|

|

【PASUKGB 0177 交流专区】创合集团

[复制链接]

[复制链接]

|

|

|

楼主 |

发表于 4-3-2018 05:46 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Pasukhas Group Berhad ("PGB" or "the Company")- Acquisition of 100% of the share capital of Midtown Pearl Sdn. Bhd. by Pasukhas Properties Sdn. Bhd., a wholly-owned subsidiary of PGB. | The Board of Directors of PGB ("Board") wishes to announce that its wholly-owned subsidiary, Pasukhas Properties Sdn. Bhd. (formerly known as Majujaya Masyhur Sdn. Bhd.) ("PPSB") had on 27 February 2018 acquired one (1) ordinary share representing 100% of the share capital of Midtown Pearl Sdn. Bhd. (Company No. 1259079-H) ("MPSB") for a total cash consideration of RM1.00 only ("Acquisition"). Upon the Acquisition, MPSB shall become a wholly-owned subsidiary of PPSB.

MPSB was incorporated on 7 December 2017 pursuant to the Companies Act 2016 as a private limited company with an issued share capital of RM1.00 with one (1) ordinary share. MPSB is presently dormant and its intended principal activity of MPSB is to carry out property development.

The Acquisition is not expected to have any material effect on PGB Group’s earnings per share, net assets per share, gearings, share capital and substantial shareholdings structure for the financial year ending 31 December 2018.

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the Acquisition.

Having considered all aspects of the Acquisition, the Board of Directors of PGB is of the opinion that the Acquisition is in the best interest of PGB.

This announcement is dated 27 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-3-2018 07:45 AM

|

显示全部楼层

创合集团收购印尼公司股权 拓展煤炭贸易业务

Sangeetha Amarthalingam/theedgemarkets.com

March 01, 2018 19:15 pm +08

(吉隆坡1日讯)创合集团(Pasukhas Group Bhd)以33亿印尼盾(100万令吉),收购一家印尼煤炭贸易公司的60%股权。

创合集团执行董事兼总执行长万天和表示,收购PT Berkah Bumi Leluhur(PT BBL)的股权,将为该集团制造拓展煤炭贸易业务的机会。

他在文告中说:“我们也乐观看待此次收购将可为集团创造可持续收益。”

文告显示,创合集团独资子公司Pasukhas Products私人有限公司与5个人签署有条件股权买卖协议,分别是Akhmad Syaifullah、Kutut Jalu Prasojo、Joko Purnomo、 Agus Triono和Masrani,以收购PT BBL的股权。

完成股权收购活动后,PT BBL的其余40%股权将继续由卖方及其附属公司拥有。

创合集团补充说:“这个收购活动将不会显著影响集团截至今年12月杪财年的每股盈利、每股净资产和负债。”

(编译:魏素雯) |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-3-2018 06:05 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Updates on the Proposed Acquisition of 60% Equity Interest in PT Berkah Bumi Luhur (Now known as PT Berkah Bumi Leluhur) by Pasukhas Products Sdn Bhd, a wholly-owned subsidiary of PGB. | Reference is made to the Company’s announcement made on 22 November 2017 pertaining to the Proposed Acquisition of 60% equity interest in PT Berkah Bumi Luhur ("PT BBL") by Pasukhas Products Sdn Bhd ("PPSB"), a wholly-owned subsidiary of PGB.

The Board of Directors of PGB wishes to announce that PT Berkah Bumi Luhur is now known as PT Berkah Bumi Leluhur ("PT BBLeluhur") had undertaken their internal restructuring. PPSB had on 1 March 2018 entered into a Conditional Sale and Purchase of Shares Agreement ("CSPA") with Akhmad Syaifullah, Kutut Jalu Prasojo, Joko Purnomo, Agus Triono and Masrani (collectively as "the Vendors") in relation to the acquisition of 1,650 shares ("Sale Shares"), representing 60% of the issued and paid-up share capital of PT BBLeluhur for a total cash consideration of IDR3.3 billion ("Purchase Price") or equivalent to approximately RM1.0 million, upon the terms and conditions as stipulated in the CSPA ("Proposed Acquisition").

