|

|

发表于 13-3-2019 08:39 PM

|

显示全部楼层

发表于 13-3-2019 08:39 PM

|

显示全部楼层

RM4.54 新低 capital :152 亿  |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2019 12:54 AM

|

显示全部楼层

发表于 12-5-2019 12:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2019 07:36 AM

|

显示全部楼层

发表于 18-6-2019 07:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 683,889 | 616,841 | 2,827,879 | 2,405,638 | | 2 | Profit/(loss) before tax | 113,680 | 134,972 | 551,866 | 526,429 | | 3 | Profit/(loss) for the period | 91,414 | 116,899 | 456,218 | 439,632 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 91,360 | 116,646 | 456,204 | 438,919 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.75 | 3.53 | 13.72 | 13.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.90 | 2.00 | 8.50 | 7.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6700 | 0.6000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2019 07:37 AM

|

显示全部楼层

发表于 18-6-2019 07:37 AM

|

显示全部楼层

| HARTALEGA HOLDINGS BERHAD |

EX-date | 11 Jun 2019 | Entitlement date | 12 Jun 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Third Interim Dividend of 1.9 sen per share single-tier dividend for the financial year ended 31 March 2019 | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN. BHD. (Company No. 378993-D)(formerly known as Symphony Share Registrars Sdn. Bhd.)Level 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanMalaysiaTel:03-78490777Fax:03-78418151 / 03-78418152 | Payment date | 27 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 12 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2019 04:58 AM

|

显示全部楼层

发表于 7-8-2019 04:58 AM

|

显示全部楼层

本帖最后由 icy97 于 7-8-2019 07:52 AM 编辑

销售走软 成本攀高 贺特佳首季营收净利齐跌

财经 发布于 2019年08月06日

https://www.orientaldaily.com.my/news/business/2019/08/06/301320

(吉隆坡6日讯)在销售走软与成本攀高夹击下,贺特佳(HARTA,5168,主板保健股)开局失利,2020财政年首季(截至6月30日止)营收与盈利齐齐挫跌。

贺特佳第1季净赚9406万令吉,相比去年同期的1亿2487万令吉,萎缩24.67%;营业额从去年同期的7亿零635万令吉,下滑9.38%,至6亿4010万令吉。

贺特佳董事经理关民亮认为,首季业绩符合预期。他表示,虽然目前产能增幅超越需求成长,但由于全球胶手套市场需求持续扩大,相信这些新产能会在未来数季度市场逐步消化。

股价逆市走高

“我们乐观地看待市场供需将在下半年改善。整体而言,手套领域预计将维持扩展模式。”

关民亮续称,公司新一代综合手套制造广场(NGC)的5号厂房已全面投产,为迎合市场作准备。

同时,6号与7号厂房兴建工程正如火如荼进行,竣工后的总产能可在2022年从原先的每年366亿只手套,扩大至446亿只。

“展望未来, N G C 的策略扩充计划、世界首创抗菌手套(AMG)的增长潜能,以及营运效率改善, 将驱动公司长期前景。”

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 640,101 | 706,353 | 640,101 | 706,353 | | 2 | Profit/(loss) before tax | 121,654 | 145,833 | 121,654 | 145,833 | | 3 | Profit/(loss) for the period | 94,254 | 125,088 | 94,254 | 125,088 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 94,063 | 124,873 | 94,063 | 124,873 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.81 | 3.77 | 2.81 | 3.77 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.90 | 2.20 | 1.90 | 2.20 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6900 | 0.6700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2019 05:52 AM

|

显示全部楼层

发表于 8-8-2019 05:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2019 06:43 AM

|

显示全部楼层

发表于 8-8-2019 06:43 AM

|

显示全部楼层

本帖最后由 icy97 于 9-8-2019 08:55 AM 编辑

供应过剩 令吉走贬 贺特佳次季忧喜参半

财经 发布于 2019年08月07日

https://www.orientaldaily.com.my/news/business/2019/08/07/301462

(吉隆坡7日讯)贺特佳(HARTA,5168,主板保健股)2020财政年首季(截至6月30日止)业绩大跌,分析员认为,该公司接下来将继续面对手套供应过剩的问题,惟令吉兑美元贬值,则可协助推高平均售价,支撑其次季盈利。

在销售走软和成本攀高夹击下,贺特佳2020财政年首季营业额和净利齐齐下挫。净利按年下挫24.67%,至9406万令吉;营业额则按年减少9.38%,至6亿4010万令吉。

