|

|

发表于 1-5-2017 05:18 AM

|

显示全部楼层

发表于 1-5-2017 05:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2017 | 28 Feb 2016 | 28 Feb 2017 | 28 Feb 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 34,446 | 17,196 | 56,255 | 36,901 | | 2 | Profit/(loss) before tax | 1,264 | 8,121 | 2,222 | 9,622 | | 3 | Profit/(loss) for the period | 509 | 8,317 | 1,013 | 9,383 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 509 | 8,317 | 1,013 | 9,383 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | 6.96 | 0.85 | 7.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2017 12:30 AM

|

显示全部楼层

发表于 27-7-2017 12:30 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2017 | 31 May 2016 | 31 May 2017 | 31 May 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,235 | 13,257 | 88,490 | 50,158 | | 2 | Profit/(loss) before tax | 1,408 | 7,662 | 3,630 | 17,285 | | 3 | Profit/(loss) for the period | 514 | 7,647 | 1,527 | 17,030 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 514 | 7,647 | 1,527 | 17,030 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | 6.40 | 1.28 | 14.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7500 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2017 03:13 AM

|

显示全部楼层

发表于 6-10-2017 03:13 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2017 03:45 AM 编辑

亿成子公司获贷款执照

2017年10月7日

(吉隆坡6日讯)亿成控股(MELATI,5129,主板建筑股)宣布,独资子公司Melati Ehsan资本私人有限公司,昨天获得来自城市和谐、房屋与地方政府部的有条件批准信函,根据1951年借贷法令下获得贷款许可执照。

该公司向交易所报备,这项有条件批准,取决于Melati Ehsan资本董事及事务所能否达到信函中所列明的条件。

此外,这项批准不会对公司截至2018年8月31日财年每股净利及净资产带来任何实质影响。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MELATI EHSAN CAPITAL SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF MELATI EHSAN HOLDINGS BERHAD (THE "COMPANY")- MONEY LENDING LICENCE UNDER THE MONEY LENDING ACT 1951 (ACT 400) | The Board of Directors of the Company wish to inform that its wholly-owned subsidiary, Melati Ehsan Capital Sdn. Bhd. (851808-D) (“MECSB”) had on 5 October 2017 obtained a conditional Letter of Approval dated 14 September 2017, from the Ministry of Wellbeing, Housing and Local Government (“Ministry”) for the Money Lending Licence under the Money Lending Act 1951 (Act 400) (“Conditional Approval”).

The Conditional Approval is subject to the Directors of MECSB and the business premises of MECSB complying to and satisfying the prescribed requirements stated in the Ministry’s approval letter.

The Conditional Approval will not have any material effect on the earnings per share and net asset per share of the Company and its subsidiaries for the financial year ending 31 August 2018. It will also not have any effects of the issued shares, gearing and substantial shareholders’ shareholdings of the Company.

None of the Directors and/or major shareholders of the Company as well as persons connected to them have any interest, direct or indirect, in the above matter.

This announcement is dated 5 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2017 04:51 AM

|

显示全部楼层

发表于 26-10-2017 04:51 AM

|

显示全部楼层

本帖最后由 icy97 于 28-10-2017 03:59 AM 编辑

亿成控股末季净利挫93%

2017年10月27日

(吉隆坡26日讯)亿成控股(MELATI,5129,主板建筑股)截至8月杪末季,净利重挫93.16%,从去年同期的1314万令吉,大跌至89万9000令吉或每股0.75仙。

亿成控股昨天向交易所报备,营业额却按年增48.14%,录得7955万8000令吉。

累计全年,净利滑落91.96%至242万6000令吉;营业额则年涨61.8%,报1亿6804万8000令吉。

全年税前盈利从3033万6000令吉,大大减少至390万9000令吉。

亿成控股解释,尽管本财年营业额取得增长,但归咎于其他收入减少及销售成本上涨,拉低盈利表现。

产业发展业务转亏

细分业务来看,产业发展业务由盈转亏,全年税前亏损195万7000令吉。营业额也按年减60.5%至648万3000令吉,归咎于目前市场情绪拖累销售走低。

不过,建筑和贸易业务的营业额和税前盈利皆取得增长。

展望未来,亿成控股称,尽管经济前景谨慎,但动工中的建筑项目,如东海岸经济特区(ECER)和人民房屋(PPR),料可贡献公司的营业额和盈利能力。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2017 | 31 Aug 2016 | 31 Aug 2017 | 31 Aug 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 79,558 | 53,705 | 168,048 | 103,863 | | 2 | Profit/(loss) before tax | 279 | 13,051 | 3,909 | 30,336 | | 3 | Profit/(loss) for the period | 899 | 13,140 | 2,426 | 30,170 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 899 | 13,140 | 2,426 | 30,170 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.75 | 11.00 | 2.03 | 25.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 1.75 | 1.00 | 1.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2017 05:12 AM

