|

|

发表于 26-12-2017 04:27 AM

|

显示全部楼层

发表于 26-12-2017 04:27 AM

|

显示全部楼层

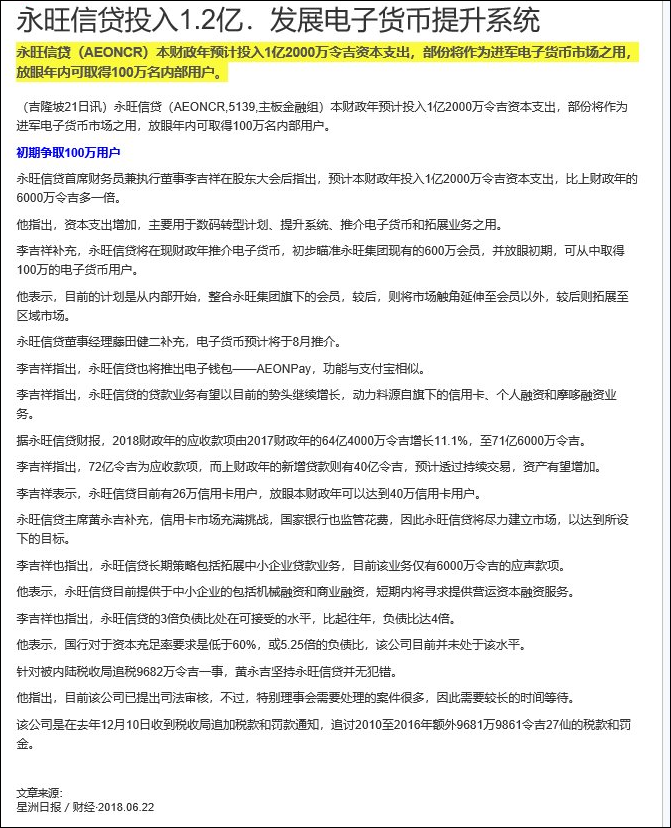

资产素质佳•追税影响微‧永旺信贷展望良好

(吉隆坡22日讯)永旺信贷(AEONCR,5139,主板金融组)第三季净利按年成长5.22%,分析员认为该公司资产素质良好、投入数码时代怀抱以及营运效率佳,因此尽管该公司被税收局追税,大多还是维持公司财测不变。

股价写1个多月新低

业绩公布后,该公司周四跌28仙或2.03%至13令吉52仙,以全天最低点闭市,并创下1个多月新低。

肯纳格研究基于内部整理(House-keeping)理由,因此调高2018年和2019年财测,分别为2%和3%。

另一方面,尽管管理层大派定心丸,声称内陆税收局追讨约9680万令吉一事影响不大,且预料结果将对永旺信贷有利。只不过,事情结果还是有转负面的风险。

兴业研究预估该公司认列一次性成本后,将使2018年净利走低至29.1%至1亿7800万令吉,但目前仍维持2亿7500万核心净利预测不变。

下季料派息25.7至45仙

如大家所测,该公司并没有宣布派息,分析员预料下季公司每股派息介于25.7仙至45仙之间。艾芬黄氏研究指出,该公司资产素质十分稳定,净呆账率(NPL)也仅仅企于2.48%。

兴业则表示,该公司的整体资本比率企于24.3%,远远超越国家银行规定的16%。

贷款成长亮眼以及赚幅稳定,肯纳格指出该公司展望依然良好。放眼未来,永旺信贷将持续专注应收账款成长以及赚幅稳定。

在第三季该公司应收账款按年成长了13%,主要是受到个人贷款所驱动,肯纳格也认为此趋势将持续,主要小宗商品贷款市场,依然会高速走扬。

至于赚幅部份,管理层透过数码化,使得分行赚幅处于成长轨道上,预测该公司将能维持34.6%至35%成本收入比的比率。更有效率的营运,也抵销了低利息赚幅(NIM)的利空,同时也提升成本控制能力。

