|

|

发表于 19-5-2017 02:44 AM

|

显示全部楼层

发表于 19-5-2017 02:44 AM

|

显示全部楼层

EX-date | 29 May 2017 | Entitlement date | 31 May 2017 | Entitlement time | 05:00 PM | Entitlement subject | Others | Entitlement description | Early Full Redemption and Cancellation of the entire outstanding 7-year 6% Redeemable Convertible Secured Loan Stocks ("2011/2018 RCSLS") | Period of interest payment | to | Financial Year End | 30 Jun 2017 | Share transfer book & register of members will be | 31 May 2017 to 31 May 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SHAREWORKS SDN BHDNo. 2-1, Jalan Sri Hartamas 8Sri Hartamas50480Kuala LumpurTel:0362011120Fax:0362013121 | Payment date | 14 Jun 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 May 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) | 0 | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 1 | Par Value (if applicable) | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2017 05:32 AM

|

显示全部楼层

发表于 31-5-2017 05:32 AM

|

显示全部楼层

本帖最后由 icy97 于 9-6-2017 04:04 AM 编辑

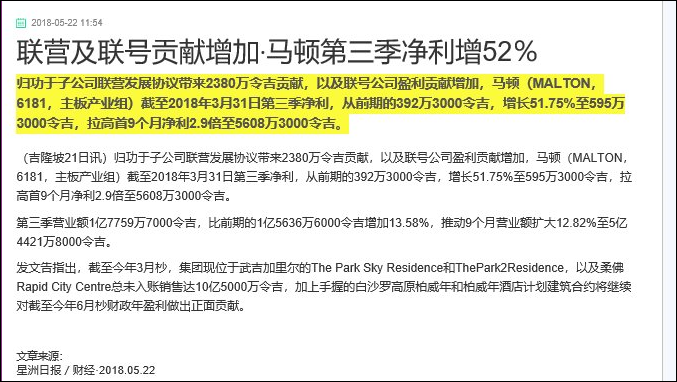

马顿第三季少赚40%

2017年5月31日

(吉隆坡30日讯)马顿(MALTON,6181,主板产业股)截至3月杪第三季,净利按年下跌39.75%,至392万3000令吉或每股净利0.87仙。

马顿向交易所报备,该公司上财年同期净赚651万1000令吉,或每股净利1.45仙。

同期营业额则按年微涨0.7%,至1亿5636万6000令吉,上财年同季报1亿5528万5000令吉。

累计首9个月,净利按年下跌5.32%,至1434万8000令吉;同期营业额则按年增加17.15%,至1515万4000令吉。

项目管理盈利增

与上财年同期比较,当季的房产发展业务营业额走低,是因为虽然Nova Saujana 及柔佛Rapid City Centre首期完工,不过录得较低的利润。

而首季的建筑与项目管理业务的营业额及盈利走高,是因为外部项目的工程进度。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 156,366 | 155,285 | 482,381 | 411,772 | | 2 | Profit/(loss) before tax | 7,523 | 12,749 | 22,510 | 24,364 | | 3 | Profit/(loss) for the period | 3,801 | 6,505 | 14,177 | 15,132 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,923 | 6,511 | 14,348 | 15,154 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.87 | 1.45 | 3.19 | 3.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 |

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6100 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2017 03:27 AM

|

显示全部楼层

发表于 18-6-2017 03:27 AM

|

显示全部楼层

地库潜在发展总值94亿

马顿足以忙碌10年

2017年6月7日

(吉隆坡7日讯)马顿(MALTON,6181,主板产业股)现有地库的潜在发展总值达94亿令吉,可供未来10年的产业发展。

马顿发言人今日出席股东大会后向记者披露,尽管市场疲软,但所推出产业反应不俗,The Park 2柏威年武吉加里尔首栋公寓认购率逾90%。

“The Park 2柏威年武吉加里尔项目发展总值高达7亿2000万令吉,是马顿庞大项目之一,首栋公寓获得热烈反应,如今正建筑着第二栋公寓。”

她透露,马顿将于今年杪推出2项发展总值达12亿令吉项目,分别是11亿令吉的Amaya Duta,以及位于的柔佛Rapid City Centre,发展总值1亿令吉。