Please refer to the full details of the announcement as attached.

This announcement is dated 1 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5710145

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-3-2018 05:36 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Pasukhas Group Berhad ("PGB" or "the Company")- Updates on the Proposed Acquisition of 60% Equity Interest in PT Berkah Bumi Luhur (Now known as PT Berkah Bumi Leluhur) by Pasukhas Products Sdn Bhd, a wholly-owned subsidiary of PGB. | We refer to the Company's Announcement dated 1 March 2018 pertaining to the Proposed Acquisition of 60% equity Interest in PT Berkah Bumi Luhur (Now known as PT Berkah Bumi Leluhur) by Pasukhas Products Sdn Bhd, a wholly-owned subsidiary of PGB.

The Board of Directors of PGB wishes to provide additional information in relation thereto as per the file attached.

This announcement is dated 5 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5712749

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2018 06:27 AM

|

显示全部楼层

本帖最后由 icy97 于 25-3-2018 06:49 AM 编辑

创合集团获4130万令吉工程

Samantha Ho/theedgemarkets.com

March 20, 2018 20:32 pm +08

(吉隆坡20日讯)创合集团(Pasukhas Group Bhd)获Paramount Property Construction私人有限公司颁发总值4130万令吉的建筑工程,在雪兰莪莎阿南兴建1间酒店及服务式公寓。

根据文告,创合集团持有70%股权的子公司Pasukhas Construction私人有限公司获得Paramount Property的决标信,以进行分包合同工程。

该项目包括5层停车场、1栋14层服务式公寓(涵盖389个单位)、1栋14层酒店(有240间客房),以及1个有盖德士站。

创合集团表示,酒店的上层建筑预计在2019年2月15日完成,价值765万令吉,而价值3365万令吉的14层服务式公寓,则估计在2019年11月杪竣工。

创合集团执行董事兼总执行长万天和在另一份文告中表示:“我们相信这个建筑项目将会为集团截至今年12月杪财年(2018财年),作出积极的收益贡献。”

(编译:魏素雯)

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Pasukhas Group Berhad ("PGB" or "the Company")- Letter of Award issued by Paramount Property Construction Sdn Bhd to Pasukhas Construction Sdn Bhd | The Board of Directors of PGB is pleased to announce that Pasukhas Construction Sdn Bhd ("PCSB"), a 70%-owned subsidiary had on 20 March 2018 accepted the Letter of Award issued by Paramount Property Construction Sdn Bhd (Main Contractor).

Please refer to full details of the announcement as attached.

This announcement is dated 20 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5730209

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-4-2018 05:08 AM

|

显示全部楼层

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | PASUKHAS GROUP BERHAD ("PGB" OR THE "COMPANY")(I) PROPOSED SPECIAL ISSUE; AND(II) PROPOSED DIVERSIFICATION(COLLECTIVELY, THE "PROPOSALS") | On behalf of the Board of Directors of PGB, M&A Securities Sdn Bhd wishes to announce that the Company intends to undertake the following proposals:- (a) Proposed special issue of up to 116,055,000 new ordinary shares in PGB , representing approximately 12.5% of the Company’s enlarged issued share capital to Bumiputera investors to be identified and/or approved by the Ministry of International Trade and Industry, Malaysia (“Proposed Special Issue”); and

(b) Proposed diversification of PGB and its subsidiaries' existing business into the property development and coal trading business segments ("Proposed Diversification")

(collectively, the “Proposals”)

Further details of the Proposals are contained in the attachment attached herein.

