|

|

发表于 20-2-2018 09:30 PM

|

显示全部楼层

发表于 20-2-2018 09:30 PM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2018 02:27 AM 编辑

国油石化末季净利破10亿

全年多赚42% 派息15仙

2018年2月21日

http://www.enanyang.my/news/20180221/国油石化末季净利破10亿br-全年多赚42-派息15仙/

(吉隆坡20日讯)国油石化(PCHEM ,5183,主板工业产品股)截至去年12月31日末季,净赚10亿500万令吉或每股13仙,并派息每股15仙。

国油石化今日向交易所报备,股息的除权日和享有权益日,分别落在3月5日和7日,支付日则在3月21日。

国油石化提到,跟随较高的扣除利息、税务、折旧与摊销前盈利(EBITDA),净利微增1.82%,部分被递延所得税产生的较高税收开销,以及沙巴尿素氨厂房(SAMUR)的较高折旧所抵消。

末季扣除利息、税务、折旧与摊销前盈利(EBITDA)上升16%,至17亿令吉。

该季营业额从去年的39亿4700万令吉,提高20.09%至47亿4000万令吉,归功于价格和销量增高,但部分被美元走弱抵消。

累计全年,净赚41亿7700万令吉,年涨42.46%;营业额年升25.59%,至174亿700万令吉。

全年营业额增长,得益于产品价格改善、销量走高及美元走强。EBITDA也走强25%,至66亿令吉。

产能使用降至93%

国油石化也在财报中点出,该季的厂房使用率为93%,略低于去年同期的96%,这是因为经历高水平的周转率和维修活动。

其中,烯烃和衍生产品业务工厂的使用率达98%,去年同期为100%;肥料和甲醇业务厂房使用率,则从89%增至90%。

虽然如此,其产能和销量都有所增长,归功于去年5月投产的SAMUR。整体上,平均产品价格随着原油价格走强而改善。

烯烃和衍生产品业务,以及肥料和甲醇业务的营业额,分别提升5%和58%。

不过,烯烃和衍生产品业务的EBITDA和净利,分别走低10%,归咎于衍生产品厂房进行维护活动后,乙烷产品的比例较低。

而肥料和甲醇业务,EBITDA和净利,分别增长82%和18%。

烯烃衍生品将走强

展望未来,国油石化称,即将到来的节日可提振需求旺盛,加上原料价格上涨的支撑,预计烯烃和衍生产品市场近期走强。

由于中东供应有限,加上亚洲需求回升,预计肥料和甲醇业务保持稳定。此外,下游需求稳健和中国供应收紧,料推高甲醇价格。

| | | 5183 PCHEM PETRONAS CHEMICALS GROUP BHD | | Quarterly rpt on consolidated results for the financial period ended 31/12/2017 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2017 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/12/2017 | 31/12/2016 | 31/12/2017 | 31/12/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 4,740,000 | 3,947,000 | 17,407,000 | 13,860,000 | | 2 | Profit/Loss Before Tax | 1,322,000 | 1,173,000 | 5,236,000 | 4,110,000 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,005,000 | 987,000 | 4,177,000 | 2,932,000 | | 4 | Net Profit/Loss For The Period | 1,049,000 | 1,033,000 | 4,414,000 | 3,222,000 | | 5 | Basic Earnings/Loss Per Shares (sen) | 13.00 | 12.00 | 52.00 | 37.00 | | 6 | Dividend Per Share (sen) | 15.00 | 12.00 | 27.00 | 19.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 3.4800 | 3.3800 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-2-2018 09:33 PM

|

显示全部楼层

发表于 20-2-2018 09:33 PM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2018 01:12 AM 编辑

EX-date | 05 Mar 2018 | Entitlement date | 07 Mar 2018 | Entitlement time | 04:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second Interim Single Tier Dividend of 15 sen per ordinary share for the financial year ended 31 December 2017. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 21 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2018 01:10 AM

|

显示全部楼层

发表于 13-3-2018 01:10 AM

|

显示全部楼层

国油化学业绩超预

安小姐问:国油化学(PCHEM,5183,主板工业产品组)最新业绩如何?我在8令吉水平买进,还可以持有吗?照看油价已经回升,该公司应该更有利可图才是,为甚么还一直处于这个水平?

