|

|

发表于 25-2-2018 06:03 AM

|

显示全部楼层

发表于 25-2-2018 06:03 AM

|

显示全部楼层

IOI产业长期融资触礁.传新加坡84亿项目受挫

(吉隆坡24日讯)市场盛传,IOI产业(IOIPG,5249,主板产业组)高达28亿4000万新元(约84亿令吉)的新加坡联营房产项目受挫,执行能力遭质疑。

《The Edge》引述消息来源指出,联营计划中的先决条件尚在处理中,长期融资计划也触礁;据悉,这可能影响到联营计划。

IOI产业:进展顺利IOI产业受询时强调,上述计划进展顺利,并将公布最新消息。与IOI产业联手的香港置地(HongkongLand)则不愿回应。

IOI产业2016年11月以28亿4000万新元投得该地段,一旦联营计划告吹,香港置地持有的33%股权或投入的9亿4000万新元(约27亿8300万令吉)将撤回。

IOI产业去年6月透过文告指出,将与在伦敦交易所挂牌的香港置地联手在新加坡中央商业区1.1公顷(或2.7英亩)地段发展产业,该联营计划料在今年首季完成。

文章来源:

星洲日报/财经‧2018.02.24 |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2018 03:25 AM

|

显示全部楼层

发表于 13-3-2018 03:25 AM

|

显示全部楼层

联营发展新加坡计划.IOI产业拟融资56亿

(吉隆坡10日讯)IOI产业(IOIPG,5249,主板产业组)欲透过多家银行融资,以从中获得19亿新元(约56亿令吉)资金,开展新加坡联营发展计划。

熟知内情的消息人士向The Edge表示,IOI产业正在和5家银行洽谈长期贷款事宜,包括星展、大华、东京三菱UFJ及华侨及三井住友银行,贷款达16亿新元(约48亿令吉),另外,IOI产业与中国银行正在洽谈3亿新元(约9亿令吉)的贷款。

有关贷款主要用于IOI产业早前在新加坡收购的地库,该地库位于金海湾,收购成本为28亿4000万新元(约84亿3000万令吉),面积为1.09公顷2017年6月,IOI产业伙同香港置地共同发展上述计划。

香港置地将持有33%的权益,因此注入9亿4000万新元(约27亿9300万令吉)予该项目。

消息人士说,IOI产业将承担余下19亿新元(约56亿4500万令吉)成本,目前,IOI产业手握16亿新元(约47亿5400万令吉)。

文章来源:

星洲日报/财经‧2018.03.10 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2018 05:33 AM

