|

|

发表于 19-7-2017 05:03 AM

|

显示全部楼层

发表于 19-7-2017 05:03 AM

|

显示全部楼层

工程項目料陸續竣工 i公司前景錢景佳

2017年7月18日

(吉隆坡18日訊)最新業績表現優異的i公司(IBHD,4251,主要板房產),在3億3470萬令吉未進賬銷售帶動下,未來盈利備受看好。

大眾投銀研究在報告指出,i公司的1萬平方尺商場架構工程已完成約70%,料可如期在2018年開張,提供房產投資相關盈利貢獻。至于DoubleTree by Hilton酒店也在建築中,料于2019年竣工。

i公司另外還有兩棟發展總值達5億2000萬令吉的住宅大樓項目,料在今年底或明年初推出,取決于特定監管單位的批準。

報告看好i公司的價值以及具吸引力地點,料從巴生谷周邊地區城市化受惠。同時,該公司專注于單一地點發展,仍可交出穩定成長和令人鼓舞的銷售額。

因此,大眾投銀研究維持i公司“跑贏大市”評級,目標價維持在91仙。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-9-2017 01:02 AM

|

显示全部楼层

发表于 6-9-2017 01:02 AM

|

显示全部楼层

EX-date | 18 Sep 2017 | Entitlement date | 20 Sep 2017 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | Fourth interest payment of 2.5% per annum on 5-year 2% to 3% Irredeemable Convertible Unsecured Loan Stocks ("ICULS") 2014/2019 | Period of interest payment | 09 Apr 2017 to 08 Oct 2017 | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel: 03-27839299Fax: 03-27839222 | Payment date | 09 Oct 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 20 Sep 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 2.5 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2017 02:48 AM

|

显示全部楼层

发表于 24-10-2017 02:48 AM

|

显示全部楼层

本帖最后由 icy97 于 24-10-2017 04:46 AM 编辑

I公司第三季净利跌13%

2017年10月24日

(吉隆坡23日讯)I公司(IBHD,4251,主板产业股)截至9月杪第三季,净利按年跌13%,写1959万6000令吉或每股1.85仙。

该公司今日向交易所报备,营业额按年减7%,录得1亿532万4000令吉,原因是i-SOHO项目于4月竣工。

3季净利扬10%

不过,累计9个月业绩均呈双位数增幅,净利按年攀升10%,报5781万6000令吉;营业额则按年走高20%,写3亿3597万4000令吉。

项目持续竣工,加上新项目带来销售,董事部相信今财年产业发展业务财务表现会比上财年标青,推动集团营业额与净利再创记录。

I公司的策略是,一旦i-City整体发展项目竣工,产业发展业务每年带来5亿令吉稳定营业额,加上价值10亿令吉的产业投资组合。

执行主席丹斯里林金煌称:“自从采用这个策略,产业发展营业额逐渐增长,我们有信心可以在明年达到这个营业额目标。”

他补充,接下来,该公司的重心为产业投资计划,至今已投入4亿3600万令吉,预计这些产业投产后,将进一步刺激表现。

拥有6500个车位的泊车场刚竣工,年杪开放给公众使用。

同时,明年会完成和开张首个会展中心和购物商场。

截至9月杪,I公司的未入账销售达3亿330万令吉。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 105,324 | 113,581 | 335,974 | 280,705 | | 2 | Profit/(loss) before tax | 28,556 | 25,444 | 78,175 | 65,143 | | 3 | Profit/(loss) for the period | 19,596 | 22,429 | 57,792 | 52,449 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 19,596 | 22,442 | 57,816 | 52,479 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.85 | 2.11 | 5.45 | 4.94 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 0.8600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2017 12:56 AM

|

显示全部楼层

发表于 26-10-2017 12:56 AM

|

显示全部楼层

I公司

今年净利下调12%

2017年10月25日

分析:大众投行研究

目标价:91仙

最新进展

I公司(IBHD,4251,主板产业股)截至9月杪第三季,净利按年跌13%,写1959万6000令吉或每股1.85仙;营业额按年减7%,录得1亿532万4000令吉,原因是i-SOHO项目于4月竣工。

