|

|

【BAUTO 5248 交流专区】(前名 BJAUTO )

[复制链接]

[复制链接]

|

|

|

发表于 15-12-2017 06:49 AM

|

显示全部楼层

发表于 15-12-2017 06:49 AM

|

显示全部楼层

本帖最后由 icy97 于 16-12-2017 05:00 AM 编辑

柏马汽车次季净利跌28%

2017年12月9日

(吉隆坡8日讯)柏马汽车(BAUTO,5248,主板贸服股)截至10月31日次季,净利按年跌27.51%至2220万1000令吉,或每股1.93仙;但仍宣布派息每股1.60仙。

柏马汽车今日向交易所报备,次季营业额微跌0.31%至4亿7170万7000令吉,归咎于Mazda2车款的国内销量滑落,不过,部分被菲律宾Mazda3车款的销量提高缓解。

该公司税前盈利也减低25.4%至3460万4000令吉。

Mazda蒙亏

除了国内销量走跌,也归咎于总盈利赚幅受压,因为预计10月推出新款CX-5,而促销旧版CX-5以及联号公司Mazda大马私人有限公司蒙受损失。

柏马汽车解释,Mazda的亏损,主要因为在推出新款CX-5前,生产量下降。

合计半年,净利跌40.88%至4240万8000令吉;营业额则减10.74%,报8亿6293万5000令吉。

股息除权日和享有权益日,分别落在1月12日和16日,支付日则在1月26日。

展望未来,鉴于推出新款CX-5和CX-9,预计下半年表现会比上半年佳。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

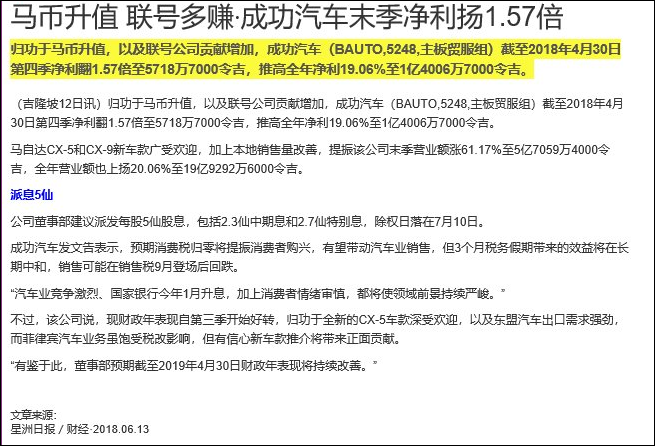

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2017 | 31 Oct 2016 | 31 Oct 2017 | 31 Oct 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 471,707 | 473,171 | 862,935 | 966,787 | | 2 | Profit/(loss) before tax | 34,604 | 46,386 | 66,327 | 104,959 | | 3 | Profit/(loss) for the period | 25,504 | 35,132 | 48,662 | 79,381 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 22,201 | 30,627 | 42,408 | 71,738 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.93 | 2.67 | 3.68 | 6.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.60 | 2.75 | 3.10 | 5.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3720 | 0.3849

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2017 06:52 AM

|

显示全部楼层

发表于 15-12-2017 06:52 AM

|

显示全部楼层

EX-date | 12 Jan 2018 | Entitlement date | 16 Jan 2018 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second interim single-tier dividend of 1.6 sen per share | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN BHDLot 06-03, Level 6, East WingBerjaya Times SquareNo. 1, Jalan Imbi55100 Kuala LumpurTel:0321450533Fax:0321459702 | Payment date | 26 Jan 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 16 Jan 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2017 06:53 AM

|

显示全部楼层

发表于 15-12-2017 06:53 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2017 02:46 AM