营运成本料趋稳

同时,MIDF研究指出,该公司获利受到整体营运成本走高14%拖累,主要是员工和应收账款拨备增加所导致。MIDF预测在未来该公司营运成本将更为稳定,主要是公司正在转型,无纸化和提供未来服务是改变价值链的重点。

另外,该公司的回收贷款比例,在选择更有素质顾客后,预料会进一步提高及大大降低公司拨备,惟肯纳格保守地认为,该公司每年贷款成长率只有8%成长。

文章来源:

星洲日报/财经·文:傅文耀·2017.12.22

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-3-2018 03:45 AM

|

显示全部楼层

发表于 10-3-2018 03:45 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2018 01:51 AM 编辑

icy97 发表于 19-12-2017 07:16 AM

税收局基于3点再出招

永旺信贷被追税9682万

2017年12月13日

(吉隆坡13日讯)内陆税收局频密追税马不停蹄,今天再有另一家上市公司中招,即永旺信贷(AEONCR,5139,主板金融股),被追讨9681万9861令吉的税 ...

被追税9682万.永旺信贷提上诉阻执行

(吉隆坡6日讯)永旺信贷(AEONCR,5139,主板金融组)针对被追税9682万令吉事宜向内陆税收局提出上诉,并向高庭申请终止执行令。

永旺信贷发文告表示,已在2018年1月5日向内陆税收局总监和特别理事会提出上诉。

该公司也根据律师及税务顾问的意见,向高庭申请司法检讨及终止程序。高庭于3月5日驳回了司法检讨申请,但批准暂缓执行。

永旺信贷指出,在谘询税务律师意见后,该公司于3月5日针对高庭的决定向上诉庭提出上诉,以及正式申请以阻止执行法律程序。

该公司认为有充份的理据对税收局总监提出的额外税款和罚款通知合理向作出抗告,主要是公司已委托独立和可靠的稽查和税务事务所来进行会计和税务事宜,同时也应将2010和2011年估税年排除在外。

该公司是在去年12月10日收到税收局追加评税和罚款通知,追讨2010至2016年额外9681万9861令吉27仙的税款和罚金。

上述新增税款和罚金,主要是税收局总监将永旺信贷与本地某家金融机构承担的应收账款抵押的贷款交易变更为出售应收账款,以及提高了2010和2011年的估税年的年限,甚至是针对涉嫌提交不正确回酬祭出罚款。

文章来源:

星洲日报/财经‧2018.03.07

Type | Announcement | Subject | OTHERS | Description | AEON CREDIT SERVICE (M) BERHAD ("THE COMPANY") - NOTICES OF ASSESSMENT RAISED ON THE COMPANY | Further to the announcement dated 13 December 2017 pertaining to the aforesaid subject matter, the Company wishes to provide an update on the said matter as follows:-

(i) The Company had on 5 January 2018 filed Notices of Appeal to the Special Commissioners of Income Tax pursuant to Section 99(1) of the Income Tax Act 1967 (“Form Q”) with the Director General of Inland Revenue (“DGIR”) to appeal against the notices of additional assessment.

(ii) On the advice of its solicitors and tax consultants, the Company had also made an Application to the High Court for Judicial Review and Stay of Proceedings. The High Court had on 5 March 2018 dismissed the Application for Judicial Review. However the High Court had granted an interim stay against the enforcement of the notices of additional assessment pending the filing and hearing of the formal application for a stay from the Court.

(iii) Upon the advice of its solicitors and tax consultants, the Company had filed an appeal to the Court of Appeal against the High Court’s decision on 5 March 2018. The Company had also filed a formal application on 5 March 2018 for a stay against the enforcement of the notices of additional assessment to the High Court pending the disposal of its appeal.

Upon consulting its tax solicitors, the Company is of the view that there are reasonable grounds to challenge the validity of the said notices of additional assessment raised by the DGIR and the penalties imposed. This is especially when at all material times, the Company had sought professional advice from an independent firm of tax consultants on the tax treatment and that the notices of additional assessment for the years of assessment 2010 and 2011 are time barred.

The Company will make further announcement if there is any material update on the above said matter.

