|

|

发表于 24-9-2016 04:33 AM

|

显示全部楼层

发表于 24-9-2016 04:33 AM

|

显示全部楼层

成熟棕油树增加.林蓬岸后年有望转盈

(吉隆坡21日讯)林蓬岸种植(PLS,9695,主板种植组)预期成熟棕油树增加有助缩减亏损,并看好2018财政年有望转亏为盈。

竞标多项工程

林蓬岸种植执行董事李翰庆在股东大会后向《星洲财经》表示,在完成芙蓉医院工程后,建筑业务目前没有营业额贡献,该公司已经提呈竞标多项工程,惟不能进一步透露详情。

“一旦争取到建筑合约,公司就可以更早摆脱亏损。”

林蓬岸种植截至2016年6月30日止首季净亏385万2000令吉,高于前期的290万1000令吉;营业额则由前期的854万2000令吉增加39.19%至1189万令吉。

他指出,与两年前相比,目前的鲜果串价格已有所提升,并预计至今年杪止,鲜果串价格将维持稳定。

他说,尽管鲜果串的价格可能会出现波动,惟相信差距在5%之内。

他也指出,该公司种植的棕油树已逐渐成熟,因此鲜果串产量每年皆在增长。

据资料显示,在2015年9月至2016年8月期间,林蓬岸种植的鲜果串平均售价约每公吨637令吉,对比前期为每公吨487令吉。

林蓬岸种植目前有约10万英亩的种植地,当中30%种植棕油,5%则种植橡胶树,剩余则是尚未种植的面积。

李翰庆说,该公司将会在2018年棕油树完全成熟后,才会继续下一阶段的种植。

他补充,主要是因为棕油树在成熟期,该公司还需要投入资本开销,为了有效管理资金流,必须等待棕油树成熟后才进行新的种植计划。

他说,剩余的尚未种植土地并不完全可以用于种植,尚必须保留约25%土地作为集水区。

李翰庆也表示,林蓬岸种植目前在物色适合种植的土地,并不排除以联营的方式进行。

此外,李翰庆透露,该公司有意成立一家炼油厂,提炼所生产的鲜果串。

他说,目前尚在与顾问商讨中,目标是希望在3至4年后设立该厂。

文章来源:

星洲日报/财经‧报道:刘玉萍·2016.09.22 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-12-2016 05:04 AM

|

显示全部楼层

发表于 4-12-2016 05:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,698 | 8,720 | 27,588 | 17,263 | | 2 | Profit/(loss) before tax | -647 | -6,282 | -6,650 | -11,438 | | 3 | Profit/(loss) for the period | -1,190 | -5,337 | -6,522 | -9,616 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -867 | -3,905 | -4,720 | -6,806 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.27 | -1.20 | -1.44 | -2.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2452 | 1.2596

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2017 04:37 AM

|

显示全部楼层

发表于 6-3-2017 04:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,235 | 8,013 | 43,822 | 25,275 | | 2 | Profit/(loss) before tax | 488 | -1,685 | -6,162 | -13,124 | | 3 | Profit/(loss) for the period | -34 | -2,056 | -6,556 | -11,672 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -52 | -371 | -4,771 | -7,177 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.02 | -0.11 | -1.46 | -2.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2450 | 1.2596

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2017 04:31 AM

|

显示全部楼层

发表于 14-6-2017 04:31 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,563 | 9,138 | 71,386 | 34,414 | | 2 | Profit/(loss) before tax | -5,529 | -7,490 | -11,691 | -20,614 | | 3 | Profit/(loss) for the period | -4,931 | -7,733 | -11,487 | -19,405 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,514 | -5,401 | -8,285 | -12,578 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.08 | -1.65 | -2.54 | -3.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2312 | 1.2596

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2017 01:59 AM

|

显示全部楼层

发表于 29-8-2017 01:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,816 | 11,890 | 16,816 | 11,890 | | 2 | Profit/(loss) before tax | -792 | -6,003 | -792 | -6,003 | | 3 | Profit/(loss) for the period | -1,346 | -5,331 | -1,346 | -5,331 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -628 | -3,852 | -628 | -3,852 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.19 | -1.18 | -0.19 | -1.18 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2292 | 1.2312

