|

|

【SDG 5285 交流专区】(前名 SIMEPLT)

[复制链接]

|

|

|

楼主 |

发表于 21-6-2018 03:08 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-8-2018 06:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-8-2018 02:23 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-8-2018 01:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-8-2018 05:12 AM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2018 02:19 AM 编辑

森那美种植2亿购巴布最大椰油出口商

財经 最后更新 2018年08月23日 21时43分

(吉隆坡23日讯)森那美种植(SIMEPLT,5285,种植股)宣布,子公司--新布列顛棕油有限公司(NBPOL)今日以5260万美元(约2亿1560万令吉)完成收购巴布亚新几內亚(Papua New Guinea)的Markham Farming公司100%股权。

森那么种植今日与Markham Agro(MAPL)公司签署买卖协议,向后者收购Markham Farming公司。

值得一提的是,NBPOL预计,Markham Farming公司与MAPL之间的未偿还净债务为1100美元。

因此,最终收购价和NBPOL最终须支付的总现金將取决于最后的审核结果。

Markham Farming公司现拥有6110公顷的农业地,可种植面积为5713公顷,其中约4018公顷已进行种植油棕业务。

同时,前者还经营2家椰干粉粹厂(copra mills),每年產能为5万5000公吨。

此外,Markham Farming公司是巴布亚新几內亚最大的椰子油出口商,因此上述收购將使森那美种植將其业务扩大至椰子油生產。【东方网财经】

Type | Announcement | Subject | OTHERS | Description | Acquisition of 100% Equity Interest in Markham Farming Company Limited(Announcement pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Sime Darby Plantation Berhad (SDP) wishes to announce that New Britain Palm Oil Limited (NBPOL), a wholly-owned subsidiary of SDP, has on 23 August 2018, completed the acquisition of 100% equity interest in Markham Farming Company Limited (MFCL) for a total cash consideration estimated at USD52.6 million (equivalent to approximately RM215.6 million), from Markham Agro Pte. Ltd. (MAPL) pursuant to a Share Sale and Purchase Agreement (SPA) entered into between NBPOL and MAPL on 23 August 2018 (Acquisition). In addition to this, NBPOL has also assumed outstanding net debt of MFCL and MAPL totalling approximately USD11.0 million. The final purchase consideration and the eventual total cash outlay to be paid by NBPOL will be subject to the findings of a post-completion audit.

MFCL is a private limited company incorporated in Papua New Guinea (PNG) on 23 May 1967 which owns 6,110 hectares of agriculture land in Markham Valley, PNG, comprising two estates, i.e. Munum (1,733 hectares) and Erap (4,377 hectares). The total plantable area is about 5,713 hectares, of which about 4,018 hectares has been planted with oil palm to date. MFCL also operates two copra mills in Buka and Madang, PNG, with a total combined copra throughput capacity of 55,000 MT per annum. MAPL is a private limited company incorporated in Singapore. The oil palm plantation is well located close to Lae, PNG’s largest port and has the ability to integrate with NBPOL’s existing supply chain. MFCL is the largest coconut oil exporter in PNG and the Acquisition enables SDP/NBPOL to expand its lauric oils business into coconut oil production.

Following the Acquisition, MFCL has become an indirect wholly-owned subsidiary of SDP with effect from 23 August 2018.

The Acquisition will not have a material effect on the earnings or net assets of the SDP Group for the financial year ending 31 December 2018. None of the Directors or major shareholders of SDP or persons connected with them has any interest, direct or indirect, in the Acquisition.