This announcement is dated 6 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 05:17 AM

|

显示全部楼层

发表于 27-4-2018 05:17 AM

|

显示全部楼层

Date of change | 25 Apr 2018 | Name | DATO ABDULLAH BIN MOHD YUSOF | Age | 78 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Demised | Qualifications | Not applicable | Working experience and occupation | Not applicable | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | (i) Ordinary Shares - 2,770 (Direct) and 69,000 (Indirect)(ii) Irredeemable Convertible Unsecured Loan Stocks (ICULS) -15,540 (Direct) and 138,000 (Indirect) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 01:39 AM

|

显示全部楼层

发表于 4-5-2018 01:39 AM

|

显示全部楼层

本帖最后由 icy97 于 5-5-2018 03:21 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 309,173 | 290,842 | 1,235,122 | 1,101,955 | | 2 | Profit/(loss) before tax | 105,366 | 103,064 | 398,335 | 351,162 | | 3 | Profit/(loss) for the period | 82,308 | 80,053 | 300,057 | 265,027 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 82,308 | 80,053 | 300,057 | 265,027 | | 5 | Basic earnings/(loss) per share (Subunit) | 31.87 | 30.94 | 143.01 | 101.17 | | 6 | Proposed/Declared dividend per share (Subunit) | 20.00 | 32.50 | 41.13 | 63.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 6.3700 | 6.6300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 01:46 AM

|

显示全部楼层

发表于 4-5-2018 01:46 AM

|

显示全部楼层

| AEON CREDIT SERVICE (M) BERHAD |

EX-date | 27 Jun 2018 | Entitlement date | 29 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Dividend of 20.00 sen per ordinary share under single-tier system in respect of the financial year ended 28 February 2018 | Period of interest payment | to | Financial Year End | 28 Feb 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HouseBlock D13, Pusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel:0378490777Fax:0378418151/8152 | Payment date | 19 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.2 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-5-2018 04:12 PM

|

显示全部楼层

发表于 10-5-2018 04:12 PM

|

显示全部楼层

Date of change | 08 May 2018 | Name | MR NG ENG KIAT | Age | 64 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Director | New Position | Chairman | Directorate | Independent and Non Executive | Qualifications | Malaysian Institute of Accountants (MIA)Malaysian Institute of Certified Public Accountants (MICPA)Fellow member of the Chartered Tax Institute of Malaysia CPA Australia | Working experience and occupation | He has more than forty (40) years of experience in the field of audit, accountancy and taxation. He had previously served as a member on a number of working groups of the Malaysian Accounting Standards Board, a co-opted member on a number of committees of the MICPA and an examiner for the final professional examination of the MICPA. Presently, he is the Managing Partner of the merged firm of Azman, Wong, Salleh & Co. and Folks DFK & Co. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | (i) 18,000 Ordinary Shares(ii) 36,500 Irredeemable Convertible Unsecured Loan Stocks (ICULS) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2018 07:10 AM

|

显示全部楼层

发表于 12-5-2018 07:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 04:50 AM

|

显示全部楼层

发表于 22-6-2018 04:50 AM

|

显示全部楼层

Date of change | 21 Jun 2018 | Name | MR LEE KIT SEONG | Age | 48 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 04:50 AM

|

显示全部楼层

发表于 22-6-2018 04:50 AM

|

显示全部楼层

Date of change | 21 Jun 2018 | Name | MR KIYOAKI TAKANO | Age | 54 | Gender | Male | Nationality | Japan | Designation | Executive Director | Directorate | Executive | Type of change | Retirement | Qualifications | Not Applicable | Working experience and occupation | Not Applicable | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | (i) 54,000 ordinary shares(ii) 108,000 Irredeemable Convertible Unsecured Loan Stocks (ICULS) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 04:51 AM

|

显示全部楼层

发表于 22-6-2018 04:51 AM

|

显示全部楼层

Date of change | 21 Jun 2018 | Name | MR AJITH A/L JAYARAM | Age | 37 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Retirement | Qualifications | Not Applicable | Working experience and occupation | Not Applicable | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | (i) 3,240 ordinary shares(ii) 6,500 Irredeemable Convertible Unsecured Loan Stocks (ICULS) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 05:15 AM