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2017 05:17 AM

|

显示全部楼层

发表于 5-12-2017 05:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 23,941 | 15,698 | 40,758 | 27,588 | | 2 | Profit/(loss) before tax | 2,437 | -647 | 1,645 | -6,650 | | 3 | Profit/(loss) for the period | 839 | -1,190 | -507 | -6,522 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 604 | -867 | -24 | -4,720 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.18 | -0.27 | -0.01 | -1.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2311 | 1.2312

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 02:45 AM

|

显示全部楼层

发表于 28-2-2018 02:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 21,715 | 16,235 | 62,473 | 43,822 | | 2 | Profit/(loss) before tax | 409 | 488 | 2,054 | -6,162 | | 3 | Profit/(loss) for the period | 165 | -34 | -341 | -6,556 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 138 | -52 | 115 | -4,771 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.04 | -0.02 | 0.04 | -1.46 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2315 | 1.2312

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 03:05 AM

|

显示全部楼层

发表于 28-2-2018 03:05 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | KUMPULAN PRASARANA RAKYAT JOHOR SDN BHD | Address | G07 & 08, Blok 4, Danga Bay

Jalan Skudai

Johor Bahru

80200 Johor

Malaysia. | Company No. | 366236-T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 26 Feb 2018 | Name & address of registered holder | Serumpun Abadi Sdn Bhd1-2-1, Jalan 2/50, Diamond SquareOff Jalan Gombak, 53000 Kuala Lumpur |

No of securities disposed | 76,500,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Ceased to be an indirect substantial shareholder following the disposal of shares by Kumpulan Prasarana Rakyat Johor Sdn Bhd in Serumpun Abadi Sdn Bhd | Nature of interest | Indirect Interest |  | Date of notice | 26 Feb 2018 | Date notice received by Listed Issuer | 26 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 03:05 AM

|

显示全部楼层

发表于 28-2-2018 03:05 AM

|

显示全部楼层

Date of change | 26 Feb 2018 | Name | MR LIM CHEN THAI | Age | 24 | Gender | Male | Nationality | Malaysia | Designation | Non Executive Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | Mr. Lim holds a Bachelor of Banking & FInance from Monash University (Caulfield Campus). | Working experience and occupation | Mr. Lim was appointed as Director of Iskandar Waterfront Holdings Sdn Bhd ("IWH") in March 2017. He has served the IWH Group in various capacities since joining in November 2015. Prior to this, he interned with Lincolns Lawyer Melbourne in 2013. In February 2017, he was appointed as a Director in Konsortium Lebuhraya Utara-Timur (KL) Sdn Bhd. | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | He is the son of Tan Sri Dato' Lim Kang Hoo, nephew of Tan Sri Lim Kang Yew and Dato' Lim Kang Poh and cousin to Mr. Lim Guan Shiun and Mr. Lee Hun Kheng. | A |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 02:41 AM

|

显示全部楼层

发表于 11-6-2018 02:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 13,805 | 27,563 | 76,278 | 71,386 | | 2 | Profit/(loss) before tax | -7,155 | -5,529 | -5,102 | -11,691 | | 3 | Profit/(loss) for the period | -4,896 | -4,931 | -5,238 | -11,487 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,030 | -3,514 | -3,916 | -8,285 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.23 | -1.08 | -1.20 | -2.54 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1317 | 1.2312