This announcement is dated 23 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-8-2018 02:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-9-2018 04:54 AM

|

显示全部楼层

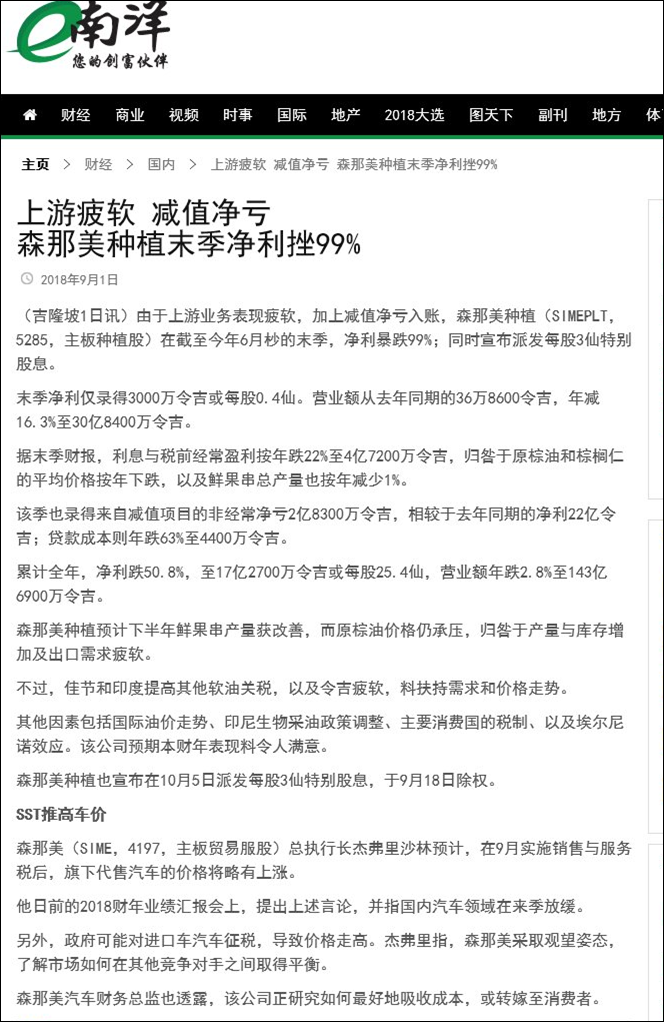

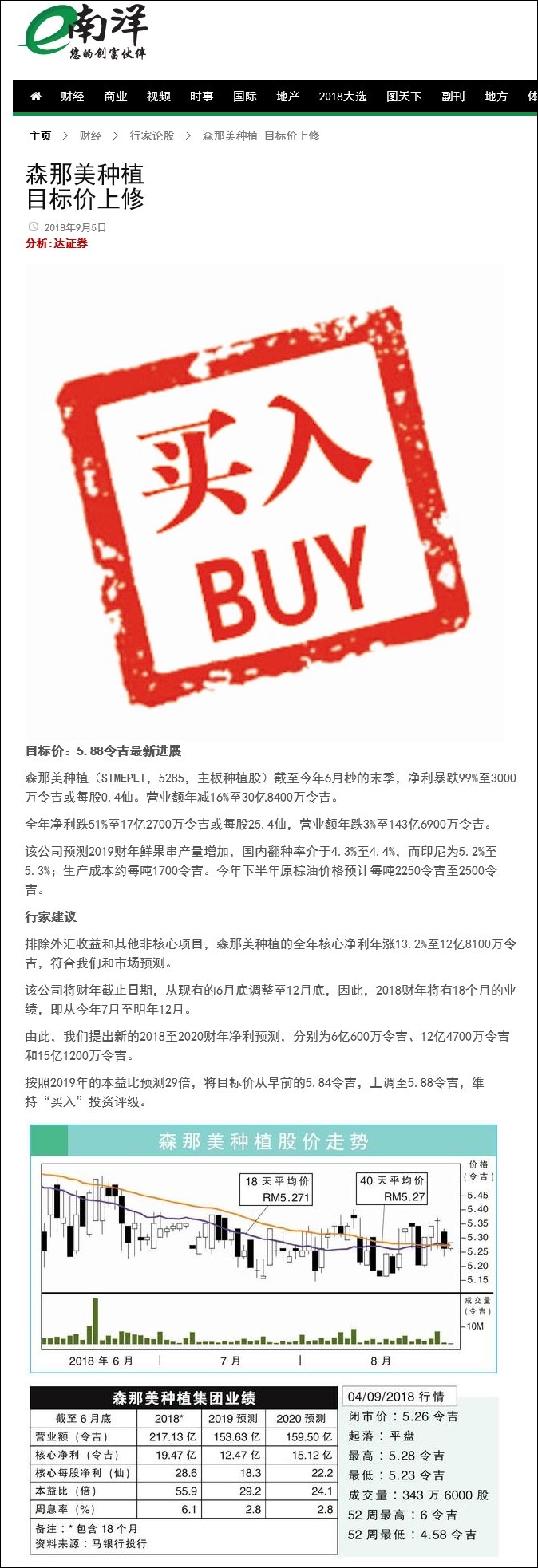

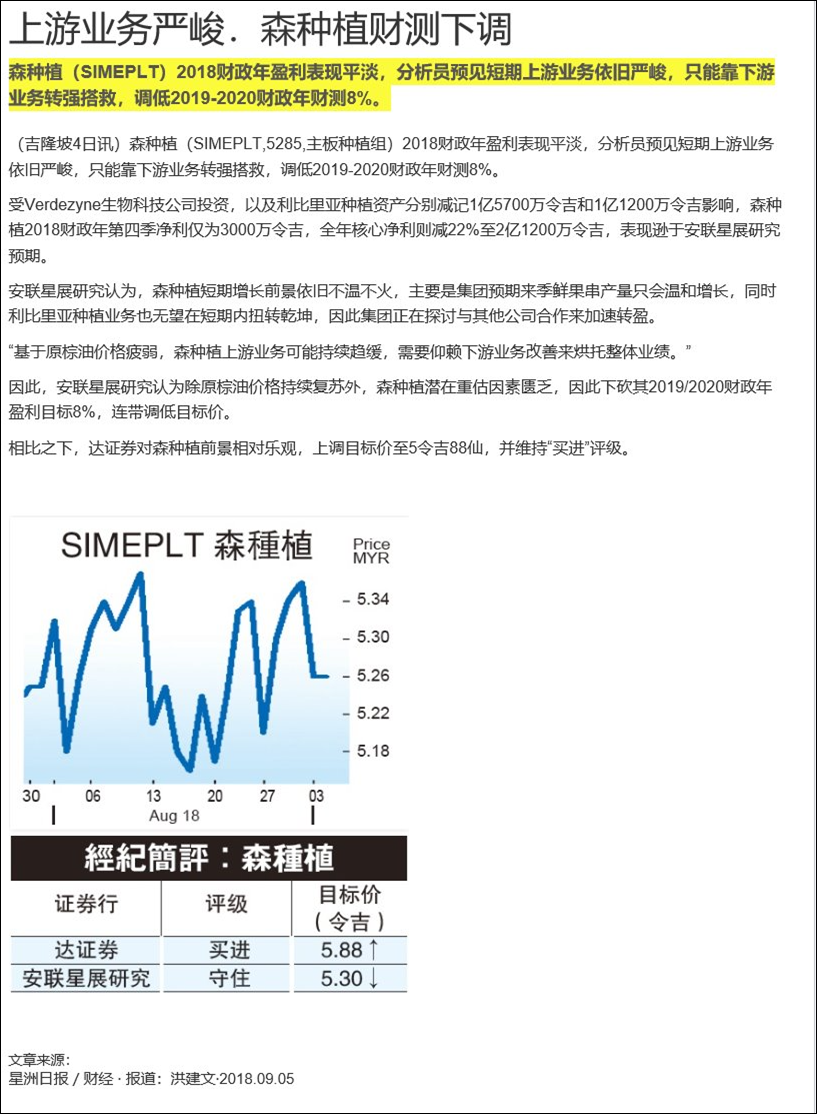

本帖最后由 icy97 于 3-9-2018 05:04 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,084,000 | 3,686,000 | 14,369,000 | 14,779,000 | | 2 | Profit/(loss) before tax | 149,000 | 2,722,000 | 2,377,000 | 4,031,000 | | 3 | Profit/(loss) for the period | 64,000 | 2,627,000 | 1,885,000 | 3,552,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 30,000 | 2,628,000 | 1,727,000 | 3,507,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.40 | 38.60 | 25.40 | 51.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 14.00 | 0.00 | 17.50 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0100 | 1.8300

