至于今年,我们估计睦兴旺可在卡塔尔和大马,锁定总值7亿令吉的合约。

虽然卡塔尔与中东沙地联盟国有外交纷争,但这并不代表该国不再释出工程项目。去年10月时,睦兴旺成功拿下总值5910万令吉的基建合约。

而起重机业务方面,虽然领域前景较为严峻,但以辉高(FAVCO,7229,主板工业产品股)的实力和其在东南亚及中东的经验,要继续立足行内理应不难。

睦兴旺依然是我们小型建筑股的首选,维持“买入”评级,并上调目标价至3.60令吉。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2018 05:29 AM

|

显示全部楼层

发表于 23-2-2018 05:29 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MUHIBBAH" OR "THE COMPANY")NEW CONTRACT SECURED | ACCEPTANCE OF AWARD FOR DESIGN, CONSTRUCTION AND ERECTION OF SYNCROLIFT AND TRAVEL LIFT WITH ANCILLARIES AND ALL ASSOCIATED WORKS IN MARSA UM ALHOUL AT UM ALHOUL SPECIAL ECONOMIC ZONE, QATAR FOR THE ECONOMIC ZONES COMPANY, QATAR (MANATEQ)

INTRODUCTION

The Board of Directors of Muhibbah (“the Board”) is pleased to announce that Muhibbah Engineering Middle East LLC, an entity in which Muhibbah has a 49% equity interest, has accepted the award from the Economic Zones Company, Qatar (MANATEQ), a company owned by the Government of Qatar, for the Design, Construction and Erection of Syncrolift and Travel Lift with Ancillaries and All Associated Works in Marsa Um Alhoul at Um Alhoul Special Economic Zone, Qatar for a total contract price of approximately Qatari Riyal 143 million (equivalent to approximately RM149 million) (“the Contract”).

DURATION OF CONTRACT

The construction works for the Contract is to be commenced immediately and is expected to be completed by the first quarter of 2019.

FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net assets of the Muhibbah Group for the curent and future financial years.

The Contract does not have any impact on the share capital and/or shareholding structure of Muhibbah.

RISKS

The risk factors affecting the Contract includes changes in economic, political and regulatory environment and operational risks such as completion risk, shortage of manpower, fluctuation of material price and foreign currencies which the Group would take appropriate measures to mitigate the risks .

DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

None of the Directors and/or major shareholders and persons connected to the Directors and/or major shareholders of Muhibbah have any interest, direct or indirect, in the Contract.

DIRECTORS' STATEMENT

The Board, after considering all the relevant factors, is of the opinion that the Contract is in the best interest of Muhibbah Group.

This announcement is dated 22 February 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2018 01:59 AM

|

显示全部楼层

发表于 25-2-2018 01:59 AM

|

显示全部楼层

睦兴旺本益比低于大市

2018年2月24日

分析:MIDF研究

目标价:3.60令吉

最新进展:

睦兴旺(MUHIBAH,5703,主板建筑股)联号公司Muhibbah Engineering Middle East(MEME),与卡塔尔经济区公司(Manateq)签署总值1亿4300万里亚尔(约1亿4900万令吉)合约。

睦兴旺向马交所报备,MEME将在卡塔尔Um Alhoul特别经济区,设计和兴建在船坞用的海事举重机系统。

行家建议:

上述合约在我们6亿令吉的新增订单的预测中,目前预计未入账订单达18亿令吉。

我们保持2018及2019财年的财测不变,合约预计能贡献1420万令吉的净利,占税后归属股东净利(PATAMI)的10.4%比重。

睦兴旺仍是我们首选的小型建筑股,维持“买入”的投资评级和3.60令吉的目标价格。

该股估值偏低,仅达11.5倍的本益比,比富时隆综指的16.9倍要低。其他在吉隆坡建筑指数的同行本益比则达22.5倍。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 02:46 AM

|

显示全部楼层

发表于 5-3-2018 02:46 AM

|

显示全部楼层

本帖最后由 icy97 于 7-3-2018 07:28 AM 编辑

末季赚3651万

睦兴旺派息7仙

2018年3月3日

(吉隆坡2日讯)睦兴旺(MUHIBAH,5703,主板建筑股)截至去年12月31日末季,净赚3651万1000令吉或每股7.60仙,年增12.74%;建议派息每股7仙。