This announcement is dated 2 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5744629

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-5-2018 06:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 47,617 | 7,056 | 47,617 | 7,056 | | 2 | Profit/(loss) before tax | 708 | 132 | 708 | 132 | | 3 | Profit/(loss) for the period | 708 | 132 | 708 | 132 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 689 | 146 | 689 | 146 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.08 | 0.03 | 0.08 | 0.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1100 | 0.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-5-2018 07:37 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-25052018-00001 | Subject | WRIT OF SUMMONS AND STATEMENT OF CLAIMS BY EMERALD CAPITAL (IPOH) SDN BHD IN THE IPOH HIGH COURT ("LITIGATION") | Description | Pasukhas Group Berhad ("PGB" or "the Company")- Writ of Summons and Statement of Claims by Emerald Capital (Ipoh) Sdn Bhd in the Ipoh High Court (Civil Suit No. AA-22NCvC-61-05/2018) | Query Letter Contents | We refer to your Company’s announcement dated 23 May 2018, in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- 1. The details of events leading to the commencement of the Litigation. 2. Where Pasukhas Sdn Bhd and Essential Value Sdn Bhd are major subsidiaries of Pasukhas Group Berhad. | (For consistency, the abbreviations used herein shall have the same meaning as defined in the announcement to Bursa Malaysia Securities Sdn Bhd (“Bursa Securities”) dated 23 May 2018 (“Announcement”) unless otherwise defined.

Reference is made to the Announcement and query letter from Bursa Securities dated 25 May 2018 in relation to the Writ of Summons and Statement of Claims by Emerald Capital (Ipoh) Sdn Bhd in the Ipoh High Court (Civil Suit No. AA-22NCvC-61-05/2018), the Board of Directors of PGB wishes to provide the additional information as attached.

This announcement is dated 28 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5806985

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-8-2018 06:21 AM

|

显示全部楼层

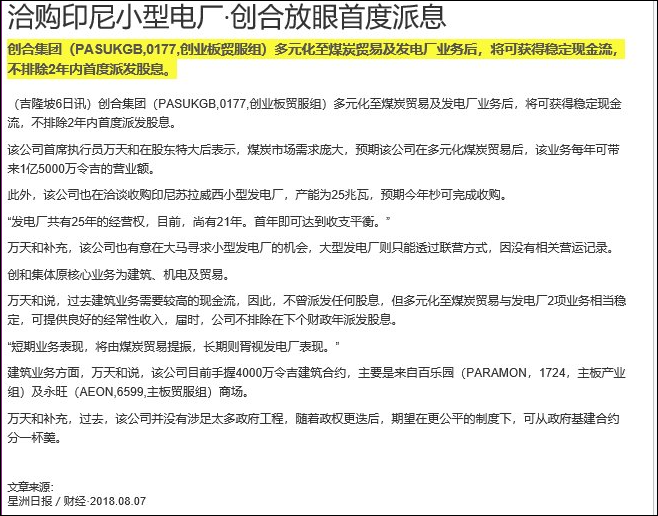

本帖最后由 icy97 于 8-8-2018 03:41 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-8-2018 03:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 24,652 | 7,667 | 72,269 | 14,229 | | 2 | Profit/(loss) before tax | -375 | 485 | 333 | 617 | | 3 | Profit/(loss) for the period | -375 | 485 | 333 | 617 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -228 | 40 | 461 | 186 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.03 | 0.01 | 0.06 | 0.04 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1100 | 0.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-9-2018 05:07 AM

|

显示全部楼层

本帖最后由 icy97 于 13-9-2018 06:08 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Pasukhas Group Berhad ("PGB" or "the Company")- Sale and Purchase Agreement of Steam Coal | PGB is pleased to announce that its wholly-owned subsidiary company, Pasukhas Products Sdn. Bhd. ("the Seller") had on 12 September 2018 entered into a Sale and Purchase Contract with Singapore Company ("the Buyer") for the sale and delivery of one (1) vessel of steam coal at FOB USD4.93 million Anchorage point of South Kalimantan, Indonesia ("the Contract").

The Contract is expected to contribute positively towards the future earnings and net assets per share of PGB Group for the financial year ending 31 December 2018 and will not have any effect on the share capital and substantial shareholders’ shareholdings of PGB Group.

None of the other directors or major shareholders of the Company, or persons connected, have any interest, direct or indirect, in the Contract.

The Board is of the view that the Contract is in the best interest of the Company, after considering amongst others, the potential financial benefits arising from the Contract.

