|

|

发表于 30-5-2018 05:56 AM

|

显示全部楼层

发表于 30-5-2018 05:56 AM

|

显示全部楼层

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 215,188 | 207,161 | 215,188 | 207,161 | | 2 | Profit/(loss) before tax | 42,925 | 44,545 | 42,925 | 44,545 | | 3 | Profit/(loss) for the period | 35,937 | 36,561 | 35,937 | 36,561 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 31,504 | 37,377 | 31,504 | 37,377 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.07 | 9.80 | 8.07 | 9.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.1300 | 3.1400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2018 04:04 AM

|

显示全部楼层

发表于 17-6-2018 04:04 AM

|

显示全部楼层

本帖最后由 icy97 于 18-6-2018 11:24 PM 编辑

Type | Announcement | Subject | MATERIAL LITIGATION | Description | SHAH ALAM HIGH COURT CIVIL SUIT NO. BA-21NCVC-63-09/2017 WRIT OF SUMMONS AND STATEMENT OF CLAIM BETWEEN GOVERNMENT OF MALAYSIA (INLAND REVENUE BOARD OF MALAYSIA) AND IDAMAN HARMONI SDN BHD | Unless otherwise stated, the definitions used throughout this announcement shall have the same meaning as defined in the announcements announced by the Company on 5 October 2016, 16 February 2017, 21 September 2017, 28 September 2017 and 16 May 2018 in relation to the Notices of Assessment for Years of Assessment 2009 and 2010 and Notice of Civil Proceedings (collectively, “the Notices”) received from the Inland Revenue Board of Malaysia.

Reference is made to the Company’s earlier announcements dated 5 October 2016, 16 February 2017, 21 September 2017, 28 September 2017 and 16 May 2018 in relation to the Notices received from the Inland Revenue Board of Malaysia (“IRBM”).

SUMMARY JUDGEMENT APPLICATION BY THE IRBM Mega First Corporation Berhad (“MFCB”) wishes to announce that IRBM had on 7 June 2018 filed a Notice of Appeal to the Court of Appeal against the Order of the High Court dated 14 May 2018 dismissing the IRBM’s application for summary judgement.

IHSB maintains its view that the assessments raised by the IRBM are statute barred and erroneous in law, and IHSB has reasonable grounds to challenge the claims. MFCB will make further announcement if there is any material update on the aforesaid matter.

This announcement is dated 13 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2018 05:04 AM

