|

|

【RANHILL 5272 交流专区】【前身 SYMPHNY (0016) 】

[复制链接]

[复制链接]

|

|

|

发表于 22-5-2018 02:54 AM

|

显示全部楼层

发表于 22-5-2018 02:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2018 06:56 AM

|

显示全部楼层

发表于 19-7-2018 06:56 AM

|

显示全部楼层

联熹联号公司获沙巴KPOC-Kebabangan平台3年合约

theedgemarkets.com

July 18, 2018 15:55 pm +08

(吉隆坡18日讯)联熹控股(Ranhill Holdings Bhd)联号公司Perunding Ranhill Worley私人有限公司(PRW)赢得Kebabangan Petroleum Operating Co私人有限公司(KPOC)的合约,为其位于沙巴KPOC-Kebabangan北部枢纽平台提供工程支援和设计服务。

合约价值并没有披露。

KPOC是一家联合营运公司,国油勘探(Petronas Carigali)持有40%,而Conoco Philips Sabah Gas Ltd和Shell Energy Asia Ltd各持30%。

PRW今日在文告指出,合约期限为3年,可选择延长1年,涵盖工程和设计服务。这包括特殊工程研究、概念工程、基础工程和工程支援。

PRW总执行长Mohamad Embong表示:“今日的签约仪式亦标志着我们的重要里程碑,因为我们开始向沙巴扩展,为PRW长期增长策略的一部分。”

(编译:陈慧珊) |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2018 03:22 AM

|

显示全部楼层

发表于 10-8-2018 03:22 AM

|

显示全部楼层

本帖最后由 icy97 于 11-8-2018 05:41 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 379,470 | 367,983 | 739,756 | 719,933 | | 2 | Profit/(loss) before tax | 43,374 | 51,719 | 91,658 | 94,847 | | 3 | Profit/(loss) for the period | 26,310 | 29,049 | 57,250 | 55,579 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 15,432 | 14,514 | 33,572 | 30,208 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.74 | 1.63 | 3.78 | 3.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6500 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2018 03:27 AM

|

显示全部楼层

发表于 10-8-2018 03:27 AM

|

显示全部楼层

EX-date | 23 Aug 2018 | Entitlement date | 27 Aug 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | First interim single tier dividend of 2.0 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 06 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 27 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-8-2018 02:23 AM

|

显示全部楼层

发表于 23-8-2018 02:23 AM

|

显示全部楼层

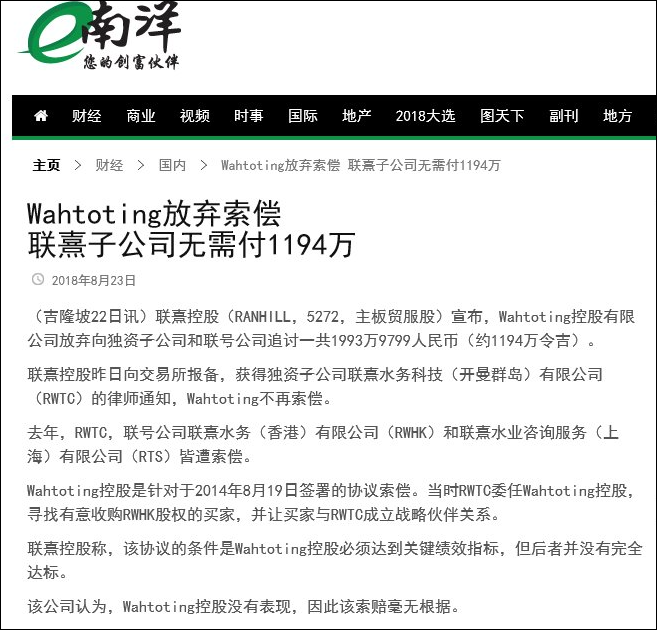

Type | Announcement | Subject | OTHERS | Description | RANHILL HOLDINGS BERHAD ("RANHILL" OR "THE COMPANY")Claims brought by Wahtoting Holding Limited ("Claimant") in the court in the People's Republic of China against Ranhill Water Technologies (Cayman) Ltd ("RWTC") and our associate companies, Ranhill Water (Hong Kong) Limited and Ranhill Technologies (Shanghai) Ltd | We refer to our announcements dated 2 November 2017, 7 November 2017 and 10 November 2017.

We wish to announce that today, we have been advised by the counsel for Ranhill Water Technologies (Cayman) Ltd (“RWTC”) that the claims have been dropped by Wahtoting Holding Limited (“Claimant”).