This announcement is dated 12 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-9-2018 05:33 AM

|

显示全部楼层

Name | TARA TEMASEK SDN. BHD. | Address | 2-1, JALAN SRI HARTAMAS 8

SRI HARTAMAS

KUALA LUMPUR

50480 Wilayah Persekutuan

Malaysia. | Company No. | 1137804-A | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | ORDINARY SHARES |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 18 Sep 2018 | 9,130,000 | Acquired | Direct Interest | Name of registered holder | TARA TEMASEK SDN. BHD. | Address of registered holder | 2-1, JALAN SRI HARTAMAS 8 SRI HARTAMAS KUALA LUMPUR 50480 WILAYAH PERSEKUTUAN | Description of "Others" Type of Transaction | | | 2 | 19 Sep 2018 | 4,379,900 | Acquired | Direct Interest | Name of registered holder | TARA TEMASEK SDN. BHD. | Address of registered holder | 2-1, JALAN SRI HARTAMAS 8 SRI HARTAMAS KUALA LUMPUR 50480 WILAYAH PERSEKUTUAN | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | ACQUISITION OF SHARES THROUGH OPEN MARKET | Nature of interest | Direct Interest | Direct (units) | 202,019,000 | Direct (%) | 24.892 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 202,019,000 | Date of notice | 21 Sep 2018 | Date notice received by Listed Issuer | 21 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-9-2018 05:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Pasukhas Group Berhad ("PGB" or "the Company") - Acquisition of 100% of the total issued share capital of Morning Summit Sdn. Bhd. by Pasukhas Energy Sdn. Bhd., a wholly-owned subsidiary of PGB. | The Board of Directors of PGB ("Board") wishes to announce that its wholly-owned subsidiary, Pasukhas Energy Sdn. Bhd. ("PESB") had on 21 September 2018 acquired one (1) ordinary share representing 100% of the total issued share capital of Morning Summit Sdn. Bhd. (Company No. 1293491-H) (“MSSB”) for a total cash consideration of RM1.00 only ("Acquisition").

Upon the Acquisition, MSSB shall become a wholly-owned subsidiary of PESB.

MSSB was incorporated on 30 August 2018 under the Companies Act 2016 as a private limited company with an issued share capital of RM1.00 comprising one (1) ordinary share. MSSB is presently dormant and its intended principal activity is to carry out business of investment holding.

The Acquisition is not expected to have any material effect on PGB Group’s earnings per share, net assets per share, gearings, share capital and substantial shareholdings structure for the financial year ending 31 December 2018.

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the Acquisition.

Having considered all aspects of the Acquisition, the Board of Directors of PGB is of the opinion that the Acquisition is in the best interest of PGB.

This announcement is dated 21 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-9-2018 05:54 AM

|

显示全部楼层

本帖最后由 icy97 于 30-9-2018 07:59 AM 编辑

ype | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PASUKHAS GROUP BERHAD (THE COMPANY OR PGB)Acquisition of Freehold Land by Pasukhas Sdn. Bhd., a wholly-owned subsidiary of the Company, from MTM Millennium Holdings Sdn. Bhd. (In-Liquidation) for a Cash Consideration of RM4,700,000.00 (Acquisition) | PGB is pleased to announce that its wholly-owned subsidiary company, Pasukhas Sdn Bhd ("the Purchaser") had on 28 September 2018 entered into a Sale and Purchase Agreement with MTM Millennium Holdings Sdn. Bhd (Company No. 136030-U) (In-liquidation) having its correspondence address at c/o Lean Oh & Associates of No. 23, 2nd Floor, Jalan SS 2/30, 47300 Petaling Jaya, Selangor Darul Ehsan ("the Vendor") to acquire all that piece of freehold land held under individual title No. GM 823, Lot 1594, Tempat Gebeng, Mukim Sungai Karang, Daerah Kuantan, Negeri Pahang measuring approximately 10,193.9994 square meter (1.0194 hectares) ( “the Land”) for a cash consideration of RM4,700,000.00 (Ringgit Malaysia: Four Million and Seven Hundred Thousand only) (“Purchase Price”).

Kindly refer to the attachment for more information.