|

显示全部楼层

发表于 26-7-2018 05:04 AM

|

显示全部楼层

本帖最后由 icy97 于 26-7-2018 05:52 AM 编辑

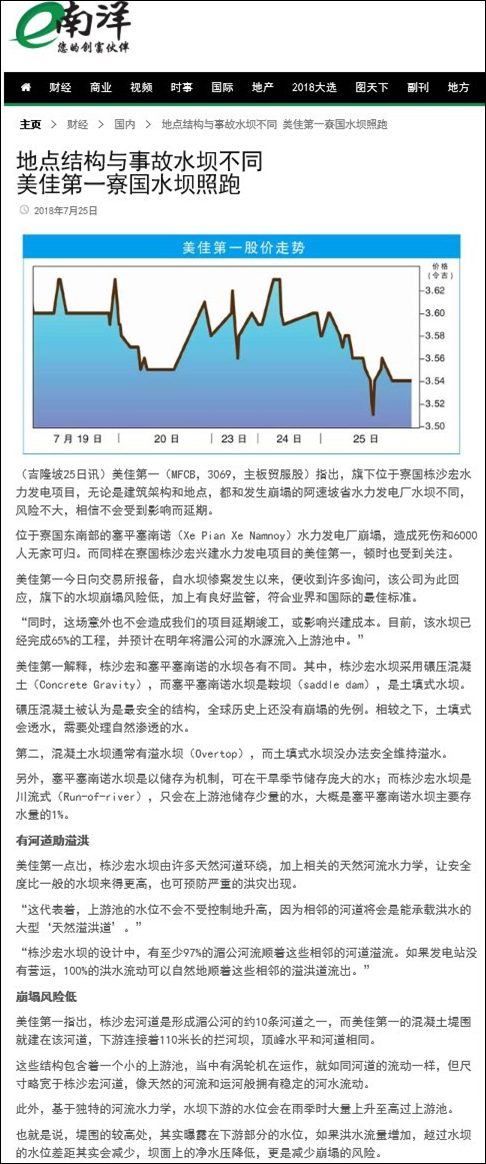

Type | Announcement | Subject | OTHERS | Description | COLLAPSE OF SADDLE DAM OF XE-PIAN XE-NAMNOY HYDROELECTRIC POWER PLANT LOCATED IN ATTAPEU PROVINCE, LAO PDR. | We refer to the above unfortunate incident that happened on 23 July 2018.

Following the incident, the Company has received queries from various stakeholders on the risk of a similar situation happening to the Company’s Don Sahong Hydroelectric Power Project (“Don Sahong Project”) and its implications thereof.

The Board of the Company has made the necessary enquiries with the management of Don Sahong Power Company (“DSPC”) and the Project consultants. Having reviewed the circumstances surrounding the incident and the specific and unique characteristics of the Don Sahong Project, the Board is satisfied that present and future dam safety risks remain low and are being (and will continue to be) appropriately monitored and managed in accordance with the industry and international best practices.

At this juncture, the Board concurs with the management of DSPC and its consultants that the incident is unlikely to result in any delay in the completion of the Don Sahong Project or a material change in the overall cost of the Project.

The Board wishes to attach the statement from the management of DSPC to the Board on the above subject.

This announcement is dated 25 July 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5864545

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 11:58 PM

|

显示全部楼层

发表于 16-8-2018 11:58 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 05:55 AM

|

显示全部楼层

发表于 30-8-2018 05:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 218,941 | 217,164 | 434,129 | 401,429 | | 2 | Profit/(loss) before tax | 51,361 | 44,631 | 95,042 | 86,454 | | 3 | Profit/(loss) for the period | 43,187 | 34,783 | 80,130 | 69,483 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 28,437 | 39,390 | 59,941 | 76,767 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.28 | 10.33 | 15.35 | 20.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 2.00 | 2.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2900 | 3.1400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 05:58 AM

|

显示全部楼层

发表于 30-8-2018 05:58 AM

|

显示全部楼层

EX-date | 26 Sep 2018 | Entitlement date | 28 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim tax-exempt dividend of 2.0 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 12 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 06:15 AM

|

显示全部楼层

发表于 19-9-2018 06:15 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2018 05:02 AM

|

显示全部楼层

发表于 8-10-2018 05:02 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-11-2018 05:49 AM

|

显示全部楼层

发表于 19-11-2018 05:49 AM

|

显示全部楼层

Name | RUBBER THREAD INDUSTRIES (M) SDN BERHAD | Address | Angkor House, 15 Jalan Bukit Ledang, Off Jalan Duta

Kuala Lumpur

50480 Wilayah Persekutuan

Malaysia. | Company No. | 122390-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 08 Nov 2018 | 5,871,500 | Others | Direct Interest | Name of registered holder | Rubber Thread Industries (M) Sdn Berhad | Address of registered holder | Angkor House, 15 Jalan Bukit Ledang, Off Jalan Duta, 50480 Kuala Lumpur | Description of "Others" Type of Transaction | Warrants Conversion |

Circumstances by reason of which change has occurred | Conversion of 5,871,500 Warrants into ordinary shares | Nature of interest | Direct Interest | Direct (units) | 95,810,000 | Direct (%) | 22.97 | Indirect/deemed interest (units) | 3,276,240 | Indirect/deemed interest (%) | 0.785 | Total no of securities after change | 99,086,240 | Date of notice | 09 Nov 2018 | Date notice received by Listed Issuer | 09 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2018 01:51 AM

|

显示全部楼层

发表于 20-11-2018 01:51 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2018 04:49 AM

|

显示全部楼层

发表于 24-11-2018 04:49 AM

|

显示全部楼层

| MEGA FIRST CORPORATION BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrants | No. of shares issued under this corporate proposal | 5,871,500 | Issue price per share ($$) | Malaysian Ringgit (MYR) 2.2200 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 417,107,525 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 539,935,439.100 | Listing Date | 13 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2018 08:18 AM

