|

|

【AIRASIA 5099 交流专区 1】亚洲航空

[复制链接]

[复制链接]

|

|

|

发表于 12-1-2008 11:00 PM

|

显示全部楼层

发表于 12-1-2008 11:00 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 12:03 AM

|

显示全部楼层

发表于 13-1-2008 12:03 AM

|

显示全部楼层

AirAsia的历史。

Company Profile

The Story So Far

Since AirAsia introduced its low fare, no frills concept in December 2001, the airline now flies to over 48 destinations in Malaysia, Thailand, Indonesia, Macau, China, Philippines, Cambodia, Vietnam and Myanmar, formed 2 successful joint ventures in Thailand through Thai AirAsia, and Indonesia through Indonesia AirAsia, expanded its fleet from the original two to twenty eight, and revolutionized air travel in these country by offering incredibly low fares through its innovative sales channels. To date the AirAsia group, has carried over 35 million guests.

In June 2003, AirAsia announced three investors, IDB Infrastructure Fund L.P., Crescent Venture Partners and Deucalion Capital II Limited who have acquired equity in AirAsia Sdn Bhd worth US$26 million (RM98.80 million).

In August 2003, AirAsia became the first airline in the world to introduce SMS booking where guests can now book their seats, check flight schedules and obtain latest updates on AirAsia promotions from the convenience of their mobile phones. AirAsia also recently introduced Go Holiday, the airline’s online programme where guests can book holiday packages online in real time.

AirAsia began regional flights in November 2003, by introducing flights to Phuket, in Thailand. The airline quickly extended flights to Bangkok, and later Hat Yai from KL International Airport. Flights to Indonesia commenced in April 2004 with routes serving Bandung, Surabaya, and Jakarta from KL International Airport. Subsequently the airline also introduced flights to Bali, Medan and Padang. AirAsia made history in Bandung, when it became the first low fare, no frills airline to operate a direct flight between Bandung and Kuala Lumpur in April 2004.

In Jan 2004, AirAsia carved a milestone in the history of Asian aviation when the low fare airline formed a partnership with Shin Corporation in Thailand to develop a low fare carrier in Thailand. Shin Corporation holds 50% stake, AirAsia has 49% and the remaining 1% by an individual. With 2 planes based in its Bangkok, AirAsia launched domestic operations in Thailand on January 13, 2004 with daily point-to-point flights from its new Bangkok hub and has since expanded to more domestic routes and new international flights to Singapore. AirAsia’s Thai operation is scheduled to expand to a fleet of eight Boeing 737-300 by end 2004.

In July 2004, the low fare airline commenced service to the Special Administrative Region (SAR) of Macau, by introducing a flight via is Thai operations from Bangkok. History will be made on Dec 15th 2004, when AirAsia launches its maiden service to Macau from its hub in Kuala Lumpur, and subsequently being the first low fare airline to do so.

In November 2004, AA International Limited (AAIL), a company that is 99.8 per cent owned by AirAsia Berhad, successfully concluded a sales and purchase agreement with Indonesian private airline PT AWAIR to acquire 49.0 per cent stake in the company. AWAIR was successfully re-launched as a low cost carrier serving domestic routes in Indonesia on 8 December 2004. AWAIR’s hub is based at Soekarno - Hatta International Airport in Jakarta, Indonesia.

In April 2005, the AirAsia Group became the first low fare, no frills airline to commence services between Bangkok and Xiamen, in China, and Clark (the Philippines) from Kuala Lumpur and Kota Kinabalu.

AirAsia is also now a public listed company on the Malaysia Stocks Exchange ( Bursa Malaysia), after having on 22 November 2004, successfully orchestrated one of the largest public offering in Malaysia and raised a whopping RM 717.4 million for its future expansion.

In line with its growth and expansion plans, AirAsia has secured a 130 aircraft commitment with Airbus for its A320s (100 firm, 30 options). The 130 aircraft order will place AirAsia as the single largest customer for the aircraft in Asia-Pacific, and potentially one of the largest airline fleets in the region. The new aircraft would gradually replaced AirAsia’s existing Boeing 737-300s.

On 23 of March 2006, AirAsia successfully moved its operations to the new Low Cost Carrier Terminal (LCCT). This is a major milestone as it is the first dedicated terminal for low cost carrier operations in the world. The LCCT is designed to cater for 10 million passengers per annum with 30 parking bays for aircraft. It is upgradeable to cater for 15 million passengers if required. This terminal provides us with numerous cost saving opportunities as well as a more efficient operation.

