|

|

【REACH 5256 交流专区】Reach能源

[复制链接]

[复制链接]

|

|

|

发表于 29-9-2018 06:56 AM

|

显示全部楼层

发表于 29-9-2018 06:56 AM

|

显示全部楼层

本帖最后由 icy97 于 30-9-2018 07:59 AM 编辑

Type | Announcement | Subject | OTHERS | Description | REACH ENERGY BERHAD ("REB" or "the Company")- AUTHORITY APPROVAL TO COMMENCE TRIAL PRODUCTION PERIOD OF THE NORTH KARIMAN FIELD FOR 15 MONTHS | The Board of Directors of REB wishes to announce that its producing asset in Kazakhstan, Emir-Oil LLP (“Emir-Oil”), has obtained authority approval to commence Trial Production Period ("TPP") of the North Kariman ("NK") Field for 15 months, from 1 October 2018 to 31 December 2019. The TPP approval allows Emir-Oil to put the NK wells on production, and this is expected to increase current oil production levels substantially.

The approval of TPP for NK Field is a clear signal of the authority for the Company to proceed with the processes required to obtain a new Production Contract for the NK Field.

This announcement is dated 28 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 04:57 AM

|

显示全部楼层

发表于 11-10-2018 04:57 AM

|

显示全部楼层

本帖最后由 icy97 于 14-10-2018 05:03 AM 编辑

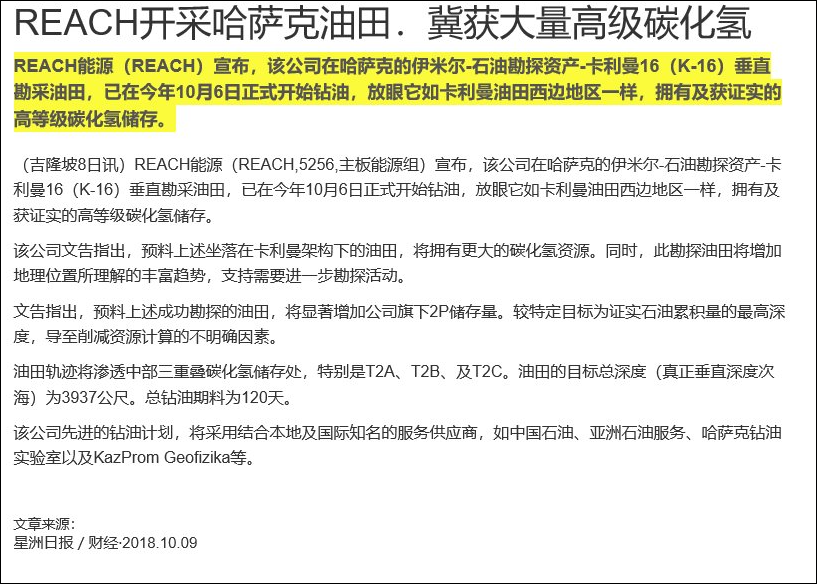

Type | Announcement | Subject | OTHERS | Description | REACH ENERGY BERHAD ("REB" or "the Company")- Spudding of Exploration Well, K-16 in Kariman Field in Kazakhstan | The Board of Directors of REB wishes to announce that as part of Emir Oil's exploration commitment, the Kariman #16 (K-16) vertical exploration well ("K-16 Well") has been spud on 6 October 2018, targeting an identified highly graded hydrocarbon trap in close proximity to the west flank of Kariman field.

Please refer to the attachment on the writeup of K-16 Well for more information.

This announcement is dated 8 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5935397

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-10-2018 05:12 AM

|

显示全部楼层

发表于 14-10-2018 05:12 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2018 04:19 AM