答:国油化学第四季及全年业绩表现超乎预期,业务展望也继续获得油价上涨的提振,分析员纷纷调高盈利预测。

该公司2017财政年净利增加42.5%,至42亿令吉,比市场预期高5%,主要归功于原料和售价差距扩增和销量提升。

联昌研究指出,该公司的肥料营运盈利赚幅增至43%,是盈利走高的主要原因。

该行认为,随原油和高密度聚乙烯(HDPE)价格上扬,该公司烯烃赚幅有望改善,相信将进一步提振其业绩表现,足可抵销使用率降低的影响,决定调高2018和2019财政年每股盈利预测1.76%和2.38%。

兴业研究表示,周边国家需求逐步回升,预期该公司产品价格可保持强劲,加上产品销售有望增加,促使该行调高2018和2019财政年营业额预测12.2%和11.7%。

国家石油(Petronas)主导的石油提炼及石化综合发展计划(RAPID)获得沙地阿美(Saudi Aramco)注资,意味国油化学的资本开销降低,因此兴业研究不排除增派股息的可能,认为这是一大潜在利多。相较之下,肯纳格研究的看法更为保守。在第四季业绩发布后,该行鉴于税率保持13至16%,而上修2018财政年盈利预测4%,惟考虑到RAPID项目折旧开销,该行估计2019财政年盈利只会微扬0.2%。

国际油价风险犹存

不过,该行认为,国际油价今年风险犹存,而且国油化学3个月内股价上扬10%,上涨空间有限,决定在调高目标价的同时,调低股票评级。

分析员给予买进和符合大市评级,目标价差距大,最低8令吉40仙,最高则达11令吉18仙。

文章来源:

星洲日报‧投资致富‧投资问诊‧文:李文龙‧2018.03.12 |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-3-2018 06:20 AM

|

显示全部楼层

发表于 20-3-2018 06:20 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | EXECUTION OF BRIDGE LOAN AGREEMENT WITH EXTERNAL LENDERS OF USD1.0 BILLION (BRIDGE LOAN) BY PRPC POLYMERS SDN BHD, A WHOLLY OWNED SUBSIDIARY OF PCG. | The Board of Directors of PCG wishes to inform that PRPC Polymers Sdn Bhd, a wholly-owned subsidiary of PCG has today, executed a Bridge Loan Agreement of USD1.0 Billion (“Bridge Loan”) with the External Lenders.

Full announcement on the above is attached herein.

This announcement is dated 19 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5728929

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-3-2018 05:32 AM

|

显示全部楼层

发表于 29-3-2018 05:32 AM

|

显示全部楼层

icy97 发表于 3-10-2017 02:08 AM

沙地阿美38亿接手

国油石化卖子公司50%

2017年10月2日

(吉隆坡2日讯)国油石化(PCHEM ,5183,主板工业产品股)宣布,以9亿美元(约38亿令吉)脱售独资子公司PRPC Polymers私人有限公司(PRPC)50%予沙地阿美 ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | 1. COMPLETION OF SHARE PURCHASE AGREEMENT WITH ARAMCO OVERSEAS HOLDINGS Coöperatief U.A. (AOHC);2. ENTRY INTO SHAREHOLDERS AGREEMENT BETWEEN PCG AND AOHC IN RESPECT OF PRPC POLYMERS SDN BHD (PRPC POLYMERS);3. PROVISION OF SUBORDINATED SHAREHOLDERS LOAN TO PRPC POLYMERS; AND4. EXECUTION OF MERCHANT PETROCHEMICALS OFFTAKE AGREEMENT BETWEEN PRPC POLYMERS, SAUDI ARABIAN OIL COMPANY (SAUDI ARAMCO) AND PETRONAS CHEMICALS MARKETING (LABUAN) LIMITED (PCML). | The Board of Directors (“Board”) of PCG wishes to announce the following: -

- COMPLETION OF SHARE PURCHASE AGREEMENT WITH ARAMCO OVERSEAS HOLDINGS Coöperatief U.A. (“AOHC”);

- ENTRY INTO SHAREHOLDERS’ AGREEMENT BETWEEN PCG AND AOHC IN RESPECT OF PRPC POLYMERS SDN BHD (“PRPC POLYMERS”);

- PROVISION OF SUBORDINATED SHAREHOLDERS’ LOAN TO PRPC POLYMERS; AND

- EXECUTION OF MERCHANT PETROCHEMICALS OFFTAKE AGREEMENT BETWEEN PRPC POLYMERS, SAUDI ARABIAN OIL COMPANY (“SAUDI ARAMCO”) AND PETRONAS CHEMICALS MARKETING (LABUAN) LIMITED (“PCML”).