不过,累计九个月业绩均呈双位数增幅,净利按年攀升10%,报5781万6000令吉;营业额则按年走高20%,写3亿3597万4000令吉。

行家建议

虽然看好高达3亿3030万令吉的未入账销售,可支撑接下来的盈利表现,但我们决定将今年的净利预估下调12%,主要是吉隆坡8 Kia Peng项目的贡献比预期来得慢,这也是导致首九个月净利仅达我们全年预估66.8%的原因。

无论如何,我们仍偏好该公司的策略和优质地点,能随着巴生谷外围地区开始城市化的趋势受惠。目前,维持“超越大市”评级。

我们预计,产业投资业务直到明年才会显著贡献,因此,产业发展将继续是主要盈利增长动力,首九个月税前盈利达7620万令吉,按年高出18.9%,归功于发展中项目稳定的建筑进度。

i-Suite项目将会在本季度移交给买家,可进一步入账销售额。

近期推介的Hill10 Residences项目,发展宗旨达1亿2000万令吉,已经取得90%的认购率,有信心该公司将能够继续发挥接下来发展总值高达70亿令吉的地库。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2017 06:23 AM

|

显示全部楼层

发表于 26-10-2017 06:23 AM

|

显示全部楼层

盈利稳健.I公司后劲看好

(吉隆坡24日讯)I公司(IBHD,4251,主板产业组)最新第三业绩净利稍为下跌,惟首9个月净利仍取得良好表现,加上未入账产业销售达逾3亿令吉,分析员看好其后劲,而股价表现也全天平稳无起落。

该公司股价一度扬升1仙,至58.5仙,惟收市时回落至57.5仙平盘水平。全天成交量为48万3400股,显示交投适中。

大众研究分析员指出,I公司最新业绩净利比预期低,主要是旗下吉隆坡8嘉炳产业计划贡献,比预期来得低所致。

I公司旗下的产业投资领域料在2018年之前不会做出显著盈利贡献,使产业发展业务仍是盈利成长的主要支柱。

分析员看好其手握1亿9060万令吉现金,或每股现金约14.5仙,或占目前市值的25%及零借贷(除了负债方面的一些债券)。

分析员表示,该公司拥有逾3亿令吉未入账销售透明度的支持及盈利成长稳定及健全赚幅,使该行对它维持“超越大市”评级,目标价则保持在91仙。

文章来源:

星洲日报‧财经‧2017.10.25 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2018 05:36 AM

|

显示全部楼层

发表于 1-3-2018 05:36 AM

|

显示全部楼层

本帖最后由 icy97 于 3-3-2018 02:48 AM 编辑

I公司末季净利增25%

2018年2月28日

(吉隆坡27日讯)由于业务普遍表现报捷,带动I公司(IBHD,4251,主板产业股)截至12月31日末季净利按年增长24.76%。

该公司末季净赚1766万令吉,或每股1.66仙,上财年同季则达1415万5000令吉,或1.33仙。

从各业务来看,产业发展和休闲业务税前盈利增加,其他业务则转亏为盈。不过,产业投资业务税前亏损却增加至146万令吉。

至于营业额,则从1亿286万令吉,按年上升25.51%至1亿2911万令吉。

合计全年,净利按年提高13.27%,至7548万令吉或每股7.11仙;而营业额则增加21.25%,至4亿6508万令吉。

I公司执行主席丹斯里林金煌指出,这是公司在2013年推出首个5年计划的成果。该项计划旨在让集团可成为一家总股本达十亿令吉的全面产业公司。

“我们只是处于属于我们的精彩故事初期阶段而已。”

他说,随着与希尔顿集团、泰国Central Pattana有限公司缔结策略合作,目前已为未来5年制定明确计划,且紧接而来则是把72英亩的i-City发展转型为繁华的Ultrapolis。