|

显示全部楼层

发表于 22-12-2017 02:46 AM

|

显示全部楼层

本帖最后由 icy97 于 23-12-2017 02:01 AM 编辑

柏马汽车

下季净利看涨

2017年12月12日

分析:达证券

目标价:2.50令吉

最新进展

柏马汽车(BAUTO,5248,主板贸服股)截至10月31日次季,净利按年跌27.51%至2220万1000令吉,或每股1.93仙;但仍宣布派息每股1.60仙。

次季营业额微跌0.31%,达4亿7170万7000令吉。

行家建议

柏马汽车首半年核心净利仅达4240万令吉,按年减27.5%,归因于销量减少、赚幅收窄,以及联号公司贡献疲软。

我们认为业绩仍符合预期,原因是10月推出新款CX-5、出口和产量提高,从而推动联号公司贡献,以及日元汇率减弱,相信接下来季度的净利会增长。

新款CX-5推出后的短短20天内,在国内就售出860辆,相信在余下季度,我国和菲律宾的销量同样杰出,因此下半年会是一个好年。

此外,日元汇率继续走低,将能推动柏马汽车的净利上涨,因该公司30%的成本以日元计算。

我们预计柏马汽车会继续派息,因为抑制资本支出需求、现金充足,约为1亿令吉,以及从菲律宾臂膀上市产生的特别股息。

维持“买入”评级和2.50令吉目标价;2018至2020周息率可观,介于5.3%至6.6%,能助缓解任何下行风险。

【e南洋】

盈利走扬.菲臂膀公司上市.成功汽车潜在股息高

(吉隆坡11日讯)成功汽车(BAUTO,5248,主板贸服组)2018财政年上半年净利表现走弱,不过,分析员普遍看好新款马自达CX-5销售增加及日圆汇率转弱将可推动下半年盈利走扬,而菲律宾臂膀公司上市,潜在带来高股息。

惟另有分析员忧虑该公司面对菲律宾的新征税政策及汽车领域竞争激烈,赚幅将承压。

首2季净利跌27.5%

受销售疲弱、赚幅下滑及联号公司表现低迷拖累,成功汽车2018财政年上半年净利按年下跌27.5%至4240万令吉。

达证券研究指出,尽管成功汽车核心净利仅达该行及市场全年预测的26%和24%,不过,该行相信成功汽车下半年核心盈利将走扬,主要受10月推出的新款CX-5、出口及产量增加,提升联号公司贡献和日圆走软所推动。

达证券补充,配合新款CX-5面市,成功汽车联号公司马自达(Mazda Malaysia)开始出口此新型号至所有东南亚国家,随需求增加,该公司旗下Inokom装配厂也将受益。

肯纳格研究表示,成功汽车预计在2018年,引进马自达CX-8型号7人座SUV汽车及全新的2018年马自达6;在2019年则预计为旗舰车型马自达3带来新一代型号。

兴业研究认同,成功汽车下半年盈利表现将显著改善,主要获新款CX-5销售推动。

尽管如此,兴业在调整马币兑日圆预测后,下调成功汽车2018财政年财测1.1%及上调2019财政年财测3.1%。

马银行研究认为,马币兑日圆将逐步转强,预计将可达到3.70兑100日圆水平,比目前的3.80高;因此,下调成功汽车2018财政年财测14%,但是,上调2019及2020财政年财测7%及3%。

基于联号公司贡献转弱,肯纳格下调成功汽车2018和2019财政年财测,分别调低19%和8%。

MIDF研究则因为旧有的CX-5比预期高的卖出成本,下调成功汽车2018财政年财测12%,不过,维持2019财政年财测。

联昌研究相对看淡成功汽车表现,大砍2018至2020财政年财测,调低幅度介于11%至20%,并因为成功汽车的大马马自达表现疲弱,而下调联号盈利贡献预测。

可维持大方派息

成功汽车宣布派发每股1.6仙股息,达证券预计该公司料维持大方的派息政策。

达证券表示,主要是因为成功汽车的资本支出相对更低,加上手握逾1亿令吉的充裕现金和菲律宾臂膀的上市,有望带来特别股息。

MIDF也指出,成功汽车派息率达83%,高于该行预测的80%。

尽管联昌认为,成功汽车在2018财政年下半年将可取得强劲盈利增长,但是,却依然面对来自SUV领域竞争激烈的挑战。

兴业则指出,菲律宾将在2018年实施新的征税政策将是成功汽车面对的挑战之一。

此外,MIDF认为,成功汽车未来12个月的股价走扬催化剂将来自于马自达汽车总销量按年走高20%、新款CX-5赚幅持续扩大、马币兑日圆走强、联号公司盈利贡献翻倍、5%周息率依然诱人及菲律宾成功汽车上市,成功释放价值。

马银行则认为,成功汽车股价因为2018财政年第二季业绩表现疲弱而被拉低,是入市的好时机,因为预计该公司未来可录得强劲的盈利表现。

受业绩表现走软拖累,成功汽车先跌后起,起1仙,报2令吉16仙。

文章来源:

星洲日报‧财经‧报道:刘玉萍‧2017.12.12 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-2-2018 06:29 AM

|

显示全部楼层

发表于 22-2-2018 06:29 AM

|

显示全部楼层

1月销售有望创新高.成功汽车净利料激增

(吉隆坡21日讯)成功汽车(BAUTO,5248,主板贸服组)在多项利多因素驱动下,料拉抬第三季净利按季飙升逾50%。

MIDF研究认为,这些利好因素包括成功汽车总销售按季扬19%、两大联号公司转亏为盈、CX5车款不再缺货(冲击次季盈利25%或500至600万令吉),且从今年1月起CX5新车款起价,加上疲弱日圆可把第三季盈利按季推高逾50%。

新款CX5需求强劲

成功汽车1月销售有望攀历来新高,达到1300至1400辆之间,其中新款CX5新年期间强劲需求,可促使第三季销售走高至3000辆,按季与按年各增长19%与37%。

未交车的CX5订单超过900辆,而且强劲的CX5需求料使赚益改善;一方面是基于1月涨价且只稍折价,一半CX5新款买家选特别颜色,每辆有2000令吉溢价。

联号公司马自达大马(30%持股)与Inokom公司(29%持股),过去两季因生产率低与CX5旧车款缺货导致盈利疲弱。预测国内业务营运赚益,可由过去最高9%,改善至超过10%,惟基于早把日圆护盘定于高位的3.85令吉兑100日圆,这个财政年净利由1亿7000万调低至1亿2900万令吉。

CX5新车款于2017年11月才推出,预料2018年财政年下半年(即2017年11月至2018年4月)新车款出口改善业绩。

CX5新车款出口至泰国、印尼、菲律宾;出口至泰每月约1000辆(财政年首半年微不足道),而大马生产量每月900辆;预期马自达大马年产量可由2016、2017财政年提高至每年2万3000辆。

MIDF预期2018年次季推出新CX8车款,起初是整装进口(CBU),接着在国内组装出口至区域,将填补18万至28万令吉运动休旅车(SUV)市场。

成功汽车这个财年预测汽车销量1万1500辆至1万2000辆之间,放眼下个财政年增长17%到30%,最高来到1万5000辆。菲律宾上市计划或推迟至2019年。

该行维持成功汽车“买进”评级,目标价由2令吉50仙调高至2令吉70仙。

文章来源:

星洲日报‧财经‧报道:张启华‧2018.02.21 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-3-2018 05:20 AM

|

显示全部楼层

发表于 14-3-2018 05:20 AM

|

显示全部楼层

本帖最后由 icy97 于 15-3-2018 07:19 AM 编辑

第三季净利劲扬61%

柏马汽车派息2.3仙

2018年3月13日

(吉隆坡12日讯)柏马汽车(BAUTO,5248,主板贸服股)截至1月杪第三季,净利按年大增61.21%,报4047万2000令吉或每股3.5仙,并宣布派息每股2.3仙。

柏马汽车今日向交易所报备,营业额也按年大涨65.17%,报5亿5939万7000令吉,归功于新款CX-5和CX-9广受欢迎,推动本地和菲律宾的销量改善。

税前盈利年升46.9%至5720万令吉,得益于新款CX-5的销量提升,及联号公司Mazda大马私人有限公司的贡献。

不过,累计9个月,净利按年跌14.42%,报8288万令吉;营业额年增8.95%,写14亿2233万2000令吉。

税前盈利按年跌14.2%至1亿2360万令吉,归咎于本地市场总盈利赚幅受压尤其首季,及Mazda大马在首半年蒙受亏损。

展望未来,大马汽车协会(MAA)预计今年汽车总销量(TIV)微增2.3%,而2018财年剩下季度的市场贸易情况料备受挑战。

该公司还说,本地和全球经济不稳定,加上升息及消费者情绪谨慎,将影响轿车需求。

但该公司相信,新款的CX-5将有助于推高需求,并推动MMSB的盈利能力。

同时,近几个月令吉兑日元的有利汇率,料会减低成本,及改善接下来的盈利。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2018 | 31 Jan 2017 | 31 Jan 2018 | 31 Jan 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 559,397 | 338,683 | 1,422,332 | 1,305,470 | | 2 | Profit/(loss) before tax | 57,236 | 38,971 | 123,563 | 143,930 | | 3 | Profit/(loss) for the period | 44,296 | 28,428 | 92,958 | 107,809 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 40,472 | 25,105 | 82,880 | 96,843 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.50 | 2.19 | 7.19 | 8.45 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.30 | 2.75 | 5.40 | 8.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3860 | 0.3849