贺特佳最新业绩不符大部份分析员和市场的预测,主要因为销量下降8.5%,唯一的亮点是,受惠于令吉贬值和原材料走低,赚幅相对稳定。

艾芬黄氏资本分析员表示,该公司整体产能使用率在首季减少至76%。

手套售价看涨

“中国至美国出口产品9月开始将被征收额外10%关税,虽然贺特佳和其它大马手套业者可能从中受惠,但在9月之前,美国经销商料提前向中国厂家买货,这预期将导致大马业者面对短期市占率减少的问题。”

与此同时,基于手套需求有重新增长迹象,肯纳格研究分析员预料未来数季胶的手套平均售价可能上涨。

根据分析员的调查,丁手套的需求再次走高,有望迅速吸纳业者的新产能,减缓供应过剩的情况。

因此,该分析员看好贺特佳将在产能增加和销量走高的带动下,取得更好的营运效率和经济规模,赚幅也将扩大,提振未来数季的表现。

贺特佳仍是肯纳格研究分析员的首选手套股,原因是其高度自动化的生产流程,同时,在赚幅和成本管理方面领先同业。此外,该公司也不断开发新产品。

整体而言,分析员基本上认为,手套领域供应过剩仍是一个隐忧,而令吉贬值却是以个有利的因素。

追踪该股的分析员中, 有4家投行认为,该股目前估值过高,而维持“卖出”投资评级,并下修目标价; 部份分析员预期销量将减少,而下砍其2020至2022财政年盈利预测3.0%至19.9%不等。

业绩欠亮点 财测下调‧贺特佳仍有看头

https://www.sinchew.com.my/content/content_2096880.html

(吉隆坡7日讯)贺特佳(HARTA,5168,主板医疗保健组)首季业绩欠缺亮点,虽无法达到多数分析员预测,以致下调未来盈利预测,惟部分分析员对公司表现仍深具信心,贸易战、美元走势和供应量左右该公司未来表现。

该公司的抗菌手套尚寻求美国联邦药管局的批准,以便在未来1年内进入美国市场。

全球手套厂的扩充产能,为手套价格带来压力,也影响赚幅。

丰隆研究表示,贺特佳首季净利低于预期,相信丁腈手套业务仍会面对挑战,因产能与需求需要几季才能相符,不过该公司展延产能有助缓和供过于求隐忧,并相信马币走软,有助于驱动股价走势。

考虑到较低的产能使用率,丰隆决定将2020及2021年的盈利预测分别下砍13.2%及8.2%。

达证券表示,随着供需预料下半年改善,贺特佳平均每只手套售价压力将会在下半年恢复正常,并相信该公司可转嫁天然气成本。但首季盈利表现未能符合预期,因此将未来3年的盈利预测下砍3.4%、3%及3.2%。

料受惠于贸易战

艾芬黄氏研究则加贺特佳销售成长从12%调低至5%,赚幅可维持强劲,因马币及原材料价格下滑。另外,中美贸易战因素,应可让贺特佳受惠。但考虑到销售成长较低,仍把2020至2022财年盈利预测下砍3.5至8.1%。

大马投行也预期贺特佳第二季有较好的表现,并相信平均售价可调高1至2%。贺特佳2018财政年第四季及2019财政年首季,每千只手套售价分别为23.4及24.8美元。

大马投行预期贺特佳今明两财政年的营运盈利赚幅可达23.9%及24.1%。不过,盈利预测则分别下砍16.8%、19.1%及19.9%。

美元走强可提振净利

马银行研究表示,贺特佳盈利仍符合该行预期,虽然工厂使用率走低,但营运盈利赚钱却走强至25%,归功与较低的维修及包装成本。马银行认为贺特佳来年销量可分别成长6%、9%及8%,并将马币汇率设定在4.10令吉,美元每走强1%可提振贺特佳3%的净利。

MIDF研究表示,各大手套业者扩充产能,形成供过于求,势必影响赚幅,但长期来说,仍符合市场需求。此外,贺特佳亦是该领域科技化的先锋,维持财测。

大众研究表示,贺特佳盈利低于预测,不过,看好下半年营运环境更有利于贺特佳,并预期未来的赚幅可恢复正常至17至18%。

艾毕斯研究相信,贺特佳第二季表现可取得较好的表现,因平均售价较高及美元走强,因此维持盈利预测,全年料可取得4亿4960万令吉盈利,并将目标价调高。

肯纳格研究认为,该公司今年盈利仍有看头,主要是5号厂已经在今年第二季全面投运,6及7号仍在建造中,该公司高度自动化,且赚幅优于同侪,因此维持盈利预测不变。

估值诱人

兴业研究最为看好贺特佳,认为当下贺特佳估值诱人,贺特佳平均5年的赚幅介于16至20%,远高于同侪6至10%,且净负债率为7%,而同侪介于25至80%。

作者 : 谢汪潮

文章来源 : 星洲日报 2019-08-08 |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-9-2019 12:41 AM

|

显示全部楼层

发表于 6-9-2019 12:41 AM

|

显示全部楼层

Loading FB Video...