|

显示全部楼层

发表于 28-12-2017 05:12 AM

|

显示全部楼层

| MELATI EHSAN HOLDINGS BERHAD |

EX-date | 08 Mar 2018 | Entitlement date | 12 Mar 2018 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 1 sen in respect of the year ended 31 August 2017 | Period of interest payment | to | Financial Year End | 31 Aug 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | INSURBAN CORPORATE SERVICES SDN BHD149 Jalan Aminuddin BakiTaman Tun Dr Ismail60000Kuala LumpurTel:0377295529Fax:0377285948 | Payment date | 19 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 04:49 AM

|

显示全部楼层

发表于 26-1-2018 04:49 AM

|

显示全部楼层

本帖最后由 icy97 于 28-3-2018 03:32 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2017 | 30 Nov 2016 | 30 Nov 2017 | 30 Nov 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 44,197 | 21,808 | 44,197 | 21,808 | | 2 | Profit/(loss) before tax | 777 | 958 | 777 | 958 | | 3 | Profit/(loss) for the period | 604 | 504 | 604 | 504 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 604 | 504 | 604 | 504 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.51 | 0.42 | 0.51 | 0.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2018 05:03 AM

|

显示全部楼层

发表于 27-1-2018 05:03 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MELATI EHSAN HOLDINGS BERHAD("MEHB" OR THE "COMPANY")PROPOSED DISPOSAL OF FORTY-SEVEN (47) 99-YEAR LEASEHOLD VACANT DETACHED LOTS AND THIRTY (30) 99-YEAR LEASEHOLD BUILDING LOTS (EACH WITH A DOUBLE STOREY DETACHED HOUSES ERECTED THEREON) AT SEKSYEN U10 SHAH ALAM, MUKIM OF BUKIT RAJA, DISTRICT OF PETALING JAYA, STATE OF SELANGOR DARUL EHSAN BY BAYU MELATI SDN. BHD. (415653-V), A WHOLLY OWNED SUBSIDIARY OF MEHB ("PROPOSED DISPOSAL") | The Board of Directors of MEHB wishes to announce that Bayu Melati Sdn. Bhd. (415653-V), a wholly-owned subsidiary of the Company has on 26 January 2018 entered into a Sale and Purchase Agreement with Kimlun Land Sdn. Bhd. (926350-P) to dispose forty-seven (47) 99-year leasehold vacant detached lots (collectively “47 Vacant Lots”) and thirty (30) 99-year leasehold building lots (each with a double storey detached houses erected thereon) (“collectively “30 Detached Houses”) on an “en bloc” and “as is where is” basis, the details of which are tabulated in Appendix A and Appendix B respectively hereinafter, for a total cash consideration of RM68,406,237.92 (“Proposed Disposal”).

The Proposed Disposal of the 30 Detached Houses were developed in the ordinary course of business of Bayu Melati Sdn. Bhd. Hence the requirements under the Main Market Listing Requirements to seek shareholders’ approval is not applicable.

Please refer to the attachment for details of the Proposed Disposal.

This announcement is dated on 26 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5677821

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 04:40 AM

|

显示全部楼层

发表于 25-3-2018 04:40 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 02:27 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MELATI EHSAN HOLDINGS BERHAD ("MELATI" OR "THE COMPANY")- ISSUANCE OF MONEYLENDING LICENCE TO MELATI EHSAN CAPITAL SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY | 1. INTRODUCTION The Board of Directors of the Company wishes to announce that Melati Ehsan Capital Sdn. Bhd. (Company No. 851808-D) (“MECSB”), a wholly-owned subsidiary of the Company, had obtained a moneylending licence ("the Licence") dated 15 March 2018 issued by Kementerian Perumahan Dan Kerajaan Tempatan (“KPKT”), Bahagian Pemberi Pinjaman Wang Dan Pemegang Pajak Gadai which was received by the Company on 22 March 2018.