We had previously announced that a suit was brought against our wholly-owned subsidiary, RWTC and our associate companies, Ranhill Water (Hong Kong) Limited and Ranhill Technologies (Shanghai) Ltd by the Claimant in the court in the People’s Republic of China for the alleged non-payment of fees in the amount RMB19,939,799.14 (equivalent to approximately RM12.76 million based on Bank Negara Malaysia’s exchange rate at the announcement date as at 2 November 2017). We were of the firm view that the allegation was without merit and that the claim was frivolous and baseless.

None of the directors, major shareholders and persons connected with the directors and major shareholders of Ranhill Holdings Berhad has any interest, direct or indirect, in the above matter.

This announcement is dated 21 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2018 06:20 AM

|

显示全部楼层

发表于 27-9-2018 06:20 AM

|

显示全部楼层

Name | TAN SRI HAMDAN MOHAMAD | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 25 Sep 2018 | 17,760,000 | Acquired | Direct Interest | Name of registered holder | MIDF AMANAH INVESTMENT NOMINEES (TEMPATAN) SDN BHD PLEDGED SECURITIES ACCOUNT FOR HAMDAN MOHAMAD | Address of registered holder | Level 15 Menara MIDF 82 Jalan Raja Chulan 50200 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Direct Business Transaction | Nature of interest | Direct Interest | Direct (units) | 58,130,000 | Direct (%) | 6.544 | Indirect/deemed interest (units) | 257,240,098 | Indirect/deemed interest (%) | 28.958 | Total no of securities after change | 315,370,098 | Date of notice | 26 Sep 2018 | Date notice received by Listed Issuer | 26 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 04:58 AM

|

显示全部楼层

发表于 16-10-2018 04:58 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 06:41 AM

|

显示全部楼层

发表于 30-10-2018 06:41 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | RANHILL HOLDINGS BERHAD ("THE COMPANY" OR "RANHILL") | We refer to our earlier announcements dated 12 February 2018, 5 September 2016 and 4 October 2016.

The Energy Commission has issued a letter dated 26 October 2018 to the consortium consisting of SM Hydro Energy Sdn Bhd (“SMHE”) and Sabah Development Energy (Sandakan) Sdn Bhd (“SDESB”) informing SMHE and SDESB on the cancellation of the proposed 300MW combined cycle gas turbine power plant in Sandakan. In its letter, the Energy Commission stated that it was informed by the Ministry of Energy, Science, Technology, Environment and Climate Change through a letter dated 25 October 2018 that the Government has decided to rescind its decision on the implementation of the project.

SMHE is a wholly-owned subsidiary of Ranhill Capital Sdn Bhd, which in turn is a wholly-owned subsidiary of Ranhill.

This announcement is dated 29 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-11-2018 07:40 AM

|

显示全部楼层

发表于 4-11-2018 07:40 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | RANHILL CORPORATION SDN BHD | Address | No. 39-43, Jalan Desa

Taman Desa, Off Jalan Kelang Lama

KUALA LUMPUR

58200 Wilayah Persekutuan

Malaysia. | Company No. | 352984-X | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 31 Oct 2018 | Name & address of registered holder | Ranhill Corporation Sdn BhdNo. 39-43, Jalan Desa, Taman DesaOff Jalan Kelang Lama58200 Kuala Lumpur |

No of securities disposed | 65,830,466 | Circumstances by reason of which a person ceases to be a substantial shareholder | Transfer to Hamdan (L) Foundation by way of Endowment with prior approval of Bursa Malaysia Depository Sdn Bhd. | Nature of interest | Direct Interest |  | Date of notice | 31 Oct 2018 | Date notice received by Listed Issuer | 31 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-11-2018 07:41 AM

|

显示全部楼层

发表于 4-11-2018 07:41 AM

|

显示全部楼层

Name | HAMDAN (L) FOUNDATION | Address | Level 5 (l), Main Office Tower, Financial Park Complex, Jalan Merdeka

87000 Labuan

Malaysia. | Company No. | LAF00157 | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 31 Oct 2018 | 65,830,466 | Transferred | Direct Interest | Name of registered holder | Hamdan (L) Foundation ("HLF") | Address of registered holder | Level 5(I), Main Office Tower, Financial Park Complex, Jalan Merdeka, 87000 Federal Territory of Labuan | Description of "Others" Type of Transaction | Transferred from RC | | 2 | 31 Oct 2018 | 65,830,466 | Transferred | Indirect Interest | Name of registered holder | Ranhill Corporation Sdn Bhd ("RC") | Address of registered holder | No. 39-43, Jalan Desa, Taman Desa, Off Jalan Kelang Lama, 58200 Kuala Lumpur | Description of "Others" Type of Transaction | Transferred to HLF |