|

显示全部楼层

发表于 23-6-2018 05:15 AM

|

显示全部楼层

本帖最后由 icy97 于 23-6-2018 07:58 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 07:11 AM

|

显示全部楼层

发表于 23-6-2018 07:11 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2018 02:38 AM

|

显示全部楼层

发表于 29-6-2018 02:38 AM

|

显示全部楼层

本帖最后由 icy97 于 29-6-2018 04:55 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 325,718 | 302,282 | 325,718 | 302,282 | | 2 | Profit/(loss) before tax | 131,763 | 101,869 | 131,763 | 101,869 | | 3 | Profit/(loss) for the period | 99,235 | 75,812 | 99,235 | 75,812 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 99,235 | 75,812 | 99,235 | 75,812 | | 5 | Basic earnings/(loss) per share (Subunit) | 38.43 | 28.98 | 38.43 | 28.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.4500 | 6.3700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2018 04:42 AM

|

显示全部楼层

发表于 30-6-2018 04:42 AM

|

显示全部楼层

本帖最后由 icy97 于 30-6-2018 06:57 AM 编辑

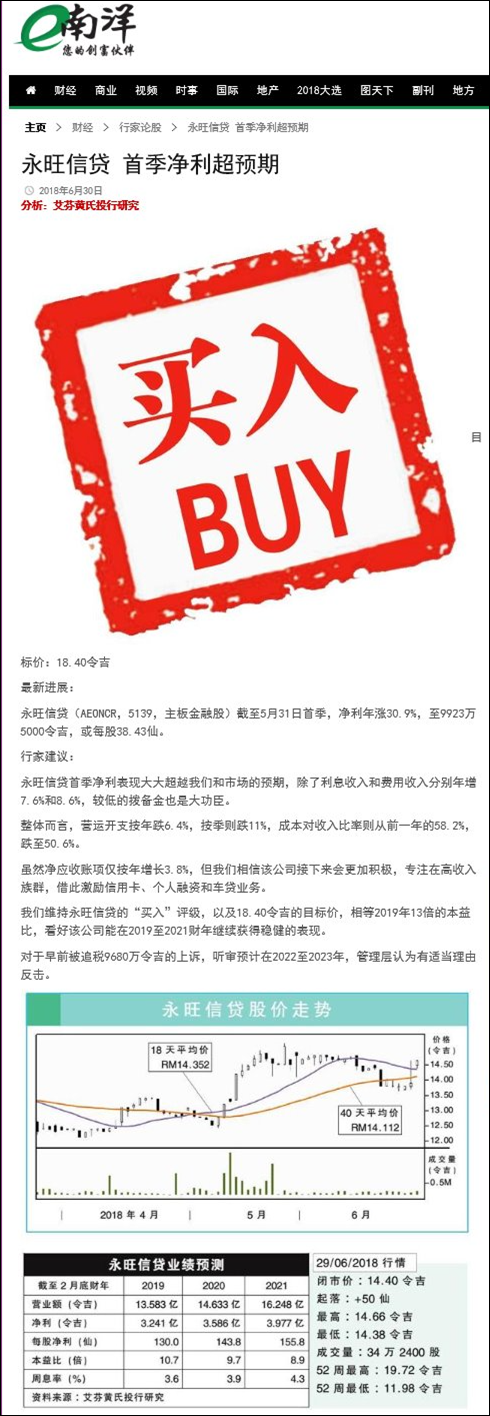

业绩超预期 財测上调 永旺信贷盘中涨逾5%

財经 最后更新 2018年06月29日 22时39分

(吉隆坡29日讯)最新业绩超越预期的永旺信贷(AEONCR,5139,主板金融股),获得分析员调高盈利预测,带动该公司股价在今天应声上涨,盘中最高触及14.66令吉,飆涨76仙或5.47%。该股最后收在14.40令吉,全天劲升50仙或3.6%,是第4大上升股。