|

显示全部楼层

发表于 26-12-2018 08:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 219,062 | 209,340 | 653,191 | 610,769 | | 2 | Profit/(loss) before tax | 51,565 | 49,085 | 146,607 | 135,539 | | 3 | Profit/(loss) for the period | 43,223 | 42,527 | 123,353 | 112,010 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 38,159 | 40,071 | 98,100 | 116,838 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.78 | 10.51 | 25.12 | 30.63 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 2.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4400 | 3.1400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2019 06:38 AM

|

显示全部楼层

发表于 28-2-2019 06:38 AM

|

显示全部楼层

本帖最后由 icy97 于 28-2-2019 06:45 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 220,928 | 222,324 | 874,119 | 833,093 | | 2 | Profit/(loss) before tax | 50,833 | 49,750 | 197,440 | 185,289 | | 3 | Profit/(loss) for the period | 36,179 | 39,924 | 159,532 | 151,934 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 31,166 | 21,498 | 129,266 | 138,336 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.92 | 5.50 | 33.03 | 36.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 2.00 | 4.00 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4100 | 3.1400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2019 06:46 AM

|

显示全部楼层

发表于 28-2-2019 06:46 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Proposed Final Dividend | The Board of Directors of Mega First Corporation Berhad ("Company") had resolved to recommend a final tax-exempt dividend of 2.0 sen per share for the financial year ended 31 December 2018, subject to the shareholders' approval at the forthcoming 53rd Annual General Meeting of the Company. The date of entitlement and payment in respect of the aforesaid proposed final dividend will be determined and announced in due course.

This annoucement is dated 26 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2019 08:02 AM

|

显示全部楼层

发表于 20-5-2019 08:02 AM

|

显示全部楼层

| MEGA FIRST CORPORATION BERHAD |

EX-date | 19 Jun 2019 | Entitlement date | 21 Jun 2019 | Entitlement time |

| | Entitlement subject | Final Dividend | Entitlement description | Tax-exempt final dividend of 2 sen per ordinary share for the Financial Year Ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Boardroom Share Registrar Sdn BhdLevel 6 Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647601 | Payment date | 12 Jul 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2019 06:54 AM

|

显示全部楼层

发表于 3-7-2019 06:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 221,842 | 215,188 | 221,842 | 215,188 | | 2 | Profit/(loss) before tax | 44,943 | 43,681 | 44,943 | 43,681 | | 3 | Profit/(loss) for the period | 37,816 | 36,943 | 37,816 | 36,943 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 33,656 | 31,504 | 33,656 | 31,504 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.48 | 8.07 | 8.48 | 8.07 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4600 | 3.4100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-8-2019 06:42 AM

|

显示全部楼层

发表于 15-8-2019 06:42 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | (i) DEED OF REVOCATION OF AGREEMENTS AMONGST ITS INDIRECT SUBSIDIARY, TERATAI ANR SDN BHD, TERATAI KEMBARA SDN BHD WITH MENTERI BESAR INCORPORATED (PERAK) AND AMANJAYA NATURAL RESOURCES SDN BHD(ii) OPTION AGREEMENT ENTERED BETWEEN MENTERI BESAR INCORPORATED (PERAK) AND BAYANGAN SUTERA SDN BHD | Mega First Corporation Berhad (“MFCB” or “The Company”) wishes to announce the following agreements have been entered into on 13 August 2019 by its indirect subsidiaries : 1) Deed of Revocation entered between MB Inc., TASB, TKSB and ANR to resind the Agreements entered on 8 May 2018; 2) Option Agreement entered between MB Inc. and BSSB to lease and/or purchase a piece of land in Daerah Kinta, Perak

Please refer to the attachment for more information.