Circumstances by reason of which change has occurred | Transfer from Ranhill Corporation Sdn Bhd by way of endowment with prior approval of Bursa Malaysia Depository Sdn Bhd | Nature of interest | Direct Interest | Direct (units) | 81,442,504 | Direct (%) | 9.168 | Indirect/deemed interest (units) | 191,167,594 | Indirect/deemed interest (%) | 21.52 | Total no of securities after change | 272,610,098 | Date of notice | 31 Oct 2018 | Date notice received by Listed Issuer | 31 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 05:49 AM

|

显示全部楼层

发表于 18-11-2018 05:49 AM

|

显示全部楼层

本帖最后由 icy97 于 21-11-2018 07:38 AM 编辑

柔州水供和污水处理账单将合并

http://www.chinapress.com.my/20181109/柔州水供和污水处理账单将合并/

Type | Announcement | Subject | OTHERS | Description | RANHILL HOLDINGS BERHAD ("RANHILL" OR "THE COMPANY")Joint Billing Arrangement Between Ranhill SAJ Sdn Bhd (formerly known as SAJ Ranhill Sdn Bhd) ("SAJ") and Indah Water Konsortium Sdn Bhd ("IWK") | (Reference is made to the announcements dated 1 December 2016, 28 February 2017, 19 May 2017, 28 August 2017, 13 November 2017, 13 February 2018, 7 May 2018 and 9 August 2018 made by Ranhill pertaining to the Memorandum of Understanding between Ranhill’s subsidiary, Ranhill SAJ Sdn Bhd (formerly known as SAJ Ranhill Sdn Bhd) (“SAJ”) and Indah Water Konsortium Sdn Bhd (“IWK”)

1. INTRODUCTION The Company is pleased to announce that its subsidiary, SAJ has concluded the Memorandum of Understanding on the Joint Billing Arrangement between SAJ and IWK, and have signed the Joint Billing Agreement on 7 November 2018, to undertake the joint billing exercise for water supply and sewerage services in the state of Johor (excluding Johor Bahru City and Pasir Gudang which are currently managed by respective city councils) with the intention to pursue the integration of water supply and sewerage services in the state of Johor.

2. INFORMATION SAJ is the sole licensee for water treatment and distribution in the state of Johor pursuant to the license issued by National Water Service Industry Commission. IWK is a company owned by Minister of Finance Incorporated, is Malaysia’s national sewerage company which has been entrusted with the task of developing and maintaining sewerage system. The joint billing exercise involved the development of a combined bill incorporating the prevailing water supply tariff and sewerage tariff rate in a single bill, with an agreed fee payable to SAJ by IWK for every joint bills issued by SAJ. Upon successful implementation of the joint billing exercise and subject to approvals from the relevant authorities, SAJ will pursue a complete integration of water supply and sewerage operations, and ultimately take over the sewerage operations in the state of Johor.

3. FINANCIAL EFFECTS The joint billing exercise will not have any material effects on the earnings of the Company for the financial year ending 31 December 2018.

4. DIRECTORS’ AND MAJOR SHAREHOLDERS’ AND/ OR PERSONS CONNECTED WITH A DIRECTOR OR MAJOR SHAREHOLDER’S INTEREST

None of the Directors and/ or substantial shareholders of the Company and persons connected with them has any interest, direct or indirect, in the Joint Billing Agreement.

This announcement is dated 8 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2018 06:58 AM

|

显示全部楼层

发表于 21-11-2018 06:58 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:40 AM

|

显示全部楼层

发表于 27-11-2018 03:40 AM

|

显示全部楼层

本帖最后由 icy97 于 14-12-2018 06:28 AM 编辑

利息开销拖累.联熹第三季净利挫35%

http://www.sinchew.com.my/node/1812311/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 401,939 | 383,549 | 1,141,695 | 1,103,482 | | 2 | Profit/(loss) before tax | 44,804 | 47,316 | 136,462 | 142,163 | | 3 | Profit/(loss) for the period | 28,428 | 34,181 | 85,678 | 89,760 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 16,485 | 25,196 | 50,057 | 55,404 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.86 | 2.84 | 5.64 | 6.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 1.00 | 2.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6500 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:42 AM

|

显示全部楼层

发表于 27-11-2018 03:42 AM

|

显示全部楼层

EX-date | 27 Nov 2018 | Entitlement date | 29 Nov 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Second interim single tier dividend of 2.0 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel:0378490777Fax:0378418151 | Payment date | 13 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-12-2018 05:23 AM