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-8-2018 04:44 AM

|

显示全部楼层

发表于 11-8-2018 04:44 AM

|

显示全部楼层

本帖最后由 icy97 于 12-8-2018 03:32 AM 编辑

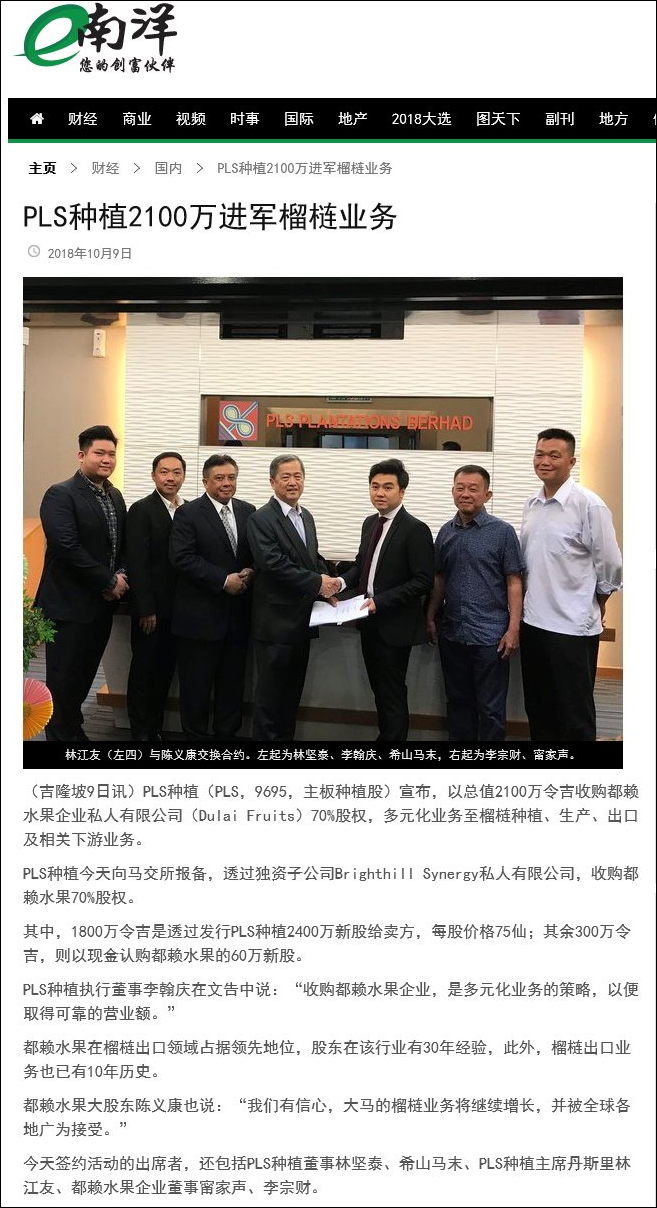

Type | Announcement | Subject | OTHERS | Description | PLS PLANTATIONS BERHAD ("PLS" OR THE "COMPANY")EXECUTION OF BINDING TERM SHEET BETWEEN PLS AND MR. ERIC CHAN YEE HONG(VENDOR) IN RESPECT OF DULAI FRUITS ENTEPRISE SDN BHD (DULAI) | The board of directors of PLS (“Board”) wishes to announce that the Company has on 10 August 2018 entered into a binding term sheet (“Term Sheet”) with the Vendor to exclusively explore and negotiate further with the Vendor on the following proposals: (i) subscription by a wholly-owned subsidiary to be incorporated by PLS (“SPV”) of new ordinary shares in Dulai (“Dulai Shares”), representing 30% of the enlarged share capital of Dulai post such subscription, for a total subscription consideration of RM3,000,000 to be satisfied in cash (“Proposed Shares Subscription”); and (ii) acquisition by the SPV of Dulai Shares from the Vendor, representing 40% of the enlarged share capital of Dulai post the Proposed Shares Subscription, for a total purchase consideration of RM18,000,000 to be satisfied via issuance of 24,000,000 new ordinary shares in PLS (“PLS Shares”) at an issue price of RM0.75 per PLS Share (“Proposed Shares Acquisition”). (Collectively, referred to as the “Proposed Transaction”)

Dulai, a private limited company incorporated in Malaysia, is engaging in the business of export and import of fresh or preserved vegetables and fruits. The Proposed Transaction is aimed to enable the Company and its subsidiaries (the “Group”) to venture into the downstream durian production and distribution businesses to provide additional revenue source and enhance the profitability of the Group.

Pursuant to the Proposed Transaction, the Vendor undertake to implement an internal reorganisation to consolidate the relevant related companies of the Vendor (“Relevant Entities”) to be wholly held under Dulai (“Dulai Internal Re-organisation and Consolidation Exercise”) prior to completion of the Proposed Transaction to eliminate any potential conflicts of interest and competition with the Company.

The aggregate consideration for the Proposed Transaction of RM21,000,000 for total 70% of the enlarged share capital of Dulai post the Proposed Transaction was arrived at on a willing-buyer willing-seller basis after taking into consideration the following: (i) the historical track records of Dulai and the Relevant Entities and experience of the Vendor in the downstream durian production and distribution businesses; and (ii) the profit guarantee to be provided by the Vendor in respect of the actual aggregate audited profit after tax and minority interests of Dulai for the financial years ending 2019, 2020 and 2021 of not less than RM10,000,000.