Full announcement on the above is attached herein.

This announcement is dated 28 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5738109

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 04:47 AM

|

显示全部楼层

发表于 7-4-2018 04:47 AM

|

显示全部楼层

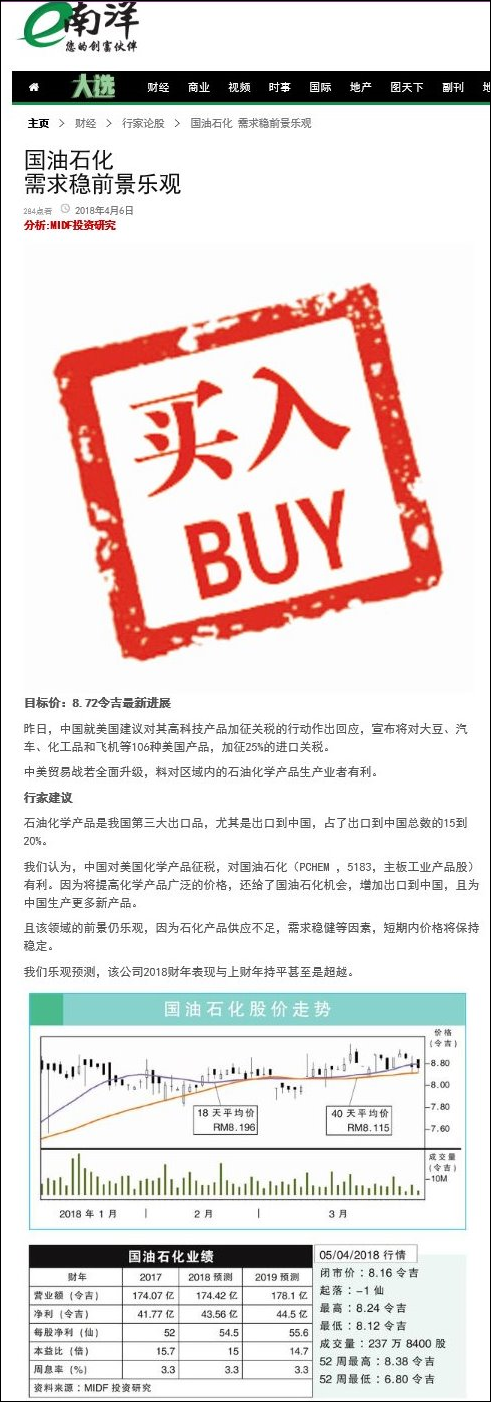

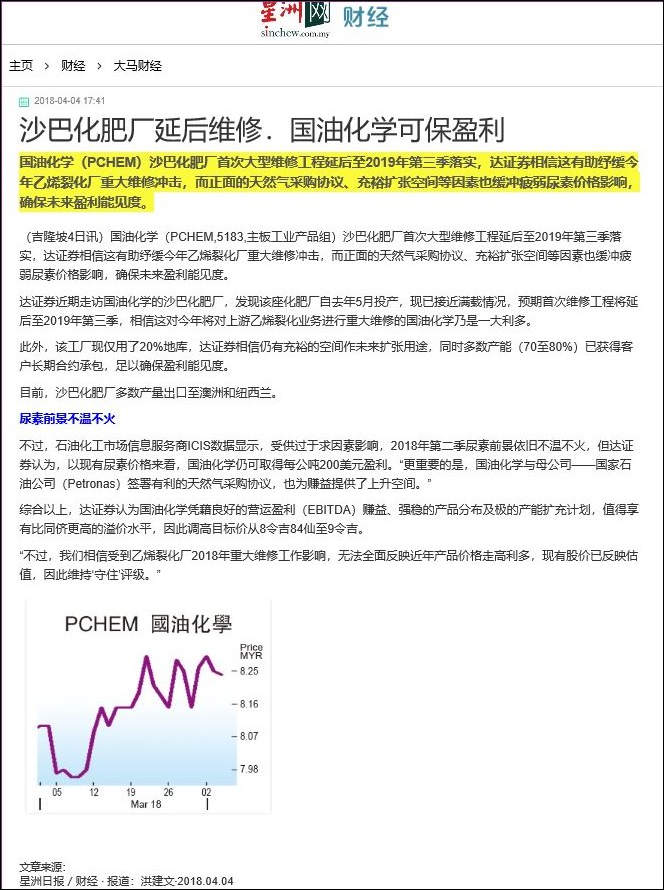

本帖最后由 icy97 于 7-4-2018 05:35 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2018 02:19 AM

