|

|

【AIRASIA 5099 交流专区 1】亚洲航空

[复制链接]

[复制链接]

|

|

|

发表于 11-1-2008 07:22 PM

|

显示全部楼层

发表于 11-1-2008 07:22 PM

|

显示全部楼层

更新: January 11, 2008 17:39

高油價影響消費需求

亞航機票不漲價

(吉隆坡11日訊)石油衝上天價,對廉價航空公司亞洲航空(AIRASIA,5099,主板貿易)造成的最大風險,就是影響消費需求;但總執行長拿督東尼費南德斯說:“我們會維持現有票價。”

他接受《彭博社》電視台專訪時說:“這簡直是惡夢,市場都瘋了,我們原本預期油價不會超過90美元(約293.09令吉),但事實卻不僅超越還長期穩定在高價位。”

他指出,高油價對廉價航空造成的最大風險,就是影響消費需求,由于油價通脹未與薪資通脹一致,故公司不可能頻密調漲價格。

航空公司最大開銷的飛機燃油,價格昨日下跌1%,每桶報108.50美元(約353.33令吉)。

根據《彭博社》資料,燃油價格較年前高漲53%。

國際油價于1月3日破百,每桶價格達100.09美元(約325.94令吉),令航空公司大喊吃不消,航空業恐怕再次掀起漲價風。

僑豐投資研究分析員吳保雲早前說,油價節節高漲之際,亞航卻冒險以82.60美元(約268.99令吉)賣出15萬桶原油看漲期權(Call Option),預計油價將從高價回落。

或損失1億

他還分析出,若油價續走高,亞航每年或損失高達1億令吉。

礙于亞航的避險政策過于複雜及投機,外資漸對該公司失去投資信心,頻頻拋售手上股票,導致股價1個月內下滑16%。

其中,外資投資機構FMR和Fidelity已不再是亞航大股東。

今日閉市時,亞航收1.58令吉,跌1仙,全日交投量達1197萬4900股。

http://www.chinapress.com.my/con ... mp;art=0112bs05.txt |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 07:31 PM

|

显示全部楼层

发表于 11-1-2008 07:31 PM

|

显示全部楼层

如果以下事件发生在AirAsia身上,不懂会如何呢?航空公司的风险很高,大家有考虑这方面吗?

新加坡•拖車故障與客機脫節

新航巨無霸滑出跑道

updated:2008-01-11 16:10:20 MYT

(新加坡訊)一架正準備從樟宜機場第三搭客大廈起飛的新航A380客機,週四(10日)晚上意外滑出跑道,所幸無人受傷。所有受影響乘客將於週五(11日)晚上之前改搭其他航班前往目的地。

發生事故的SQ221航班,原定於週四晚上8時30分飛往澳洲悉尼。

新航週五(11日)早上解釋說,客機準備起飛時,都是先由拖車拖離停機坪至跑道上,然後才啟動引擎。但事發時,拖車卻不知何故半途出現故障與客機脫節,導致還未啟動引擎的客機部份滑出跑道,滑到草坪上。

雖然客機所受影響看似不大,但發言人表示,公司目前還在詳細檢查並且已著手調查事故導因。

無人因事故受傷

據瞭解,當時客機上有446名乘客,但無人因事故受傷。

事發後,工作人員隨即請所有乘客下機,把他們送回機場,然後才把客機拖回跑道、進行檢查。

至於受影響的乘客,多數已於週四晚上凌晨時分,改搭替代的波音747客機前往悉尼,或其他航班改往墨爾本和布里斯班。剩餘的約10名乘客則將於週五下午或晚上乘搭別趟班機前往悉尼。

被詢及賠償課題時,新航表示已為所有受影響的乘客,免費提供必要的住宿和所有餐飲需要。 (星洲日報/國際•2008.01.11)

http://www.sinchew.com.my/conten ... ;artid=200801111070 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 07:41 PM

|

显示全部楼层

发表于 11-1-2008 07:41 PM

|

显示全部楼层

|

看来短期内,airasia是不能有所作为了...不过这公司绝对是只千里马!我觉得可以在底价时买进。我的目标价是1.20左右。。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 07:45 PM

|

显示全部楼层

发表于 11-1-2008 07:45 PM

|

显示全部楼层

回复 235# 的帖子

|

safety of margin是蛮重要,外国基金既然不要做大股东了,应该会把所有股份卖出,不会留的。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 07:47 PM