截至去年12月31日,集团未入账销售达2亿7400万令吉,而Hill10 Residences项目和King of the Hill-8Kia Peng@KLCC计划预计将扶持未入账销售及盈利能见度。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 129,106 | 102,864 | 465,080 | 383,569 | | 2 | Profit/(loss) before tax | 27,244 | 23,029 | 105,419 | 88,172 | | 3 | Profit/(loss) for the period | 17,663 | 14,145 | 75,455 | 66,594 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,660 | 14,155 | 75,476 | 66,634 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.66 | 1.33 | 7.11 | 6.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9100 | 0.8500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-3-2018 07:11 AM

|

显示全部楼层

发表于 10-3-2018 07:11 AM

|

显示全部楼层

EX-date | 22 Mar 2018 | Entitlement date | 26 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | Fifth interest payment of 3% per annum on 5-year 2% to 3% Irredeemable Convertible Unsecured Loan Stocks (ICULS) 2014/2019 | Period of interest payment | 09 Oct 2017 to 08 Apr 2018 | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel: 03-2783 9299Fax: 03-2783 9222 | Payment date | 09 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 26 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 3 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-6-2018 06:41 AM

|

显示全部楼层

发表于 8-6-2018 06:41 AM

|

显示全部楼层

本帖最后由 icy97 于 17-6-2018 06:02 AM 编辑

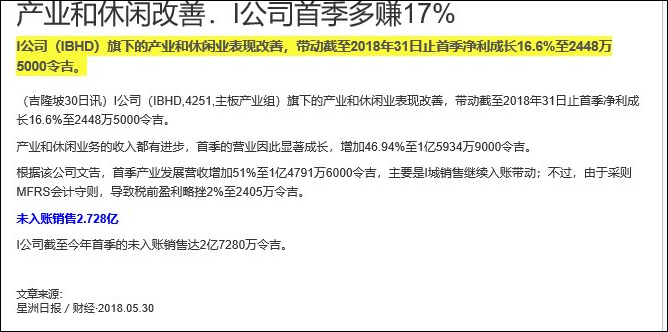

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 159,349 | 108,447 | 159,349 | 108,447 | | 2 | Profit/(loss) before tax | 25,016 | 25,440 | 25,016 | 25,440 | | 3 | Profit/(loss) for the period | 24,476 | 20,989 | 24,476 | 20,989 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 24,485 | 20,999 | 24,485 | 20,999 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.31 | 1.98 | 2.31 | 1.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9600 | 0.9400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2018 07:17 AM

|

显示全部楼层

发表于 16-6-2018 07:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-6-2018 12:11 AM

|

显示全部楼层

发表于 19-6-2018 12:11 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2018 02:24 AM

|

显示全部楼层

发表于 27-6-2018 02:24 AM

|

显示全部楼层

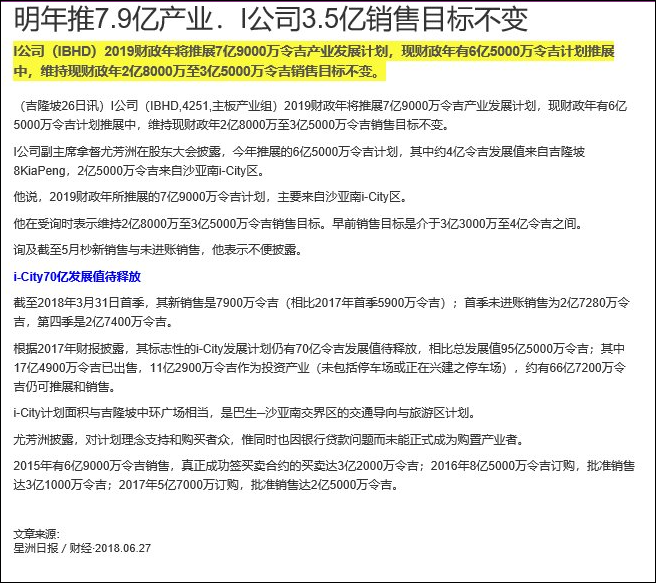

本帖最后由 icy97 于 28-6-2018 05:10 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2018 05:44 AM