|

显示全部楼层

发表于 26-10-2018 04:19 AM

|

显示全部楼层

本帖最后由 icy97 于 31-10-2018 05:06 AM 编辑

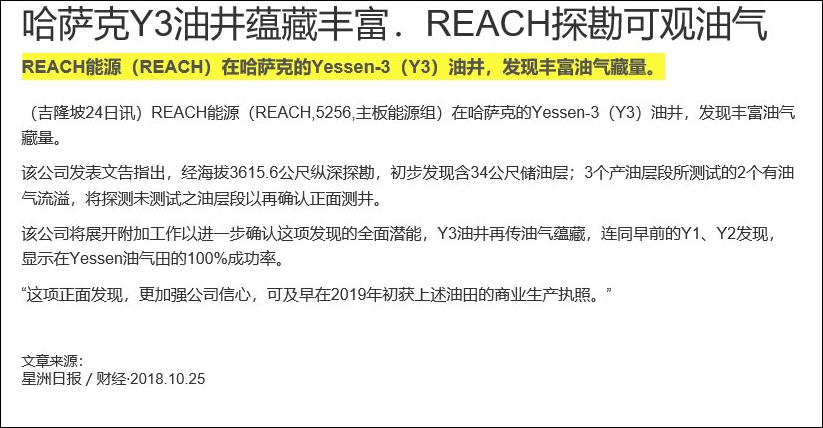

Type | Announcement | Subject | OTHERS | Description | REACH ENERGY BERHAD ("REB" or "the Company")- Results of Yessen-3 Exploration Well (Y-3) | The Board of Directors of REB wishes to announce the positive results arising from subsequent testing and evaluations of the Yessen-3 exploration well (Y-3), which was drilled and completed on 19 September 2016. The Y-3 well was drilled in the eastern section of the Yessen Field, located within the Emir-Oil Concession Block in Kazakhstan.

Please refer to the Attachment on the Y-3 results for more information.

This announcement is dated 24 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5952293

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2018 02:22 AM

|

显示全部楼层

发表于 1-12-2018 02:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 06:36 AM

|

显示全部楼层

发表于 2-1-2019 06:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 40,836 | 22,106 | 150,987 | 107,468 | | 2 | Profit/(loss) before tax | -13,861 | -23,651 | -42,176 | -63,751 | | 3 | Profit/(loss) for the period | -18,287 | -20,508 | -40,986 | -59,522 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,125 | -12,312 | -14,928 | -36,574 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.01 | -0.01 | -0.01 | -0.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7300 | 0.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2019 07:07 AM

|

显示全部楼层

发表于 3-1-2019 07:07 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2019 04:01 AM 编辑

icy97 发表于 10-2-2018 04:21 AM

REACH哈萨克油田勘探井投运

(吉隆坡9日讯)REACH能源(REACH,5256,主板工业产品组)在哈萨克Kariman北部油田的勘探井已投入营运,以鉴定潜在石油蕴藏。

该公司发文告表示,此次勘探期为85日,而鉴于Kariman北 ...

reach能源-哈萨克发现新油藏

http://www.enanyang.my/news/20181204/reach能源br-哈萨克发现新油藏/

Type | Announcement | Subject | OTHERS | Description | REACH ENERGY BERHAD ("REB" or "the Company")- Results of Exploration Well, North Kariman (NK-3) | Reference is made to the Company's previous announcement dated 9 February 2018 (Reference number GA1-09022018-00018) pertaining to the Spudding of Exploration Well in North Kariman Field in Kazakhstan.

In relation thereto, the Board of Directors of REB wishes to announce the positive results of the North Kariman-3 Exploration Well (NK-3). The NK-3 well was drilled in close proximity to the North Kariman field, located within the Emir-Oil Concession Block in Kazakhstan.

Please refer to the attachment on North Kariman ( NK-3) results for more information.

This announcement is dated 3 December 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5994669

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2019 05:06 AM

|

显示全部楼层

发表于 26-1-2019 05:06 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | LEMBAGA TABUNG HAJI | Address | 201, Jalan Tun Razak, Peti Surat No. 11025

Kuala Lumpur

50732 Wilayah Persekutuan

Malaysia. | Company No. | ACT 5351995 | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 28 Dec 2018 | Name & address of registered holder | Lembaga Tabung Haji 201, Jalan Tun Razak Peti Surat No. 1102550732 Kuala LumpurMaybank Asset Management Sdn BhdLevel 12 Tower C Dataran MaybankNo 1 Jln Maarof59000 Kuala Lumpur |

No of securities disposed | 106,480,800 | Circumstances by reason of which a person ceases to be a substantial shareholder | Transfer of Shares to URUSHARTA JAMAAH SDN. BHD. as a result of the restructuring exercise - 106,480,800 units | Nature of interest | Direct Interest |  | Date of notice | 28 Dec 2018 | Date notice received by Listed Issuer | 28 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2019 06:00 AM

|

显示全部楼层

发表于 27-1-2019 06:00 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | REACH ENERGY BERHAD ("REB" or "the Company")- Spudding of Exploration Well, K-15 in Kariman Field in Kazakhstan | The Board of Directors of REB wishes to announce that as part of Emir Oil's exploration commitment, the Kariman 15 (K-15) vertical exploration well was spud on 30 December 2018, targeting an identified highly graded hydrocarbon trap in close proximity to the northwest flank of the Kariman field.