|

显示全部楼层

发表于 11-1-2008 07:47 PM

|

显示全部楼层

原帖由 Mr.Business 于 11-1-2008 07:45 PM 发表

safety of margin是蛮重要,外国基金既然不要做大股东了,应该会把所有股份卖出,不会留的。

版主,是margin of safety才对 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 08:06 PM

|

显示全部楼层

发表于 11-1-2008 08:06 PM

|

显示全部楼层

FMR LLC & FIDELITY INTERNATIONAL LIMITED是于30/11/2006成为AirAsia的大股东,那时他们拥有118,896,300股 (5.05%股份)。

FMR LLC & FIDELITY INTERNATIONAL LIMITED在10月时还是买入AirAsia的股份的,最后一次买进是在08/10/2007,那时他们共拥有161,993,500股 (6.85%股份)。之后他们却于11月份开始卖出股份。

卖出日期 卖出票数

29/11/2007 2,170,000

30/11/2007 2,210,900

03/12/2007 1,827,200

04/12/2007 775,400

05/12/2007 1,110,000

06/12/2007 2,035,000

07/12/2007 360,000

10/12/2007 744,700

11/12/2007 343,400

12/12/2007 1,294,000

13/12/2007 425,000

14/12/2007 300,000

19/12/2007 10,269,400

24/12/2007 9,820,300

FMR LLC & FIDELITY INTERNATIONAL LIMITED是于24/12/2007不再是AirAsia的大股东,那时他们应该还拥有117.65 million股 (AirAsia大约有2373.72 million股的票数)。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 08:29 PM

|

显示全部楼层

发表于 11-1-2008 08:29 PM

|

显示全部楼层

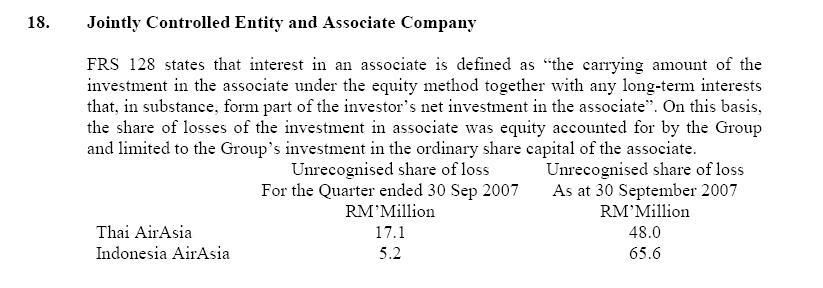

原帖由 invest_klse 于 11-1-2008 04:43 PM 发表

建议不妨研究多一项:

AirAsia最近几次的的财报并没有把泰国和印尼的亏损纳入。

下面这段看不懂,有人可以解释吗?

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 08:33 PM

|

显示全部楼层

发表于 11-1-2008 08:33 PM

|

显示全部楼层

新闻。

11-01-2008: AirAsia targets 7m passengers on KL-S’pore route by 2013

by Lim Shie-Lynn

SINGAPORE: Low-cost carrier AirAsia Bhd, which is scheduled to operate the KL-S’pore route from Feb 1, targets to carry some seven million passengers over the next five years, its group chief executive officer Datuk Tony Fernandes said.

“For our first two flights, we hope to do about 250,000 passengers this year, and grow that to 500,000 very quickly. The projection is based on huge demand for this route which is still under-served. It is a huge market.

“It is a fairly large number and that is what we are doing to impress both the Malaysian and Singapore airport authorities that 25% of new passengers will be a contribution (to Changi and KLIA),” Fernandes told a media briefing to announce AirAsia’s inaugural flight here yesterday.

Asked if the low-cost carrier would soon be allowed to fly from other cities such as Penang, Kota Kinabalu and Kuching, to Singapore, Fernandes said: “KL-S’pore was the Trojan horse, once this is done, the rest would be quite simple and I do not believe it would take a longer time for that to happen.”

Once the Asean Open Sky Policy comes into effect in January 2009, the airline targets to operate 20 flights daily to Singapore.

AirAsia is also looking to launch more air routes to destinations in Indonesia and to operate an air route to Ho Chi Minh City, Vietnam.