|

显示全部楼层

发表于 15-3-2018 05:33 AM

|

显示全部楼层

本帖最后由 icy97 于 15-3-2018 07:45 AM 编辑

IOI产业香港置地

终止联营狮城项目

2018年3月14日

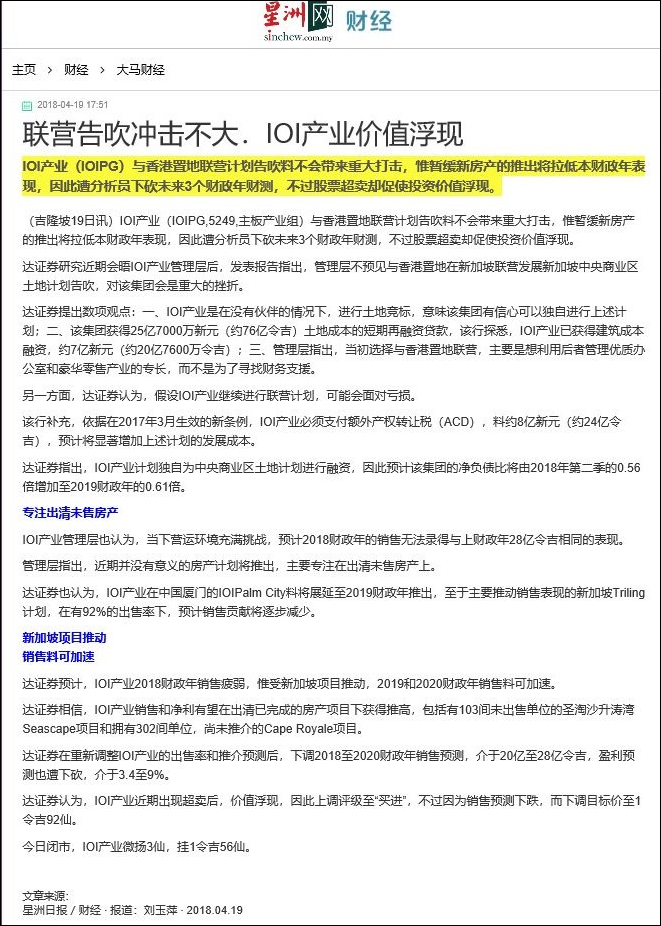

(吉隆坡13日讯)IOI产业(IOIPG,5249,主板产业股)终止与香港置地(HongKong Land)联手发展新加坡中央林蔭道路地段的了解备忘录。

该公司今日向交易所报备,因未能履行先决条件,于3月13日给予香港置地通知,终止备忘录。

不影响发展

IOI产业指出,终止备忘录不会影响中央林蔭道路地段发展项目,因为该公司拥有足够的专业知识、财务能力和其他新加坡项目竣工的良好记录。

该公司也预计,不会明显影响每股净利和每股净资产。并有信心,有能力继续进行和完成该项目。

IOI产业在2016年标得该地,过后,去年中与香港置地签署联营合约。【e南洋】

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | TERMINATION OF MEMORANDUM OF AGREEMENT ("MOA") BETWEEN IOI PROPERTIES GROUP BERHAD AND HONGKONG LAND INTERNATIONAL HOLDINGS LIMITED IN RELATION TO A PROPOSED JOINT VENTURE | 1. INTRODUCTION Reference is made to our announcement dated 12 June 2017 in relation to the MOA between the Company and Hongkong Land International Holdings Limited (“HKLI”) in relation to a proposed joint venture through Wealthy Link Pte Ltd (“Wealthy Link”) as the joint venture company (“Proposed Joint Venture”), to jointly own and undertake a proposed development and management of a land parcel at Central Boulevard in Singapore (“Central Boulevard Site”).

The Board of Directors of the Company wishes to announce that the Company has terminated the MOA with HKLI by due notice dated 13 March 2018 for the non-fulfillment of certain conditions precedent.

IOIPG and HKLI are jointly referred to as the “Parties” and individually as “Party”.

2. SALIENT TERMS OF THE MOA 2.1 Objective of the MOA The MOA sets out the Parties’ mutual understanding in relation to the Proposed Joint Venture for the proposed development and management of a land parcel at the Central Boulevard Site. Wealthy Link had successfully tendered for the Central Boulevard Site on 11 November 2016 from the Urban Redevelopment Authority (“URA”) acting for and on behalf of the Government of Singapore.

2.2 Conditions precedent The Parties’ agreement to proceed with the joint venture on the terms of the MOA, is conditional on the fulfillment of the following conditions precedent by the Long Stop Date, which is 12 March 2018:- (i) obtaining of Additional Conveyance Duties Remission approval; (ii) obtaining of URA approval; (iii) obtaining of lenders’ approval; (iv) obtaining of Additional Buyer Stamp Duty Remission approval; and (v) obtaining of Bank Negara Malaysia approval.

3. STATUS OF THE CENTRAL BOULEVARD DEVELOPMENT & MATERIAL OBSERVATIONS The Company had announced on 9 November 2016 and 11 November 2016 that Wealthy Link had successfully tendered for the Central Boulevard Site for a tender sum of approximately SGD2.57 billion. Wealthy Link has obtained the provisional permission from the URA in February 2018, to commence development works on the land. The tender for the piling works has been awarded and construction has already commenced.

In our announcement dated 12 June 2017, we had disclosed at the outset that the main risk factor associated with the Proposed Joint Venture is the risk of termination of the joint venture. The termination will not impact the development of the Central Boulevard Site as the Group has sufficient in depth expertise, financial capabilities, track record of other completed projects in Singapore and is confident that it will be able to proceed with and complete the proposed development of the Central Boulevard Site.

4. STATEMENT BY THE BOARD OF DIRECTORS The Board of the Directors of the Company, after having considered the status of the MOA and the conditions precedent, has decided to exercise its rights under the MOA to issue a notice of termination.

The termination of the MOA is not expected to have any material impact on the earnings per share and net asset per share of the Company.