|

显示全部楼层

发表于 13-12-2018 05:23 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2018 03:00 AM

|

显示全部楼层

发表于 14-12-2018 03:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 04:58 AM

|

显示全部楼层

发表于 9-2-2019 04:58 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | RANHILL HOLDINGS BERHAD ("RANHILL" or "the Company"):COMMENCEMENT OF OPERATIONS FOR THE COMPLETED 7 MLD RECLAMATION WATER TREATMENT PLANT IN AMATA CITY PHASE 4 INDUSTRIAL ESTATE, THAILAND | Pursuant to the Company’s earlier announcements on 20 October 2017 and 2 March 2018, RANHILL wishes to inform that the new seven (7) million litres per day (“MLD”) reclamation water treatment plant in Thailand’s Amata City Rayong Industrial Estate has commenced operations.

The official opening of the plant was officiated by Deputy Prime Minister of Malaysia Y.A.B. Dato' Seri Dr. Wan Azizah Dr. Wan Ismail today. The ceremony was also attended by Malaysian Ambassador to Thailand H.E. Dato’ Jojie Samuel, Ranhill Group’s President and Chief Executive Tan Sri Hamdan Mohamad, while Bangkok-based Amata Industrial Park was represented by Mr Chu Chat Saitin, Amata Water Managing Director.

The build, operate and transfer (“BOT”) project with a 20-year concession agreement was signed between RANHILL’s indirect subsidiary AnuRAK Water Treatment Facilities Co Ltd and Amata Water Co Ltd in March 2018. The completion of this BOT project brings the Group’s investment in the water treatment, wastewater treatment and water reclamation plants in Thailand to THB992 million, capable of generating water, waste water and reclaim water sales of over THB4,100 million throughout the concession period.

With the completion of this project, Ranhill Group currently has two water reclamation projects in Thailand with a total capacity of 17MLD. In addition to the 7MLD plant, RANHILL also ‘build and operate’ a similar 10MLD facility in Amata City Chonburi (formerly known as Amata Nakorn) which has been in operation since 2008 and performing well. With 10 water treatment, wastewater treatment and water reclamation plants in operations, RANHILL’s total water treatment aggregate capacity in Thailand now stands at 114MLD.

Please find attached the news release for more detail information.

This announcement is dated 25 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6047373

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 05:25 AM

|

显示全部楼层

发表于 12-2-2019 05:25 AM

|

显示全部楼层

Date of change | 02 Feb 2019 | Name | TAN SRI MOHAMED AZMAN BIN YAHYA | Age | 55 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Non-Independent Director | New Position | Independent Director | Directorate | Independent and Non Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Science (First Class Honours) in Economics | London School of Economics and Political Science | | | 2 | Professional Qualification | Accounting | Member of the Institute of Chartered Accountants in England and Wales | | | 3 | Professional Qualification | Banking | Fellow of the Institute of Bankers | | | 4 | Professional Qualification | Accounting | Member of the Malaysian Institute of Accountants | |

Working experience and occupation | Tan Sri Azman Yahya started his career at KPMG in London. In 1988 he returned to Malaysia where he built his career in investment banking to become the Chief Executive of Amanah Merchant Bank.During the Asian Financial Crisis in 1998, Tan Sri Azman was tasked by the Malaysian Government to set-up and head Danaharta, the national asset management company to acquire, manage and resolve the non-performing loans in the banking sector. He was also the Chairman of Corporate Debt Restructuring Committee, set up by Bank Negara Malaysia, to mediate and assist in debt restructuring programmes of viable companies.In 2003, he returned to the private sector and is currently the Executive Chairman of Symphony Life Berhad. | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest: 1,500,000 ordinary shares (0.169%)Indirect interest: 1. Virtuoso Capital Sdn Bhd - 14,000,000 ordinary shares (1.576%) 2. CIMB Trustees Berhad (TR1032) - 2,500,000 ordinary shares (0.281%) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2019 07:53 AM

|

显示全部楼层

发表于 23-2-2019 07:53 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | RANHILL HOLDINGS BERHAD ("RANHILL or "The Company"): - COLLABORATION AGREEMENT TO BE ENTERED WITH TREASURE SPECIALTY CO. LTD ("TS Co") | 1. INTRODUCTION The Board of Directors of Ranhill Holdings Berhad (“Board”) wishes to announce that Ranhill Holdings Bhd’s Board had on 20 February 2019 approved the execution of the collaboration agreement (“Collaboration Agreement”) to be entered with Treasure Specialty Co. Ltd (“TS Co”).