“We have got the planes, it is a matter of where to put them,” Fernandes said, adding that 175 Airbus A320s were ordered and would be delivered by 2013.

To celebrate the liberalisation of the coveted route, AirAsia announced it was giving away 30,000 free seats which was made available for reservation yesterday till Jan 13 for the travel period of Feb 1 to Oct 25, 2008.

Beginning Feb 1, its two daily flights to Singapore will depart from Kuala Lumpur at 10am and 7.50pm, while flights from Singapore will depart at 11.30am and 9.40pm.

To date, AirAsia has carried over 40 million passengers and has grown from a two-aircraft fleet to 65. It also has the most extensive low-cost network in the region serving on over 86 routes.

http://www.theedgedaily.com/cms/ ... a-39060b00-4440d31e

[ 本帖最后由 Mr.Business 于 11-1-2008 08:35 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 08:39 PM

|

显示全部楼层

发表于 11-1-2008 08:39 PM

|

显示全部楼层

今天馬股在飛,亞航5099 飛不起來 。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 08:39 PM

|

显示全部楼层

发表于 11-1-2008 08:39 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2008 11:53 PM

|

显示全部楼层

发表于 11-1-2008 11:53 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 12:12 AM

|

显示全部楼层

发表于 12-1-2008 12:12 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 12:25 AM

|

显示全部楼层

发表于 12-1-2008 12:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 08:23 PM

|

显示全部楼层

发表于 12-1-2008 08:23 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 08:40 PM

|

显示全部楼层

发表于 12-1-2008 08:40 PM

|

显示全部楼层

亞航停止油價投機性護盤-12th Jan 2008

(新加坡11日訊)在錯誤預測油價而導致其股價于上個月暴跌16%后,亞洲航空(AIRASIA,5099,主板貿服股)決定停止對油價進行投機性護盤。

亞航首席執行員東尼費南德斯表示,「這是個噩夢,因油價的波動走勢已顯瘋狂。」

「我們估計油價不會走至90美元水平,但是油價確實上揚至有關水平,而且還停留在該水平。」

僑豐投資銀行分析員表示,若油價維持在該水平,亞航的盈利會因為投機性的護盤,而每月減少260萬美元。儘管油價上漲,亞航無意調高票價。

東尼費南德斯在接受《彭博社》專訪時說,「你無法一直調高票價,油價的上漲並未與薪金的漲幅同步。」

3.8%股權場外易手

另一方面,亞洲航空今日有3.8%股權在場外易手。

大馬交易所的資料顯示,這批9020萬股的股票是在下午3時32分易手 ,交易價為1億3600萬令吉,相等于每股1.51令吉。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 09:43 PM

|

显示全部楼层

发表于 12-1-2008 09:43 PM

|

显示全部楼层

他终于认了。

现在,外资会原谅他吗?

另一方面,亞洲航空今日有3.8%股權在場外易手。大馬交易所的資料顯示,這批9020萬股的股票是在下午3時32分易手 ,交易價為1億3600萬令吉,相等于每股1.51令吉。

这个是一个指标,所以要看下个礼拜了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 10:15 PM

|

显示全部楼层

发表于 12-1-2008 10:15 PM

|

显示全部楼层

AirAsia是投机高手。。。

看回AirAsia的30/06/2007季度业绩,那一季AirAsia的净利是RM185 million,可是其中RM73 million是卖出19项interest rate swaps而得到的获利。

The Group had disposed of 19 interest rate swaps on 12 June 2007 resulting in a gain from the sales of these swaps of RM73 million which is included in other operating income. As of the end of the financial year 30 June 2007, the Group has a total of 41 interest rate swaps.

......

Other operating income included the gains on disposal of 19 interest rate swaps for RM73 million as a result of profit taking activities in the current quarter as disclosed in Note 5. The interest rate futures market spiked during the period due to geopolitical factors and increased demand for treasuries. The management was in the view that the market value for interest rate swaps was attractive and decided to monetize 19 interest rate swaps. The Group has 41 remaining interest rate swaps.