The issue price of RM0.75 per PLS Share for the Proposed Shares Acquisition represents a discount of approximately 12.94% and 7.37% to the 5-day and 30-day volume weighted average market price of PLS Shares up to and including 8 August 2018 of RM0.8615 and RM0.8097 respectively.

The cash consideration for the Proposed Shares Subscription is envisaged to be funded by the Company vide internally generated funds and/or bank borrowings.

The Proposed Transaction is subject to inter alia the following conditions precedent being obtained/fulfilled: (i) the Company being satisfied with the results of the due diligence review to be carried out on Dulai and the Relevant Entities; (ii) the completion of the Dulai Internal Re-organisation and Consolidation Exercise; (iii) the approval of the board of directors and shareholders of Dulai; (iv) the approval of the Board; (v) the signing of the relevant definitive agreements in relation to the Proposed Transaction; (vi) the approval or consent of financiers/creditors of Dulai and/or the Company, where required; (vii) the approval of Bursa Malaysia Securities Berhad for the listing of and quotation for the PLS Shares to be issued pursuant to the Proposed Shares Acquisition; and (viii) any other approvals, waivers or consents of any authorities and/or parties, where required. The Proposed Shares Subscription and the

Proposed Shares Acquisition are inter-conditional upon each other.

A detailed announcement on the Proposed Transaction will be made upon finalisation of the terms and conditions of the relevant definitive agreements.

Astramina Advisory Sdn Bhd is the appointed Financial Advisor for the Company in relation to the Proposed Transaction.

This announcement is dated 10 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 04:42 AM

|

显示全部楼层

发表于 28-8-2018 04:42 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,922 | 16,816 | 11,922 | 16,816 | | 2 | Profit/(loss) before tax | -5,875 | 3,854 | -5,875 | 3,854 | | 3 | Profit/(loss) for the period | -4,712 | 2,399 | -4,712 | 2,399 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,190 | 2,058 | -3,190 | 2,058 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.98 | 0.63 | -0.98 | 0.63 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5742 | 0.5840

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-9-2018 02:10 AM

|

显示全部楼层

发表于 12-9-2018 02:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 03:21 AM

|

显示全部楼层

发表于 14-9-2018 03:21 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ACQUISITION OF SUBSIDIARY | The Board of Directors of PLS Plantations Berhad (“the Company”) wishes to announce that the Company had on 13 September 2018 acquired the entire issued and paid-up share capital of Brighthill Synergy Sdn Bhd at a purchase consideration of Ringgit Malaysia One Only (RM1.00).

Brighthill Synergy Sdn Bhd was incorporated on 12 April 2018 with an issued and paid-up share capital of RM1.00.

The intended principal activity of Brighthill Synergy Sdn Bhd is an investment holding company to facilitate implementation of the proposed acquisition and subscription of shares in Dulai Fruits Enterprise Sdn Bhd as announced by the Company on 10 August 2018.

This announcement is dated 13 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 08:00 AM

|

显示全部楼层

发表于 11-10-2018 08:00 AM

|

显示全部楼层

本帖最后由 icy97 于 14-10-2018 05:11 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PLS PLANTATION BERHAD ("PLS" or "COMPANY")(I) PROPOSED SHARES SUBSCRIPTION AND PROPOSED SHARES ACQUISITION; AND(II) PROPOSED DIVERSIFICATION(TO BE COLLECTIVELY REFERRED TO AS "PROPOSED TRANSACTION") | Reference is made to the Company’s announcement on 10 August 2018 whereby the Company had on even date entered into a binding term sheet (“Term Sheet”) with Eric Chan Yee Hong (“Vendor”) to exclusively explore and negotiate further on the Proposed Transaction (as defined hereunder).

Following thereto, the Board of Directors of PLS (“Board”) wishes to announce the following:- (i) On 9 October 2018, Brighthill Synergy Sdn Bhd (“Brighthill” or “Subscriber” or “Purchaser”), a wholly-owned subsidiary of PLS, had entered into a share subscription agreement (“Subscription Agreement”) to subscribe for 600,000 new ordinary shares in Dulai Fruits Enterprise Sdn Bhd (“Dulai”) (“Dulai Shares”) (“Subscription Shares”), for a total subscription consideration of RM3,000,000 to be satisfied in cash (“Proposed Shares Subscription”); and

(ii) On 9 October 2018, Brighthill had entered into a share sale and purchase agreement (“SPA”) with the Vendor for the acquisition of 800,000 Dulai Shares from the Vendor (“Sale Shares”), for a total purchase consideration of RM18,000,000 to be satisfied via issuance of 24,000,000 new ordinary shares in PLS (“PLS Shares”) (“Consideration Shares”) at an issue price of RM0.75 per Consideration Share (“Proposed Shares Acquisition”).