不并WCT

另外,马顿计划明年杪推出发展总值8亿1500令吉的Nova Pantai,且明年末季推行Ukay Spring,发展总值达6亿6000万令吉。

截止12月杪财报,马顿建筑合约总值录得23亿4000万令吉,未入账销售达15亿6000万令吉,可支撑集团至5年。

至于产业发展业务,发展总值达28亿1000万令吉,未入账销售9亿6700万令吉,可让集团忙碌至3年。

没标大马城

关于马顿是否考虑和WCT控股(WCT,9679,主板建筑股)合并,发言人否认此事,强调马顿将维持和WCT控股合作关系,若有合并将会向交易所报备。

此外,马顿发言人也否认与中国大连万达集团和雇员公积金局(EPF)洽谈竞标大马城计划。

“之前我们已向交易所报备,并无与大连万达集团和公积金局洽谈竞标大马城计划。”

她进一步补充,集团冀望给予投资者准确的信息。

“我们不希望因传言而呈现炒股情况,这将影响集团股价,也对投资者不公平。”【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-6-2017 07:14 AM

|

显示全部楼层

发表于 24-6-2017 07:14 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MALTON BERHAD ("MALTON" OR "COMPANY")JOINT VENTURE AGREEMENT BETWEEN LAYAR RAYA SDN BHD AND FAME ACTION SDN BHD ("JOINT VENTURE") | The Board of Directors of Malton wishes to announce that Layar Raya Sdn Bhd (“LRSB”), a wholly-owned subsidiary of Malton had on 23 June 2017 entered into a Joint Venture Agreement (“JVA”) with Fame Action Sdn Bhd (“FASB” or “Developer”), a wholly-owned subsidiary of Global Oriental Berhad, for the purpose of developing seven (7) pieces of freehold, all situated in Mukim of Cheras, Daerah Ulu Langat, Selangor (“Lands”) owned by LRSB.

The details of the Joint Venture are set out in the attached file.

This announcement is dated 23 June 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5470565

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2017 04:28 AM

|

显示全部楼层

发表于 18-8-2017 04:28 AM

|

显示全部楼层

柏威年武吉加里尔2020年开业

马顿冀首年租户总销售17亿

2017年8月17日

(武吉加里尔17日讯)马顿(MALTON,6181,主板产业股)旗下柏威年武吉加里尔购物中心,即将于2020年末季开张,放眼首年租户的总销售额达到17亿令吉。

柏威年广场零售业务总执行长叶素清,今日出席“The Park 2柏威年武吉加里尔”第二栋大楼推介礼后对媒体说,相信可达到17亿令吉目标。

她补充,一般上新开张的购物中心必须取得70%至75%出租率才能成功,对柏威年武吉加里尔购物中心而言并不是问题。

尽管大马零售空间过剩,但市场对柏威年武吉加里尔购物中心的反应热烈,已有约1000个潜在租户表达兴趣。

针对知名外国品牌大马零售店倒闭,她称,与进军大马市场的新品牌数量相比,这只是少数。

叶素清认为,虽然零售商谨慎,但依然需要增长,而成功关键在于改变生意模式。

The Park 2 售出70%

她解释,柏威年武吉加里尔购物中心不是一个小区商场,而是一个吸引国际游客与本地人的商场。

“我们计划引进至少10至20个新品牌和概念。目前,建议中的娱乐设施包括溜冰场、影院和保健中心。”

市场反应良好,马顿提前推介The Park 2服务式公寓第二栋大楼,现已取得70%认购率。

马顿执行董事方礼泉称,这证明处于利基地点,具良好概念、品牌与交付的高楼住宅需求仍高。

“这是‘武吉加里尔城’项目的最后一个住宅大楼,精明投资者和购屋者纷纷入手。这里的卖点是两个优质品牌、生活方式和地点。”