The Collaboration Agreement expressed the intentions of the parties to explore the establishment of a partnership, co-operation or collaboration (“Collaboration”) and to develop the proposal to build, operate and own (“BOO”) 1150MW combined cycle gas turbine power plant in Kedah, Malaysia (“Project”) with the intention to export the entire power generated from the power plant to Thailand.

2. INFORMATION ON TS Co

TS Co is registered as a private limited company in Thailand, having its business office at 54 BB Tower, 17th Floor, Room No. 1706, Klongtoey-Nua, Wattana, Bangkok 10110, Thailand.

TS Co is currently the advisor for RANHILL’s Thai water businesses and moving forward will jointly develop and co-invest with RANHILL in new water concessions in Thailand. For the purpose of the Project, TS Co will be the co-promoter of the Project with RANHILL and will take the lead in project development aspect on the Thailand side.

3. SALIENT TERMS OF THE COLLABORATION AGREEMENT

3.1 Proposed Collaboration and Time Frame for the Project The parties have agreed to explore the Collaboration on an exclusive basis based on their respective expertise and resources. RANHILL and TS Co agree to mutually discuss and collaborate for a period of six (6) months from the date of the Collaboration Agreement or such period as may be mutually extended by the parties.

Parties further agreed that TS Co and its group of investors, may subscribe up to 30% of the interest in the Project whereas RANHILL may subscribe to no less than 70% interest in the Project. Both parties will be responsible to source for its own equity injection and may source for additional investors.

3.2 Purpose The purpose of the collaboration is to propose the development of a 1150MW gas-fired combined cycle gas turbine (“CCGT”) power plant project in Kedah which will dispatch the entire of its generation capacity (100%) to Thailand through a dedicated transmission line with interconnection to substation interconnection in Thailand.

The parties believe that the proposed Project, utilising existing infrastructures for gas-fired CCGT, will be able to provide a cost competitive solution to the provision of clean electricity power to the provinces of Southern Thailand.

4. EFFECTS OF THE COLLABORATION

The Collaboration Agreement will regulate the relationship between the parties and define their strategic alliance and co-operation for the purposes of jointly submitting to the authorities in both Malaysia and Thailand the proposal for the Project.

The Board believes that the Collaboration Agreement will provide the platform for the Consortium to move forward in the Project and undertake other development requirements pursuant to the guidelines of The Sub-Committee on Electric Power Cooperation between Thailand and Neighbouring Countries (“S-ECTN”), Ministry of Energy Thailand.

5. RISK FACTORS

The Board is of the view that execution of the Collaboration Agreement does not entail any legal or financial risk.

6. FINANCIAL EFFECTS OF THE COLLABORATION AGREEMENT

The execution of the Collaboration Agreement will not have any material effect on the earnings, net assets and gearing of RANHILL for the current financial year ending 31 December 2019. The execution of the Collaboration Agreement has no effect on the issued and paid-up share capital and the substantial shareholders’ shareholdings of RANHILL.

7. DIRECTORS AND MAJOR SHAREHOLDERS’ INTEREST

None of the Directors, Substantial Shareholders of the Company and persons connected to them has any interest, direct and/or indirect, in the Collaboration Agreement.

8. STATEMENT BY DIRECTORS

The Board, having taken into consideration all aspects of the Collaboration Agreement, is of the opinion that the Collaboration Agreement is in the best interest of RANHILL Group.

9. APPROVALS REQUIRED

The Collaboration Agreement is not subject to any approvals.

However, the Project is subject to approval from relevant authorities in both Malaysia and Thailand.

10. DOCUMENTS FOR INSPECTION

The Collaboration Agreement will be made available for inspection at the Company’s registered office Bangunan Ranhill SAJ, Jalan Garuda, Larkin, 80350 Johor Bahru, Johor, Malaysia during normal office hours from Mondays to Fridays (except on public holidays) for a period of twelve (12) months from the date of the execution of the Collaboration Agreement.

This announcement is dated 20 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2019 07:13 AM

|

显示全部楼层

发表于 12-3-2019 07:13 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 418,161 | 375,237 | 1,559,856 | 1,478,719 | | 2 | Profit/(loss) before tax | 19,151 | 55,935 | 155,613 | 198,098 | | 3 | Profit/(loss) for the period | 2,861 | 30,816 | 88,539 | 120,576 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,509 | 16,948 | 45,548 | 72,352 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.51 | 1.91 | 5.13 | 8.14 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 4.00 | 4.00 | 5.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6200 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|