This announcement is dated 14 August 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6252477

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-8-2019 04:47 AM

|

显示全部楼层

发表于 23-8-2019 04:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 159,050 | 218,941 | 380,892 | 434,129 | | 2 | Profit/(loss) before tax | 30,039 | 51,361 | 74,982 | 95,042 | | 3 | Profit/(loss) for the period | 24,481 | 43,187 | 62,297 | 80,130 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 22,213 | 28,437 | 55,869 | 59,941 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.59 | 7.28 | 14.03 | 15.35 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.5000 | 3.4100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2019 02:48 AM

|

显示全部楼层

发表于 25-8-2019 02:48 AM

|

显示全部楼层

寮发电厂将投运售电‧美佳第一盈利看涨

https://www.sinchew.com.my/content/content_2105301.html

(吉隆坡23日讯)美佳第一(MFCB,3069,主板公用事业组)最新业绩符预期,分析员认为该公司盈利下滑不足为虑,寮国水力发电厂即将竣工和售电,将带动盈利强劲增长。

盈利下滑不足为虑

马银行研究表示,美佳第一上半年盈利下跌26%至5200万令吉,占该行/市场全年财测的52%,表现符预期,因其寮国水力发电厂已竣工92.1%,令建筑盈利减少。

该行已在财测中预期下半年的建筑盈利将下跌,该发电厂开始测试售电,则可能带来盈利上升潜能。

大众研究指出,寮国水力发电厂将在9月杪开始测试售电,料带来一次性赚益,约500万至1000万美元(2000万-4000万令吉),这尚未纳入财测中,此盈利料在最后一季入账。

同时,该公司建议建造第五个涡轮,有望带动2020年盈利增加20至25%。

“如果该公司成功赢得大马100兆瓦太阳能光伏发电厂(LSS3)合约,将有更多盈利上升空间。”

大众研究表示,能源业务可支撑该公司盈利表现,为其他受影响的业务提供了缓冲。

建筑资源业务料放缓

大众早前会晤该公司管理层后表示,对该公司水力发电厂业务甚具信心,并相信可在2020年1月可投运。不过,建筑与资源业务将会放缓,因国内与国外需求放缓,惟电力销售起到了缓冲作用,并不会影响2019财政年的盈利。

值得一提的是发电厂第二及第三个涡轮也在空运行(dry test)中,第四个涡轮也在安装中。随着大坝围堰在5月份结束,该公司也在全面测试。

石灰业务料受冲击

大众补充,上述发电厂临近寮国与柬埔寨的边界,寮国相关机构已经与柬埔寨签署了购电协议(PPA),当地将会建造传输线,目前已经完成了25公里或41%的建筑长度。待寮柬两国完成传输线安装之时,上述发电厂将会投运。

美佳第一其他业务方面,大众说,基于建筑领域放缓及竞争,石灰业务亦受到影响,所幸在新客户需求,使用率仍维持在60至65%。

大众也提及,低利率也有助于提振美佳第一的盈利表现,因该公司背负1亿500万美元(约6亿1800万令吉)的债务,若利率下砍25基点,那可节约40万美元(约170万令吉)利息开销,可推高每股净利,幅度达0.36仙。

作者 : 谢汪潮

文章来源 : 星洲日报 2019-08-24 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2019 03:52 AM

|

显示全部楼层

发表于 1-9-2019 03:52 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INCORPORATION OF SUBSIDIARY, MFP SOLAR SDN BHD | Mega First Corporation Berhad ("MFCB”) wishes to announce the incorporation of MFP Solar Sdn Bhd ("MFP Solar"), an indirect wholly-owned subsidiary of MFCB on 29 August 2019.

MFP Solar was incorporated on 29 August 2019 under the Companies Act 2016. The entire issued share capital of MFP Solar of RM2.00 comprising two (2) ordinary shares are held by Mega First Power Industries Sdn Bhd, a wholly-owned subsidiary of MFCB. The purpose of the incorporation is to facilitate MFCB Group’s business expansion plans. The intended principal activity of MFP Solar is to undertake Solar Photovoltaic business and activities incidental thereto.

The incorporation of MFP Solar is not expected to have any material effect on the earnings or net assets of MFCB Group for the financial year ending 31 December 2019.

None of the Directors or major shareholders of MFCB or persons connected with them has any interest, direct or indirect, in the incorporation.

This announcement is dated 30 August 2019.

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|