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-9-2018 04:55 AM

|

显示全部楼层

EX-date | 28 Sep 2018 | Entitlement date | 02 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single tier interim dividend of 1.5 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHDLevel 7, Menara MileniumJalan Damanlela, Pusat Bandar DamansaraDamansara Heights50490 Kuala LumpurTel:03-20849000Fax:03-20949940 | Payment date | 30 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 02 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.015 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-9-2018 04:55 AM

|

显示全部楼层

EX-date | 18 Sep 2018 | Entitlement date | 20 Sep 2018 | Entitlement time | 04:00 PM | Entitlement subject | Special Dividend | Entitlement description | Special interim single tier dividend of 3.0 sen per ordinary share in Sime Darby Plantation Berhad for the financial year ended 30 June 2018. | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 18 Sep 2018 to 20 Sep 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business SuiteAvenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel No.: 03-2783 9299 | Payment date | 05 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 20 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 18 Sep 2018 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-9-2018 05:08 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

OTHER ISSUE OF SECURITIES | Description | SIME DARBY PLANTATION BERHAD ("SDP" OR "COMPANY")PROPOSED DIVIDEND REINVESTMENT PLAN | On behalf of the Board of Directors of SDP (“Board”), CIMB Investment Bank Berhad is pleased to announce that the Board has on 29 August 2018 approved a proposed dividend reinvestment plan which will provide shareholders of SDP with an option to elect to reinvest in whole or in part, their cash dividend, which includes any interim, final, special or other types of cash dividend, in new ordinary shares of SDP (“Proposed DRP”).

Please refer to the attachment for the full announcement in relation to the Proposed DRP.

This announcement is dated 30 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5900845

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-9-2018 04:35 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 07:07 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-9-2018 04:05 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-12-2018 07:06 AM

|

显示全部楼层

| SIME DARBY PLANTATION BERHAD |

EX-date | 05 Dec 2018 | Entitlement date | 07 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend (with Dividend Re-Investment Plan) | Entitlement description | Final single tier dividend of RM0.08 per Sime Darby Plantation Berhad ("SDP") share and special final single tier dividend of RM0.03 per SDP share for the financial year ended 30 June 2018 ("FYE June 2018 Final Dividend") | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 07 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-12-2018 07:07 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

OTHER ISSUE OF SECURITIES | Description | SIME DARBY PLANTATION BERHAD ("SDP" OR "COMPANY")DIVIDEND REINVESTMENT PLAN ("DRP") | We refer to the announcements dated 30 August 2018, 5 October 2018, 23 October 2018 and 21 November 2018 in relation to the DRP.

On behalf of the Board of Directors of SDP, CIMB Investment Bank Berhad (“CIMB”) wishes to announce that the issue price of the new SDP shares to be issued pursuant to the DRP (“New Shares”) which is appplicable to the entire final single tier dividend of RM0.08 per SDP share and special final single tier dividend of RM0.03 per SDP share (“FYE June 2018 Final Dividend”) ("First DRP"), has been fixed today (“Price Fixing Date”) at RM4.85 per New Share (“Issue Price”).

The Issue Price is computed based on the five (5)-day volume weighted average market price (“VWAMP”) of RM5.2203 per SDP share up to and including 21 November 2018, being the last full trading day prior to the Price-Fixing Date after adjusting for the following:

(i) a dividend adjustment of RM0.11 to the five (5)-day VWAMP (“Ex-Dividend VWAMP”); and

(ii) a discount of RM0.2603 which is approximately 5.09% discount to the Ex-Dividend VWAMP of RM5.1103.

The books closure date pursuant to the FYE June 2018 Final Dividend and the First DRP has been fixed for 7 December 2018.

A copy of the DRP Statement and Notice of Election (including the Dividend Reinvestment Form) will be despatched to all entitled shareholders of SDP (save for foreign-addressed shareholders of SDP) accordingly.