永旺信贷昨天公布的2019財政年首季(截至5月31日止)税后盈利按年成长3 2 . 4 %,至9 5 6 0 万令吉, 超乎分析员预期,主要是因为採纳MFRS 9会计准则后,融资应收账款的拨备大幅减少,信贷成本从333.6个基点,降低至约154个基点。

此外,分析员指出,该公司盈利大增也归功于利息和非利息收入分別按年提高7.6%和8.6%。非利息收入包括呆账回收、保险佣金收入和客户忠诚计划的处理费。

资產素质良好

虽然净利息收入赚幅( NIM ) 从13.2% , 下滑至12.8%,但该公司的资產素质依然良好。该公司自2019財政年採纳MFRS 9会计准则,总呆账率从2018財政年末季的2.33%,降低至2.26%。

第一天採纳( Day-1 adjustment)后,资產负债表调整了3亿4450万令吉,但对该公司的资本没有负面影响。

与此同时,分析员称,该公司首季总运营开销按年减少6.4%,而成本对收入比(CIR)方面,总运营开销占营业额的比重下降至50.6%,前期比重为58.2%。

该公司积极减少运营开销,相信有关比重將继续维持在健康的水平。

虽然凈营收账款只按年微增3.8%至69亿令吉,但艾芬黄氏资本分析员认为,永旺信贷的未来成长將更加迅速,因为该公司打算专注开拓高收入市场,以推动其信用卡、个人融资和汽车贷款业务。

该分析员说,「永旺信贷2019至2021財政年將有不错的业绩表现,归功于它的价值链转型、更高的应收账款回酬。此外,中低收入群体获得的2%所得税减免,料也將使该公司受益。」

MIDF 研究分析员相信,2019財政年的总运营开销將按年减少5.7%,因此略为上调永旺信贷2019財政年盈利预测,但该分析员並没有透露调升幅度。

营收稳定前景乐观

他表示,该公司进军电子钱包和电子货幣卡业务,有助于提高客户的忠诚度,並为公司带来稳定的营业额,因此乐观看待该公司前景。

肯纳格研究分析员也將2019至2020年的盈利预测,分別调高6%至7%,以反映应收账款减值损失缩小。

该分析员预测2019和2020財政年的每股盈利將分別成长12%和11%,而核心净利將分別提高16%和11%。

此外,他相信,该公司將在2019財政年派发每股46仙股息。

另一方面,永旺信贷去年杪遭內陆税收局追税和罚款共9682万令吉。

对此,管理层表示,该公司有强大的法律依据,可以质疑这笔税务的有效性。

该公司已经就高等法院在今年3月5日的裁决提交上诉申请,预计法院將在2022年至2023年开庭审理此案。

MIDF研究和艾芬黄氏资本都维持该股「买入」评级,前者將目標价从14.75令吉,提高至15.40令吉,后者则维持目標价在18.40令吉。

另外,肯纳格研究维持该股「与大市同步」评级,但將目標价从13.40令吉,调高至14.25令吉。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2018 12:03 AM

|

显示全部楼层

发表于 14-8-2018 12:03 AM

|

显示全部楼层

| AEON CREDIT SERVICE (M) BERHAD |

EX-date | 27 Aug 2018 | Entitlement date | 29 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | First interest payment in respect of RM432,000,000 Nominal Value of 3-year 3.5%, Irredeemable Convertible Unsecured Loan Stocks 2018/2020 | Period of interest payment | 15 Sep 2017 to 15 Sep 2018 | Financial Year End | 28 Feb 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN. BHD.Level 6, Symphony HouseBlock D13, Pusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel: 03 7849 0777Fax:03 7841 8151/8152 | Payment date | 18 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