The phenomenal growth of AirAsia reflects its vision to become an ASEAN brand. As one of the leading low fare airline in the region, AirAsia is the epitome of ASEAN with its rich cultures and wealth of resources. The airline further aspires to bring low fare travel to the people of ASEAN, and to encourage and boost trade and tourism amongst countries in ASEAN.

The Philosophy

With the tagline 'Now everyone can fly', AirAsia’s philosophy of low fares is aimed to make flying affordable for everyone. AirAsia also aims at making travel easy, convenient and fun for its guests.

The Essentials

AirAsia’s operations are based on the following key strategies:

Low fare, no frills

AirAsia’s fares are significantly lower than those of other operators. This service targets the guests who will do without the frills of meals, frequent flyer miles or airport lounges in exchange for fares up to 80% lower than those currently offered with equivalent convenience.

No complimentary drinks or meals are offered. Instead, AirAsia recently introduced 'Snack Attack', a range of delicious snacks and drinks available on board at very affordable prices and prepared exclusively for AirAsia’s guests. Guests now have the choice of purchasing food and drinks on board.

Frequent flights

AirAsia’s high frequency service ensures guest convenience is met. The airline practices a quick turnaround of 25 minutes, which is the fastest in the region, resulting in high aircraft utilization, lower costs and greater airline and staff productivity.

Guest Convenience

AirAsia believes in providing convenient service to make traveling easier and more affordable for its guests. Guests can make bookings through a combination of the following:

o Nationwide call centre - Launched in April 2002, AirAsia’s Nationwide call centre in LCC Terminal is now fully equipped with 180 telephone lines providing convenient telephone booking services to guests. The call centre now takes an average of 6,000 calls daily.

o Ticketless service – Launched on 18 April 2002, this concept complements AirAsia’s internet booking and call centre service by providing a low cost alternative to issuing printed tickets. Guests no longer need to go through the hassle of collecting tickets!

o Easy payment channels - In line with its “ Easy to Book, Easy to Pay & Easy to Fly” approach, on 1 March 2002 AirAsia became Malaysia’s first airline to enable their guests to pay for their telephone bookings by credit card or by cash at any Alliance Bank branches.

o Internet booking – As Asia’s first online airline, AirAsia offers a new convenience in buying seats by logging on to its website www.airasia.com. No more phone calls, no more queuing. Launched on 10 May 2002, www.airasia.com is now available in 6 languages - English, Bahasa Malaysia, Simplified Chinese, Traditional Chinese, Thai and Bahasa Indonesia.

o Reservations and sales offices - These are available at airports and town centres for the convenience of walk-in customers.

o Authorised travel agents – AirAsia also introduced a direct B2B engine to its agents. The internet-based real time inventory booking engine is the first in Asia. The agents make immediate payment via a virtual AirAsia credit card, developed through one of its strategic partners, Alliance Bank.

o Improving customer service - AirAsia is constantly looking for ways to improve its services and increase savings for its guests. AirAsia is the first airline in Asia to have a multi-lingual website with six languages available on www.airasia.com.

Safety first

AirAsia’s cost optimisation philosophy is in no way at the expense of the airline’s safety. The airline’s fleet of 30 Boeing 737-300 fully complies with the conditions of the International Aviation Safety and are regulated by the internationally reputed Malaysian Department of Civil Aviation. In July 2002, AirAsia signed a US$20 million agreement with GE Engineering Services for engine maintenance and later in the month, a US$3million aircraft engine and aircraft frame parts leasing agreement with VolvoAero. AirAsia also signed a US$7 million agreement with ST Aero, covering the airline’s engineering components support for seven years.

Cost optimization operations

AirAsia strives to maximize profit and provide low fares at quality service. The airline has optimised costs by operating a faster turnaround time, improving aircraft utilization and crew efficiency, providing a 'no frills' service, using one type of aircraft to save training costs, all of which result in savings which are passed back to consumers in the form of low fares.

http://www.airasia.com/site/my/en/page.jsp?name=Company%20Profile&id=75dbf230-ac1e2082-29962900-ae960618

[ 本帖最后由 Mr.Business 于 13-1-2008 12:09 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 12:48 AM

|

显示全部楼层

发表于 13-1-2008 12:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 12:50 AM

|

显示全部楼层

发表于 13-1-2008 12:50 AM

|

显示全部楼层

回复 255# invest_klse 的帖子

请问invest_klse兄,

Deferred taxation为何会增加AirAsia的盈利?Deferred taxation是?