出席推介礼者包括吉隆坡市长拿督斯里阿敏诺丁以及马顿执行董事潘斯里陈丽云。

东姑安南:重振隆市黄金路段

吉隆坡市政局积极重振市容,包括武吉免登路、邱得煜路、苏丹依斯迈路以及安邦路。

联邦直辖区部长拿督斯里东姑安南说,武吉免登捷运站至联邦酒店部分仍落后,将探讨设立商业区或者重新发展。

此外,市政局留意到,许多外国人在邱得煜路租赁公寓,而衍生问题,原本有意强制收购这些建筑物并重建,但得知已有买家,因此将交由私人界处理。

针对被遗弃的The Grand Duta Hyatt酒店,业主向东姑安南表示会重振该项目,而市政局会继续跟进。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2017 08:36 PM

|

显示全部楼层

发表于 29-8-2017 08:36 PM

|

显示全部楼层

本帖最后由 icy97 于 30-8-2017 12:34 AM 编辑

| 6181 MALTON MALTON BHD | | Quarterly rpt on consolidated results for the financial period ended 30/06/2017 | | Quarter: | 4th Quarter | | Financial Year End: | 30/06/2017 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/06/2017 | 30/06/2016 | 30/06/2017 | 30/06/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 334,699 | 220,444 | 817,080 | 632,216 | | 2 | Profit/Loss Before Tax | 89,265 | 46,837 | 111,775 | 71,201 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 48,175 | 21,273 | 62,523 | 36,427 | | 4 | Net Profit/Loss For The Period | 48,240 | 21,183 | 62,417 | 36,315 | | 5 | Basic Earnings/Loss Per Shares (sen) | 9.34 | 4.74 | 13.43 | 8.12 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.6500 | 1.6500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2017 02:30 AM

|

显示全部楼层

发表于 19-9-2017 02:30 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MALTON BERHAD ("MALTON" OR "COMPANY")ACQUISITION OF INTEREST IN UNQUOTED COMPANY | The Board of Directors of Malton wishes to inform that Khuan Choo Realty Sdn Bhd, a wholly-owned subsidiary of Malton had, on 18 September 2017, acquired the entire issued share capital of Ambang Suriamas Sdn Bhd (“ASSB”) comprising one (1) ordinary share for the total cash consideration of Ringgit Malaysia One Only (RM1.00) (“Acquisition”).

Details of the Acquisition are set out in the attached document.

This announcement is dated 18 September 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5546593

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2017 04:00 AM

|

显示全部楼层

发表于 31-10-2017 04:00 AM

|

显示全部楼层

本帖最后由 icy97 于 1-11-2017 04:28 AM 编辑

EX-date | 29 Nov 2017 | Entitlement date | 04 Dec 2017 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and final single-tier dividend of 2.5 sen for every ordinary share in respect of the year ended 30 June 2017 | Period of interest payment | to | Financial Year End | 30 Jun 2017 | Share transfer book & register of members will be | 04 Dec 2017 to 04 Dec 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SHAREWORKS SDN BHDNo. 2-1, Jalan Sri Hartamas 8Sri Hartamas50480Kuala LumpurTel:0362011120Fax:0362013121 | Payment date | 29 Dec 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 04 Dec 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.025 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2017 10:45 PM

|

显示全部楼层

发表于 20-11-2017 10:45 PM

|

显示全部楼层

本帖最后由 icy97 于 23-11-2017 04:56 AM 编辑

撤消联合发展合约获利‧马顿首季净利增314%

http://www.sinchew.com.my/node/1703204/

(吉隆坡20日讯)由于旗下公司撤销联合发展合约而确认盈利2380万令吉,使马顿(MALTON,6181,主板产业组)截至2017年9月30日止第一季净利激增314.26%至2592万9000令吉,较前期净利为625万9000令吉。

该公司第一季营业额为1亿2511万7000令吉,较前期的1亿3004万1000令吉,微跌3.78%。

该公司文告指出,公司第一季盈利大增,主要是旗下子公司——Silver Setup有限公司撤销一项联合发展合约,使公司确认盈利2380万令吉所致。

文告指出,旗下产业发展业务第一季营业额下跌19.8%,因武吉加里尔城市Signature店屋于今年6月完成、SK One Residence则于今年8月完成,惟武吉加里尔The Park2Residence开始作出营收抵消部份利空。