睦兴旺日前向交易所报备,营业额按年大跌52.52%至3亿650万令吉。

累计全年,净利年升24.75%至1亿3160万8000令吉;营业额报13亿8828万1000令吉,按年减27.64%。

包括联号公司营业额,睦兴旺全年综合营业额达20亿令吉,净利为1亿9630万令吉。

上财年同期分别为23亿令吉和1亿6100万令吉。

未完成订单21亿

柬埔寨国际机场特许经营,也取得较高收入和贡献。

截至2月杪,睦兴旺手握未完成订单合约总值达21亿令吉,并将持续在海外及本地市场寻求基建及海事项目。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 306,500 | 645,591 | 1,388,281 | 1,918,623 | | 2 | Profit/(loss) before tax | 53,368 | 59,420 | 216,458 | 182,546 | | 3 | Profit/(loss) for the period | 50,349 | 48,826 | 196,317 | 160,955 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 36,511 | 32,386 | 131,608 | 105,501 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.60 | 6.74 | 27.40 | 22.19 | | 6 | Proposed/Declared dividend per share (Subunit) | 7.00 | 5.50 | 7.00 | 5.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1800 | 2.0300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 07:35 AM

|

显示全部楼层

发表于 7-3-2018 07:35 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MEB" or "the Company")- Proposed First and Final Dividend | The Board of Directors of MEB is pleased to recommend a first and final tax exempt dividend of 7.0 sen per ordinary share in respect of the financial year ended 31 December 2017. The declaration of the first and final tax exempt dividend is subject to the approval of the Company's shareholders at the forthcoming Annual General Meeting of the Company.

The dividend entitlement and payment dates will be determined by the Board of Directors at a later date.

This announcement is dated 28 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2018 03:35 AM

|

显示全部楼层

发表于 11-3-2018 03:35 AM

|

显示全部楼层

本帖最后由 icy97 于 12-3-2018 06:19 AM 编辑

睦兴旺赢5760万LRT3工程

2018年3月10日

(吉隆坡9日讯)睦兴旺(MUHIBAH,5703,主板建筑股)获国家基建公司颁发轻快铁第3路线(LRT3)配套工程,总值约5760万令吉。

睦兴旺今日向交易所报备,该合约是通过持股49%的联营公司获得,负责在雪州万达镇(Bandar Utama)至佐汉瑟迪亚(Johan Setia)的轻快铁路线。

该公司将为Package NBE(NBE)设计、供应、交付、安装、测试和调试隔音屏障。

工程预计于2020年第三季完成,料能贡献现有和未来财年的净利和净资产。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MEB" OR "THE COMPANY")ACCEPTANCE OF AWARD FOR DESIGN, SUPPLY, DELIVERY, INSTALLATION, TESTING AND COMMISSIONING OF NOISE BARRIER FOR PACKAGE NBE (E) FOR LIGHT RAIL TRANSIT LINE 3 (LRT3) FROM BANDAR UTAMA TO JOHAN SETIA | INTRODUCTION

The Board of Directors of Muhibbah (“the Board”) is pleased to announce that Muhibbah Engineering (M) Bhd has via a joint venture in which Muhibbah has 49% equity interest accepted the award from Prasarana Malaysia Berhad, for the Design, Supply, Delivery, Installation, Testing and Commissioning of Noise Barrier for Package NBE (E) for Light Rail Transit Line 3 (LRT3) from Bandar Utama to Johan Setia for a contract sum of approximately RM57.6 million (“the Contract”).

DURATION OF CONTRACT

The construction works for the Contract is to be commenced immediately and is expected to be completed by the third quarter of 2020.

FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net assets of the Muhibbah Group for the current and future financial years.

The Contract does not have any impact on the share capital and/or shareholding structure of Muhibbah.

RISKS

The risk factors affecting the Contract includes changes in economic, political and regulatory environment and operational risks such as completion risk, shortage of manpower, fluctuation of material price and foreign currencies of which the Group would take appropriate measures to mitigate the risks .

DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

None of the Directors and/or major shareholders and persons connected to the Directors and/or major shareholders of Muhibbah have any interest, direct or indirect, in the Contract.

DIRECTORS' STATEMENT

The Board, after considering all the relevant factors, is of the opinion that the Contract is in the best interest of Muhibbah Group.

This announcement is dated 9 March 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 01:30 AM

|

显示全部楼层

发表于 16-3-2018 01:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-3-2018 08:30 AM

|

显示全部楼层

发表于 24-3-2018 08:30 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 05:26 AM 编辑

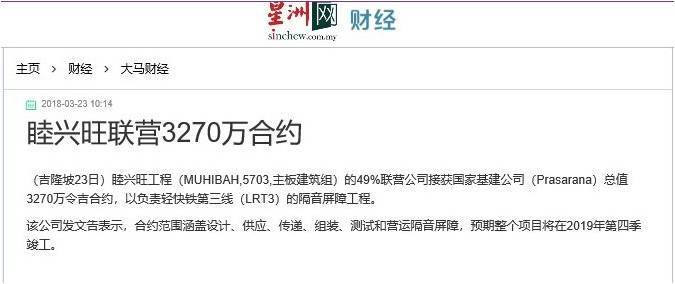

Type | Announcement | Subject | OTHERS | Description | MUHIBBAH ENGINEERING (M) BHD ("MUHIBBAH" OR "THE COMPANY")NEW CONTRACT SECURED | ACCEPTANCE OF AWARD FOR DESIGN, SUPPLY, DELIVERY, INSTALLATION, TESTING AND COMMISSIONING OF NOISE BARRIER FOR PACKAGE NBE (W) FOR LIGHT RAIL TRANSIT LINE 3 (LRT3) FROM BANDAR UTAMA TO JOHAN SETIA