请看看AirAsia的2006和2007财政年的tax,是positive的,是tax incentive来的。 Tax incentive真的算是盈利的一部分吗?我有点犹豫。。。

如果抽出那大笔的Tax incentive,再来计算AirAsia的盈利。。。

[ 本帖最后由 Mr.Business 于 13-1-2008 01:25 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 07:20 PM

|

显示全部楼层

发表于 13-1-2008 07:20 PM

|

显示全部楼层

亚航每天有新闻!

否認投機油價

亞航充分護盤

(吉隆坡13日訊)亞洲航空(AIRASIA,5099,主板貿易)指並未投機油價,以每桶82.60美元(約269令吉)賣出買入期權(Call Option)充份護盤。

《The Edge Weekly》報導,亞航副總執行長卡瑪魯丁指出:“我們並非投機,只是想安穩經營,買入期權將確保我們能以特定價格購入燃油。”

他說:“油價下跌時,我們會因買入期權蒙虧。不過,當你認為油價高企時,就是我們的安穩的時候。”

已鎖定80美元

他說,公司已充份護盤,並以市價支付。

僑豐投資研究分析員吳保雲日前指出,亞航複雜的原油避險策略,或導致外資減碼。

他在報告中指出,亞航在油價一片看漲下,竟然每月以82.60美元賣出15萬桶原油買入期權,合約行使價為90美元(約293令吉)。

換言之,若油價持續穩定在100美元,亞航每年或損失1億令吉,該複雜避險政策,將造成亞航面對較大財務風險。

卡瑪魯丁解釋,買入期權已充份護盤,由于每桶油價已鎖定80美元(約261令吉),因此並不擔心油價高于該水平。

此外,分析報告也指出,亞航已透過買入期權護盤。

亞航今年1月至6月間,每月以每桶82美元(約267令吉)買入35萬桶原油期權,以及以79.50美元(約259令吉)買進20萬桶原油。

因此,僑豐投資研究認為,上述避險政策目前未造成任何損失。

不過,吳保雲也指出,近期外資關注亞航避險策略,導致該股自11月底宣佈業績以來股價已下跌約9.6%,外資股東也顯著減持股權。

此外,他指出,亞航以往向來看漲油價,避險策略贏得投資者贊許,惟去年中,該公司開始轉向看跌油價。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 10:31 PM

|

显示全部楼层

发表于 13-1-2008 10:31 PM

|

显示全部楼层

回复 256# Mr.Business 的帖子

原帖由 Mr.Business 于 13-1-2008 12:50 AM 发表

请问invest_klse兄,

Deferred taxation为何会增加AirAsia的盈利?Deferred taxation是?

...

Deferred tax 有点复杂。由于我不是来自 accounting 背景的,所以很难给出它的正确定义。无论如何,根据我从网上阅读得来的知识,我可以大略的给出一些简单化了的概念。

Deferred Tax有两种,即deferred tax liability 和 deferred tax asset。

一般上,deferred tax 的产生是因为公司呈现给股东的账目与呈交于税收局的账目有些不同(当然,这是合法的),因而出现了应缴税款和实缴税款的差异。公司少缴了的税,被记录为 deferred tax liability,因为那是欠税务局的钱,以后还是必须缴上。多交了的税,则是 deferred tax asset,可以从以后的应缴税款中扣除。

AirAsia的情况比较特别。它是由于政府给予的一些税务优惠(tax incentive),而可以从每年的 CAPEX 中获得 tax credit。往后的年份,AirAsia可以利用这些累积 tax credit 来进行税务扣除。因此,这也是一种 deferred tax assets。

由于AirAsia这两年在购买飞机上花了很多 CAPEX,因都得到非常大笔的tax credit。扣除了该年应缴的税务后,还剩很多tax credit用不完,怎么办呢?根据 AirAsia 的报告说,它用不完的 tax credit 是可以 extend 到往后的年份用的,一直到用完为止。所以就把它记录进了deferred tax asset。

问题是,这项 deferred tax asset 是不是一种收入?