This announcement is dated 22 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-12-2018 01:49 AM

|

显示全部楼层

本帖最后由 icy97 于 18-12-2018 04:10 AM 编辑

棕油与棕仁油价格齐跌-森那美种植净利挫89%

http://www.enanyang.my/news/20181123/棕油与棕仁油价格齐跌-森那美种植净利挫89/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | Three Months | Three Months | Three Months | Three Months | 01 Jul 2018

To | 01 Jul 2017

To | 01 Jul 2018

To | 01 Jul 2017

To | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,039,000 | 3,541,000 | 3,039,000 | 3,541,000 | | 2 | Profit/(loss) before tax | 212,000 | 1,239,000 | 212,000 | 1,239,000 | | 3 | Profit/(loss) for the period | 153,000 | 1,059,000 | 153,000 | 1,059,000 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 115,000 | 1,019,000 | 115,000 | 1,019,000 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.70 | 15.00 | 1.70 | 15.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0500 | 2.0100

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-12-2018 06:59 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-1-2019 05:56 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Disposal of Golden Hope - Nha Be Edible Oils Company Limited (Announcement pursuant to Paragraph 9.19(24) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad) | Sime Darby Plantation Berhad (SDP) wishes to announce that Golden Hope Overseas Sdn Bhd (GHOSB), a wholly-owned subsidiary of SDP, has on 11 December 2018, completed the disposal of its entire 51% equity interest in Golden Hope - Nha Be Edible Oils Company Limited (GHNB) to Kido Group Corporation (KIDO) for a total cash consideration of VND45.9 billion (equivalent to approximately RM8.2 million or USD2.0 million) (Disposal) pursuant to the Capital Contribution Transfer Agreement (CCTA) entered into between GHOSB and KIDO on 29 November 2018.

Following completion of the Disposal, GHNB ceased to be an indirect subsidiary company of SDP. Notwithstanding the Disposal, SDP will continue to serve its business to business (B2B) multinational customers in Vietnam.

GHNB, a limited liability company incorporated in Vietnam, is principally engaged in processing and refining vegetable oils for sales mainly in the domestic Vietnamese market and export in both B2B and business to consumer segments.

KIDO is an integrated food and beverage consumer company listed on the Ho Chi Minh Stock Exchange in Vietnam.

The proceeds will be utilised to fund the SDP Group’s general corporate and working capital requirements. The Disposal is not expected to have a material effect on the earnings, consolidated net assets and consolidated gearing of SDP for the financial period ending 31 December 2018.

None of the Directors or major shareholders of SDP or persons connected with them has any interest, direct or indirect, in the Disposal.

The announcement is dated 11 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-1-2019 08:24 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-1-2019 04:07 AM

|

显示全部楼层

| SIME DARBY PLANTATION BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | DIVIDEND REINVESTMENT PLAN | No. of shares issued under this corporate proposal | 83,735,906 | Issue price per share ($$) | Malaysian Ringgit (MYR) 4.8500 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 6,884,575,283 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 1,506,119,144.100 | Listing Date | 08 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-1-2019 06:54 AM

|

显示全部楼层

Name | PERMODALAN NASIONAL BERHAD | Address | Tingkat 4, Balai PNB

201-A, Jalan Tun Razak

Kuala Lumpur

50400 Wilayah Persekutuan

Malaysia. | Company No. | 38218-X | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 08 Jan 2019 | 7,721,237 | Others | Direct Interest | Name of registered holder | Permodalan Nasional Berhad | Address of registered holder | Tingkat 4, Balai PNB 201-A, Jalan Tun Razak 50400 Kuala Lumpur | Description of "Others" Type of Transaction | Subscription of DRP |

Circumstances by reason of which change has occurred | Permodalan Nasional Berhad (Subscription of 7,721,237 shares under the Dividend Reinvestment Plan (DRP) on 8 January 2019) | Nature of interest | Direct Interest | Direct (units) | 349,657,611 | Direct (%) | 5.079 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 349,657,611 | Date of notice | 08 Jan 2019 | Date notice received by Listed Issuer | 10 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|