Please refer to the attachment on K-15 Well for more information.

This announcement is dated 2 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6024625

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2019 07:28 AM

|

显示全部楼层

发表于 12-3-2019 07:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 69,297 | 49,647 | 220,284 | 157,115 | | 2 | Profit/(loss) before tax | -333 | -57,954 | -42,507 | -121,705 | | 3 | Profit/(loss) for the period | -19,782 | -87,664 | -60,766 | -147,186 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -29,506 | -51,262 | -44,434 | -87,836 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.03 | -0.05 | -0.04 | -0.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7700 | 0.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-5-2019 07:29 AM

|

显示全部楼层

发表于 14-5-2019 07:29 AM

|

显示全部楼层

Name | REACH ENERGY HOLDINGS SDN BHD | Address | D3-5-8, Level U5, Block D3

Solaris Dutamas

No. 1, Jalan Dutamas 1

Kuala Lumpur

50480 Wilayah Persekutuan

Malaysia. | Company No. | 1034624-D | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 11 Apr 2019 | 25,000,000 | Disposed | Direct Interest | Name of registered holder | Reach Energy Holdings Sdn Bhd | Address of registered holder | D-3-5-8, Level U5, Block D3 Solaris Dutamas No. 1, Jalan Dutamas 1 50480 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal (off-market) | Nature of interest | Direct Interest | Direct (units) | 230,600,200 | Direct (%) | 21.032 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 230,600,200 | Date of notice | 16 Apr 2019 | Date notice received by Listed Issuer | 16 Apr 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2019 07:47 AM

|

显示全部楼层

发表于 2-6-2019 07:47 AM

|

显示全部楼层

Name | REACH ENERGY HOLDINGS SDN BHD | Address | D3-5-8, Level U5, Block D3

Solaris Dutamas

No. 1, Jalan Dutamas 1

Kuala Lumpur

50480 Wilayah Persekutuan

Malaysia. | Company No. | 1034624-D | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 23 Apr 2019 | 40,000,000 | Disposed | Direct Interest | Name of registered holder | Reach Energy Holdings Sdn Bhd | Address of registered holder | D3-5-8, Level U5, Block D3 Solaris Dutamas No. 1, Jalan Dutamas 1 50480 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal (off-market) | Nature of interest | Direct Interest | Direct (units) | 190,600,200 | Direct (%) | 17.384 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 190,600,200 | Date of notice | 26 Apr 2019 | Date notice received by Listed Issuer | 26 Apr 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2019 07:00 AM

|

显示全部楼层

发表于 30-6-2019 07:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 50,774 | 42,481 | 50,774 | 42,481 | | 2 | Profit/(loss) before tax | -20,116 | -40,873 | -20,116 | -40,873 | | 3 | Profit/(loss) for the period | -12,755 | -27,281 | -12,755 | -27,281 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -12,881 | -21,029 | -12,881 | -21,029 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.01 | -0.02 | -0.01 | -0.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7600 | 0.7800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-7-2019 06:49 AM

|

显示全部楼层

发表于 13-7-2019 06:49 AM

|

显示全部楼层

Particulars of substantial Securities HolderName | REACH ENERGY HOLDINGS SDN BHD | Address | D3-5-8, Level U5, Block D3

Solaris Dutamas

No. 1, Jalan Dutamas 1

Kuala Lumpur

50480 Wilayah Persekutuan

Malaysia. | Company No. | 1034624-D | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 12 Jun 2019 | 62,800,100 | Disposed | Direct Interest | Name of registered holder | Reach Energy Holdings Sdn Bhd | Address of registered holder | D3-5-8, Level U5, Block D3 Solaris Dutamas No. 1, Jalan Dutamas 1 50480 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal (off-market) | Nature of interest | Direct Interest | Direct (units) | 127,800,100 | Direct (%) | 11.656 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 127,800,100 | Date of notice | 14 Jun 2019 | Date notice received by Listed Issuer | 14 Jun 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2019 07:41 AM