This announcement is dated 13 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 01:29 AM

|

显示全部楼层

发表于 16-3-2018 01:29 AM

|

显示全部楼层

本帖最后由 icy97 于 16-3-2018 01:46 AM 编辑

失去香港金主负面 IOI產业盘中挫新低

財经 最后更新 2018年03月14日

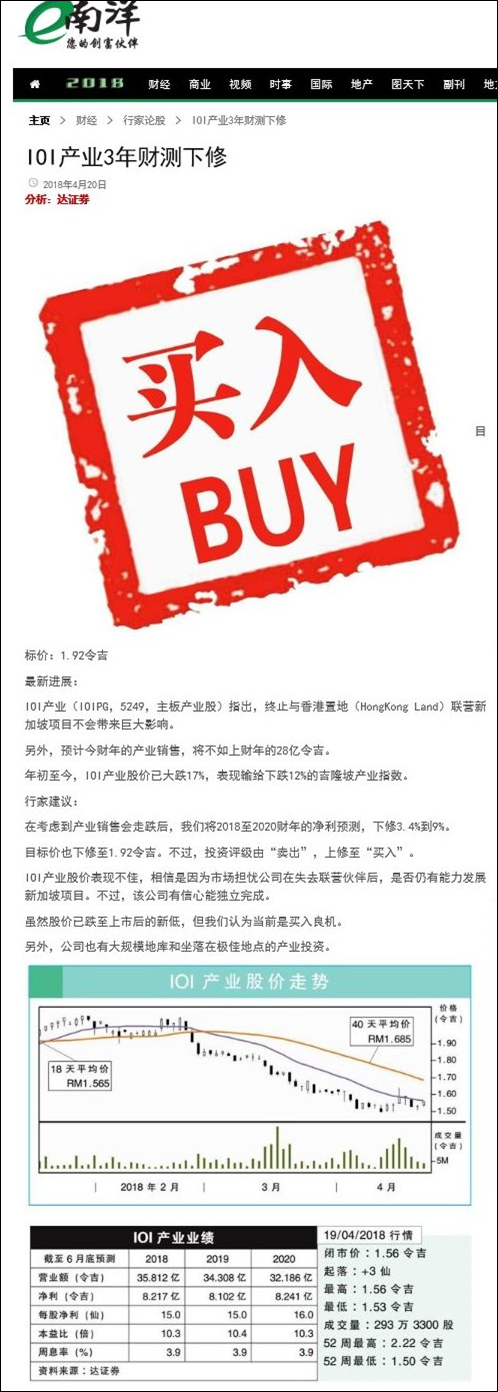

(吉隆坡14日讯)IOI產业(IOIPG,5249,主板產业股)和香港置地国际控股有限公司联营协议告吹,分析员认为,失去国际合作伙伴,IOI產业需独自进行有关项目,可能带来较大的负债压力,因此下修其投资评级和目標价。

上述坏消息致使IOI產业在週三(14日)以1.80令吉开低,並一度跌4仙或2.21%,至1.77令吉,刷新52周新低,之后才稍微收復失地,最后以1.77令吉掛收,全天下滑4仙或2.21%,成交量为528万5500股。

基于一些协议条款未能达成,IOI產业和香港置地国际控股宣布停止联营协议备忘录(MOA),不会联手发展和管理新加坡市中心中央林荫道的一片地皮。这意味著,IOI產业接下来得单枪匹马执行这项发展项目。

分析员皆认为,上述发展对IOI產业来说,是一项负面的消息,並可能推高该公司负债率。

IOI產业是于2016年11月以25亿7000万新元(约76亿3961万令吉)標得中央林荫道地皮,该公司隨后在去年6月与香港置地签署备忘录,成立联营公司联手发展有关土地,香港置地將出资9亿4000万新元,以获得联营公司的33%股权。

MIDF研究分析员指出,当初招揽到这家合作伙伴时,他认为双方联手可缓和IOI產业资產的负债压力,但如今联营协议告吹,则表示IOI產业得独自承担上述项目的融资。

负债率提高

「按7亿至8亿新元的预估建筑成本计算,我们预计,IOI產业净负债率將从2018財政年次季(截至去年12月31日止)的0.6倍,提高至0.68倍。」

丰隆投行分析员也认同,失去在高档办公楼资產管理上拥有丰富经验的香港置地作为伙伴非常可惜,IOI產业也表示暂时无意再找联营伙伴。没有了来自香港置地的资金,IOI產业的净负债率將扩大至0.8倍。