|

显示全部楼层

发表于 29-6-2018 05:44 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-7-2018 01:51 AM

|

显示全部楼层

发表于 25-7-2018 01:51 AM

|

显示全部楼层

本帖最后由 icy97 于 25-7-2018 04:00 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 107,164 | 131,944 | 266,513 | 240,391 | | 2 | Profit/(loss) before tax | 28,698 | 28,082 | 53,714 | 53,522 | | 3 | Profit/(loss) for the period | 22,310 | 21,110 | 46,786 | 42,099 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 22,313 | 21,124 | 46,798 | 42,123 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.10 | 1.99 | 4.41 | 3.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9800 | 0.9400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2018 06:06 AM

|

显示全部楼层

发表于 26-7-2018 06:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2018 05:16 AM

|

显示全部楼层

发表于 18-8-2018 05:16 AM

|

显示全部楼层

EX-date | 04 Sep 2018 | Entitlement date | 06 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single tier dividend of 2.13 sen per ordinary share in respect of the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel: 03-2783 9299Fax: 03-2783 9222 | Payment date | 21 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 06 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0213 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 02:24 AM

|

显示全部楼层

发表于 25-8-2018 02:24 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 05:10 AM

|

显示全部楼层

发表于 7-9-2018 05:10 AM

|

显示全部楼层

EX-date | 20 Sep 2018 | Entitlement date | 24 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Loan Stock Interest | Entitlement description | Sixth interest payment of 3% per annum on 5-year 2% to 3% Irredeemable Convertible Unsecured Loan Stocks ("ICULS") 2014/2019 | Period of interest payment | 09 Apr 2018 to 08 Oct 2018 | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel: 03-2783 9299Fax: 03-2783 9222 | Payment date | 08 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 24 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 3 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 01:21 AM

|

显示全部楼层

发表于 6-11-2018 01:21 AM

|

显示全部楼层

本帖最后由 icy97 于 26-2-2019 02:00 AM 编辑

Date of change | 01 Nov 2018 | Name | DR CHOO HAO JIAN | Age | 24 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Medical Doctor (MD) | Gadjah Mada University | | | 2 | Degree | Bachelor Degree in Medical Science | Gadjah Mada University | |

Working experience and occupation | Dr Choo Hao Jian graduated as a Medical Doctor (MD) from Gadjah Mada University in July 2018 and holds a Degree in Medical Science from the same University. He was previously the Patient Care Ambassador with Chiropractic First Group since June 2018. | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | Dr Choo Hao Jian is the son of Madam Goh Yeang Kheng. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 02:07 AM

|

显示全部楼层

发表于 18-11-2018 02:07 AM

|

显示全部楼层

本帖最后由 icy97 于 20-11-2018 01:31 AM 编辑

i公司第三季净利跌21%

http://www.enanyang.my/news/20181108/i公司第三季净利跌21/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 60,662 | 75,312 | 327,175 | 315,703 | | 2 | Profit/(loss) before tax | 17,165 | 16,132 | 70,879 | 69,655 | | 3 | Profit/(loss) for the period | 5,671 | 7,172 | 52,457 | 49,272 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,688 | 7,172 | 52,486 | 49,296 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.54 | 0.68 | 4.95 | 4.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9700 | 0.9400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 02:01 AM

|

显示全部楼层

发表于 26-2-2019 02:01 AM

|

显示全部楼层

Date of change | 22 Feb 2019 | Name | DR CHOO HAO JIAN | Age | 25 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Alternate Director | New Position | Non Executive Director | Directorate | Non Independent and Non Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Medical Doctor (MD) | Gadjah Mada University | | | 2 | Degree | Bachelor Degree in Medical Science | Gadjah Mada University | |

Working experience and occupation | Dr Choo Hao Jian graduated as a Medical Doctor from Gadjah Mada University in July 2018 and holds a Degree in Medical Science from the same University. He was previously the Patient Care Ambassador with Chiropractic First Group since June 2018. | Family relationship with any director and/or major shareholder of the listed issuer | Dr Choo Hao Jian is the son of Madam Goh Yeang Kheng |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|