INTRODUCTION

The Board of Directors of Muhibbah (“the Board”) is pleased to announce that Muhibbah has via a joint venture in which the Company has 49% equity interest accepted the award from Prasarana Malaysia Berhad, for the Design, Supply, Delivery, Installation, Testing and Commissioning of Noise Barrier for Package NBE (W) for Light Rail Transit Line 3 (LRT3) Package GS06 to Package GS10 from Bandar Utama to Johan Setia for a contract sum of approximately RM32.7 million (“the Contract”).

DURATION OF CONTRACT

The construction works for the Contract is to be commenced immediately and is expected to be completed by the fourth quarter of 2019.

FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net assets of Muhibbah Group for the current and future financial years.

The Contract does not have any impact on the share capital and/or shareholding structure of Muhibbah.

RISKS

The risk factors affecting the Contract includes changes in economic, political and regulatory environment and operational risks such as completion risk, shortage of manpower, fluctuation of material price and foreign currencies of which the Group would take appropriate measures to mitigate the risks .

DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

None of the Directors and/or major shareholders and persons connected to the Directors and/or major shareholders of Muhibbah have any interest, direct or indirect, in the Contract.

DIRECTORS' STATEMENT

The Board of Director, after considering all the relevant factors, is of the opinion that the Contract is in the best interest of Muhibbah Group.

This announcement is dated 22 March 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 02:29 AM

|

显示全部楼层

发表于 4-5-2018 02:29 AM

|

显示全部楼层

| MUHIBBAH ENGINEERING (M) BHD |

EX-date | 07 Sep 2018 | Entitlement date | 13 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | A first and final tax exempt dividend of 7.0 sen per ordinary share in respect of the financial year ended 31 December 2017. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | 13 Sep 2018 to 13 Sep 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 24 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 06:30 AM

|

显示全部楼层

发表于 24-5-2018 06:30 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)| MUHIBBAH ENGINEERING (M) BHD |

Particulars of Substantial Securities HolderName | FIL LIMITED | Address | Pembroke Hall, 42 Crow Lane, HMCX Hamilton

Bermuda. | Company No. | EC01462 | Nationality/Country of incorporation | Bermuda | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | BROWN BROS HARRIMAN (BOSTON)BROWN BROS HARRIMN LTD LUX (C)CLEARSTREAM BANKING SA LUX (C)JP MORGAN, BOURNEMOUTH (C)MASTER TRUST BANK OF JAPAN (C)STATE STR BK AND TR CO LNDN (C) |

| Date interest acquired & no of securities acquired | Date interest acquired | 15 May 2018 | No of securities | 24,446,500 | Circumstances by reason of which Securities Holder has interest | Transaction of securities by the fund managers of FIL Limited | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 24,446,500 | Direct (%) | 5.09 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 18 May 2018 | Date notice received by Listed Issuer | 21 May 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-6-2018 06:13 AM

|

显示全部楼层

发表于 10-6-2018 06:13 AM

|

显示全部楼层

本帖最后由 icy97 于 15-6-2018 07:27 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 249,089 | 241,487 | 249,089 | 241,487 | | 2 | Profit/(loss) before tax | 63,485 | 48,873 | 63,485 | 48,873 | | 3 | Profit/(loss) for the period | 59,378 | 44,373 | 59,378 | 44,373 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 36,177 | 29,314 | 36,177 | 29,314 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.53 | 6.10 | 7.53 | 6.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1000 | 2.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2018 02:26 AM

|

显示全部楼层

发表于 2-9-2018 02:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 311,617 | 467,848 | 560,706 | 709,335 | | 2 | Profit/(loss) before tax | 49,965 | 63,565 | 113,450 | 112,438 | | 3 | Profit/(loss) for the period | 44,470 | 53,742 | 103,848 | 98,115 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 32,998 | 37,831 | 69,175 | 67,145 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.87 | 7.88 | 14.40 | 13.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1900 | 2.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 06:55 AM

|

显示全部楼层

发表于 30-12-2018 06:55 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2019 03:55 AM 编辑

睦兴旺第三季净利扬35%

http://www.enanyang.my/news/20181204/睦兴旺第三季净利扬35/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 557,326 | 372,446 | 1,118,032 | 1,081,781 | | 2 | Profit/(loss) before tax | 77,647 | 50,652 | 191,097 | 163,090 | | 3 | Profit/(loss) for the period | 64,366 | 47,853 | 168,214 | 145,968 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 37,743 | 27,952 | 106,918 | 95,097 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.84 | 5.82 | 22.25 | 19.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.3300 | 2.1900

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|