兴业投行分析员也估计,IOI產业需要做出更高的银行借贷,来融资建筑成本,虽然如此,由于整个发展项目会在2022年或2023年竣工,所以其负债不会一下大幅增加,而是每年逐步提高。

为了反映负债成本增加,该分析员把IOI產业2019至2020財政年(6月30日结账)净利预测各下砍2%至4%。並將该公司投资评级从「买进」,下修至「中和」,目標价也从2.19令吉,降低至1.75令吉。

MIDF研究分析员亦把目標价自原本的2.09令吉,下调至1.89令吉,但维持「中和」评级。

至于丰隆投行分析员,则维持「买进」投资评级和目標价2.50令吉不变。【东方网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-4-2018 04:43 AM

|

显示全部楼层

发表于 22-4-2018 04:43 AM

|

显示全部楼层

本帖最后由 icy97 于 23-4-2018 02:55 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 05:11 AM

|

显示全部楼层

发表于 19-5-2018 05:11 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 03:56 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 541,212 | 895,824 | 2,118,635 | 2,990,064 | | 2 | Profit/(loss) before tax | 221,734 | 201,329 | 765,271 | 887,014 | | 3 | Profit/(loss) for the period | 170,435 | 114,094 | 535,604 | 602,460 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 166,647 | 121,136 | 518,638 | 584,234 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.03 | 2.57 | 9.42 | 12.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2700 | 3.3100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2018 05:14 AM

|

显示全部楼层

发表于 2-6-2018 05:14 AM

|

显示全部楼层

本帖最后由 icy97 于 4-6-2018 02:51 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:29 AM

|

显示全部楼层

发表于 28-8-2018 06:29 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | IOI Properties Group Berhad ("IOIPG" or the "Company")- Revaluation in Compliance with Financial Reporting Standard (FRS) 140 | The Board of Directors (the “Board”) of IOIPG is pleased to announce that the Board has approved the incorporation of the net gain arising from fair value adjustment of the investment properties of the Group in its unaudited fourth quarter results for the financial year ended 30 June 2018.

Please refer to the attachment for details of the announcement.

This announcement is dated 27 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5895025

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:33 AM

|

显示全部楼层

发表于 28-8-2018 06:33 AM

|

显示全部楼层

| IOI PROPERTIES GROUP BERHAD |

EX-date | 13 Sep 2018 | Entitlement date | 18 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single tier dividend of 5.0 sen per ordinary share | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Tricor Investor & Issuing House Services Sdn Bhd Unit 32-01, Level 32, Tower A Vertical Business Suite, Avenue 3 Bangsar South, No. 8, Jalan Kerinchi 59200 Kuala Lumpur Tel: +60 3 2783 9299 Fax: +60 3 2783 9222 | Payment date | 28 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 18 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 13 Sep 2018 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:51 AM

|

显示全部楼层

发表于 28-8-2018 06:51 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2018 02:09 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 673,975 | 1,195,297 | 2,792,610 | 4,185,361 | | 2 | Profit/(loss) before tax | 306,261 | 549,611 | 1,071,532 | 1,436,625 | | 3 | Profit/(loss) for the period | 272,540 | 365,366 | 808,144 | 967,826 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 264,993 | 336,636 | 783,631 | 920,870 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.81 | 5.79 | 14.23 | 18.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 6.00 | 5.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3300 | 3.3100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2018 01:44 AM

|

显示全部楼层

发表于 3-9-2018 01:44 AM

|

显示全部楼层

本帖最后由 icy97 于 3-9-2018 07:03 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2018 05:42 AM

|

显示全部楼层

发表于 20-9-2018 05:42 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | IOI Properties Group Berhad ("IOIPG" or the "Company")Incorporation of Subsidiary | The Board of Directors of IOIPG wishes to announce that Palmy Max Limited, an indirect subsidiary of IOIPG, has on 19 September 2018 received a business license for the incorporation of its wholly-owned subsidiary known as IOI (Xiamen) Business Management Co., Ltd. (“IOIXB”) in Xiamen, the People’s Republic of China.