|

显示全部楼层

发表于 24-8-2019 07:41 AM

|

显示全部楼层

本帖最后由 icy97 于 24-8-2019 09:16 AM 编辑

reach能源次季转亏

https://www.enanyang.my/news/20190824/reach能源次季转亏/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 47,070 | 67,670 | 97,844 | 110,151 | | 2 | Profit/(loss) before tax | -9,344 | 12,558 | -29,460 | -28,315 | | 3 | Profit/(loss) for the period | -16,994 | 4,582 | -29,749 | -22,699 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -11,386 | 11,227 | -24,267 | -9,802 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.02 | 0.01 | -0.03 | -0.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7600 | 0.7800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2019 05:22 AM

|

显示全部楼层

发表于 30-8-2019 05:22 AM

|

显示全部楼层

本帖最后由 icy97 于 5-9-2019 06:23 AM 编辑

Type | Announcement | Subject | OTHERS | Description | REACH ENERGY BERHAD ("REB" OR "THE COMPANY") - CLARIFICATION ON NEWS ARTICLE IN STARBIZ ON TUESDAY, 27 AUGUST 2019 | Reference is made to the article titled “Reach to buy remaining 40% in Emir-Oil Concession” which appeared in the Business News, The Star Online on 27 August 2019 (“the Article”).

The Board of Directors (“Board”) of REB wishes to announce that it is in the process of making due inquiries with regards to the highly specific statements made in the Article, with the intention of making a further announcement in response to the Article.

The Board is cognisant of the need for proper dissemination of information to the public and would release announcement on Bursa Securities on any material issue on a timely basis as required by the Main Market Listing Requirements of the Bursa Securities.

The Company will continue to monitor rumours, reports or inaccurate information affecting the Company. The Company views this matter seriously and is considering all appropriate action including legal recourse as it deems fit against any party that initiates, disseminates or circulates baseless allegations or rumours.

This announcement is dated 28 August 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-9-2019 06:23 AM

|

显示全部楼层

发表于 5-9-2019 06:23 AM

|

显示全部楼层

本帖最后由 icy97 于 5-9-2019 07:11 AM 编辑

reach能源驳斥报道-没洽购emir油田余股

https://www.enanyang.my/news/20190904/reach能源驳斥报道-br没洽购emir油田余股/

Type | Announcement | Subject | OTHERS | Description | REACH ENERGY BERHAD ("REB" OR "THE COMPANY") - CLARIFICATION ON NEWS ARTICLE IN STARBIZ ON TUESDAY, 27 AUGUST 2019 |

Reference is made to the article titled “Reach to buy remaining 40% in Emir-Oil Concession” which appeared in the Business News, The Star Online on 27 August 2019 (“the Article”), and to the Company’s announcements on 28 August 2019 and 29 August 2019.

Having made due and appropriate inquiries, the Board has identified certain statements contained in the Article which are untrue and/or unfounded.

Alleged acquisition of MIE Holdings Corporation’s 40% interest in Palaeontol B.V.

Whilst the Company is continuously exploring investment prospects, including potential corporate and asset acquisitions, the Board denies that, as at the date of this announcement, the Company has entered into any arrangements or negotiations with MIE Holdings Corporation (“MIE”) for the acquisition of MIE’s 40% interest in Palaeontol B.V. (“PBV”) which holds, via Emir-Oil LLP (“Emir-Oil”), the entire working interest in an approximately 850.3 square kilometres onshore contracted area located in the Mangystau Oblast in the southwestern region of the Republic of Kazakhstan (the “Emir-Oil Asset”).

Furthermore, the Company has not received any offer from MIE for any such acquisition of MIE’s interest in PBV, nor has any offer been made to MIE to acquire the same.

Untrue statement that funding of up to US$110million has been secured from a PE Fund

The Article also alleges that the Company has secured funding of up to US$110 million from a private equity fund.

The Board wishes to clarify that whilst the Company is actively exploring funding and financing options to facilitate the administration of its investment portfolio and managing its debt obligations, to-date no financing facility or arrangement with any private equity fund has been secured by the Company or otherwise approved by the Board.