根据 International Accounting Standard,这个项目是可以记录在 Income Statement 里面的。但常识告诉我,deferred tax asset 并不会马上带来 cash flow 的。它的效果只能在往后的年份中反映出来。也就是在未来年份当 AirAsia 需要缴税时,它可用 tax credit 来 off-set 掉应缴税款,从中节省了一大笔税务。

当然,我们可以说,节省了就是赚到了,这完全没错。AirAsia 管理层可能也是这么认为,(又或者是为了美化财务报告),所以我们就看到了deferred tax asset 出现在它的 Income Statement。虽然,这些 deferred tax 是要在未来的财政年才能带来 cash flow 的,但 AirAsia 管理层认为这些deferred tax asset 是因为今年的 Capex 而得到的,因此应全部记入今年的 Income statement。

但我个人觉得,我们不应该把未来的cash flow(不管是“节省”或“收入”)算入今年的 Income。因此,我计算 AirAsia 的 PE 时,会用它的PBT,而不是PAT。

[ 本帖最后由 invest_klse 于 13-1-2008 11:23 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 10:35 PM

|

显示全部楼层

发表于 13-1-2008 10:35 PM

|

显示全部楼层

删。。。。。

[ 本帖最后由 invest_klse 于 15-1-2008 08:45 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 10:52 PM

|

显示全部楼层

发表于 13-1-2008 10:52 PM

|

显示全部楼层

AirAsia的财务报告

先说说我和AirAsia的 渊缘。

去年,我还没有注意到 AirAsia 的 Deferred tax,所以毫不犹豫的把一笔钱拿来买了 AirAsia。当时我以 PAT 来算,得出它的 PE =12 左右,所以觉得很值得买。可是后来(在大约几个星期前),我发现自己中了 deferred tax 这个会计陷阱。从那时起,我就抱着怀疑心态重新审查 AirAsia 的财报。这一段时间下来,还真发现了不少新的疑点。

以下,我以AirAsia FY-2007的财报为例子,把我觉得有争议的项目做个总结。希望大家可以多加留意。

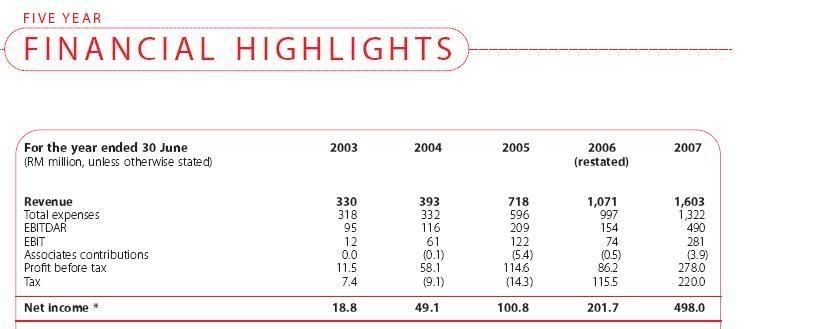

在 AirAsia 高达 RM 498 million 的 Net Income 中,包含了以下项目:

(1) Deferred taxation – (扣除current tax后)RM 220 million。

(2) Gain from termination of interest rate swaps – RM 73 million。

(3) Exchange gain on borrowings – RM 81 million。(有注意到吗: 高负债的AirAsia,在它 income statement 中,financial cost 竟然是 positive的。)

同时,AirAsia 的 Income statement 和 balance sheet 中没有包括以下的项目。

(4) Net unrecognised & unrealised losses on open Foreign Currency exchange contracts – RM 140 million。

(5) Unregconised losses in Jointly Controlled Entity and Associates – (大约估计)RM40 million。

我觉得以上各项值得注意的原因是:

(1) Deferred taxation – 这是未来的钱,不应记录于这年的 Income Statement。

(2) Gain from interest rate swaps – 是投机获利,属于非经常项目。

(3) Exchange gain on borrowings – 获利于美元贬值,并非企业获利。

(4) unrealised losses on open Foreign Currency exchange contracts – 虽然contract还没到期,但我觉得至少应该对该项亏损拨出provision。

(5) Unregconised losses in Jointly Controlled Entity and Associates – 虽然,根据有限公司法,AirAsia 已不需承担泰国和印尼子公司的亏损,但长远来看,只要 AirAsia 想继续经营这两间子公司,这亏损是迟早要填补的。(也许要重新注资。不然就是当子公司转亏为盈后,无法分享其盈利,直到它们的 equity 由负变正为止。)虽然,在 accounting 上我们不能把这些亏损记录进账,但如果我们把大马、泰国、印尼的 AirAsia 当作一个大家庭来看,身为投资者的我们至少应该把此项亏损在我们心中记一记。

结论:

如果我们把(1)、(2)、(3)项从AirAsia 的盈利中扣除,它的盈利就只剩 RM123 million 左右。那么,它的 EPS 就是 5.2sen。以现有股价 RM 1.60 来计算,本益比为 30,非常的高。