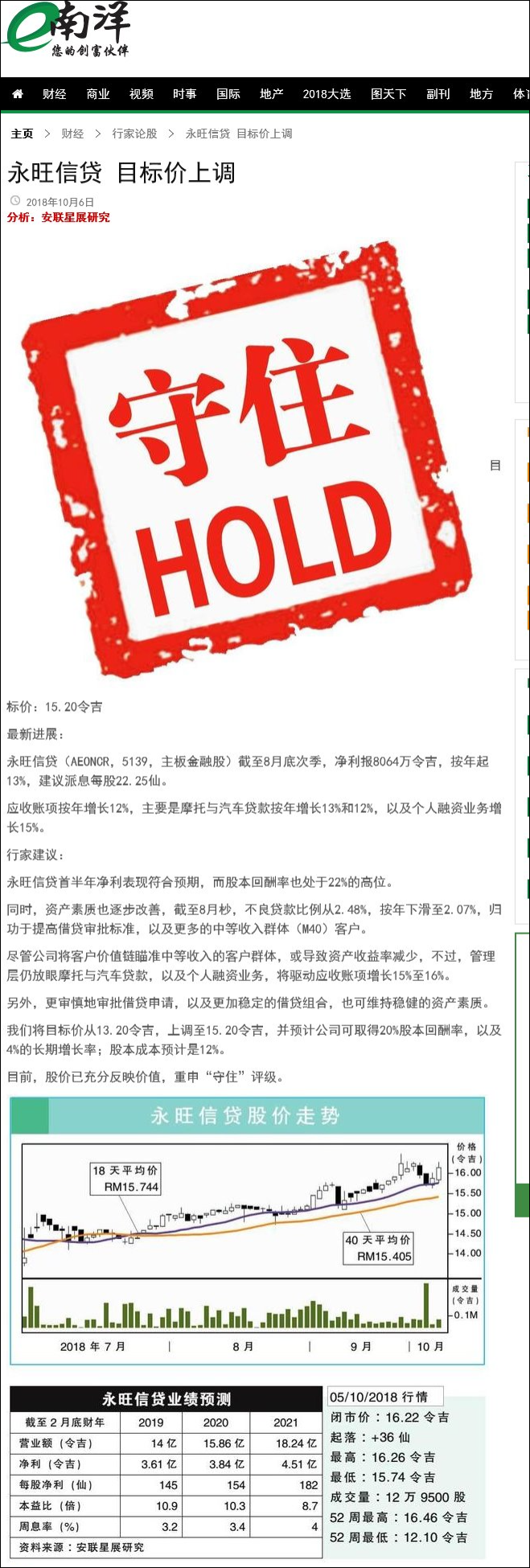

发表于 6-10-2018 05:33 AM

|

显示全部楼层

发表于 6-10-2018 05:33 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2018 07:48 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 332,092 | 311,322 | 657,810 | 613,604 | | 2 | Profit/(loss) before tax | 107,233 | 95,793 | 238,996 | 197,662 | | 3 | Profit/(loss) for the period | 80,640 | 71,385 | 179,875 | 147,197 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 80,640 | 71,385 | 179,875 | 147,197 | | 5 | Basic earnings/(loss) per share (Subunit) | 31.03 | 27.30 | 69.45 | 56.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 22.25 | 21.13 | 22.25 | 21.13 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.5800 | 6.3700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2018 05:36 AM

|

显示全部楼层

发表于 6-10-2018 05:36 AM

|

显示全部楼层

EX-date | 16 Oct 2018 | Entitlement date | 18 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single-tier dividend of 22.25 sen per ordinary share for the financial year ending 28 February 2019 | Period of interest payment | to | Financial Year End | 28 Feb 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN. BHD.Level 6, Symphony HouseBlock D13, Pusat Dagangan Dana 1Jalan PJU 1a/4647301 Petaling JayaSelangor Darul EhsanTel: 03 7849 0777Fax: 03 7841 8185/8152 | Payment date | 08 Nov 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 18 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.2225 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2018 08:07 AM

|

显示全部楼层

发表于 8-10-2018 08:07 AM

|

显示全部楼层

本帖最后由 icy97 于 9-10-2018 05:06 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 12:36 AM

|

显示全部楼层

发表于 6-11-2018 12:36 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | AEON CREDIT SERVICE (M) BERHAD ("AEON CREDIT" OR "THE COMPANY") - PROPOSED SUBSCRIPTION OF SHARES IN PT. AEON CREDIT SERVICE INDONESIA | The Board of Directors of the Company (“Board”) wishes to announce that AEON Credit would be entering into a transaction as set out in 1(i) of the attachment, which involves the interest of AEON Financial Service Co., Ltd. (“AFSJ”), the major shareholder of the Company, who is the related party. A further two (2) transactions entered into by the Company with the same related party (AFSJ) within the preceding twelve (12) months are set out in 1(ii) and 1(iii) of the attachment.