讲解HARTALEGA的:

1)概况

2)公司营运状况

3)股票未来动向 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-9-2019 03:12 PM

|

显示全部楼层

发表于 11-9-2019 03:12 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-9-2019 07:35 AM

|

显示全部楼层

发表于 12-9-2019 07:35 AM

|

显示全部楼层

| HARTALEGA HOLDINGS BERHAD |

EX-date | 25 Sep 2019 | Entitlement date | 26 Sep 2019 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single Tier Dividend of 1.9 sen per share for the Financial Year Ended 31 March 2019 | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | 26 Sep 2019 to 26 Sep 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHD(Formerly known as Symphony Share Registrars Sdn Bhd)Level 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaSelangor Darul EhsanTel: 037849 0777Fax: 037841 8151/8152 | Payment date | 10 Oct 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 26 Sep 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-9-2019 07:32 AM

|

显示全部楼层

发表于 16-9-2019 07:32 AM

|

显示全部楼层

本帖最后由 icy97 于 18-9-2019 08:28 AM 编辑

受惠贸战·贺特佳下半年料更好

https://www.sinchew.com.my/content/content_2114137.html

(吉隆坡10日讯)全球最大丁腈手套制造商贺特佳(HARTA,5168,主板医疗保健组)谨慎乐观看待在中美贸易战的潜在贸易转移下,预计可从中受惠并在下半年取得更好表现,但强调竞争将依旧存在。

该公司董事经理关民亮在股东大会后受访时指出,该公司看到2020财政年下半年有强劲需求的良好讯息。

不过,他认为,中国在失去美国市场后,将可能转移出口至其他市场如欧洲和日本。

据报道,美国自9月1日起实行对中国进口的1250亿美元商品实施15%的额外关税。

关民亮指出,2019财政年该公司总销量为290亿只手套,出口至美国的销售收入占总额54%,其中90%出口为医用手套产品。

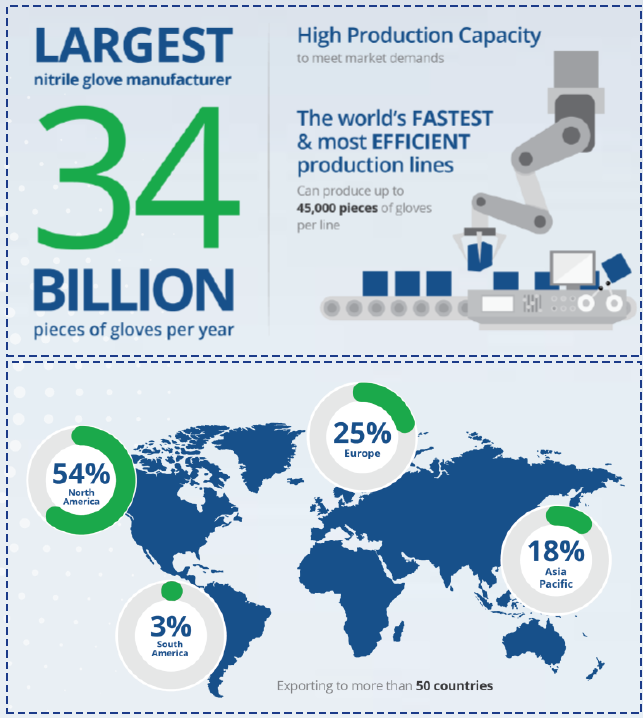

据资料显示,截至2019年3月31日的财政年,贺特佳其余出口市场比重分别为欧洲占了25%、亚太为18%和3.0%出口到南美。

关民亮表示,目前还很难确定贺特佳在美国市场有多大程度上的受惠,加上中国将转移出口至其他市场,纵观下来预计不会有太大振奋。

此外,他指出,中国的手套出口以乳胶和聚氯乙烯手套为主,而丁腈手套年均产量约200亿只,占全球总产量的较小比重。

被问及我国是否可能也面临被征税,该公司主席关锦安认为,美国不太可能对本地制造商征收额外关税,否则该国的医疗成本将会很高。

关民亮指出,公司已准备好应对新的产能增长超越需求增长而衍生的激烈竞争压力。

“我们认为市场正在调整,加上全球对橡胶手套的需求持续增加。”