This announcement is dated 28 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5926677

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-10-2018 02:54 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-01102018-00002 | Subject | ACQUISITION OF FREEHOLD LAND BY PASUKHAS SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY, FROM MTM MILLENNIUM HOLDINGS SDN. BHD. (IN-LIQUIDATION) ("MTM") FOR A CASH CONSIDERATION OF RM4,700,000.00 ("ACQUISITION") | Description | PASUKHAS GROUP BERHAD (THE COMPANY OR PGB)Acquisition of Freehold Land by Pasukhas Sdn. Bhd., a wholly-owned subsidiary of the Company, from MTM Millennium Holdings Sdn. Bhd. (In-Liquidation) for a Cash Consideration of RM4,700,000.00 (Acquisition) | Query Letter Contents | We refer to your Company’s announcement dated 28 September 2018, in respect of the aforesaid matter.

In this connection, kindly furnish Bursa Securities with the following additional information for public release:-

1. The proposed use of the Land and where the Land is to be developed, the following additional details:- (a) the details of development potential, i.e. name of the project, type of development - residential, industrial or commercial, number of units in respect of each type of development; (b) the total development cost; (c) the expected commencement and completion date(s) of development; (d) the expected profits to be derived; (e) the sources of funds to finance the development cost; and (f) whether relevant approvals for the development have been obtained and date(s) obtained. 2. The net book value of the Land based on latest audited financial statements of MTM. 3. The basis for tendering for the Land at the price of RM4,700,000.00. 4. To elaborate on how the Company plans "to expand its existing business activities and to take more business opportunities" via the Acquisition. | We refer to the announcement dated 28 September 2018 and query letter from Bursa Malaysia Berhad dated 01 October 2018 (Ref: IQL-01102018-00002).

The Board of Directors of PGB wishes to annouce the following:- The Proposed Use of the Land Currently, PGB has yet to decide on the proposed use of the Land. The net book value of the Land based on latest audited financial statements of MTM. The net book value of the Land was not made known to the Company as MTM is in liquidation and the last audited financial statements of MTM was in 2014. The basis for tendering for the Land at the price of RM4,700,000.00. The market value of the Land is RM4,000,000 as indicated in the valuation report from the Liquidator. The valuation was conducted by Henry Butcher Malaysia on 31 May 2018 using the “Comparison Method” of valuation. PSB has bid for the Land at a price of RM4,700,000 in the open tender offered by the Liquidator and PSB values the buildings on the land at RM700,000. To elaborate on how the Company plans "to expand its existing business activities and to take more business opportunities" via the Acquisition. PGB has diversified into the property developer business and the Acquistion is a strategic move of the Company to expand its property devlopment activities.

This announcement is dated 2 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-10-2018 07:36 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Pasukhas Group Berhad ("PGB" or "the Company") - Acquisition of 100% of the total issued share capital of Prominent Hectare Sdn. Bhd. by Pasukhas Sdn. Bhd., a wholly-owned subsidiary of PGB. | The Board of Directors of PGB ("Board") wishes to announce that its wholly-owned subsidiary, Pasukhas Sdn. Bhd. ("PSB") had on 3 October 2018 acquired one (1) ordinary share representing 100% of the total issued share capital of Prominent Hectare Sdn. Bhd. (Company No. 1291418-T) (“PHSB”) for a total cash consideration of RM1.00 only ("Acquisition").

Upon the Acquisition, PHSB shall become a wholly-owned subsidiary of PSB.

PHSB was incorporated on 17 August 2018 under the Companies Act 2016 as a private limited company with an issued share capital of RM1.00 comprising one (1) ordinary share. PHSB is presently dormant and its intended principal activity is to carry out business of development and construction.

The Acquisition is not expected to have any material effect on PGB Group’s earnings per share, net assets per share, gearings, share capital and substantial shareholdings structure for the financial year ending 31 December 2018.

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the Acquisition.

Having considered all aspects of the Acquisition, the Board of Directors of PGB is of the opinion that the Acquisition is in the best interest of PGB.