Kindly refer to the attachment for further information.

The announcement is dated 1 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5963253

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 07:01 AM

|

显示全部楼层

发表于 15-1-2019 07:01 AM

|

显示全部楼层

本帖最后由 icy97 于 19-1-2019 06:29 AM 编辑

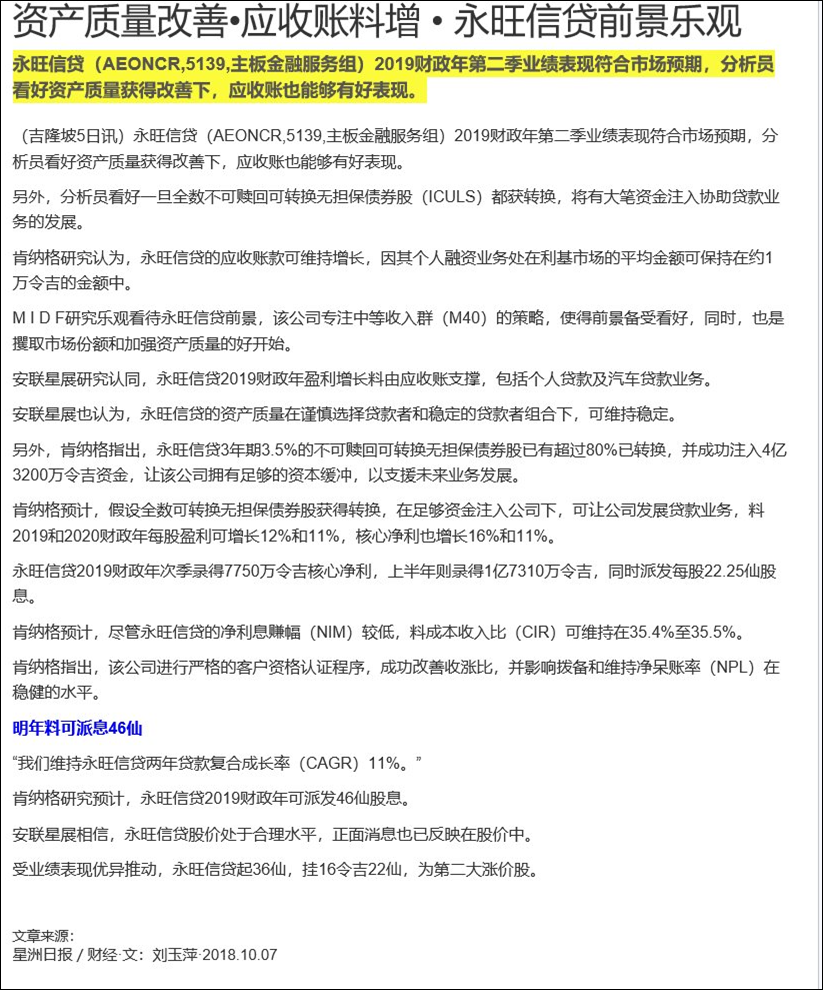

信贷账款增.永旺信贷第三季多赚24%

http://www.sinchew.com.my/node/1823744/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2018 | 30 Nov 2017 | 30 Nov 2018 | 30 Nov 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 348,497 | 312,345 | 1,006,307 | 925,949 | | 2 | Profit/(loss) before tax | 118,072 | 95,307 | 357,068 | 292,969 | | 3 | Profit/(loss) for the period | 87,136 | 70,552 | 267,011 | 217,749 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 87,136 | 70,552 | 267,011 | 217,749 | | 5 | Basic earnings/(loss) per share (Subunit) | 33.35 | 28.74 | 102.80 | 110.93 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 22.25 | 21.13 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.6600 | 6.3700

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|