他指出,自8月起其厂房利用率增至95%,归因于美国和其他区域的需求增长,而此前利用率约在88%。

他预计,贺特佳10和11月的厂房产能可充份利用。

NGC扩展分阶段运作

与此同时,他表示,其新一代综合手套制造厂(NGC)扩展计划将分阶段逐步运作,以满足需求增长。

他指出,NGC整体计划料可在2021年完工,并将提升其年产能从340只手套至440亿只。

他透露,厂房7之后,他们将探寻新土地,以在未来进行进一步扩展。

文章来源 : 星洲日报 2019-09-11 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-9-2019 06:06 PM

|

显示全部楼层

发表于 21-9-2019 06:06 PM

|

显示全部楼层

本帖最后由 哭哭鸟 于 21-9-2019 06:08 PM 编辑

HARTA (5168)

手套界的龙头

✅ 主要生产丁晴手套Nitrile Gloves

✅ 生产线

➡️拥有60条生产线

➡️ Plant 6 - 2020 Q1开始运作

➡️ Plant 7 - 2020 的下半年开始运作

➡️ Plant 6 & 7 将会为NGC增加多22条生产线

➡️在未来的三年,将会投资RM630m来做扩张

➡️目标是三年平均产量增长10%p.a.

➡️在FY2022前,年产量将会从现在的34b支手套增加到42b支

✅ 研发了AMG(Antimicrobial Gloves)自动杀菌手套,有可能成为手套新的票准

➡️已经出售给20个国家

➡️预计在 2H 2020可以拿到美国FDA的准证

✅ 生产技术 – 投资工业4.0技术,目的是要减少对外劳的依赖

➡️The world’s FASTEST & most EFFICIENT production line

➡️ Robotic Auto Packing System – 自动包装系统(取代传统)

➡️ Digital Imaging System – 把有残缺的手套从生产线拿掉

➡️ Fully integrated Enterprise Resource Planning system

➡️ Manufacturing Execution System - 用于跟踪所有工厂生产的产品

马来西亚是全世界最大的手套供应商(63% Market Share)

过去,手套的需求量不断的增长(约8-10% p.a.)。尤其是Europe 和 Asia

风险

✅ 中美贸易战有可能令到更多美国的顾客和马来西亚公司购买,这也会令到欧洲市场剧烈竞争因为中国把目标转向欧洲市场

➡️美国早前已针对中国工业手套征税25%,本月1日起则对医疗手套征税15%

✅ Natural Gas Price上涨

➡️ 不能立刻把原料上涨转给顾客

➡️ 需要2-3个月的时间才能把Cost转给顾客

➡️ 可是净利润的影响小于1% |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2020 08:58 AM

|

显示全部楼层

发表于 15-1-2020 08:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 709,424 | 714,244 | 1,349,525 | 1,420,597 | | 2 | Profit/(loss) before tax | 137,327 | 142,352 | 258,981 | 288,185 | | 3 | Profit/(loss) for the period | 104,206 | 120,381 | 198,460 | 245,469 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 103,867 | 120,216 | 197,930 | 245,089 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.09 | 3.62 | 5.90 | 7.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.80 | 2.20 | 3.70 | 4.40 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7000 | 0.6700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2020 08:58 AM

|

显示全部楼层

发表于 15-1-2020 08:58 AM

|

显示全部楼层

| HARTALEGA HOLDINGS BERHAD |

EX-date | 03 Dec 2019 | Entitlement date | 04 Dec 2019 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Single Tier Dividend of 1.8 sen per share for the Financial Year Ending 31 March 2020 | Period of interest payment | to | Financial Year End | 31 Mar 2020 | Share transfer book & register of members will be | 04 Dec 2019 to 04 Dec 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHD(Formerly known as Symphony Share Registrars Sdn Bhd)11th Floor, Menara Symphony,No. 5, Jalan Prof. Khoo Kay Kim,Seksyen 13,46200 Petaling JayaSelangorMalaysiaTel: 03 -78904700Fax: 03 -78904670 | Payment date | 27 Dec 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 04 Dec 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-4-2020 08:01 AM

|

显示全部楼层

发表于 18-4-2020 08:01 AM

|

显示全部楼层

| HARTALEGA HOLDINGS BERHAD |

Date of change | 10 Feb 2020 | Name | MR LOH KEAN WOOI | Age | 44 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Accounting/Finance | Association of Chartered Certified Accountants (ACCA) | | | 2 | Professional Qualification | Accounting/Finance | Malaysian Institute of Accountants (MIA) | |