This announcement is dated 3 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-12-2018 07:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10,962 | 10,031 | 83,231 | 24,260 | | 2 | Profit/(loss) before tax | -2,882 | 106 | -2,549 | 723 | | 3 | Profit/(loss) for the period | -2,852 | 103 | -2,519 | 720 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,954 | -158 | -2,493 | 28 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.36 | -0.03 | -0.31 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1100 | 0.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-2-2019 07:05 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PASUKHAS GROUP BERHAD ("PGB" or "the Company") - INTERNAL RESTRUCTURING WITHIN THE GROUP | The Board of Directors of PGB wishes to announce that the Company had on 14 January 2019 undertaken an internal restructuring within the Group via a transfer of four million (4,000,000) ordinary shares representing the entire share capital of I.S. Energy Sdn. Bhd. (“ISE”) (Company No. 612985-D) from Pasukhas Energy Sdn. Bhd. (Company No. 1184019-V) (“PESB”) to Pasukhas Green Assets Sdn. Bhd. (“PGASB”) (Formerly known as Morning Summit Sdn. Bhd.) (Company No. 1293491-H) for a total cash consideration of RM 1,000,000.00 (Ringgit Malaysia One Million) only (“Internal Restructuring”).

PGASB and ISE are both 100% owned by PESB which in turn 100% owned by PGB.

Consequent to the Internal Restructuring, ISE shall become a 100% direct-owned subsidiary of PGASB and become the third-tier subsidiary of the PGB.

The Internal Restructuring would not have material effect on PGB Group’s earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding for the financial year ending 31 December 2019.

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the Internal Restructuring.

Having considered all aspects, the Board of Directors of PGB is of the opinion that the Internal Restructuring is in the best interest of PGB.

This announcement is dated 14 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-3-2019 07:44 AM

|

显示全部楼层

icy97 发表于 25-12-2017 06:28 AM

创合全购印尼2发电厂

(吉隆坡23日讯)创合集团(PASUKGB,0177,创业板贸服组)决定全购印尼苏拉威西北部两座燃煤发电厂,并已获得卖方的批准。

该公司文告说,今年6月间,旗下独资子公司Bidara Majujaya有限 ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Pasukhas Group Berhad ("PGB" or "the Company")- Proposed Acquisition of 100% Equity Interest in PT Bangun Daya Perkasa (PT BDP) by Pasukhas Energy Sdn. Bhd. (PESB), a wholly-owned subsidiary of the Company | We refer to the Company’s announcements made on 13 June 2017 and 22 December 2017 in relation to:- - the Approval Letter ("AL") entered into between PESB with PT BDP for the acquisition of 92.5% equity interest held by PT BDP in PT Tenaga Listrik Gorontalo (“PT TLG”), a subsidiary company of PT BDP; and

- the Letter of Offer (“Offer Letter”) from PESB to PT Persada Capital Investama and PT Saratoga Sentra Business, the shareholders of PT BDP (collectively known as “the Vendors”) which was accepted by the Vendors for the acquisition of 100% equity interest in PT BDP.

[(A) and (B) collectively referred to “Proposed Acquisition”]

The Board of PGB wishes to announce that PESB, PT BDP and the Vendors have mutually agreed to terminate the Proposed Acquisition and thus, the Company had issued a letter to PT BDP and the Vendors to terminate the AL and Offer Letter for the Proposed Acquisition.

The Proposed Termination would not have material effect on PGB Group’s earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholdings for the financial year ending 31 December 2019.

None of the Directors and/or major shareholders of PGB and/or persons connected to them have any interests, direct or indirect, in the Proposed Termination.

Having considered all aspects, the Board of Directors of PGB is of the opinion that the Proposed Termination is in the best interest of PGB.

This announcement is dated 28 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-3-2019 08:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,902 | 12,599 | 95,133 | 36,859 | | 2 | Profit/(loss) before tax | -6,253 | 696 | -8,802 | 1,419 | | 3 | Profit/(loss) for the period | -6,253 | 4 | -8,772 | 724 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,407 | 578 | -7,900 | 606 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.67 | 0.09 | -0.97 | 0.09 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1000 | 0.1300

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|