2. BACKGROUND INFORMATION ON MECSB MECSB was incorporated on 31 March 2009 in Malaysia under the Companies Act 1965, as a private limited company. The total issued and paid-up capital of MECSB is RM2,000,000.00 comprising 2,000,000 ordinary shares. The Directors of MECSB are Encik Radzulai Bin Yahaya and Mr. Lim Tong Hee. Both of them are also Executive Directors of the Company. MECSB is currently dormant. The proposed nature of business are those of moneylenders, financial agents and financiers in general.

3. DURATION/ VALIDITY OF THE LICENCE The moneylending licence of MECSB dated 15 March 2018, which is governed by the “Akta Pemberi Pinjam Wang 1951” and renewable every two years, is valid for the period commencing from 15 March 2018 to 14 March 2020.

The announcement is dated 23 March 2018. . |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 01:05 AM

|

显示全部楼层

发表于 27-4-2018 01:05 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 46,821 | 34,446 | 91,018 | 56,255 | | 2 | Profit/(loss) before tax | 1,017 | 1,264 | 1,794 | 2,222 | | 3 | Profit/(loss) for the period | 416 | 509 | 1,020 | 1,013 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 416 | 509 | 1,020 | 1,013 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.35 | 0.43 | 0.85 | 0.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7700 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2018 03:54 AM

|

显示全部楼层

发表于 31-7-2018 03:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 127,545 | 32,235 | 218,563 | 88,490 | | 2 | Profit/(loss) before tax | 469 | 1,408 | 2,263 | 3,630 | | 3 | Profit/(loss) for the period | 434 | 514 | 1,454 | 1,527 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 434 | 514 | 1,454 | 1,527 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.36 | 0.43 | 1.22 | 1.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-10-2018 02:00 AM

|

显示全部楼层

发表于 20-10-2018 02:00 AM

|

显示全部楼层

本帖最后由 icy97 于 22-10-2018 05:12 AM 编辑

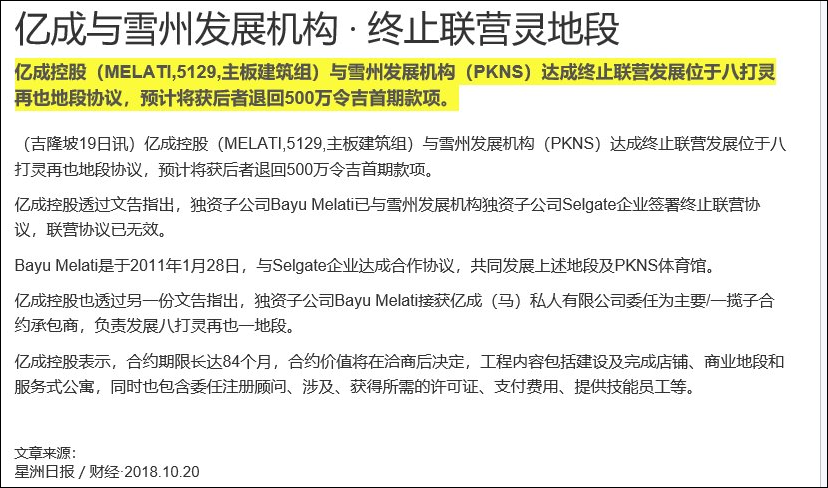

Type | Announcement | Subject | OTHERS | Description | TERMINATION OF JOINT VENTURE AGREEMENT DATED 28 JANUARY 2011 MADE BETWEEN BAYU MELATI SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY AND SELGATE CORPORATION SDN. BHD. (FORMERLY KNOWN AS PKNS HOLDINGS SDN. BHD.) FOR THE DEVELOPMENT OF THREE PIECES OF FREEHOLD COMMERCIAL LANDS LOCATED AT BANDAR PETALING JAYA, DAERAH PETALING, NEGERI SELANGOR | Reference is made to the Company’s announcement on 28 January 2011 in relation to the joint venture agreement entered between Bayu Melati Sdn. Bhd. (415653-V) ("Bayu Melati"), a wholly owned subsidiary of the Company and Selgate Corporation Sdn. Bhd. (formerly known as PKNS Holdings Sdn. Bhd.) (190684-D) (“Selgate Corporation”), a wholly owned subsidiary of Perbadanan Kemajuan Negeri Selangor (“JVA”) for the development of the lands under title nos. Geran 102826, Lot 36473, Seksyen 40, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor; HS(D) 245808, PT 235, Seksyen 40, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor and Geran 90689, Lot 36471, Seksyen 40, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor with a Sports Complex known as “Kompleks Sukan PKNS” (hereinafter collectively referred to as “the Lands”).