它指出,公司旗下建筑业务营业额及税前盈利,按季分别增长84.9%及217.2%,因赚幅较高及节省成本措施收效。

文告指出,大马2017年经济成长料介于5.2%至5.7%之间。截至2017年9月30日为止,公司未入账销售额达12亿令吉,及手握持续发展中的建筑合约,公司预料截至2018年6月30日为止财政年的业绩表现将令人满意。

文章来源:

星洲日报/财经·2017.11.21

| 6181 MALTON MALTON BHD | | Quarterly rpt on consolidated results for the financial period ended 30/09/2017 | | Quarter: | 1st Quarter | | Financial Year End: | 30/06/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/09/2017 | 30/09/2016 | 30/09/2017 | 30/09/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 125,117 | 130,041 | 125,117 | 130,041 | | 2 | Profit/Loss Before Tax | 27,926 | 9,873 | 27,926 | 9,873 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 25,929 | 6,259 | 25,929 | 6,259 | | 4 | Net Profit/Loss For The Period | 25,768 | 6,234 | 25,768 | 6,234 | | 5 | Basic Earnings/Loss Per Shares (sen) | 4.91 | 1.39 | 4.91 | 1.39 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.7000 | 1.6500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 06:17 AM

|

显示全部楼层

发表于 4-3-2018 06:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 241,504 | 195,974 | 366,621 | 326,015 | | 2 | Profit/(loss) before tax | 32,467 | 5,114 | 60,393 | 14,987 | | 3 | Profit/(loss) for the period | 24,048 | 4,142 | 49,816 | 10,376 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 24,201 | 4,166 | 50,130 | 10,425 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.59 | 0.92 | 9.50 | 2.31 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7200 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-4-2018 02:18 AM

来自手机

|

显示全部楼层

发表于 4-4-2018 02:18 AM

来自手机

|

显示全部楼层

http://www.klsescreener.com/v2/news/view/361359

颜大师的话,灵验吗? |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-5-2018 11:10 AM

|

显示全部楼层

发表于 10-5-2018 11:10 AM

|

显示全部楼层

Date of change | 04 May 2018 | Name | MR TAN PENG SHEUNG | Age | 65 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Independent and Non Executive | Type of change | Demised | Qualifications | 1. Associate Member of the Chartered Institute of Management Accountants (CIMA)2. Chartered Accountant with the Malaysian Institute of Accountants (MIA) | Working experience and occupation | He started his accountancy and audit career with Price Waterhouse & Co., and had acquired more than 36 years of valuable corporate experience in companies which straddle a diverse range of business and industry sectors, including insurance and financial services, property development, manufacturing, trading, confectionery, F&B, specialty and consumer retailing. His experience as Chief Financial Officer of a large retail chain of stores, to director/ senior management level of operating companies, some of which are successful joint venture franchise establishments, has provided valuable dimension to the advisory and consulting projects he developed and managed, both on a regional and global basis. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 06:28 AM

|

显示全部楼层

发表于 24-5-2018 06:28 AM

|

显示全部楼层

本帖最后由 icy97 于 4-6-2018 04:14 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 177,597 | 156,366 | 544,218 | 482,381 | | 2 | Profit/(loss) before tax | 6,052 | 7,523 | 66,445 | 22,510 | | 3 | Profit/(loss) for the period | 5,687 | 3,801 | 55,503 | 14,177 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,953 | 3,923 | 56,083 | 14,348 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.13 | 0.87 | 10.62 | 3.19 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7300 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 01:24 AM

|

显示全部楼层

发表于 30-5-2018 01:24 AM

|

显示全部楼层

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 1.0000 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 12 Jun 2018 05:00 PM | Date & Time of Suspension | 13 Jun 2018 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 22 Jun 2018 04:00 PM | Date & Time of Expiry | 29 Jun 2018 05:00 PM | Date & Time for Delisting | 02 Jul 2018 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5804685

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-7-2018 02:36 AM

|

显示全部楼层

发表于 8-7-2018 02:36 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2018 12:25 AM

|

显示全部楼层

发表于 14-8-2018 12:25 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MALTON BERHAD ("MALTON" OR "COMPANY")INVITATION TO PARTICIPATE IN THE OWNERSHIP OF AN ON-GOING DEVELOPMENT ("OFFER") | The Board of Directors of Malton wishes to inform that Pioneer Haven Sdn Bhd, a wholly-owned subsidiary of Malton, had on 8 August 2018 formally invited Pavilion Real Estate Investment Trust (“Pavilion REIT”) to participate in the ownership of an on-going development comprising one block of retail mall with five (5) levels of retail spaces and two (2) levels of basement parking to be provisionally known as Pavilion Bukit Jalil.