|

显示全部楼层

发表于 11-5-2018 02:19 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 01:37 AM

|

显示全部楼层

发表于 24-5-2018 01:37 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 05:16 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,951,000 | 4,695,000 | 4,951,000 | 4,695,000 | | 2 | Profit/(loss) before tax | 1,336,000 | 1,636,000 | 1,336,000 | 1,636,000 | | 3 | Profit/(loss) for the period | 1,107,000 | 1,381,000 | 1,107,000 | 1,381,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,065,000 | 1,295,000 | 1,065,000 | 1,295,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 13.00 | 16.00 | 13.00 | 16.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4200 | 3.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2018 05:52 AM

|

显示全部楼层

发表于 2-6-2018 05:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 12:09 AM

|

显示全部楼层

发表于 16-8-2018 12:09 AM

|

显示全部楼层

本帖最后由 icy97 于 16-8-2018 05:49 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,733,000 | 3,959,000 | 9,684,000 | 8,654,000 | | 2 | Profit/(loss) before tax | 1,495,000 | 1,162,000 | 2,831,000 | 2,798,000 | | 3 | Profit/(loss) for the period | 1,380,000 | 1,023,000 | 2,487,000 | 2,404,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,372,000 | 964,000 | 2,437,000 | 2,259,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 17.00 | 12.00 | 30.00 | 28.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 14.00 | 12.00 | 14.00 | 12.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.6200 | 3.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 12:13 AM

|

显示全部楼层

发表于 16-8-2018 12:13 AM

|

显示全部楼层

EX-date | 29 Aug 2018 | Entitlement date | 03 Sep 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Single Tier Dividend of 14 sen per ordinary share for the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 20 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 03 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.14 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 06:54 AM

|

显示全部楼层

发表于 17-8-2018 06:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 03:07 AM

|

显示全部楼层

发表于 21-8-2018 03:07 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PCG LAUNCHES NEW BRANDS FOR ITS PETROCHEMICAL PRODUCTS | PETRONAS Chemicals Group Berhad (“PCG”) wishes to announce that it will be launching its 10 new brands for its existing and upcoming isononanol, polymer and shale inhibitor products at the Asia Petrochemical Industry Conference 2018 (APIC 2018) on 21 August 2018.

The 10 new brands are PETRONAS INA-9 for its isononanol product; PETRONAS Propelinas Homopolymer, PETRONAS Propelinas Copolymer and PETRONAS Propelinas Terpolymer for its polypropylene products; PETRONAS Etilinas Petlin for its Low-density Polyethylene products; PETRONAS Etilinas Alfatene and PETRONAS Etilinas Metalene for its Linear Low-density Polyethylene products; PETRONAS Etinilas Chrom and PETRONAS Etilinas Trimod for its High-density Polyethylene products; and PETRONAS GLYDE for its shale inhibitor product.

The PETRONAS Etilinas Petlin, PETRONAS Etilinas Chrom, PETRONAS Etilinas Alfatene and PETRONAS GLYDE are already available in the market. The remaining products will be made available in Q1 of 2019, while PETRONAS INA-9 is scheduled to be available by Q4 2019.

This announcement is dated 20 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 06:30 AM

|

显示全部楼层

发表于 21-8-2018 06:30 AM

|

显示全部楼层

本帖最后由 icy97 于 22-8-2018 06:05 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2018 06:48 AM

|

显示全部楼层

发表于 10-11-2018 06:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-11-2018 03:25 AM

|

显示全部楼层

发表于 30-11-2018 03:25 AM

|

显示全部楼层

本帖最后由 icy97 于 15-12-2018 07:39 AM 编辑

国油化学第三季净利涨38%

theedgemarkets.com

November 16, 2018 14:26 pm +08

http://www.theedgemarkets.com/article/国油化学第三季净利涨38

(吉隆坡16日讯)截至今年9月30日止第三季(2018财年第三季),国油化学(Petronas Chemicals Group Bhd)净利按年弹升37.7%至12亿6000万令吉,上财年同季为9亿1300万令吉,归功于营业额增加、税务开支减少及利息收入提高。