The Board of Directors of the Company (“the Board”) wishes to announce that Bayu Melati has on 19 October 2018, entered into a Deed of Mutual Termination (“the Deed”) with Selgate Corporation to terminate the joint venture in development of the Lands.

Upon mutual termination, the JVA shall be null and void and of no further effect. Selgate Corporation shall refund to Bayu Melati the initial payment of Ringgit Malaysia Five Million (RM5,000,000.00) immediately from the execution of the Deed.

The mutual termination will not have any effect on the share capital and the shareholding of the substantial shareholders of the Company.

The mutual termination is not expected to have any material effect on the earnings and net assets of the Company for the financial year ending 31 August 2019. None of the directors, major shareholders of the Company and/or persons connected to them has any interest.

The Board, having considered all aspect of the termination of JVA, is of the opinion that the termination of the JVA is in the best interest of the MEHB Group. The Deed is available for inspection by members of the Company at the registered office of the Company at No. 5, Jalan Titiwangsa, 53200 Kuala Lumpur during business hours from Mondays to Fridays (except Public Holidays) for a period of 3 months from the date of this announcement.

This announcement is dated 19 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-10-2018 02:06 AM

|

显示全部楼层

发表于 20-10-2018 02:06 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MELATI EHSAN HOLDINGS BERHAD ("MEHB" or THE "COMPANY")APPOINTMENT OF BAYU MELATI SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY AS MAIN/TURNKEY CONTRACTOR FOR THE DEVELOPMENT ON THE LAND HELD UNDER PN 109367, LOT 72699, SEKSYEN 40, BANDAR PETALING JAYA, DAERAH PETALING BY MELATI EHSAN (M) SDN. BHD. | The Board of Directors of MEHB (“the Board”) wishes to announce that Bayu Melati Sdn. Bhd. (415653-V) ("BMSB"), a wholly owned subsidiary of the Company has on 19 October 2018, via a letter of award issued by Melati Ehsan (M) Sdn. Bhd. (277882-X) (“MEMSB”) (“Letter of Award”), been appointed as main/turnkey contractor for the development on the land held under PN 109367, Lot 72699, Seksyen 40, Bandar Petaling Jaya, Daerah Petaling in accordance with the terms and conditions of the Letter of Award (“Project”). The completion period of the Project is Eighty-Four (84) months from the commencement date of the Project. The appointment of BMSB as main/turnkey contractor of the Project is by virtue of the Privatisation Agreement dated 19 October 2018 entered into between Perbadanan Kemajuan Negeri Selangor (“PKNS”) and MEMSB.

Please refer to the attachment for details.

This announcement is dated on 19 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5947417

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 05:39 AM

|

显示全部楼层

发表于 27-10-2018 05:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 69,286 | 79,558 | 287,849 | 168,048 | | 2 | Profit/(loss) before tax | 939 | 279 | 3,202 | 3,909 | | 3 | Profit/(loss) for the period | 959 | 899 | 2,413 | 2,426 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 959 | 899 | 2,413 | 2,426 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.80 | 0.75 | 2.02 | 2.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 1.00 | 1.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7700 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 05:42 AM

|

显示全部楼层

发表于 27-10-2018 05:42 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | RECOMMENDATION FOR DECLARATION OF A FIRST AND FINAL SINGLE TIER DIVIDEND IN RESPECT OF THE FINANCIAL YEAR ENDED 31 AUGUST 2018 | The Board of Directors of Melati Ehsan Holdings Berhad ("the Company") is pleased to announce the recommendation for the declaration and payment of first and final single tier dividend of 1.0 sen per ordinary share in respect of the financial year ended 31 August 2018, which is subject to the approval of the shareholders of the Company at its forthcoming Annual General Meeting. The date of entitlement and date of payment in respect of the aforesaid dividend will be announced in due course.