(Collectively, referred to as the “Proposed Transaction”)

Further details of the Proposed Transaction are set out in the attachment.

This announcement is dated 9 October 2018 |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5937145

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-12-2018 07:29 AM

|

显示全部楼层

发表于 31-12-2018 07:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 19,349 | 23,942 | 31,271 | 40,758 | | 2 | Profit/(loss) before tax | 528 | 7,864 | -5,347 | 11,719 | | 3 | Profit/(loss) for the period | -387 | 5,179 | -5,099 | 7,578 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -164 | 3,707 | -3,354 | 5,765 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.05 | 1.13 | -1.03 | 1.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5737 | 0.5840

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 08:06 AM

|

显示全部楼层

发表于 21-2-2019 08:06 AM

|

显示全部楼层

Date of change | 14 Feb 2019 | Name | TAN SRI DATO' LIM KANG HOO | Age | 64 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Non Executive Director | New Position | Executive Chairman | Directorate | Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information |

Working experience and occupation | Tan Sri Dato' Lim is a businessman with over 40 years of experience in the construction industry and machinery related industry. He started his involvement in the construction industry soon after completing his secondary education, assisting the family construction business. His dynamism and vision coupled with experience saw the companies that he leads grow by leaps and bound. At present, he is a Executive Chairman of Ekovest Berhad and Executive Vice Chairman of Iskandar Waterfront City Berhad which are public companies listed on the Bursa Malaysia and also a Director of several other private limited companies. | Family relationship with any director and/or major shareholder of the listed issuer | Brother to Tan Sri Dato' Lim Kang Yew and Dato' Lim Kang PohFather to Mr. Lim Chen ThaiUncle to Mr. Lee Hun Kheng and Mr. Lim Guan Shiun | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | Indirect Interest - 76,500,000 ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-3-2019 07:45 AM

|

显示全部楼层

发表于 10-3-2019 07:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,969 | 21,715 | 50,240 | 62,473 | | 2 | Profit/(loss) before tax | -5,039 | 4,448 | -10,385 | 16,167 | | 3 | Profit/(loss) for the period | -4,768 | 3,450 | -9,867 | 11,028 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,363 | 2,503 | -6,717 | 8,268 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.03 | 0.77 | -2.06 | 2.53 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5634 | 0.5840

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2019 03:38 AM

|

显示全部楼层

发表于 2-4-2019 03:38 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | EKOVEST BERHAD | Address | Ground Floor, Wisma Ekovest

No. 118, Jalan Gombak

Kuala Lumpur

53000 Wilayah Persekutuan

Malaysia. | Company No. | 132493-D | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Ekovest BerhadGround Floor, Wisma EkovestNo. 118, Jalan Gombak53000 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Date interest acquired | 12 Mar 2019 | No of securities | 76,500,000 | Circumstances by reason of which Securities Holder has interest | Share Purchase Agreement between Serumpun Abadi Sdn Bhd and Ekovest Berhad | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 76,500,000 | Direct (%) | 23.42 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 13 Mar 2019 | Date notice received by Listed Issuer | 13 Mar 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2019 03:38 AM

|

显示全部楼层

发表于 2-4-2019 03:38 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | SERUMPUN ABADI SDN BHD | Address | 1-2-1 Jalan 2/50, Diamond Square

Off Jalan Gombak

Kuala Lumpur

53000 Wilayah Persekutuan

Malaysia. | Company No. | 989701-W | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 12 Mar 2019 | Name & address of registered holder | Serumpun Abadi Sdn Bhd1-2-1 Jalan 2/50, Diamond SquareOff Jalan Gombak, 53000 Kuala Lumpur |

No of securities disposed | 76,500,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Share Purchase Agreement between Serumpun Abadi Sdn Bhd and Ekovest Berhad | Nature of interest | Direct Interest |  | Date of notice | 13 Mar 2019 | Date notice received by Listed Issuer | 13 Mar 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|