IOIXB was incorporated on 12 September 2018 with a total registered capital of RMB80 million and is currently dormant.

The incorporation of IOIXB will not have a material effect on the earnings or net assets of IOIPG Group for the financial year ending 30 June 2019.

None of the directors or substantial shareholders of IOIPG or persons connected to them has any interest, direct or indirect, in the incorporation of IOIXB.

This announcement is dated 19 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:06 AM

|

显示全部楼层

发表于 18-10-2018 05:06 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | IOI Properties Group Berhad ("IOIPG" or the "Company")Incorporation of Wholly-Owned Subsidiary | The Board of Directors of IOIPG wishes to announce that the Company has on 17 October 2018 incorporated a wholly-owned subsidiary, known as IOI Business Hotel Sdn Bhd (“IOIBH”).

IOIBH was incorporated in Malaysia as a private limited company under the Companies Act, 2016 with share capital of RM100.

IOIBH is currently dormant and its intended principal activity is hotel and hospitality services.

The incorporation of IOIBH is not expected to have any material effect on the earnings per share, net assets per share, gearing, share capital and shareholding structure of IOIPG Group for the financial year ending 30 June 2019.

None of the directors or substantial shareholders of IOIPG or persons connected to them has any interest, direct or indirect, in the incorporation of IOIBH.

This announcement is dated 17 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2018 07:04 AM

|

显示全部楼层

发表于 1-11-2018 07:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2018 06:55 AM

|

显示全部楼层

发表于 10-11-2018 06:55 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2018 03:10 AM

|

显示全部楼层

发表于 5-12-2018 03:10 AM

|

显示全部楼层

本帖最后由 icy97 于 18-12-2018 04:21 AM 编辑

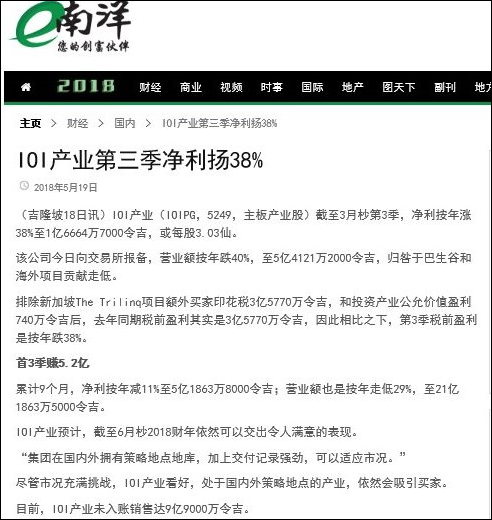

产业发展营收跌44%-ioi产业首季净利减半

http://www.enanyang.my/news/20181125/产业发展营收跌44br-ioi产业首季净利减半/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 560,062 | 882,767 | 560,062 | 882,767 | | 2 | Profit/(loss) before tax | 202,154 | 371,562 | 202,154 | 371,562 | | 3 | Profit/(loss) for the period | 113,044 | 253,222 | 113,044 | 253,222 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 111,958 | 245,104 | 111,958 | 245,104 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.03 | 4.45 | 2.03 | 4.45 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3200 | 3.3300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2019 03:35 AM

|

显示全部楼层

发表于 6-1-2019 03:35 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2019 07:16 AM

|

显示全部楼层

发表于 3-3-2019 07:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 666,150 | 695,407 | 1,226,212 | 1,578,174 | | 2 | Profit/(loss) before tax | 355,012 | 159,533 | 557,166 | 531,095 | | 3 | Profit/(loss) for the period | 214,582 | 102,499 | 327,626 | 355,721 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 214,864 | 97,451 | 326,822 | 342,555 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.90 | 1.77 | 5.94 | 6.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3600 | 3.3300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2019 10:25 AM

|

显示全部楼层

发表于 2-6-2019 10:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2019 07:57 AM

|

显示全部楼层

发表于 30-6-2019 07:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 487,739 | 510,518 | 1,699,723 | 2,065,732 | | 2 | Profit/(loss) before tax | 300,902 | 201,253 | 858,068 | 732,348 | | 3 | Profit/(loss) for the period | 193,286 | 159,935 | 520,912 | 515,656 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 194,700 | 156,159 | 521,522 | 498,714 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.54 | 2.84 | 9.47 | 9.06 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3800 | 3.3300

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|