This announcement is dated 25 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2019 04:11 AM

|

显示全部楼层

发表于 25-1-2019 04:11 AM

|

显示全部楼层

| MELATI EHSAN HOLDINGS BERHAD |

EX-date | 07 Mar 2019 | Entitlement date | 11 Mar 2019 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 1 sen in respect of the year ended 31 August 2018 | Period of interest payment | to | Financial Year End | 31 Aug 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | INSURBAN CORPORATE SERVICES SDN BHD149 Jalan Aminuddin BakiTaman Tun Dr Ismail60000Kuala LumpurTel:0377295529Fax:0377285948 | Payment date | 19 Mar 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2019 06:27 AM

|

显示全部楼层

发表于 27-1-2019 06:27 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)| MELATI EHSAN HOLDINGS BERHAD |

Particulars of Substantial Securities HolderName | LEMBAGA TABUNG HAJI | Address | 201, Jalan Tun Razak

Kuala Lumpur

50400 Wilayah Persekutuan

Malaysia. | Company No. | ACT 535 (TABUNG HAJI ACT,1995) | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 28 Dec 2018 | Name & address of registered holder | Lembaga Tabung Haji 201, Jalan Tun Razak,50400 Kuala Lumpur |

No of securities disposed | 8,612,900 | Circumstances by reason of which a person ceases to be a substantial shareholder | Transfer of shares to Urusharta Jamaah Sdn. Bhd. as a result of the restructuring exercise - 8,612,900 units. | Nature of interest | Direct Interest |  | Date of notice | 28 Dec 2018 | Date notice received by Listed Issuer | 02 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 03:57 AM

|

显示全部楼层

发表于 9-2-2019 03:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2018 | 30 Nov 2017 | 30 Nov 2018 | 30 Nov 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 40,450 | 44,197 | 40,450 | 44,197 | | 2 | Profit/(loss) before tax | 954 | 791 | 954 | 791 | | 3 | Profit/(loss) for the period | 571 | 618 | 571 | 618 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 571 | 618 | 571 | 618 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.48 | 0.52 | 0.48 | 0.52 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7700 | 1.7700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2019 07:25 AM

|

显示全部楼层

发表于 2-6-2019 07:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2019 | 28 Feb 2018 | 28 Feb 2019 | 28 Feb 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 63,646 | 46,821 | 104,096 | 91,018 | | 2 | Profit/(loss) before tax | 1,307 | 1,019 | 2,261 | 1,810 | | 3 | Profit/(loss) for the period | 312 | 418 | 884 | 1,036 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 312 | 418 | 884 | 1,036 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.26 | 0.35 | 0.74 | 0.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7800 | 1.7700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-7-2019 08:45 AM

|

显示全部楼层

发表于 8-7-2019 08:45 AM

|

显示全部楼层

| MELATI EHSAN HOLDINGS BERHAD |

Date of change | 31 May 2019 | Name | MR CHEAH JIT PENG | Age | 54 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Business Administration | University of Southern Queensland, Australia | | | 2 | Degree | Civil Engineering | Loughborough University of Technology, United Kingdom | |

Working experience and occupation | Mr Cheah joined Melati Ehsan Group as Project Director on 1 September 2016. He has over 28 years experience in both construction and property development with regional working experience which span across South East Asia and China including working in MNC. Mr Cheah has successfully completed numerous projects e.g. township development, plant construction, commercial building etc throughout his career. He is also familiar with various form of contracts and project delivery methods e.g. EPC, EPCM, turnkey and conventional design-bid-built. Before joining Melati Ehsan Group, he was the General Manager (Construction) for Tan Chong Group involved in land matters, construction and plant expansion across South-East Asia. Prior to this, he was involved in the township development in Rawang, Selangor. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2019 07:21 AM

|

显示全部楼层

发表于 31-7-2019 07:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2019 | 31 May 2018 | 31 May 2019 | 31 May 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 39,631 | 125,766 | 143,727 | 216,784 | | 2 | Profit/(loss) before tax | 1,053 | -913 | 3,314 | 897 | | 3 | Profit/(loss) for the period | 308 | -949 | 1,192 | 88 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 308 | -949 | 1,192 | 88 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.26 | -0.80 | 1.00 | 0.07 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7700 | 1.7700

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|