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-3-2018 05:21 AM

|

显示全部楼层

发表于 14-3-2018 05:21 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-3-2018 06:22 AM

|

显示全部楼层

发表于 14-3-2018 06:22 AM

|

显示全部楼层

EX-date | 06 Apr 2018 | Entitlement date | 10 Apr 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Third interim single tier dividend of 2.30 sen per share | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN BHDLot 06-03, Level 6, East WingBerjaya Times SquareNo. 1, Jalan Imbi55100 Kuala LumpurTel:0321450533Fax:0321459702 | Payment date | 26 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Apr 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.023 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 01:01 AM

|

显示全部楼层

发表于 16-3-2018 01:01 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2018 01:50 AM

|

显示全部楼层

发表于 14-6-2018 01:50 AM

|

显示全部楼层

本帖最后由 icy97 于 18-6-2018 02:15 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2018 | 30 Apr 2017 | 30 Apr 2018 | 30 Apr 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 570,594 | 354,032 | 1,992,926 | 1,659,997 | | 2 | Profit/(loss) before tax | 73,671 | 32,640 | 197,234 | 175,158 | | 3 | Profit/(loss) for the period | 58,160 | 25,651 | 151,118 | 131,485 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 57,187 | 22,211 | 140,067 | 117,648 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.93 | 1.93 | 12.13 | 10.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 3.15 | 10.40 | 11.65 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4113 | 0.3849

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2018 02:03 AM

|

显示全部楼层

发表于 14-6-2018 02:03 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2018 02:23 AM

|

显示全部楼层

发表于 14-6-2018 02:23 AM

|

显示全部楼层

EX-date | 06 Jul 2018 | Entitlement date | 10 Jul 2018 | Entitlement time | 05:00 PM | Entitlement subject | Special Dividend | Entitlement description | Special single tier dividend of 2.7 sen per share | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN BHDLot 06-03, Level 6, East WingBerjaya Times SquareNo. 1, Jalan Imbi55100 Kuala LumpurTel : 03 21450533Fax : 03 21459702 | Payment date | 26 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Jul 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.027 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2018 02:24 AM

|

显示全部楼层

发表于 14-6-2018 02:24 AM

|

显示全部楼层

EX-date | 06 Jul 2018 | Entitlement date | 10 Jul 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Fourth interim single-tier dividend of 2.30 sen per share | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN BHDLot 06-03, Level 6, East WingBerjaya Times SquareNo. 1, Jalan Imbi55100 Kuala LumpurTel : 03 21450533Fax : 03 2145 9702 | Payment date | 26 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Jul 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.023 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2018 02:20 AM

|

显示全部楼层

发表于 18-6-2018 02:20 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 05:31 AM

|

显示全部楼层

发表于 23-6-2018 05:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2018 04:54 AM

|

显示全部楼层

发表于 17-7-2018 04:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-8-2018 03:50 AM

|

显示全部楼层

发表于 3-8-2018 03:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2018 01:49 AM

|

显示全部楼层

发表于 14-8-2018 01:49 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-9-2018 05:18 AM

|

显示全部楼层

发表于 10-9-2018 05:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 03:35 AM

|

显示全部楼层

发表于 14-9-2018 03:35 AM

|

显示全部楼层

本帖最后由 icy97 于 14-9-2018 04:57 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2018 | 31 Jul 2017 | 31 Jul 2018 | 31 Jul 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 485,396 | 391,228 | 485,396 | 391,228 | | 2 | Profit/(loss) before tax | 67,244 | 31,723 | 67,244 | 31,723 | | 3 | Profit/(loss) for the period | 51,593 | 23,158 | 51,593 | 23,158 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 50,278 | 20,207 | 50,278 | 20,207 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.33 | 1.75 | 4.33 | 1.75 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.50 | 1.50 | 2.50 | 1.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4085 | 0.4113

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|