如果我们再把(4)、(5)项也纳入计算。AirAsia 就是一间亏钱的公司了。

[ 本帖最后由 invest_klse 于 13-1-2008 10:54 PM 编辑 ] |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2008 11:32 PM

|

显示全部楼层

发表于 13-1-2008 11:32 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 01:04 AM

|

显示全部楼层

发表于 14-1-2008 01:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 01:04 AM

|

显示全部楼层

发表于 14-1-2008 01:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 08:59 AM

|

显示全部楼层

发表于 14-1-2008 08:59 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 09:24 AM

|

显示全部楼层

发表于 14-1-2008 09:24 AM

|

显示全部楼层

原帖由 梦之龙 于 14-1-2008 01:04 AM 发表

还有股息。。。投资关键重点的考量

AirAsia上市到现在没分过股息。以她现在债务这么多又要买飞机的情形下,我相信再过5年都不会分股息。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 09:34 AM

|

显示全部楼层

发表于 14-1-2008 09:34 AM

|

显示全部楼层

新闻。

Firefly offers airfares starting from RM1.88

Published: 2008/01/13

IN conjunction with the Chinese New Year celebration, Malaysia’s first community airline Firefly is offering the lowest airfares to all its destinations, especially from the Sultan Abdul Aziz Shah Airport in Subang.

The one-way airfares from Subang to Kota Baru and Kuala Terengganu would be as low as RM1.88 while other destinations as low as RM3.88 for the promotion period between January 15 and April 30, said Firefly in a statement yesterday.

As for the period between May 1 and October 25, Firefly said the promotion fares to all its destinations would start from only RM8.88 one-way.

The booking period for the promotional fares would start from today to January 21, it said.

Launched in April 2007, Firefly is operated under FlyFirefly Sdn Bhd, a wholly-owned subsidiary of Malaysian Airline System Bhd (MAS).

Firefly now flies from Penang to Kuantan, Kota Baru, Kuala Terengganu and Langkawi and to Phuket and Koh Samui in Thailand.

From Subang, Firefly flies to Kuala Terengganu, Kota Baru, Penang and Langkawi. — Bernama

http://www.btimes.com.my/Current ... 0113205727/Article/ |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 10:58 AM

|

显示全部楼层

发表于 14-1-2008 10:58 AM

|

显示全部楼层

原帖由 Mr.Business 于 14-1-2008 09:24 AM 发表

AirAsia上市到现在没分过股息。以她现在债务这么多又要买飞机的情形下,我相信再过5年都不会分股息。

完全赞同。

以下段落,摘自AirAsia 网站- investor relation - FAQ。

Q: What is AirAsia’s dividend policy?

A: AirAsia does not pay dividends nor do we foresee paying dividends in the near future. The business is in the early stages of development and capital is required to be reinvested for the future’s well being. We believe this will ultimately yield the most beneficial returns when viewed on a long-term basis.

[ 本帖最后由 invest_klse 于 14-1-2008 10:59 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 11:22 AM

|

显示全部楼层

发表于 14-1-2008 11:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 11:24 AM

|

显示全部楼层

发表于 14-1-2008 11:24 AM

|

显示全部楼层

為什麼今天AIR ASIA 跌這樣多, |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 11:27 AM

|

显示全部楼层

发表于 14-1-2008 11:27 AM

|

显示全部楼层

原帖由 invest_klse 于 14-1-2008 10:58 AM 发表

完全赞同。

以下段落,摘自AirAsia 网站- investor relation - FAQ。

Q: What is AirAsia’s dividend policy?

A: AirAsia does not pay dividends nor do we foresee paying dividends in the near future. The business is in the early stages of development and capital is required to be reinvested for the future’s well being. We believe this will ultimately yield the most beneficial returns when viewed on a long-term basis.

油價上漲,我想連東尼費南達斯也想不到油價會沖上US 100 美金,這短短幾個月的暴漲。

亞航不起機票的附加費用,這肯定先吃虧了,因為油價如果一直抱持在US 100 美金上下,一年就要一億 RM,如果2008年,分析員講會上到 US 150-200美金的話,那如果還是不加附加費來講,我想亞航最終會變成負債公司了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 11:29 AM

|

显示全部楼层

发表于 14-1-2008 11:29 AM

|

显示全部楼层

回复 269# joycce 的帖子

外资抛售预料之中 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2008 11:42 AM

|

显示全部楼层

发表于 14-1-2008 11:42 AM

|

显示全部楼层

原帖由 cocoloco 于 14-1-2008 11:22 AM 发表

终于在RM1.55以下了,有谁今天进货

外资抛售股票是很无情的,现在买进我个人不觉得是适当的。要买的话可以再等等,等AirAsia跌到最低点过后回升时你再买进可能比较安全。 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|