Clarification on other statements in the Article

The Board wishes to further clarify the following statements:

- Original Acquisition Price: The Article reported that the Company had paid US$154.9 million (RM651million) or US$3.28 per barrel for its original 60% stake in PBV in 2016. The Board wishes to clarify that US$154.9 million was the purchase price prior to adjustments pursuant to the terms of the conditional sale and purchase agreement entered into between the Company and MIE. As was disclosed in page 17 of our Circular to Shareholders dated 13 October 2016, the final adjusted purchase consideration for the Company’s acquisition of its 60% interest in PBV and the Emir-Oil Asset in 2016 was US$175.9 million.

- Payment to Dissenting Shareholders: The Article reported that the Company had paid US$175.9 million to dissenting shareholders who had voted against the Company’s acquisition of the 60% stake in PBV. The Board wishes to clarify that in accordance with Paragraph 6.25 of the applicable Securities Commission’s Equity Guidelines, dissenting shareholders were entitled to receive, in exchange for their securities, a sum equivalent to a pro rata portion of the amount then held in the trust account (net of any taxes payable and expenses related to the facilitation of the exchange), provided that the qualifying acquisition is approved and completed within the permitted time frame. The basis of computation for this was set out at Section 5.1.3 of our Prospectus dated 24 July 2014. The total amount repaid to dissenting shareholders following the completion of the qualifying acquisition exercise was RM 138,050,739.

Save as clarified above, the remainder of the Article contains statements which are either historical or emphatically speculative, and as such the Board is of the view that no response is warranted in respect of the same.

The Board reiterates that it is cognisant of the need for proper dissemination of information to the public and will continue to release the appropriate announcement(s) on Bursa Securities on a timely basis as required by the Main Market Listing Requirements of the Bursa Securities.

In addition, the Board will continue to monitor rumours, reports or inaccurate information affecting the Company.

This announcement is dated 4 September 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2019 04:58 AM

|

显示全部楼层

发表于 30-9-2019 04:58 AM

|

显示全部楼层

Date of change | 18 Sep 2019 | Name | ENCIK IKRAM ISKANDAR BIN ABD RAHIM | Age | 37 | Gender | Male | Nationality | Malaysia | Designation | Non-Independent Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | in Business Administration (2010) | University of Strathclyde, Glasgow, Scotland, U.K | | | 2 | Degree | of Science in Mechanical Engineering (2003) | Georgia Institute of Technology, Atlanta, Georgia, U.S.A. | |

Working experience and occupation | Encik Ikram Iskandar Bin Abd Rahim ("En. Ikram") began his career as Senior Reservoir Engineer in ExxonMobil Exploration and Production Malaysia Inc. in 2004 with established track record in complex commercial and technical assignments.In 2010, he joined Newfield Sarawak Malaysia Inc. ("Newfield") as a Senior Reservoir Engineer and served Newfield for 3 years. He was responsible for conducting field development studies to support drilling program including overseeing Company's reserves management and reporting process.He then joined Sapura Exploration and Production Inc. (previously known as Newfield Malaysia) ("Sapura") as a Business Development and Planning Manager in Sapura for a period of 5 years. He was responsible in analysing country, market and competitor's trends and develop internal financial and economic models. In addition, he is required to conduct quantitative analysis of internal and financial data to forecast revenue, identify future trends, assessing market and emerging opportunities.In 2017, he joined Hess Exploration and Production Malaysia B.V. as a Reservoir Engineer Manager. His responsibilities were to lead a Field Development Planning team and to make decision on economic analysis relating to strategic and long-term commercial opportunities in Malaysia-Thai are to enhance asset value. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-1-2020 11:49 AM

|

显示全部楼层

发表于 22-1-2020 11:49 AM

|

显示全部楼层

(吉隆坡22日讯)获哈萨克斯坦能源部的油气生产合约,激励Reach能源(Reach Energy Bhd)今早上涨2仙或11.76%。

截至10时10分,该股挂于盘中最高的19仙,成交量有1629万2500股,为主要热门股之一,市值报2亿284万令吉。

Reach能源昨日向大马交易所报备,旗下Emir-Oil的哈萨克斯坦业务获得该国能源部授予North Kariman和Yessen油田的油气生产合约。

此外,油气勘探合约-482获该部延长3年。

“由于Emir-Oil之前的勘探合约-482到2020年1月9日,公司很高兴地宣布获得延长合约,至2022年12月31日。”

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2020 07:38 AM

|

显示全部楼层

发表于 28-1-2020 07:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|