我知道interest rate swaps是为了为利息避险用的,可是AirAsia却可以从中获得巨利,AirAsia可有在这些避险/对冲活动采取有效控制措施,可有让股东得到充分讯息?希望Kawan AirAsia来一起分享。

[ 本帖最后由 Mr.Business 于 12-1-2008 10:16 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 10:26 PM

|

显示全部楼层

发表于 12-1-2008 10:26 PM

|

显示全部楼层

透明度不够的公司,大家因该特别小心, Transparency is VERY IMPORTANT for SHAREHOLDER, 而不是等到无法补救才公布。

小弟愚见  |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 10:30 PM

|

显示全部楼层

发表于 12-1-2008 10:30 PM

|

显示全部楼层

新闻。

AirAsia: No more bets on oil price

There has been significant selling from AirAsia's foreign shareholders and this is 'related to AirAsia's fuel-hedging policy', says an analyst

Published: 2008/01/11

AIRASIA Bhd, Asia's biggest discount carrier by fleet size, will stop making bets on the price of oil, after incorrect forecasts contributed to a 16 per cent slide in shares over the last month.

"It's a nightmare because the volatility is crazy," chief executive officer Datuk Tony Fernandes said in a Bloomberg Television interview on Thursday. "We took a bet that oil won't go above US$90 a barrel and it has and it's staying there."

Crude oil rose to a record US$100 a barrel earlier this month instead of falling as AirAsia had predicted. If the price of oil remains at that level, earnings could fall by RM8.45 million a month because of speculative hedging, according to Christopher Eng, an analyst at OSK Research Sdn. in Kuala Lumpur.

There has been significant selling from AirAsia's foreign shareholders," Eng wrote in a January 9 report. The drop is "related to AirAsia's fuel-hedging policy, which some parties considered excessively speculative."

Fidelity International cut its stake by 9.8 million shares as of December 24, according to Bloomberg data.

The Sepang, Malaysia-based carrier also said it will keep ticket prices unchanged even as the cost of fuel rises.

"The danger for low-cost carriers is that it will impact demand," Fernandes said in Singapore. "You can't keep raising prices all the time. Oil inflation doesn't move in line with salary inflation."

Fernandes is counting on higher ticket sales and revenue from selling food, drinks and other services to offset higher expenses.

The price of jet fuel, the biggest expense at most Asian airlines, fell one per cent to US$108.50 a barrel in Singapore yesterday, according to data compiled by Bloomberg.

That is 53 per cent higher than a year earlier. Crude oil futures reached a record US$100.09 a barrel on January 3.

AirAsia fell one sen, or 0.6 per cent, to RM1.58 at the 5pm close of trading in Kuala Lumpur yesterday.

AirAsia has ordered 175 single-aisle A320s from Airbus SAS, worth at least RM39.33 billion at list prices, as it wins permission to start new routes, including flights between Kuala Lumpur and neighbouring Singapore.

For now, it has enough aircraft to expand operations and will not need to exercise options to purchase another 50 planes of the same model "for the next few years," Fernandes said.

The carrier, which will begin services between Singapore and Kuala Lumpur on February 1, plans to operate as many as 20 daily return flights between the two capitals by 2013, carrying as many as seven million passengers, he said. - Bloomberg

http://www.btimes.com.my/Current ... /ASOIL.xml/Article/

[ 本帖最后由 Mr.Business 于 12-1-2008 10:31 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2008 10:42 PM

|

显示全部楼层

发表于 12-1-2008 10:42 PM

|

显示全部楼层

Tune Money矯正金錢本色

2008-01-12 18:26

東姑再弗:市場上很多金融產品都較以中上階層為目標,產品價格也當然以該階層收入為準,造成收入較低一族無法透過產品獲得最基本的保障。

東姑再弗:新一代的財務規劃醒覺意識不高,尤其一些剛踏入社會的年輕人,往往在擁有財務自主後盡情消費,終於導致欠下卡債。

想到金融服務,很多人自然會將其與“複雜”聯想在一起,這也造成一些人對金融交易產生恐懼感。另外,基於產品價格高昂,一些金融產品也令人卻步。

Tune Money私人有限公司首席執行員東姑再弗接受《財富廣場》專訪時指出,市場上很多金融產品都較眷顧中上階層,產品價格也以該階層收入為標準,而在收入較低的群眾眼裡,這就變成一種奢侈品。

他說,一些人往往因為金錢負擔,而連最基本的保障也放棄了,例如保險。也因為收入較低,他們無法如願享用一般的金融交易便利如信用卡。這群客戶可稱得上為一群未被發掘的客戶。