| | | Working experience and occupation | Mr. Loh Kean Wooi started his career with Berjaya Group as management trainee and last position held was the Group Accountant of one of the affiliate listed companies of Berjaya Group. Thereafter, Mr. Loh Kean Wooi started working with fast consumers moving business namely Carlsberg, Reckitt Benckiser and Unilever in Malaysia. Prior joining to Hartalega, he spent 10 years in FrieslandCampina group of companies where he started as Financial Controller of Dutch Lady Milk Industries Berhad. In 2014, he posted to FrieslandCampina corporate office in the Netherland where he worked as Corporate Controller. Thereafter, Mr. Loh Kean Wooi spent three year as Regional Business Controller based in Singapore and before returning to Malaysia, he was appointed as CFO based in Bangkok for Betagen Group, a joint venture of FrieslandCampina and a Thais family. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-4-2020 08:30 AM

|

显示全部楼层

发表于 19-4-2020 08:30 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 796,550 | 723,393 | 2,146,075 | 2,143,990 | | 2 | Profit/(loss) before tax | 159,697 | 150,001 | 418,678 | 438,186 | | 3 | Profit/(loss) for the period | 121,661 | 119,335 | 320,121 | 364,804 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 121,273 | 119,755 | 319,203 | 364,844 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.60 | 3.60 | 9.49 | 10.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.80 | 2.20 | 5.50 | 6.60 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7300 | 0.6700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-4-2020 08:31 AM

|

显示全部楼层

发表于 19-4-2020 08:31 AM

|

显示全部楼层

| HARTALEGA HOLDINGS BERHAD |

Entitlement subject | Second Interim Dividend | Entitlement description | Second Single Tier Dividend of 1.8 sen per share for the Financial Year Ending 31 March 2020 | Ex-Date | 05 Mar 2020 | Entitlement date | 06 Mar 2020 | Entitlement time | 5:00 PM | Financial Year End | 31 Mar 2020 | Period |

| | Share transfer book & register of members will be | 06 Mar 2020 to 06 Mar 2020 closed from (both dates inclusive) for the purpose of determining the entitlement | Payment Date | 27 Mar 2020 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 06 Mar 2020 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units)

(If applicable) |

| | Entitlement indicator | Currency | Announced Currency | Malaysian Ringgit (MYR) | Disbursed Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | Malaysian Ringgit (MYR) 0.0180 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2020 08:40 AM

|

显示全部楼层

发表于 17-5-2020 08:40 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ACQUISITION OF LAND BY HARTALEGA NGC SDN. BHD., (HNGC), A WHOLLY-OWNED SUBSIDIARY OF HARTALEGA HOLDINGS BERHAD | The Board of Directors of Hartalega Holdings Berhad (“HARTALEGA” or “the Company”) wishes to announce that Hartalega NGC Sdn. Bhd. (“HNGC”), a wholly-owned subsidiary of the Company, has on 25 March 2020 entered into a Sale and Purchase Agreement (“the Agreement”) with Bonus Essential Sdn. Bhd. (“the Vendor” or “BESB”) [Registration No. 201201017489 (1003001-U)] for the acquisition of land for a total cash consideration of Ringgit Malaysia Two Hundred Sixty Three Million Ninety Six Thousand Five Hundred Sixty Two and Ninety Six Cents (RM263,096,562.96) only for Industrial Land upon the terms and conditions as stipulated in the Agreement (“the Acquisition”).

The details of the Acquisition is attached.

This announcement is dated 25 March 2020. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3038928

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2020 07:00 AM

|

显示全部楼层

发表于 19-5-2020 07:00 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ACQUISITION OF LAND BY HARTALEGA NGC SDN. BHD., (HNGC), A WHOLLY-OWNED SUBSIDIARY OF HARTALEGA HOLDINGS BERHAD | (For consistency, the abbreviation used in this announcement shall have the same meaning defined in the announcement dated 25 March 2020, where applicable, unless stated otherwise or defined herein)

We refer to the Company’s announcement dated 25 March 2020 on the subject matter.

The details of additional information in relation to the Proposed Acquisition is attached.

This announcement is dated 27 March 2020. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3039830

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2020 08:31 AM

|

显示全部楼层

发表于 30-5-2020 08:31 AM

|

显示全部楼层

RM 12.54+1.40  ,市值 420++亿 ! ,市值 420++亿 ! |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|