每股盈利从2017财年第三季的11仙,增至2018财年第三季的16仙。

季度营业额也按年上涨20.4%至48亿3000万令吉,2017财年第三季报40亿1000万令吉,得益于产品价格增加,部分抵消了销量下跌及令吉兑美元走强所带来的影响。

国油化学向大马交易所报备,其尿素和甲醇工厂的法定周转活动水平较高,导致厂房使用率从一年前的86%,下滑至现财年第三季的79%。

因此,产量与销量均降低。

该集团补充说,随着原油价格上涨,其整体平均产品价格走强。

累积现财年首9个月(2018财年首9个月),该集团净赚36亿9000万令吉,比上财年同期的31亿7000万令吉,按年提高了16.5%,营业额则按年增长14.6%至145亿1000万令吉,2017财年首9个月报126亿7000万令吉。

展望未来,国油化学预计,其业务主要受全球经济状况、外汇汇率变动、厂房使用率以及与原油价格高度相关的石化产品价格影响,特别是烯烃和衍生产品业务。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,830,000 | 4,013,000 | 14,514,000 | 12,667,000 | | 2 | Profit/(loss) before tax | 1,342,000 | 1,116,000 | 4,173,000 | 3,914,000 | | 3 | Profit/(loss) for the period | 1,272,000 | 961,000 | 3,759,000 | 3,365,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,257,000 | 913,000 | 3,694,000 | 3,172,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 16.00 | 11.00 | 46.00 | 40.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 14.00 | 12.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.6600 | 3.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2018 06:25 AM

|

显示全部楼层

发表于 15-12-2018 06:25 AM

|

显示全部楼层

國油化學Q3淨利漲37% 分析員看衰末季業績

財經 最後更新 2018年11月16日 21时12分

http://www.orientaldaily.com.my/s/267883

(吉隆坡16日訊)國油化學(PCHEM,5183,主板工業股)2018財政年第3季(截至9月30日止)淨利從9億1300萬令吉,按年大起36.68%,至12億5700萬令吉;營業額則從40億1300萬令吉,按年提高20.36%,至48億3000萬令吉。

首9個月而言,累積淨利和營業額各別按年揚升16.46%和14.58%,至36億9400萬令吉和145億1400萬令吉,去年同期分別為31億7200萬令吉和126億6700萬令吉。

大馬投行分析員表示,國油化學首9個月營業額實現強穩增長,很大程度是因為產品價格走高及工廠平均使用率持穩在91%高水平。同時,有效稅率降低至10%,促使該公司首9個月核心淨利亦按年大增21%。

按季比較,該公司第3季淨利下跌8%,主要受東盟民都魯化肥廠的維修活動影響,致工廠使用率從次季的95%大跌至79%。

維持財測

儘管該公司業績意外高出預期,佔全年預測的86%,但分析員依然維持2018至2020財政年的盈利預測不變。

無論如何,有鑑於近期產品價格隨著原油價格下滑而開始走低,中國和中東地區的產能過剩問題浮現,及全球需求增長放緩,分析員不看好該公司末季表現,並預測業績將出現大幅萎縮。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-12-2018 08:10 AM

|

显示全部楼层

发表于 17-12-2018 08:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 04:12 AM

|

显示全部楼层

发表于 26-2-2019 04:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 5,062,000 | 4,740,000 | 19,576,000 | 17,407,000 | | 2 | Profit/(loss) before tax | 1,477,000 | 1,322,000 | 5,650,000 | 5,236,000 | | 3 | Profit/(loss) for the period | 1,299,000 | 1,049,000 | 5,058,000 | 4,414,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,285,000 | 1,005,000 | 4,979,000 | 4,177,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 16.00 | 13.00 | 62.00 | 52.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 18.00 | 15.00 | 32.00 | 27.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.8100 | 3.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 04:16 AM

|

显示全部楼层

发表于 26-2-2019 04:16 AM

|

显示全部楼层

EX-date | 08 Mar 2019 | Entitlement date | 12 Mar 2019 | Entitlement time | 04:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Interim Single Tier Dividend of 18 sen per ordinary share for the financial year ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BoardRoom Share Registrars Sdn Bhd (Company No. 378993-D)(Formerly known as Symphony Share Registrars Sdn. Bhd.)Level 6, Symphony House, Pusat Dagangan Dana 1, Jalan PJU 1A/46,47301 Petaling Jaya,Selangor Darul Ehsan, MalaysiaTel:0378490777Fax:0378418151 | Payment date | 27 Mar 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.18 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|