因此,該公司致力提供較可負擔,但涵蓋範圍廣泛的金融產品,以協助一些未能享用銀行產品的客戶。但選購金融產品也不能草草了事,那有一定的學問。

保險:奢侈品Vs必需品

提及大馬保險市場需求時,他說大馬公眾對保險的接受程度還未達到超高水平。一般人還是抱著沒事不需要認購保險或者認為就職公司所提供的保險保障已足夠的態度。

當然那些中上階級的人都意識到保險的重要性,收入較低的人則因為經濟負擔而不敢多加觸碰。對他們來說,那些產品屬於“奢侈品”多過“必需品”。

他透露,在一切發生前做好安全設施,總好過在後來才亡羊補勞或為金錢問題煩惱,因此大眾必須為自己做好保障。

然而,他並沒有督促大家必須認購各類保險,而是以自己可負擔範圍作出考量,並考慮自己的需求在哪裡。但最基本的保單如個人保險、醫藥報單及房屋保單等則是不可缺少的。

他說,基於省下中間人的抽佣階段,該公司能在致力控制成本下,提供較市場價格廉宜30%至40%的產品,但涵蓋範圍依然相同。

信用卡:預付信用卡行情看漲

信用卡則是現代人步入“無現金”交易時代的重要工具,但有沒有必要就視本身的需求而定,不然會引發呆賬問題。

東姑再弗指出,目前市場上也出現越來越多預付信用卡,讓一些希望控制自己消費或無法符合信用卡申請資格的消費者利用信用卡進行交易。

他說,這類型信用卡在歐美國家盛行已久,而美國市場上的預付信用卡數量更超越傳統信用卡,並預計這將成為大馬未來的一個趨勢。

他透露,一般銀行給予信用卡持有人的消費額度都是收入的一倍,但如果持有人每個月的消費額都超過本身的收入,那是不健康或不容易處理的。

詢及現代年輕人缺乏財務規劃時,他認為,新一代的財務規劃醒覺意識不高,特別是一些剛畢業,且擁有財務自主權的年輕人。他們都不會顧慮太多,並盡情享受。

另外,儘管大馬人民的儲蓄率是屬於非常高的,但大部份都屬於“強制性”儲蓄,例如繳付公積金,至於財務規劃習慣的真正滲透率則不算高超。

“大馬公共領域也缺乏這類的課程供修讀,中小學綱要也沒有真正納入理財部份,當中存有一定偏差,因此政府可以進行考慮將理財變成必修知識。”

信託基金:投資者須審核管理單位

他說,投資必須是理財的一部份,但消費者必須先規劃自己的財務及瞭解本身的風險承擔水平。

信託基金方面,投資者必須審核該基金的管理單位、基金表現、過去記錄及收費等,並瞭解自己的需求。其特點在於擁有專業人士負責進行投資,風險則視個別基金而定。

Tune Money檔案:3合1迎向未來

2006年9月正式成立的Tune Money為一家提供保險、信用卡及信託基金的本地金融相關公司,並透過網上交易推廣公司產品。該公司現有50個員工。

Tune Ventures私人有限公司持有該公司44.83%股權,聯昌銀行則持有25%。亞洲航空(AIRASIA,5099)創辦人拿督東尼費南達斯則持有Tune Ventures 40%股權。

該公司提供的保險產品包括房屋險、電單車騎士意外保險及個人意外保險,並計劃近期推出醫藥與手術保單及車險。

Tune Money目前也忙於申請信託基金執照,並計劃在明年推出4項基金。最低投資額料只達100令吉,比較一般基金所要求的最低1000令吉。公司也不會收取一般公司所徵收的5%至7%預付費用。

同時,計劃明年6月進軍越南及印尼市場,並看好泰國及菲律賓等東盟國家的發展潛能,而目前也在積極探討中。

東姑再弗對本地現有的70%網絡滲透率抱持樂觀態度,並會繼續透過網絡推銷帶動公司業務成長,而大馬市場已在這一方面稱得上是個成熟國度。

星洲日報/財富廣場/財源滾滾.2008.01.12

http://biz.sinchew-i.com/node/8672?tid=9

[ 本帖最后由 Mr.Business 于 12-1-2008 10:44 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|