Pavilion REIT had on 13 August 2018 accepted the Offer and both parties shall enter into a non-disclosure agreement to commence due diligence, discussions on method of participation and negotiate relevant terms and conditions.

This announcement is dated 13 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2018 05:22 AM

|

显示全部楼层

发表于 2-9-2018 05:22 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 274,555 | 348,358 | 818,773 | 830,739 | | 2 | Profit/(loss) before tax | 16,583 | 92,155 | 83,028 | 114,665 | | 3 | Profit/(loss) for the period | 146 | 49,004 | 55,649 | 63,181 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 399 | 48,939 | 56,482 | 63,287 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.08 | 9.49 | 10.70 | 13.59 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7300 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-10-2018 02:05 AM

|

显示全部楼层

发表于 4-10-2018 02:05 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2018 07:24 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MALTON BERHAD ("MALTON" OR "COMPANY")SUBMISSION OF BID FOR PROPERTY PROJECT IN TAIPEI, TAIWAN ROC | The Board of Directors of Malton wishes to inform that the Company, together with Nan Hai Corporation Limited (“Nan Hai”), had jointly submitted a bid to the Taipei City authorities on 1 October 2018 for the construction of the superstructure above the airport express train station located near the Taipei main train station (‘‘Project’’). The Project involves the development of a landmark high rise multipurpose complex comprising hotel, retail and prime office space above the airport express train station that has a base area of approximately 31,700 square meters. This complex will have direct access to the Taipei City station of the express rail service to the Taoyuan International Airport. Nan Hai holds 80% interest in the bid while Malton holds the remaining 20% interest. The above-mentioned bid is subject to approval which may or may not be successful and announcement on the status of the bid will be made accordingly.

Nan Hai is a Hong Kong based corporation listed on the Main Board of The Stock Exchange of Hong Kong Limited and is engaged mainly in culture and media services, property development and enterprise cloud services.

This announcement is dated 2 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-11-2018 05:43 AM

|

显示全部楼层

发表于 3-11-2018 05:43 AM

|

显示全部楼层

EX-date | 28 Nov 2018 | Entitlement date | 30 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final single-tier dividend of 2.0 sen for every ordinary share in respect of the financial year ended 30 June 2018 | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 30 Nov 2018 to 30 Nov 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SHAREWORKS SDN BHDNo. 2-1, Jalan Sri Hartamas 8Sri Hartamas50480Kuala LumpurTel:0362011120Fax:0362013121 | Payment date | 28 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-11-2018 08:16 PM

|

显示全部楼层

发表于 15-11-2018 08:16 PM

|

显示全部楼层

本帖最后由 icy97 于 14-12-2018 03:40 AM 编辑

马顿首季净利挫83%

http://www.enanyang.my/news/20181116/马顿首季净利挫83/

| 6181 MALTON MALTON BHD | | Quarterly rpt on consolidated results for the financial period ended 30/09/2018 | | Quarter: | 1st Quarter | | Financial Year End: | 30/06/2019 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/09/2018 | 30/09/2017 | 30/09/2018 | 30/09/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 157,936 | 124,831 | 157,936 | 124,831 | | 2 | Profit/Loss Before Tax | 7,899 | 28,856 | 7,899 | 28,856 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,661 | 26,652 | 4,661 | 26,652 | | 4 | Net Profit/Loss For The Period | 4,448 | 26,491 | 4,448 | 26,491 | | 5 | Basic Earnings/Loss Per Shares (sen) | 0.88 | 5.05 | 0.88 | 5.05 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.7500 | 1.7400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|